Surety Bond Templates

Documents:

823

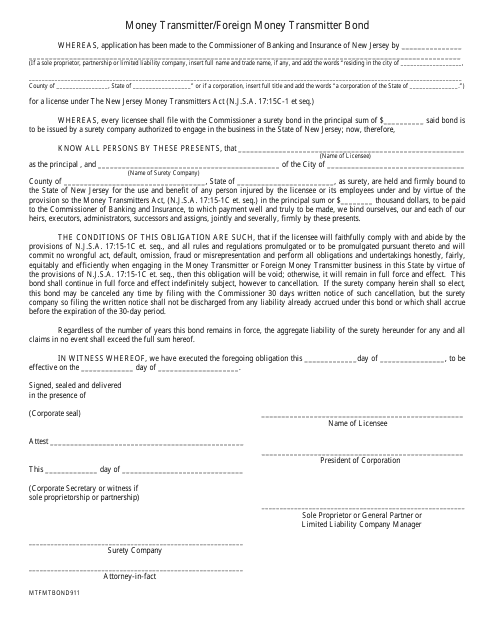

This document is for obtaining a bond required for operating as a Money Transmitter or Foreign Money Transmitter in the state of New Jersey.

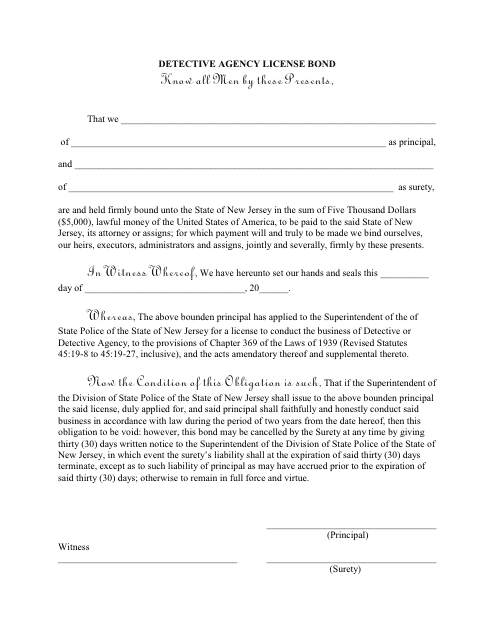

This document specifies the requirement for private detectives in New Jersey to obtain a $5000 bond.

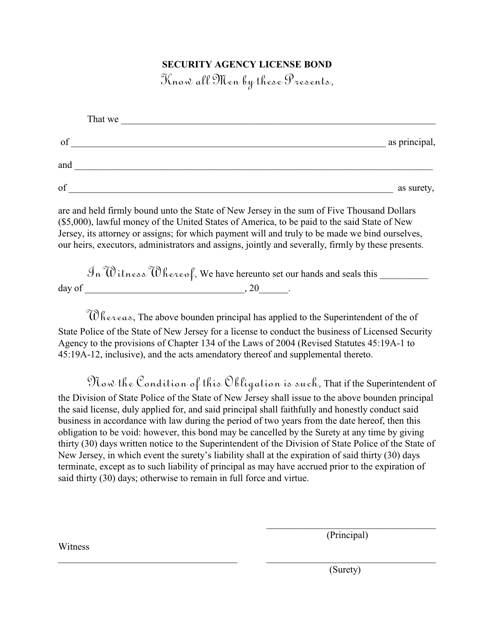

This document is for obtaining a security agency license bond in the state of New Jersey. It is a form of financial guarantee required by the state to ensure that the security agency complies with all regulations and obligations related to their operations.

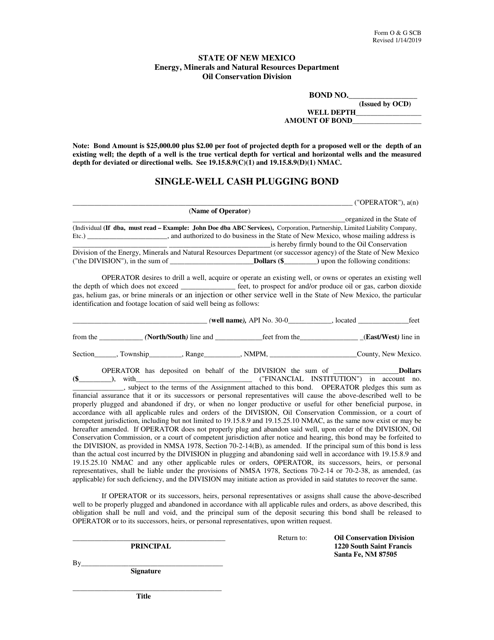

This form is used for obtaining a Single-Well Cash Plugging Bond in New Mexico for the Oil and Gas industry.

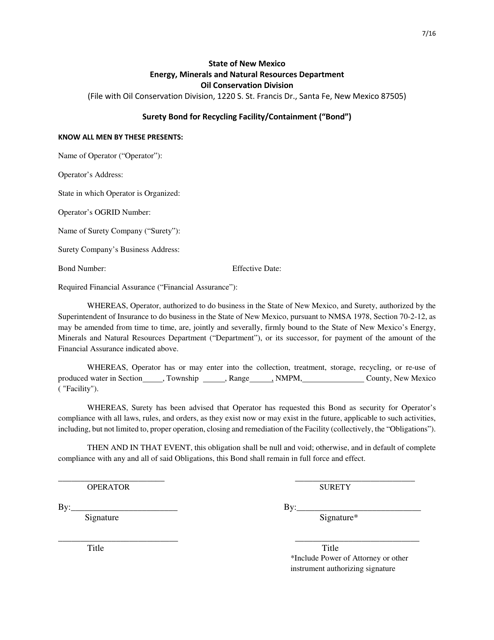

This type of document is a surety bond specifically designed for a recycling facility or containment in the state of New Mexico. It ensures that the facility operates in accordance with state regulations and protects against any potential financial losses or damages caused by the facility.

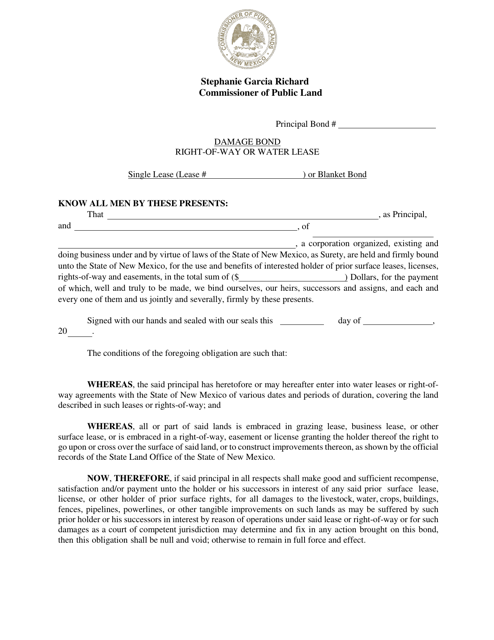

This document is a type of bond used in New Mexico to ensure compensation for any damages caused during the use of a right-of-way.

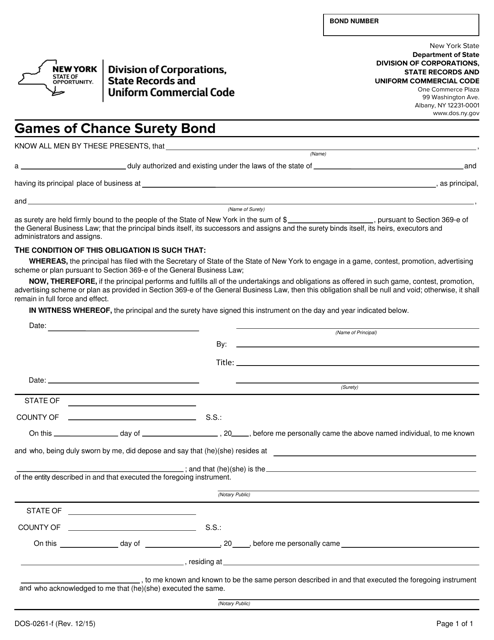

This document is a form used for obtaining a surety bond for games of chance in New York. It is required by the New York Department of State (DOS) to ensure compliance and protection for participants in such games.

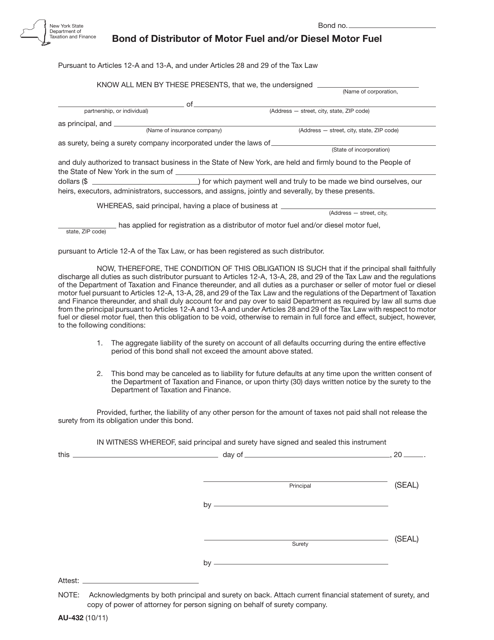

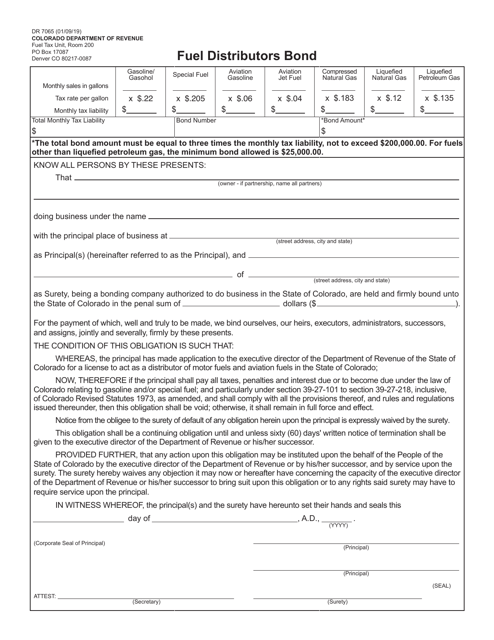

This form is used for distributors of motor fuel and/or diesel motor fuel in New York to submit a bond. It is required by the state to ensure compliance with tax obligations related to fuel distribution.

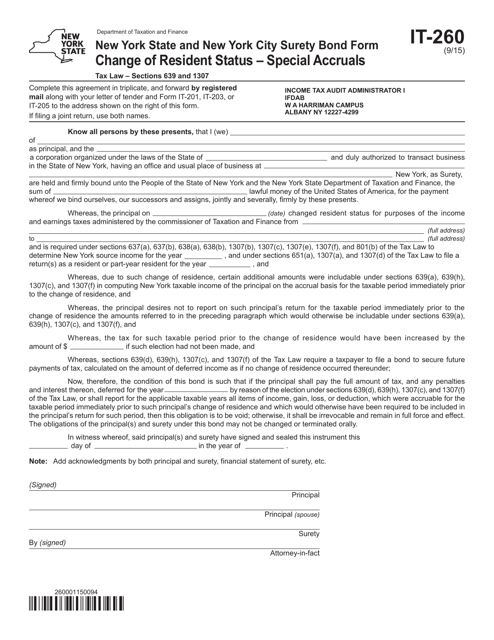

This Form is used for residents of New York State and New York City to change their resident status and report any special accruals in New York. It also includes a Surety Bond Form.

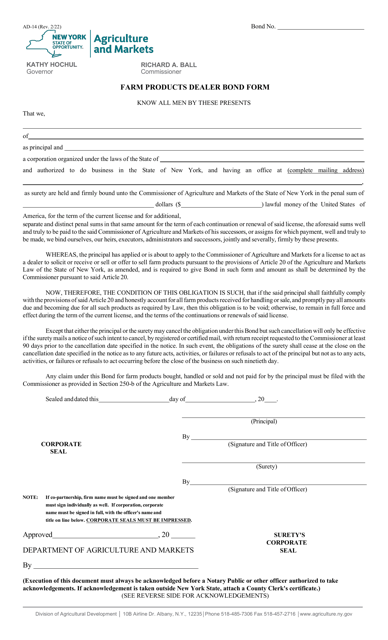

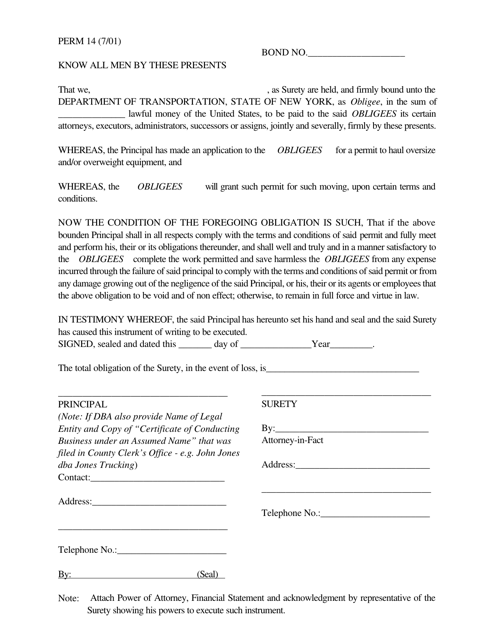

This Form is used for obtaining a surety bond in New York.

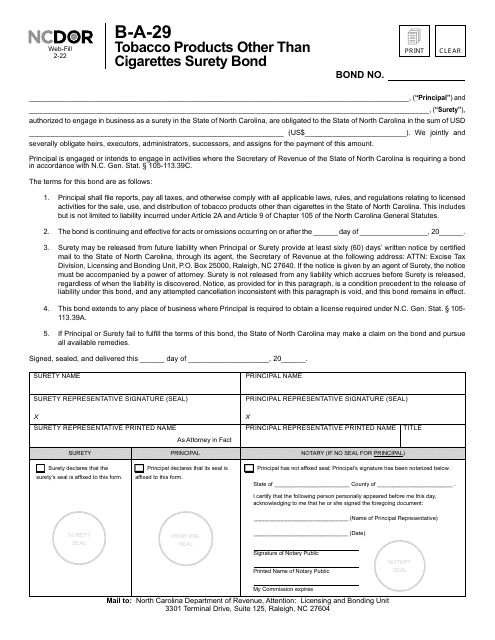

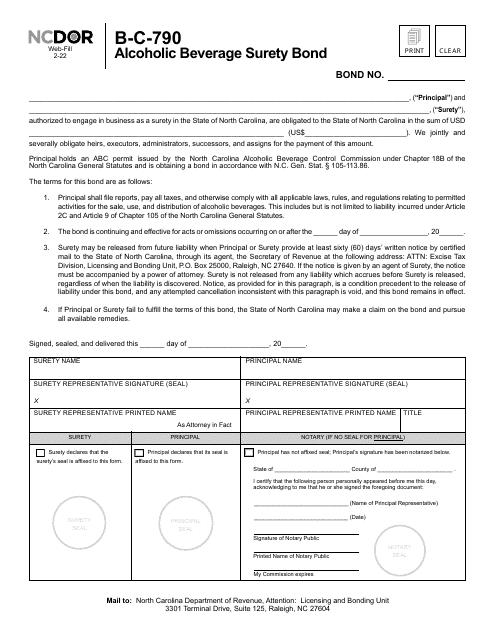

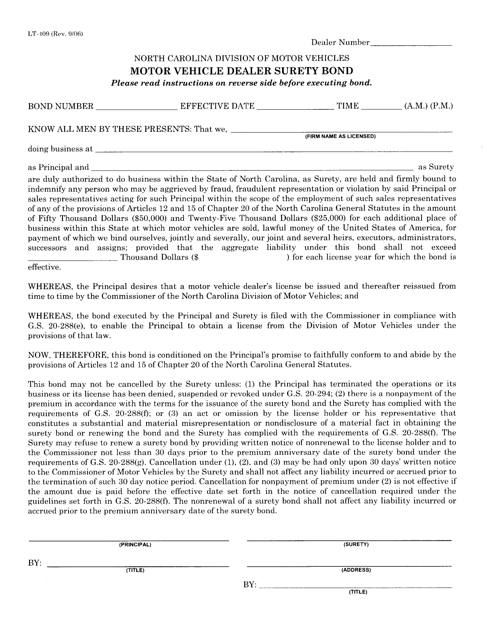

This form is used for obtaining a surety bond for motor vehicle dealers in North Carolina.

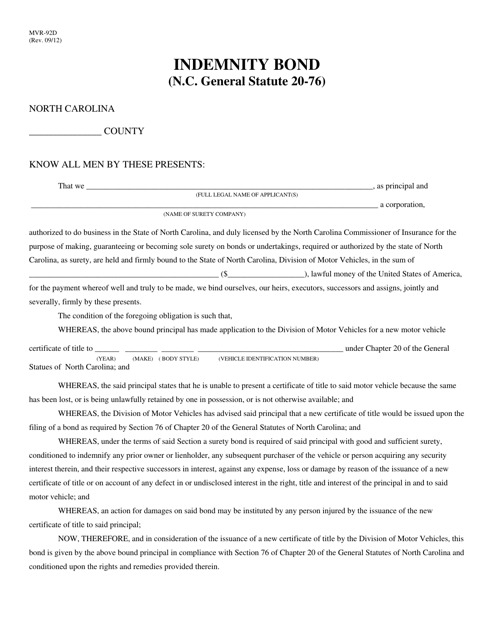

This form is used for an Indemnity Bond, as required by North Carolina General Statute 20-76.

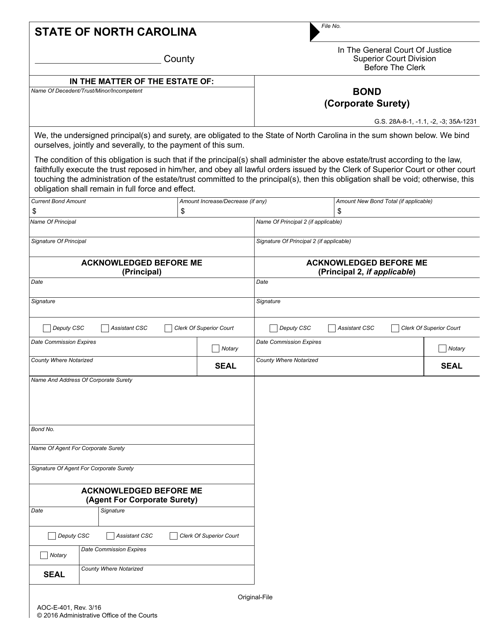

This form is used for posting a bond in North Carolina using either a corporate surety or personal sureties.

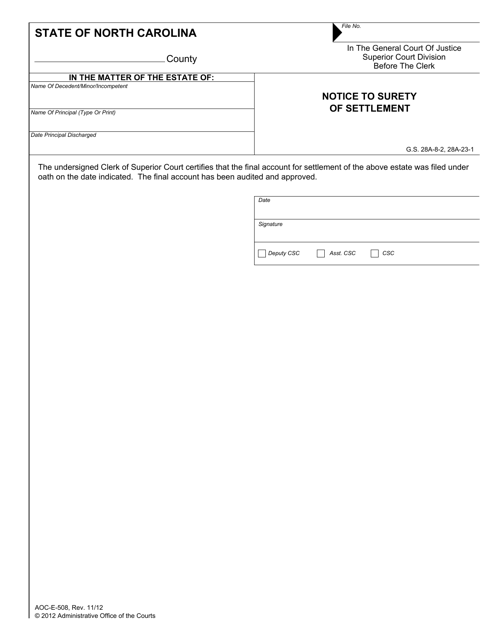

This Form is used for notifying the surety of a settlement in North Carolina.

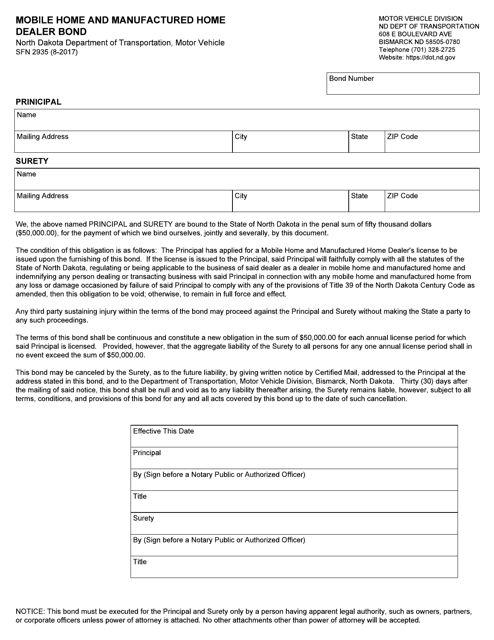

This form is used for obtaining a mobile home and manufactured home dealer bond in North Dakota. It is required for individuals or businesses who deal in the sale or distribution of mobile homes and manufactured homes in the state.

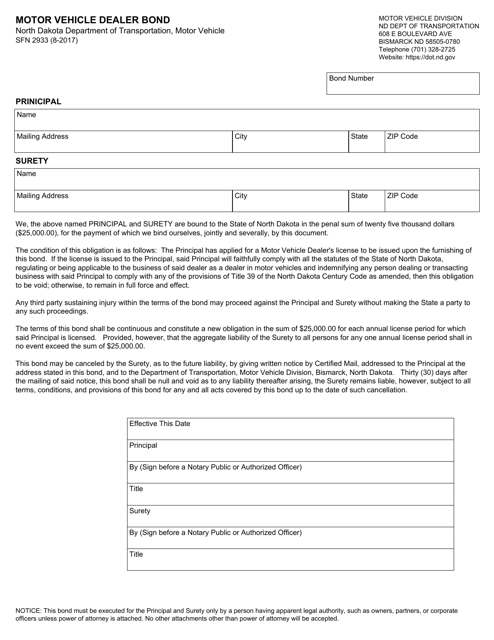

This Form is used for obtaining a motor vehicle dealer bond in North Dakota.

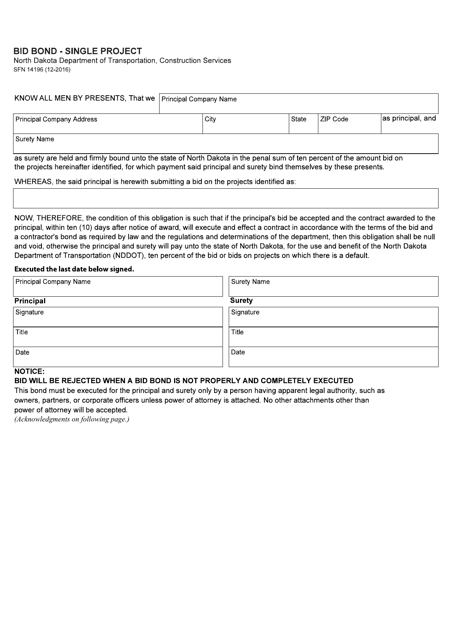

This form is used for submitting a bid bond for a single project in North Dakota.

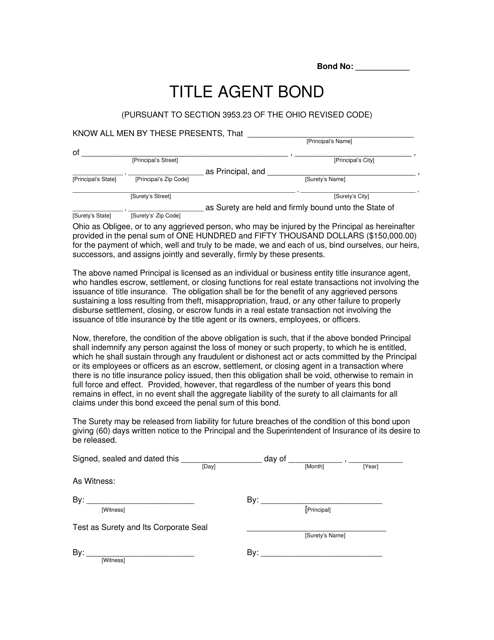

This document is used for obtaining an agent bond in the state of Ohio.

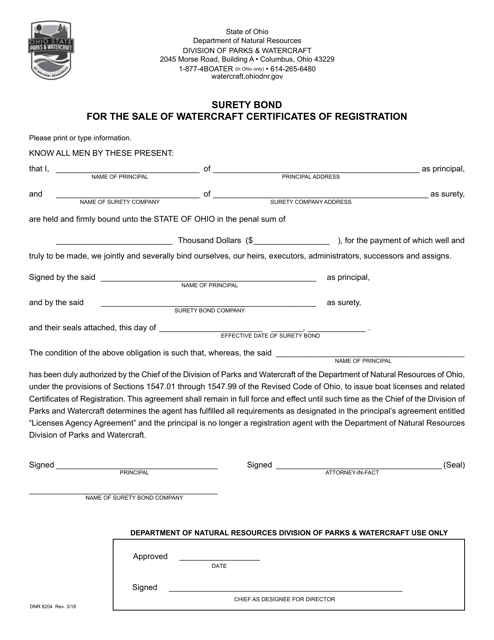

This document is used for obtaining a surety bond for the sale of watercraft certificates of registration in Ohio.

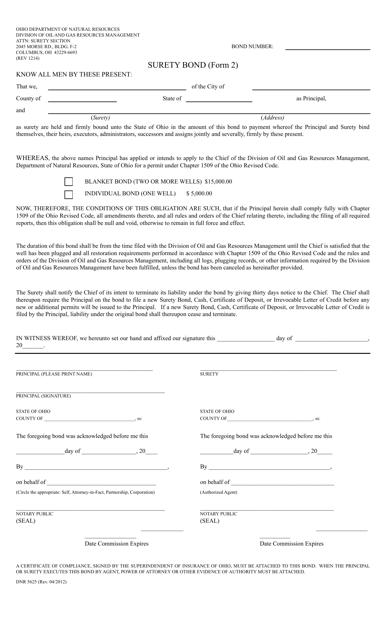

This Form is used for obtaining a surety bond in Ohio. It is specifically known as Form DNR5625 (2). A surety bond is a type of financial guarantee that ensures that certain obligations will be fulfilled.

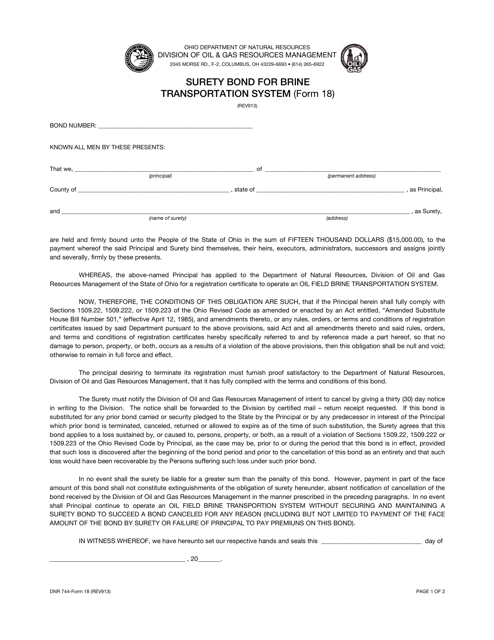

This form is used for obtaining a surety bond for a brine transportation system in Ohio.

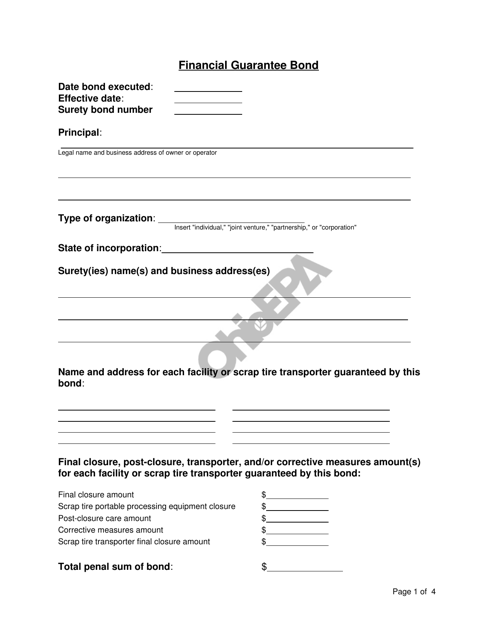

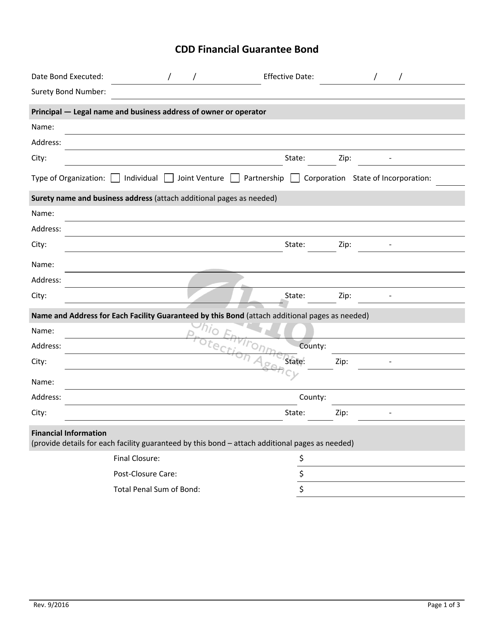

This document is a type of bond used in Ohio to provide a financial guarantee. It ensures that a specified amount of money will be available to cover financial obligations or potential damages.

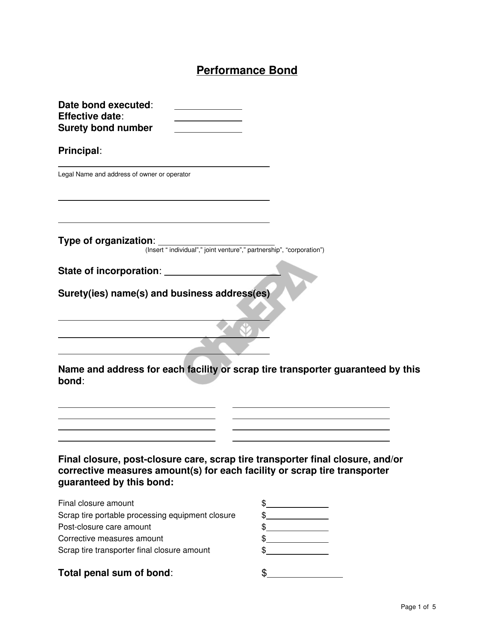

This document serves as a performance bond in the state of Ohio. It guarantees that a contractor will complete a project according to the terms of their agreement.

This Form is used for obtaining a financial guarantee bond in Ohio. It ensures that the bonded party fulfills their financial obligations.

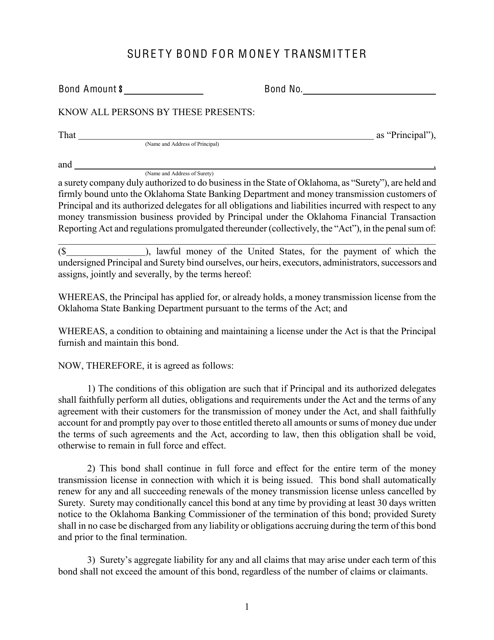

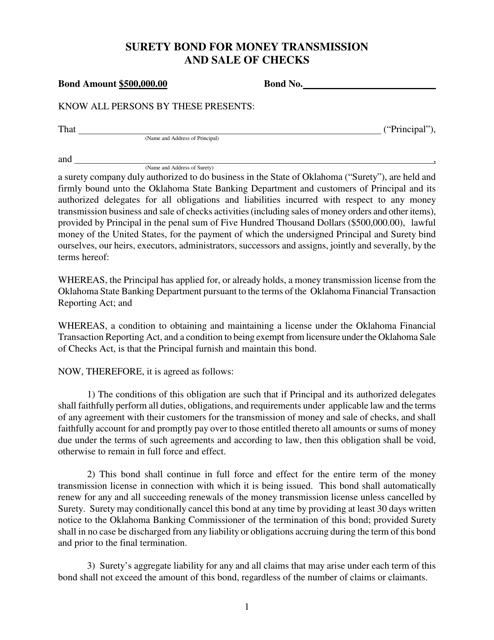

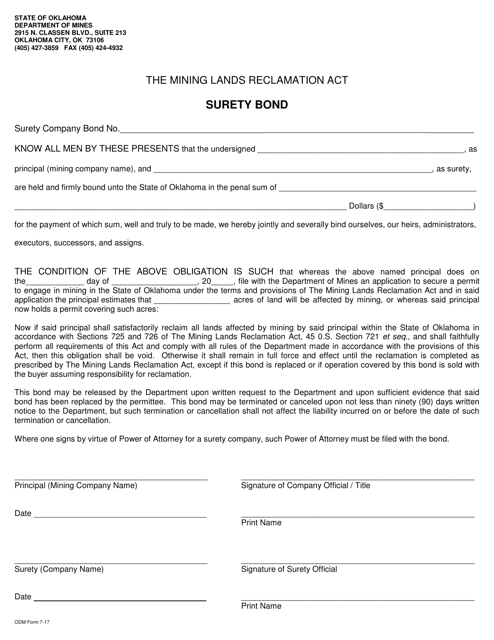

This document is a surety bond required for companies operating as money transmitters in the state of Oklahoma. It serves as a financial guarantee to protect consumers in case the money transmitter fails to fulfill their obligations.

This type of document is a surety bond used for the money transmission and sale of checks in the state of Oklahoma.

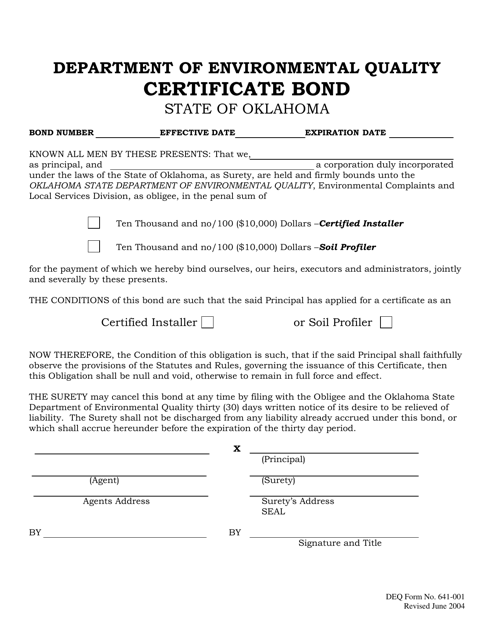

This document is used for obtaining a surety bond in the state of Oklahoma. It ensures that the bonded party will fulfill their legal obligations.

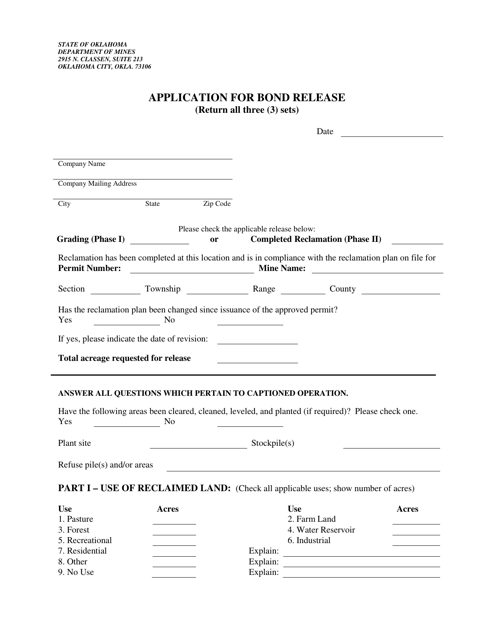

This form is used for requesting the release of a bond in the state of Oklahoma.

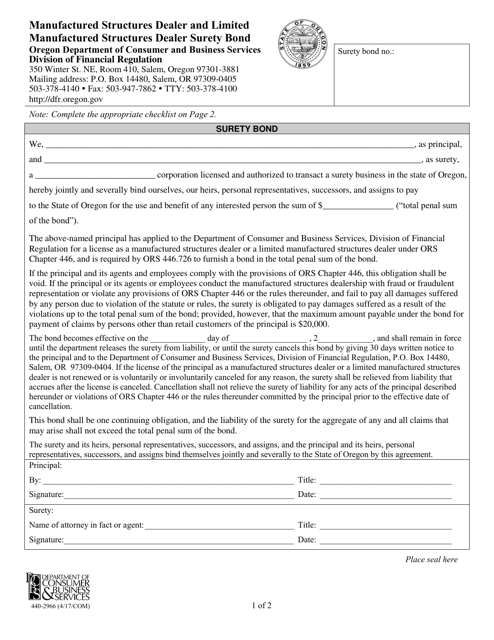

This form is used for obtaining a surety bond for manufactured structures dealers and limited manufactured structures dealers in Oregon.

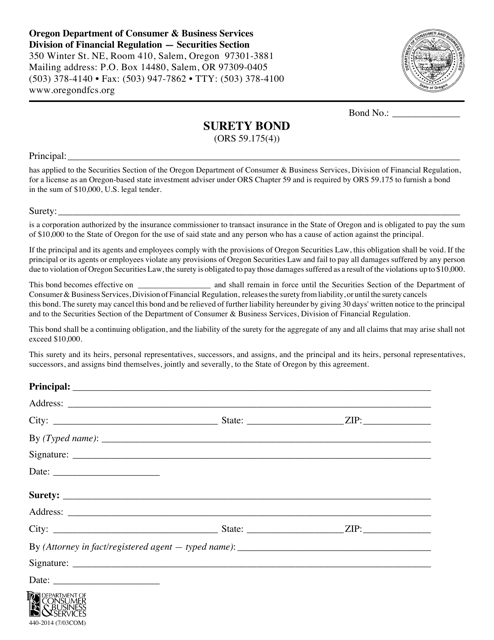

This Form is used for obtaining a surety bond in the state of Oregon.

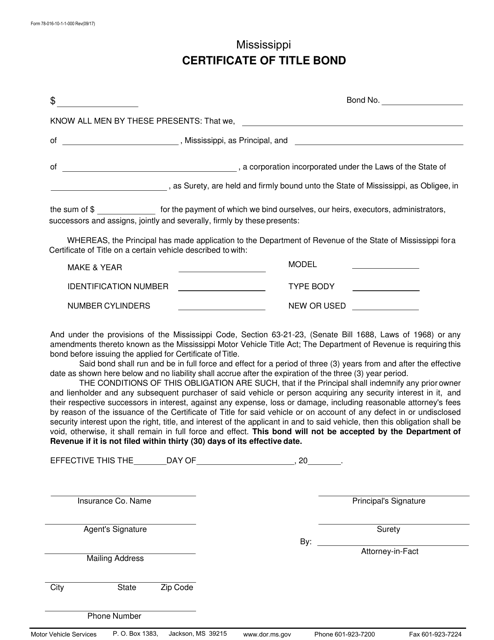

This document is used for obtaining a certificate of title bond in the state of Mississippi.

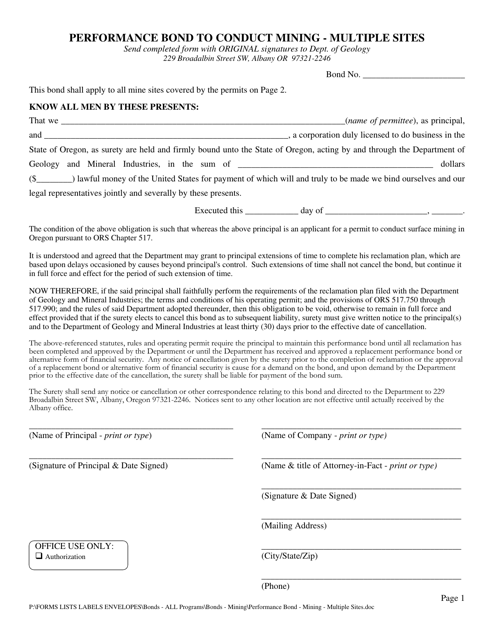

This Form is used for obtaining a performance bond to conduct mining operations at multiple sites in Oregon.

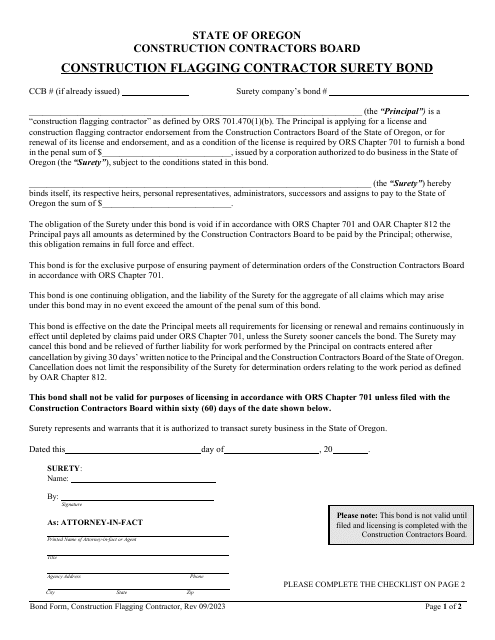

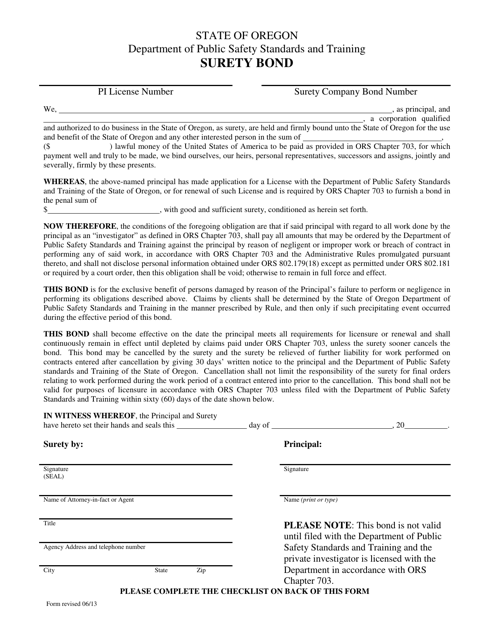

This document is used for obtaining a surety bond in the state of Oregon. A surety bond is a form of financial guarantee that ensures the fulfillment of a specific obligation or responsibility. This form is necessary for individuals or organizations seeking to be bonded in Oregon.

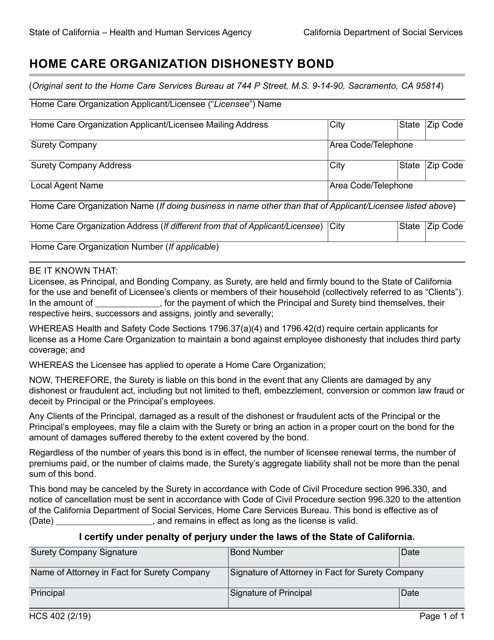

This form is used for obtaining a dishonesty bond for home care organizations operating in California.