Surety Bond Templates

Documents:

823

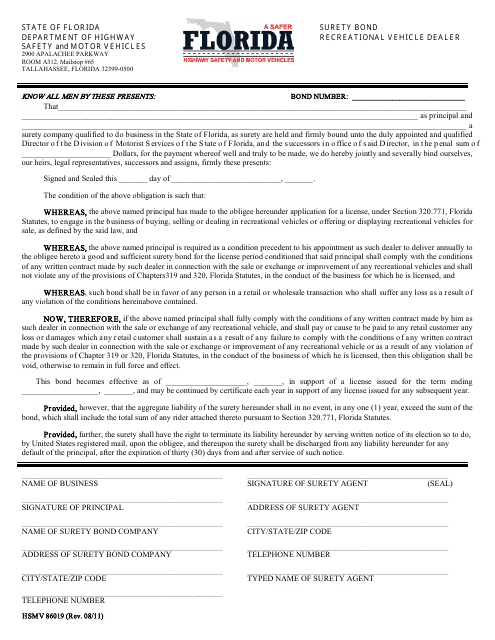

This form is used for obtaining a surety bond for becoming a recreational vehicle dealer in Florida.

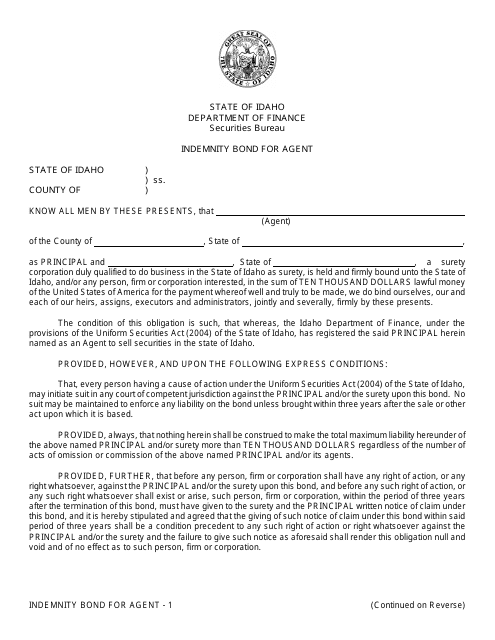

This type of document is used to protect an agent in Idaho from any financial losses or liabilities that may occur while performing their duties. It serves as a legal agreement between the agent and the entity they are representing.

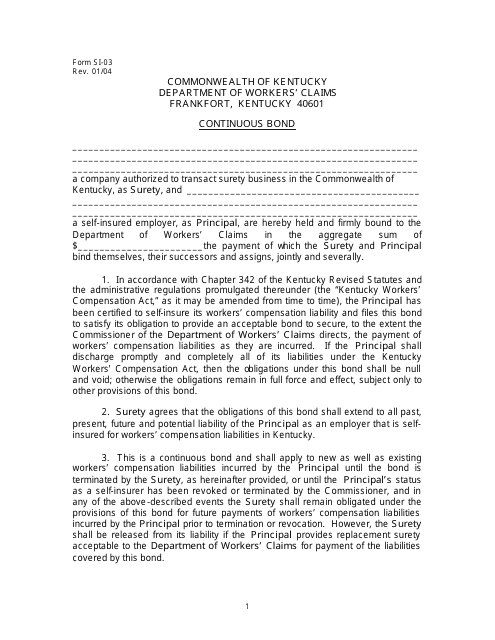

This Form is used for applying for a continuous bond in the state of Kentucky. It is required for businesses that engage in certain activities like importing or exporting goods. The bond acts as a guarantee for compliance with relevant laws and regulations.

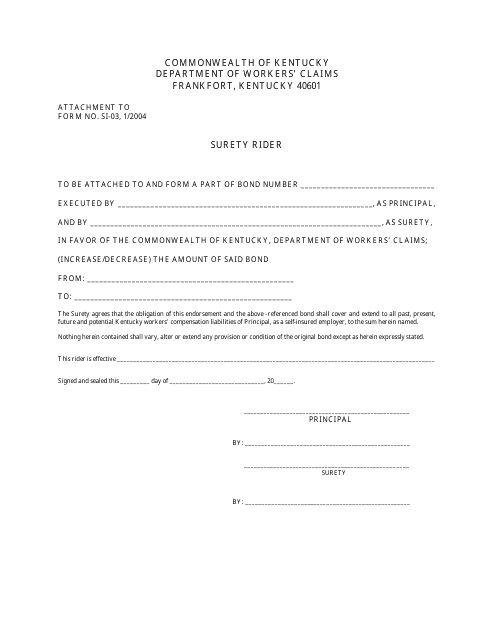

This form is used for adding a surety rider to a contract or agreement in the state of Kentucky. It provides additional security for a party involved in the contract.

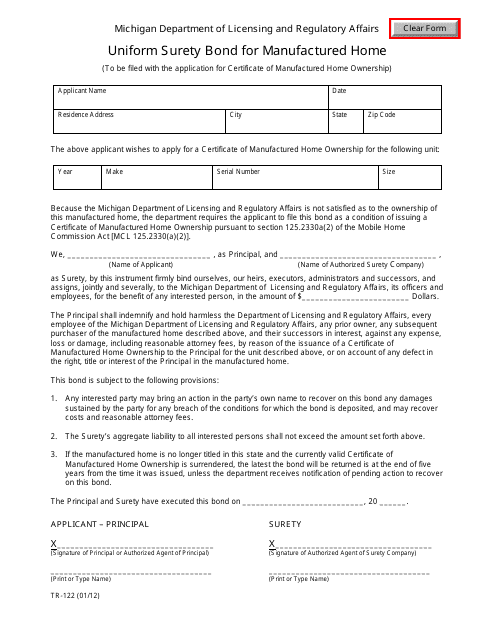

This form is used for obtaining a surety bond for a manufactured home in the state of Michigan. It ensures that the manufacturer meets the necessary requirements and provides protection for the buyer.

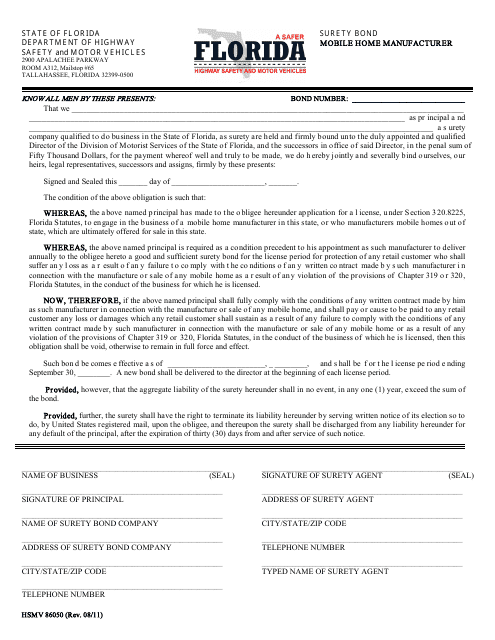

This form is used for obtaining a surety bond as a mobile home manufacturer in the state of Florida.

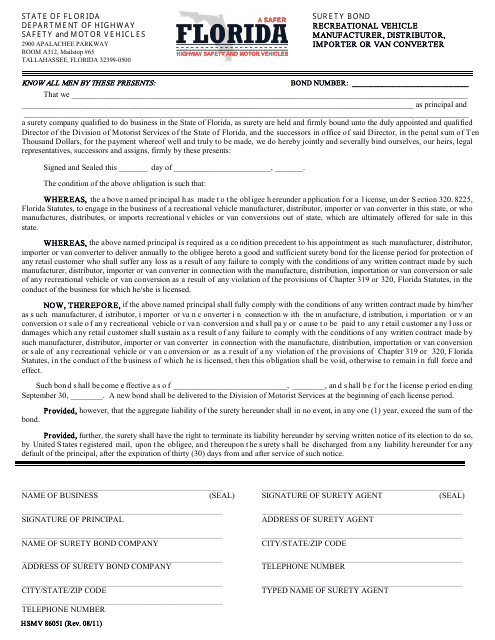

This form is used for obtaining a surety bond for recreational vehicle manufacturers, distributors, importers, or van converters in the state of Florida. The bond serves as a financial guarantee to protect consumers in case the manufacturer or distributor fails to fulfill their obligations.

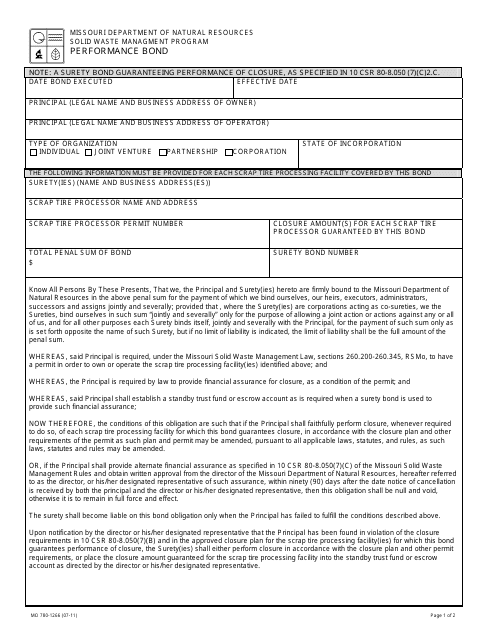

This type of document is a Performance Bond form used in Missouri. It is used to provide assurance that a contractor will complete a project according to the agreed-upon terms and specifications.

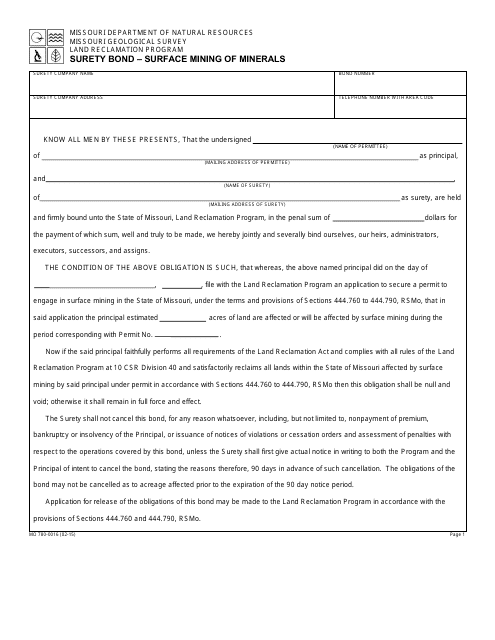

This Form is used for obtaining a Surety Bond for surface mining of minerals in the state of Missouri. It is required by the Missouri Department of Natural Resources to ensure compliance with mining regulations and to protect the environment.

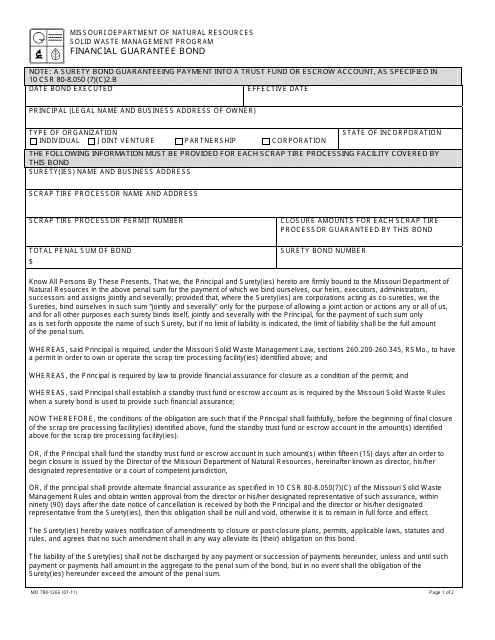

This form is used for obtaining a financial guarantee bond in the state of Missouri.

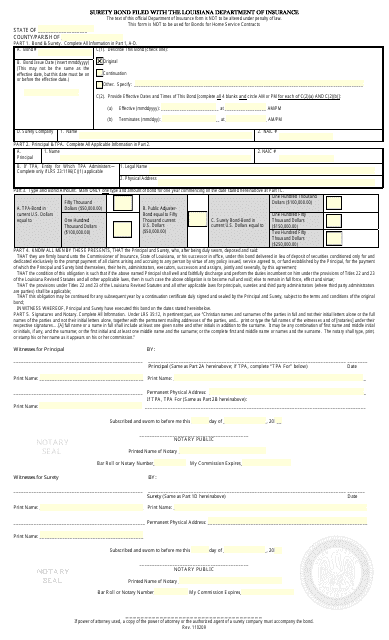

This type of document, called a Surety Bond, is used in the state of Louisiana. It is a form of guarantee that ensures the completion of a contract or the fulfillment of certain obligations.

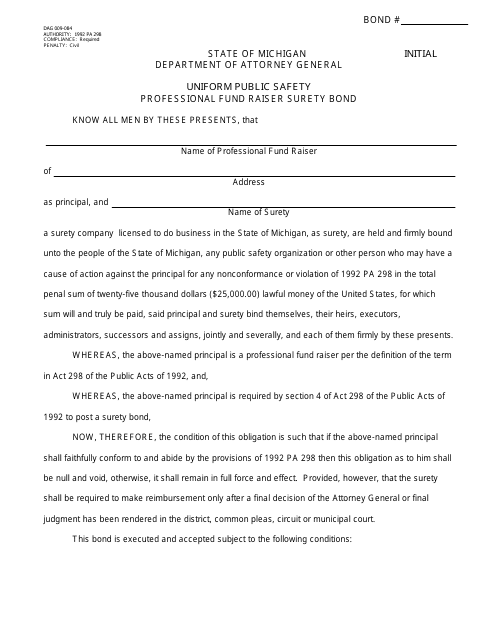

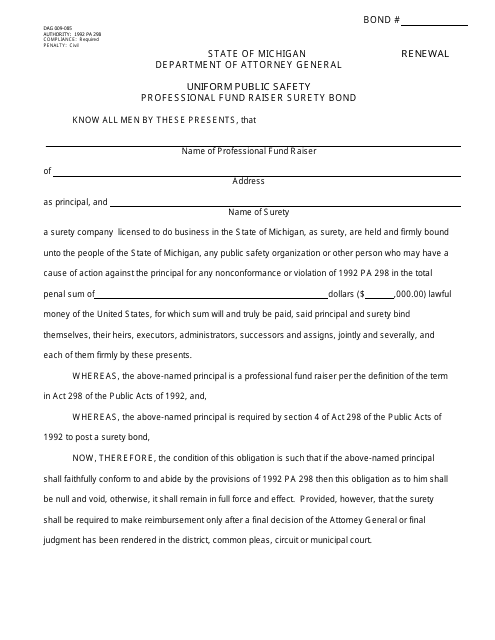

This Form is used for obtaining a surety bond for public safety professional fund raisers in Michigan.

This form is used for renewing the Uniform Public Safety Professional Fund Raiser Surety Bond in Michigan.

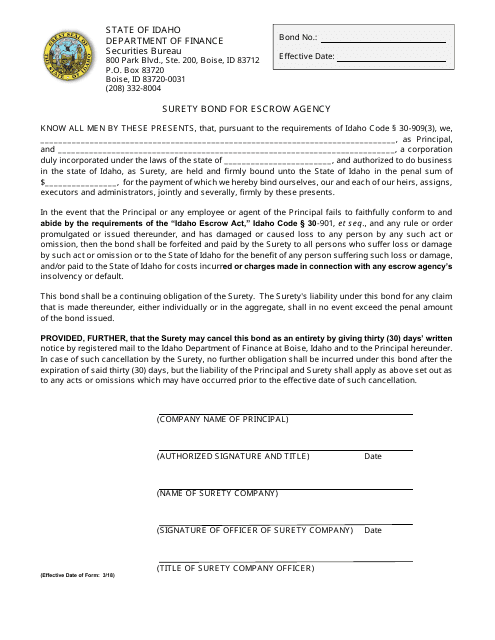

This document is used for obtaining a surety bond for an escrow agency located in Idaho. It is a type of insurance that protects clients in the event of financial loss or misconduct by the escrow agency.

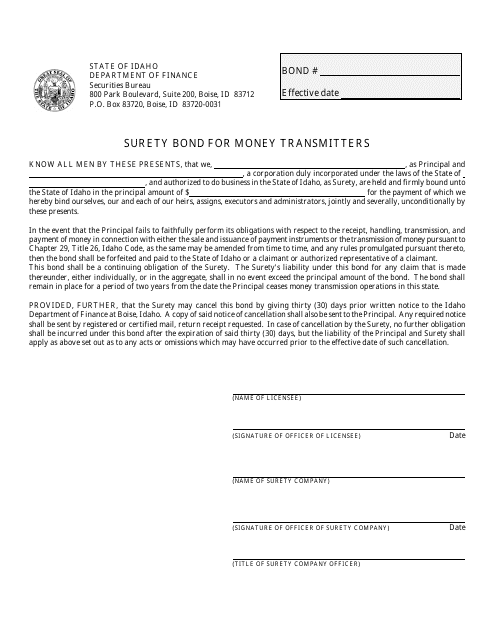

This document is a surety bond required for money transmitters operating in the state of Idaho. It is a type of financial guarantee that ensures the transmitters will comply with state laws and regulations regarding the handling of money.

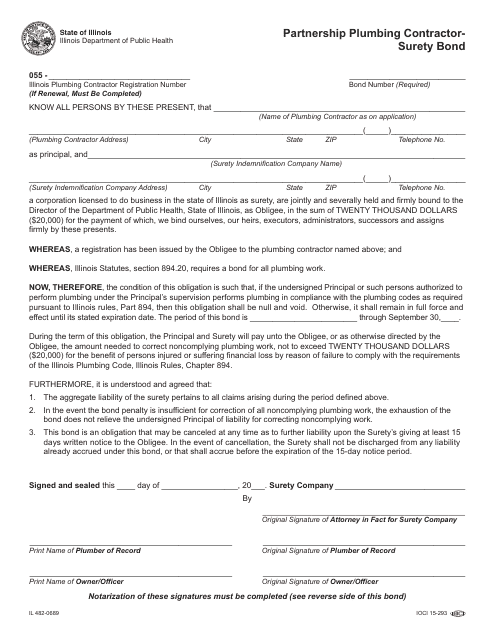

This Form is used for obtaining a surety bond for a partnership plumbing contractor in the state of Illinois.

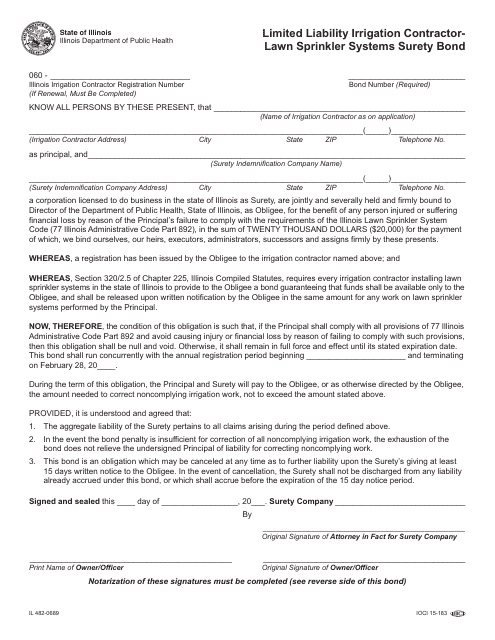

This type of document is a Surety Bond form that is used by Limited Liability Irrigation Contractors in Illinois who specialize in installing lawn sprinkler systems. The form serves as a guarantee to protect customers in case the contractor fails to fulfill their obligations.

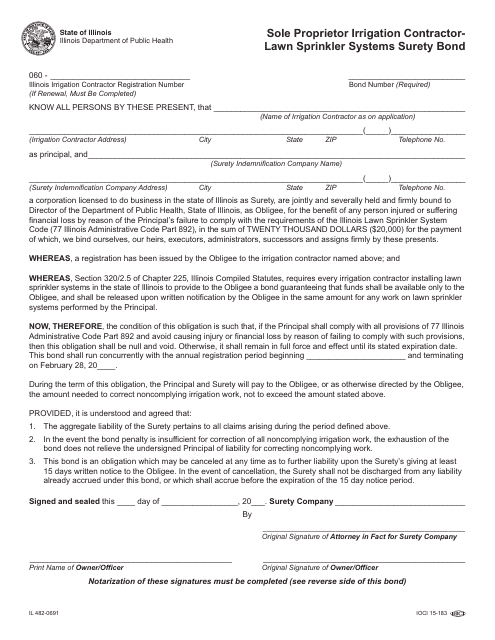

This form is used for applying for a surety bond for individuals operating as a sole proprietor irrigation contractor who install lawn sprinkler systems in Illinois.

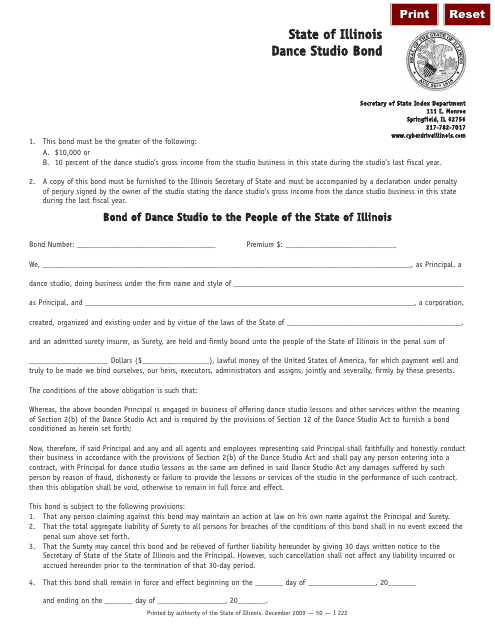

This form is used for a dance studio in Illinois to obtain a bond. The bond ensures that the dance studio will comply with state regulations and fulfill its financial obligations.

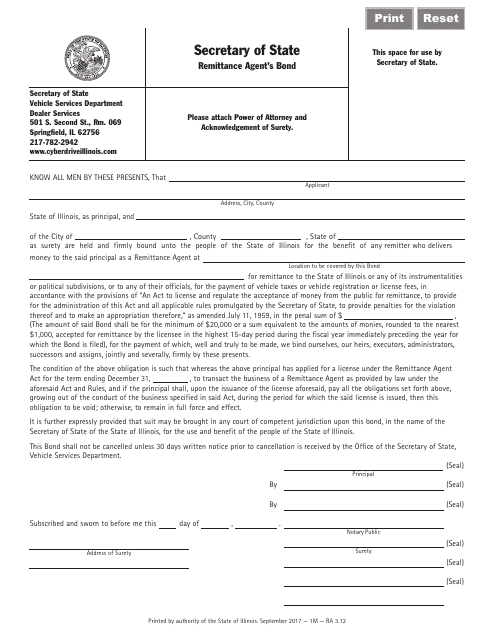

This form is used for obtaining a Remittance Agent's Bond in the state of Illinois.

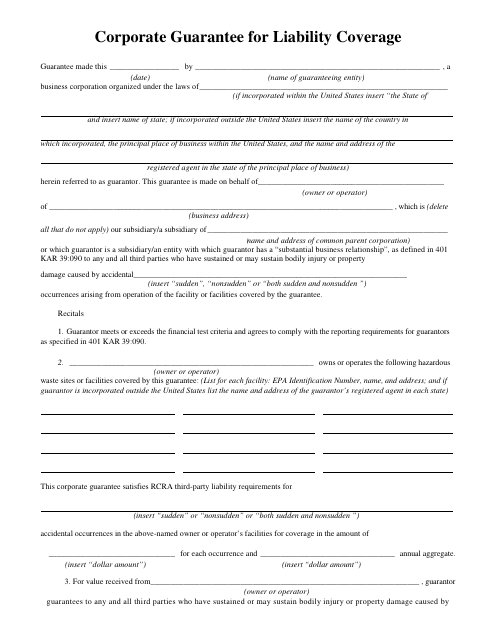

This form is used for providing a corporate guarantee for liability coverage in the state of Kentucky. It ensures that a corporation will cover any liabilities that may arise.

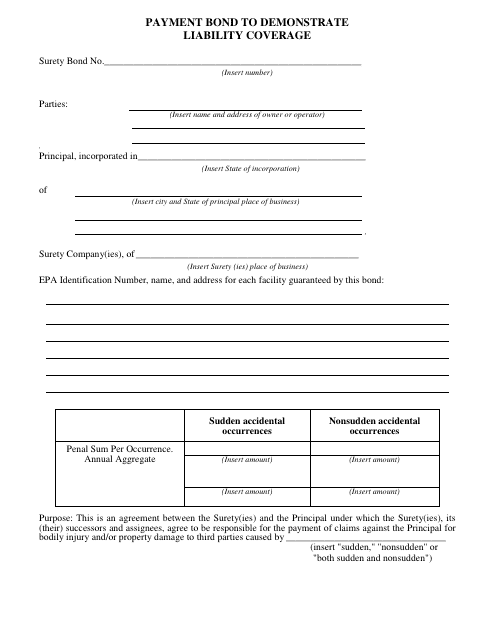

This form is used for submitting a payment bond to demonstrate liability coverage in the state of Kentucky. The payment bond ensures that the contractor will pay all workers, subcontractors, and suppliers involved in a construction project.

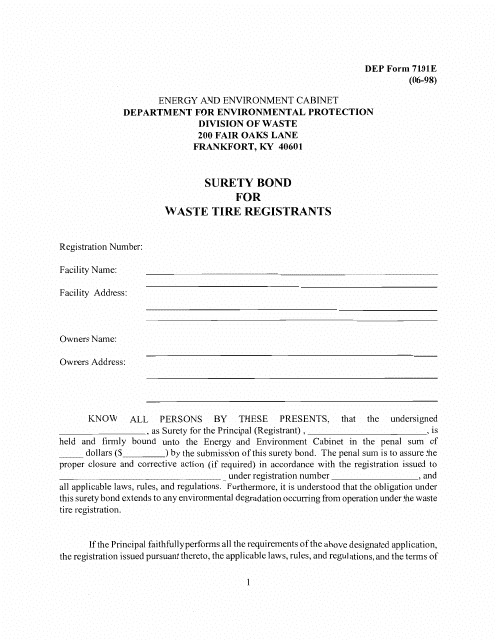

This Form is used for obtaining a Surety Bond for Waste Tire Registrants in the state of Kentucky.

This Form is used for obtaining an individual surety bond in the state of Kentucky.

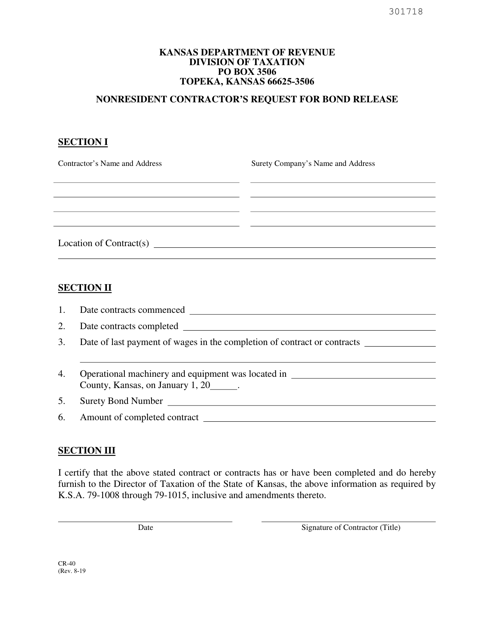

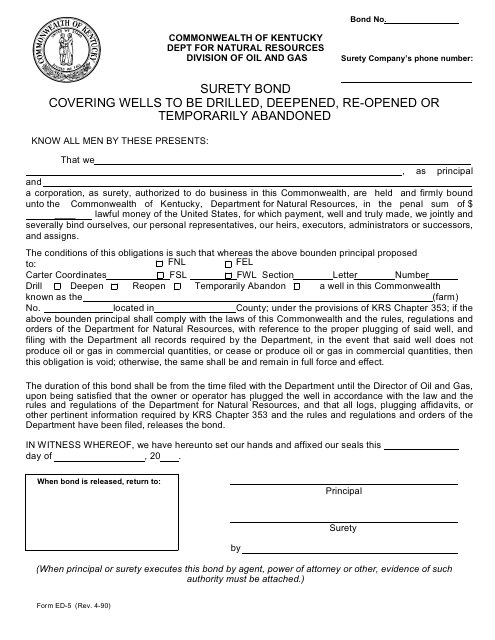

This form is used for requesting the release of a bond in the state of Kentucky. It allows individuals to formally request the return of their bond funds that were previously submitted as a guarantee for certain legal obligations.

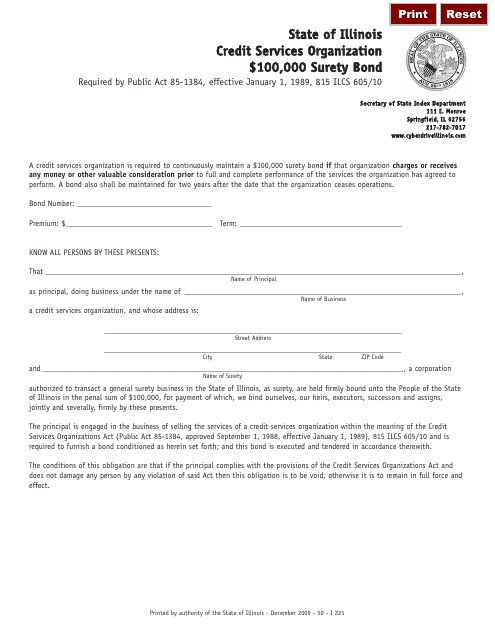

This form is used for obtaining a $100,000 surety bond for a Credit Services Organization operating in Illinois.

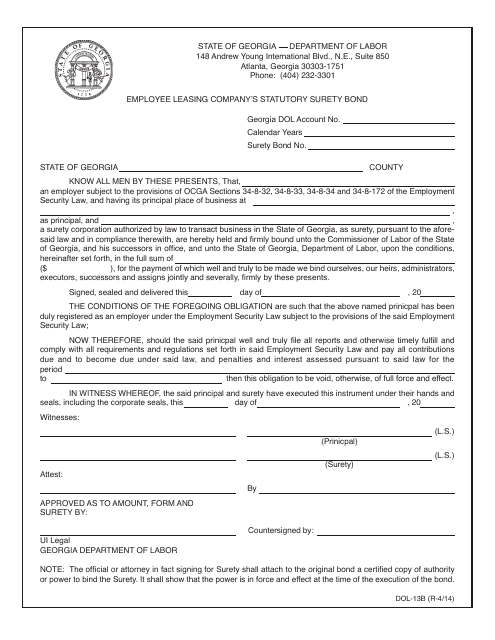

This document is for obtaining a surety bond for employee leasing companies in Georgia. It ensures financial security and protection for employees.

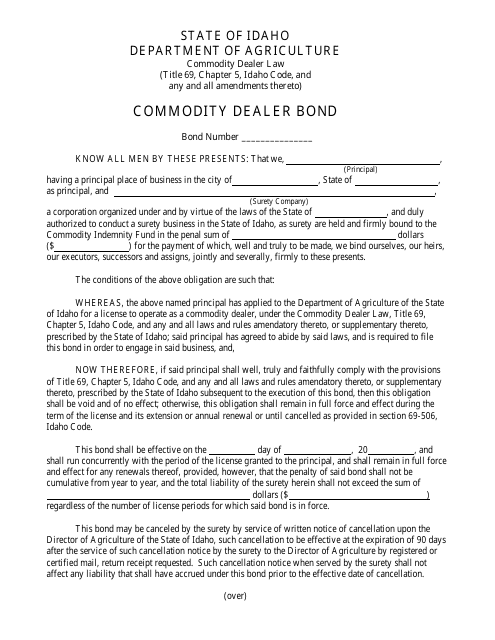

This form is used for obtaining a commodity dealer bond in the state of Idaho.

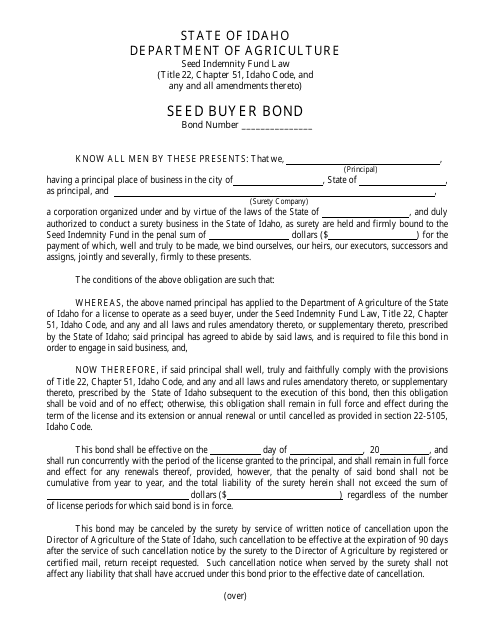

This form is used for obtaining a seed buyer bond in the state of Idaho. It is a requirement for individuals or businesses involved in buying or selling seeds to ensure compliance with state regulations.

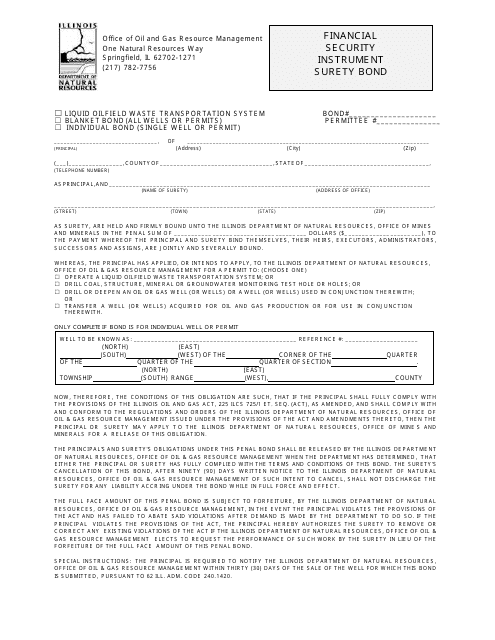

This type of document, called a Financial Security Instrument Surety Bond, is used in the state of Illinois. It provides financial security to guarantee that a party will fulfill their obligations as specified in a contract or agreement.

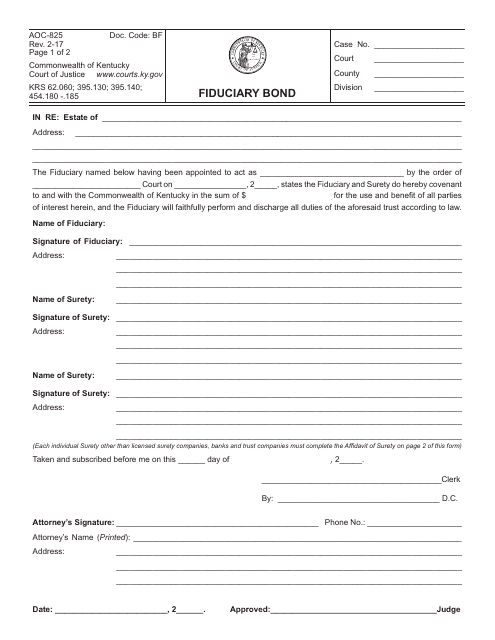

This Form is used for obtaining a fiduciary bond in Kentucky. A fiduciary bond is a type of insurance that protects beneficiaries in case the fiduciary does not fulfill their duties.

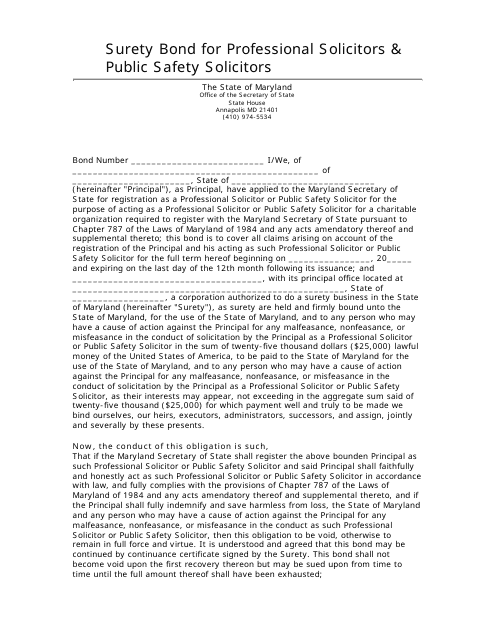

This type of document is a surety bond specifically designed for professional solicitors and public safety solicitors in the state of Maryland. The bond serves as a guarantee that the solicitors will abide by the applicable laws and regulations in their profession.

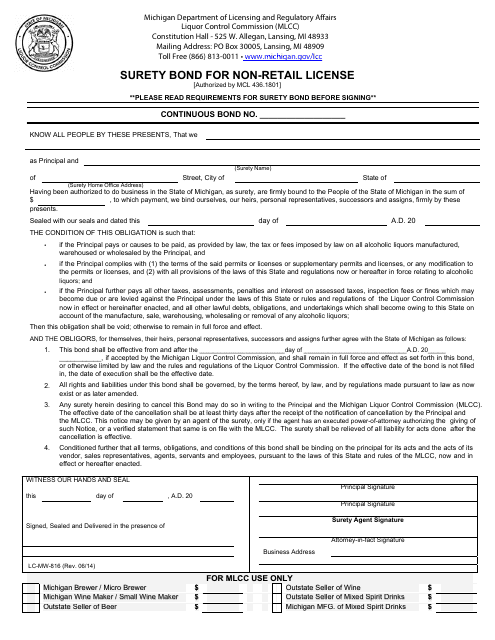

This Form is used for obtaining a surety bond for a non-retail license in the state of Michigan.

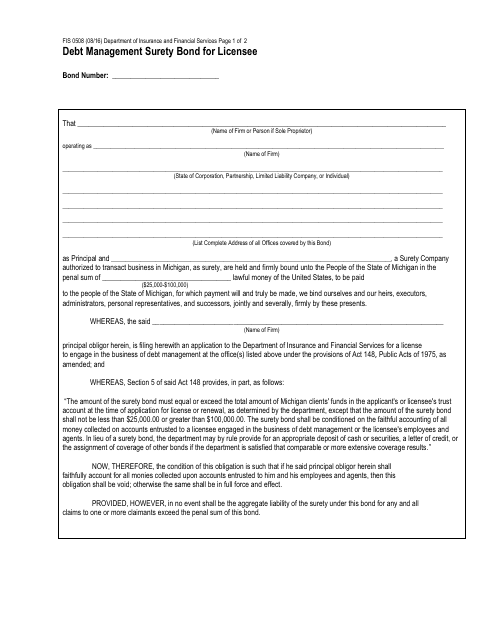

This form is used for obtaining a Debt Management Surety Bond as a licensee in the state of Michigan.

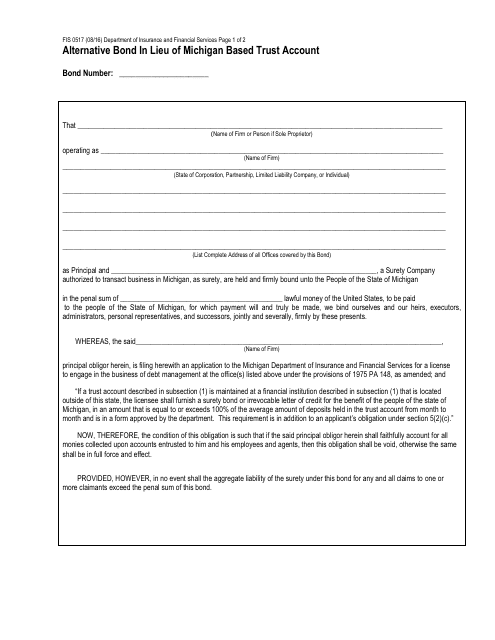

This Form is used for requesting an alternative bond in lieu of a Michigan based trust account in the state of Michigan.

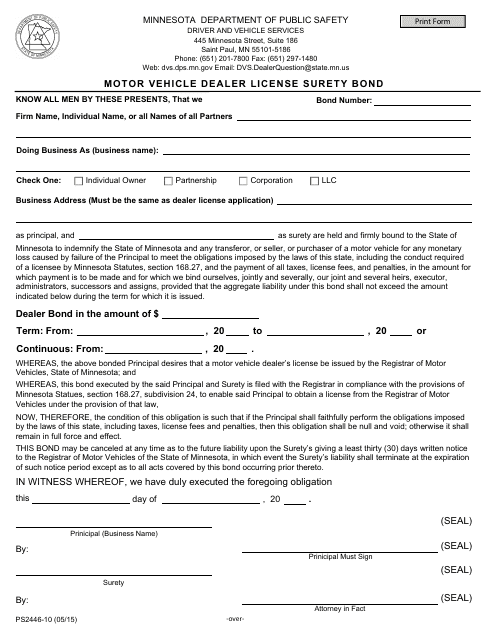

This form is used for applying for a motor vehicle dealer license surety bond in the state of Minnesota. The surety bond is required for individuals or businesses that wish to become licensed motor vehicle dealers in the state. It acts as a guarantee that the dealer will comply with all state laws and regulations related to the sale and trade of motor vehicles.

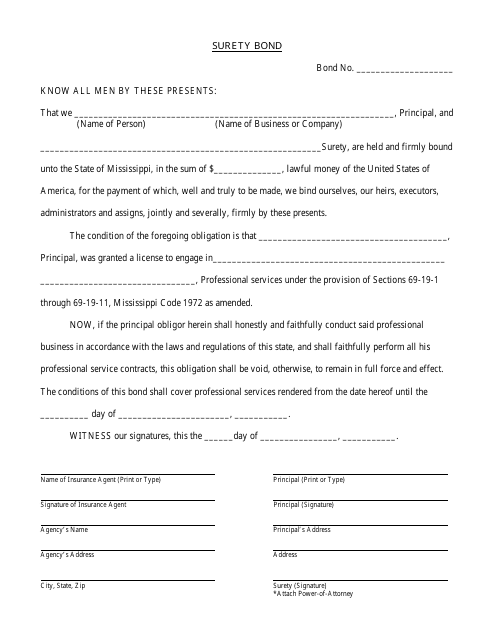

This form is used for applying for a surety bond in Mississippi. A surety bond is a type of insurance that provides financial protection in case of default or non-performance of a contract or legal obligation. This document helps individuals or businesses ensure their obligations are fulfilled and provides peace of mind to clients or customers.