Surety Bond Templates

Documents:

823

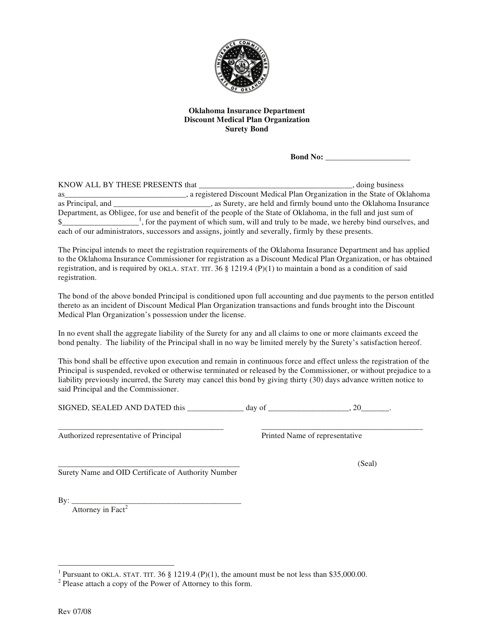

This document is a bond required by the state of Oklahoma for Discount Medical Plan Organizations. It ensures that the organization will fulfill its obligations to members and comply with state regulations.

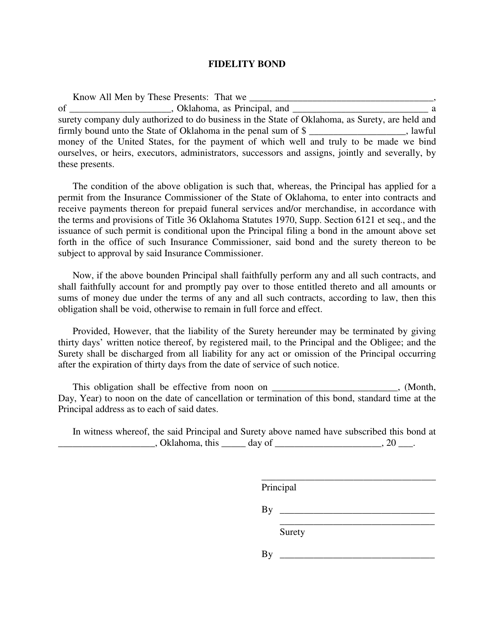

This document is used for obtaining a fidelity bond in the state of Oklahoma. A fidelity bond is a form of insurance that protects businesses against financial losses caused by employee dishonesty or theft.

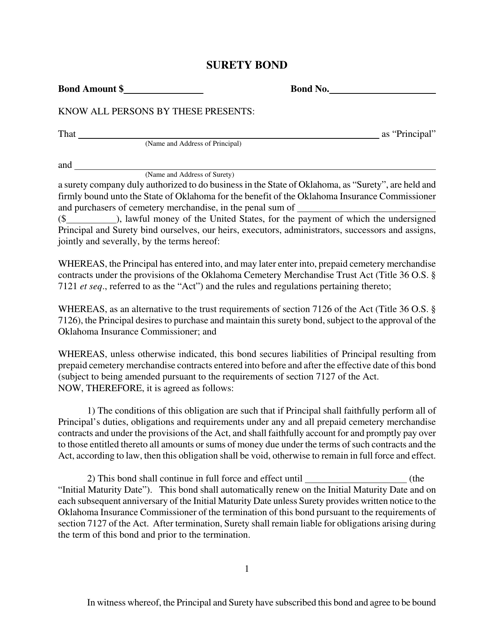

This type of document, known as a Surety Bond, is used in Oklahoma. It is a legal agreement between three parties: the principal, the obligee, and the surety. The surety provides a guarantee that the principal will fulfill their obligations to the obligee. This is commonly used in situations where a license or permit is required, such as construction projects or professional services.

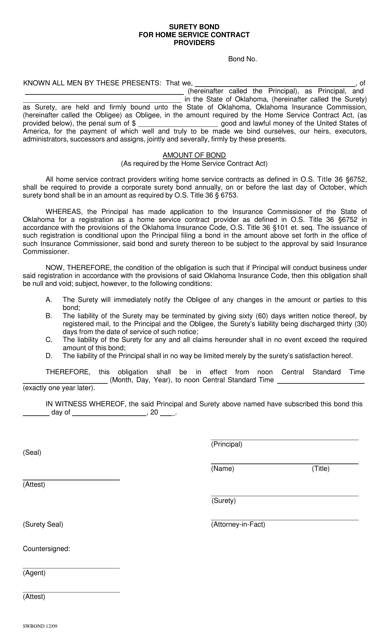

This surety bond is required for home service contract providers in Oklahoma. It serves as a financial guarantee to protect consumers in case the provider fails to fulfill their obligations under the contract.

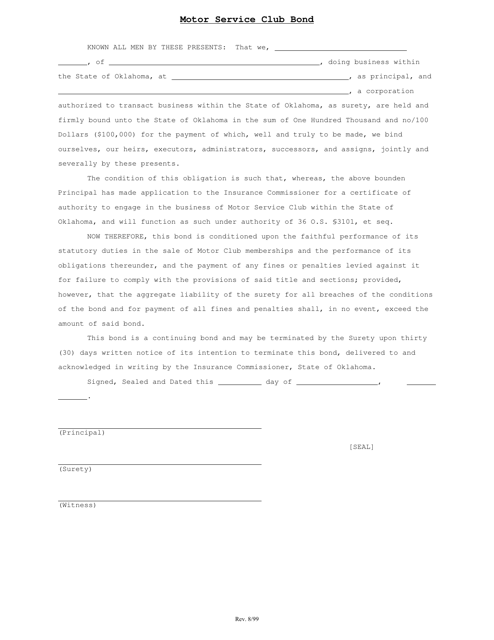

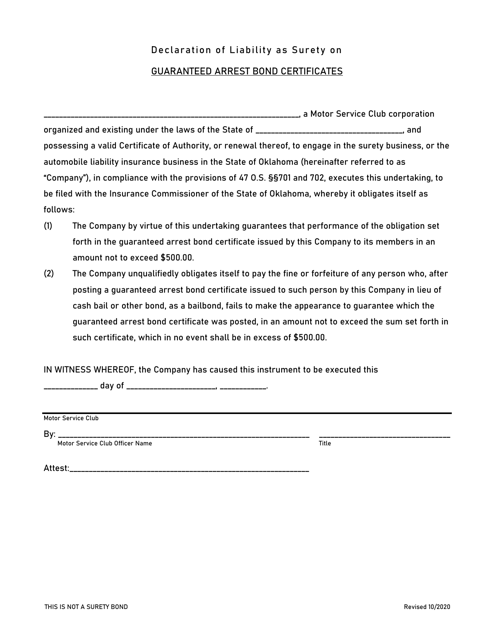

This document is a bond specifically for motor service clubs in the state of Oklahoma. It ensures that these clubs comply with relevant regulations and provide the services they offer to their members.

This document is used for declaring liability as a surety on guaranteed arrest bond certificates in the state of Oklahoma.

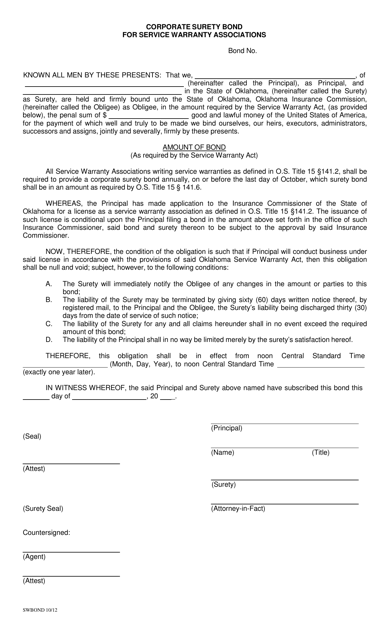

This document is a corporate surety bond required for service warranty associations operating in Oklahoma. It serves as a guarantee that the association will fulfill its contractual obligations to customers.

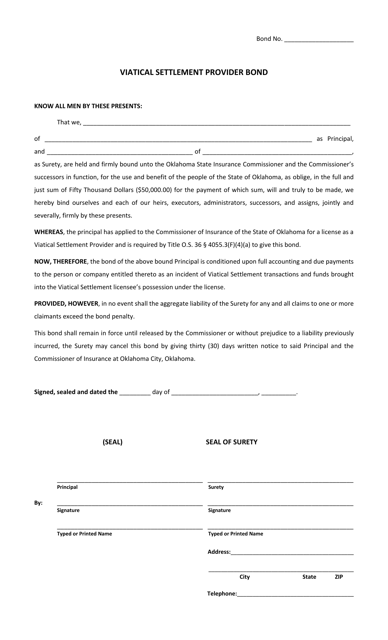

This document is a Viatical Settlement Provider Bond required by the state of Oklahoma. It ensures that viatical settlement providers comply with regulations and protects consumers.

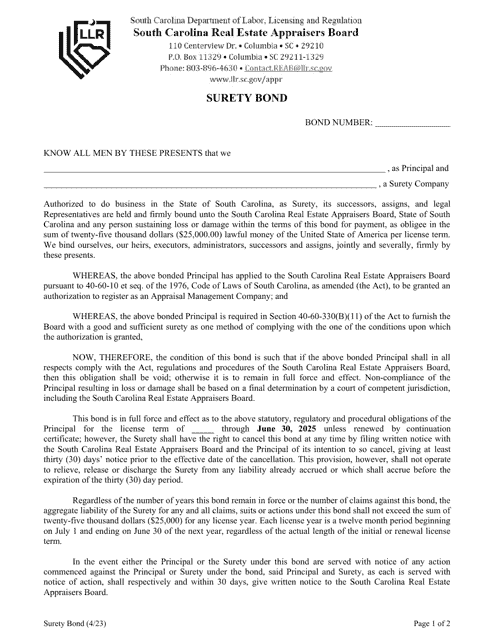

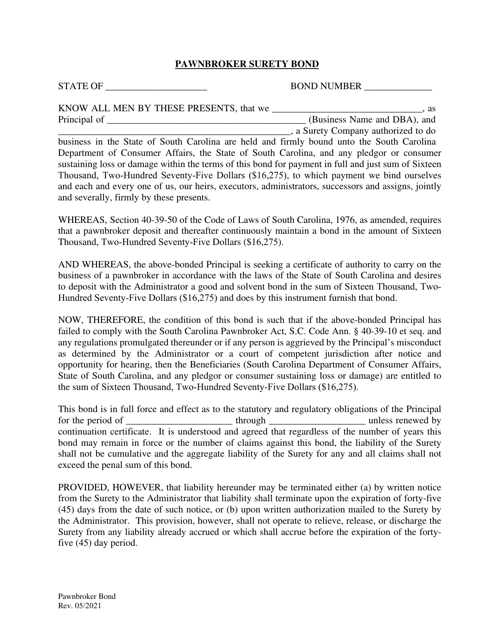

This type of document is a Pawnbroker Surety Bond specific to South Carolina. It is a form used by pawnbrokers in the state to ensure that they meet the legal requirements and financial obligations of their business. The bond serves as a guarantee that the pawnbroker will operate ethically and fulfill their obligations to customers.

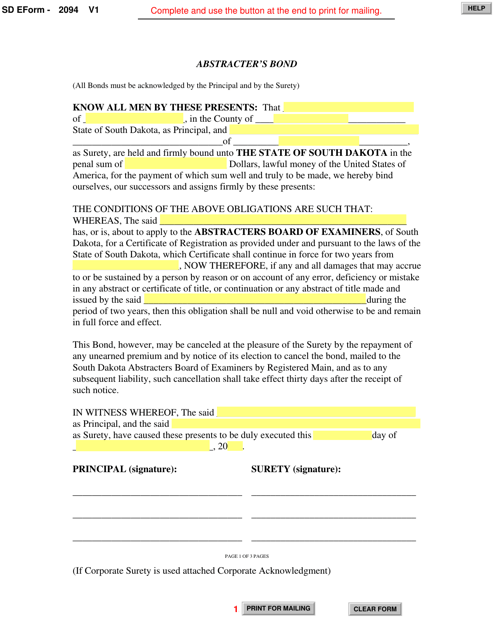

This Form is used for obtaining an Abstracter's Bond in South Dakota for professionals in the real estate industry.

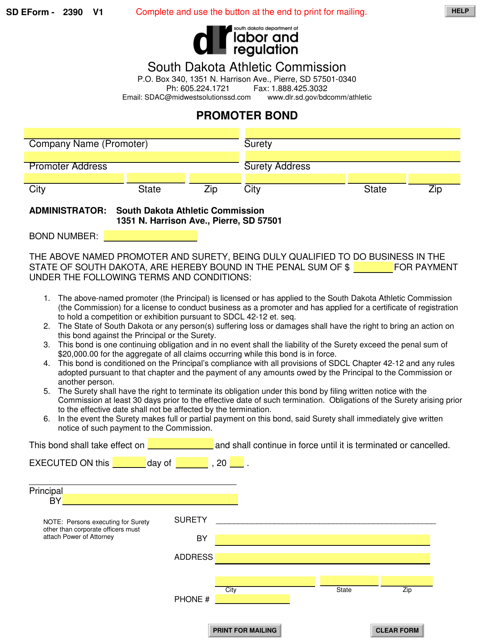

This Form is used for obtaining a promoter bond in South Dakota.

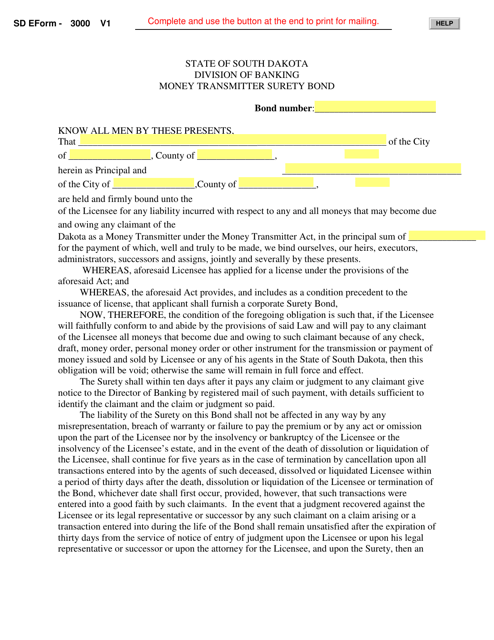

This form is used to apply for a money transmitter surety bond in South Carolina, providing financial protection for consumers against potential losses due to the activities of money transmitters.

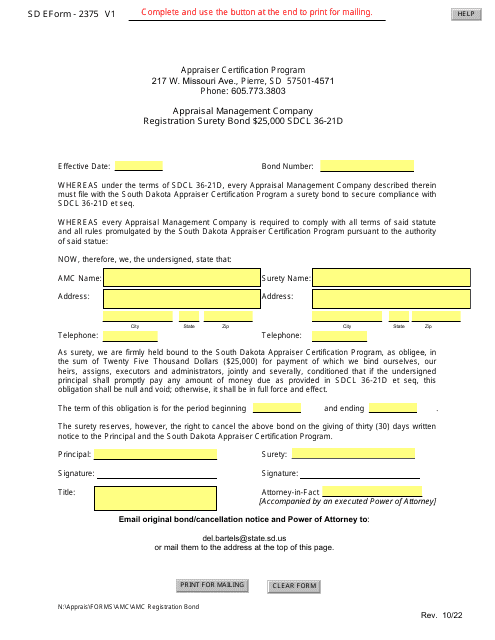

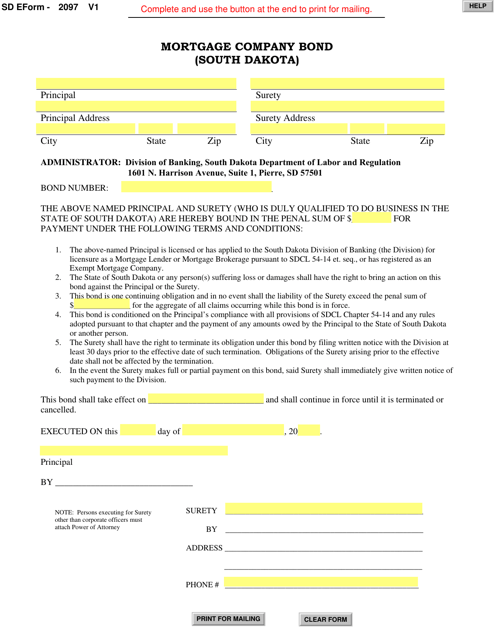

This form is used for obtaining a mortgage company bond in South Dakota.

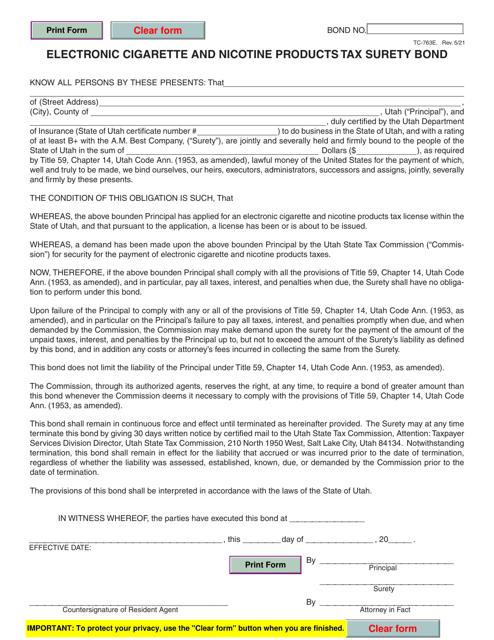

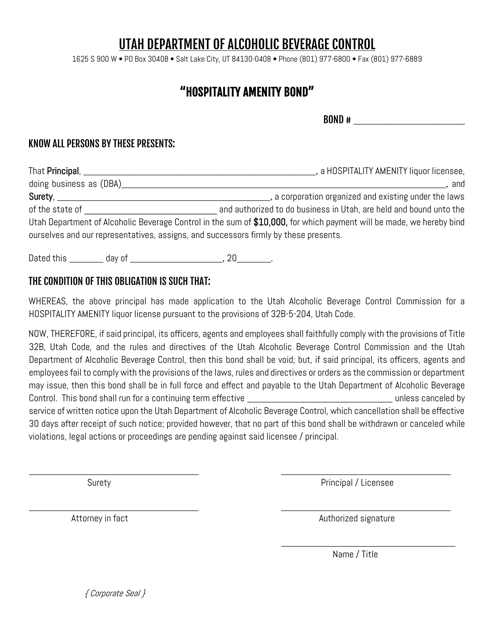

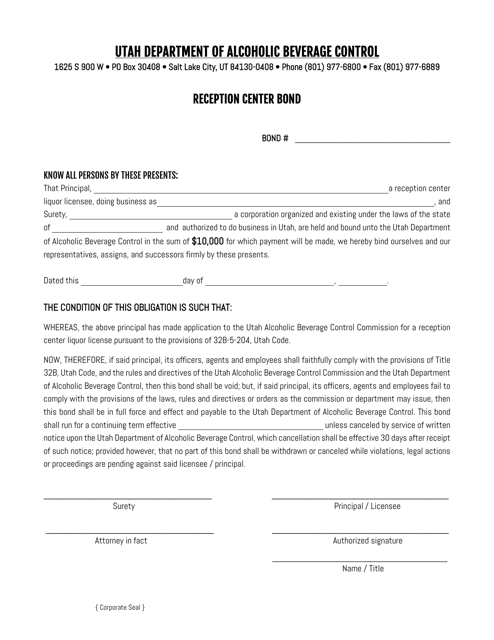

This document is a bond required by the state of Utah for certain businesses in the hospitality industry. It ensures that the business will provide certain amenities and services to guests.

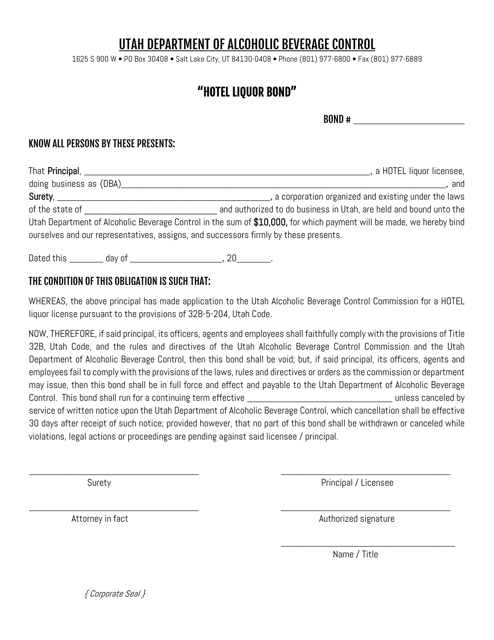

This document is a type of bond required by the state of Utah for hotels that wish to sell and serve liquor to their guests. It serves as a guarantee to the state that the hotel will comply with all liquor laws and regulations.

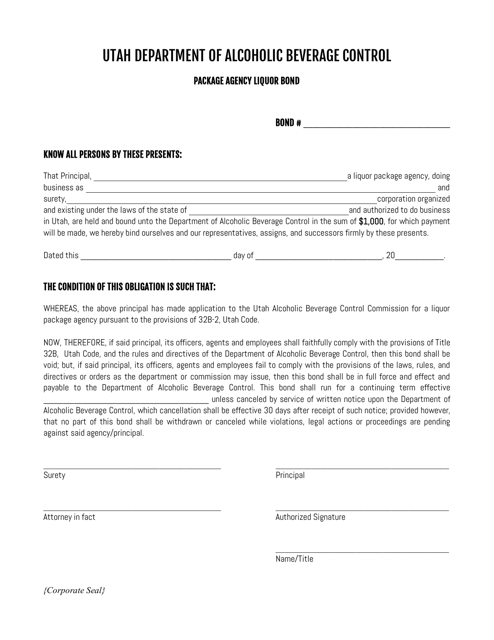

This document is a Package Agency Liquor Bond specific to the state of Utah. It is used by individuals or businesses applying for a license to sell liquor in packages. The bond serves as a financial guarantee to ensure compliance with state regulations and payment of taxes related to the sale of alcohol.

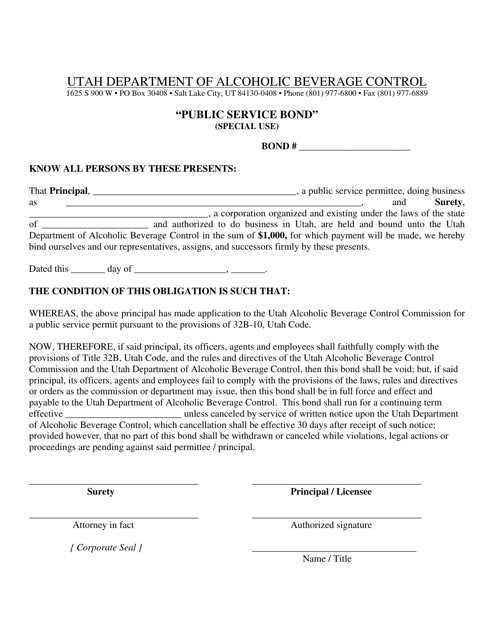

This document is a Public Service Bond specific to the state of Utah. It is used to ensure that individuals holding public service positions fulfill their obligations and responsibilities.

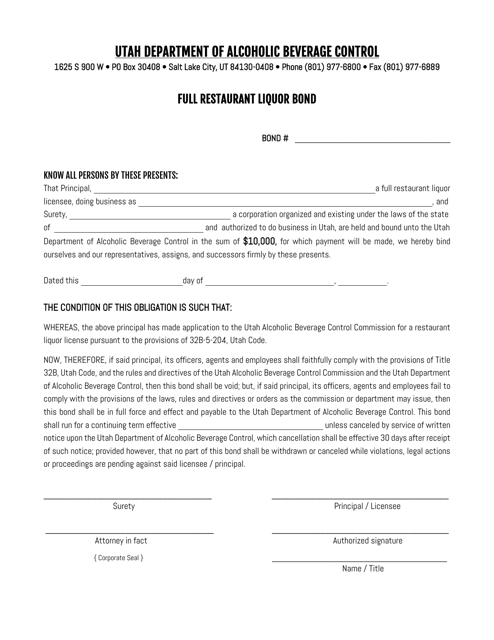

This document is used for obtaining a full restaurant liquor bond in the state of Utah.

This document is a type of surety bond required for well drillers in the state of Utah. It ensures that well drillers adhere to all regulations and meet their financial obligations.

This Form is used for acquiring a surety bond for pump installers in the state of Utah. It is a requirement for pump installers to obtain this bond to ensure compliance with state regulations and protect consumers.

This Form is used for applying for an Automobile Club Surety Bond in the state of Texas.

This document is used for obtaining a commercial facility bond in the state of Texas. It ensures that a business will comply with all legal and financial obligations related to the operation of the facility.

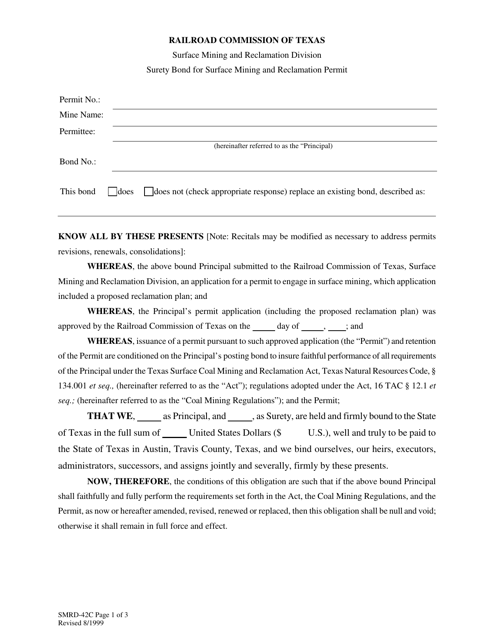

This form is used for obtaining a surety bond for a surface mining and reclamation permit in Texas. The bond serves as a guarantee to cover any potential damages or reclamation costs associated with the mining operation.

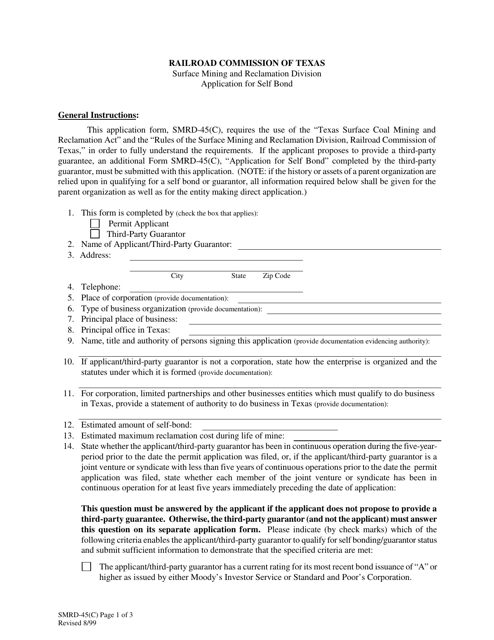

This form is used for applying for a self bond in the state of Texas.

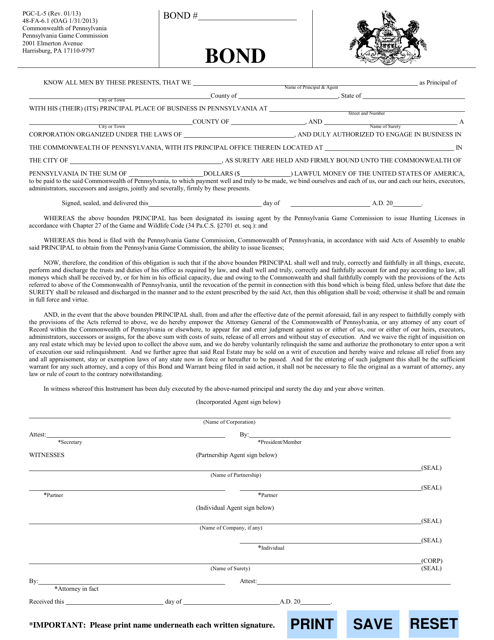

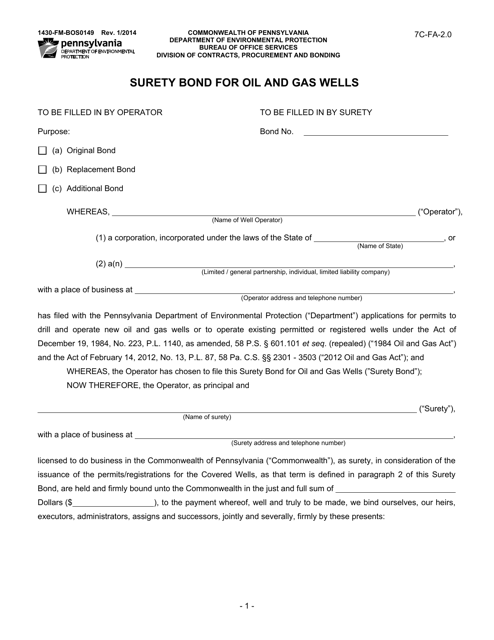

This form is used for obtaining a bond in the state of Pennsylvania.

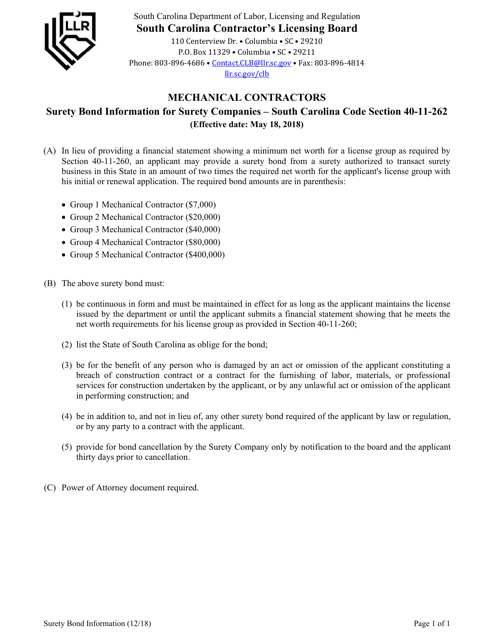

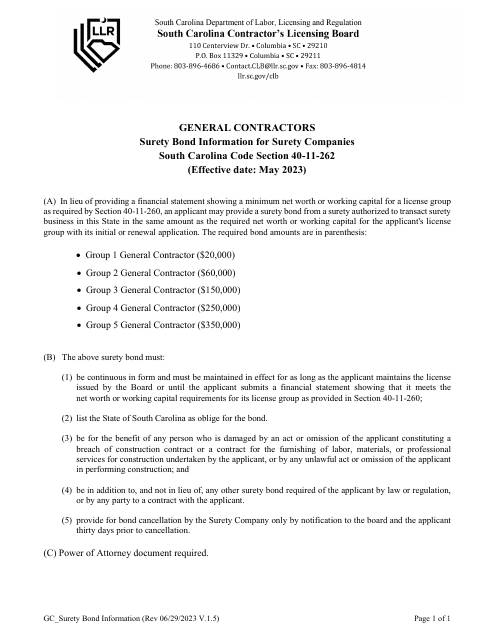

This document is used for filing a claim for a surety bond with the Contractor's Licensing Board in South Carolina. It is a form that contractors can use to request compensation from a surety bond when the terms of a contract are not fulfilled.

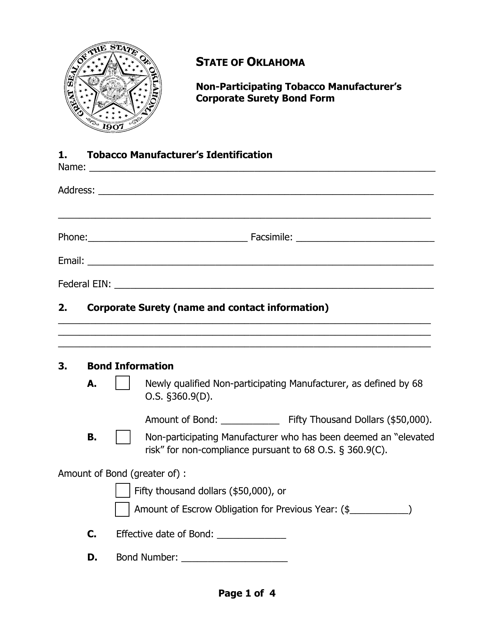

This form is used for non-participating tobacco manufacturers in Oklahoma to obtain a corporate surety bond.

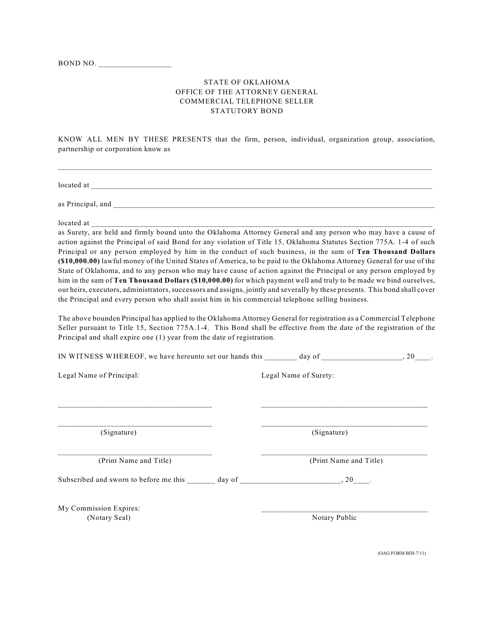

This document is a statutory bond required for commercial telephone sellers operating in Oklahoma. It provides financial protection to consumers in case the seller fails to fulfill its obligations.

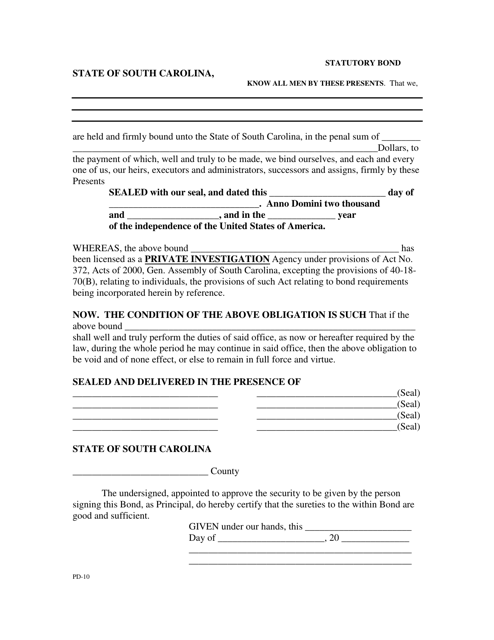

This form is used for obtaining a statutory bond in South Carolina. It is necessary for certain legal matters and ensures financial security for the involved parties.

This form is used for obtaining a surety bond for oil and gas wells in Pennsylvania. It is required to ensure compliance with applicable regulations and safeguard against any potential financial losses.

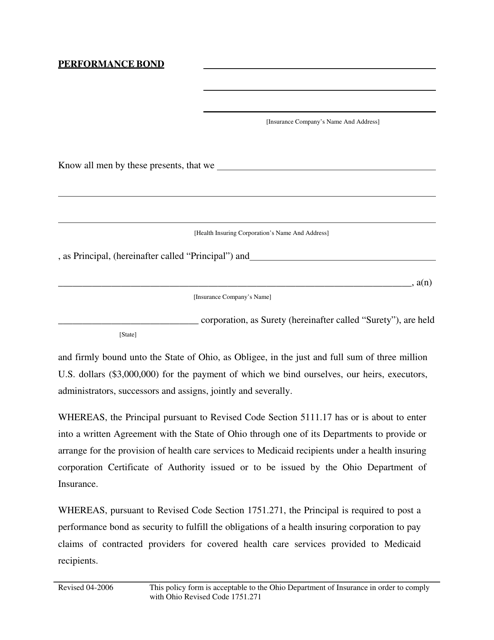

This document is a performance bond specifically for Medicaid HICS (Health Insurance Cost Sharing) in Ohio. A performance bond is a guarantee provided by a surety company that a contractor will fulfill their obligations under a contract. In the context of Medicaid HICS in Ohio, this bond ensures that the contractor performing the services will meet the necessary performance standards.

This document is used for witnessing the signature of the principal and the surety in South Carolina.