Surety Bond Templates

Documents:

823

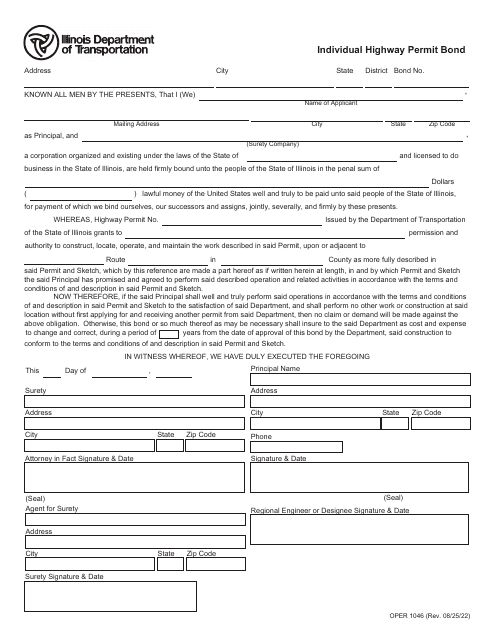

This form is used to secure a bond for mining leases in Osage County.

This Form is used for extending the coverage of a bond to assume liabilities for operations conducted by parties other than the principal. It requires the consent of the surety.

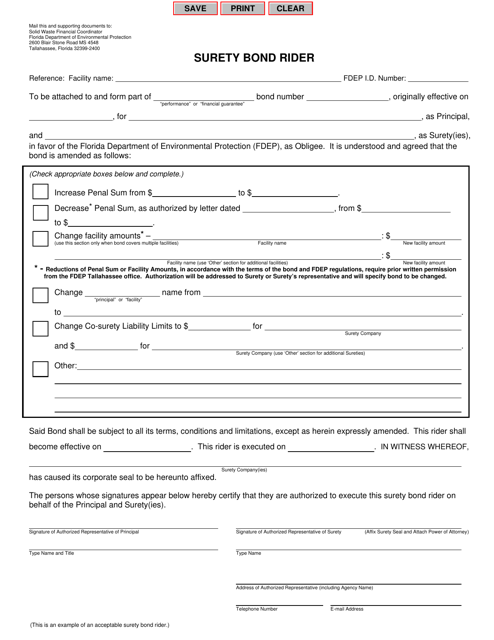

This document is a type of surety bond rider specific to the state of Florida. It is used to modify or add additional terms to an existing surety bond agreement.

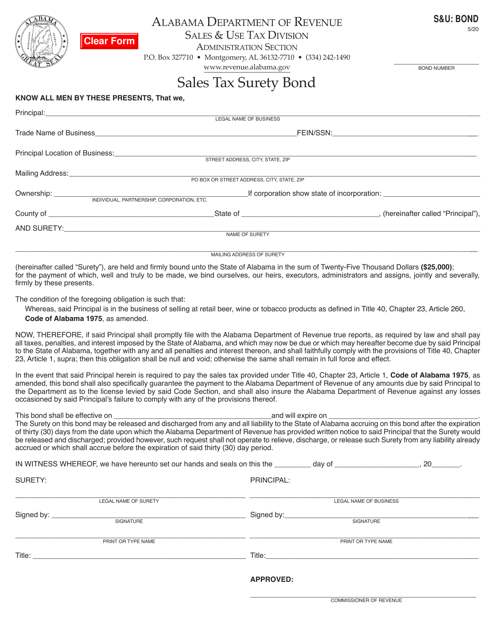

This form is used for obtaining a sales tax surety bond in Alabama.

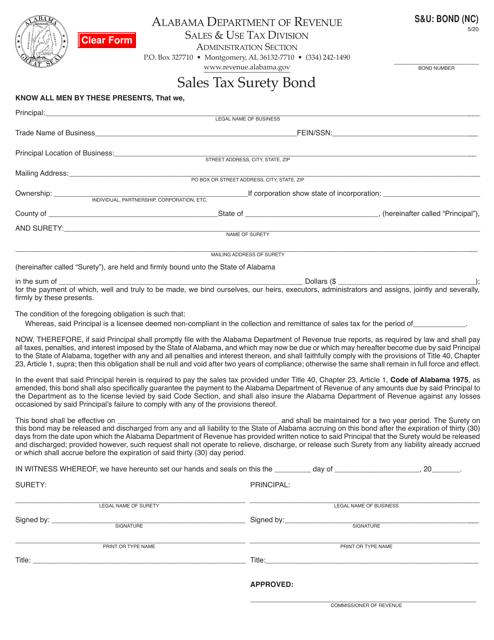

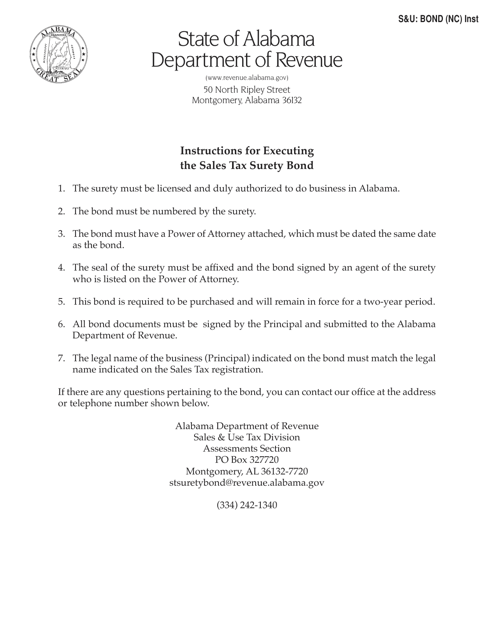

This form is used for obtaining a Sales Tax Surety Bond for non-compliant taxpayers in Alabama.

This Form is used for obtaining a Sales Tax Surety Bond for non-compliant taxpayers in Alabama. The bond is required to ensure payment of sales tax liabilities by businesses.

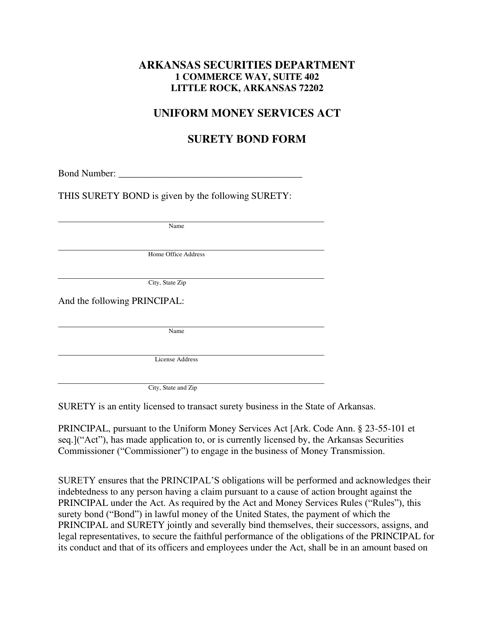

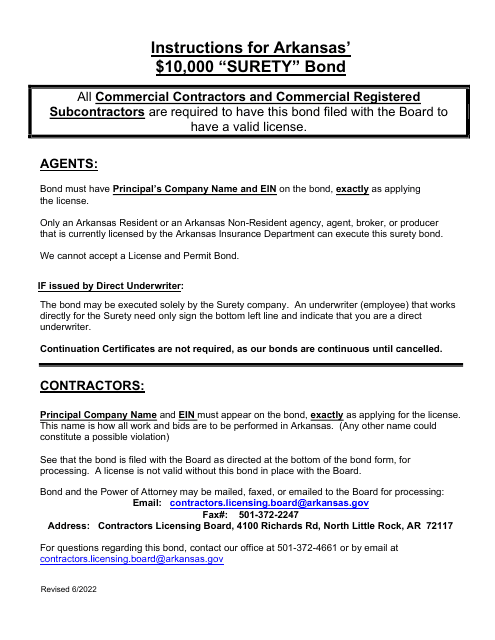

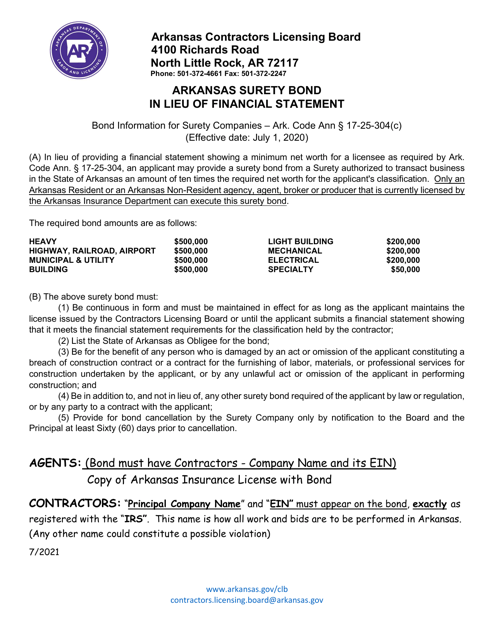

This type of document, called a Surety Bond Form, is used in the state of Arkansas. It is typically used as a contract between three parties: the principal (person or business), the surety (insurance company), and the obligee (the party requiring the bond). The form outlines the terms and conditions of the bond, such as the amount of coverage, the purpose of the bond, and any specific requirements. It serves as a guarantee that the principal will fulfill their obligations, and if they fail to do so, the surety will compensate the obligee.

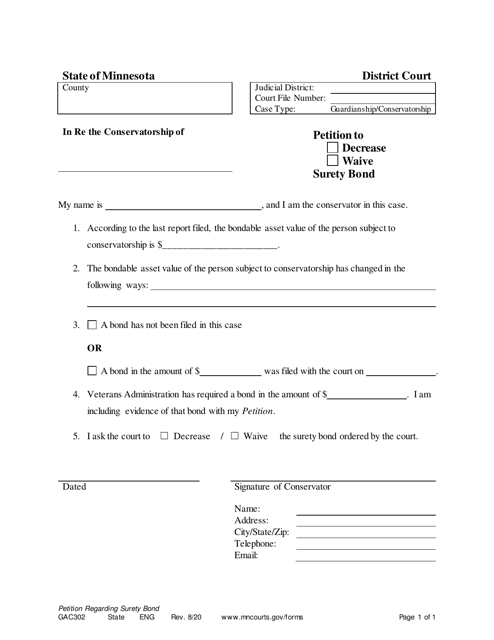

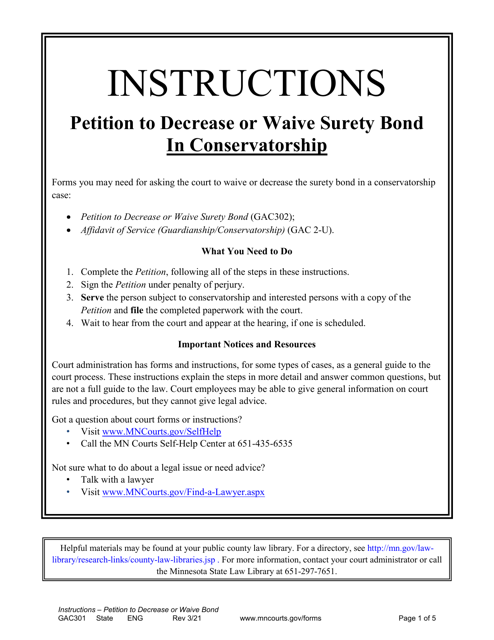

This Form is used for filing a petition to decrease or waive a surety bond requirement in the state of Minnesota.

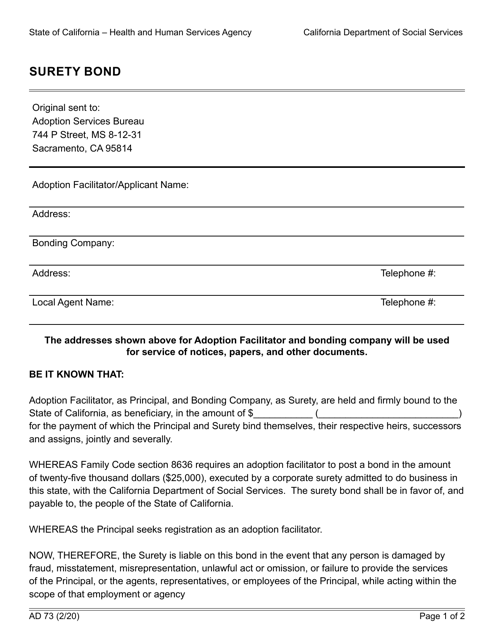

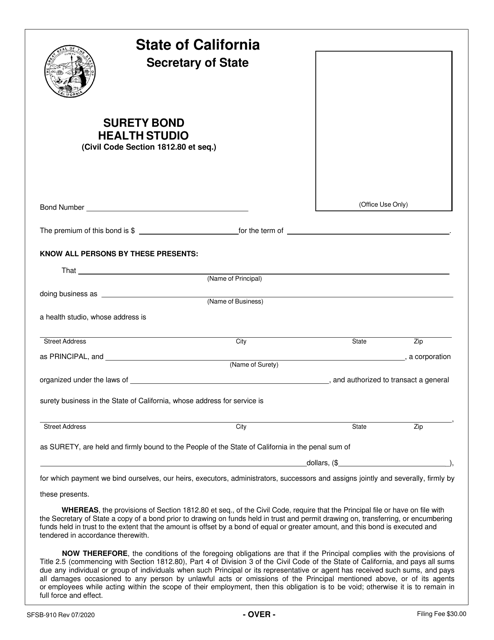

This Form is used for obtaining a surety bond in the state of California. It is a legal document that ensures that obligations outlined in a contract will be fulfilled by the party involved.

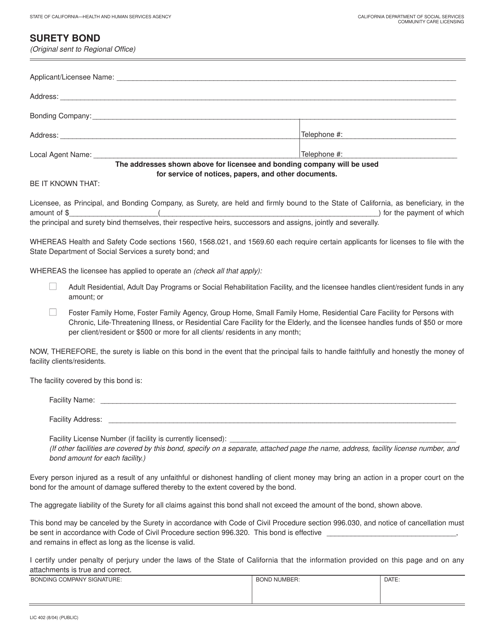

This Form is used for obtaining a surety bond in the state of California. A surety bond is a type of financial guarantee that ensures the completion of a project or the fulfillment of a contractual obligation.

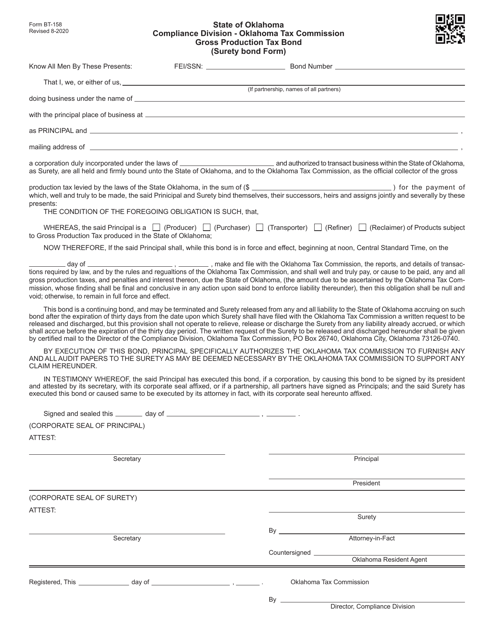

This document is used for obtaining a surety bond for the Gross Production Tax in Oklahoma.

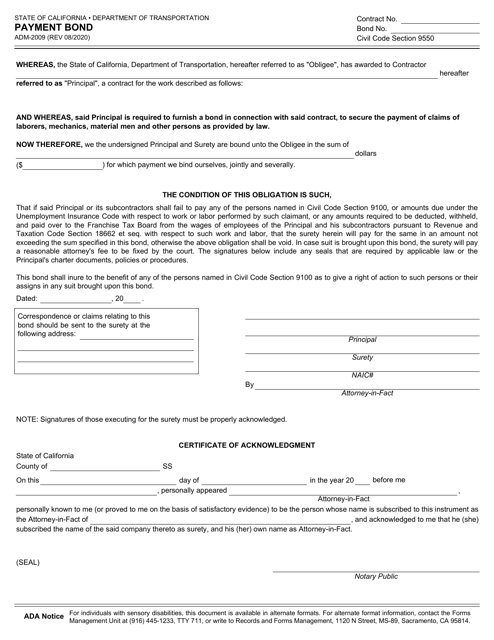

This form is used for submitting a payment bond in the state of California. It is a legal document that ensures payment to contractors and subcontractors for construction projects.

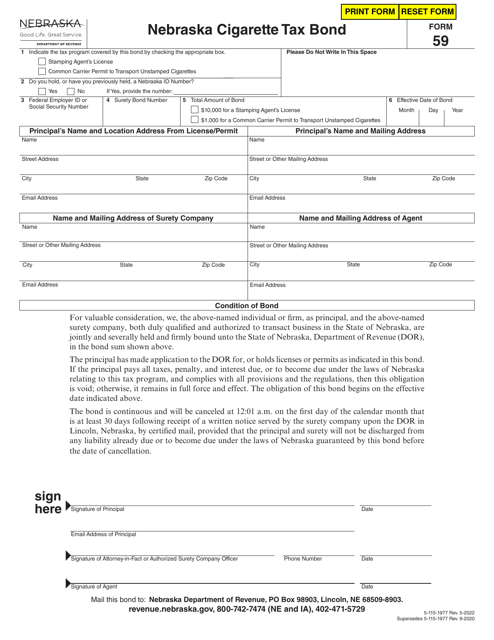

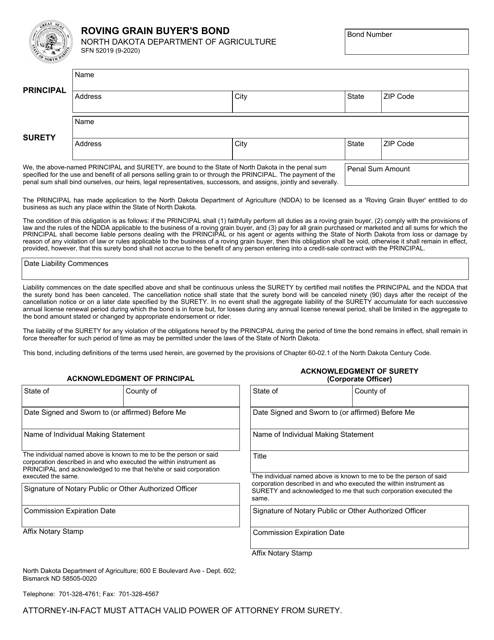

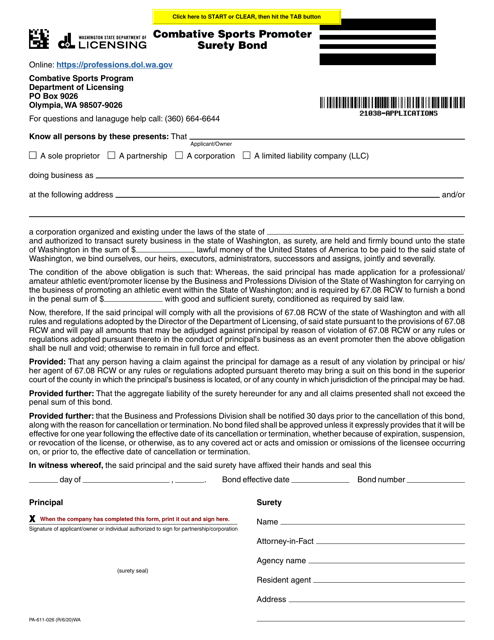

This form is used for obtaining a Roving Grain Buyer's Bond in North Dakota.

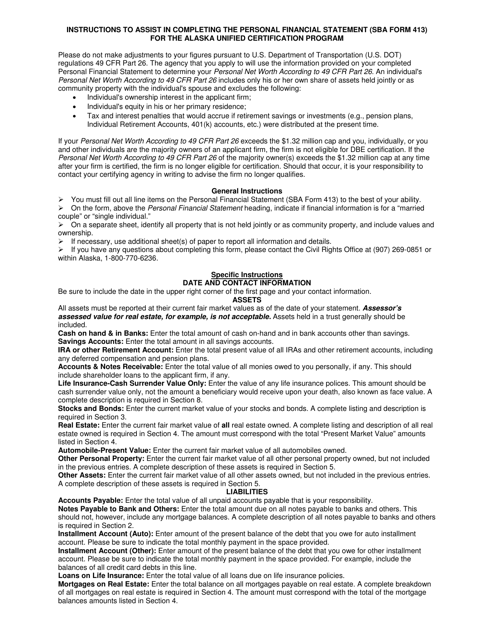

This document is used for applying for 7(A)/504 loans and surety bonds in Alaska. It provides instructions for filling out SBA Form 413 Personal Financial Statement.

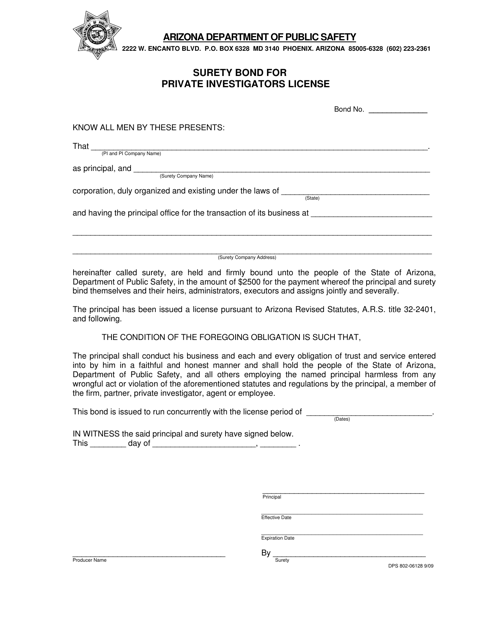

This form is used for obtaining a surety bond for a private investigator's license in Arizona.

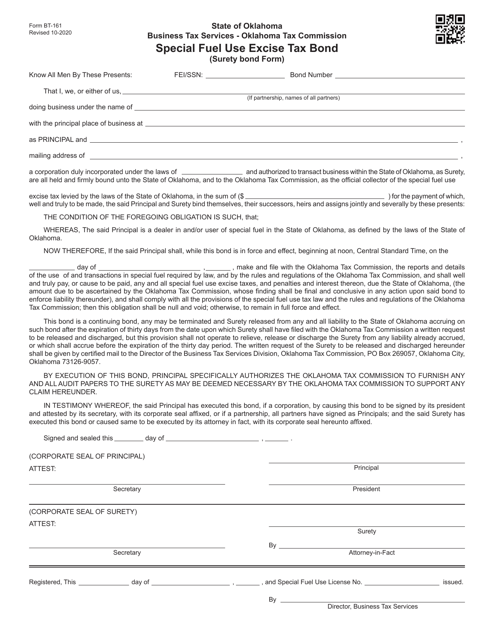

This form is used for obtaining a special fuel use excise tax bond in Oklahoma.

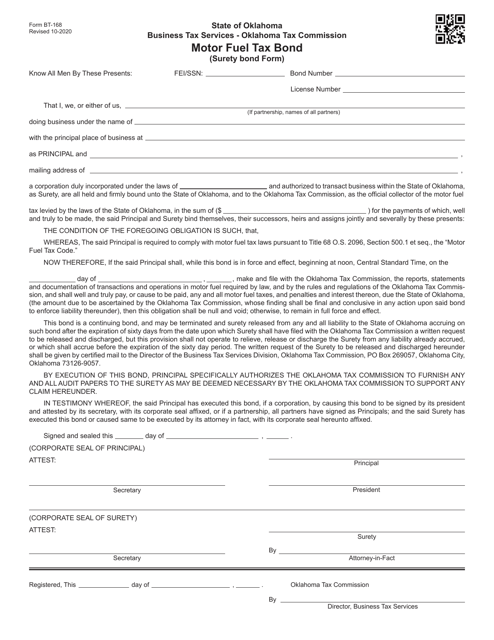

This form is used for obtaining a motor fuel tax bond in Oklahoma. It is a surety bond form that ensures the payment of motor fuel taxes by the person or entity responsible.

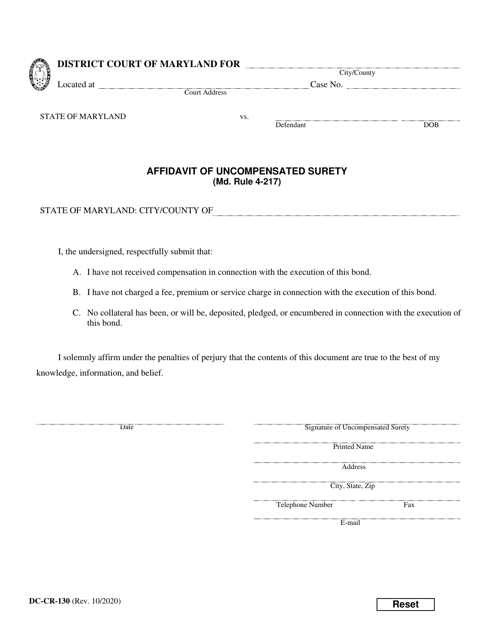

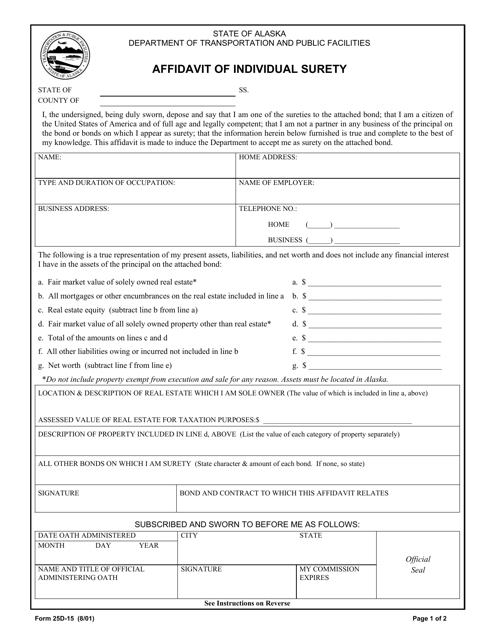

This form is used for individuals to provide an affidavit as a surety in Alaska.

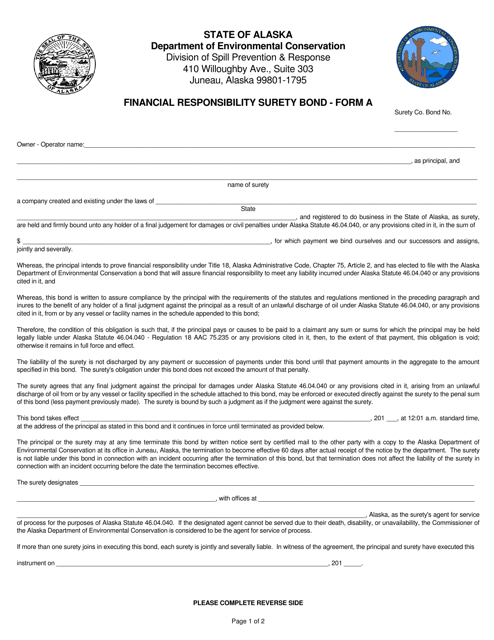

This form is used for obtaining a Financial Responsibility Surety Bond in Alaska. It is a legal document that ensures the payment of financial obligations as agreed upon.

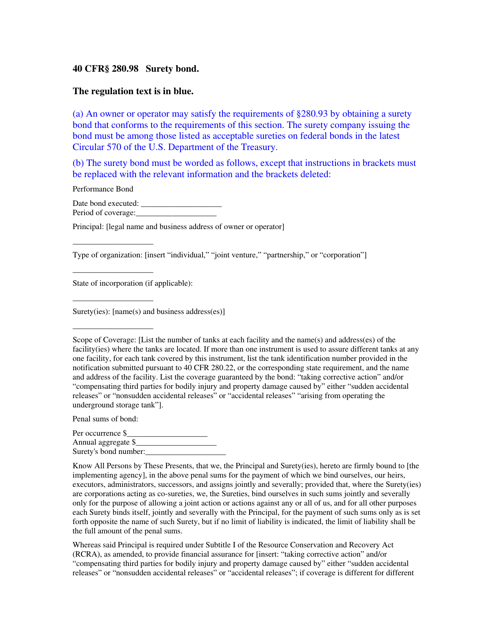

This document is for obtaining a surety bond in Alaska, as required under 40 CFR 280.98.

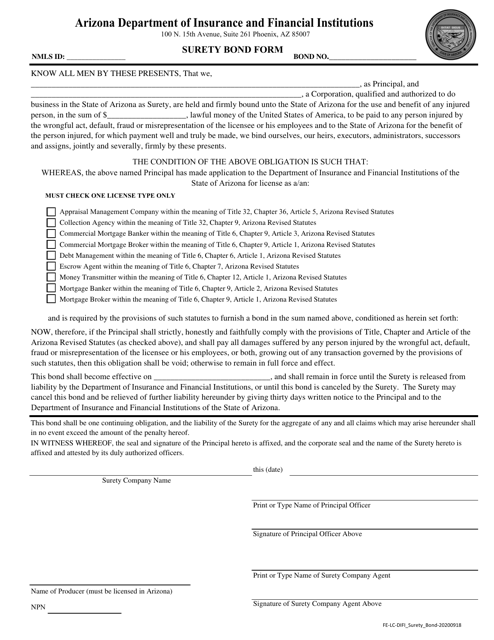

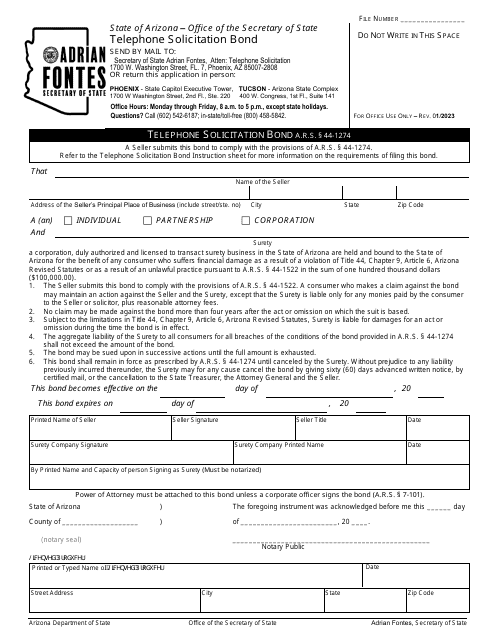

This document is a Surety Bond Form used in the state of Arizona. It is typically used in situations where a party needs to provide financial assurance to another party.

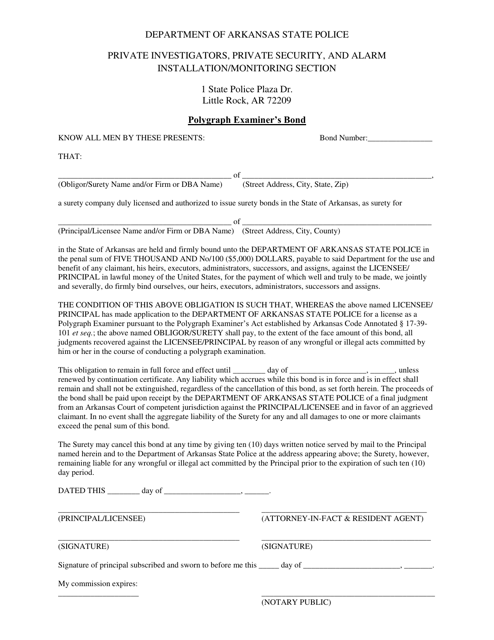

This document is a bond required for polygraph examiners in the state of Arkansas. It ensures that the examiner follows ethical and professional standards in conducting polygraph tests.

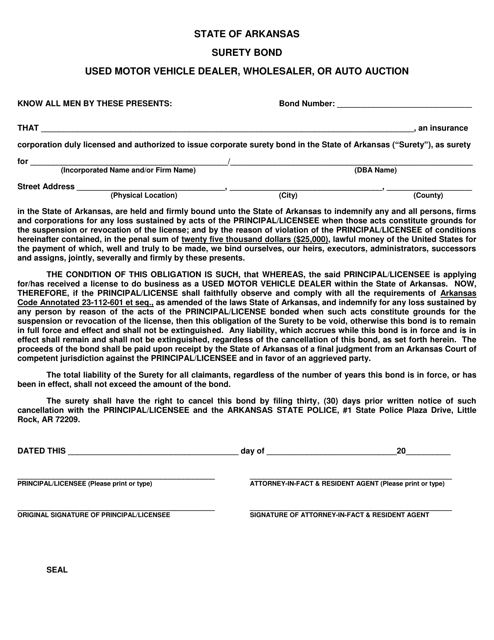

This Form is used for obtaining a surety bond for motor vehicle dealers, wholesalers, or auto auctions in the state of Arkansas. It is a requirement for operating these businesses in the state.