Maine Revenue Services Forms

Documents:

354

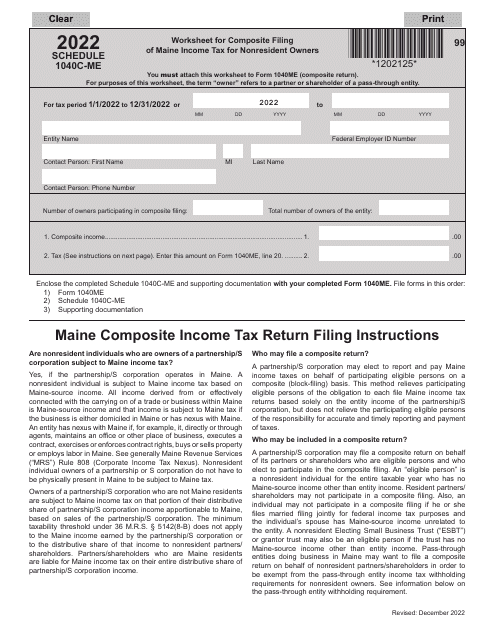

This type of document is used for completing the Schedule 1040C-ME worksheet in Maine for nonresident owners who need to file composite income tax.

This Form is used to apportion income and calculate the nonresident credit for a married person electing to file as single in Maine.

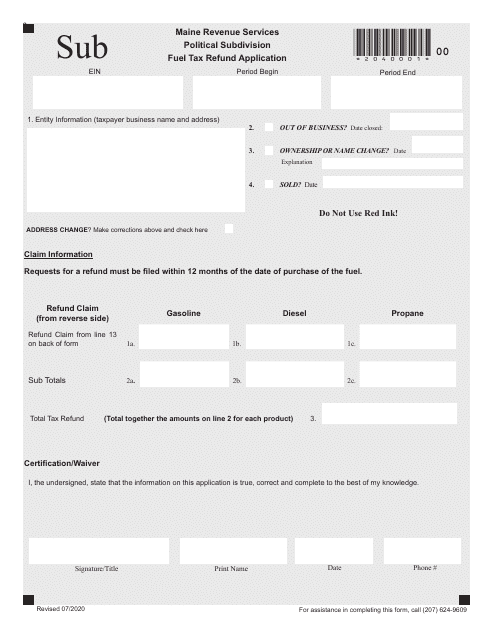

This Form is used for applying for a fuel tax refund in the state of Maine. It is specifically for political subdivisions such as municipalities and school districts.

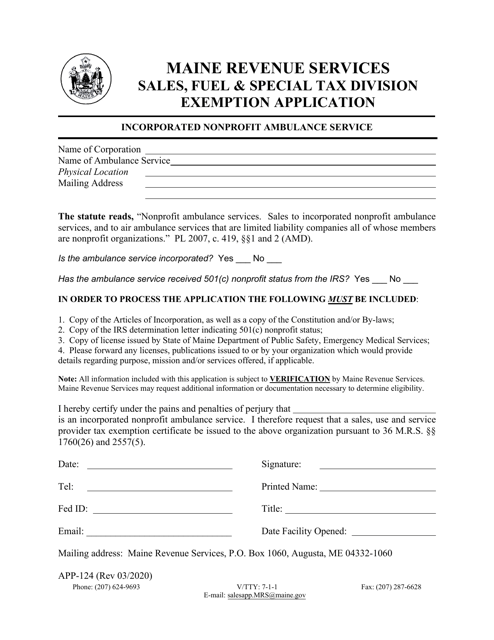

This form is used for applying for an exemption for an incorporated nonprofit ambulance service in the state of Maine.

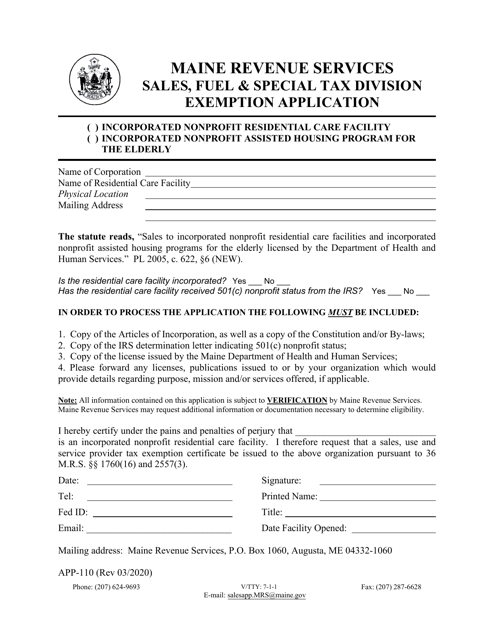

This form is used for applying for an exemption for residential care facilities in the state of Maine.

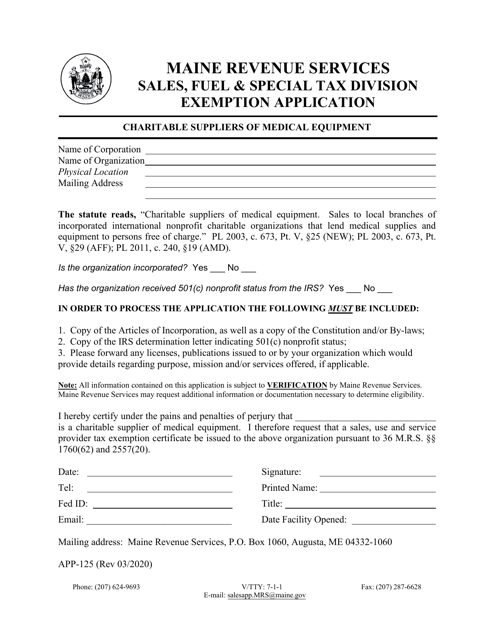

This form is used for charitable suppliers of medical equipment to apply for an exemption in Maine.

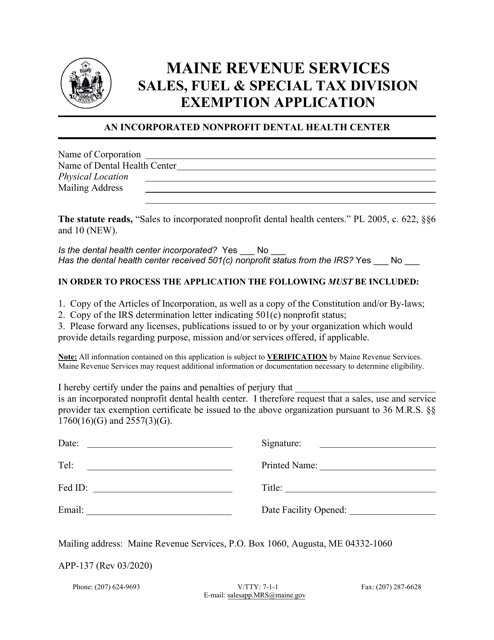

This form is used for applying for an exemption for an incorporated nonprofit dental health center in the state of Maine.

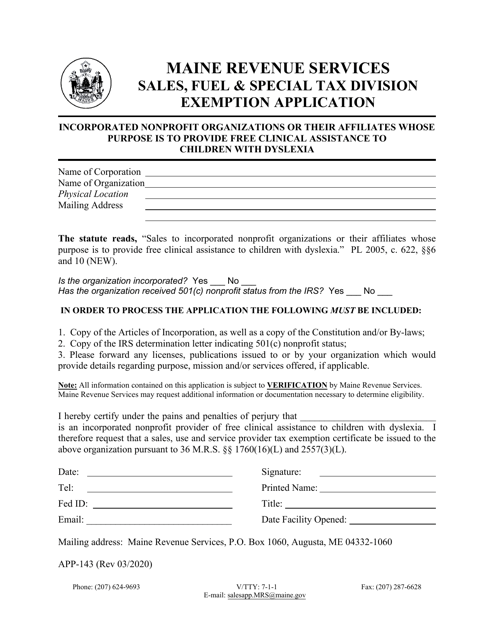

This Form is used for applying for an exemption for incorporated nonprofit organizations or their affiliates in Maine. The exemption is for those who provide free clinical assistance to children with dyslexia.

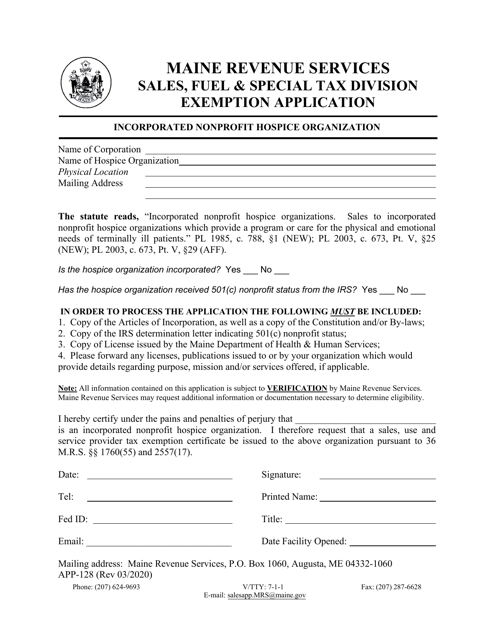

This Form is used for applying for an exemption as an incorporated nonprofit hospice organization in Maine.

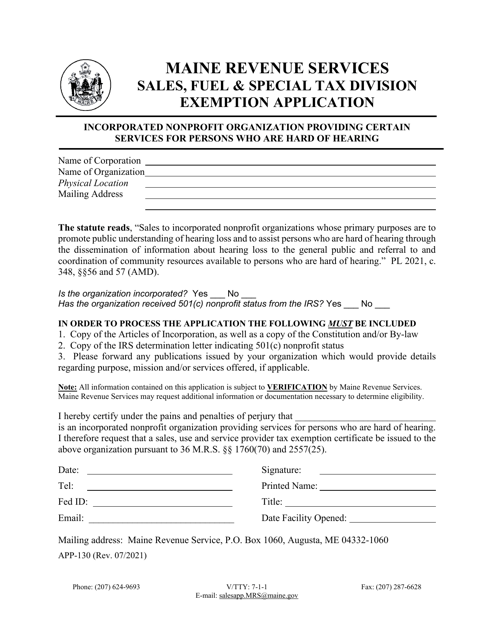

This Form is used for applying for an exemption for an incorporated nonprofit organization that provides certain services for persons who are hard of hearing in the state of Maine.

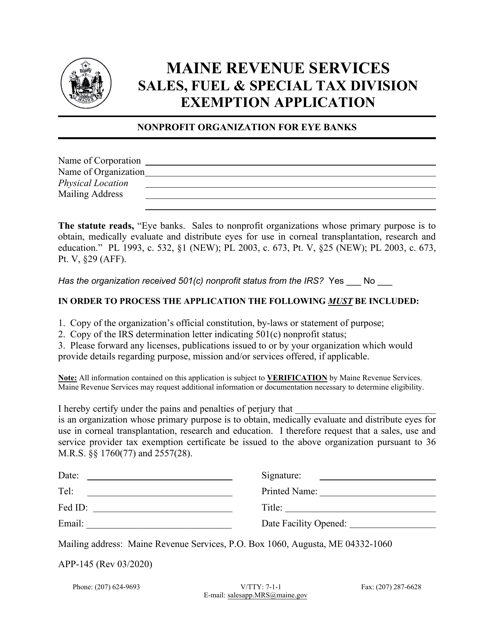

This Form is used for nonprofit organizations operating eye banks in Maine to apply for exemption from certain taxes.

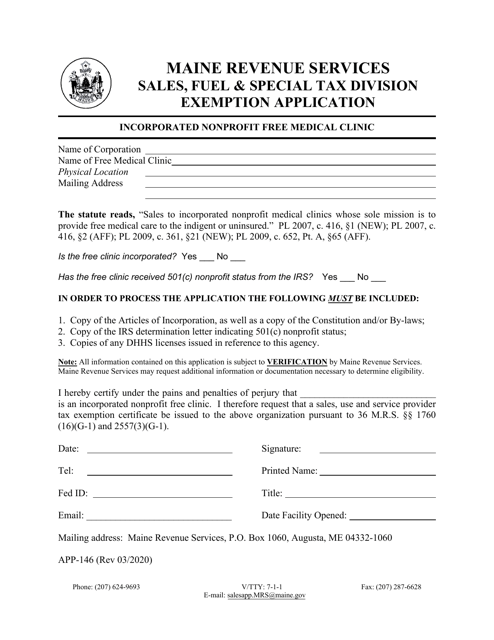

This Form is used for applying for a nonprofit free medical clinic exemption in the state of Maine. It is specifically designed for incorporated organizations.

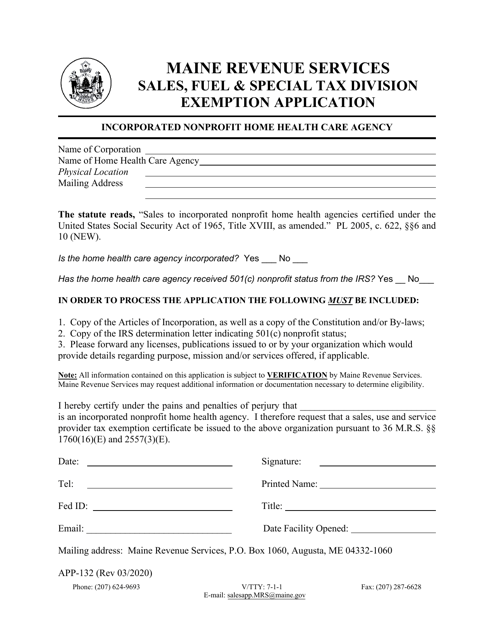

This form is used for applying for an exemption for a nonprofit home health care agency in Maine.

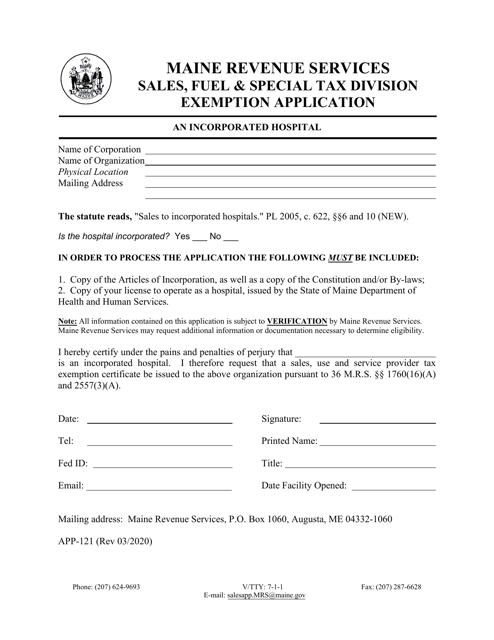

This Form is used for applying for tax exemption for incorporated hospitals in the state of Maine.

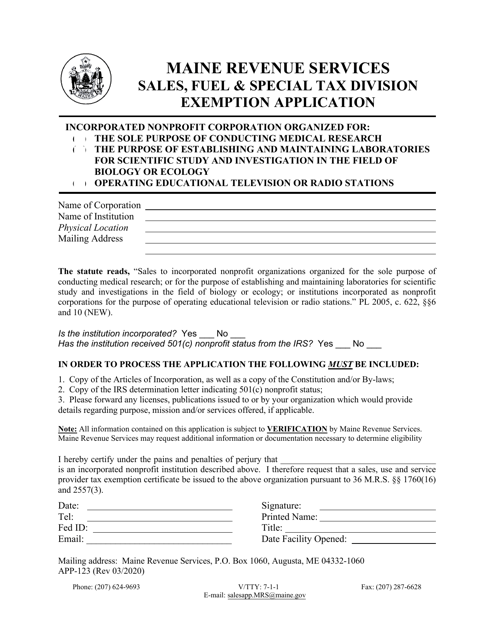

This form is used for applying for an exemption for medical research institutions in the state of Maine.

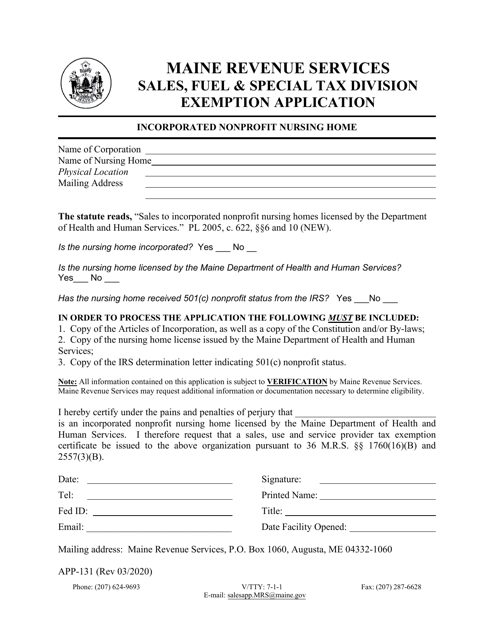

This form is used for applying for a tax exemption for nonprofit nursing homes in the state of Maine.

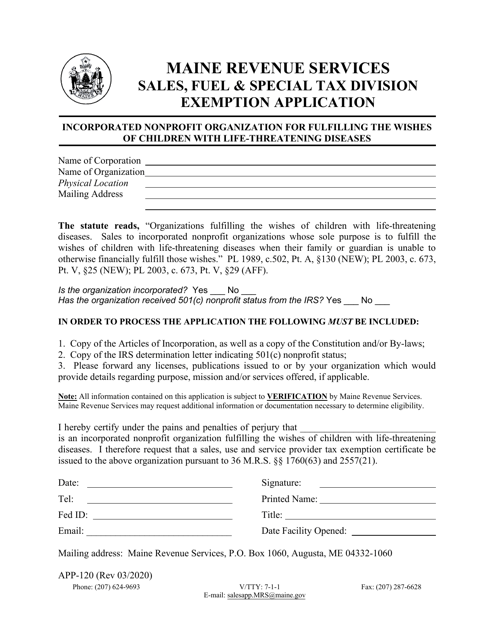

This Form is used for applying for a Maine state tax exemption for an incorporated nonprofit organization that fulfills the wishes of children with life-threatening diseases.

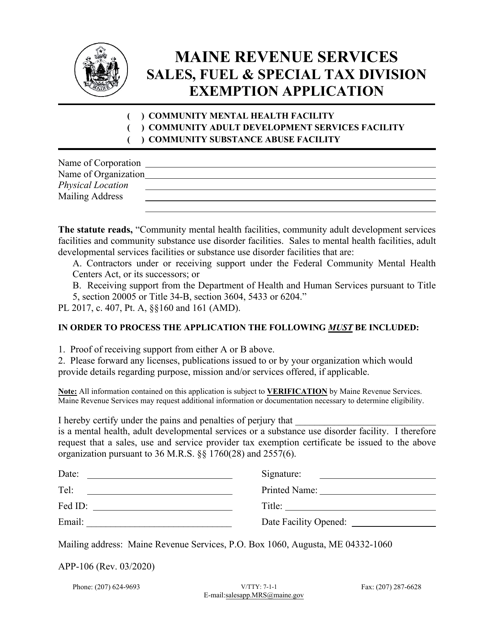

This form is used for applying for an exemption for mental health, adult developmental, and substance use disorder facilities in Maine.

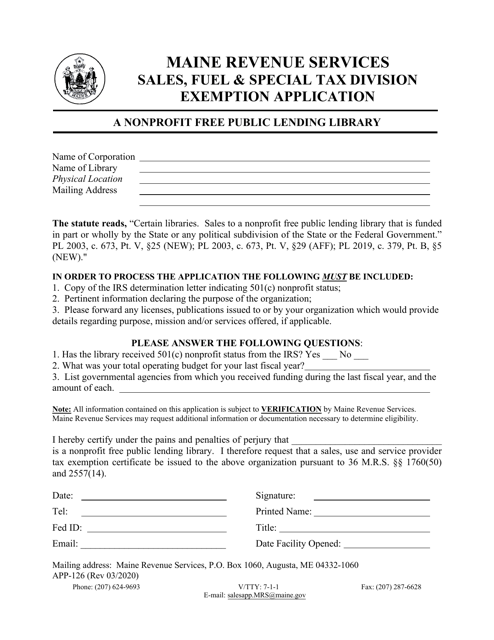

This Form is used for applying for a nonprofit free public lending library exemption in the state of Maine. It allows libraries to seek exemption from certain taxes and access benefits for their charitable activities.