Maine Revenue Services Forms

Documents:

354

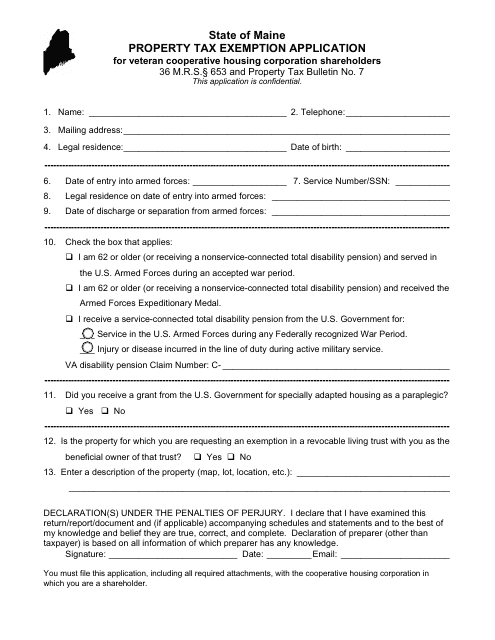

This Form is used for applying for property tax exemption for shareholders of veteran cooperative housing corporations in Maine.

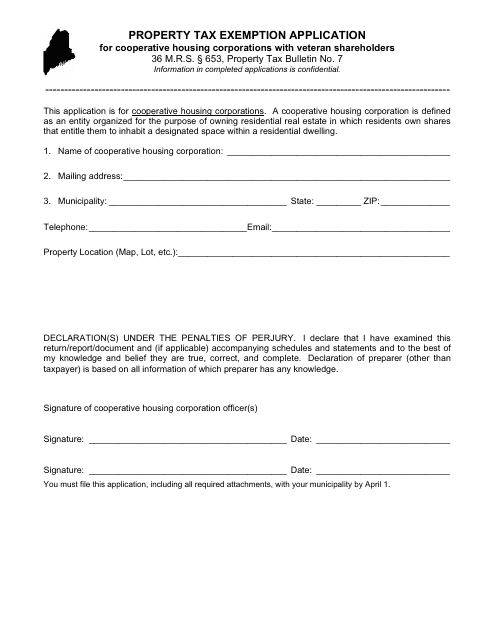

This form is used for Cooperative Housing Corporations in Maine to apply for property tax exemption if they have veteran shareholders.

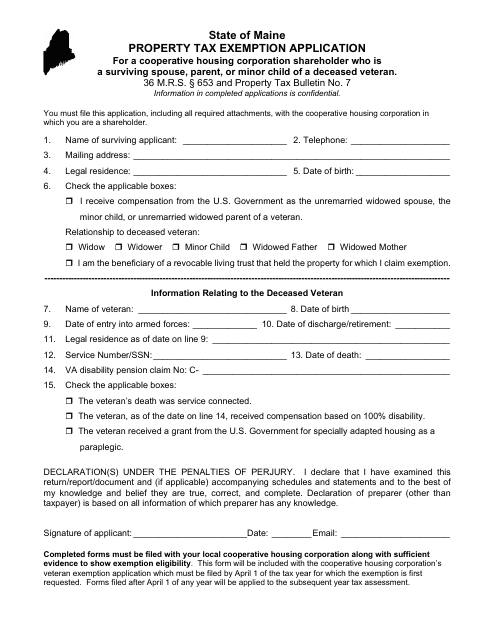

This form is used for applying for a property tax exemption in Maine if you are a surviving spouse, parent, or minor child of a deceased veteran and a shareholder in a cooperative housing corporation.

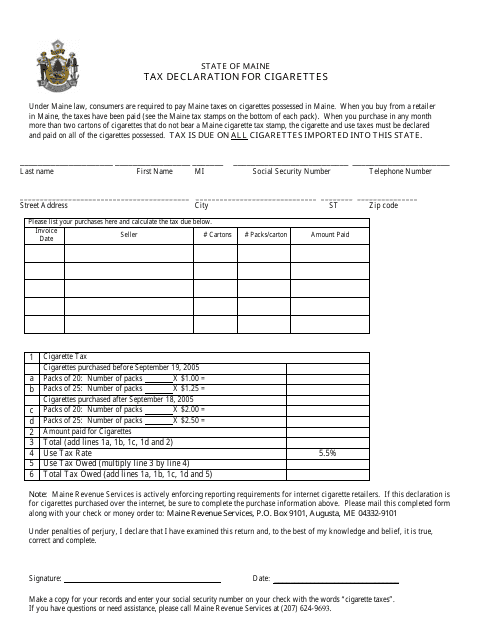

This form is used for declaring taxes on cigarettes in the state of Maine.

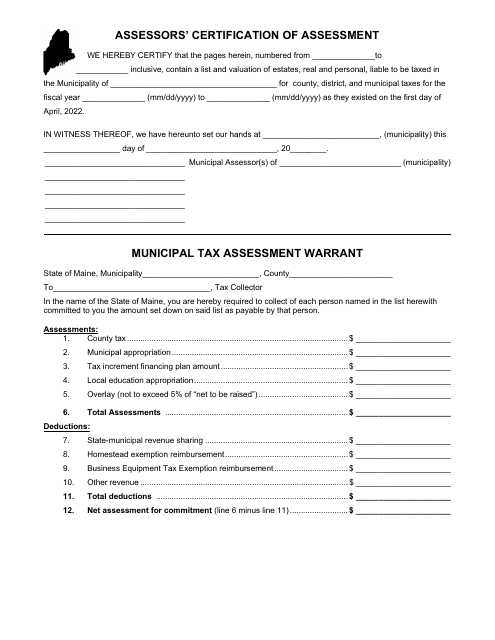

This document is used for assessors to certify the assessment and issue a tax assessment warrant in the state of Maine.

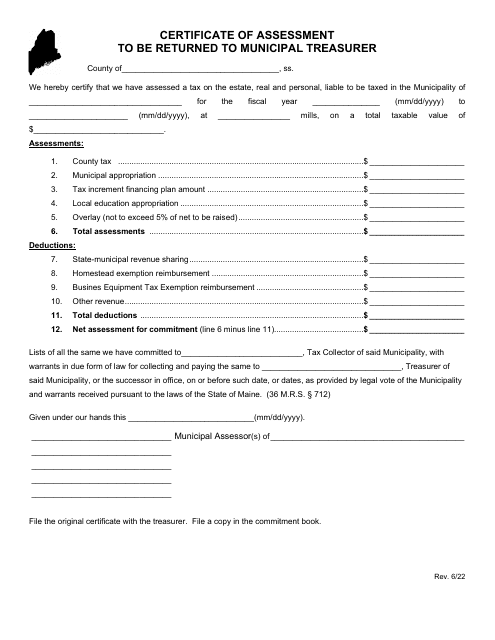

This document is for the return of a Certificate of Assessment to the Municipal Treasurer in the state of Maine. It is used to update and provide accurate information about the assessed value of a property for tax purposes.

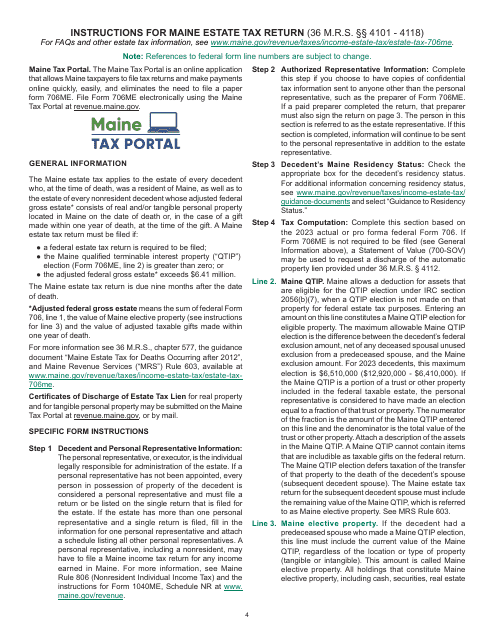

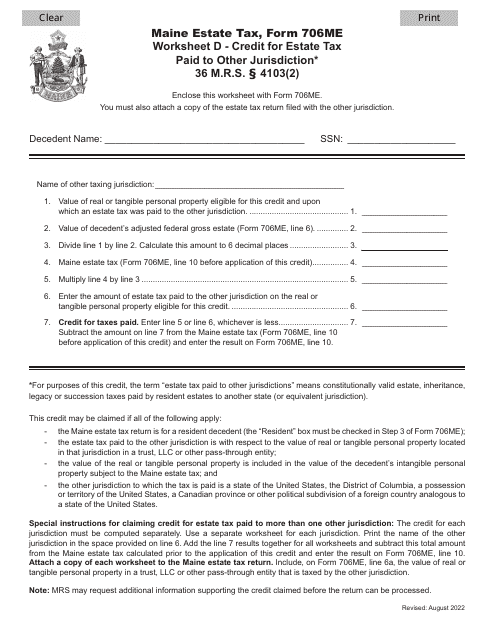

This form is used for claiming a credit for estate tax paid to another jurisdiction in the state of Maine.

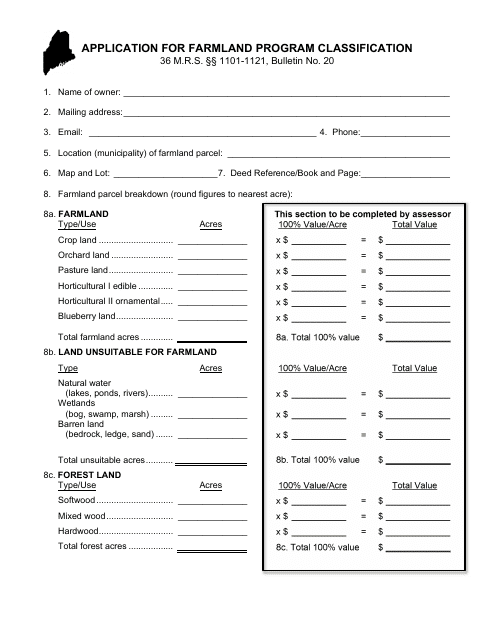

This form is used for applying for classification in the Farmland Program in the state of Maine. The program provides certain tax benefits to individuals who own agricultural land.

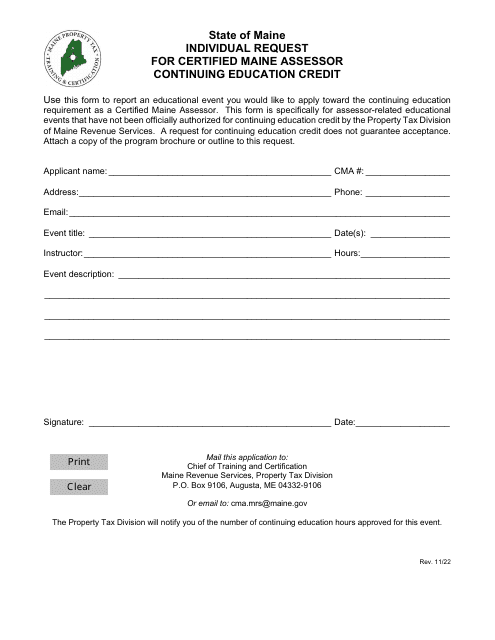

This form is used for individual requests to receive certified Maine Assessor Continuing Education credits in Maine.

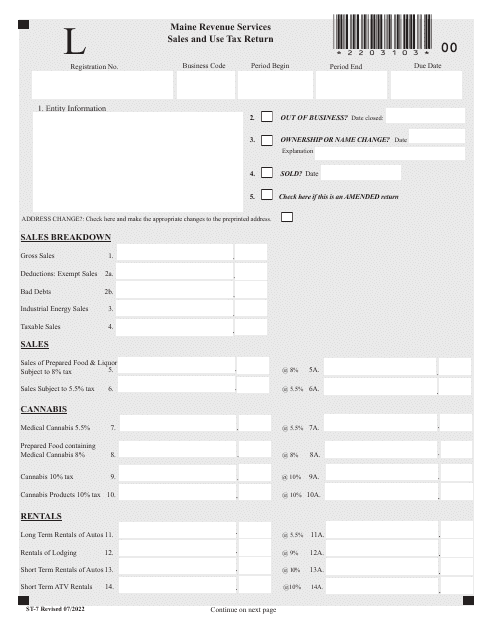

This Form is used for filing your sales and use tax return in the state of Maine.

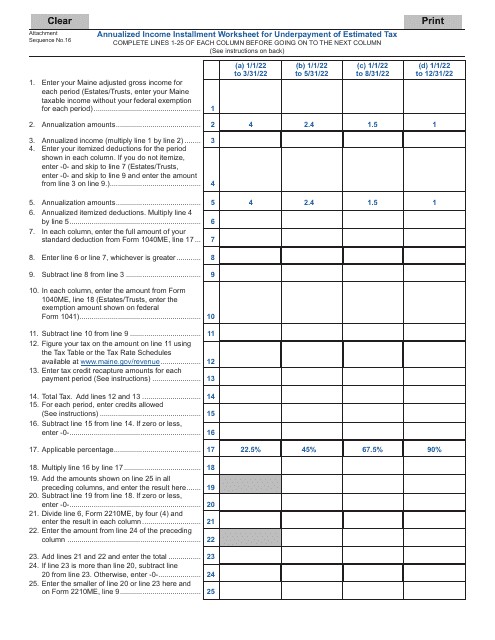

This Form is used for calculating annualized income installment and assessing underpayment of estimated tax in Maine.