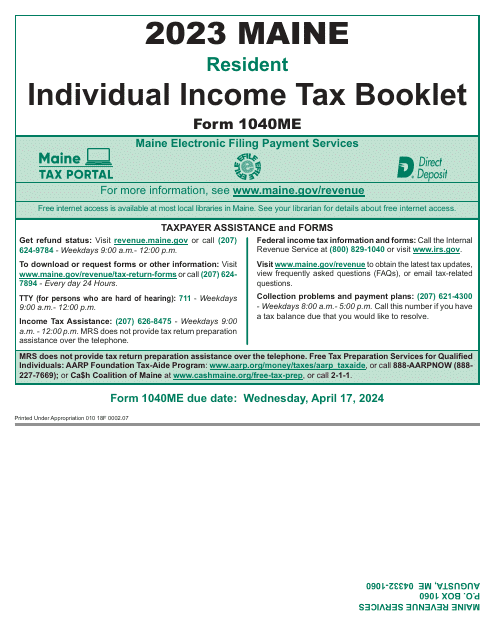

Maine Revenue Services Forms

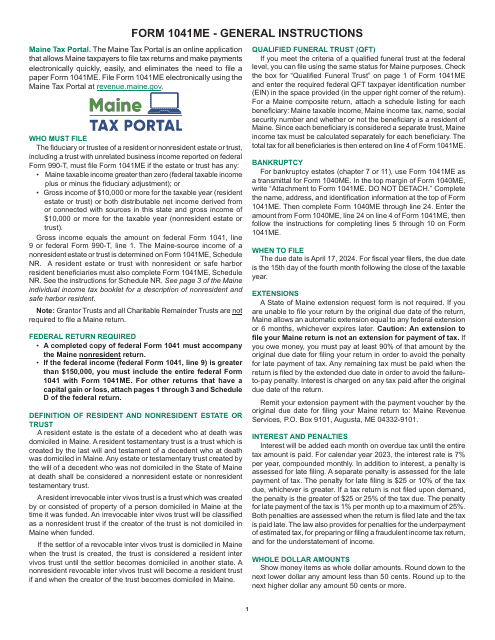

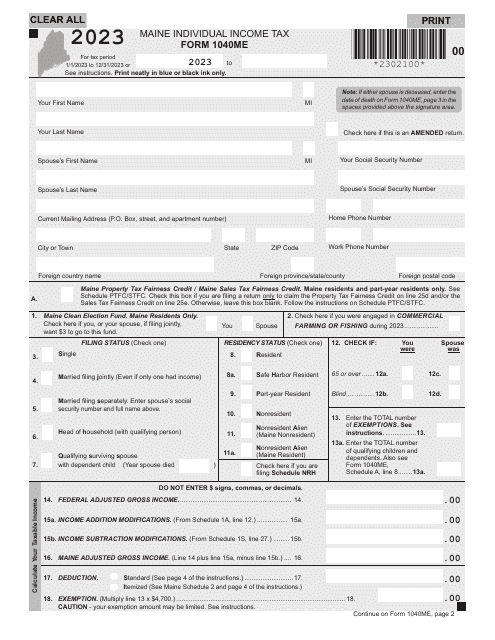

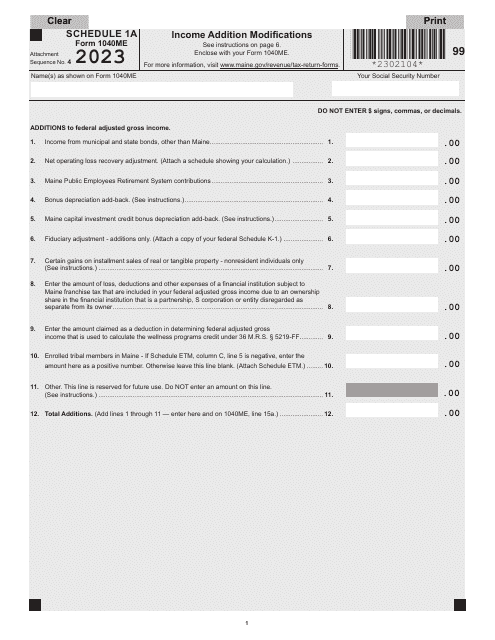

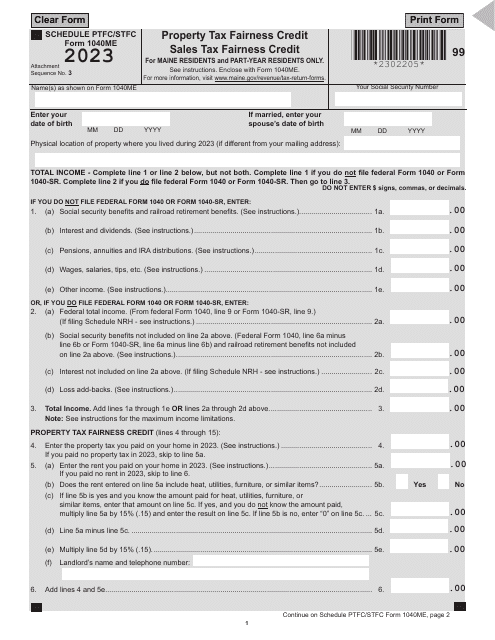

Maine Revenue Services (MRS) is the state agency responsible for administering and enforcing tax laws in the state of Maine. Its primary purpose is to collect state taxes, including income tax, sales tax, property tax, and various other taxes and fees. MRS also provides taxpayer assistance and education programs to help individuals and businesses understand and comply with their tax obligations.

Documents:

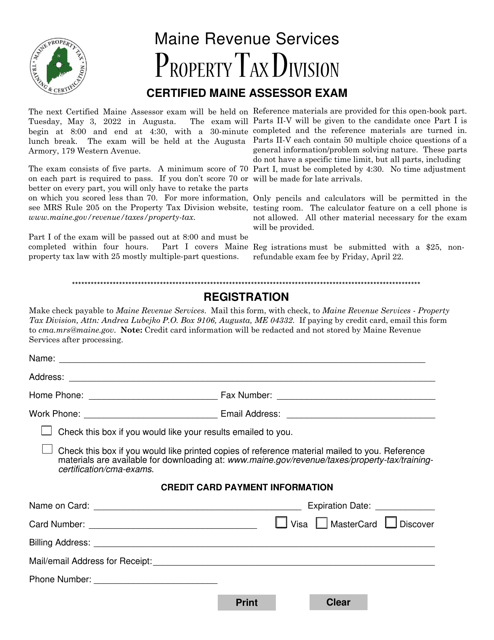

354

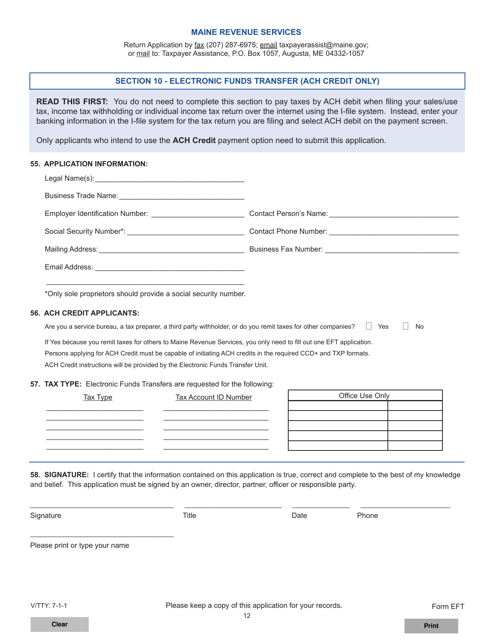

This document is used for electronic funds transfer (ACH credit) in Maine.

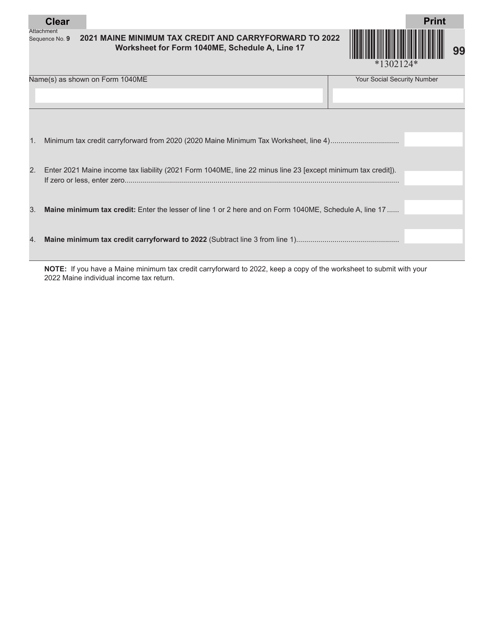

This form is used for calculating and reporting the Maine Minimum Tax Credit and Carryforward for individuals filing taxes in Maine.

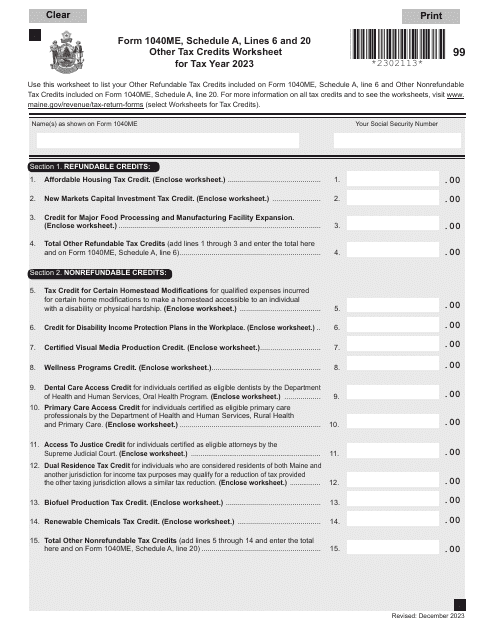

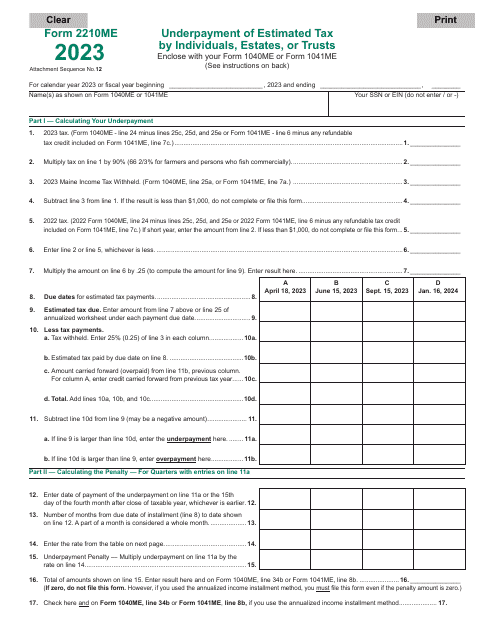

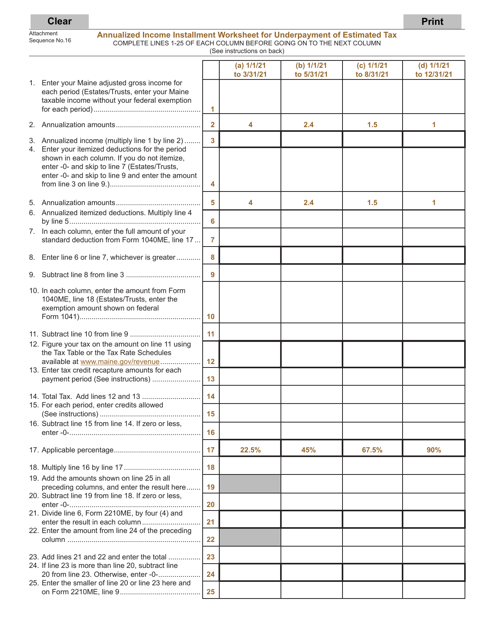

This Form is used for calculating and reporting any underpayment of estimated tax for residents of Maine. It helps taxpayers determine if they owe any additional tax due to not paying enough estimated tax throughout the year.

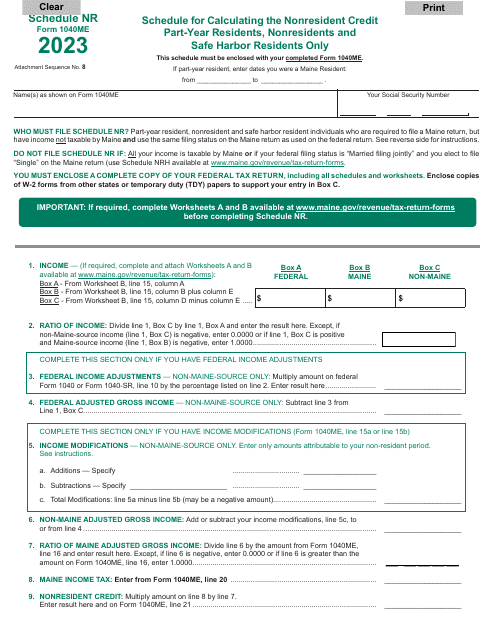

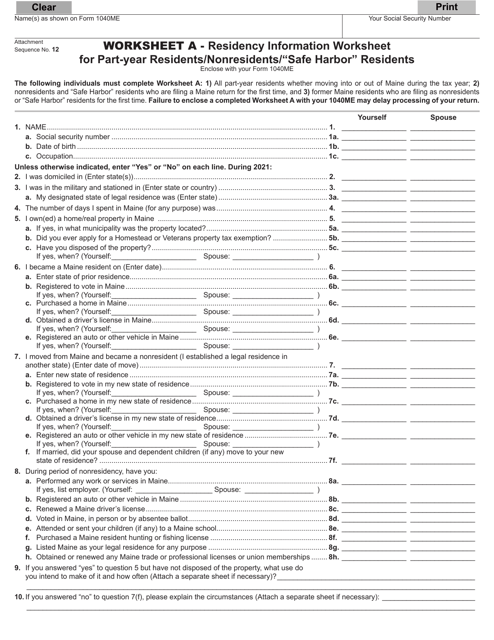

This form is used for determining residency information and income allocation for individuals who are part-year residents, nonresidents, or "safe harbor" residents in the state of Maine.

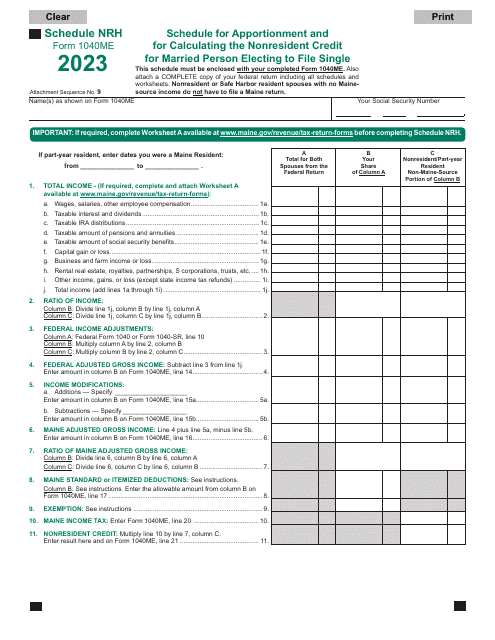

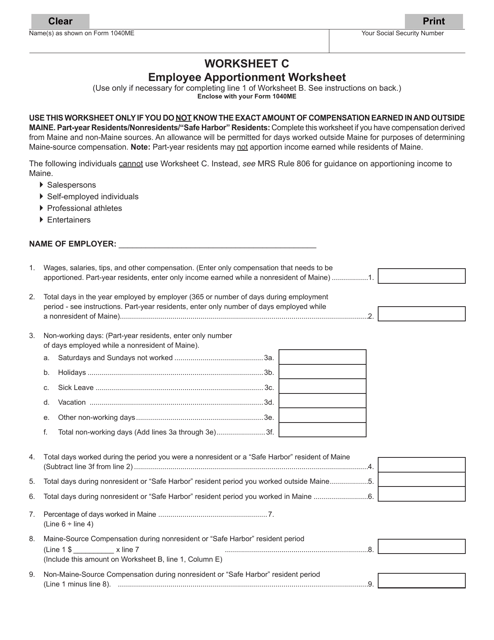

This document is a worksheet used to calculate employee apportionment for state income tax in Maine.