Free New Hampshire Small Estate Affidavit Forms and Templates

New Hampshire Small Estate Affidavit Form: What Is It?

A New Hampshire Small Estate Affidavit refers to an enforceable document that allows the heir of the deceased estate owner to come into possession the assets from the estate of the person that passed away quickly and without court proceedings in case the estate is considered small enough and there are no potential disputes about the contents of the inheritance or the identities of heirs.

New Hampshire Small Estate Affidavit Types

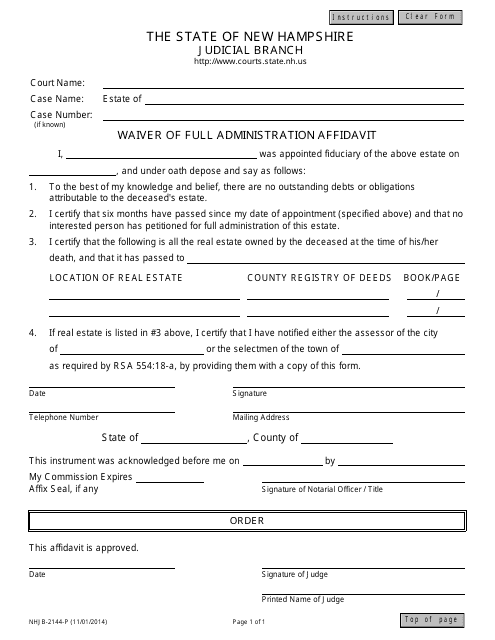

- Form NHJB-2144-P, Waiver of Full Administration Affidavit. Unlike most states, New Hampshire requires the affiant to fill out a separate document that will confirm they were named the fiduciary of the estate and notify the court about the absence of obligations and debts in the deceased individual's name;

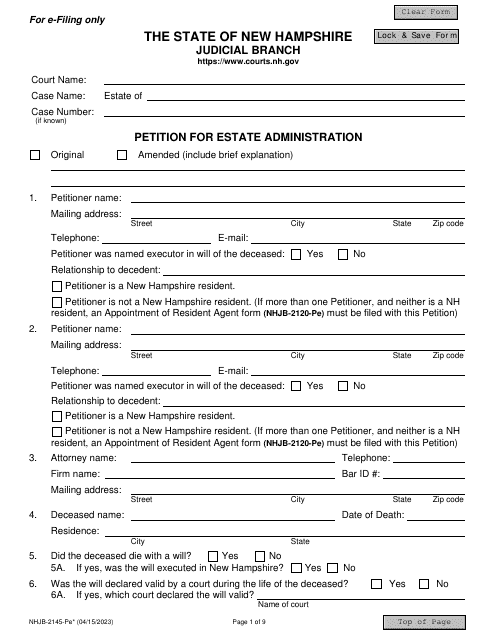

- Form NHJB-2145-PE, Petition for Estate Administration. This instrument is needed to specify the property the deceased individual owned in life and identify the heir to the assets, including real estate - it will also contain the request to waive full administration. Only after the judge approves this petition, you will be able to gain access to the estate.

How to File a Small Estate Affidavit in New Hampshire?

Here is how you can create and submit a New Hampshire Affidavit of Small Estate:

- You are obliged to follow the state rules that determine the settlement of small estates . This procedure is only possible for several individuals - the only beneficiary identified in the will, their spouse, child, parent, or a trustee if the estate owner set up a trust. One of the people listed has to become the administrator of the estate.

- Complete the New Hampshire Small Estate Affidavit Form . You need to provide your own name and contact details, identify the person that died, elaborate on the will they prepared before passing, explain your administrator or executor status, list people and organizations that are entitled to receive the assets from the estate, name the spouse and children of the deceased person if they were not mentioned in the will, indicate names and contact information of other relatives that may be the heirs to the estate, record the value of the real and personal property that comprises the estate, sign and date the form.

- Draft a waiver of administration . State the number of the estate and case if you know the latter, enter your full name and the date you were appointed as a fiduciary, name the person that is entitled to inherit the real property from the estate and indicate the location of the real estate, make a reference to the local registry of deeds that contains the information about the real property, sign and date the document. Its authenticity must be checked by a notary public who will sign the waiver.

- File the documentation with the local court - the judge will make their ruling closing the case.

Documents:

2

This form is used for waiving the requirement of full administration in the probate process in New Hampshire.