Free Real Estate Forms for Homebuyers

So, you have decided to purchase a house for your family or a farm to conduct your business. How to properly close a real estate deal? What documents may be required by the bank if I take out a loan to cover the purchase of a new house? And how do I reduce my expenses and obtain watertight guarantees that protect my interests? All these questions and many more issues will be resolved - read our guide on the Homebuyer Real Estate Forms and complete them to ensure your ownership is safe.

For a full list of Homebuyers Real Estate templates please check out our library below.

Types of Real Estate Forms for Homebuyers

Before you buy a house or apartment and sign all the papers with the property owner, you need to do your research on the documents that establish the liability of every individual who participates in the transfer of ownership. The templates and forms we offer will guide you through the complex process of becoming a homeowner.

Property Title Transfer (Deed Forms)

Here you can find the most common deeds - these Real Estate Forms for Homebuyers are used to transfer the title from the previous owner to the new owner, with or without warranties in relation to the property's condition, indefinitely or for a set period of time.

- A Special Warranty Deed confirms the seller is the legal owner of the property and establishes their liability for the issues that arose during their ownership;

- Bargain and Sale Deed. Often signed in tax sales and foreclosure auctions, this statement transfers the ownership without any guarantees - the beneficiary may inherit liens;

- Deed of Trust. Use this document if you want to give the third party the right to hold and manage the property - generally, until the purchaser pays the price for it;

- Warranty Deed. Buy any real estate from the seller who guarantees the property title is not burdened by any liens or encumbrances;

- A Quitclaim Deed is often used by relatives and friends to transfer property without any warranties;

- Gift Deed. Record the gift by signing this statement if you receive the gift without any compensation or conditions;

- Survivorship Deed. If one of the co-owners dies, this document will automatically transfer the title on the real estate to the other party;

- A Life Estate Deed will allow the beneficiary to own real property through the duration of their lifetime;

- Transfer on Death Deed. Prevent the real estate from the probate process and let the beneficiary inherit the house or apartment without delay.

Mortgages

Make a large real property purchase without paying the total value upfront or get out of the existing mortgage stress-free.

- Mortgage Lien Release Form/Letter. Transfer the ownership of your property to the third party to be free from the loan and future payments;

- How to Get a Mortgage - Home Loans, Land Loans, and Refinancing. Our guide will introduce you to the concept of mortgage - find out more about documentation necessary at every stage of taking out a real property loan;

- A Satisfaction of Mortgage Form confirms the mortgage has been paid in its entirety;

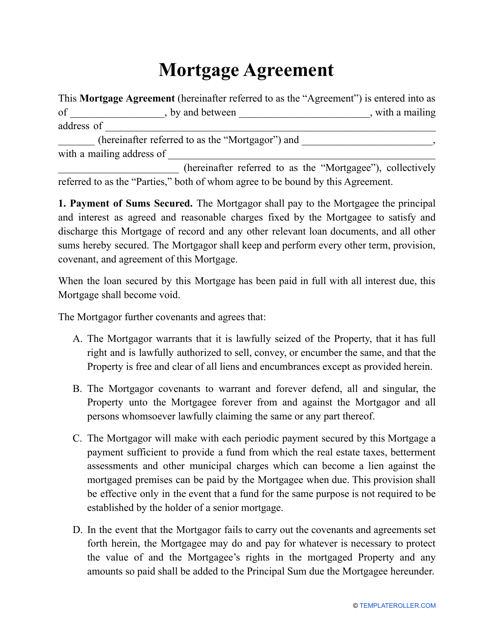

- A Mortgage Agreement is the main form signed by the lender and borrower to outline the terms of the lien put on the property in the borrower's possession.

Buying or Selling Real Estate

Below you can learn more about the process of selling and buying real property in the United States and different ways to own real estate.

- A Property Disclosure Statement informs the purchaser about existing issues and defects of the real property;

- A Land Purchase Agreement allows the seller to retain ownership until the buyer pays in full;

- A Letter of Intent to Purchase Real Estate confirms your wish to commit to the deal and buy real property;

- A Land Contract Form Templates formally transfer ownership of the piece of land;

- An Offer To Purchase Real Estate Form Templates are used by the seller and buyer to finalize negotiations on the sale and purchase contract;

- Real Estate Purchase Agreement. Buy residential or commercial real estate after outlining all rights and responsibilities of the parties to the transaction;

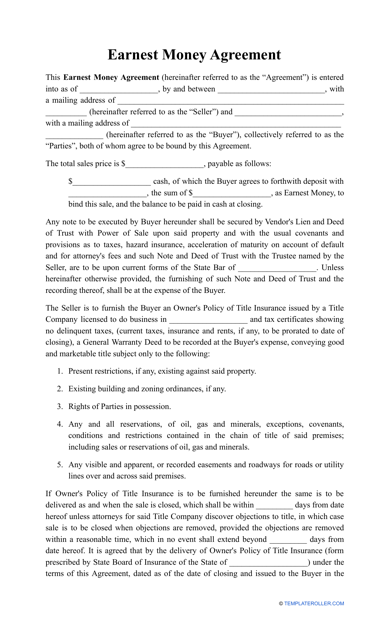

- Earnest Money Agreement. Deposit a portion of the total price of the property while you negotiate a deal with the seller;

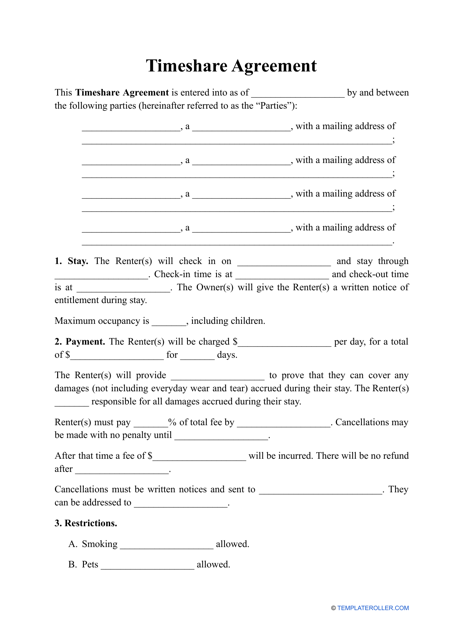

- Timeshare Agreement. Secure ownership in a particular real estate to occupy it for a specified time of the year;

- Can Foreigners Buy Property in the USA? If you have recently moved to the country and are thinking about becoming a homeowner, we have some advice to help you with that;

- How to Buy Land in the USA? Learn about the basic requirements and recommendations for every individual who wants to own land for their house or farm;

- 10 Tips for Buying Land for Commercial Use in the United States. If you are a long-time developer or an investor who makes their first steps, we will show you the advantages and disadvantages of purchasing land for your business;

- How to Buy Land and Build a House? In case you are interested in purchasing a parcel of land to build the house from the ground up, here is a manual for you to start;

- The 5 Types of Property Ownership. Determine the mode of ownership suitable for you before you purchase real estate;

- How to Sell a House in the USA? Find out what steps you are required to take to quickly transfer ownership of your house and earn more money;

- How To Buy a House in the United States? We share tips useful for first-time buyers and experienced purchasers - minimize your expenses and own the house of your dreams.

Haven't found the template you're looking for? Take a look at the related forms below:

Documents:

3

Use this document to create a lien on the property the mortgagor has in their possession as a means to secure the loan.

This agreement documents the relationship between multiple purchasers of vacation real estate in which these individuals own allotments of usage in the same property (aka "vacation ownership").

This contract is signed before entering into a Sale and Purchase Agreement to transfer ownership of the real estate and outline the terms of the deposit offered by the buyer.