Free Small Business Debt Consolidation Forms and Templates

Any business owner who needs to wait out the tough times, it might be necessary to make the correct choice for the survival of the business. When troubles persist, small business debt consolidation can be a viable alternative for you. It will reduce the pressure of owing money to creditors and help you to save finances while paving a path toward financial security.

The Small Business Administration (SBA) offers small business debt relief for a variety of purposes, including debt consolidation. Their primary programs of financial assistance are the 7(a) Loan program and 504 Loan program. In addition to small business debt consolidation loans, the money you receive can be used to purchase buildings and equipment, finance construction, refinance business debt, and buy furniture and supplies.

The forms below will help you to start the process of debt consolidation for your business:

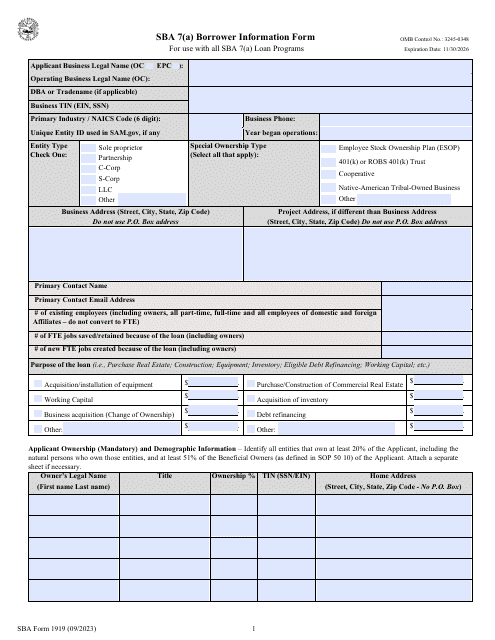

- SBA Form 1919, SBA 7(a) Borrower Information Form , contains basic information about the applicant and the request for a loan;

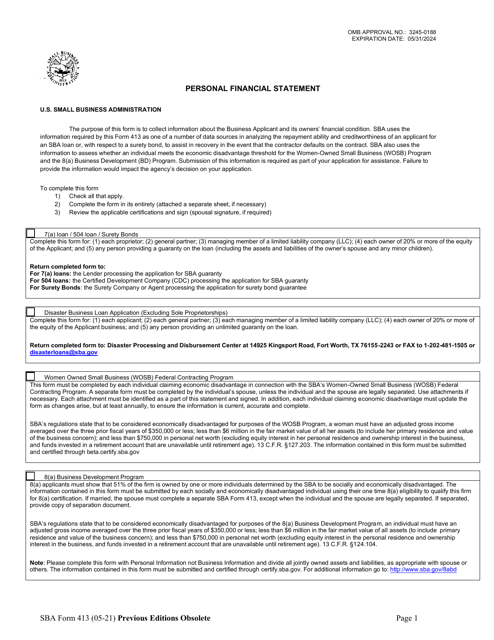

- SBA Form 413, Personal Financial Statement - 7(a)/504 Loans and Surety Bonds , provides personal financial details and confirms eligibility for loans;

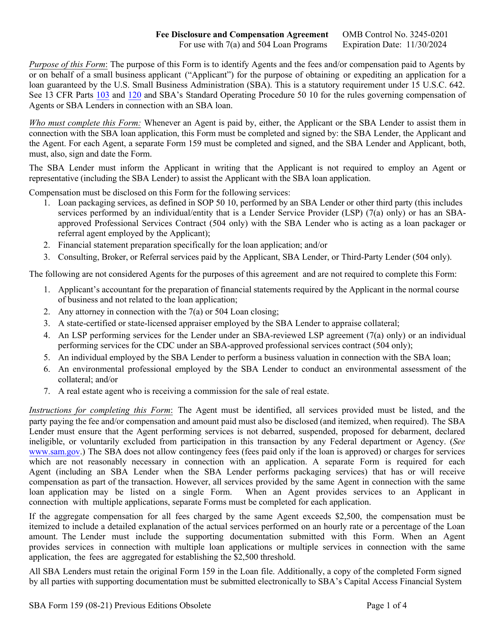

- SBA Form 159, Fee Disclosure and Compensation Agreement , is completed if you were matched with a lender by an intermediary service;

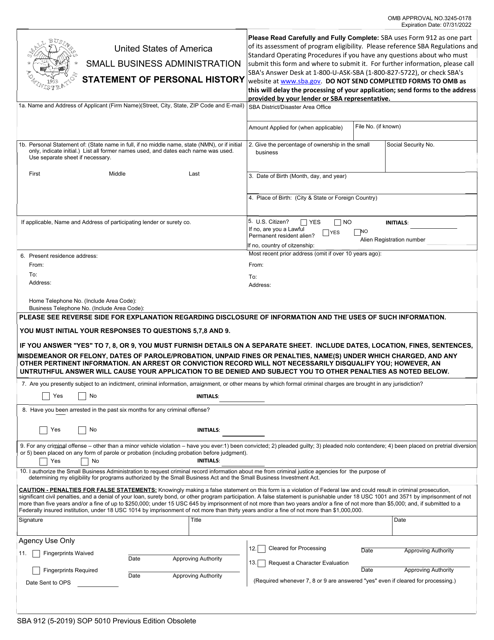

- SBA Form 912, Statement of Personal History , is another form that assesses business owner’s loan eligibility by reviewing their criminal history.

Follow these steps to participate in a small business debt relief program:

- Determine which debts need to be consolidated. Consult your credit history to identify which loans can qualify for a loan.

- Apply for a small business debt consolidation loan . Learn about the lenders to discover the terms for consolidation.

- When a nonprofit lender that provides small business debt consolidation loans approves your request, use the obtained proceeds to pay off the qualified loans you have decided to consolidate.

- Make payments toward the new loan in accordance with the conditions established by the lender.

Did this answer your question? If not, check out these related topics:

- Find out how toapply for an SBA Disaster Loan;

- Learn more about small business tax deductions;

- Browse bankruptcy forms by chapter.

Related Articles

Documents:

4

This form is issued by the Small Business Administration (SBA) and used by small businesses applying for a 7(a) loan and submitted to the SBA participating lender.

Download this form in order to identify a third party agent hired by a small business owner for assistance in a Small Business Administration (SBA) loan application.