Free Small Business Debt Relief Forms and Templates

Small Business Debt Relief is a set of measures implemented by the Small Business Administration (SBA) that are necessary when a company owes money for certain purposes, such as business development, but became unable to implement its obligations and pay off their debt.

How Can a Small Business Get Out of Debt?

Debt relief for small business owners includes the following steps:

- Debt settlement process, which implies negotiation with the company's creditors about decreasing the monthly payment, outstanding balance, or interest rate, permission to pay a certain percentage of the balance, the establishment of new payment terms, etc;

- Review of the company's current financial situation;

- Reduction of costs and assets on the organization's balance sheet, selling unused equipment, vehicles, raw materials, and inventory.

There are several ways in which small businesses can relieve their financial burden: applying for an SBA Disaster Loan, trying to consolidate their debt with the SBA, and applying for small business tax relief.

SBA Disaster Loans

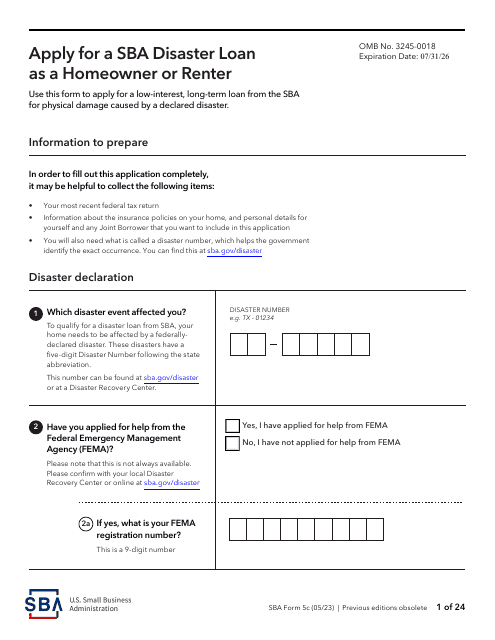

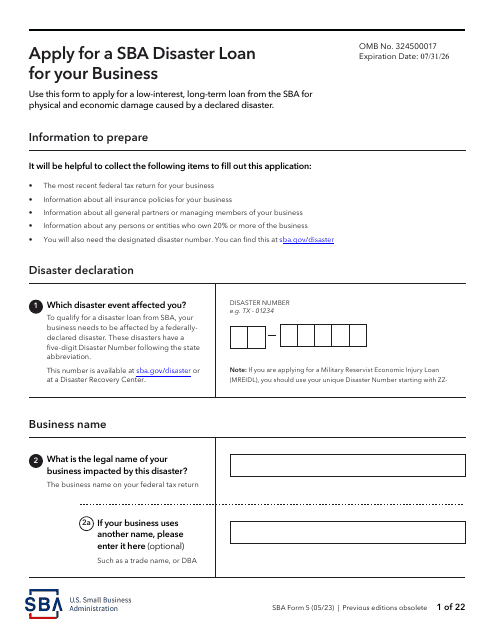

An SBA Disaster Loan a small business debt relief program offered by the SBA to businesses, private non-profits, homeowners, and renters located in regions affected by the declared disaster. This assistance comes in the form of a low-interest, long-term credit, that provides support for a faster recovery in an emergency.

The forms required to apply for an SBA Disaster Loan can be found through this link.

Small Business Debt Consolidation

Small business debt consolidation is a strategy that is also used for debt relief purposes and involves obtaining a single loan to repay several existing loans. The process often provides a lower overall interest rate across the summary debt load. As a result, the borrower has one monthly payment and can more easily manage their outstanding debt.

The forms required to apply for a consolidation loan with the SBA can be found through this link.

There are two kinds of debt consolidation loans:

- A secured consolidation loan is a loan with a secured debt. It is collateral for the loan, such as a vehicle or other property of the borrower. If the borrower fails to meet the conditions of a loan, the creditor becomes the owner of this asset. But the availability of collateral allows the borrower to get approval for a loan;

- An unsecured consolidation loan is not connected to any property of the borrower. In order to qualify, a company should be able to provide a positive credit history, the ability to repay, and a high credit score.

Small Business Tax Relief

The last thing you want to miss out when crisis strikes is any of the small business tax deductions you are eligible for. Trust us - you don't want to skip on a deduction that would have saved you a couple of hundred dollars or, even worse, make a mistake that will leave you in hot water with the Treasury Department.

A compilation of all available small business tax deductions can be found through this link.

Related Articles

Documents:

11

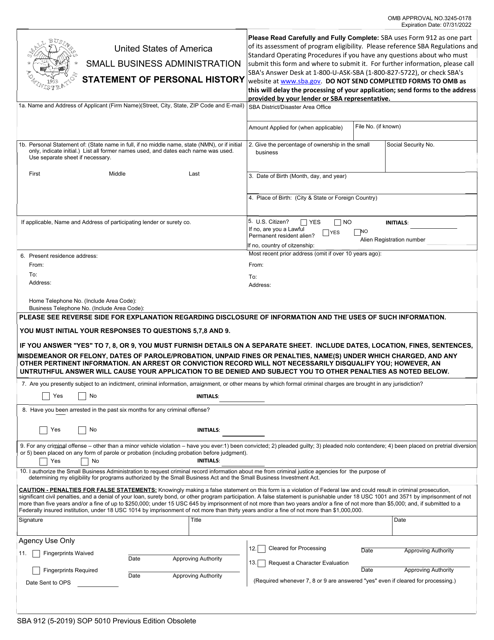

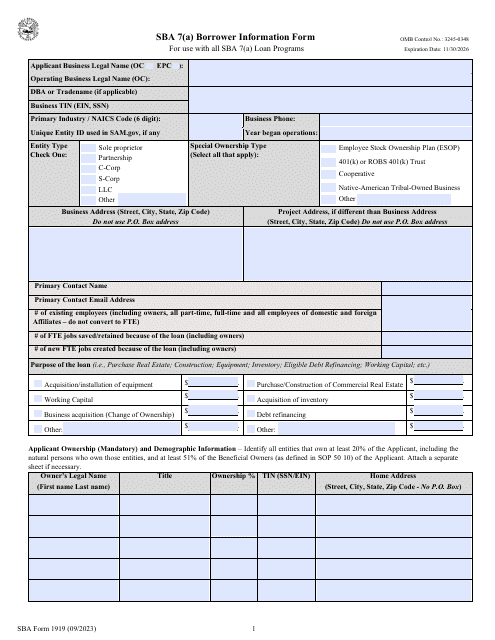

This form is issued by the Small Business Administration (SBA) and used by small businesses applying for a 7(a) loan and submitted to the SBA participating lender.

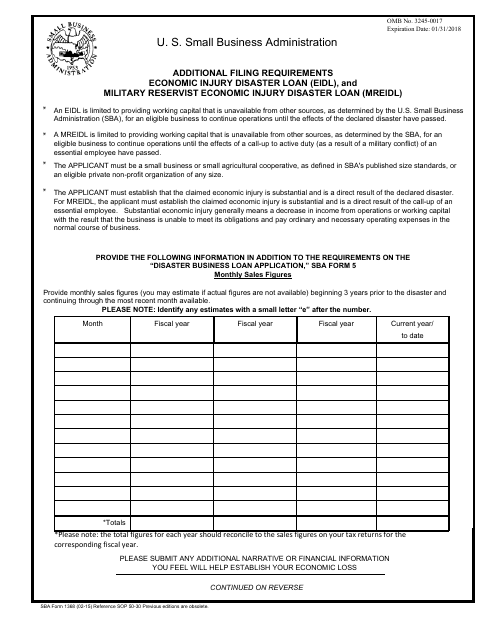

Use this form to enter information on the business's monthly revenue for three years prior to the disaster. You can also use this form to provide your financial forecast of income and expenses until the time when you estimate your business will operate normally.

This form is used for borrowers to certify their progress in the SBA Disaster Assistance Program. It helps track and verify the borrower's use of funds and the progress made towards recovery.

Download this form in order to identify a third party agent hired by a small business owner for assistance in a Small Business Administration (SBA) loan application.