Ontario Legal Forms and Templates

Documents:

2373

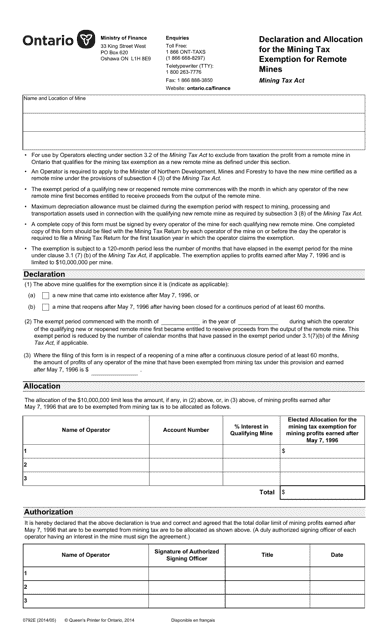

This Form is used for declaring and allocating the mining tax exemption for remote mines in Ontario, Canada.

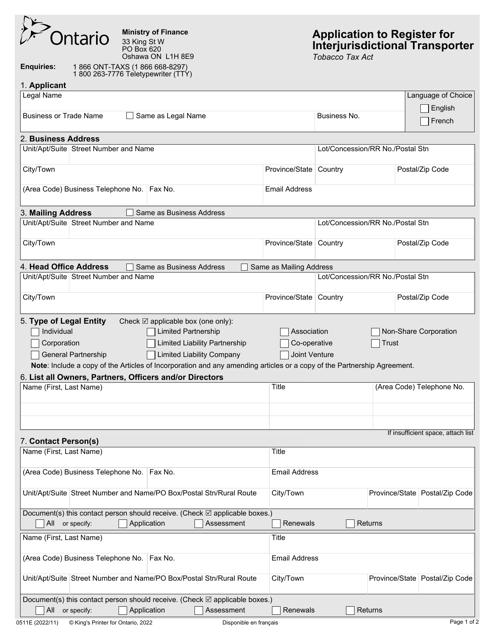

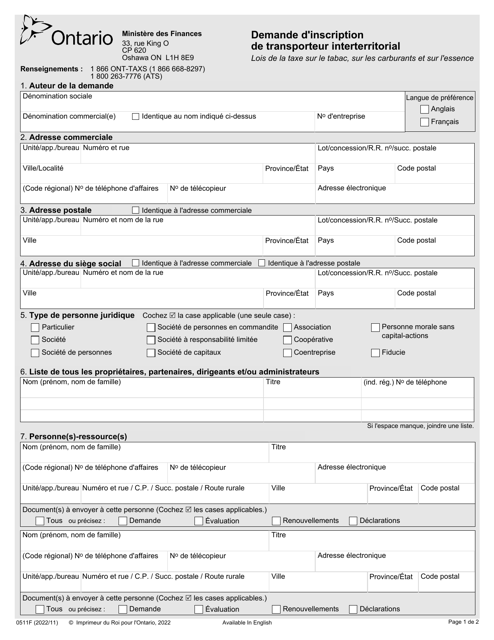

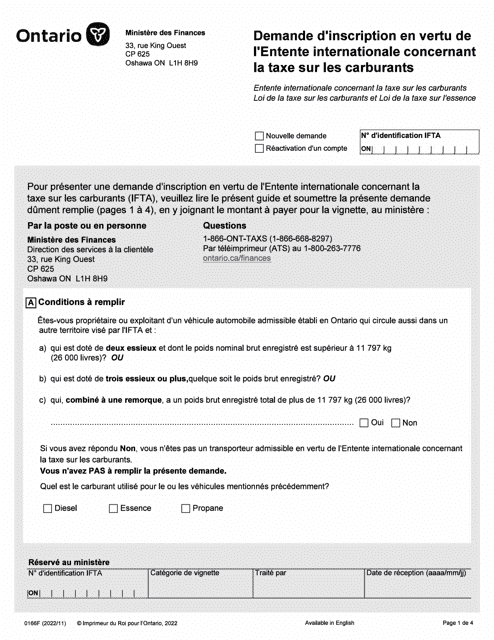

This form is used for registering as an interjurisdictional transporter in Ontario, Canada.

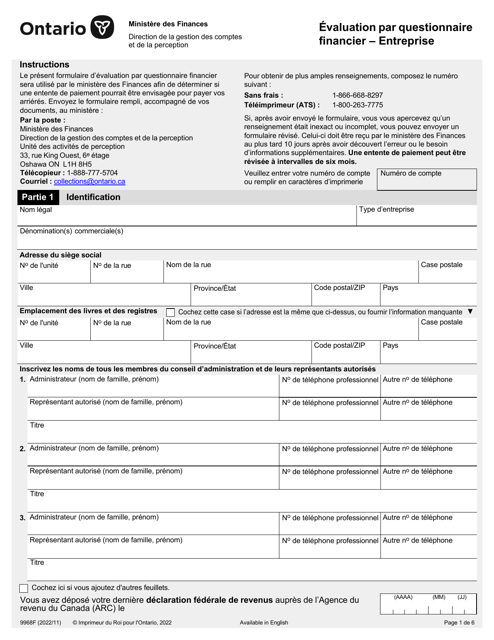

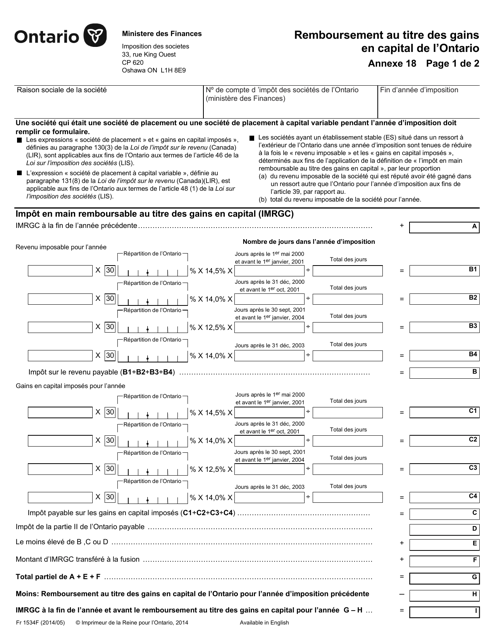

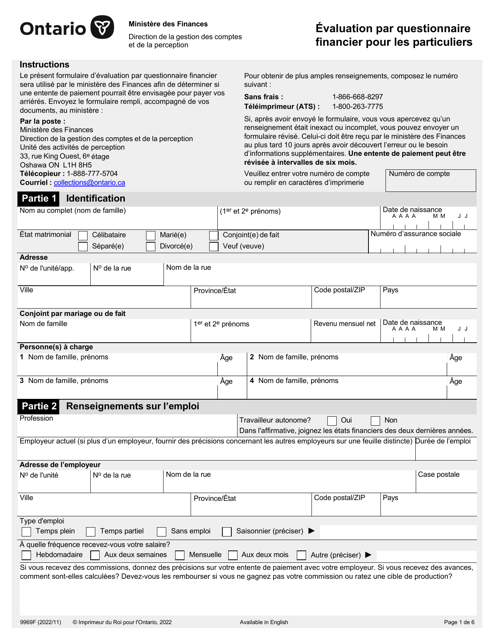

This type of document is used for the financial evaluation of a company in Ontario, Canada. (French)

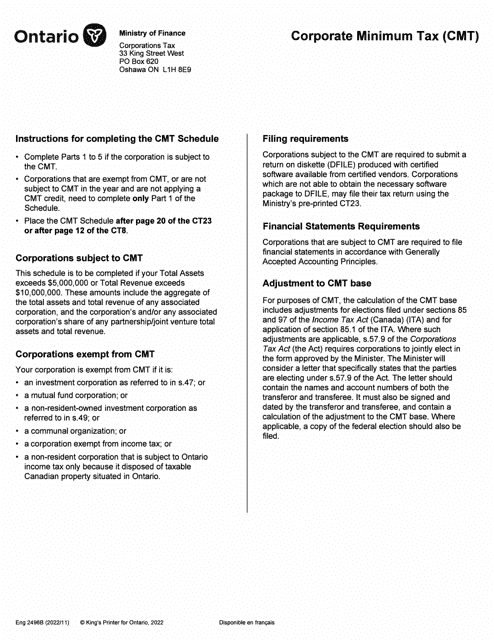

This form is used for calculating and reporting the Corporate Minimum Tax (CMT) in Ontario, Canada. It is required for certain corporations to determine the minimum tax they owe based on their Ontario taxable income.

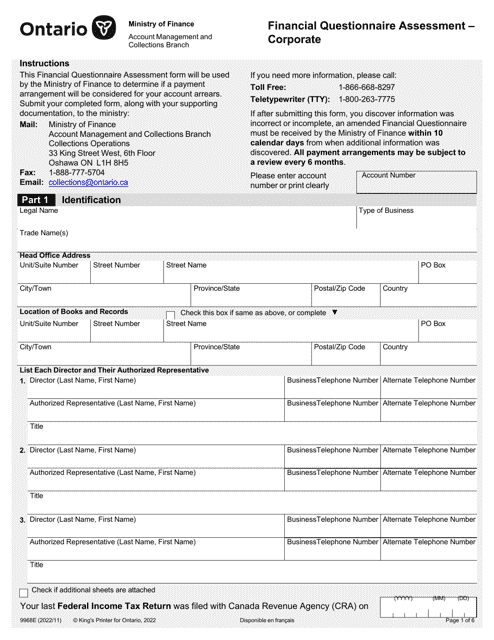

This Form is used for assessing the financial situation of corporations in Ontario, Canada.

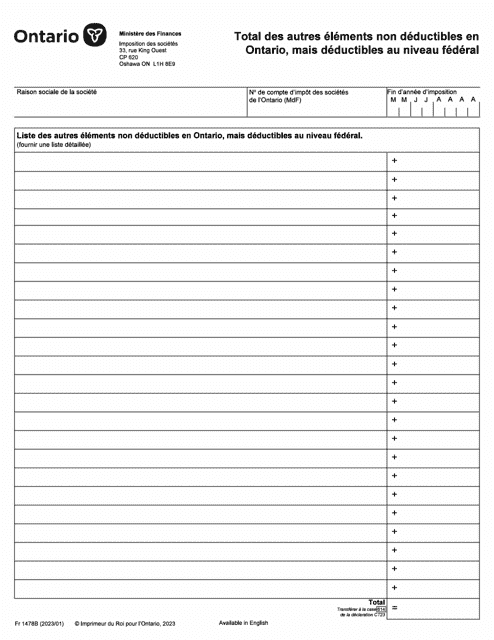

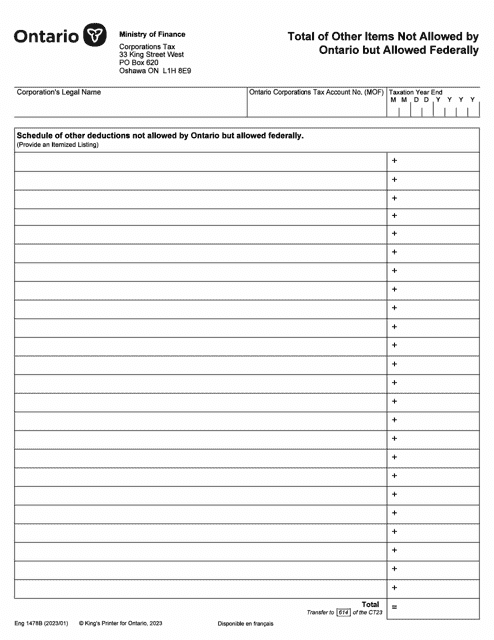

This form is used for reporting the total of other nondeductible items in Ontario that are deductible at the federal level.

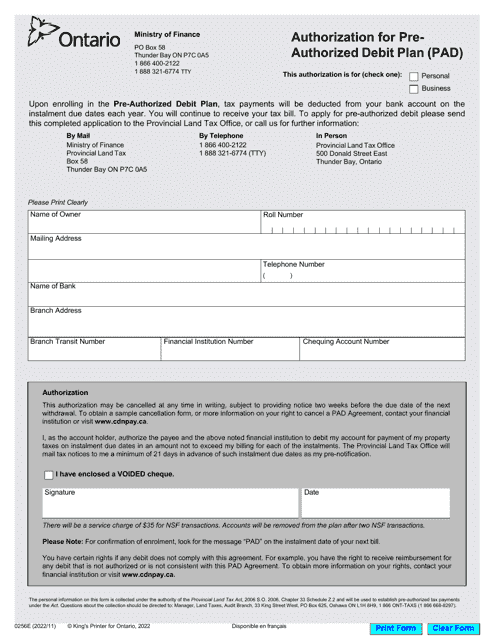

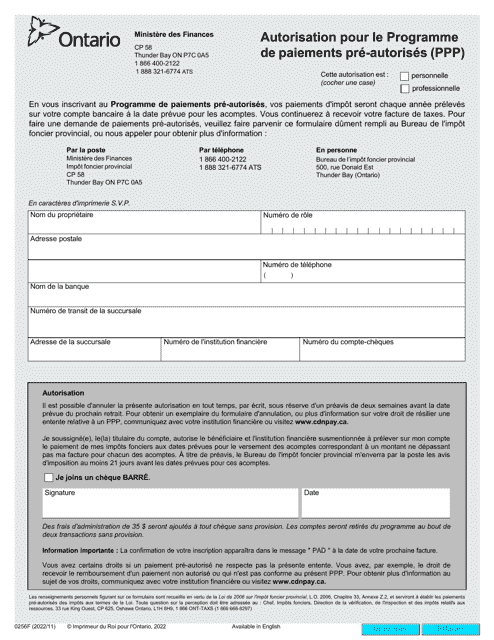

This type of document is used for obtaining authorization for the Pre-Authorized Payment Program (PPP) in Ontario, Canada.

This form is used for reporting the total of other expenses or items that are not allowed for deduction in Ontario, Canada but are allowed federally. It helps individuals and businesses to accurately report their taxable income in Ontario.

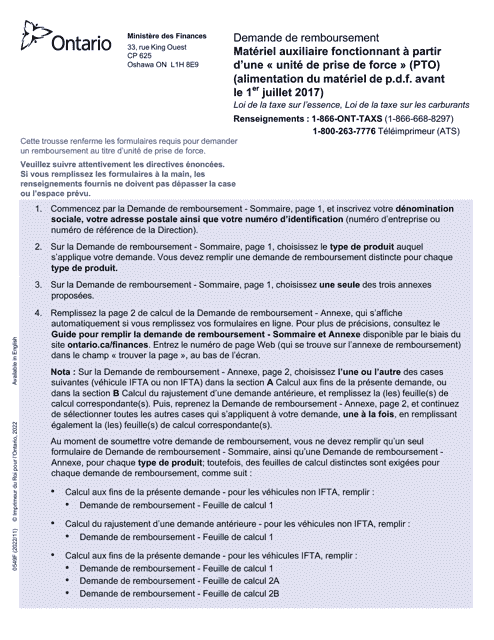

This Form is used for requesting reimbursement for auxiliary equipment powered by a Power Take-Off Unit (PTO) that supplies power to the equipment before July 1, 2017. This form is specific to Ontario, Canada.

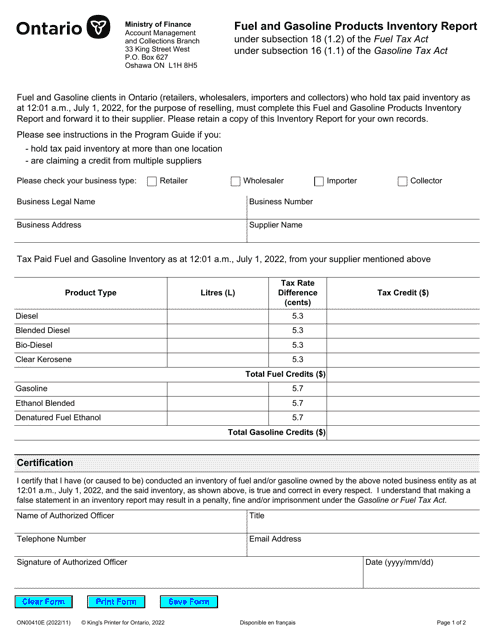

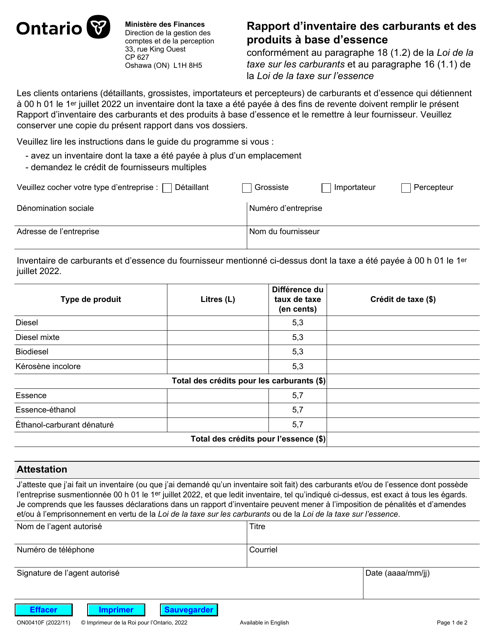

This Form is used for reporting the inventory of fuel and gasoline products in Ontario, Canada.

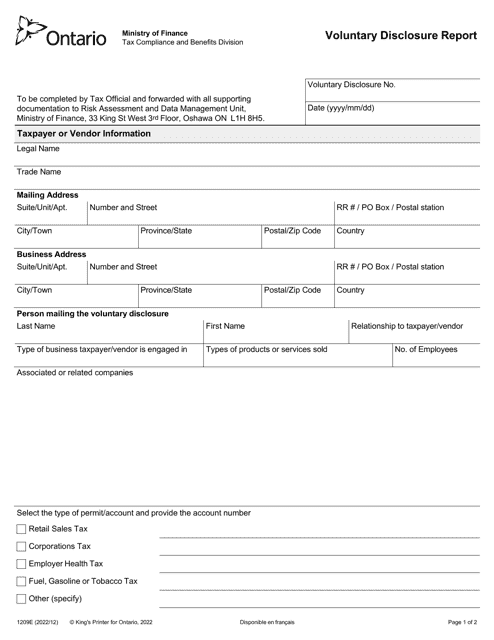

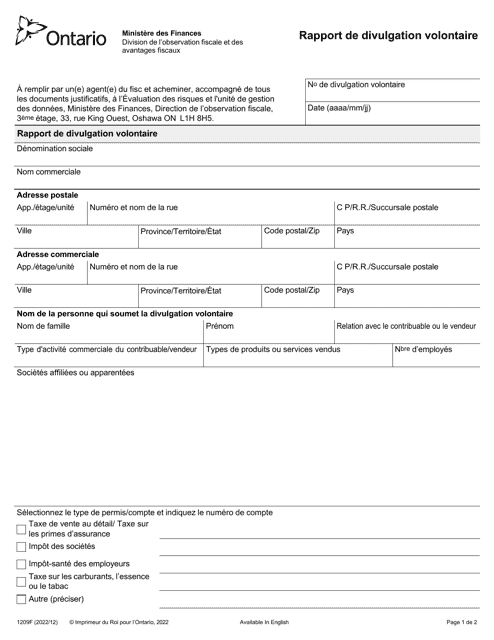

This form is used for reporting voluntary disclosure of tax information in Ontario, Canada.

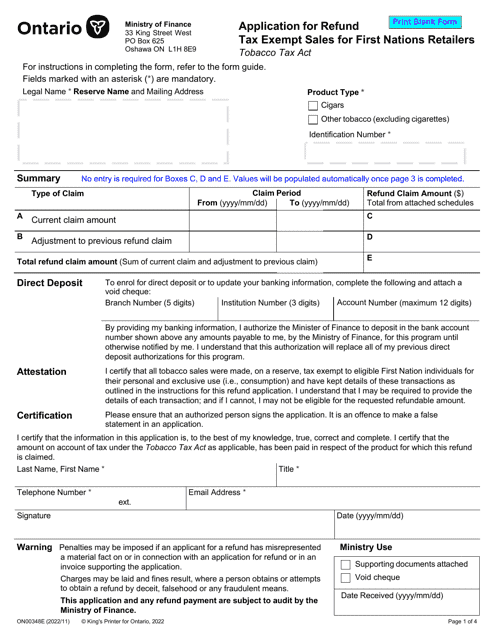

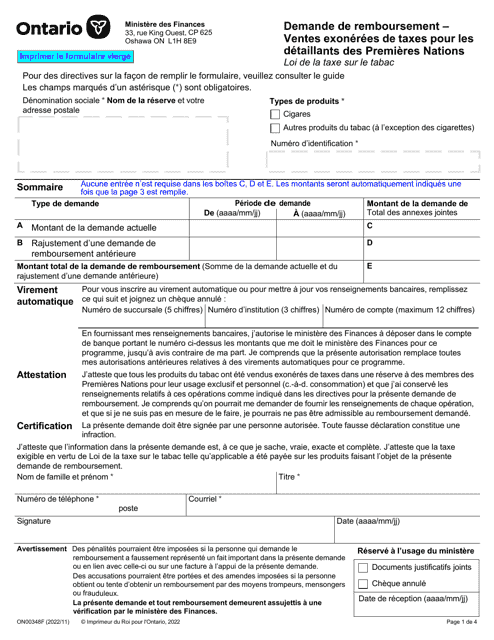

This form is used for First Nations retailers in Ontario, Canada to apply for a refund on tax-exempt sales.

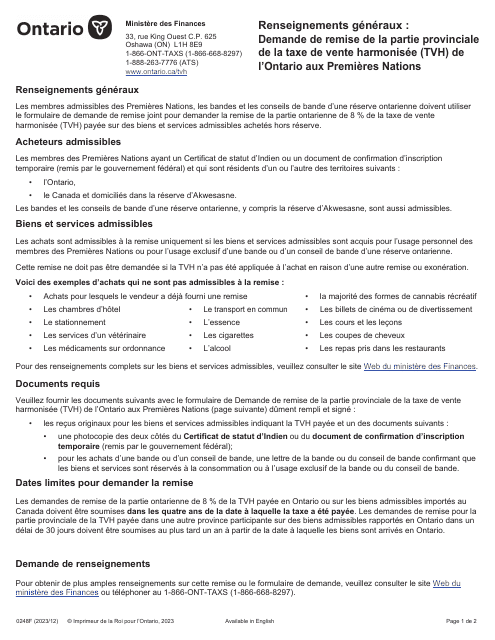

This type of document is a French form in Ontario, Canada. It is used for requesting reimbursement for tax-exempt sales made by retailers of First Nations people.

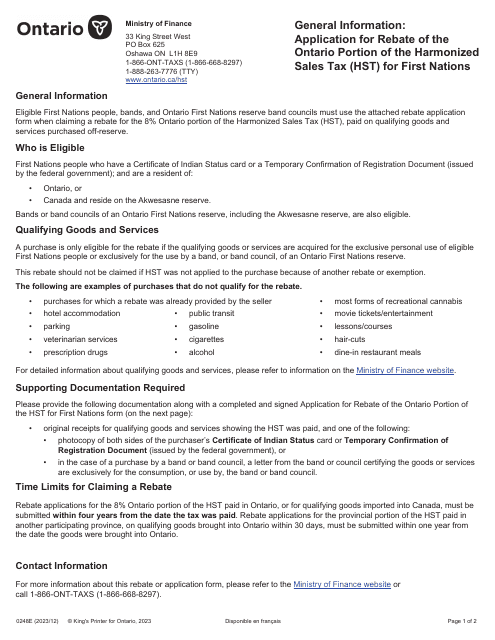

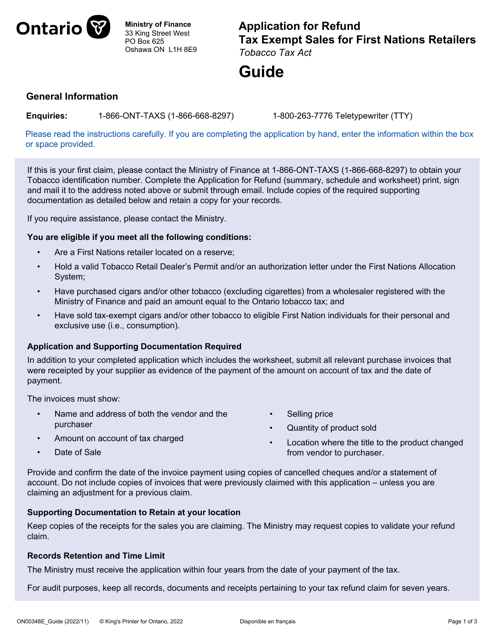

This form is used for applying for a refund of tax-exempt sales for First Nations retailers in Ontario, Canada. It provides instructions on how to properly complete and submit the application.

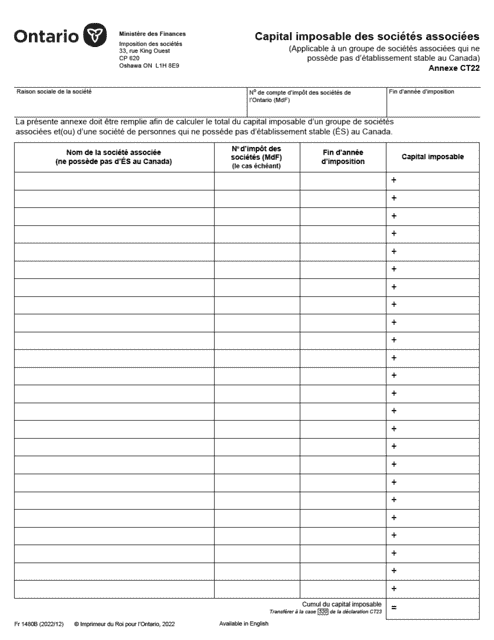

This form is designed for corporations in Ontario, Canada, allowing them to compute and declare their taxable capital. It's primarily intended for the French-speaking corporate entities.

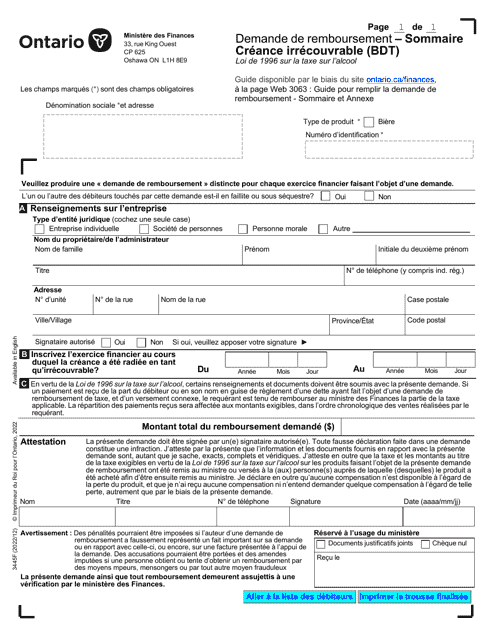

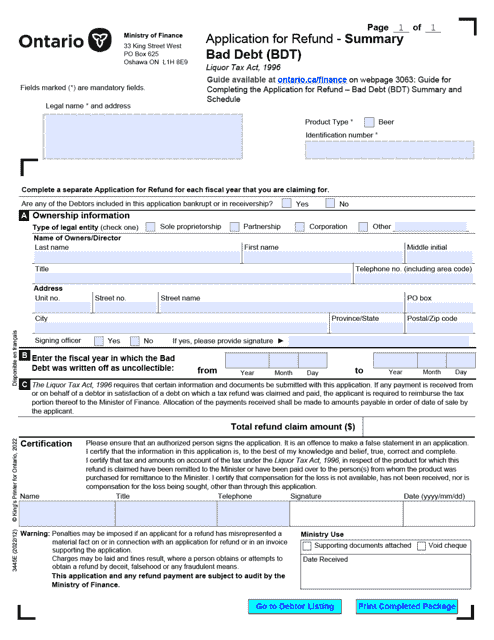

This type of document is used for requesting reimbursement for an irrecoverable debt in Ontario, Canada.

This form is used for applying for a refund on bad debt in Ontario, Canada.

This type of document is used for reporting inventory of fuels and gasoline-based products in Ontario, Canada.

This form is used for applying for registration under the International Fuel Tax Agreement in the province of Ontario, Canada.

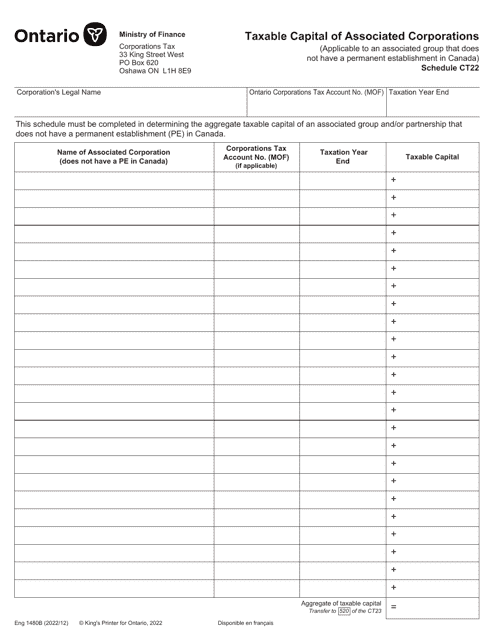

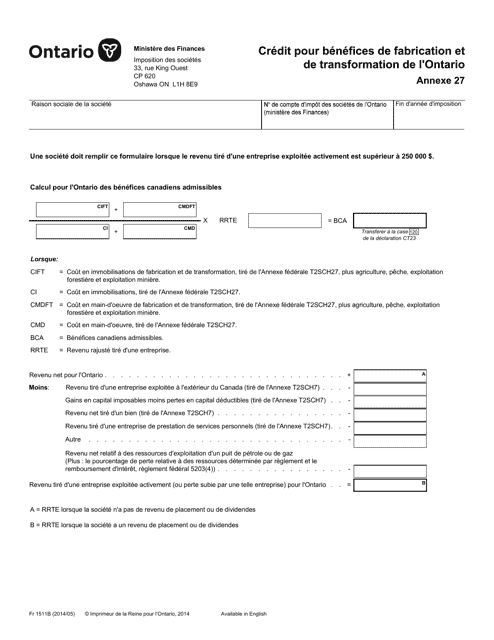

This form is used for reporting the taxable capital of associated corporations in Ontario, Canada.

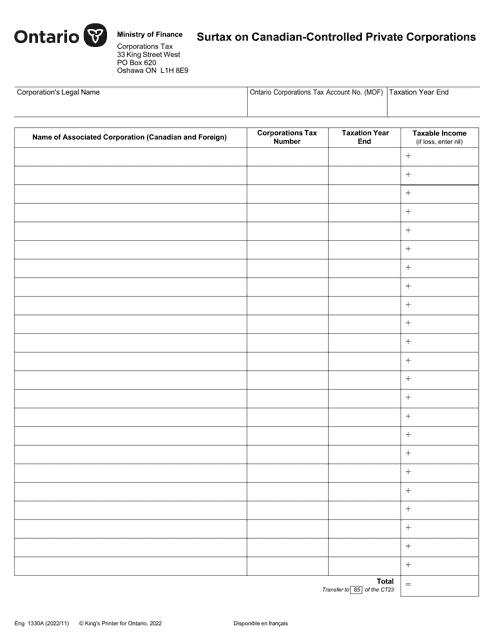

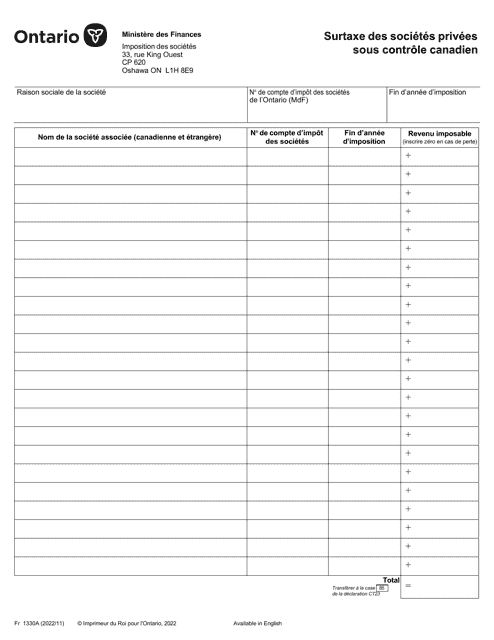

This type of document is used for paying the surtax by privately controlled Canadian companies in Ontario, Canada.

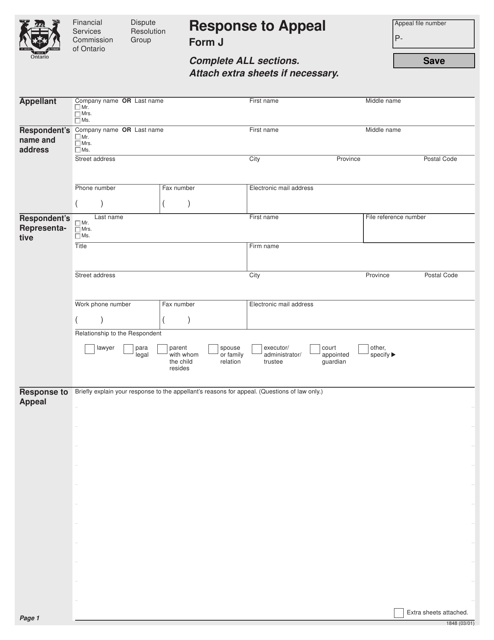

This Form is used for responding to an appeal in the province of Ontario, Canada.

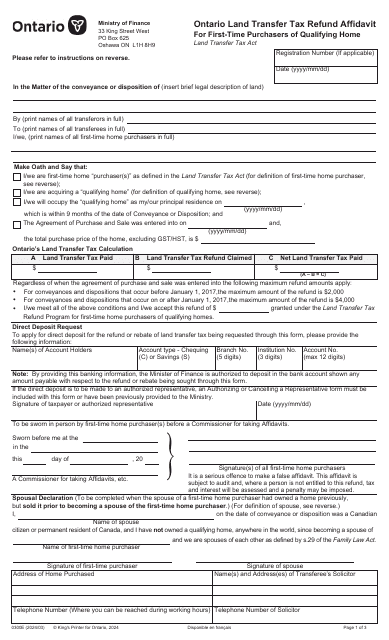

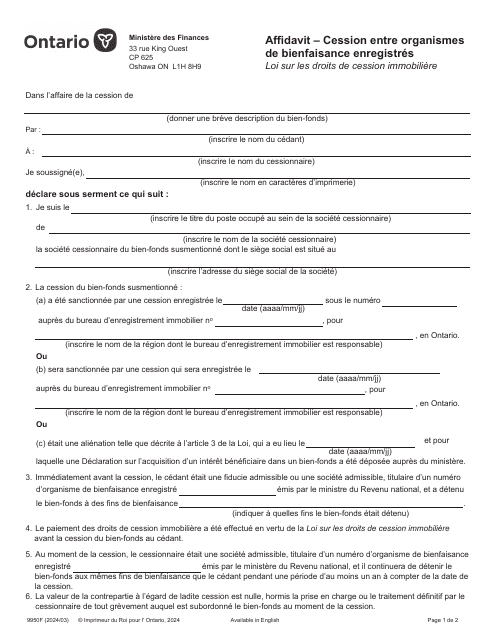

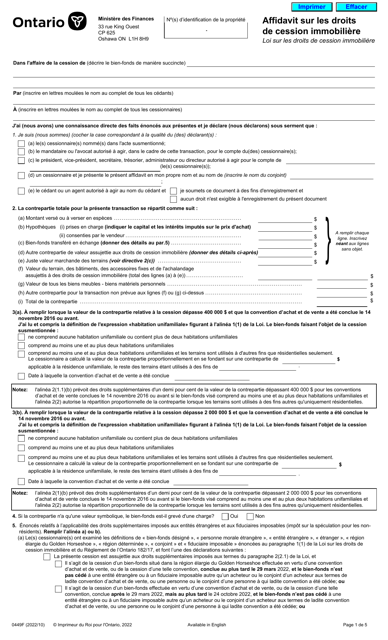

This Form is used for submitting an Affidavit on Real Estate Transfer Tax in Ontario, Canada. (French version)

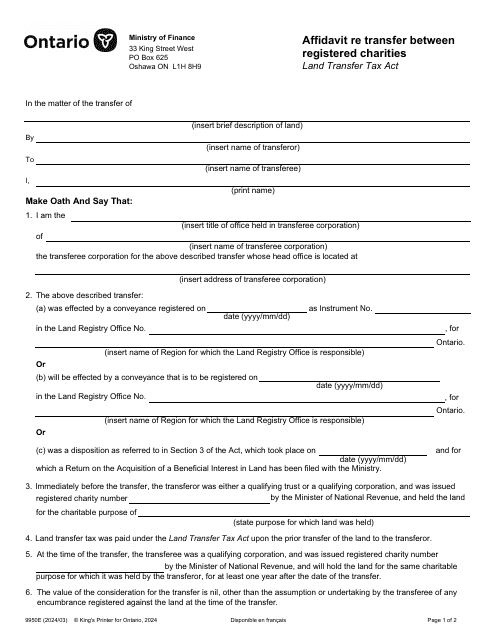

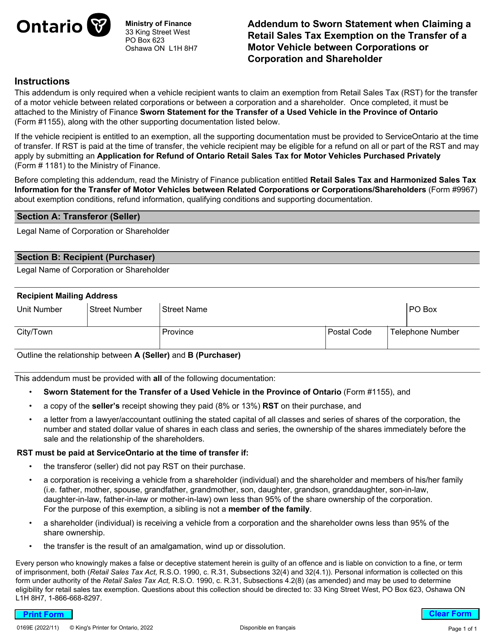

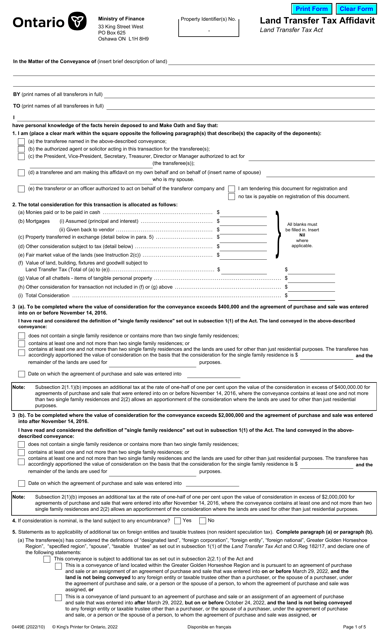

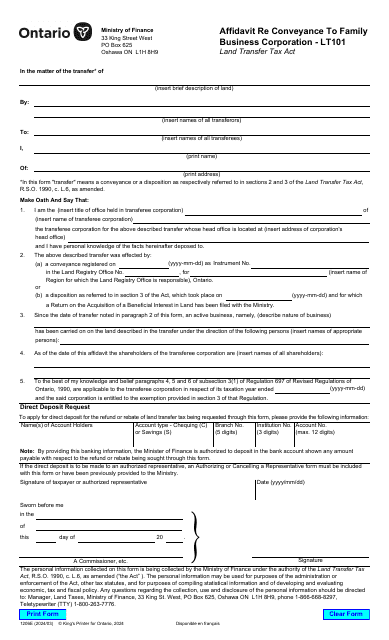

This form is used for completing a Land Transfer Tax Affidavit in Ontario, Canada. It is required to declare the value of the property being transferred and pay any applicable land transfer tax.

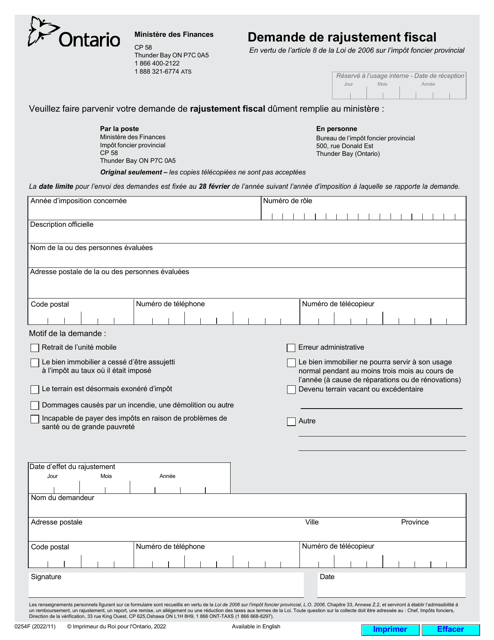

This form is used for requesting a tax adjustment in the province of Ontario, Canada.