Ontario Legal Forms and Templates

Documents:

2373

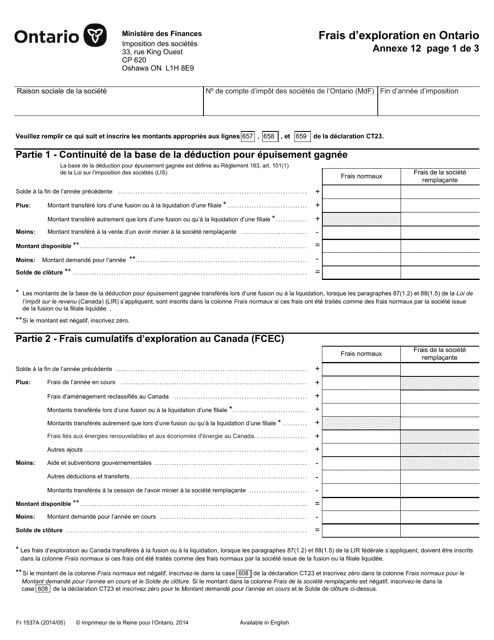

This Form is used for reporting exploration expenses in Ontario, Canada. It is specifically for the French-speaking residents of Ontario.

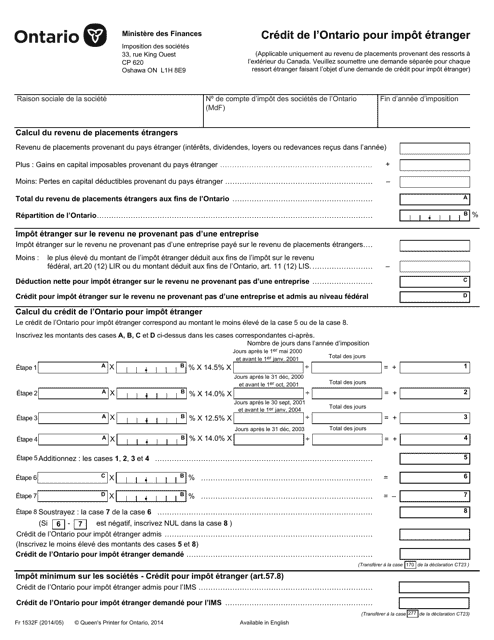

This document is used for claiming foreign tax credit in Ontario, Canada. (French version)

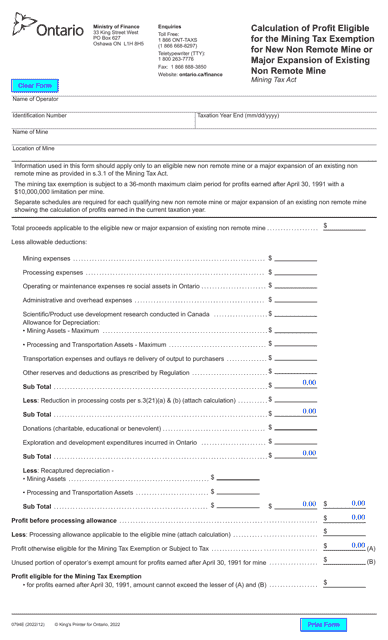

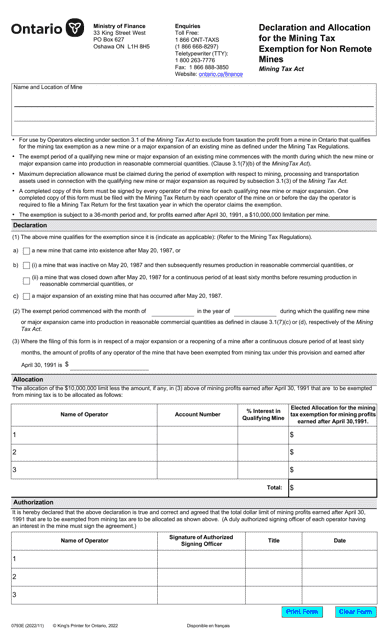

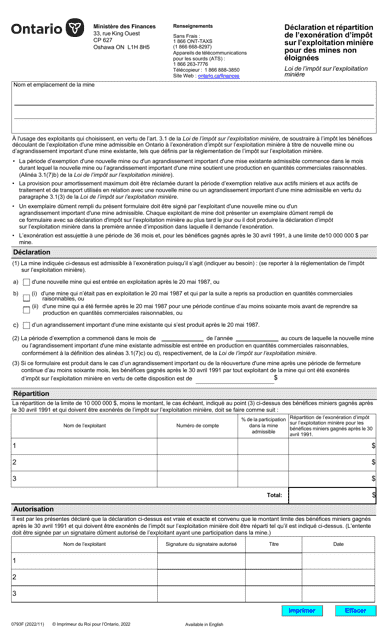

This form is used for calculating the profit eligible for the mining tax exemption for new non-remote mines or major expansions of existing non-remote mines in Ontario, Canada.

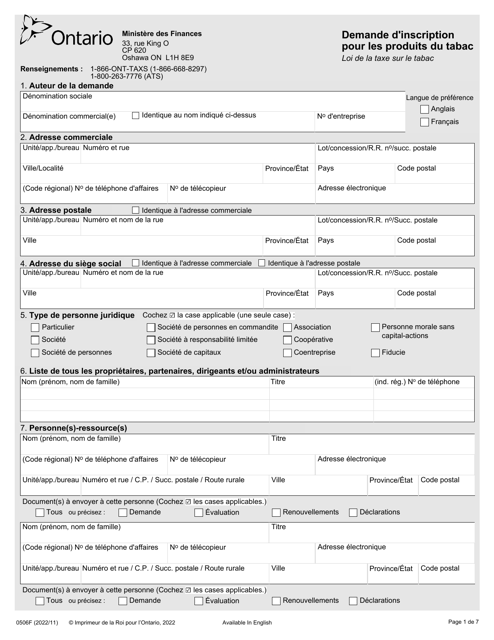

This document is used for applying to register tobacco products in Ontario, Canada. (French)

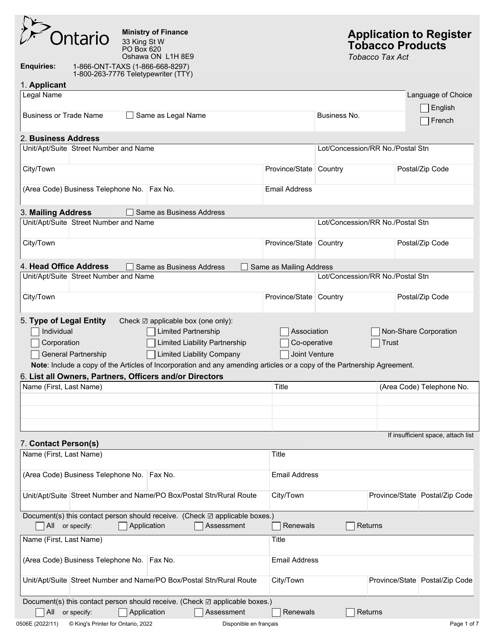

This Form is used for applying to register tobacco products in the province of Ontario, Canada.

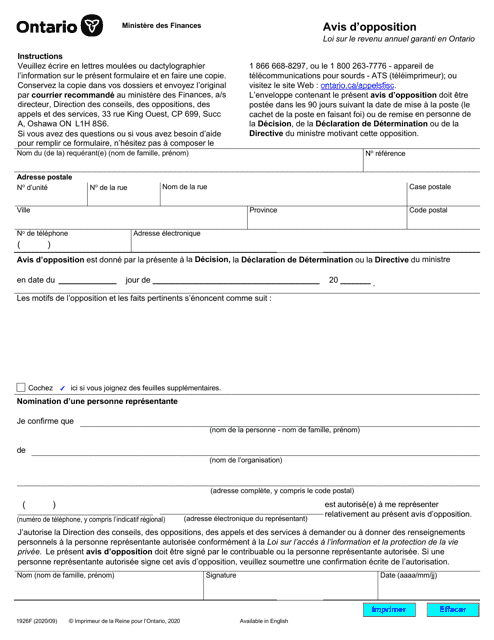

This document for filing an opposition notice in Ontario, Canada. (French)

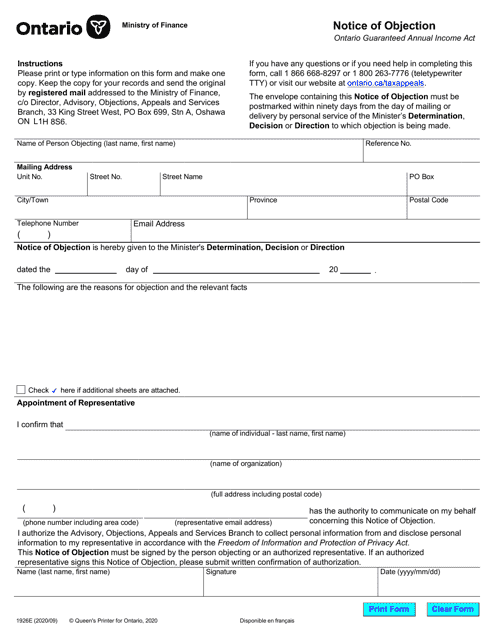

This Form is used for filing a notice of objection under the Ontario Guaranteed Annual Income Act in Ontario, Canada.

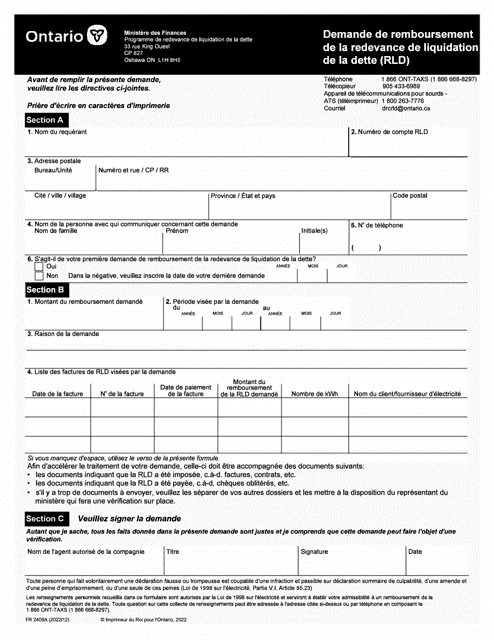

This document is used for requesting reimbursement of the Debt Settlement Fee (Rld) in Ontario, Canada.

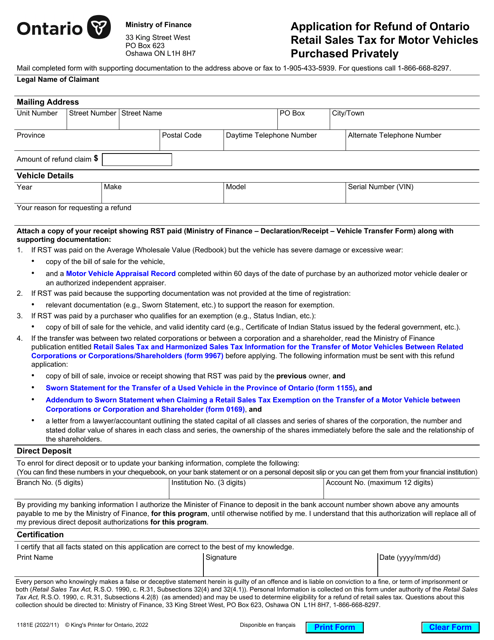

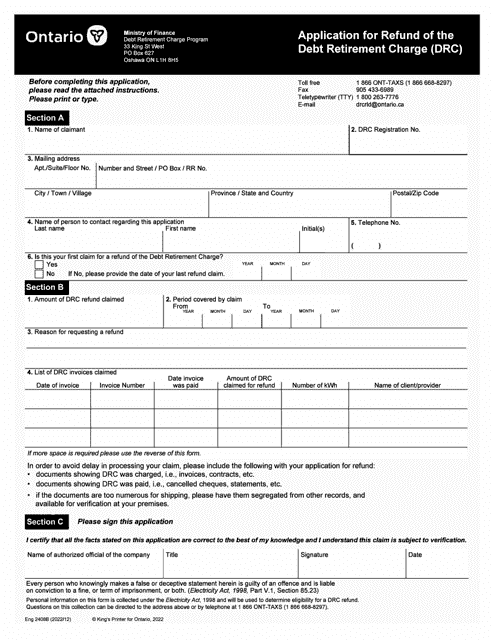

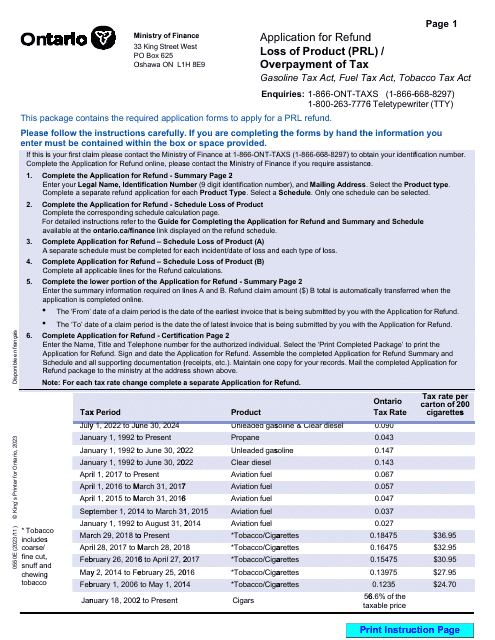

This Form is used for applying for a refund of the Debt Retirement Charge (DRC) in Ontario, Canada.

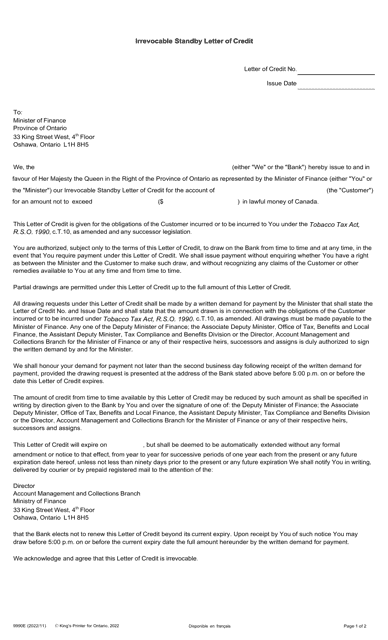

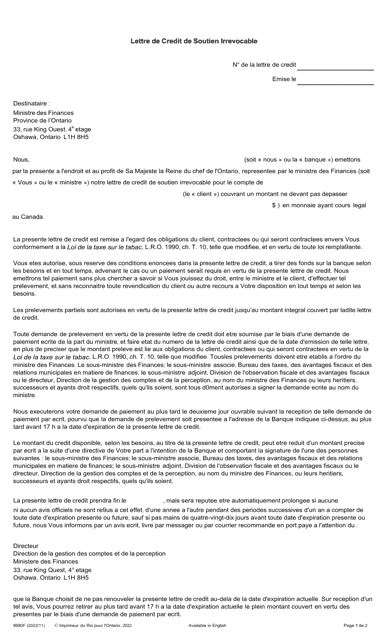

This form is used for establishing an Irrevocable Standby Letter of Credit in Ontario, Canada.

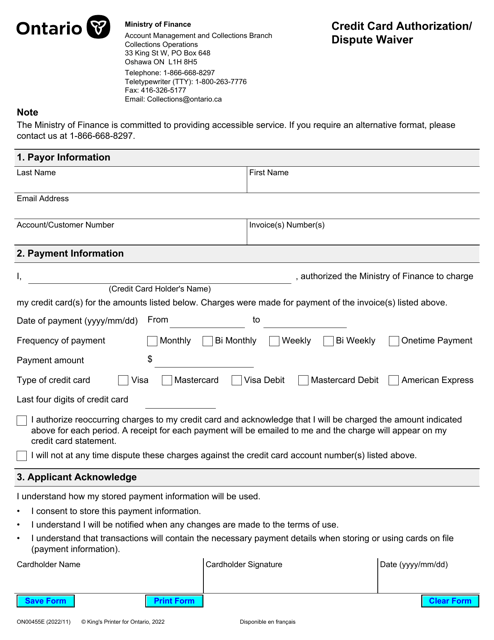

This form is used for authorizing credit card charges and waiving the right to dispute them in Ontario, Canada.

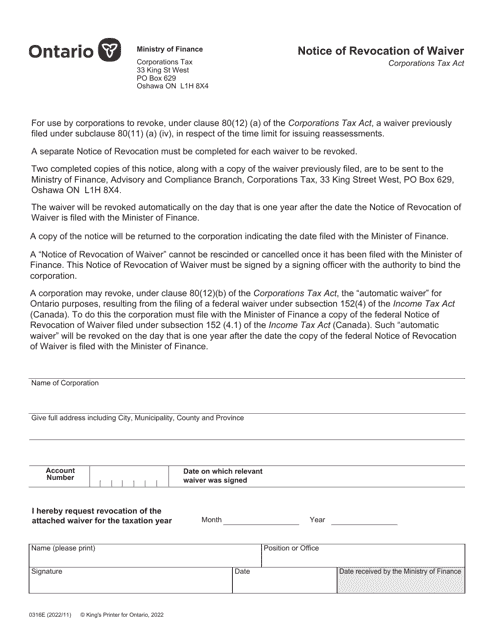

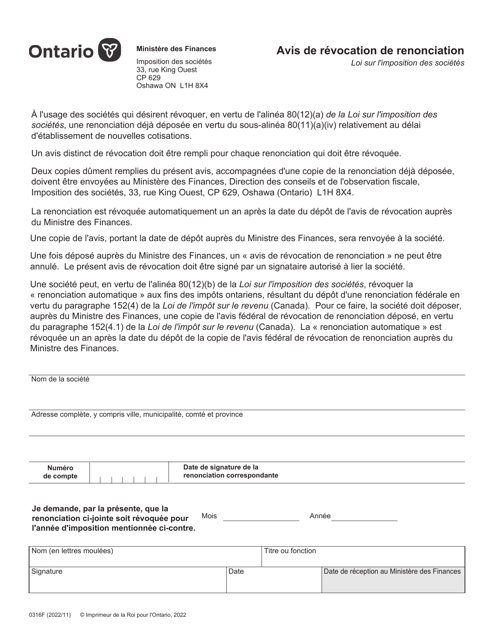

This document is used for submitting a notice to revoke a renunciation in Ontario, Canada. It is written in French.

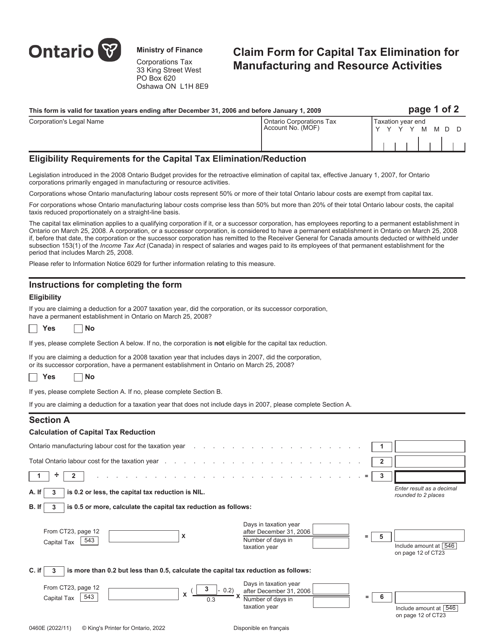

This form is used for claiming tax elimination for manufacturing and resource activities in Ontario, Canada.

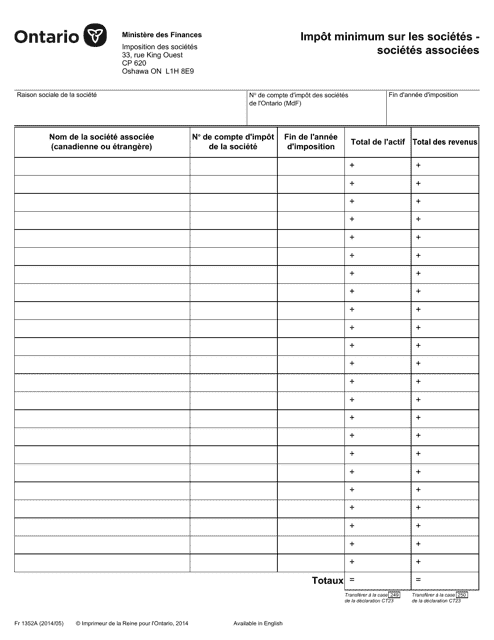

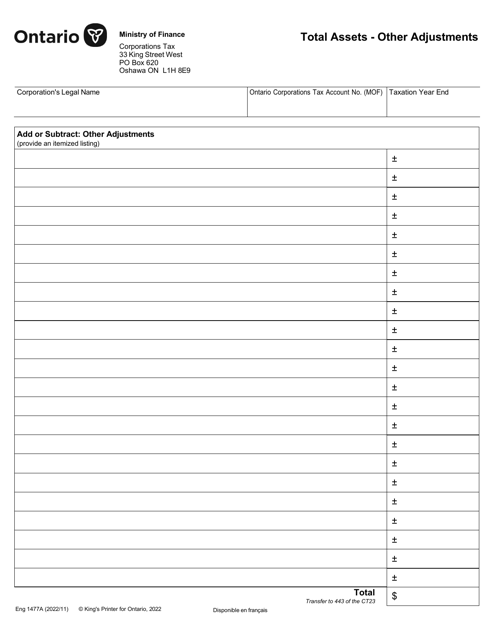

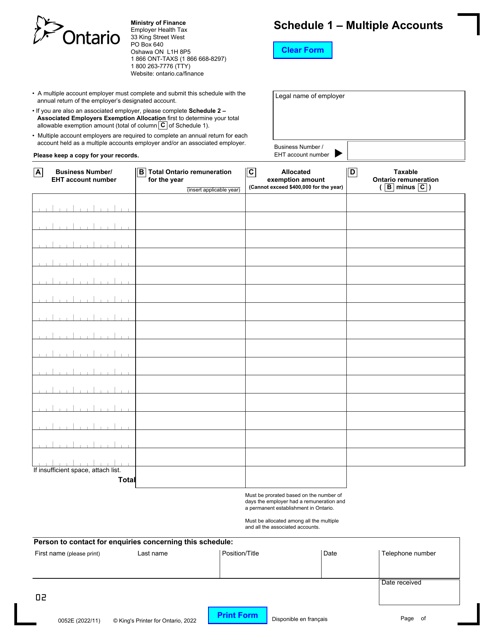

This form is used for reporting total assets and other adjustments specific to the province of Ontario in Canada.

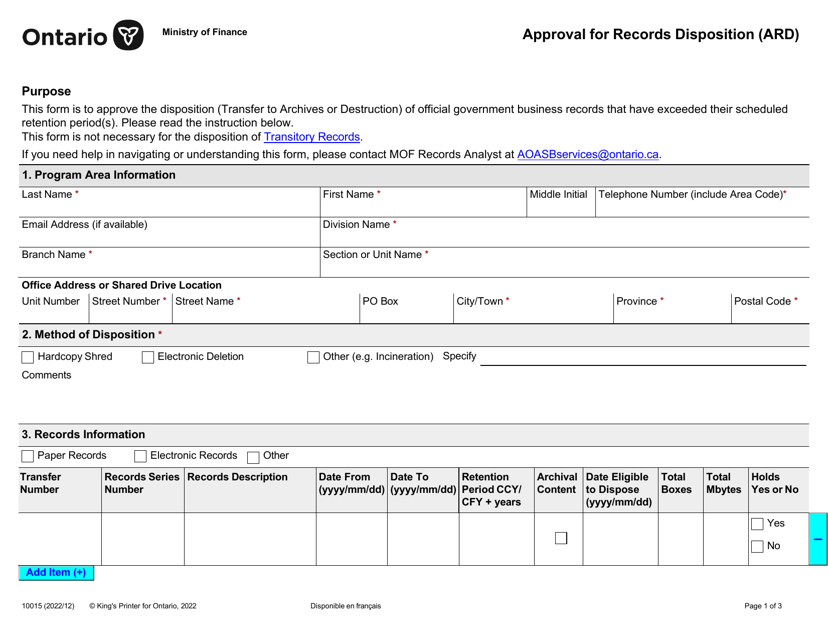

This Form is used for obtaining approval to dispose of records in Ontario, Canada.

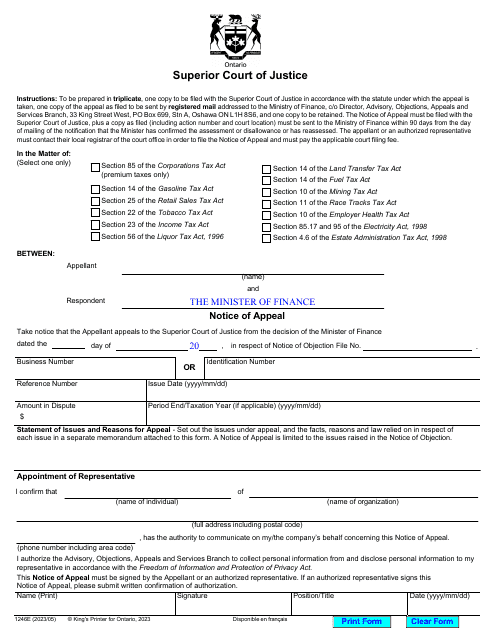

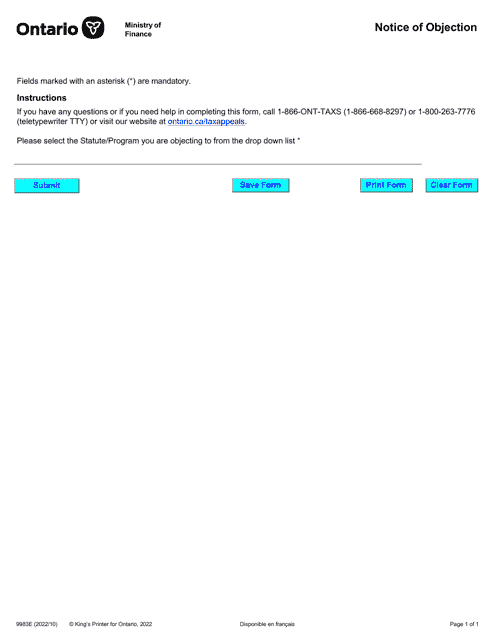

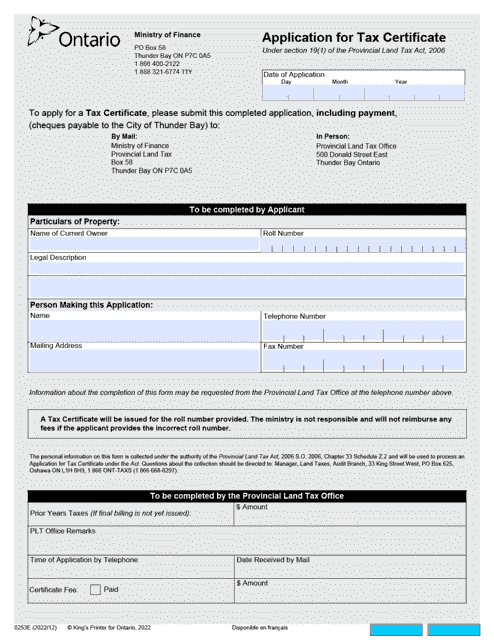

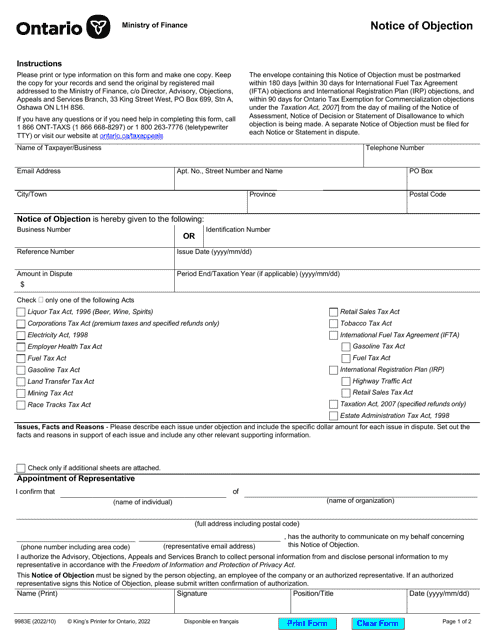

This Form is used for filing a Notice of Objection in Ontario, Canada. It allows individuals to formally dispute a decision made by the Canada Revenue Agency (CRA) regarding their taxes or benefits.

This form is used for submitting a notice of objection to the Ontario, Canada tax authorities via mail.

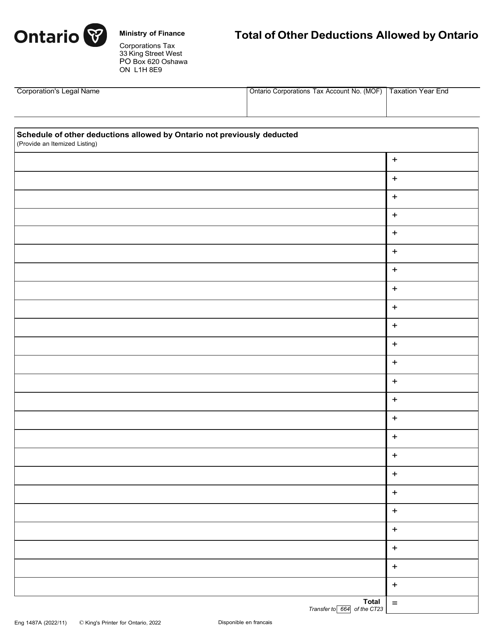

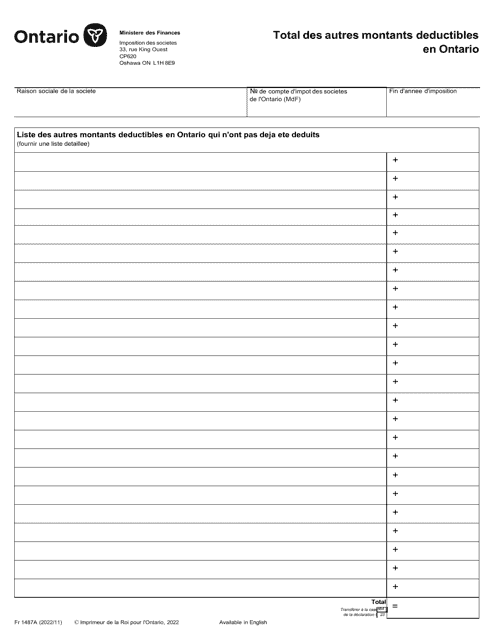

This form is used for reporting the total amount of other deductions allowed by the province of Ontario in Canada. It is important for individuals and businesses to accurately report these deductions for tax purposes.

This Form is used for declaring and allocating the mining tax exemption for non-remote mines in Ontario, Canada.

This document for declaring and distributing tax exemptions for mining operations in non-remote mines in Ontario, Canada. (French)

This form is used by residents in Ontario, Canada for declaring and deducting additional amounts in provincial taxes. The document is entirely in French and includes a detailed guide for filling out the form.

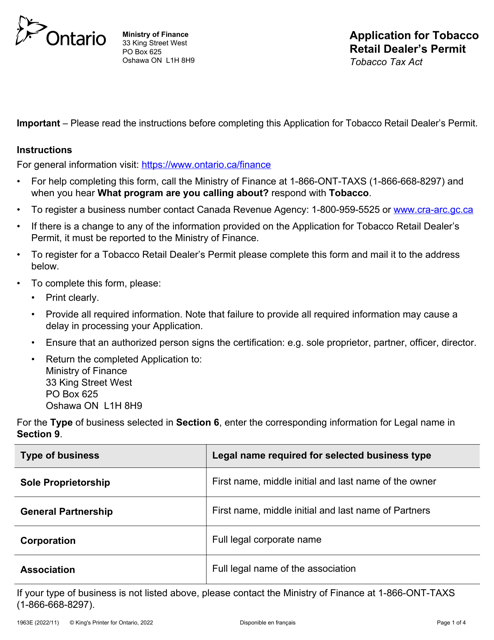

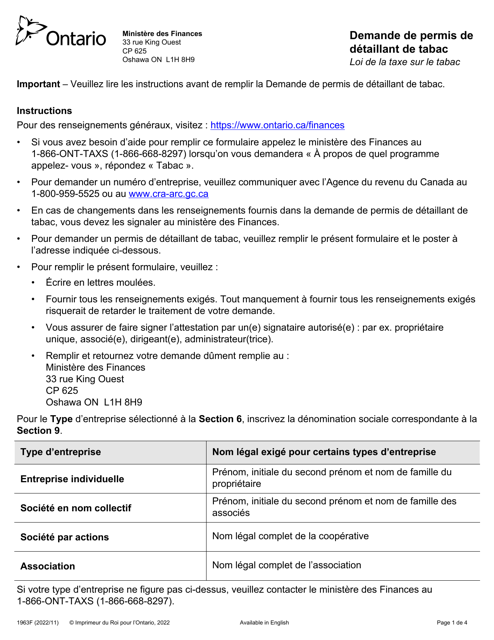

This form is used for applying for a tobacco retail dealer's permit in Ontario, Canada.

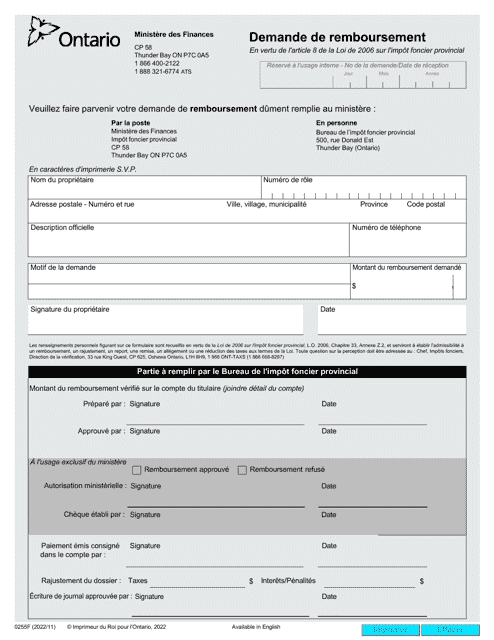

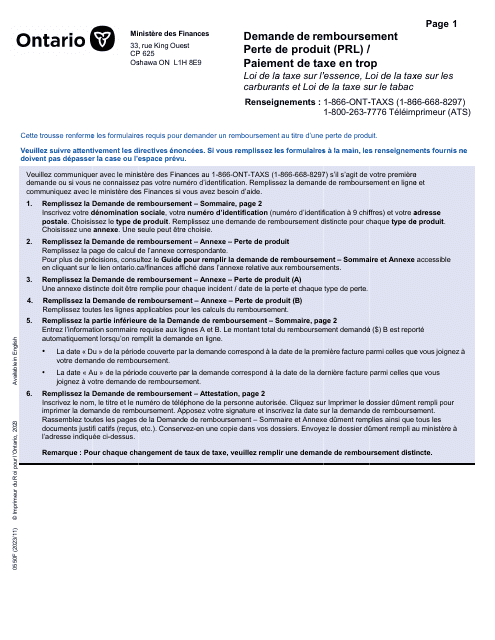

This document is a French form used for requesting reimbursement in the province of Ontario, Canada.

This document is used for applying for a tobacco retailer permit in Ontario, Canada.

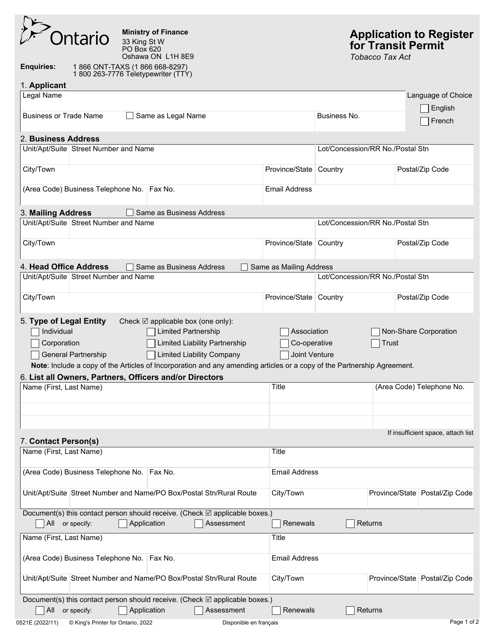

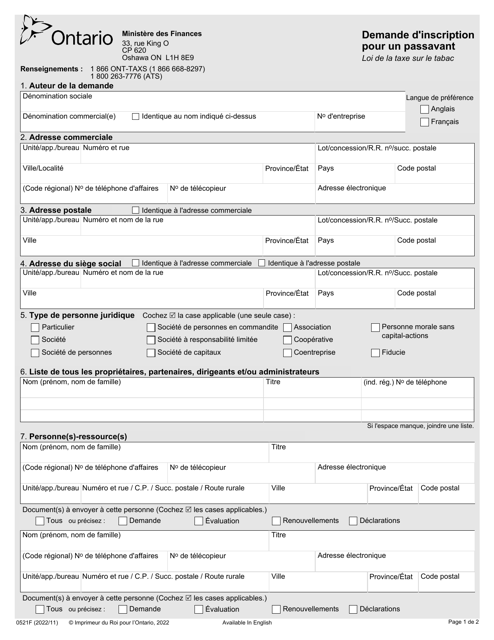

This form is used for applying to register for a transit permit in Ontario, Canada.

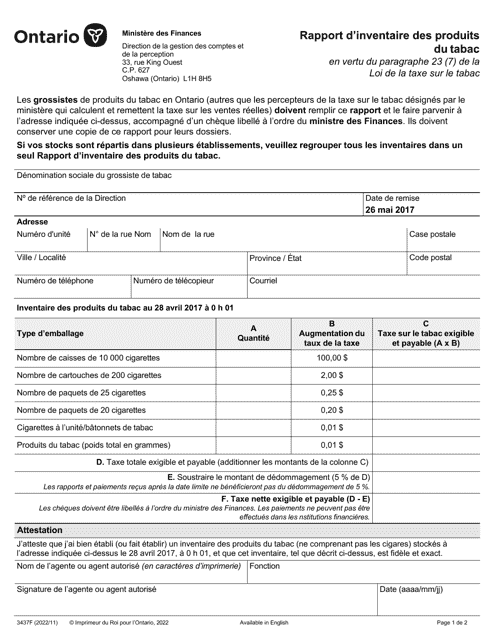

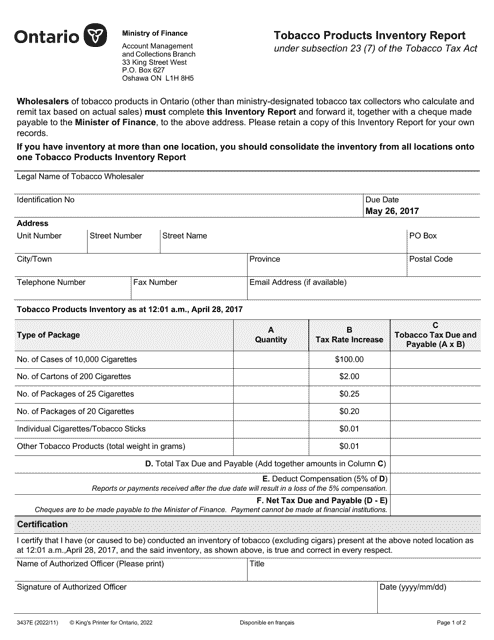

This document is used for reporting the inventory of tobacco products in Ontario, Canada. It is a form specifically designed for this purpose.

This form is used for reporting the inventory of tobacco products in Ontario, Canada. It is a requirement for businesses that sell tobacco products to submit this report to the government.

This type of document is used for requesting an entry permit in Ontario, Canada. It is written in French.