Canadian Federal Legal Forms and Templates

Documents:

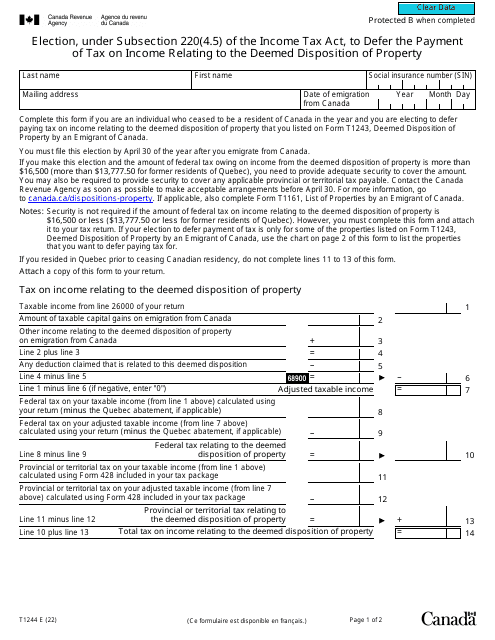

5112

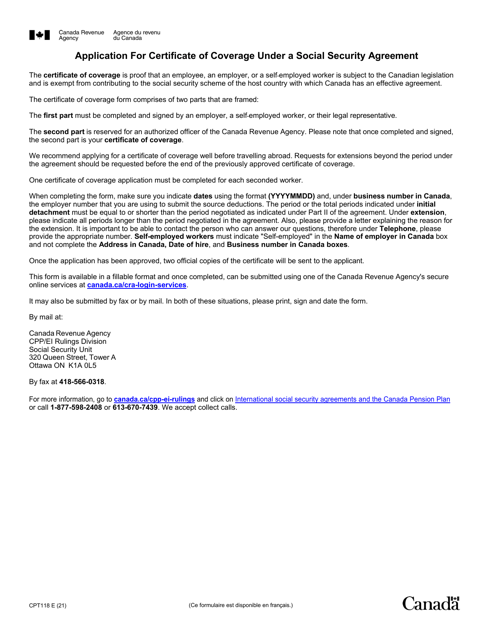

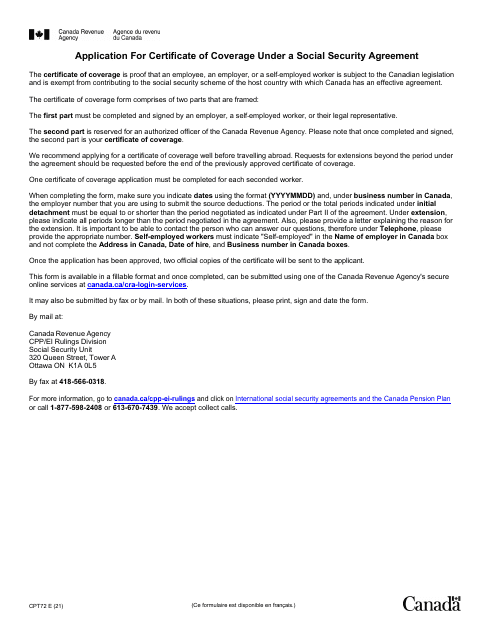

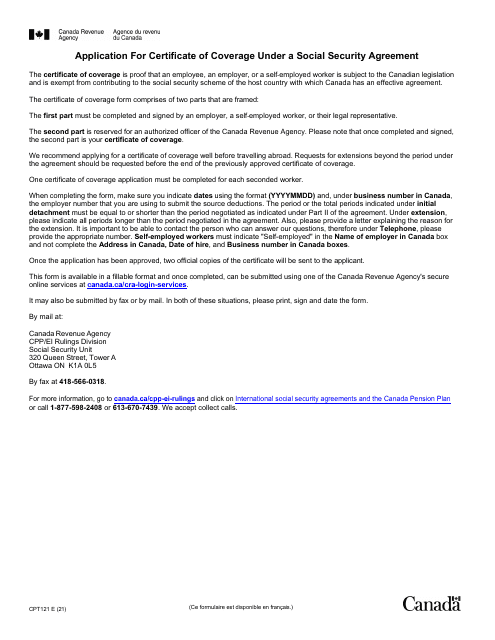

This form is used to certify coverage under the Canada Pension Plan for individuals living in Morocco, as per the social security agreement between Canada and Morocco.

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals residing in Canada and the Commonwealth of Dominica. It ensures that individuals are eligible for benefits under the social security agreement between both countries.

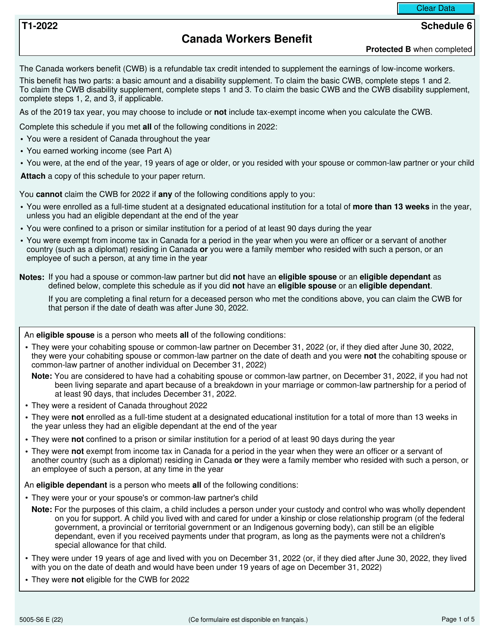

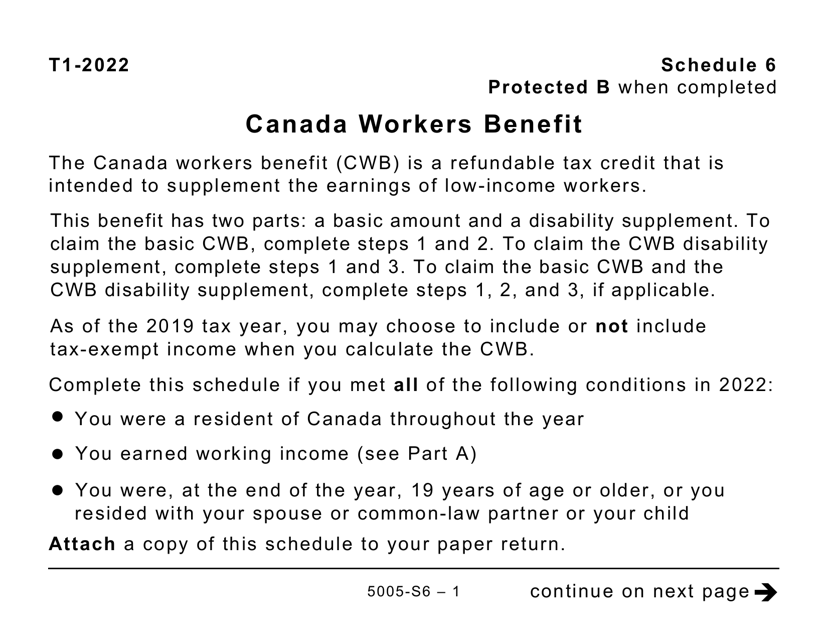

This Form is used for reporting the Canada Workers Benefit for Quebec residents. It is specifically designed for those who require a large print format.

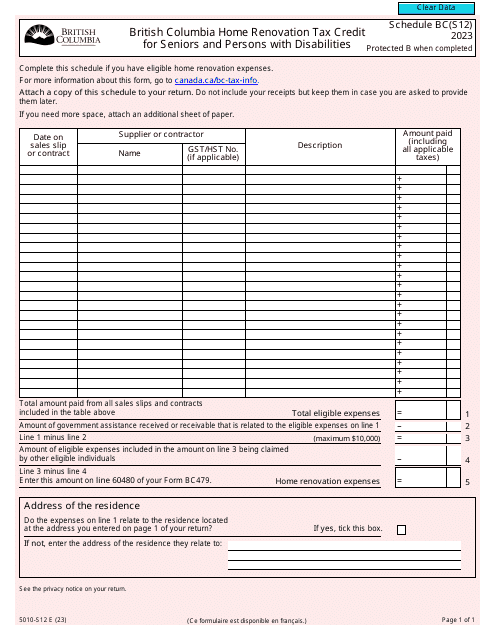

This form is used for applying for the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities in Canada. It is specifically designed for individuals who require a large print format.

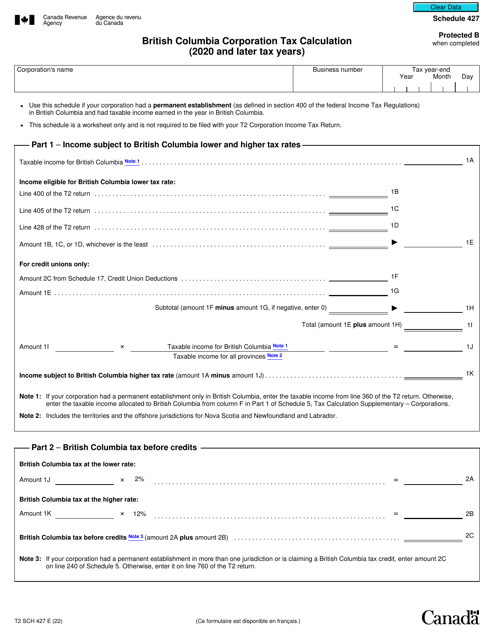

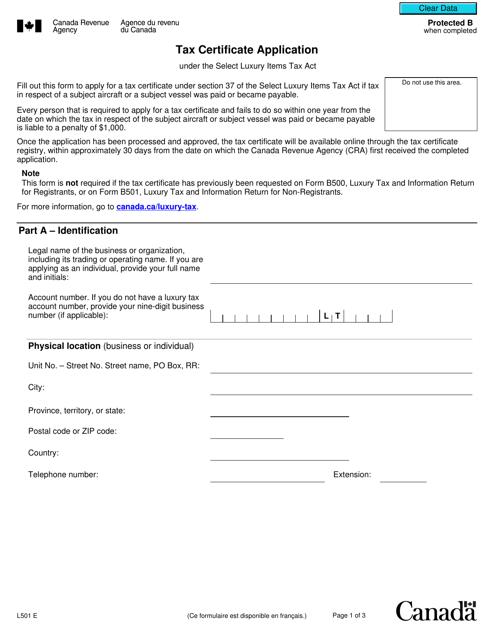

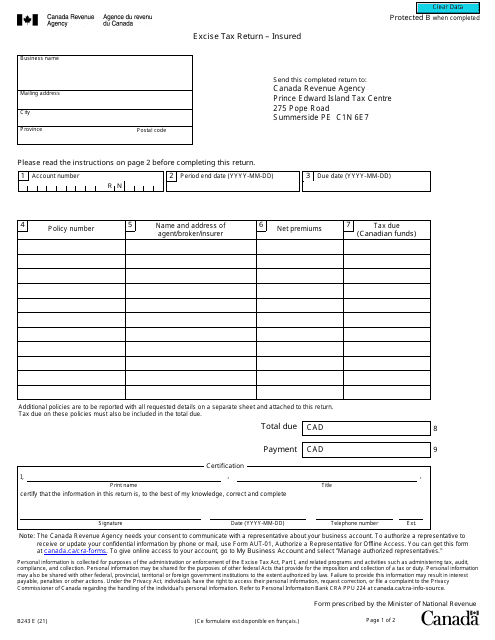

This form is used for applying for a tax certificate in Canada.

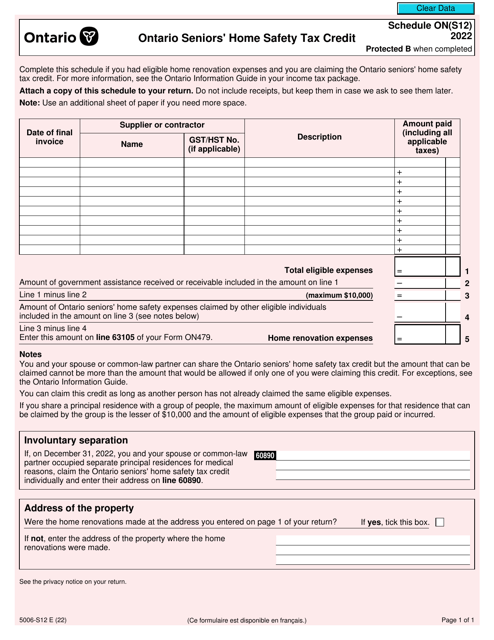

This Form is used for claiming the Ontario Seniors' Home Safety Tax Credit in Canada. It is specifically designed for Ontario residents who are seniors and have made eligible home renovation expenses to improve safety and accessibility in their residences.

This Form is used for claiming the Ontario Seniors' Home Safety Tax Credit in Canada. This specific version of the form is in large print format for seniors with visual impairments.

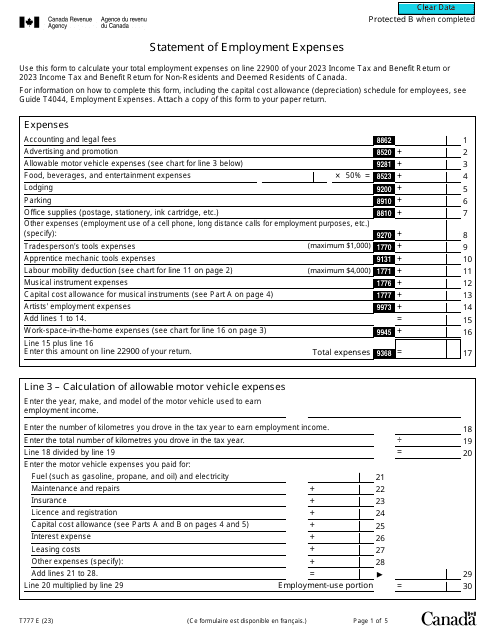

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

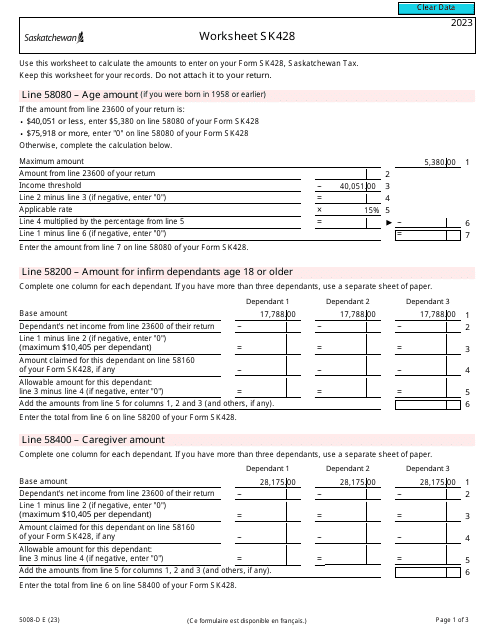

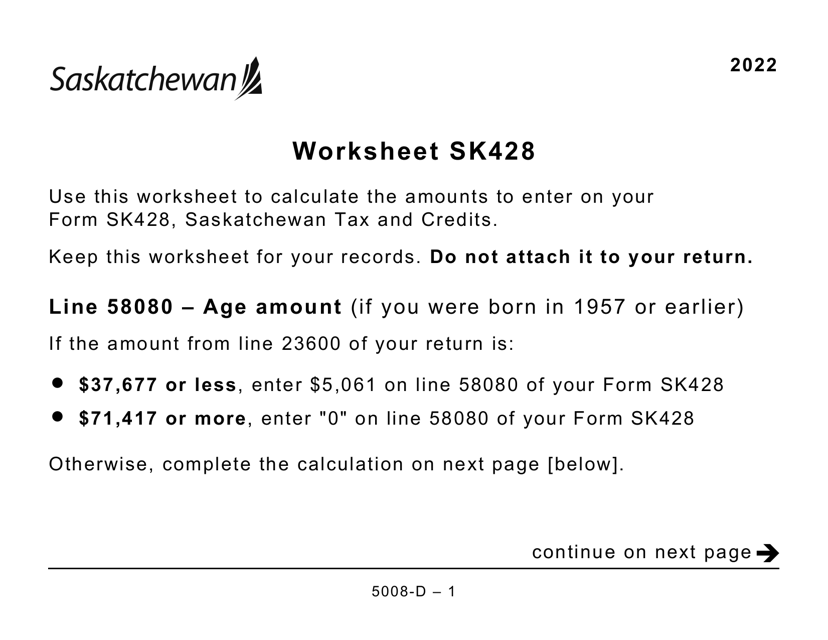

This form is used for completing a worksheet for individuals filing taxes in Saskatchewan, Canada. It is specifically designed for individuals who require a larger print format.

This Form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals who are covered under the social security agreement between Canada and Turkey.

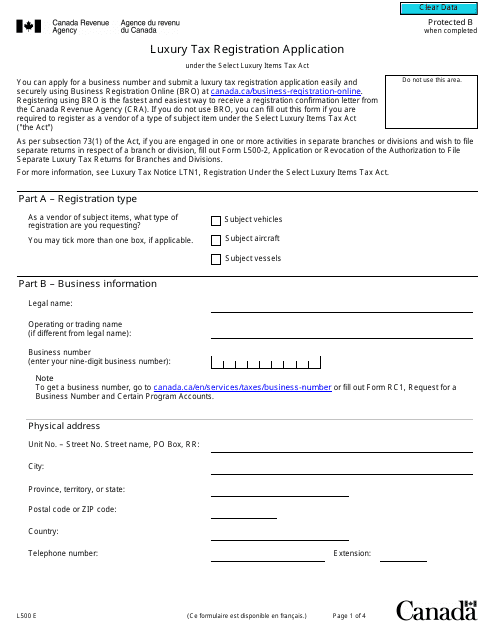

This Form is used for registering for luxury tax in Canada. It is required for businesses that sell luxury goods and services.

This Form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals who are covered under the social security agreement between Canada and Belgium. It ensures that individuals are not subject to double taxation and can access social security benefits in both countries.