Canadian Federal Legal Forms and Templates

Documents:

5112

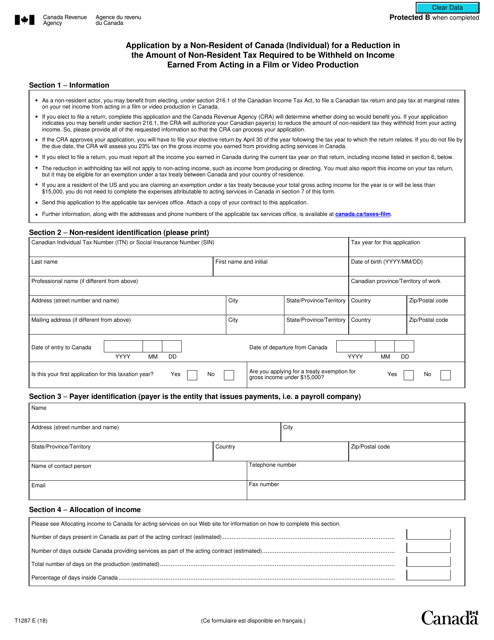

This form is used for non-residents of Canada to apply for a reduction in the amount of non-resident tax required to be withheld on income earned from acting in a film or video production in Canada.

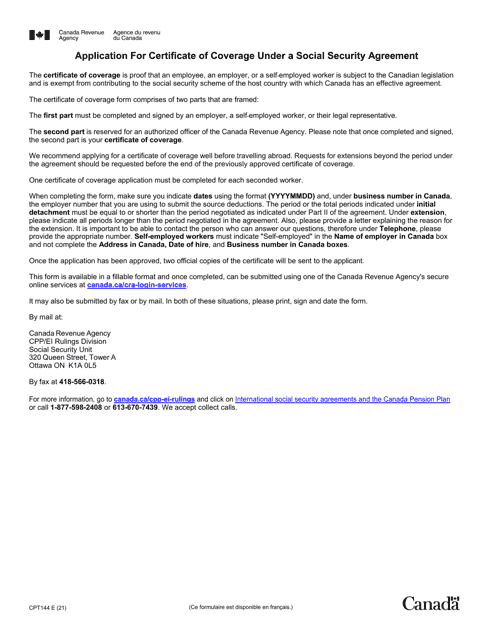

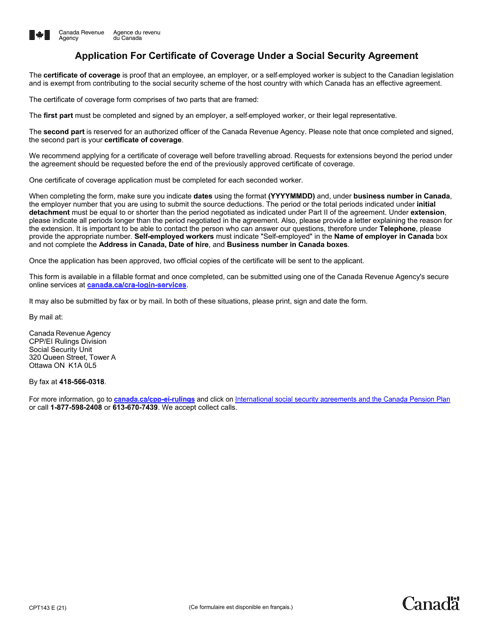

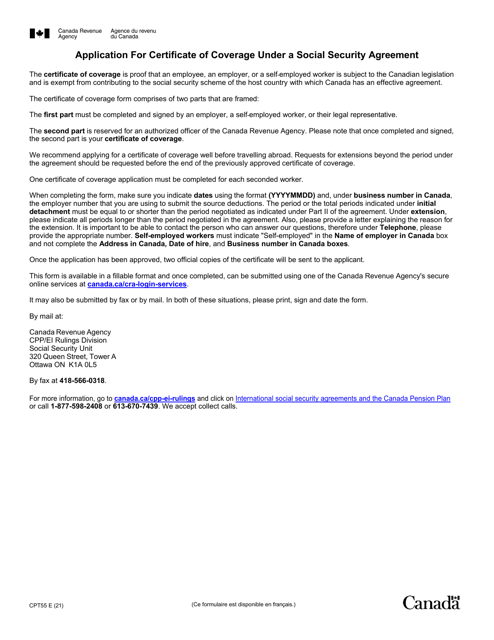

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals residing in Canada and covered by the Social Security Agreement between Canada and Lithuania.

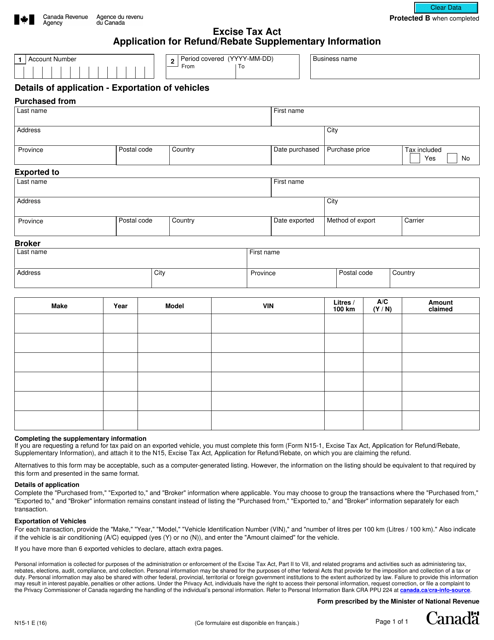

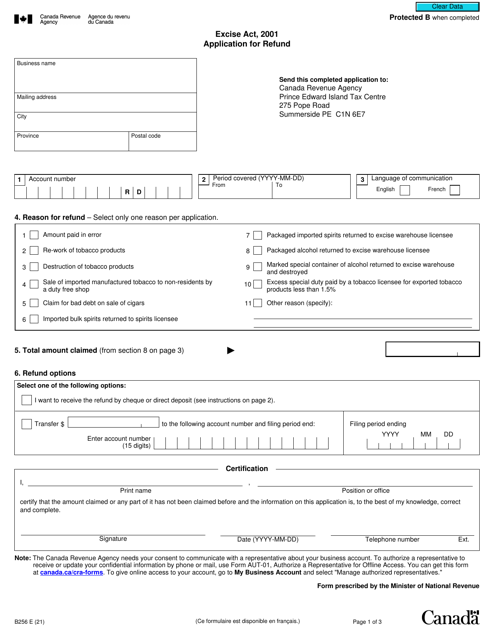

This form is used for applying for a refund or rebate of excise tax in Canada. It is the supplementary information form for Form N15-1.

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan (CPP) for individuals who are covered by the social security agreement between Canada and the Republic of Latvia.

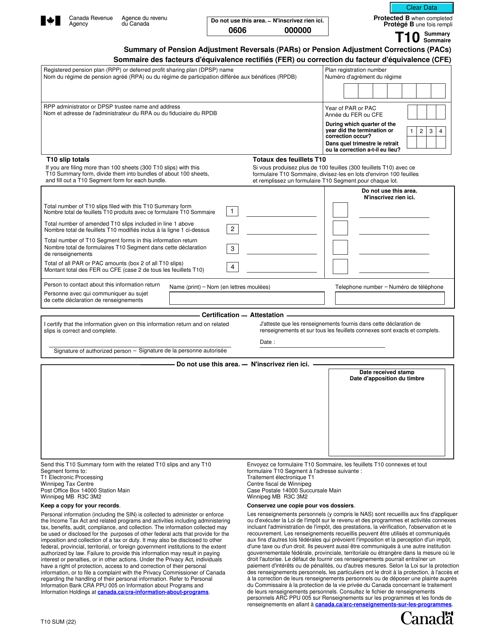

This form is used for reporting the summary of pension adjustment reversals or corrections in Canada. It is available in both English and French.

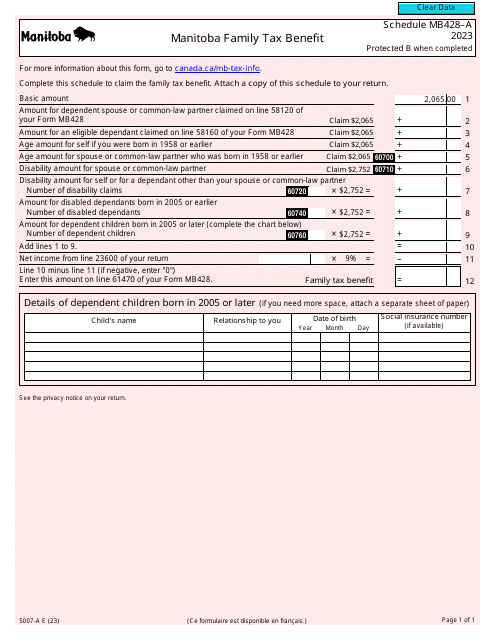

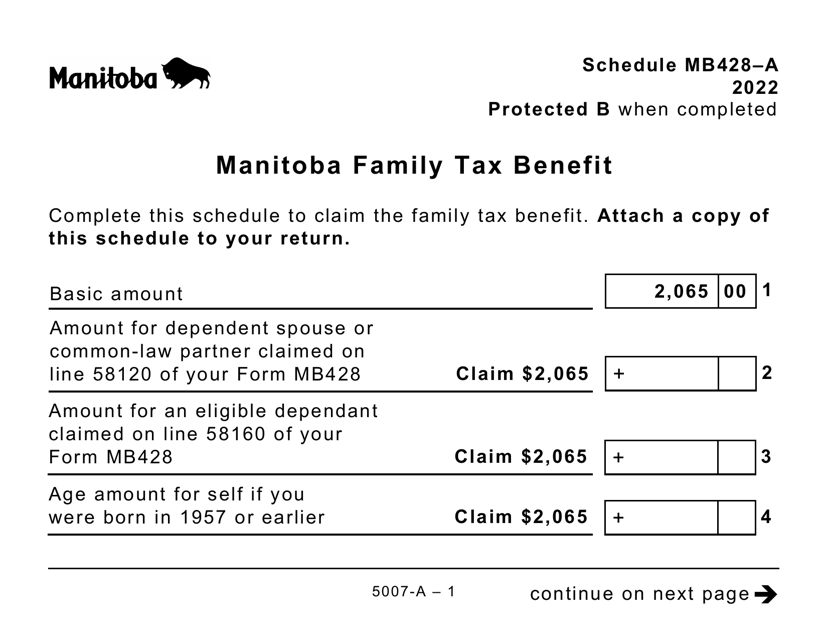

This form is used for claiming the Manitoba Family Tax Benefit in Canada. It is in large print format to aid readability for individuals with visual impairments.

This form is used by individuals who have worked in both Canada and Portugal and need to apply for a Certificate of Coverage under the Canada Pension Plan. It is based on the social security agreement between Canada and Portugal.

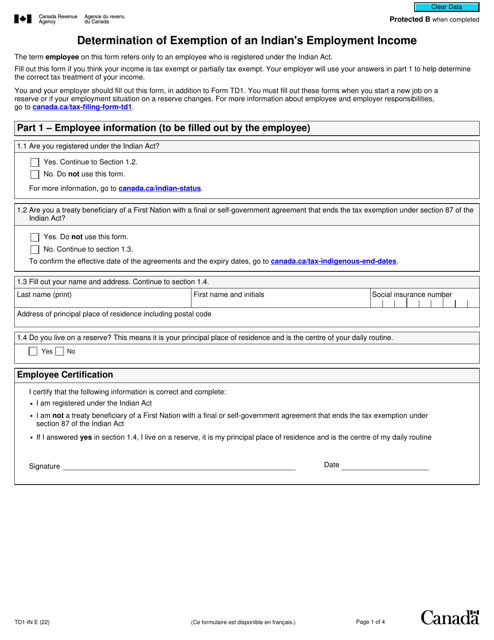

Employees who are defined as Indians under the Canadian Indian Act are supposed to use this form when they want to figure out whether their income from employment is exempt from income tax.

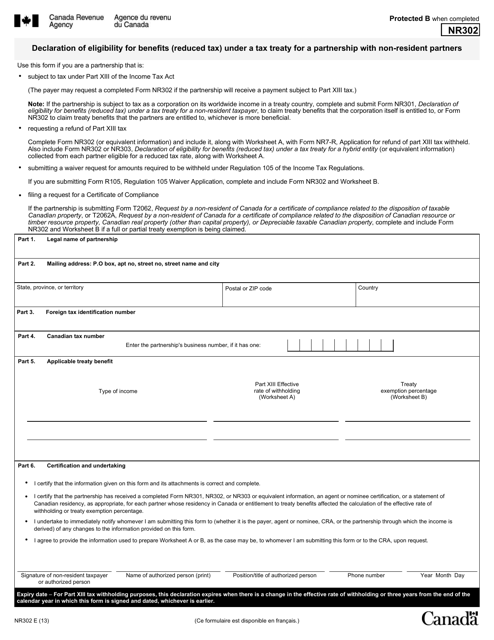

This form is used for declaring eligibility for tax benefits under a tax treaty for a partnership with non-resident partners in Canada.

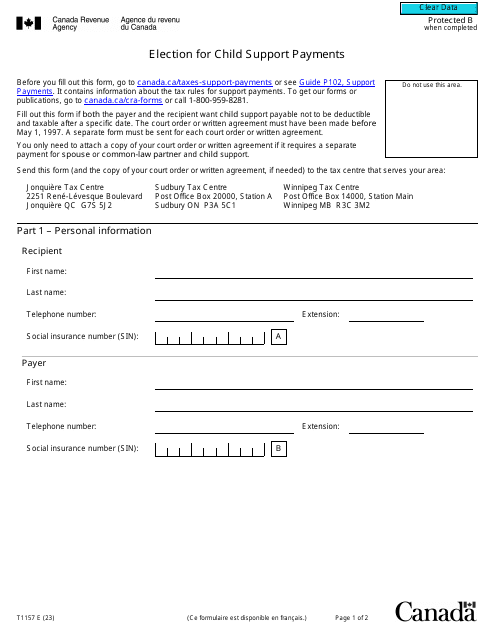

This is a legal document that needs to be completed to register an election for child support payments in Canada.