Canadian Federal Legal Forms and Templates

Documents:

5112

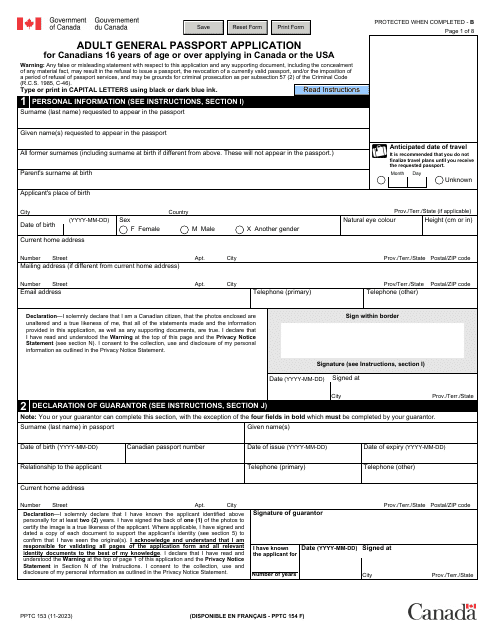

Canadian citizens over the age of 16 may prepare this form to request the issuance of a Canadian passport.

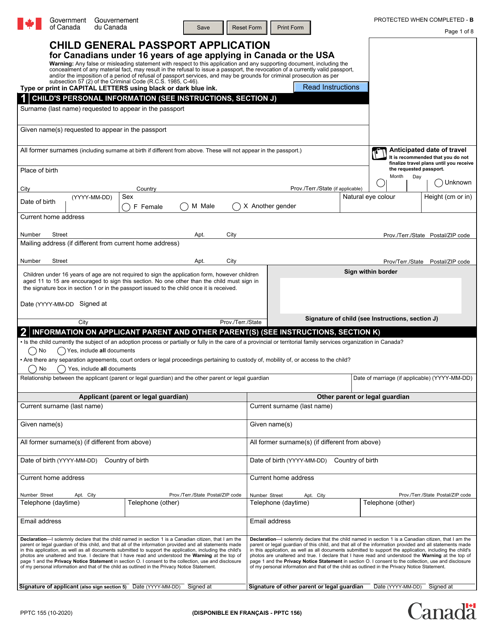

A Canadian child's parent or parents (alternatively, a custodial parent or legal guardians) may use this form to apply for a passport on behalf of the child if they are under the age of sixteen years old.

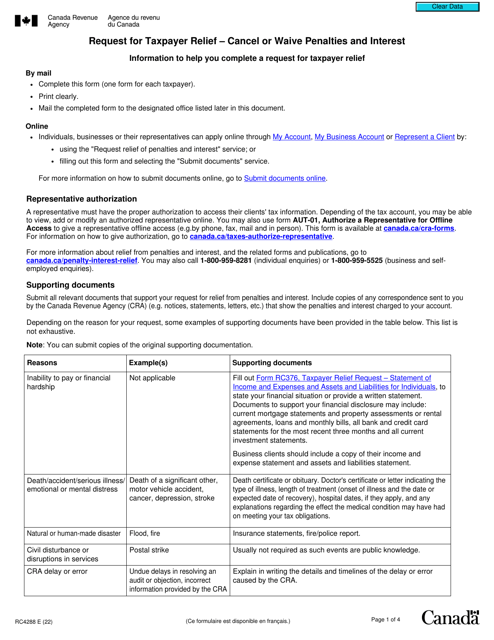

This form acts as the supporting documentation a Canadian person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances.

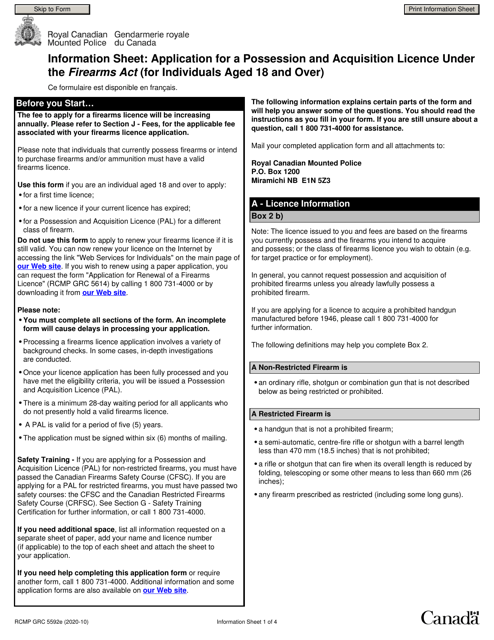

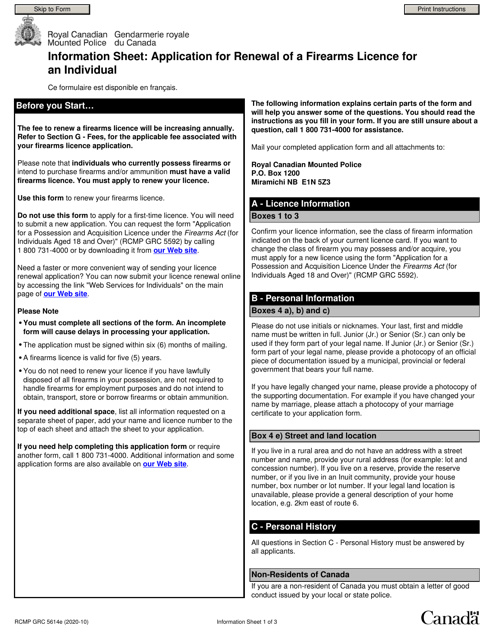

Canadian residents must submit this form to receive a licence to possess a firearm, replace an existing license that has expired, or request a Possession and Acquisition Licence (PAL) for another gun.

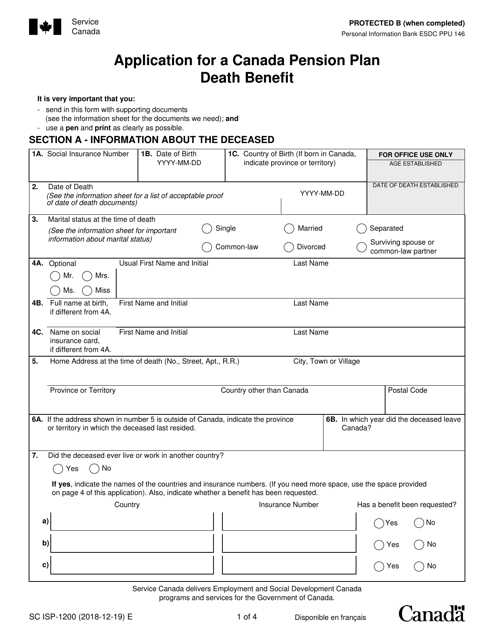

Eligible individuals may prepare this form when they wish to receive a lump-sum payment on behalf of a deceased person who has contributed to the Canada Pension Plan (CPP).

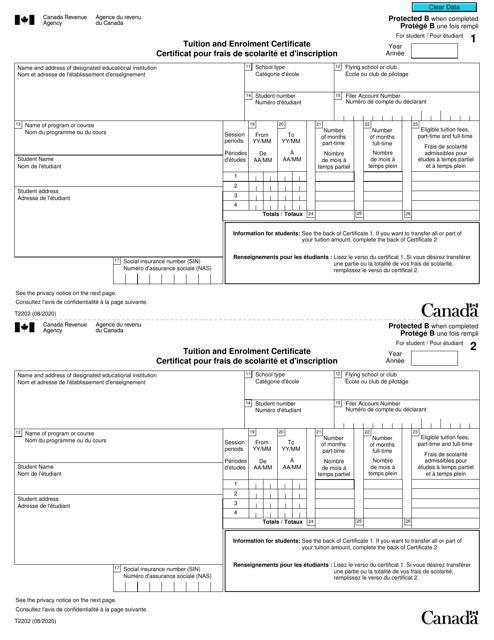

This form is used for reporting tuition and enrollment information for tax purposes in Canada. It is available in both English and French.

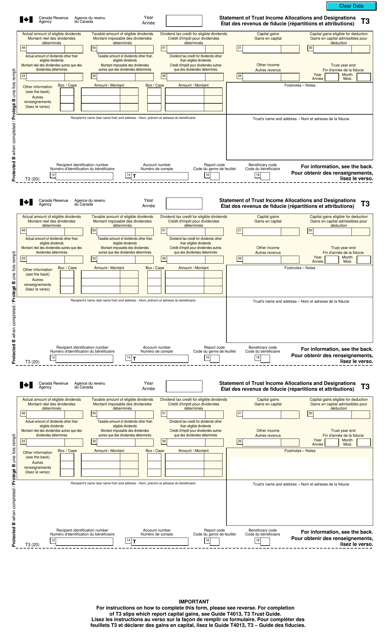

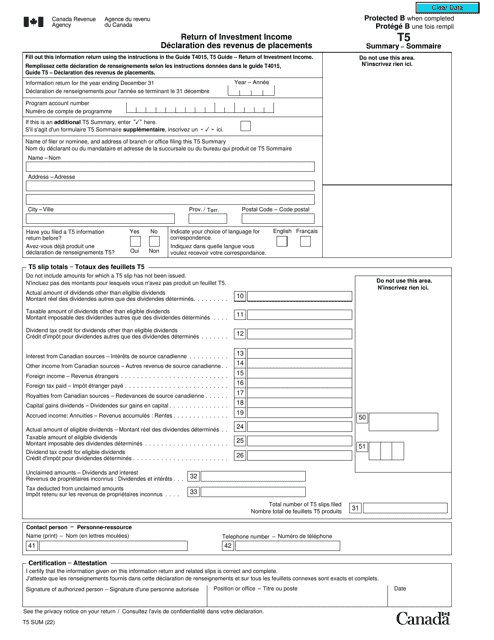

Canadian taxpayers may use this form when they would like to report the investment income they have received during the year.

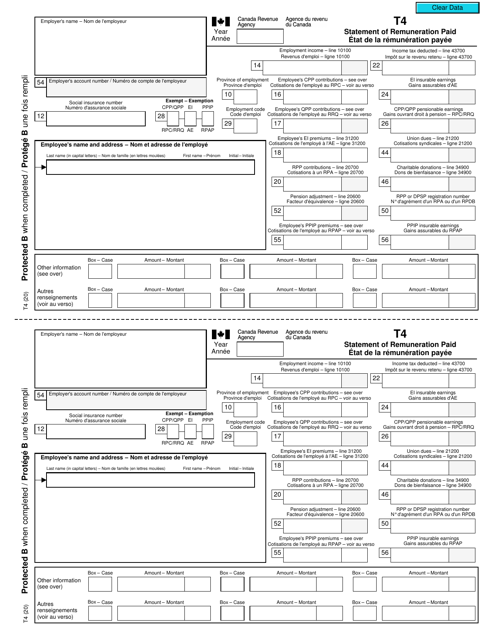

Employers of Canada must provide this form to all of their employees that receive salaries, wages, bonuses, and other employment payments.

This guide from the Canada Revenue Agency covers any questions connected with rental income across Canada.

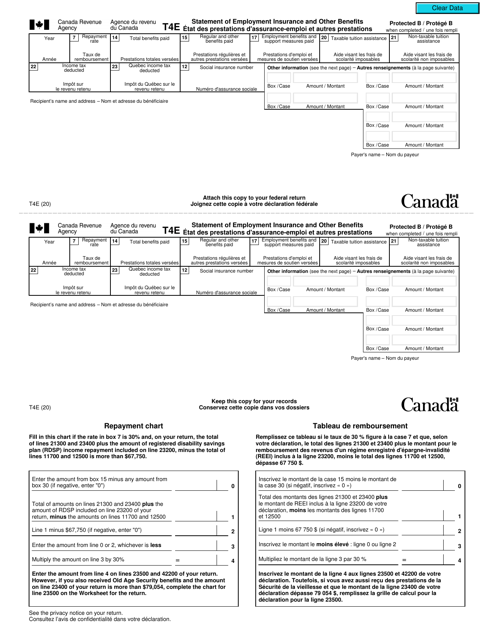

Canadian taxpayers may use this form if they have received certain types of employment insurance benefits or for repaying an overpayment from a previous year.

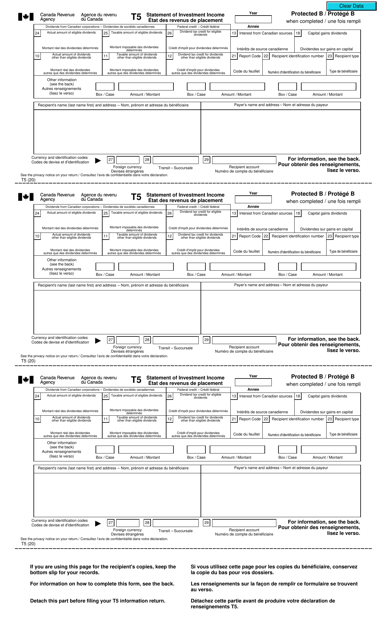

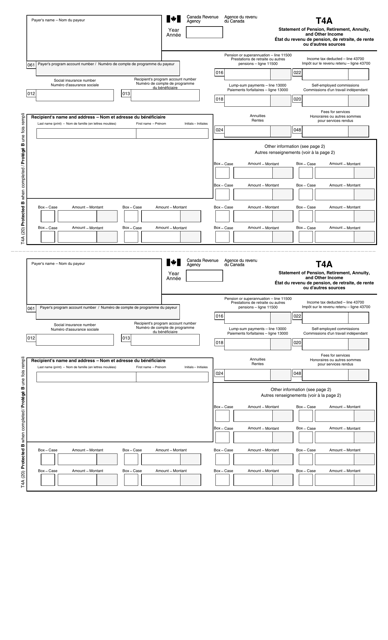

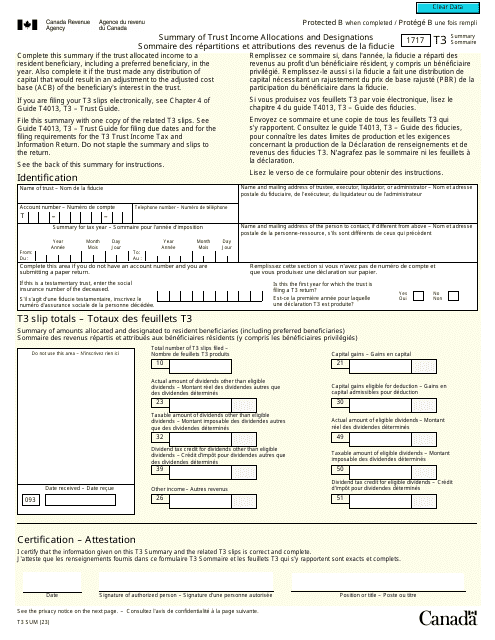

Individuals may use this form when they wish to provide information about certain investment income payments they have made to a Canadian resident, or if they are a Canadian resident who has received certain investment income payments.

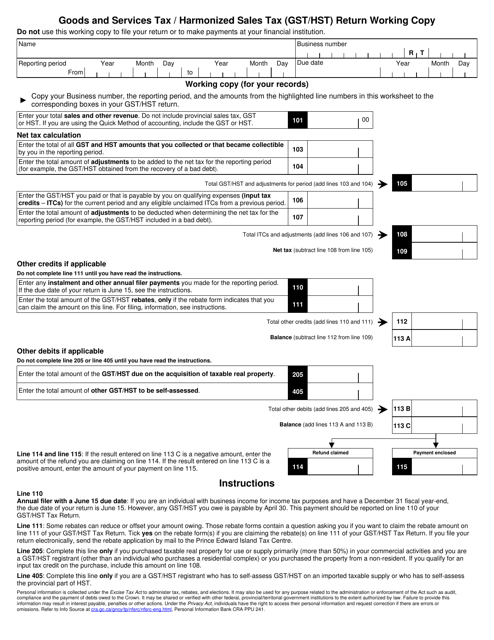

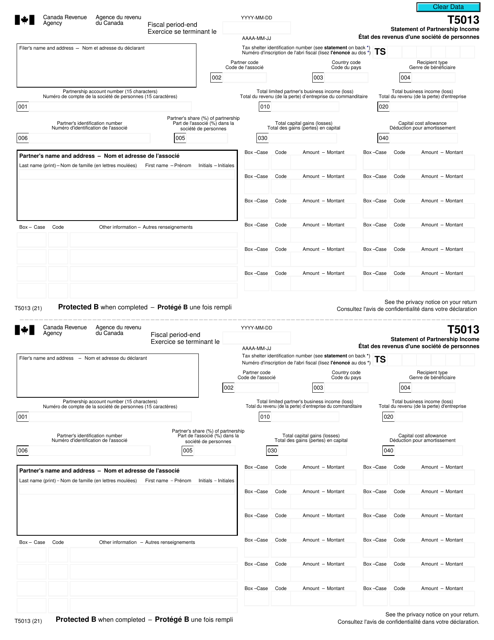

Canadian small business owners will need to complete this form as part of filing their taxes.

This form is used for applying to renew a firearms licence for individuals in Canada.

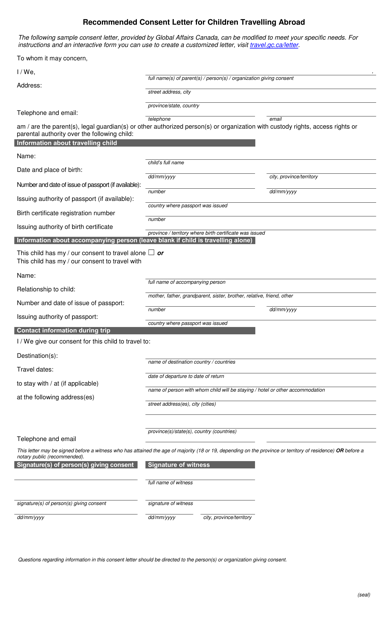

This form acts as a documentation of consent from a parent or guardian when a minor is travelling outside the borders of Canada without their normal adult caregivers.

Canadian individuals may use this form when they are filing their taxes to report additional income that does not come from wages earned from completing work.