Canadian Federal Legal Forms and Templates

Documents:

5112

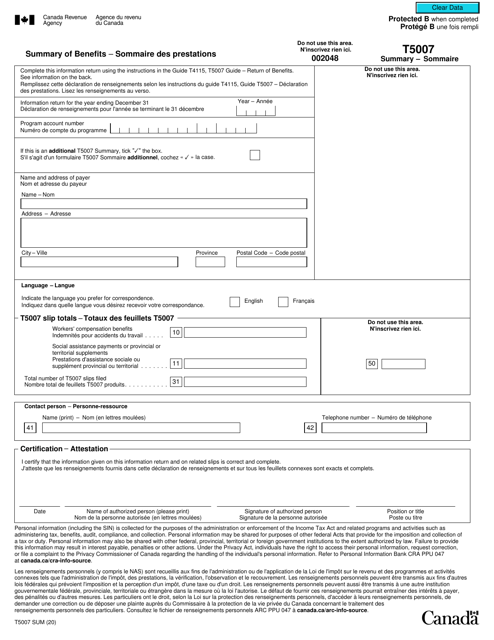

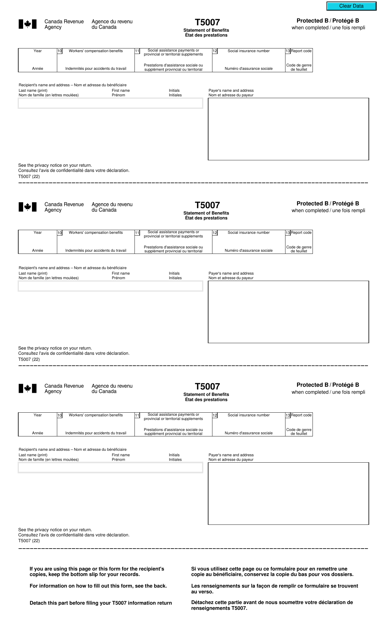

This document is a summary of benefits received in Canada. It is available in both English and French.

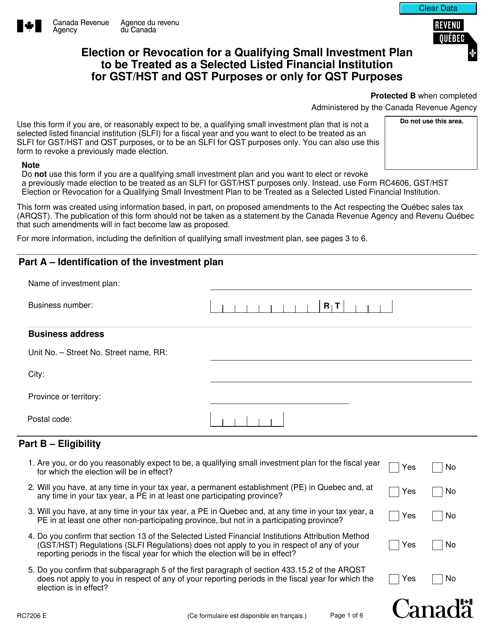

This form is used for electing or revoking a qualifying small investment plan to be treated as a selected listed financial institution for GST/HST and QST purposes or only for QST purposes in Canada.

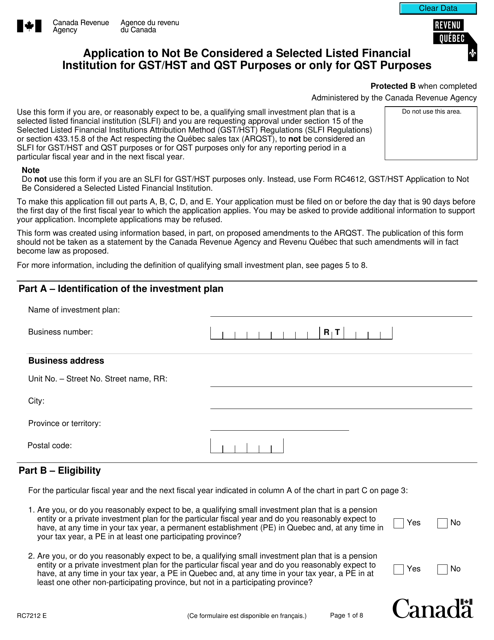

This form is used for applying to not be considered a selected listed financial institution for GST/HST and QST purposes or only for QST purposes in Canada.

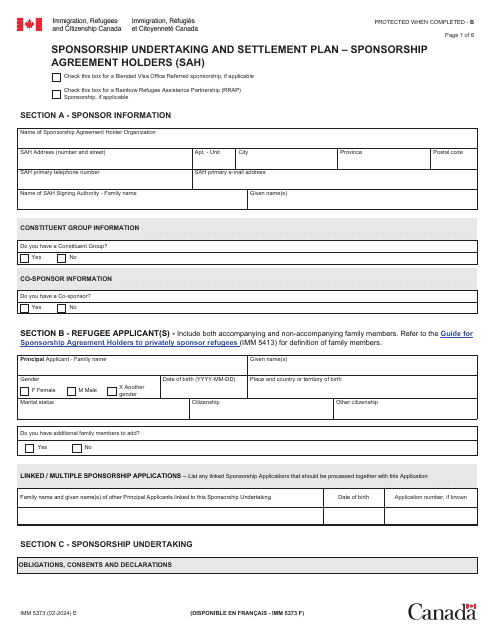

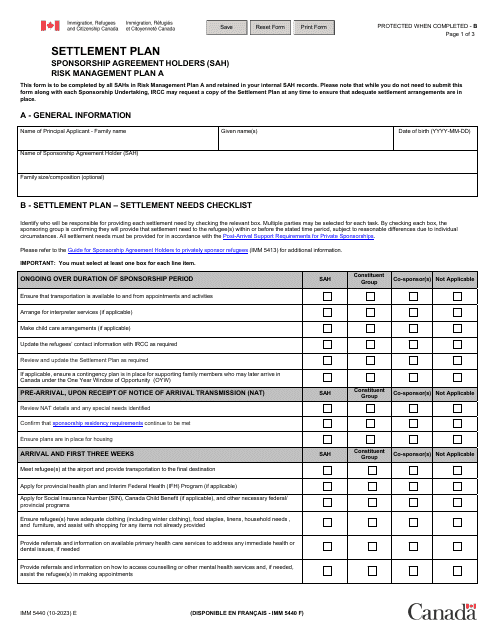

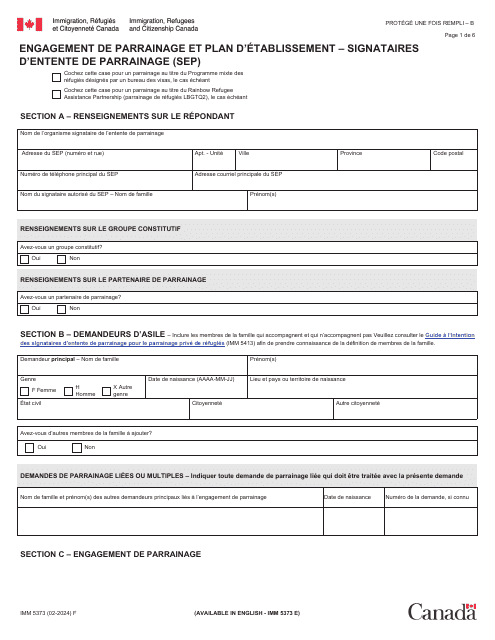

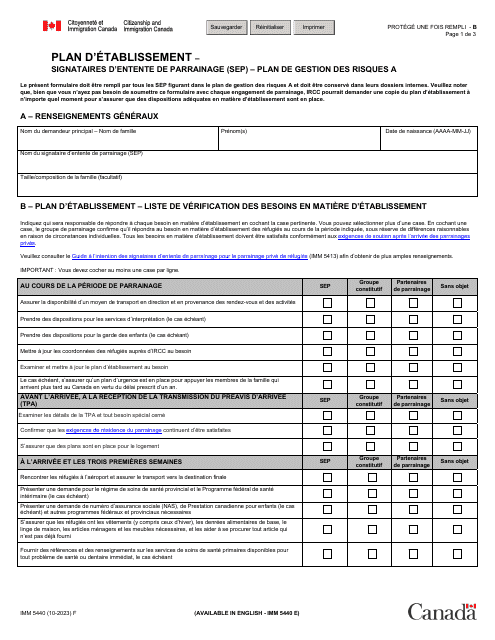

Form IMM5440 Settlement Plan - Sponsorship Agreement Holders (Sah) - Risk Management Plan a - Canada

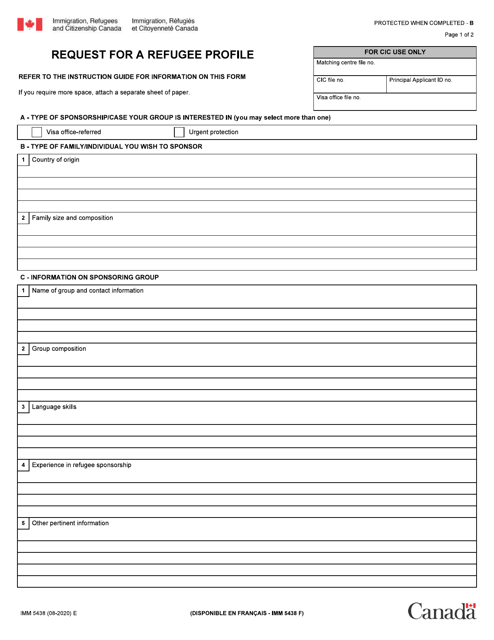

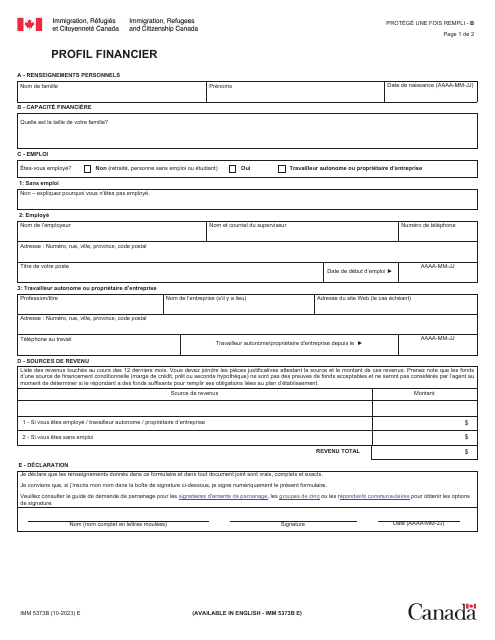

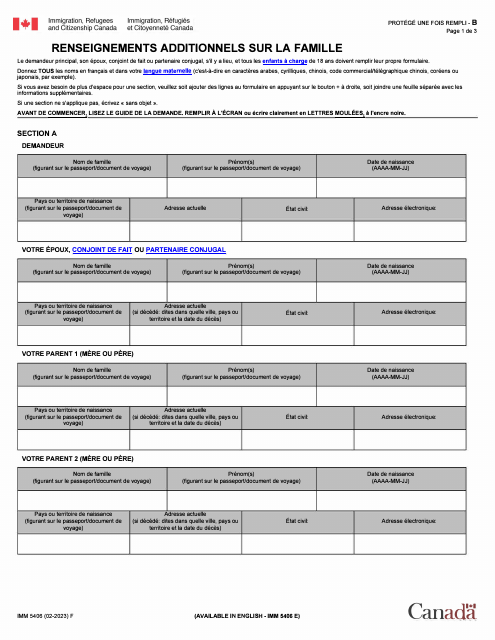

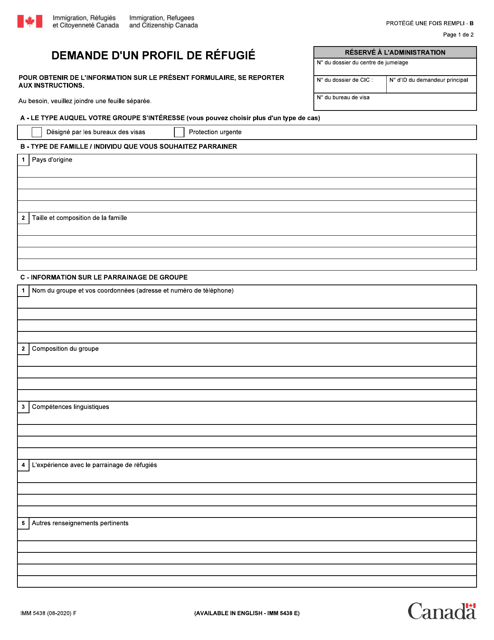

This Form is used for requesting a refugee profile in Canada. It is typically used by individuals seeking refugee status in Canada to provide their personal information and background details. This form helps the Canadian government assess their eligibility for asylum.

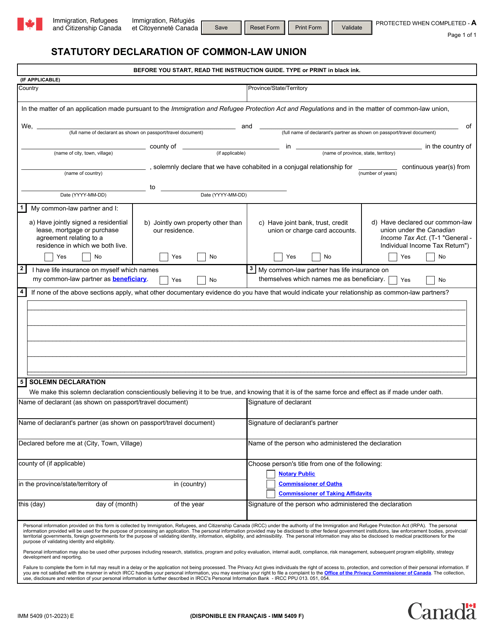

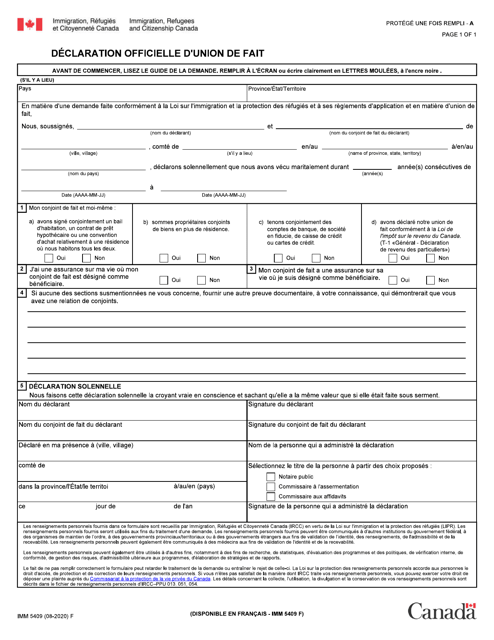

This Form is used for making an official declaration of common-law partnership in Canada.

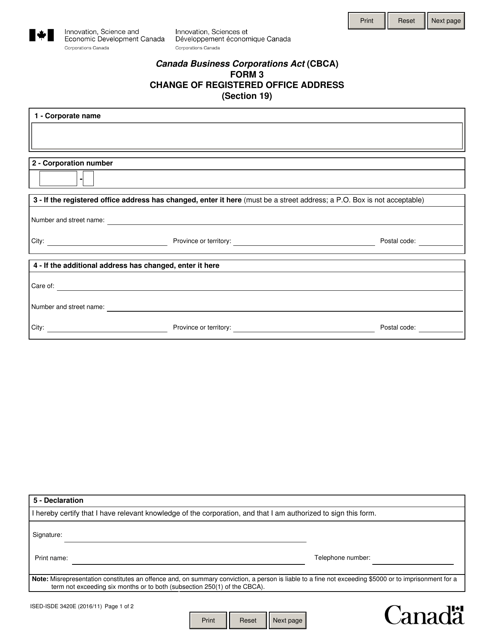

Canadian corporations may use this form to notify the authorities about a change in their registered address.

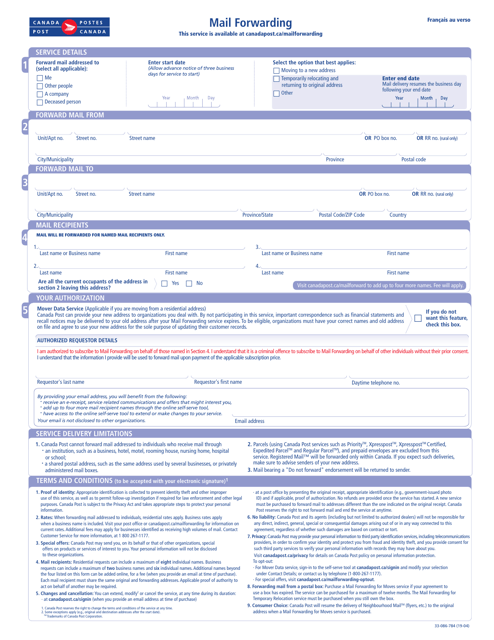

Canadian residents may use this form to choose the option of resending their mail from one address to another location - whether for a limited period of time or indefinitely.

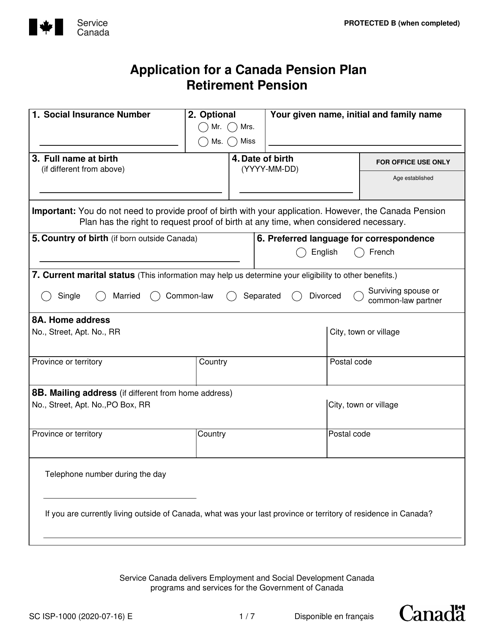

Individuals residing in Canada can use this form to apply to become members of the Canada Pension Plan (CPP).

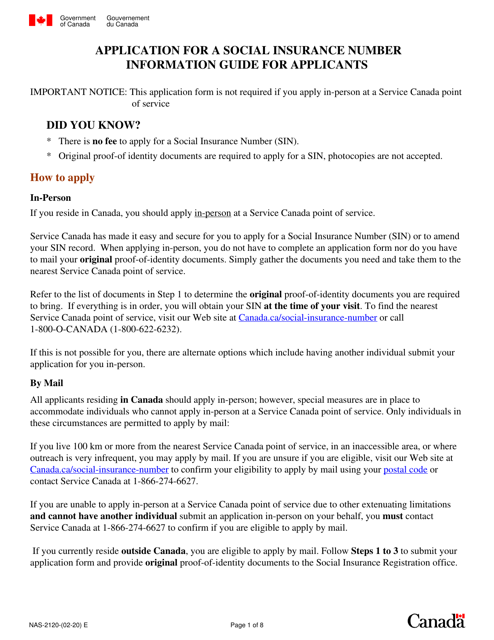

Individuals may complete this form when they are seeking to obtain a social insurance number (SIN) in Canada.