Canadian Federal Legal Forms and Templates

Documents:

5112

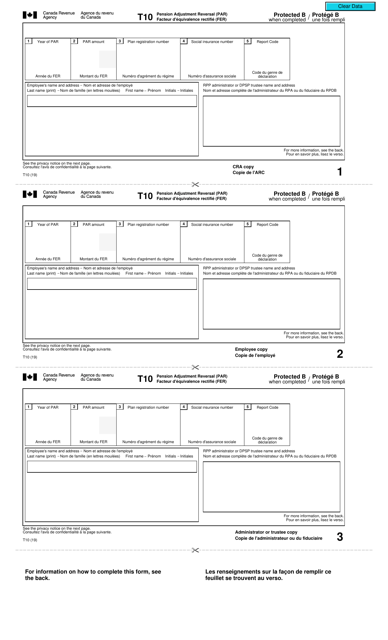

This form is used for reversing a pension adjustment in Canada. It is available in English and French.

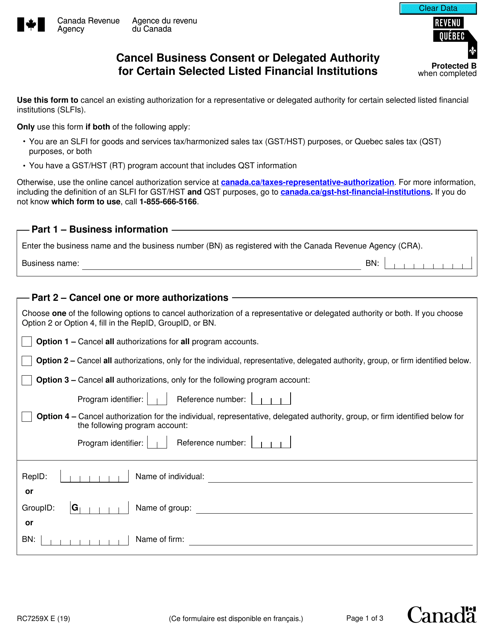

This form is used for canceling the business consent or delegated authority for certain selected listed financial institutions in Canada.

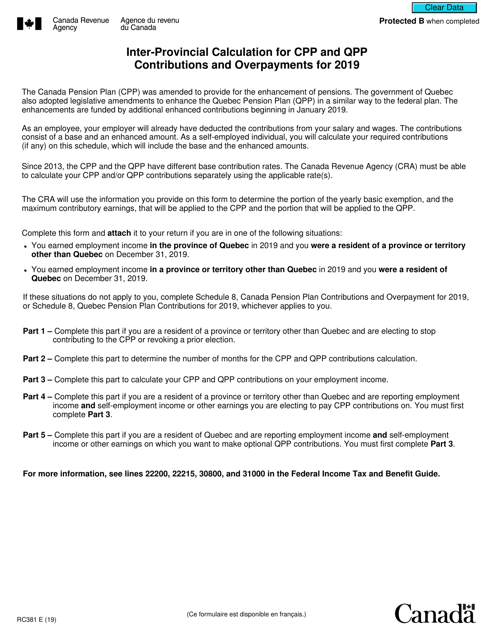

This form is used for calculating and reporting CPP and QPP contributions and overpayments between provinces in Canada.

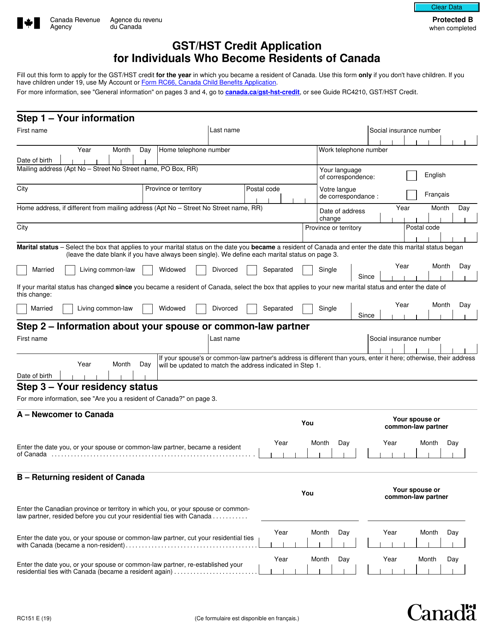

This form is completed within the first twelve months a person qualifies as a resident of Canada, allowing you to formally take part in the GST/HST reimbursement system.

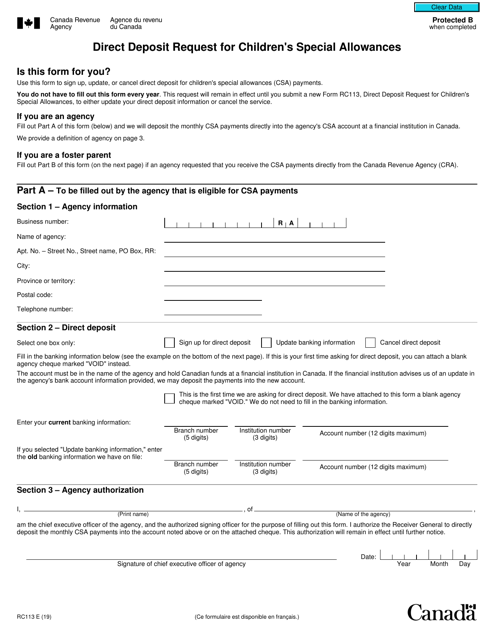

This Form is used for requesting direct deposit of Children's Special Allowances in Canada.

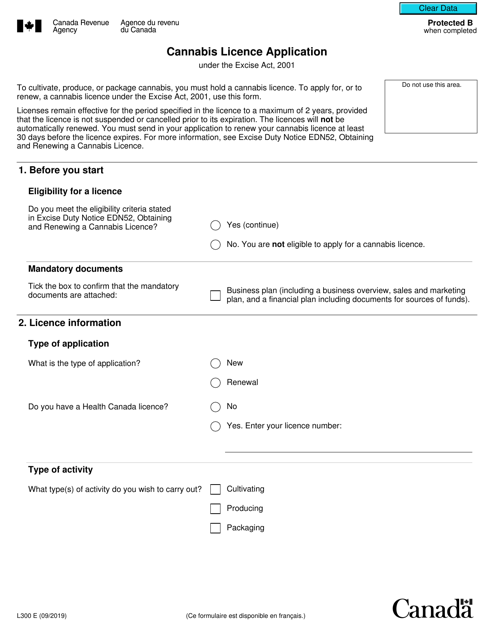

This form is used for applying for a cannabis license in Canada under the Excise Act, 2001.

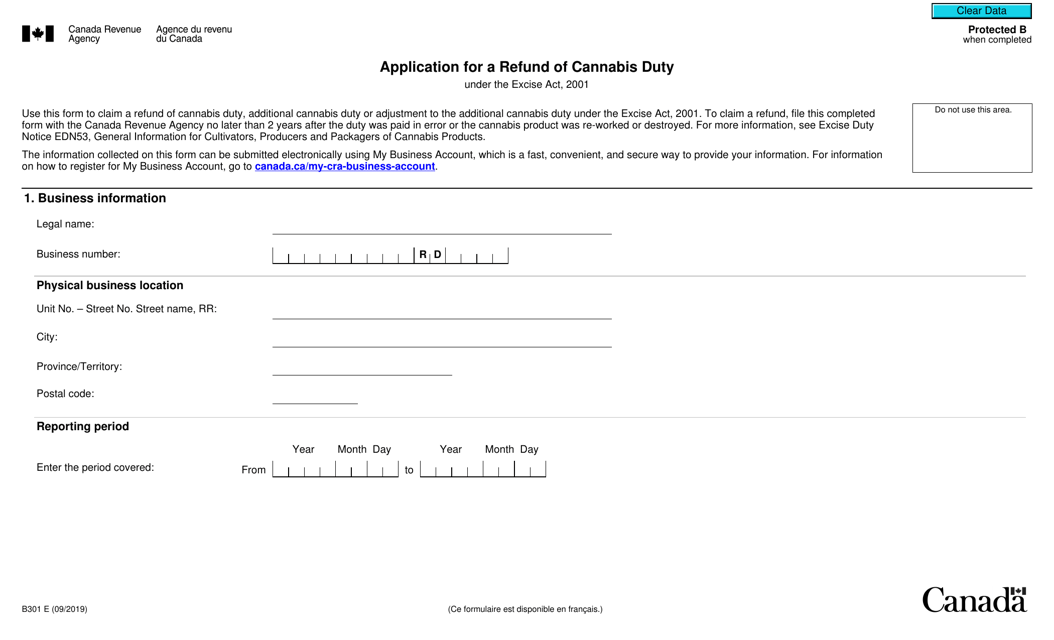

This form is used for applying for a refund of cannabis duty under the Excise Act, 2001 in Canada.

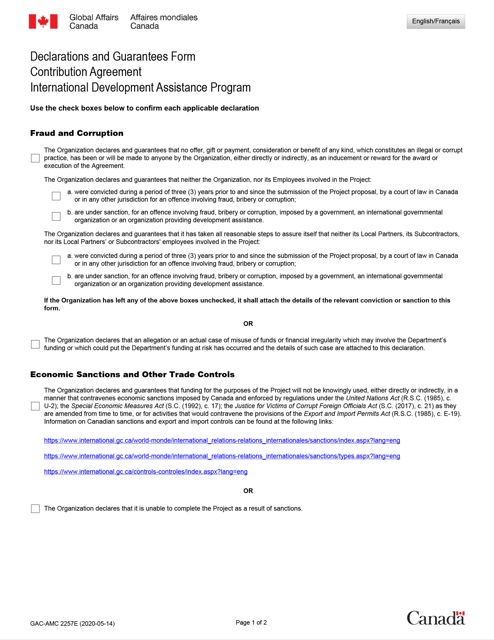

This form is used for declarations and guarantees in the Contribution Agreement in Canada. It is available in English and French.

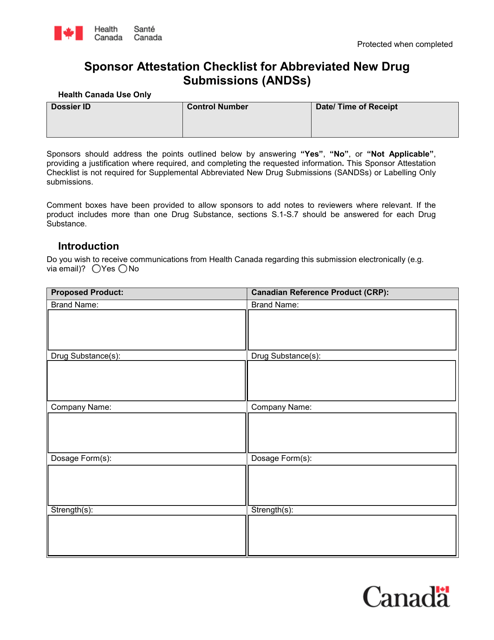

This document is a sponsor attestation checklist for abbreviated new drug submissions (ANDSS) in Canada. It provides a list of requirements and criteria that sponsors must meet when submitting their abbreviated new drug applications.

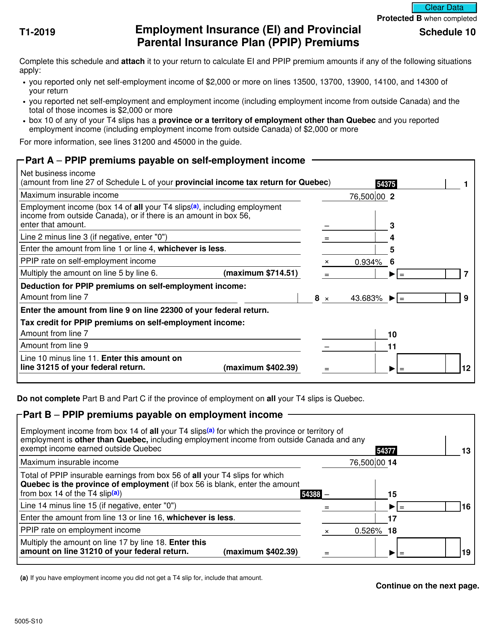

This document is used for calculating employment insurance (EI) and provincial parental insurance plan (PPIP) premiums for residents of Quebec and non-residents in Canada.

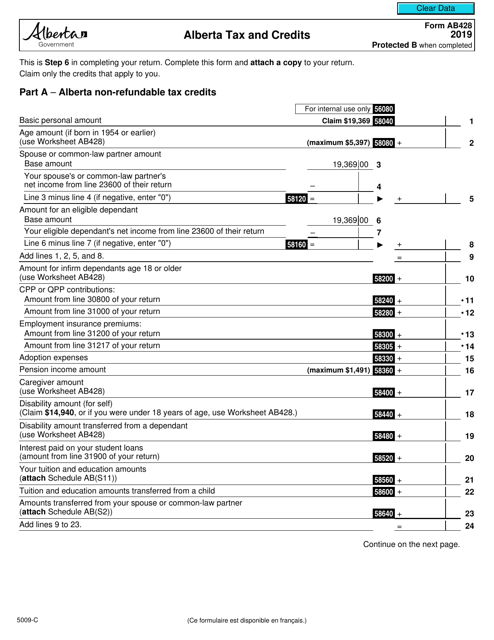

This form is used for reporting Alberta tax and claiming tax credits in Canada.

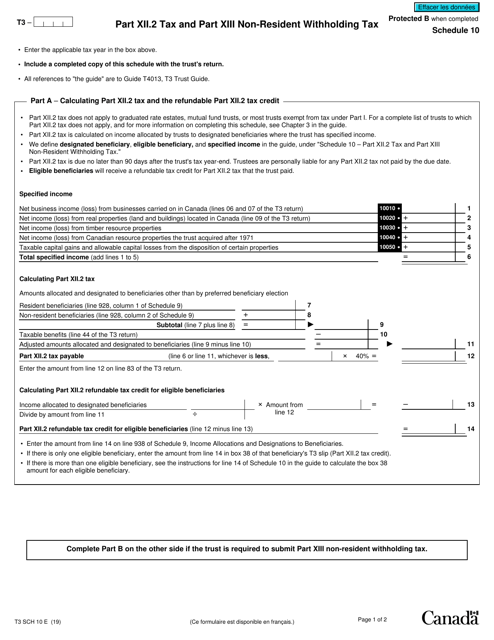

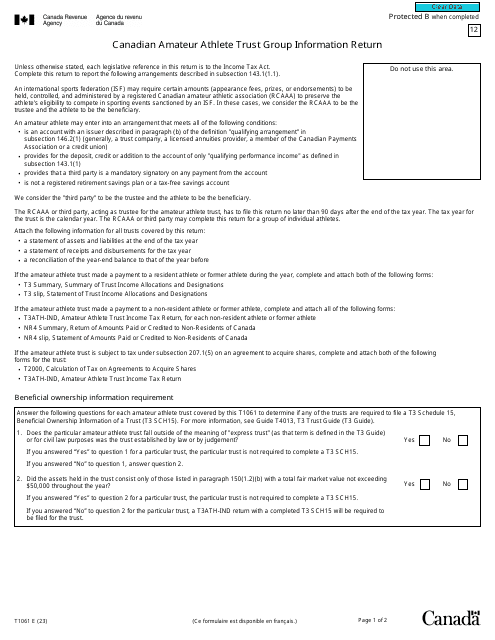

This form is used for reporting and calculating tax amounts and non-resident withholding tax in Canada. It specifically deals with Part XII.2 tax and Part XIII non-resident withholding tax.

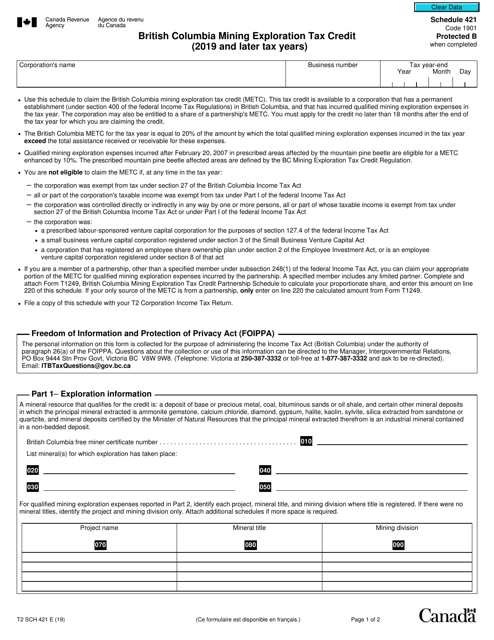

This form is used for claiming the British Columbia Mining Exploration Tax Credit for the tax year of 2019 and later in Canada. It is specific to the province of British Columbia and is related to tax credits for mining exploration activities.

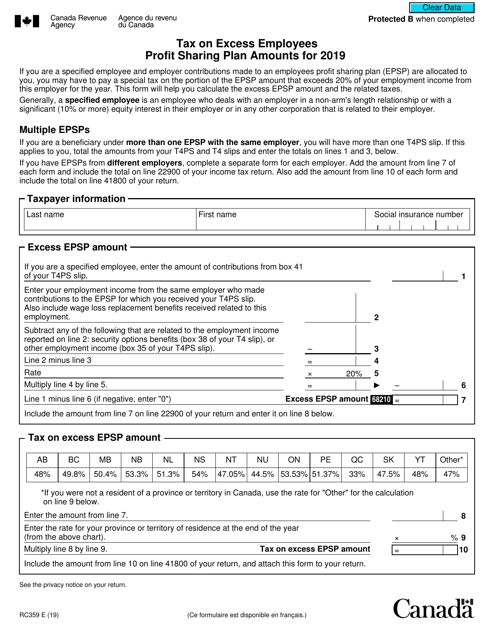

This form is used for reporting and calculating taxes on excess amounts in an employee profit sharing plan in Canada.

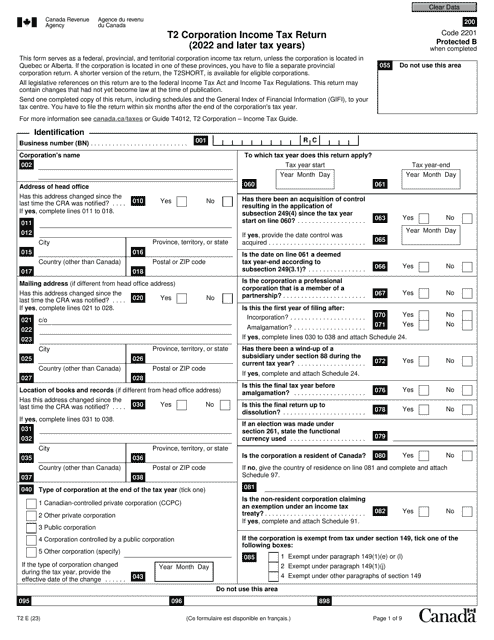

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

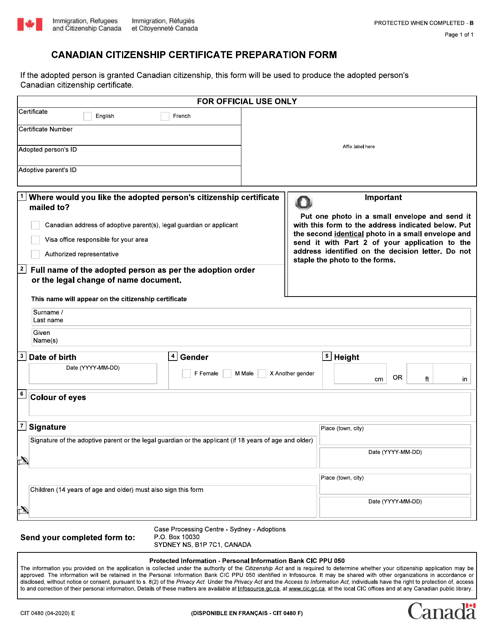

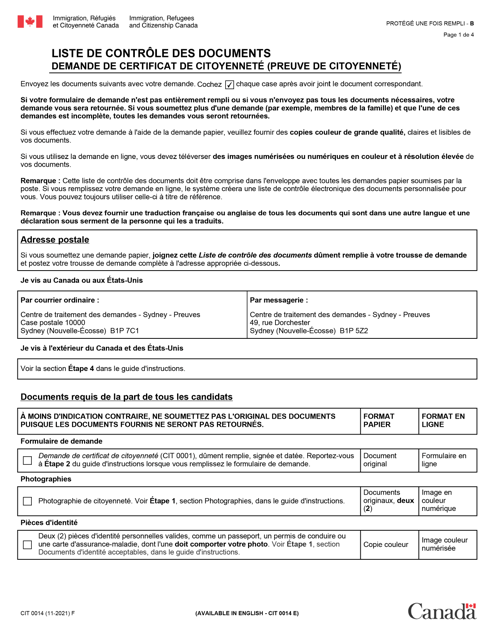

This form is used for preparing and applying for a Canadian Citizenship Certificate.

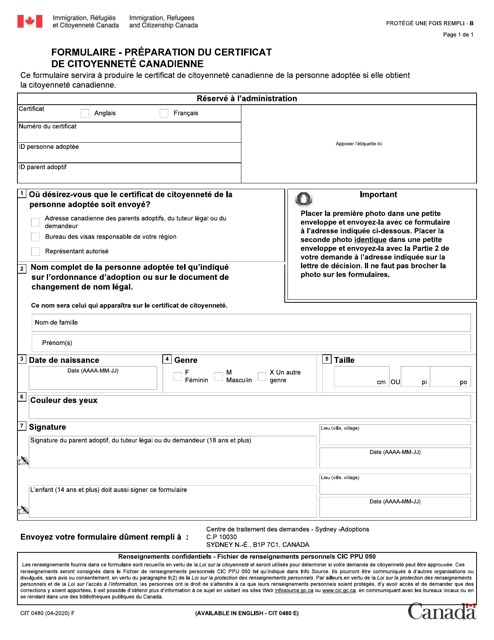

This document is for preparing the Certificate of Canadian Citizenship in Canada.

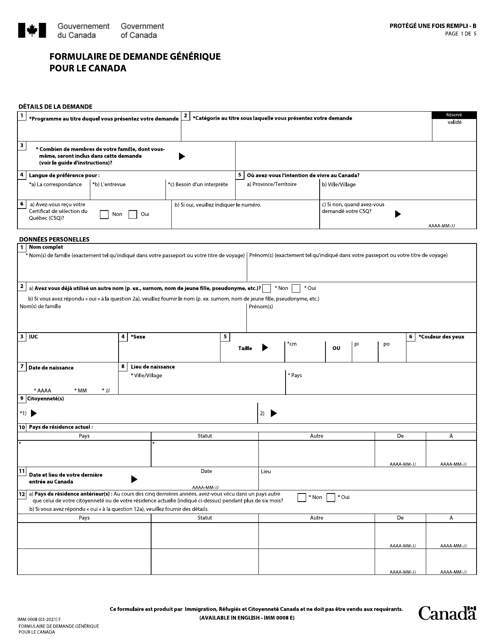

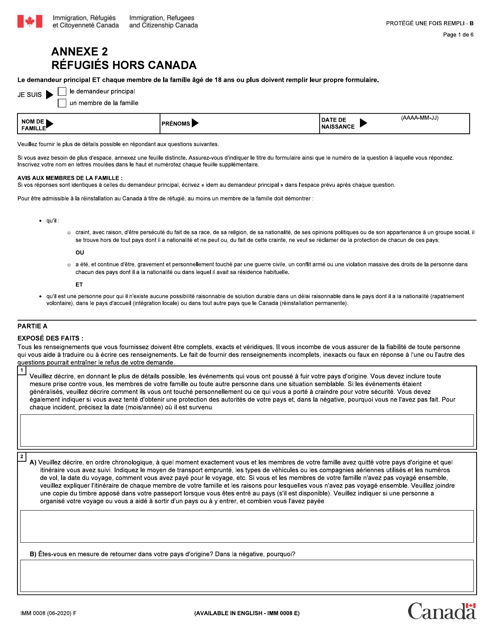

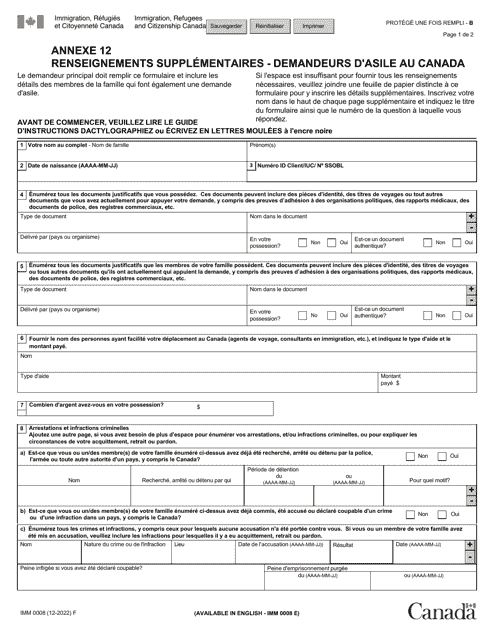

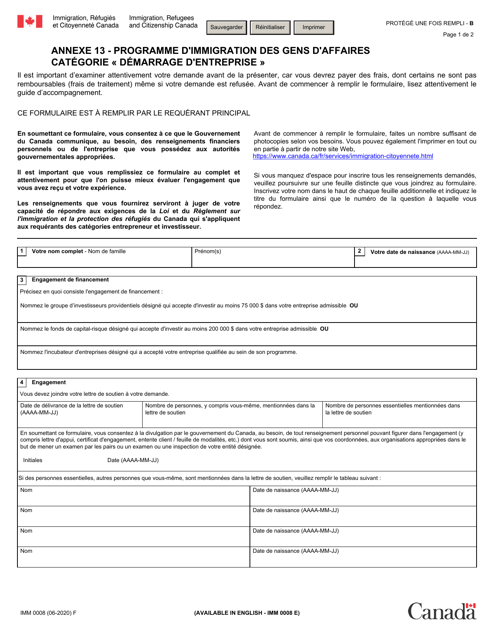

Ce formulaire est utilisé pour demander l'admission au Canada en tant que réfugié se trouvant à l'extérieur du pays. Le formulaire IMM0008 est uniquement disponible en français et est destiné aux demandeurs francophones. Il contient des informations sur l'identité du demandeur, son pays d'origine, les raisons de sa demande d'asile et d'autres informations pertinentes.

This document is for the Canadian immigration program for business startup category for French-speaking individuals.

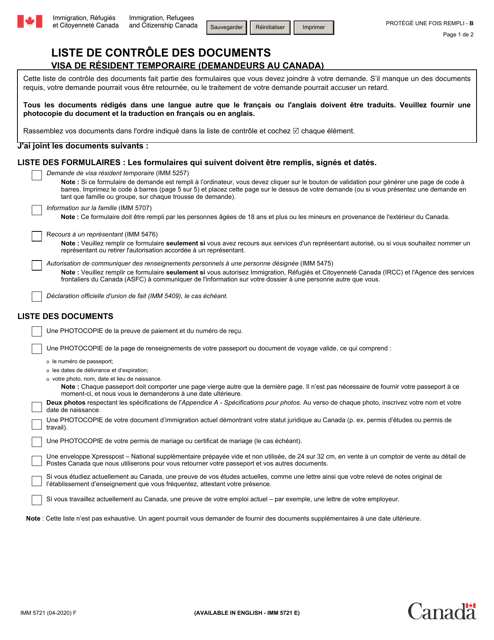

This document is a checklist for temporary resident visa applicants in Canada. It is used to list and ensure that all the required documents are included in the visa application.

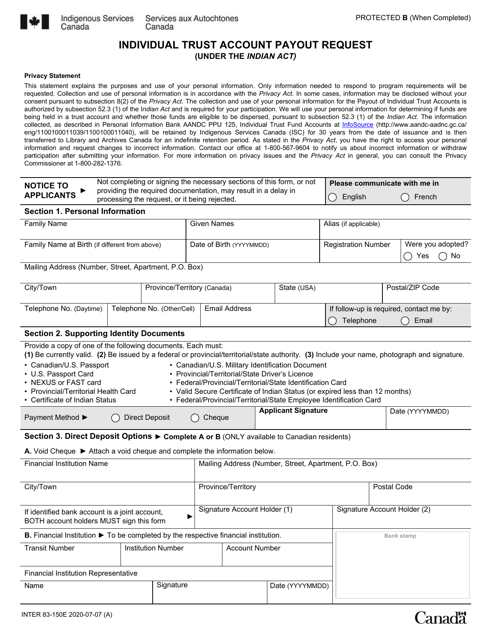

This form is used for requesting a payout from an individual trust account in Canada.

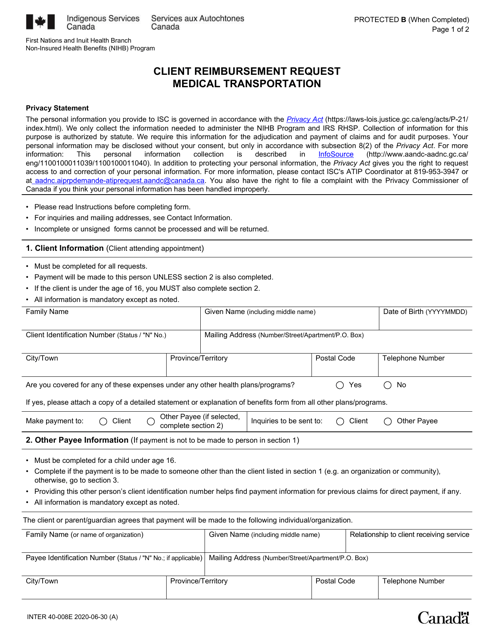

This form is used for clients in Canada to request reimbursement for medical transportation expenses.

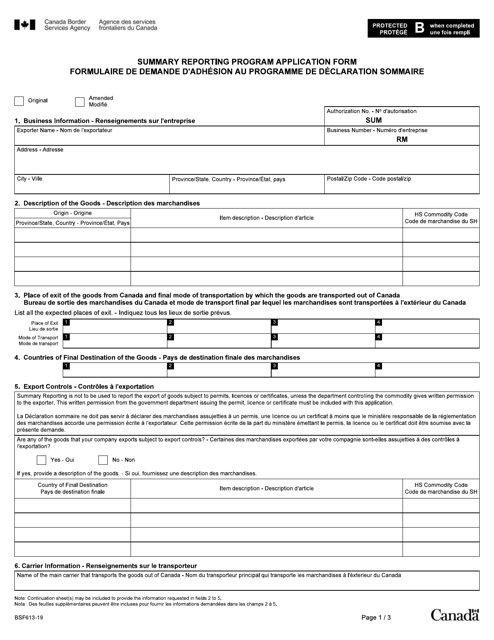

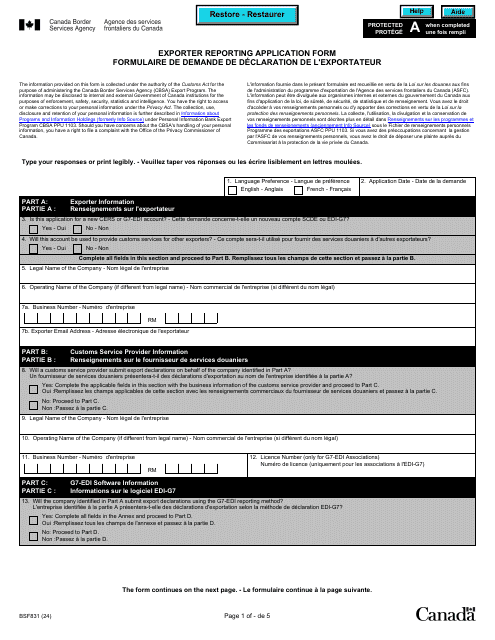

This form is used for applying to the Summary Reporting Program in Canada. It is available in English and French.

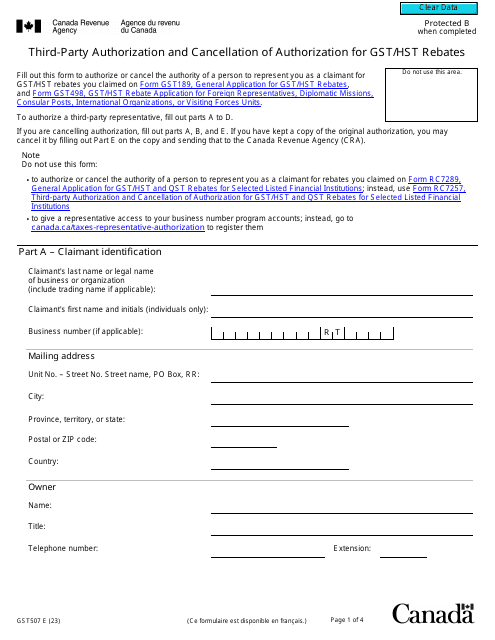

Form GST507 Third-Party Authorization and Cancellation of Authorization for Gst/Hst Rebates - Canada