Canadian Federal Legal Forms and Templates

Documents:

5112

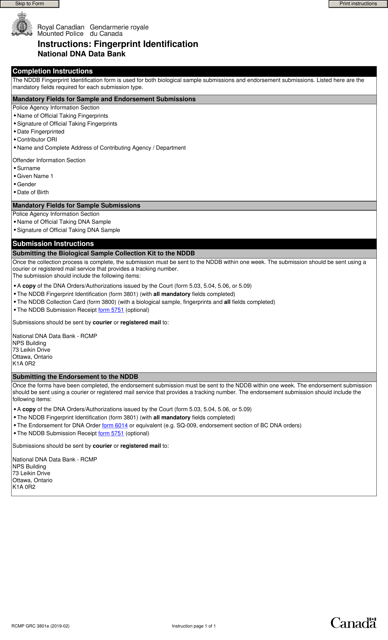

This form is used for submitting fingerprints to the RCMP's National DNA Data Bank for identification purposes in Canada.

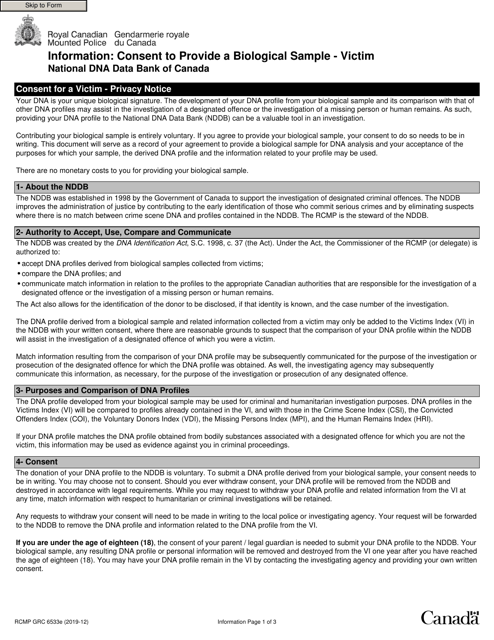

This form is used for obtaining consent from a victim in Canada to provide a biological sample for forensic analysis.

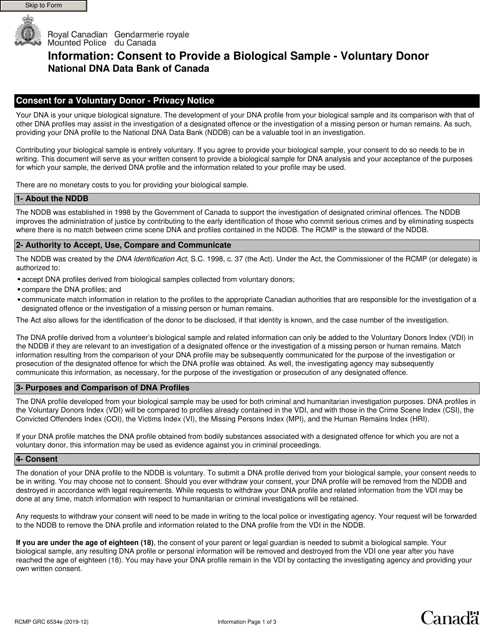

This form is used for consenting to provide a biological sample as a voluntary donor in Canada.

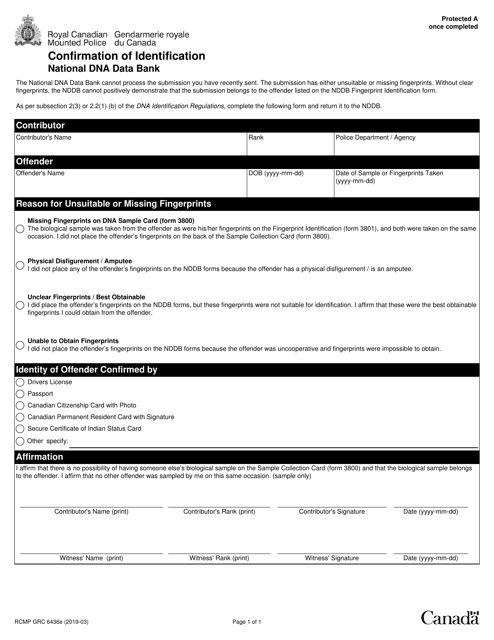

This form is used for confirming a person's identification in Canada by the Royal Canadian Mounted Police (RCMP).

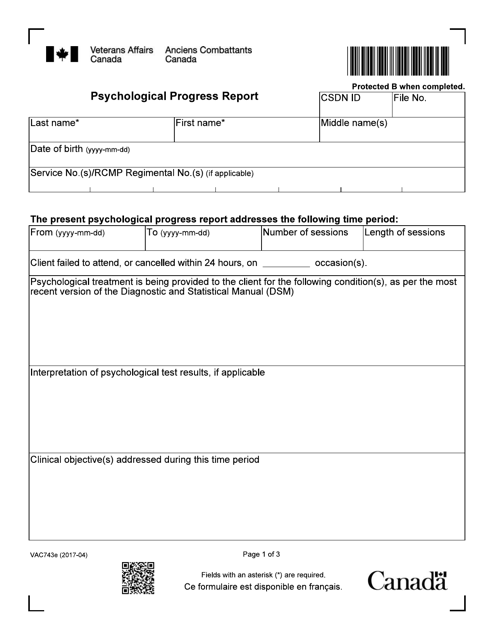

This form is used for submitting a psychological progress report in Canada.

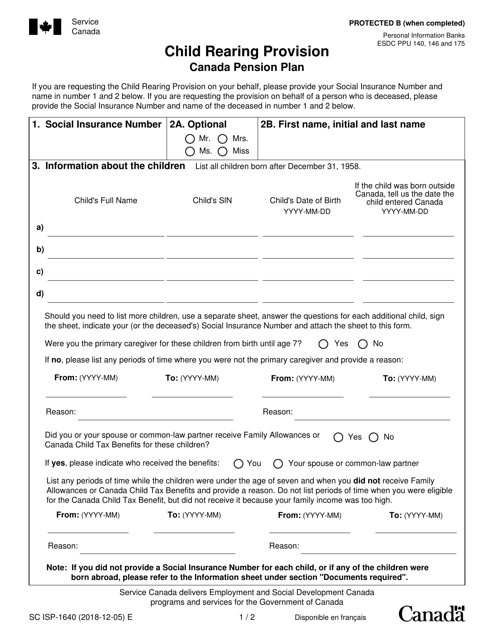

This form is used for applying for the Child Rearing Provision of the Canada Pension Plan in Canada.

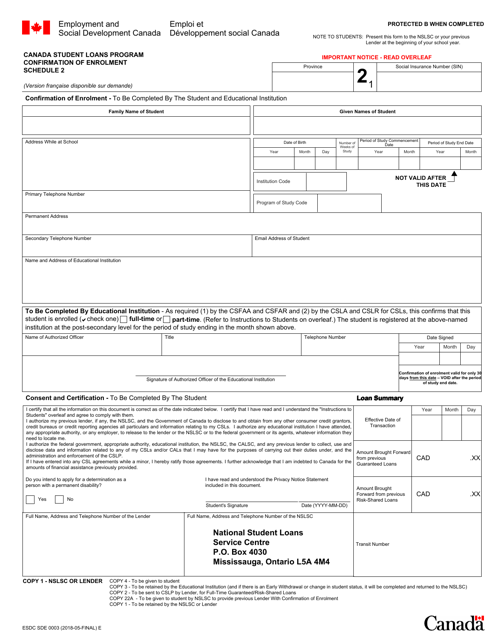

This form is used for confirming enrolment in the Canada Student Loans Program.

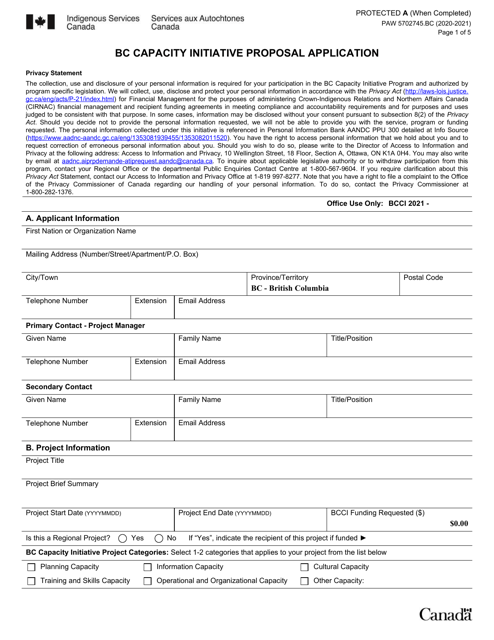

This form is used for submitting a proposal application for the BC Capacity Initiative in Canada.

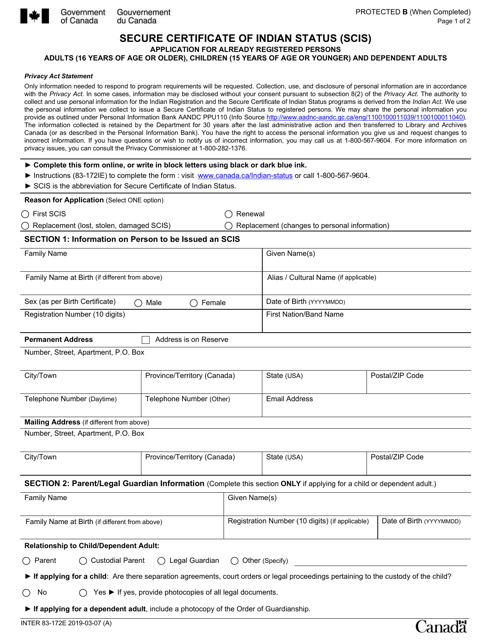

This form is used for applying for a Secure Certificate of Indian Status (SCIS) for individuals who are already registered as Indians in Canada.

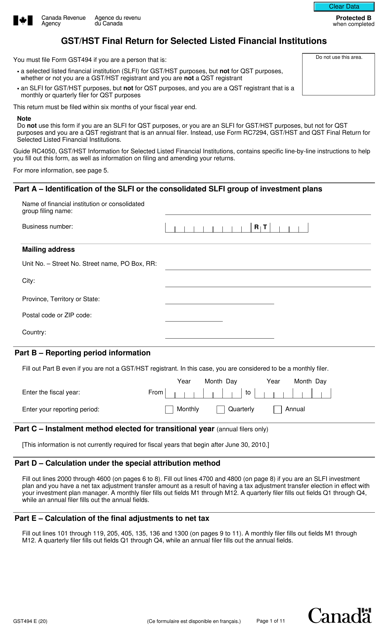

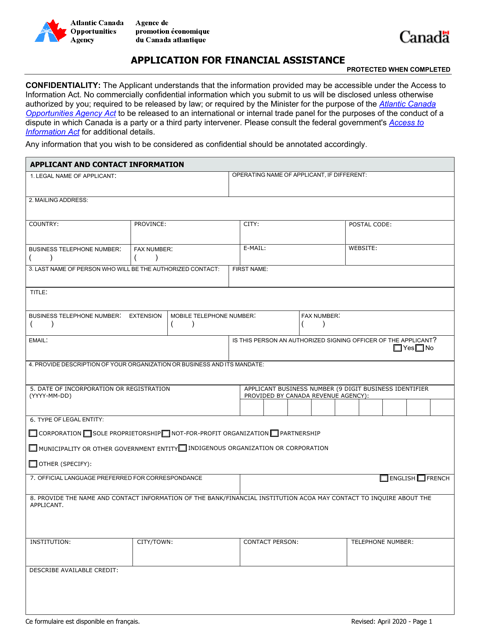

This type of document is an application for financial assistance in Canada. It is used to request financial support from the government or other organizations for various purposes such as education, healthcare, or starting a business.

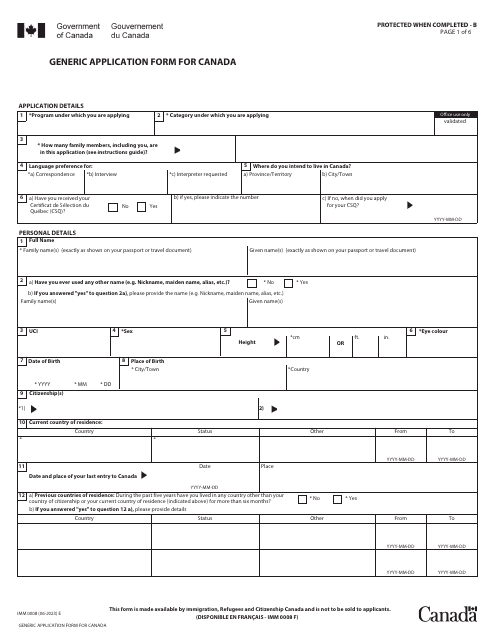

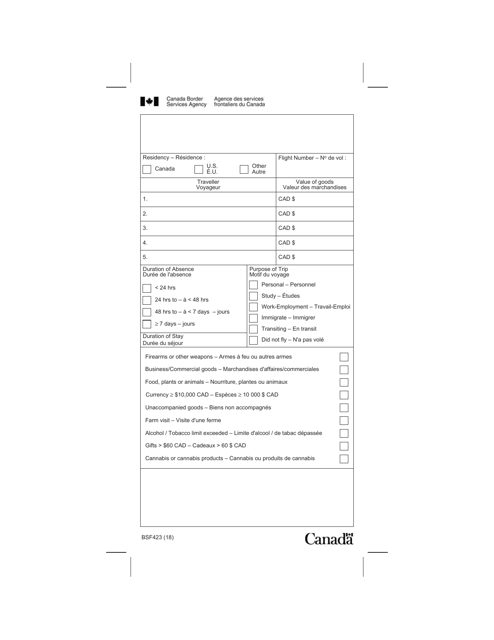

This form is used for in-person processing of air travel to Canada. It is available in both English and French.

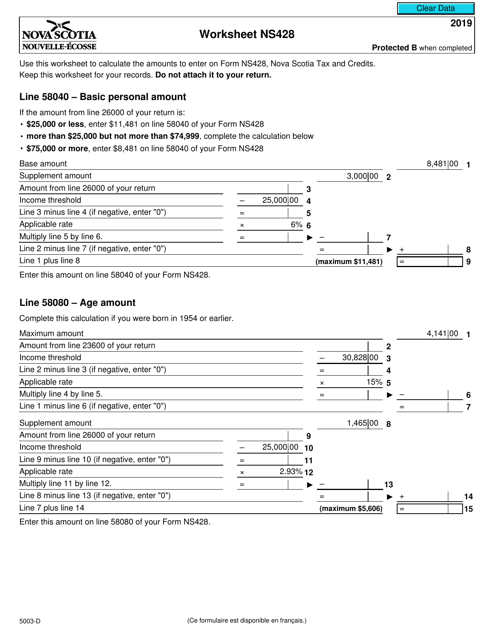

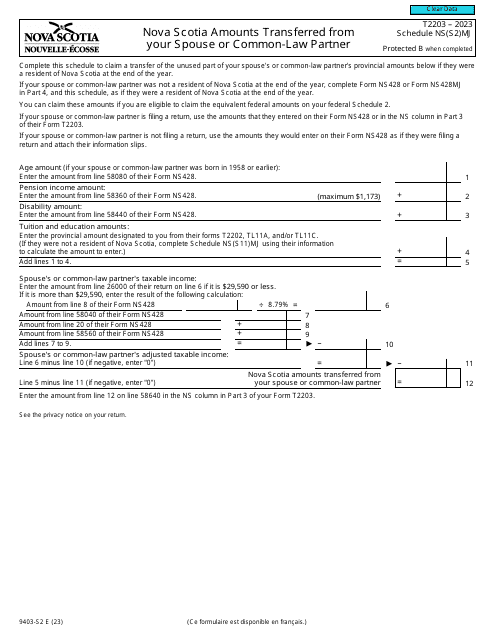

This form is used for completing the Worksheet NS428 for residents of Nova Scotia, Canada. It helps calculate provincial tax credits and deductions.

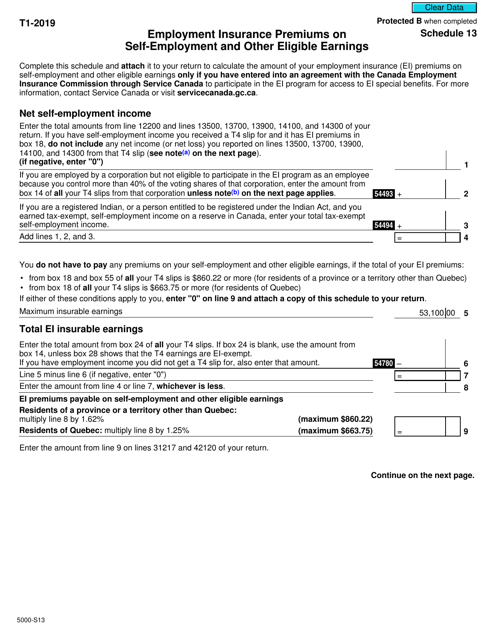

This Form is used for reporting employment insurance premiums on self-employment and other eligible earnings in Canada.

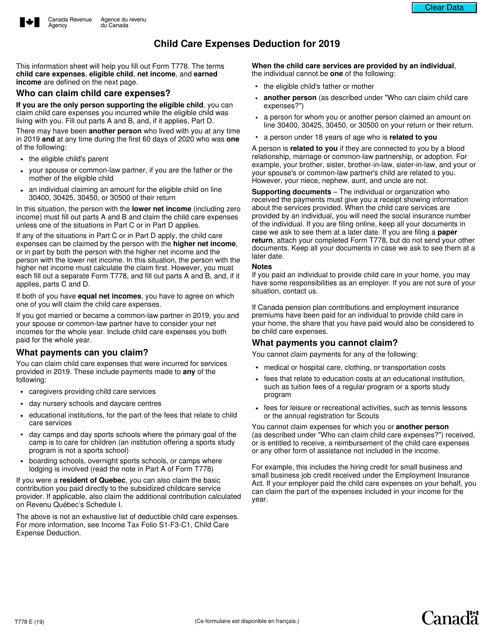

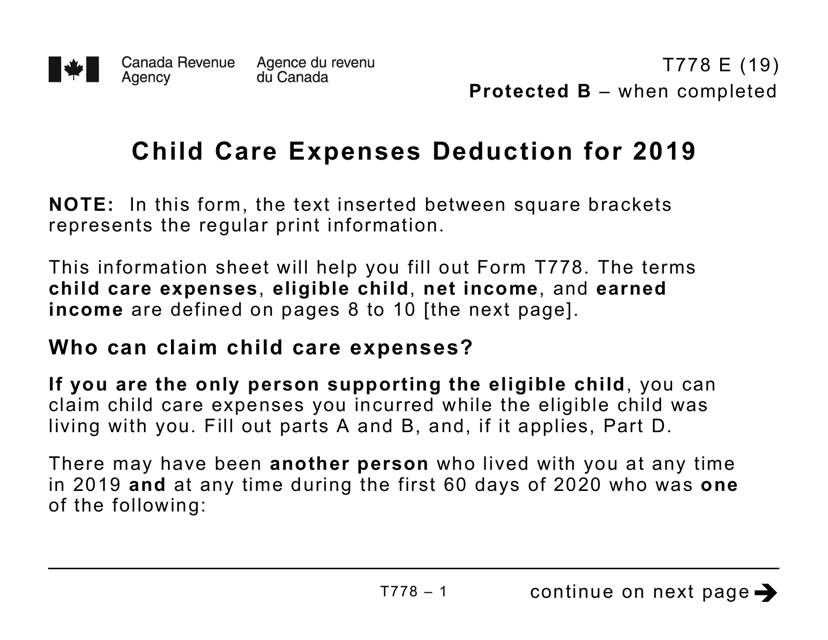

Canadian parents or guardians may use this form to claim expenses incurred from child care on their taxes.

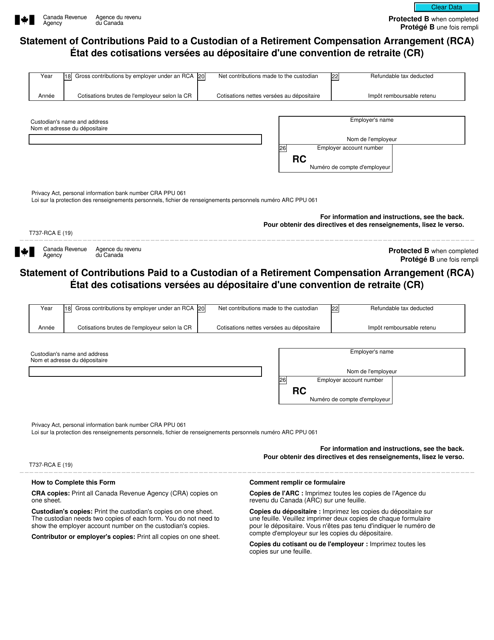

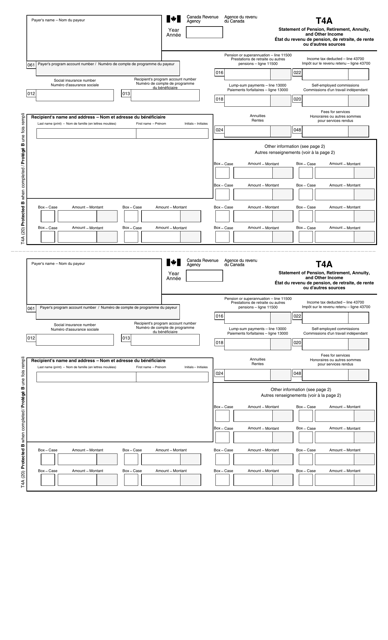

This form is used for reporting the contributions paid to a custodian of a Retirement Compensation Arrangement (RCA) in Canada. It is available in both English and French.

This form is used for claiming child care expenses deduction in Canada. It is available in large print format for individuals with visual impairments.

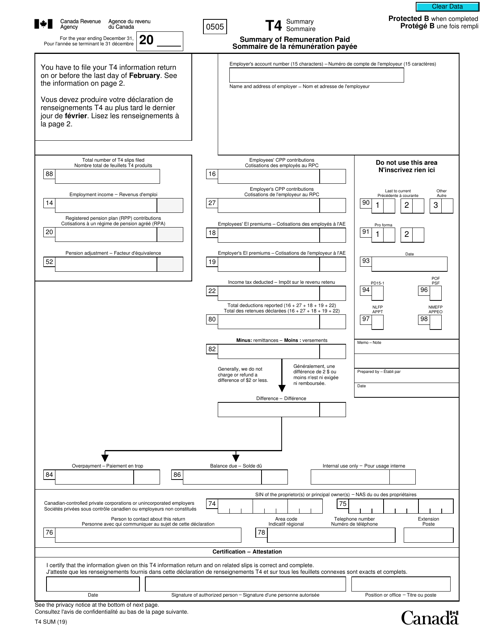

This form is used for summarizing the amount of money paid as remuneration in Canada. It is available in both English and French languages.

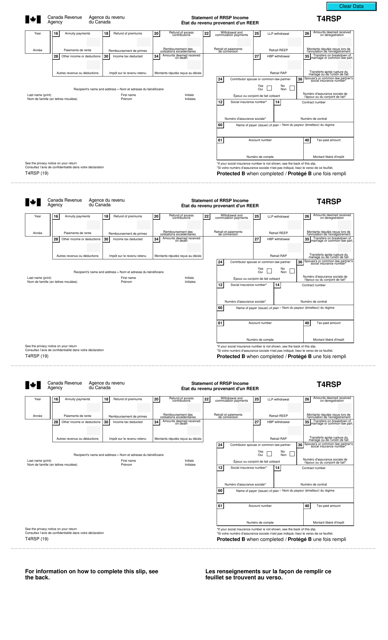

This form is used for reporting RRSP income in Canada. It is available in both English and French languages.

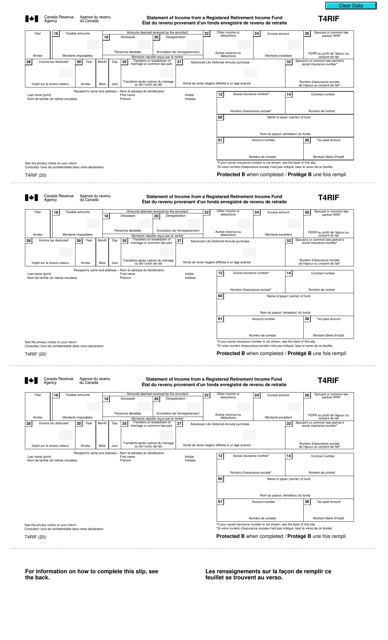

Canadian individuals may use this form when they are filing their taxes to report additional income that does not come from wages earned from completing work.

Canadian taxpayers may use this form when they would like to report the investment income they have received during the year.

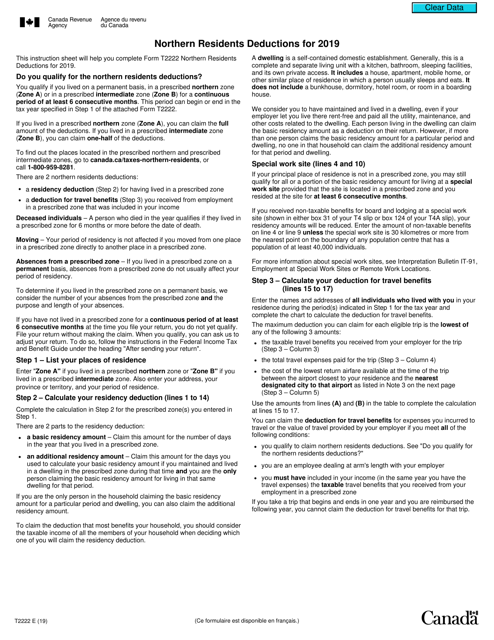

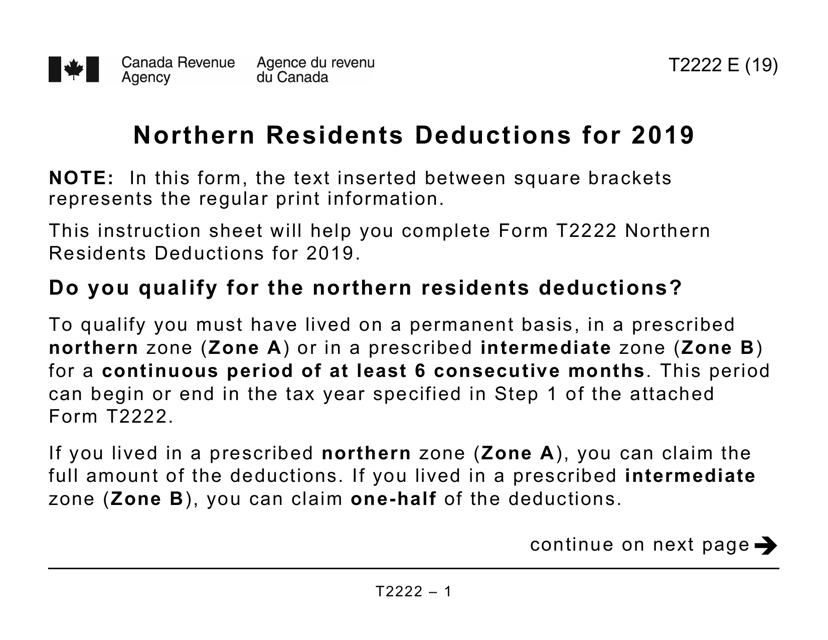

This form is used for claiming northern residents deductions in Canada. It helps residents of certain northern regions to reduce their taxable income by claiming expenses related to living in these regions.

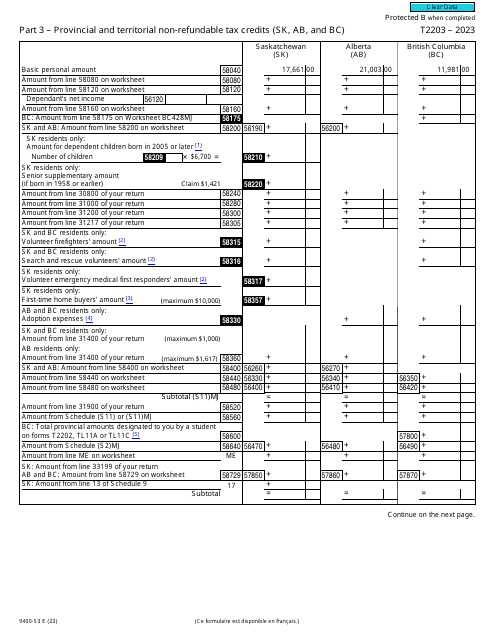

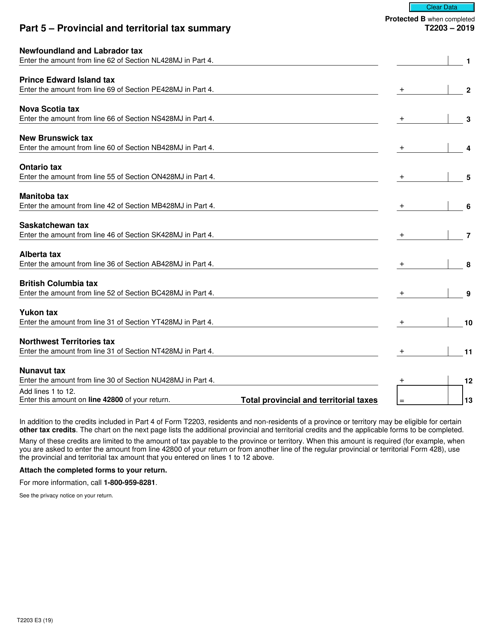

This form is used for providing a summary of the provincial and territorial tax information in Canada. It helps individuals and businesses report their taxes accurately and comply with the Canadian tax laws.

This form is used for claiming northern residents deductions in Canada. It is available in large print format for those who have visual impairments.

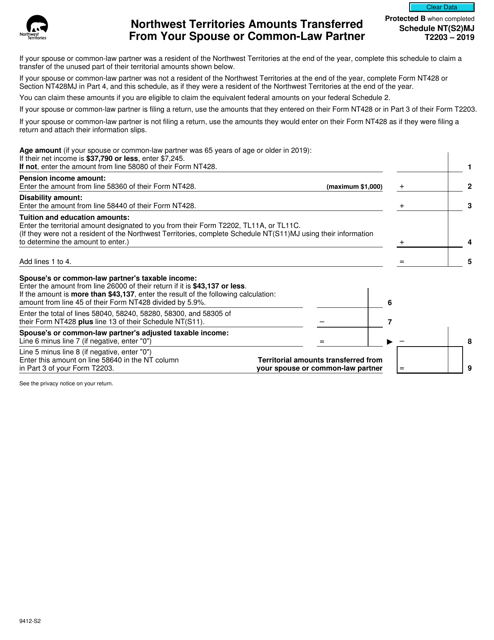

This form is used for reporting the amounts transferred from your spouse or common-law partner as part of the Northwest Territories tax return process in Canada.

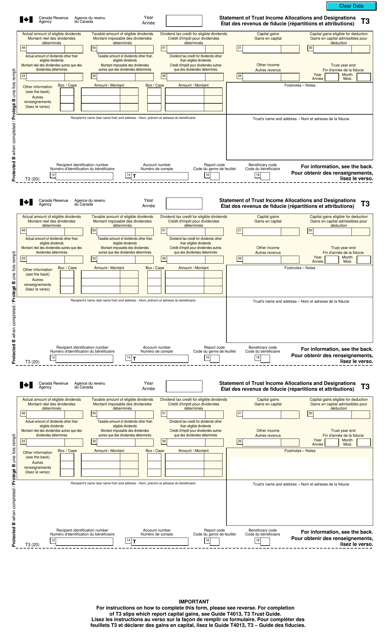

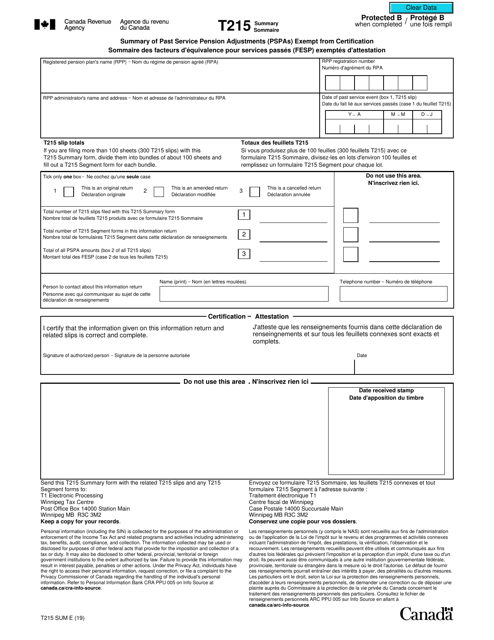

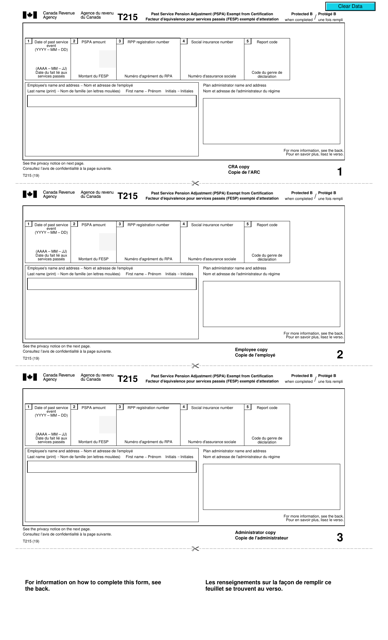

This type of document is used for providing a summary of past service pension adjustments (PSPAs) that are exempt from certification in Canada.

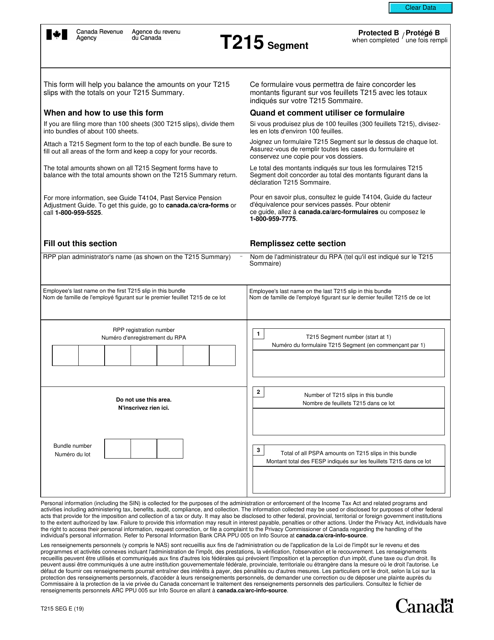

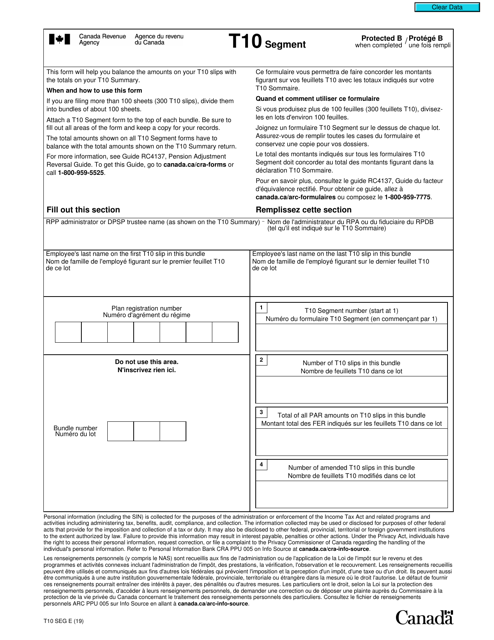

This document is a form used in Canada for reporting information related to a specific segment. It is available in both English and French.

Form T215 Past Service Pension Adjustment (Pspa) Exempt From Certification - Canada (English/French)

This form is used in Canada to report past service pension adjustments that are exempt from certification. It is available in both English and French.

This form is used for segmenting data in Canada. It is available in both English and French.

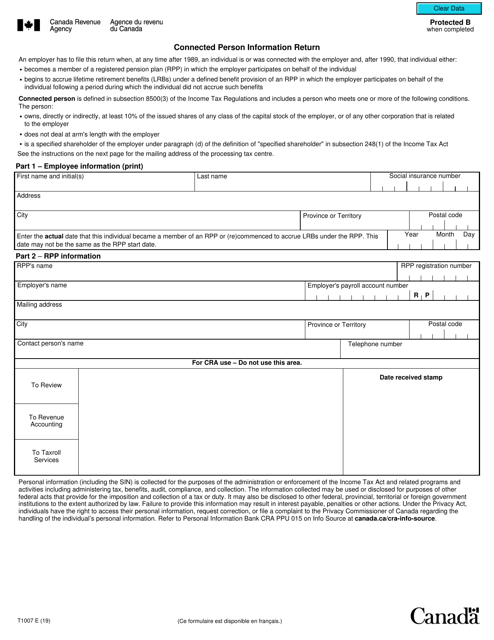

This form is used for reporting information about connected persons for tax purposes in Canada.