Canadian Federal Legal Forms and Templates

Documents:

5112

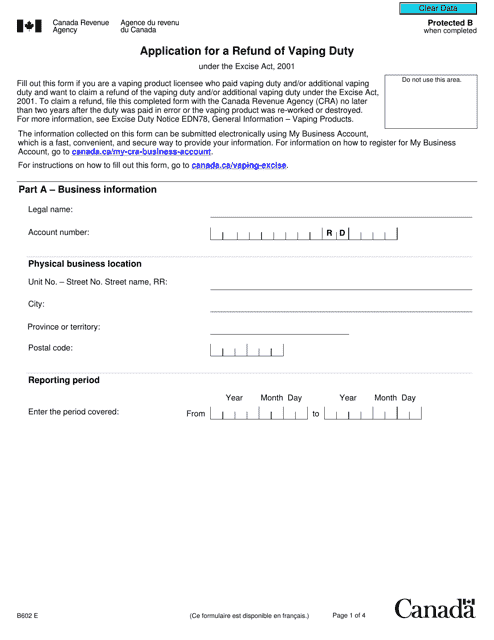

This form is used for applying for a refund of vaping duty in Canada.

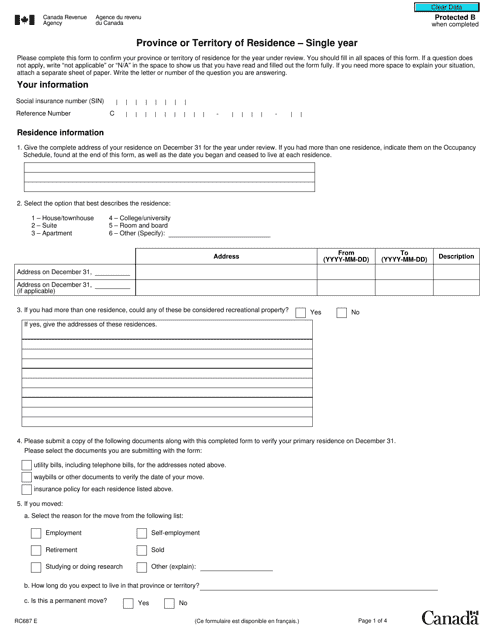

This form is used for determining an individual's province or territory of residence for a single tax year as part of the Refund Examination Program in Canada.

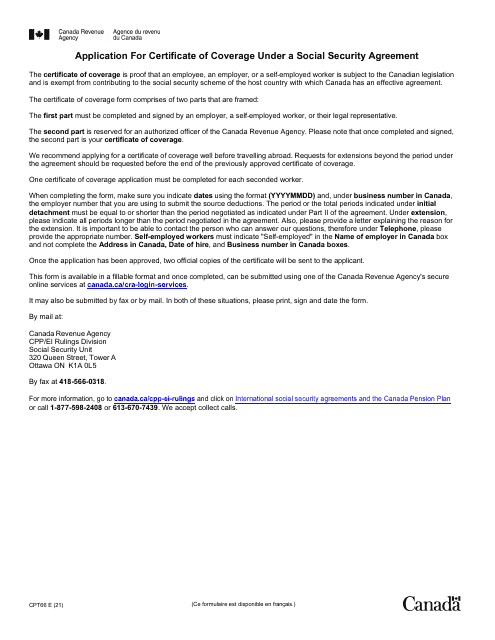

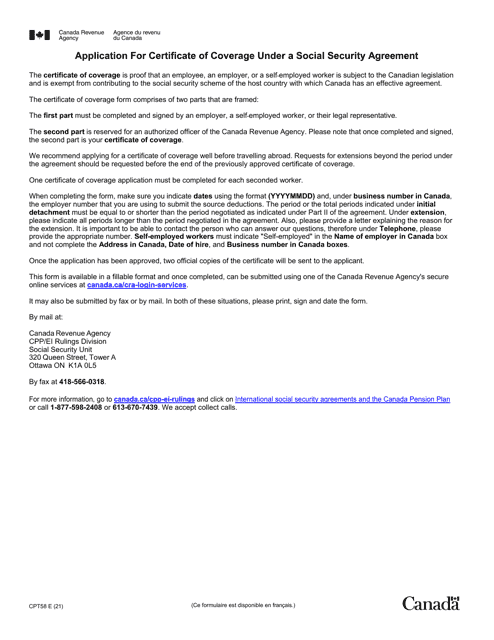

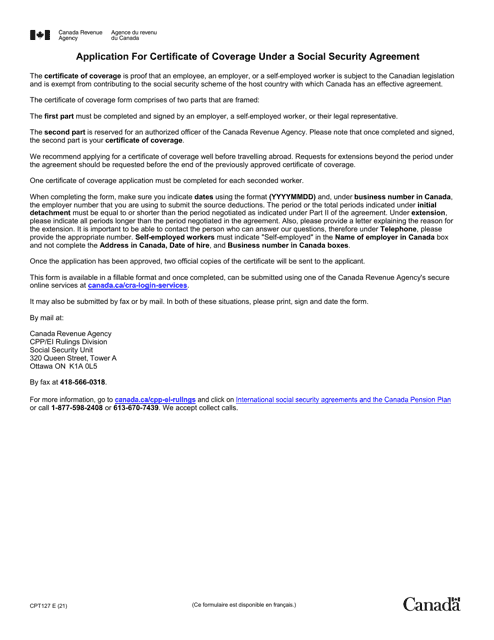

This Form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for residents of Canada and Saint Vincent and the Grenadines. It is used to certify the coverage and benefits under the Canada Pension Plan for individuals who have worked in both countries.

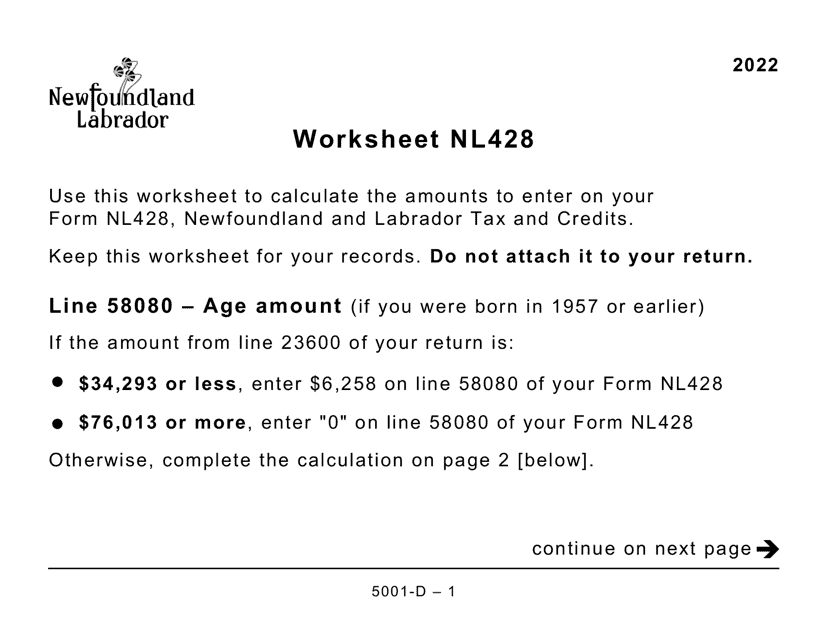

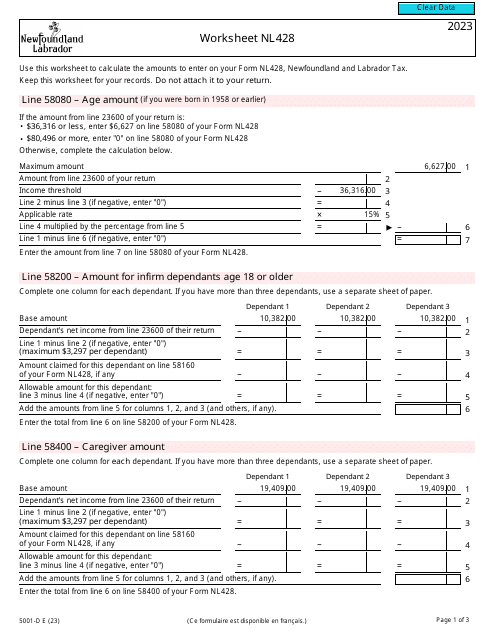

This Form is used for completing the Worksheet NL428 for residents of Newfoundland and Labrador in Canada. It is designed in large print format to assist those with visual impairments.

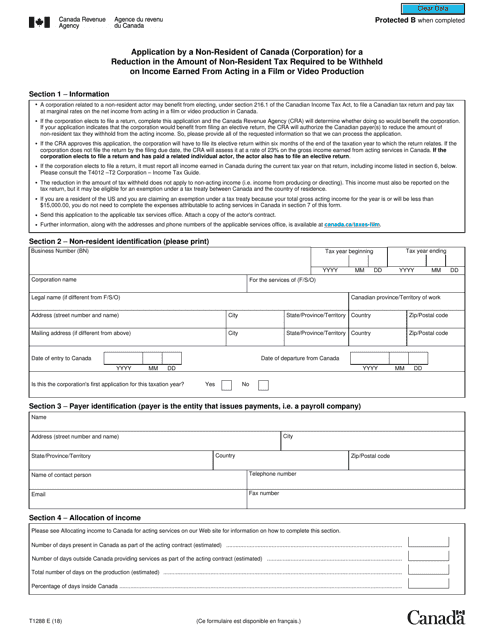

This form is used by non-resident corporations in Canada to apply for a reduction in the amount of non-resident tax that needs to be withheld on income earned from acting in a film or video production.

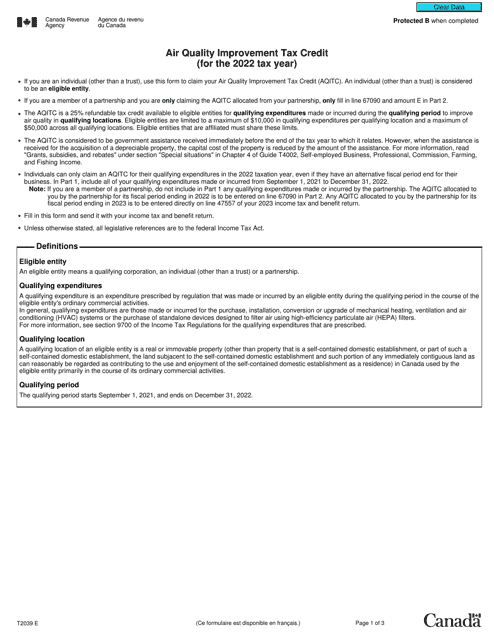

This Form is used for claiming the Air Quality Improvement Tax Credit in Canada.

This Form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals who are covered by both the Canada Pension Plan and the social security system of the Republic of Korea. It is required under the Agreement on Social Security between Canada and the Republic of Korea.

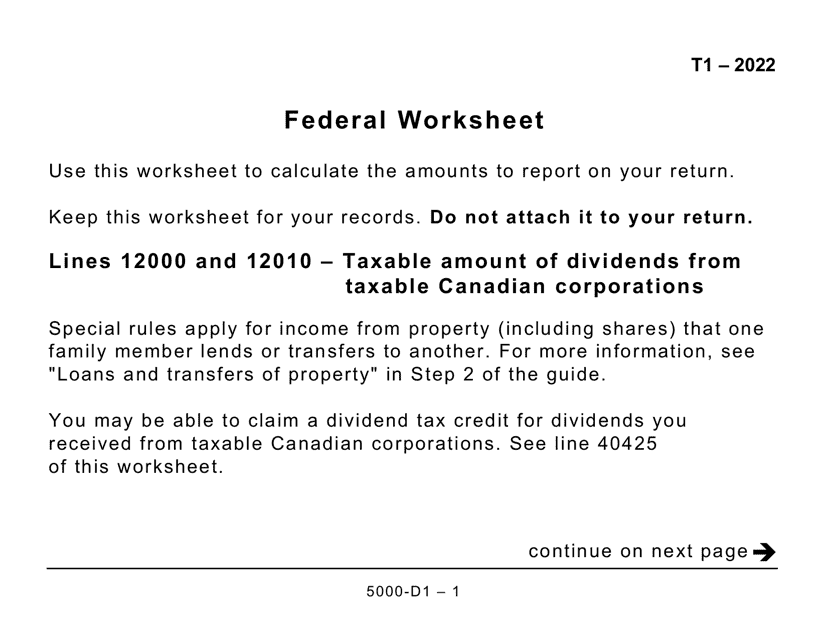

This Form is used for providing a large print version of the Federal Worksheet in Canada. It is designed to accommodate individuals with visual impairments or those who require larger text size.

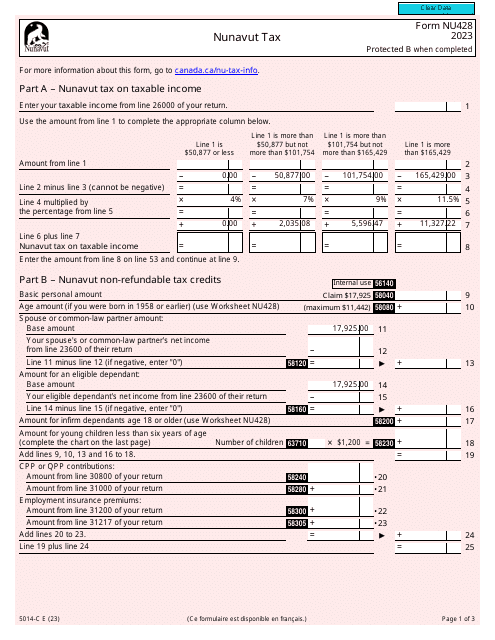

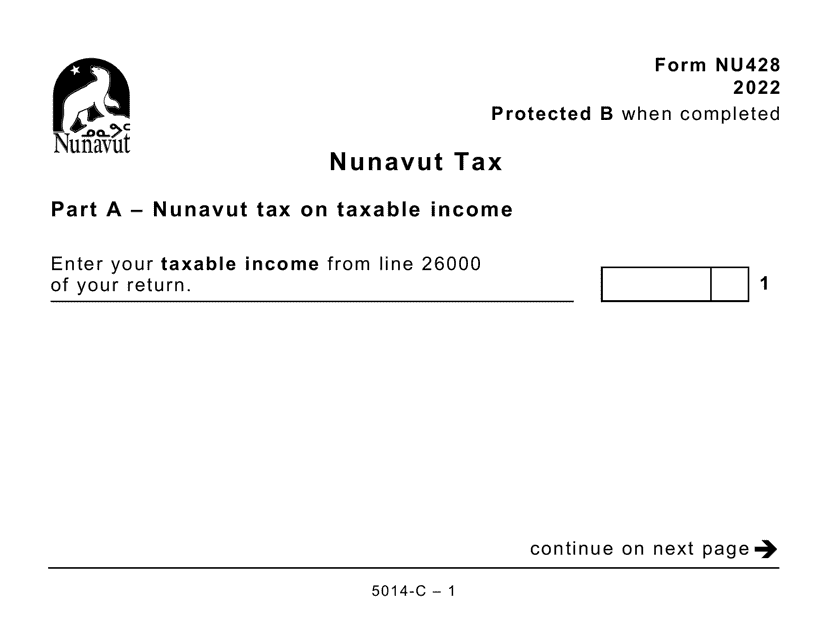

This document is for filing taxes in Nunavut, Canada. It is a large print version of Form 5014-C (NU428).

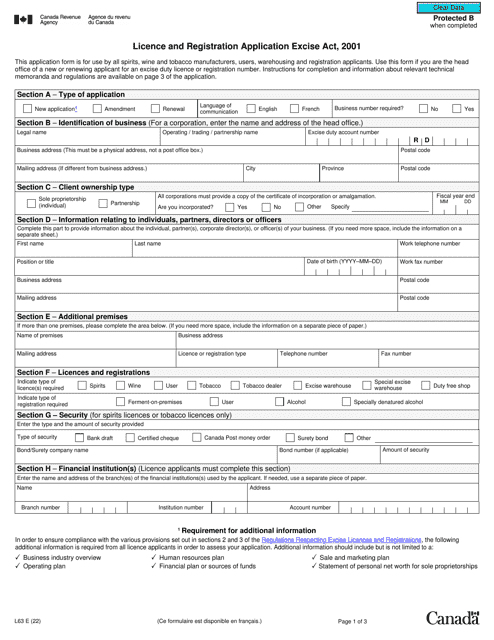

This document is an application form used in Canada for obtaining a license and registration under the Excise Act, 2001. It is required for individuals or businesses engaged in excise-related activities.

This form is used for certifying coverage under the Canada Pension Plan for individuals who are covered under the social security agreement between Canada and Norway.

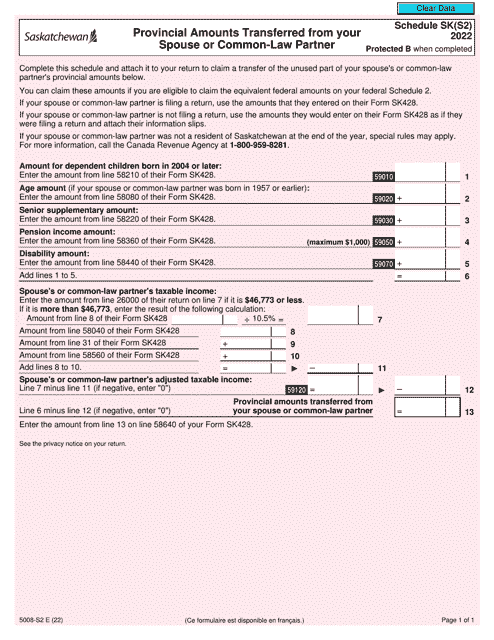

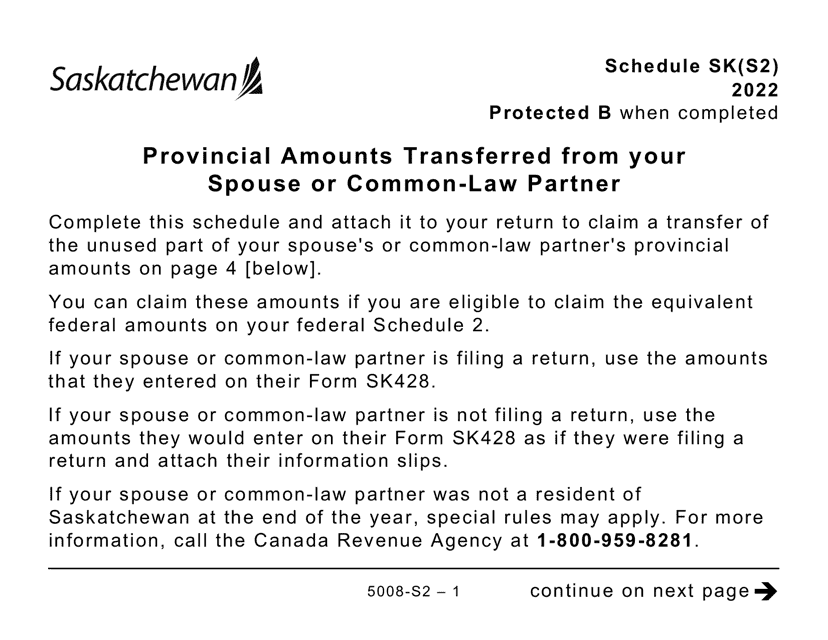

This form is used in Canada for reporting the provincial amounts transferred from your spouse or common-law partner. It is available in large print format.