Canadian Federal Legal Forms and Templates

Documents:

5112

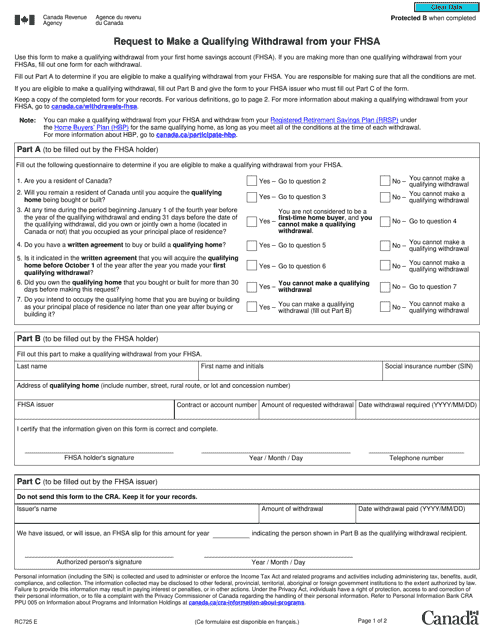

This form is used for requesting a qualifying withdrawal from your FHSAs in Canada.

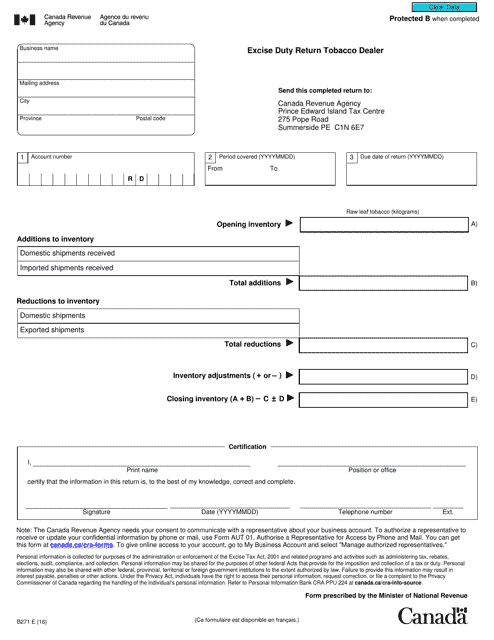

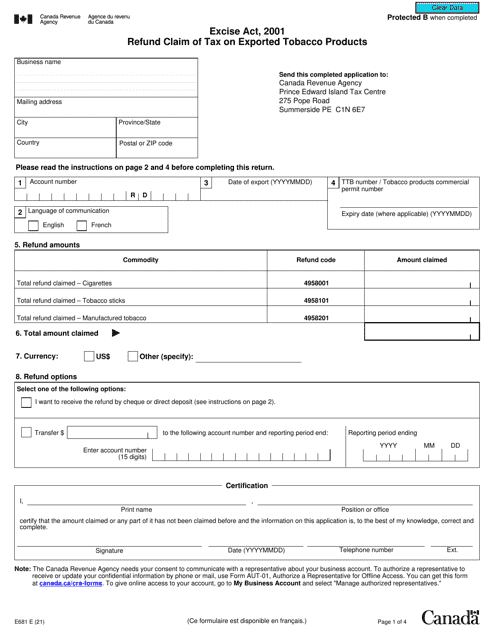

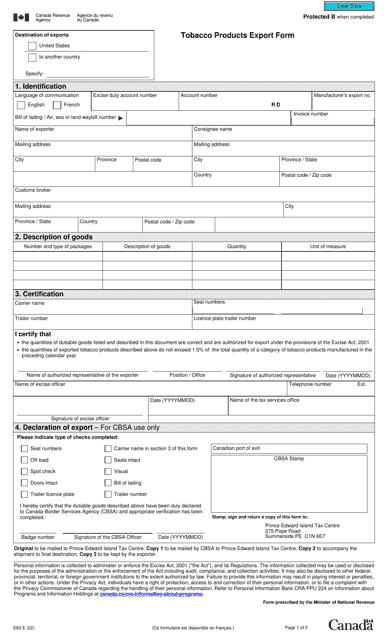

This document is used by tobacco dealers in Canada to report and pay their excise duty.

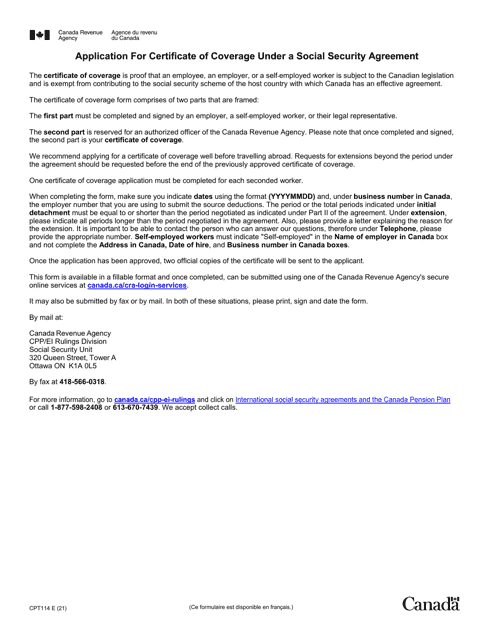

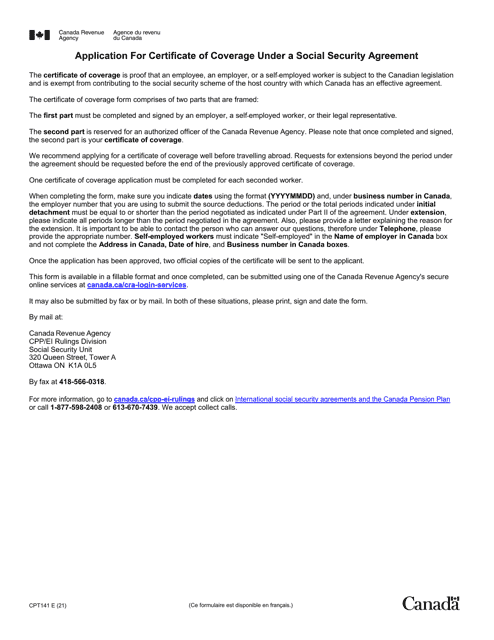

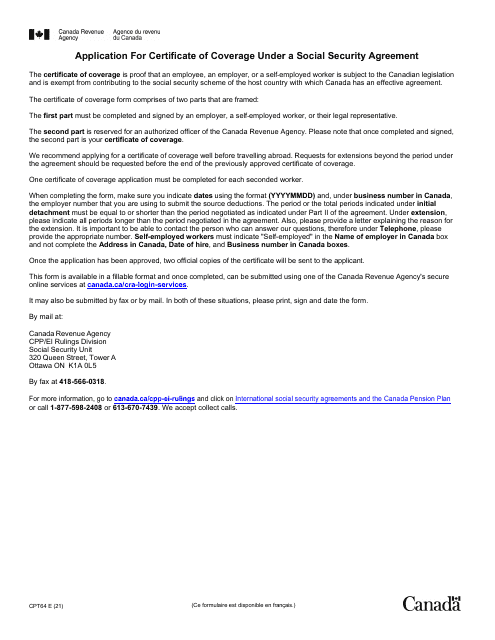

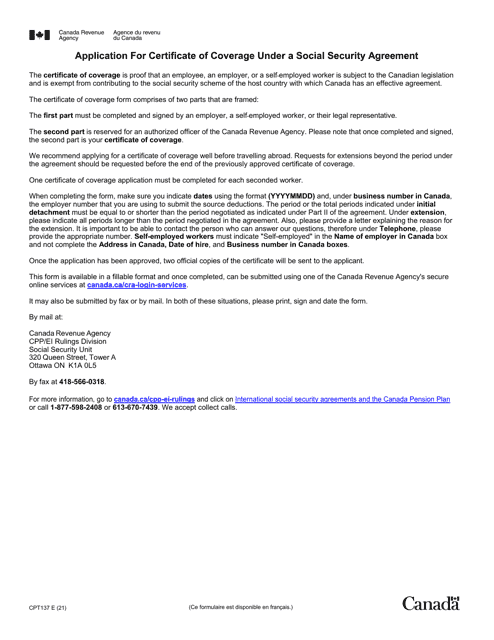

This form is used for obtaining a certificate of coverage under the Canada Pension Plan for individuals covered by the social security agreement between Canada and Estonia.

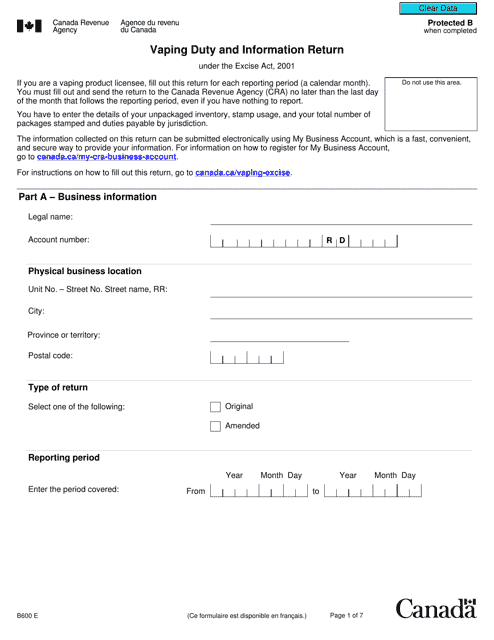

This form is used for reporting vaping duty and providing information to the Canadian government.

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals covered under the Agreement on Social Security between Canada and the Republic of Chile.

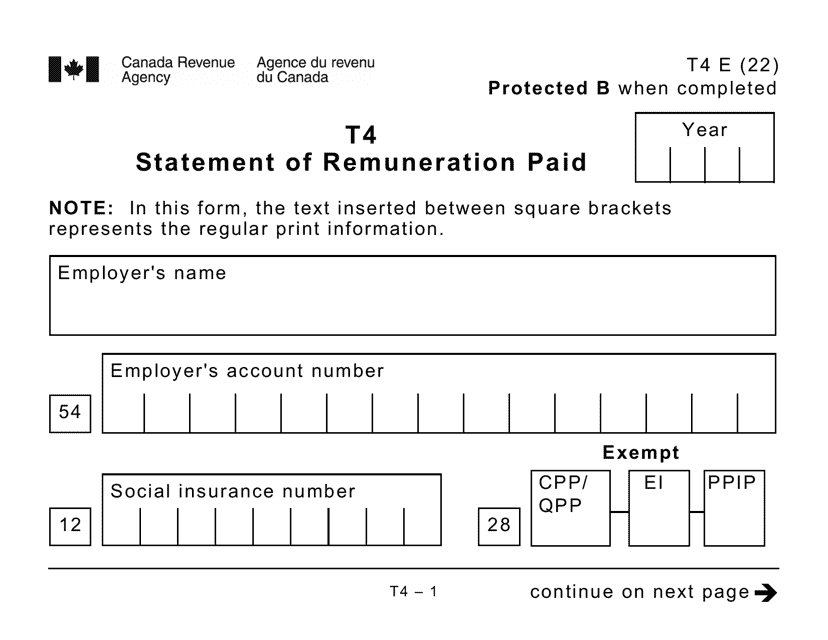

This form is used for reporting the amount of money paid to an employee in Canada and is available in a large print format.

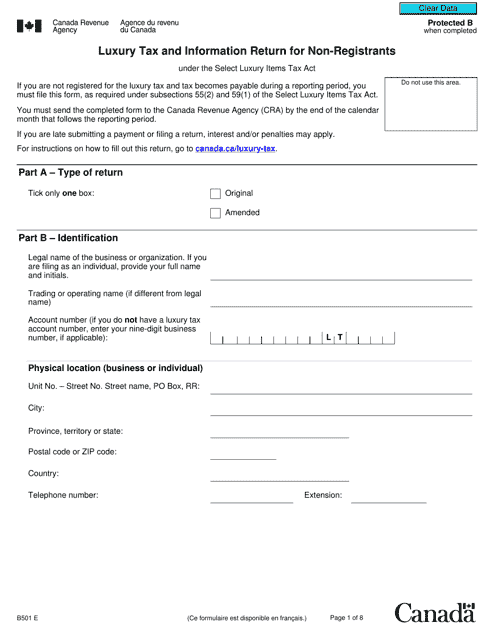

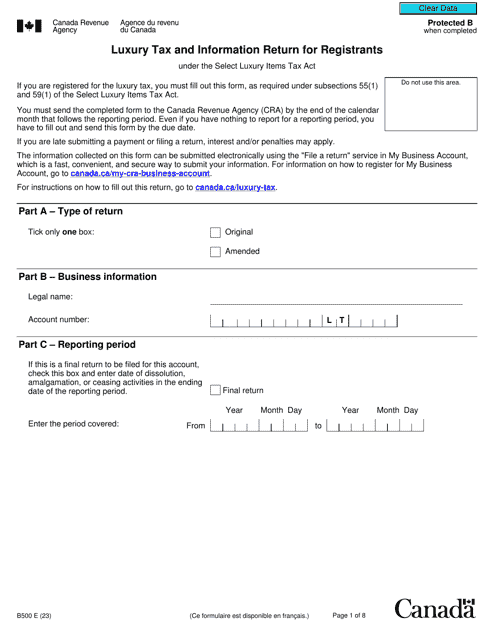

This Form is used for reporting luxury tax and providing information for non-registrants in Canada.

This form is used for certificate of coverage under the Canada Pension Plan for individuals covered by the social security agreement between Canada and Hungary.

This form is used for obtaining a certificate of coverage under the Canada Pension Plan for individuals from the Philippines who are covered by the social security agreement between Canada and the Republic of the Philippines.

This form is used for obtaining a Certificate of Coverage under the Canada Pension Plan for individuals who are covered under the social security agreement between Canada and the Czech Republic.

This Form is used for reporting luxury tax and providing information by registrants in Canada.

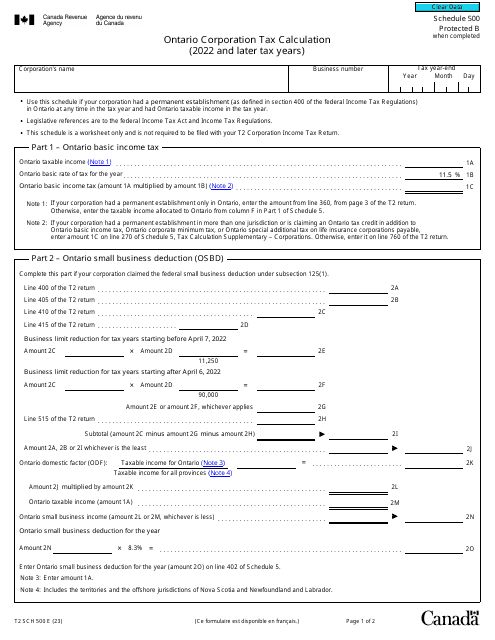

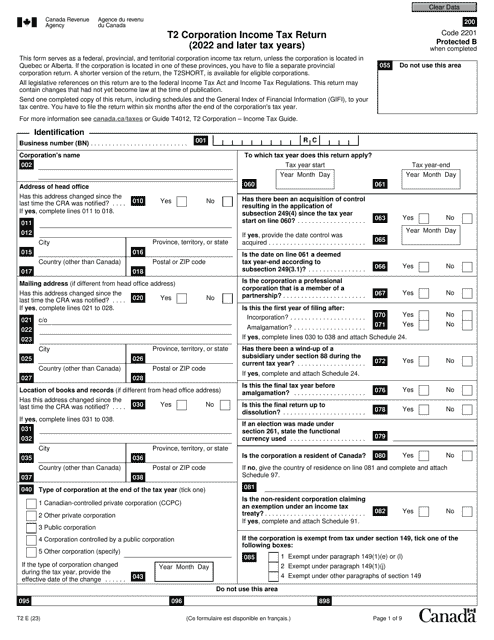

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

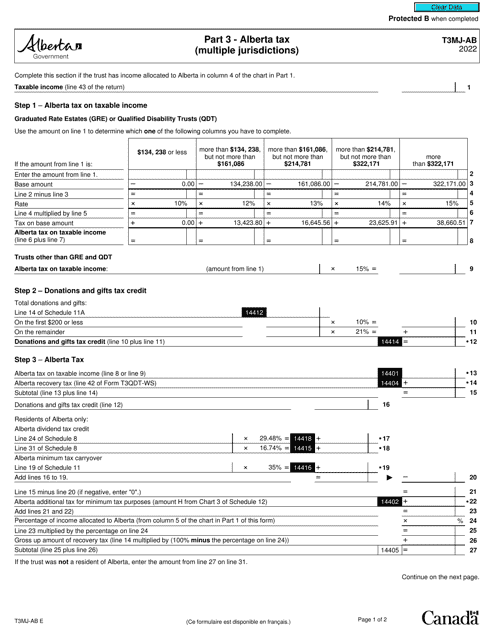

This form is used for reporting Alberta tax in multiple jurisdictions in Canada.

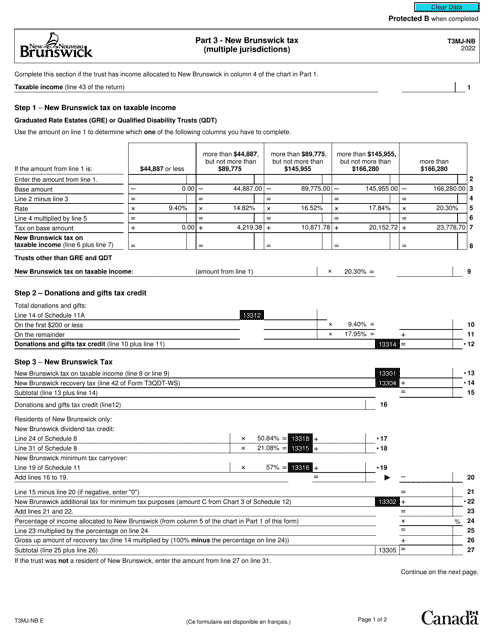

This document is for reporting New Brunswick tax information when multiple jurisdictions are involved in Canada.