Fill and Sign United States Federal Legal Forms

Documents:

24261

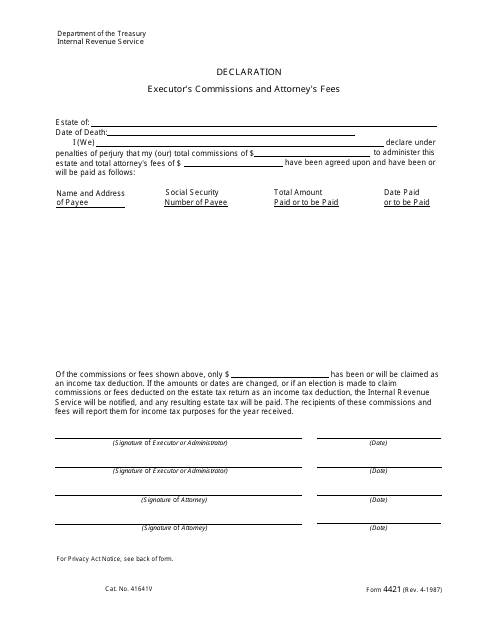

This is a form that should be filled in by an executor and an attorney, hired to manage the probate estate of a deceased person.

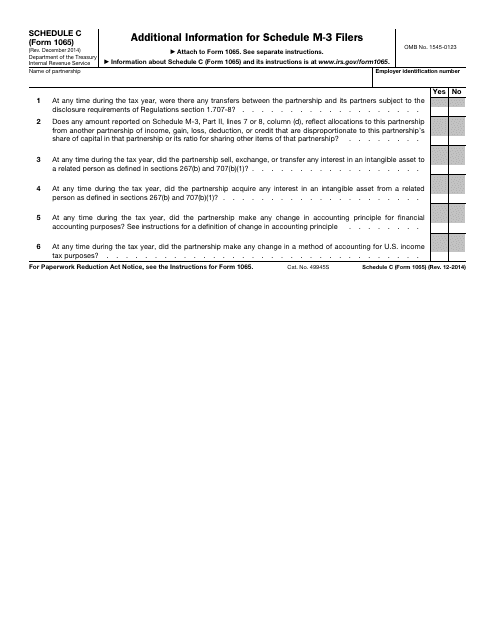

This form is used for providing additional information specifically for filers of Form 1065 Schedule C who also need to complete Schedule M-3.

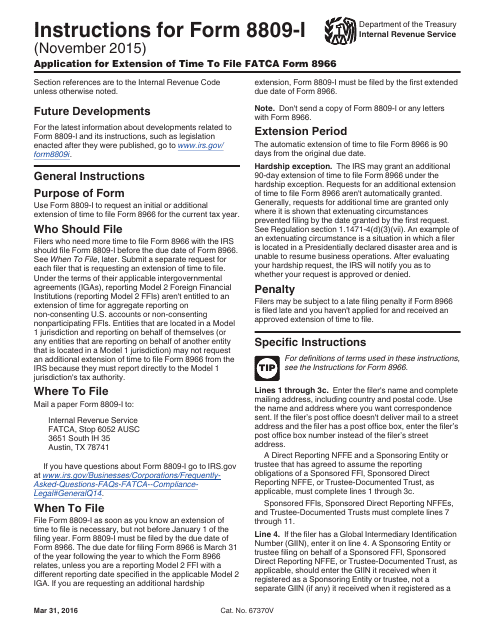

This Form is used for requesting an extension of time to file the Fatca Form 8966 with the IRS.

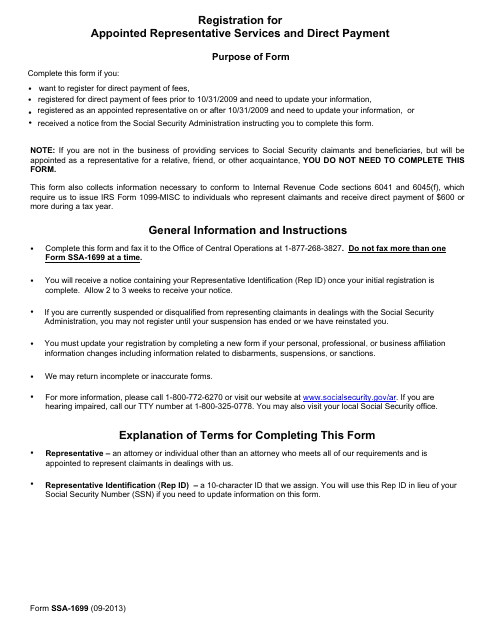

This is a document that individuals may use when they would like to register for the direct payment of fees or if they have registered as an appointed representative before but now want to change some of the information they have submitted in the past.

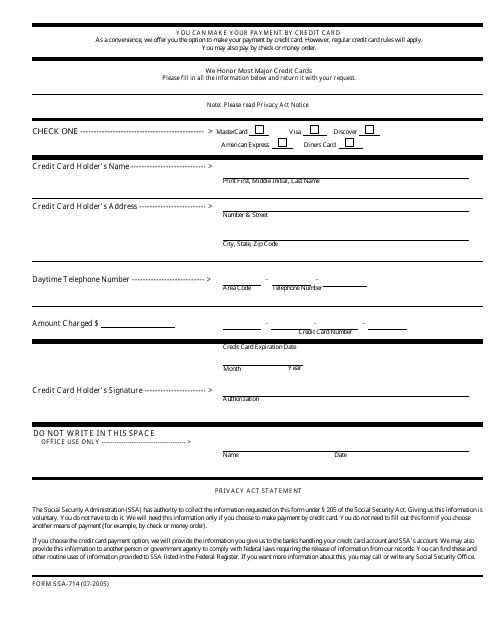

This form is used for applying to make credit card payments for services provided by the Social Security Administration.

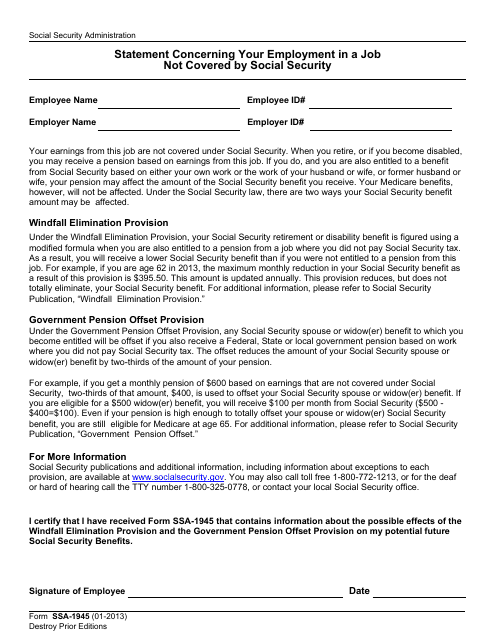

Use this form if you have a job and do not pay Social Security tax, in order to provide an explanation as to how your present job can affect your Social Security benefits.

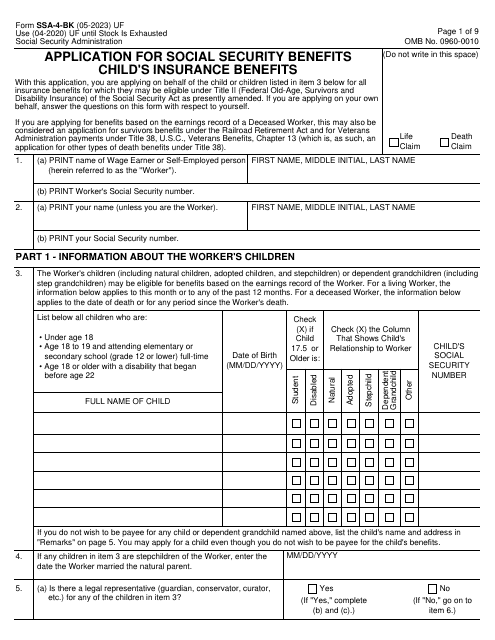

Use this form to apply for Child's Insurance Benefits with the Social Security Administration on behalf of children of eligible workers.

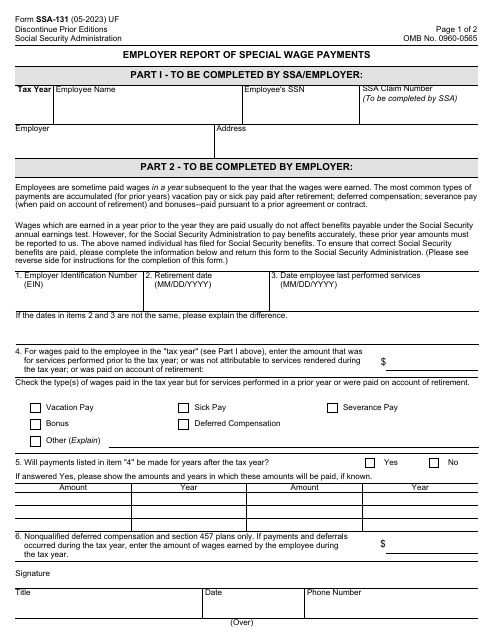

Download this form if you are an employer and need to report the special wages you pay to an employee.

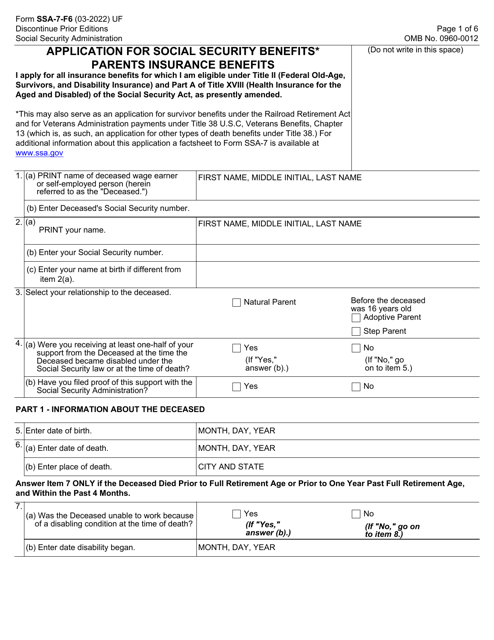

This application is filed by dependent parents of deceased workers with enough Social Security credits to confirm eligibility for SSA benefits.

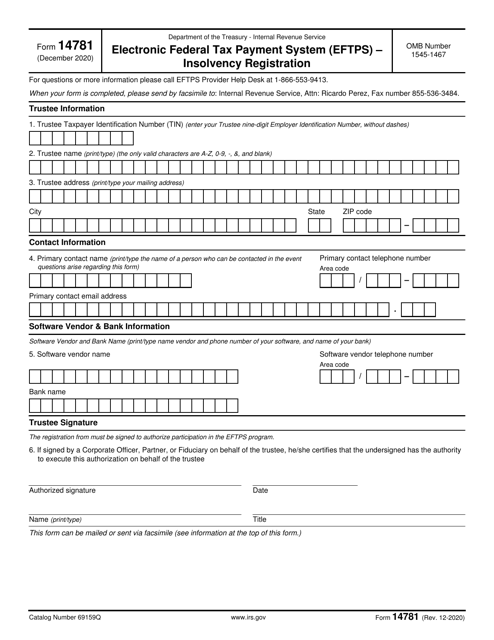

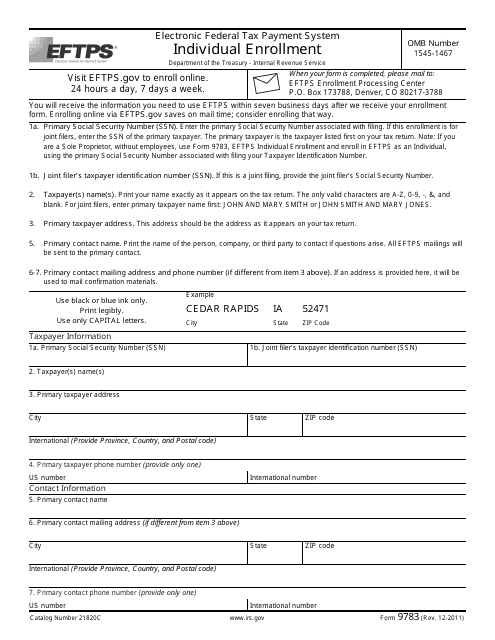

This Form is used for enrolling individuals in the Electronic Federal Tax Payment System (EFTPS). EFTPS allows individuals to make electronic tax payments to the IRS.

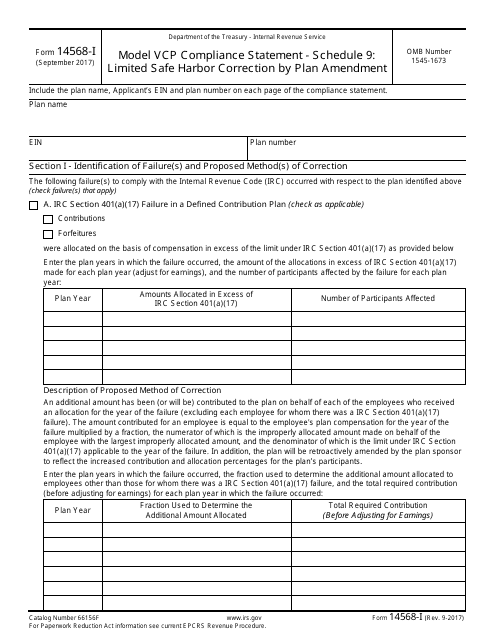

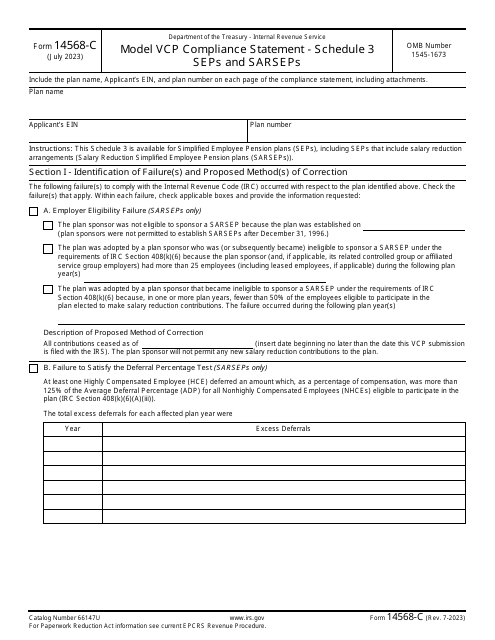

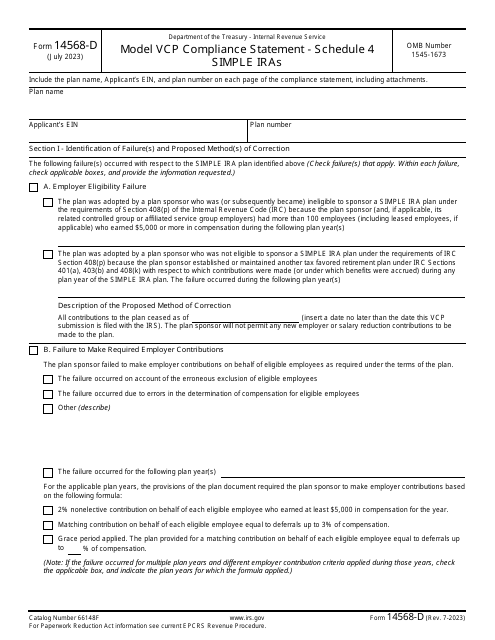

This form is used for making limited safe harbor corrections by plan amendment for IRS Form 14568-I Schedule 9.

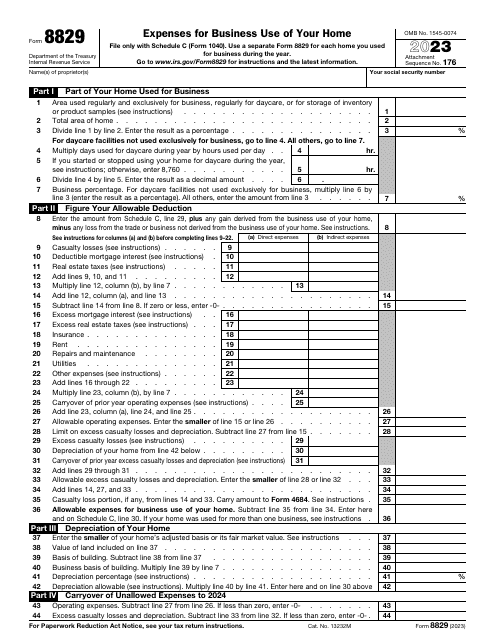

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

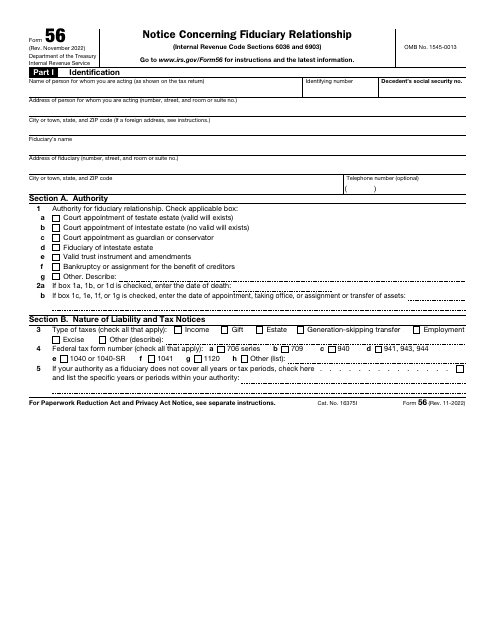

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

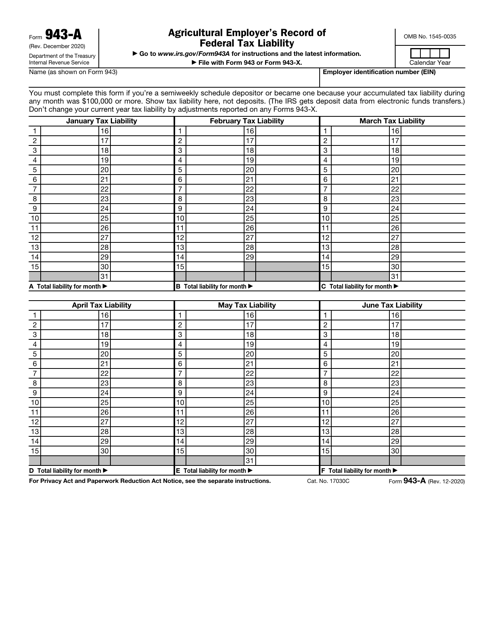

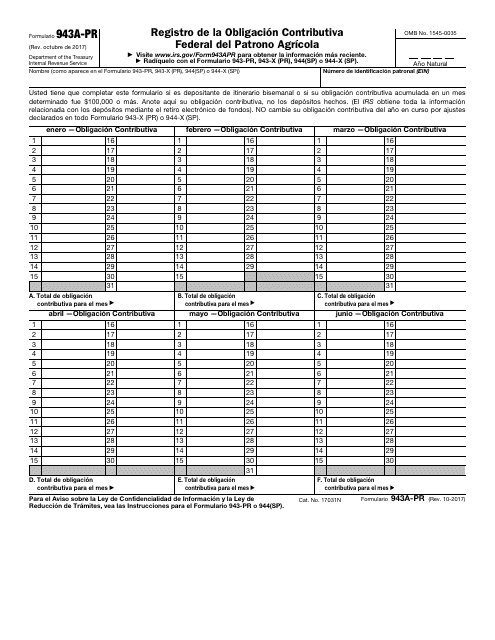

This is an IRS form used by agricultural employers that deposit schedules every two weeks or whose tax liability equals or exceeds $100,000 during any month of the year.

This document is for Puerto Rican farmers to report their federal employment taxes.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

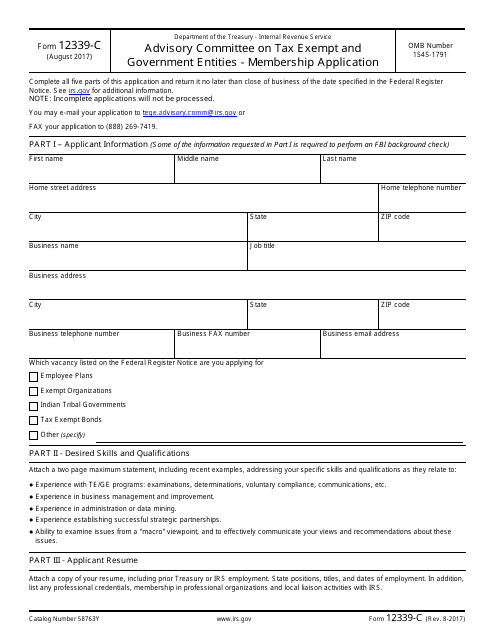

This form is used for applying to become a member of the Advisory Committee on Tax Exempt and Government Entities.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

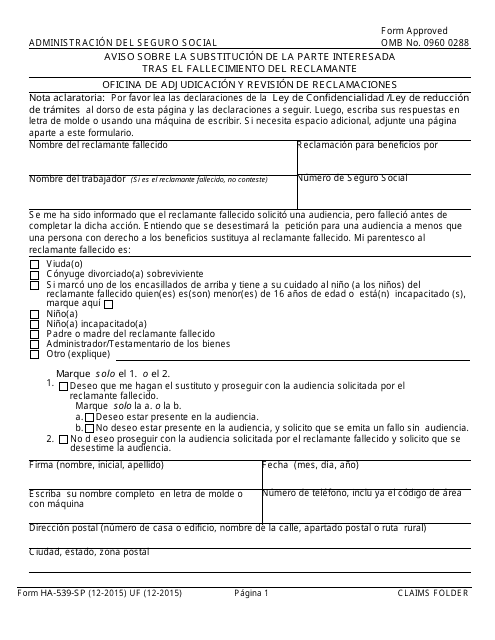

This form is used for notifying about the substitution of the interested party after the death of the claimant.

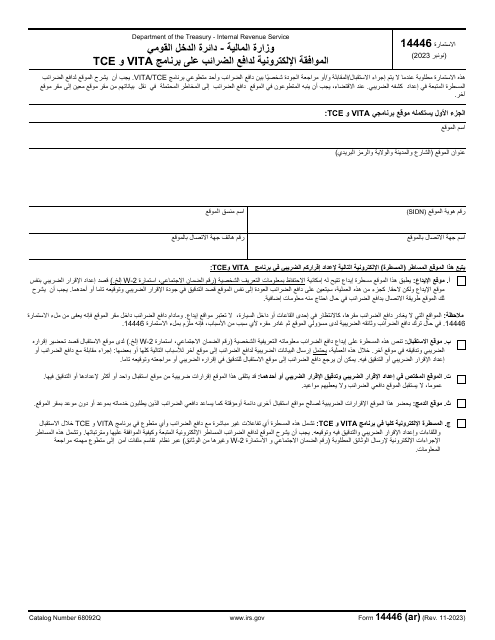

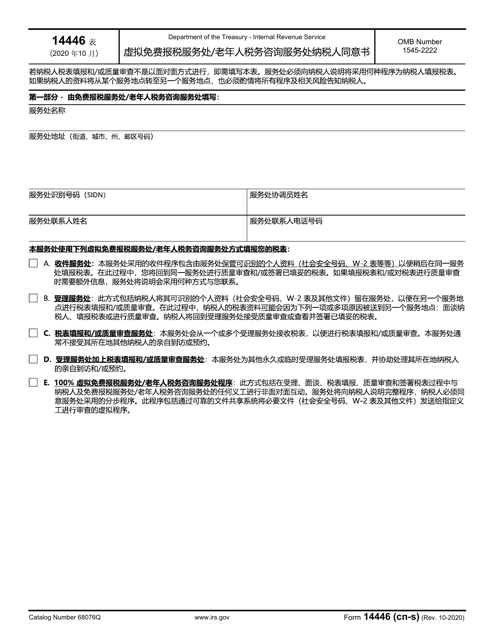

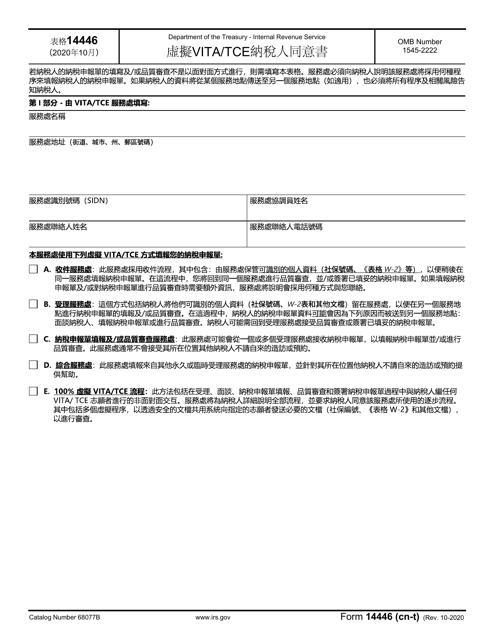

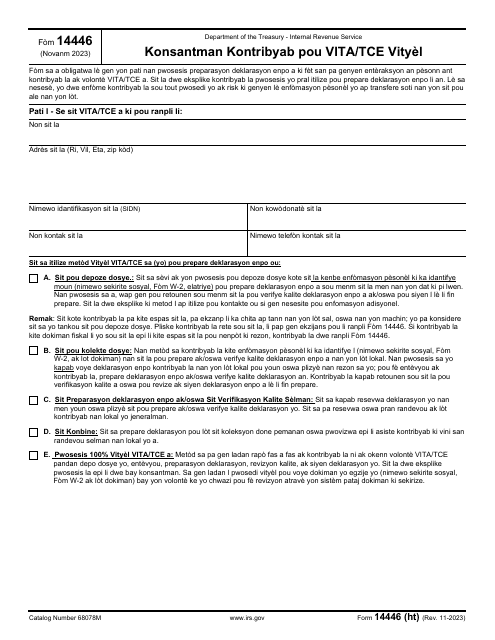

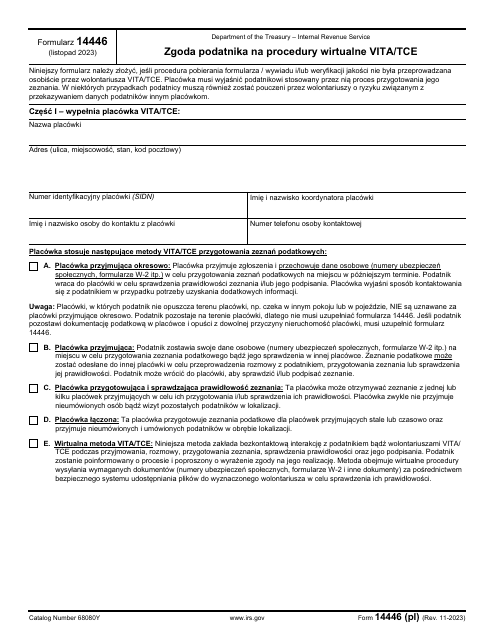

This document is used for obtaining the taxpayer's consent in the Virtual Vita/TCE program, specifically for Vietnamese-speaking taxpayers.

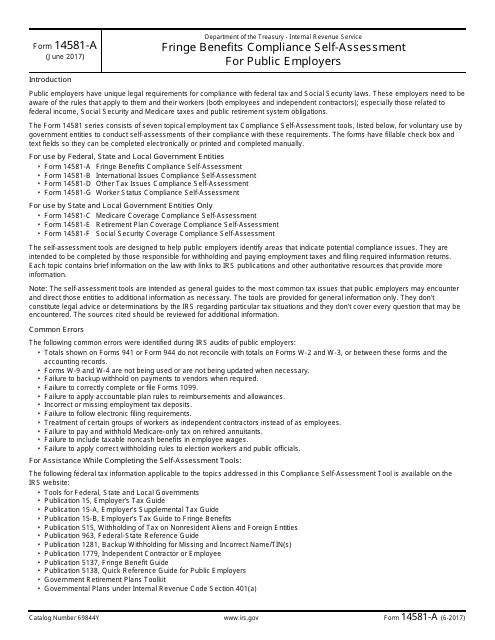

This Form is used for public employers to self-assess their compliance with fringe benefits regulations set by the IRS.

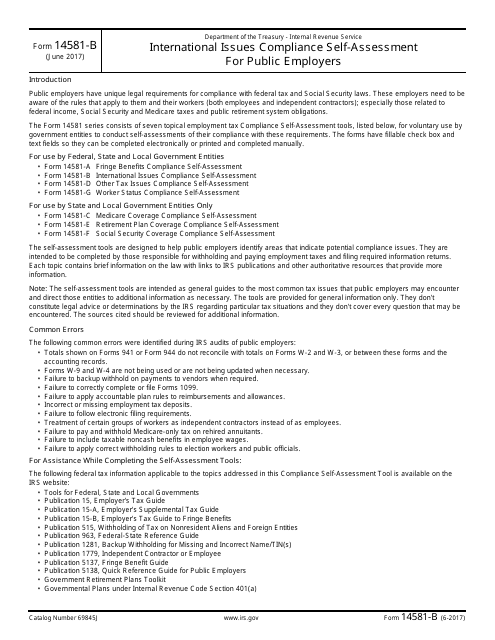

This form is used for public employers to self-assess their compliance with international issues related to taxation.

This document is used for conducting a Medicare coverage compliance self-assessment by state and local government employers.

This Form is used for public employers to assess their compliance with other tax issues for the purpose of tax compliance.

This Form is used for state and local government entities to assess their retirement plan coverage compliance.

This form is used for state and local government entities to complete a self-assessment of their compliance with social security coverage requirements.