Fill and Sign United States Federal Legal Forms

Documents:

24261

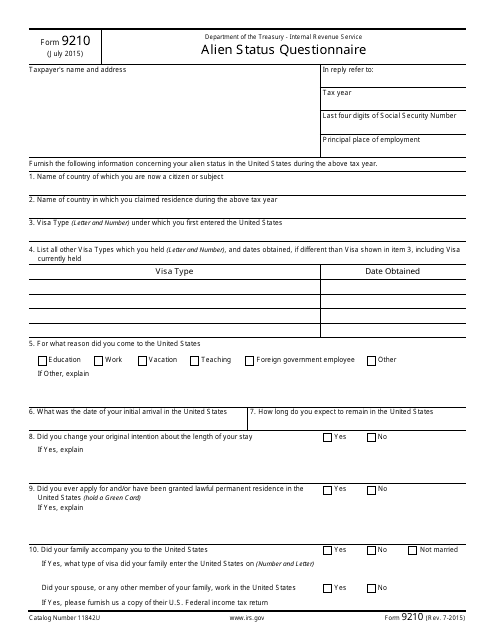

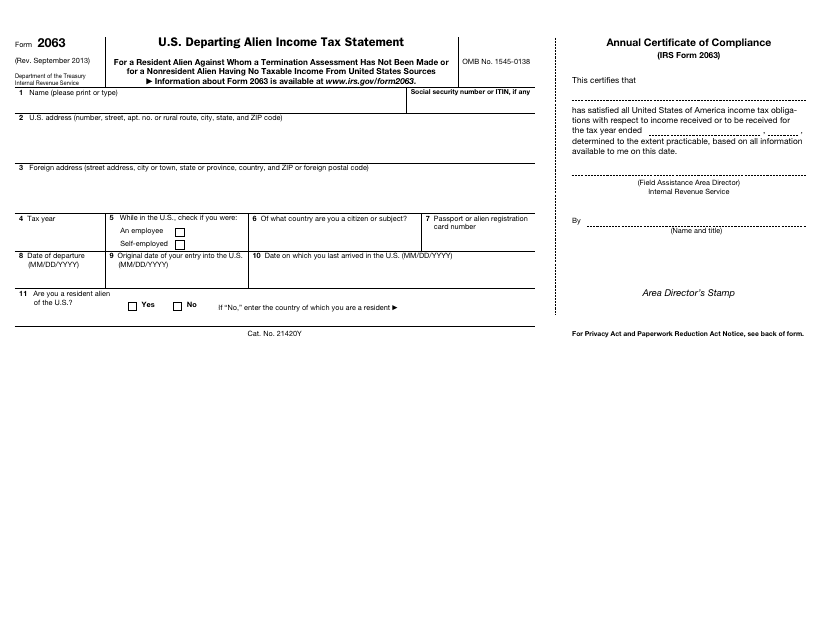

This document is used for determining the alien status of an individual for tax purposes.

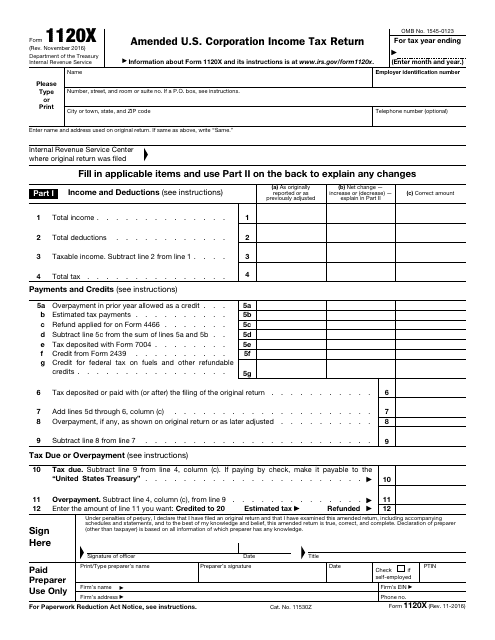

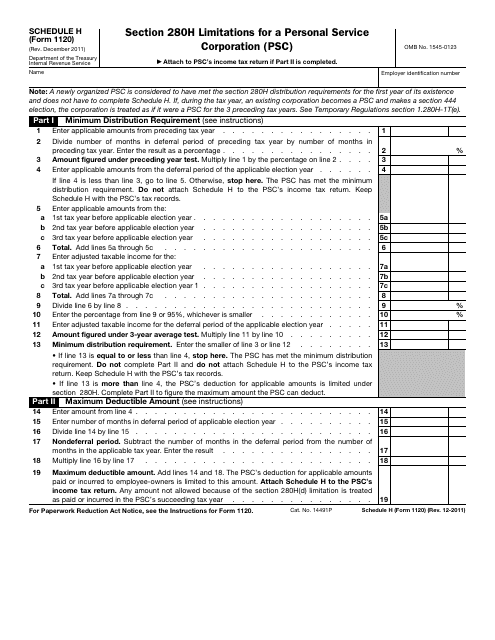

This document is filled out by corporations in order to correct Form 1120 (or Form 1120-A), a claim for a refund, or an examination, as well as to make certain elections after the prescribed deadline.

This form is used for reporting income earned by non-resident aliens who are leaving the United States.

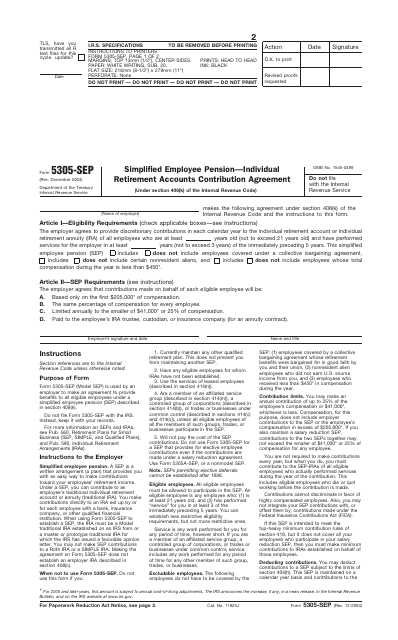

This is a formal agreement signed by an employer to arrange a simplified employee pension.

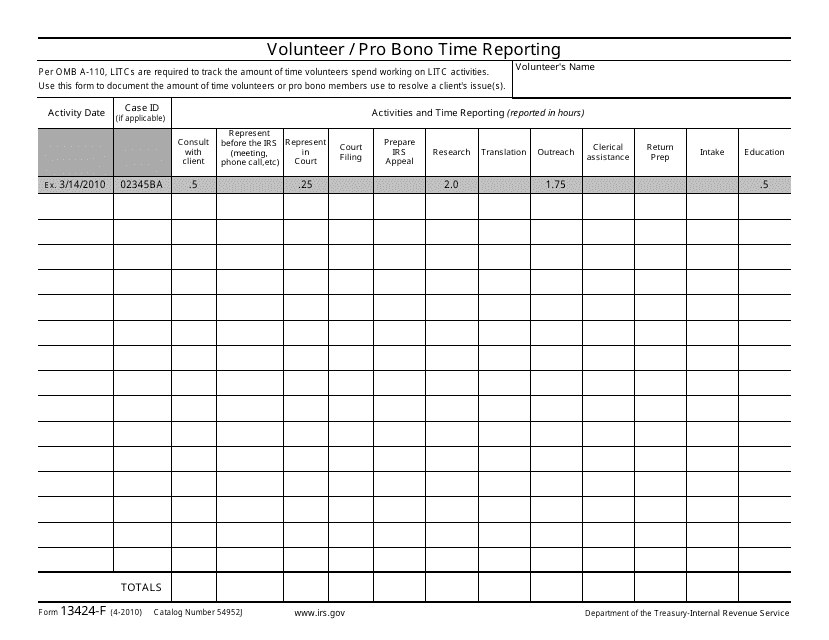

This form is used for reporting volunteer or pro bono time to the IRS. It helps individuals or organizations document the time they have devoted to providing free services to the community.

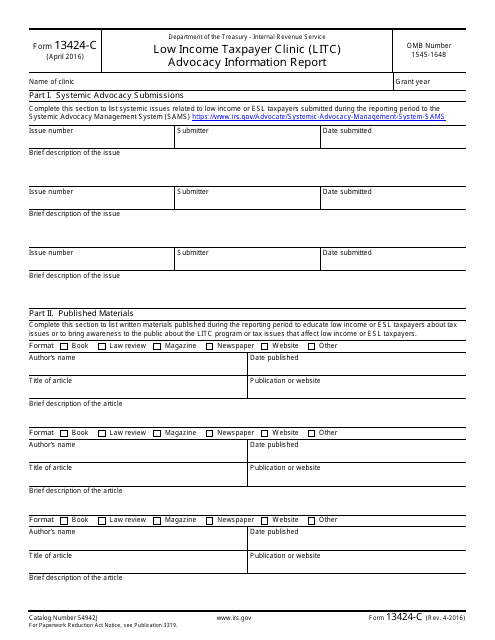

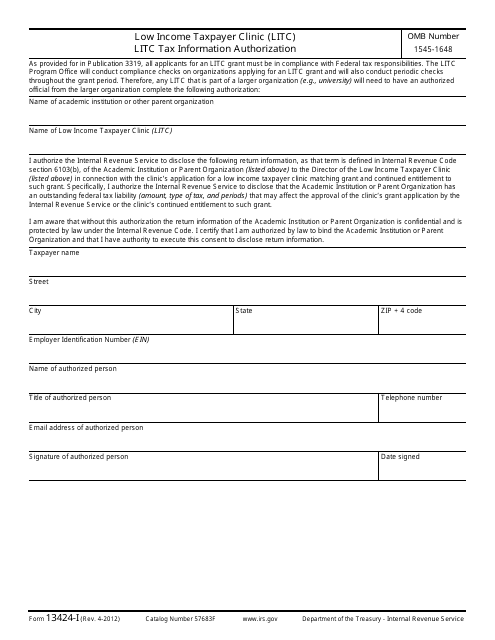

This document is for a Low Income Taxpayer Clinic (LITC) to authorize the tax information for LITC tax purposes.

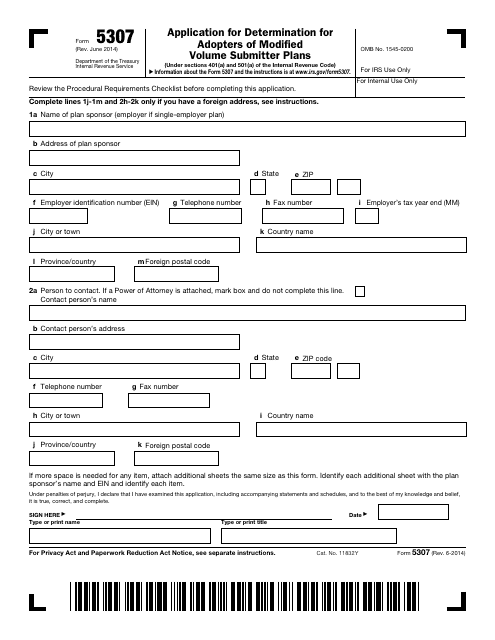

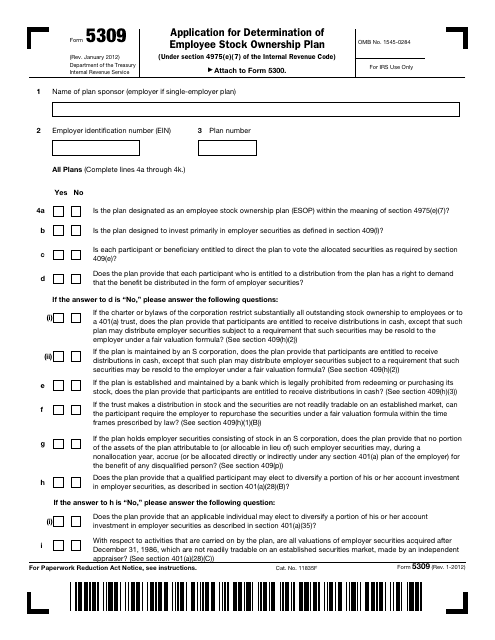

This Form is used for applying for determination for adopters of master or prototype or volume submitter plans with the IRS.

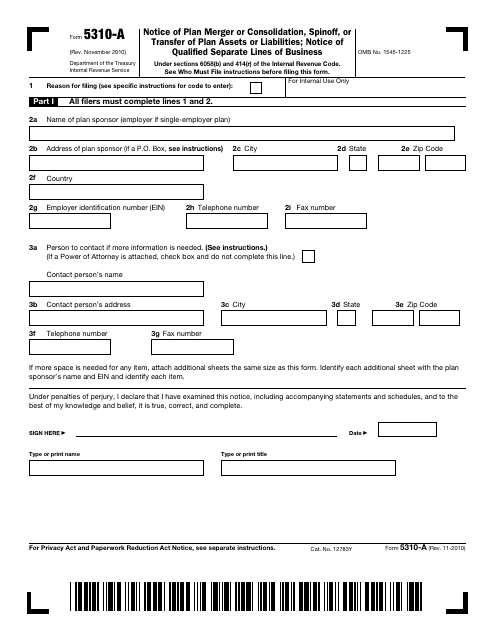

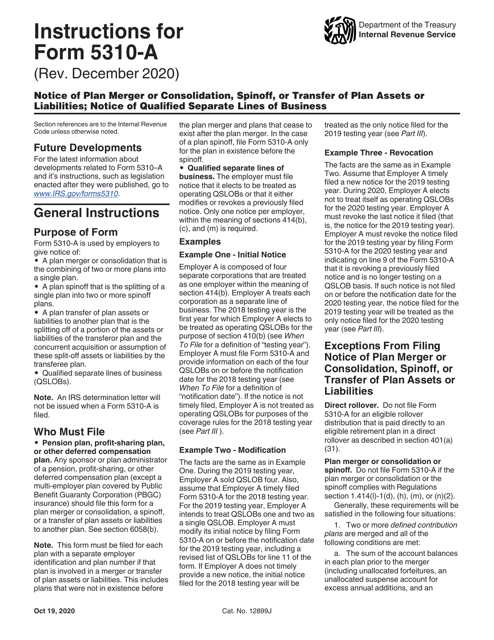

This Form is used for reporting a plan merger or consolidation, spinoff, transfer of plan assets or liabilities, or qualified separate lines of business.

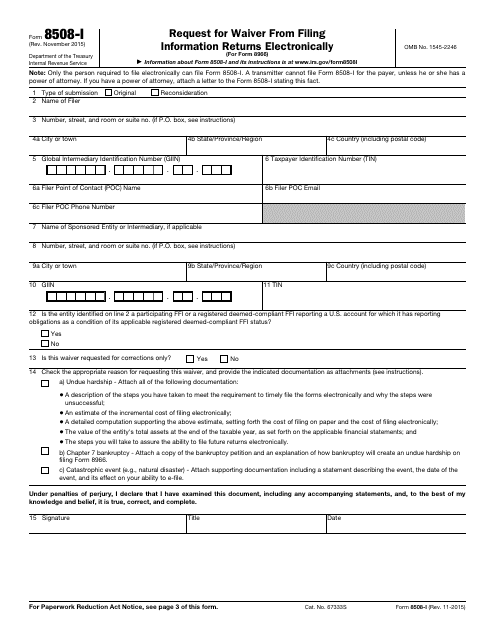

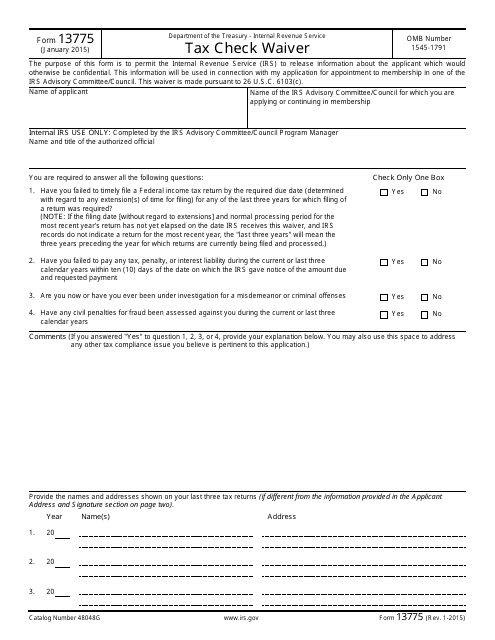

This form is used for requesting a waiver for tax checks from the IRS.

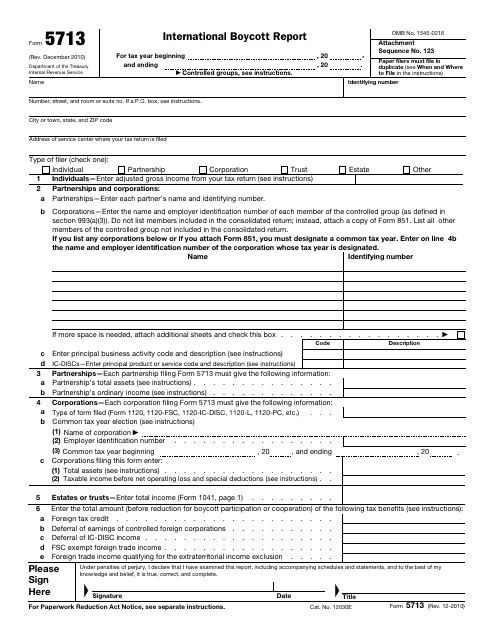

This Form is used for reporting international boycott activities to the Internal Revenue Service (IRS). Businesses may be required to complete this form to comply with U.S. tax laws.

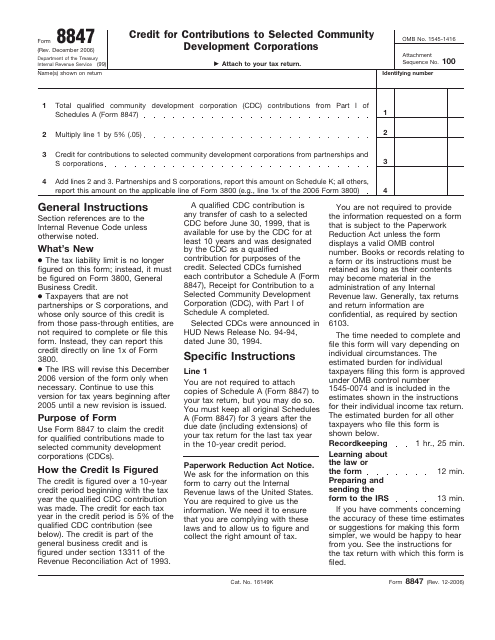

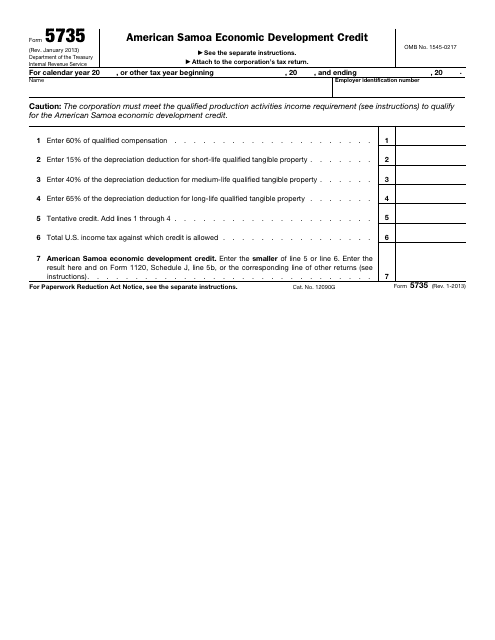

This form is used for claiming the American Samoa Economic Development Credit on your federal taxes.

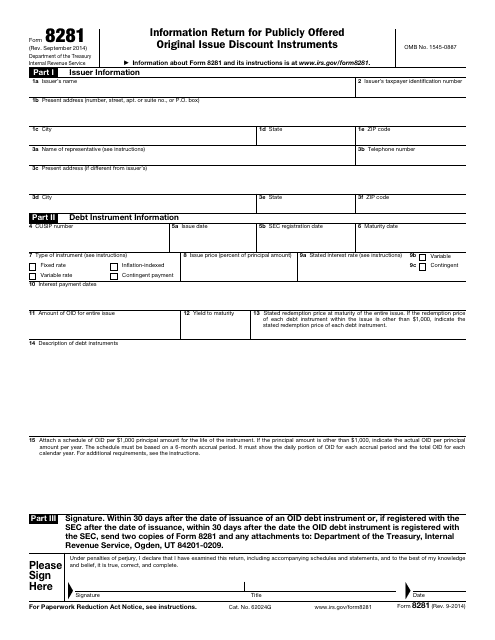

This is a written form filled out and filed by the taxpayers that issued publicly offered debt instruments with an original issue discount.

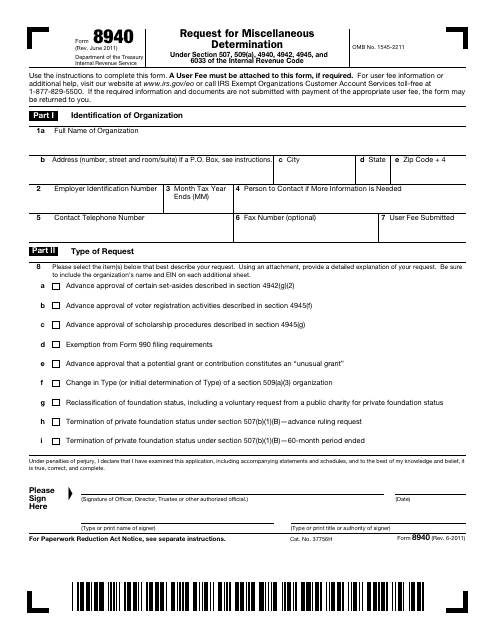

This form is used for requesting miscellaneous determinations from the IRS.