IRS W-7 Forms and Templates

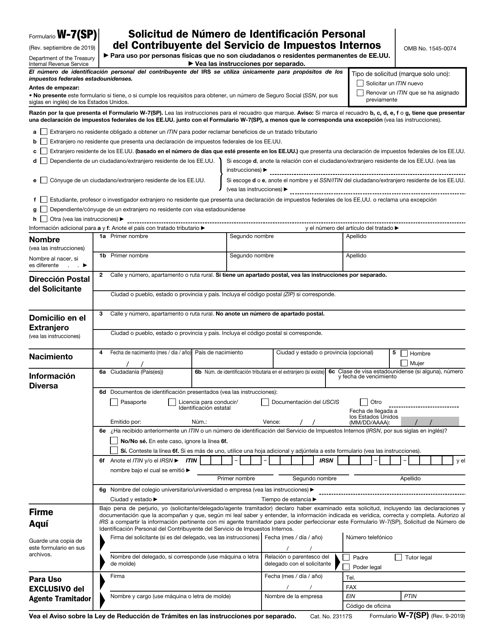

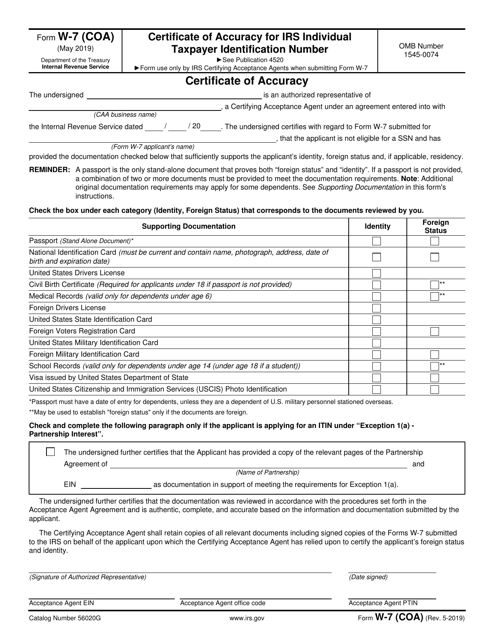

IRS W-7 Forms are used for applying for an Individual Taxpayer Identification Number (ITIN). ITINs are issued by the Internal Revenue Service (IRS) to individuals who are required to have a taxpayer identification number for tax purposes, but are not eligible for a Social Security Number (SSN). The W-7 forms are used to apply for an ITIN and establish a taxpayer's identity and foreign status.

Related Articles

Documents:

4

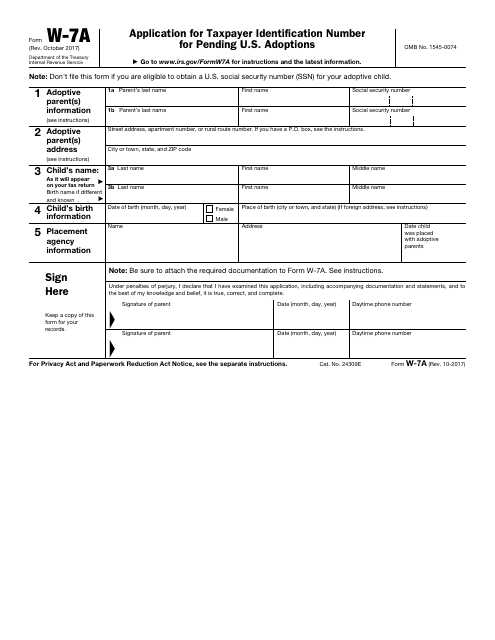

This form is used for applying for a taxpayer identification number for pending U.S. adoptions. It is required to establish the adoptive parent's identity for tax purposes.