IRS 8582 Forms and Templates

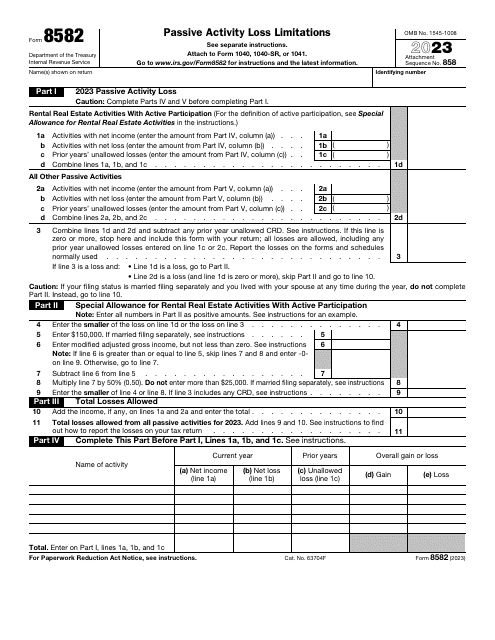

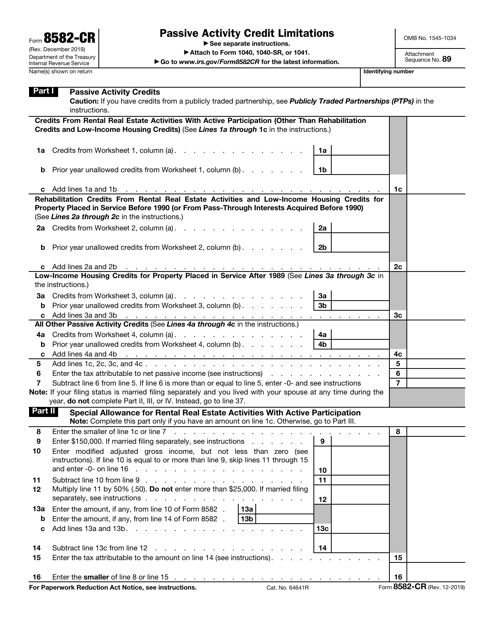

IRS Form 8582 is used to report passive activity income and losses for individuals and certain trusts and estates. The form is used to calculate the limitations on the amount of passive activity loss that can be deducted against other income. It is also used to report any passive activity credits that may be available to offset tax liability. The form helps taxpayers determine how much of their passive activity losses and credits they can currently use on their tax return.

Related Articles

Documents:

2

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.