IRS W-3 Forms and Instructions for 2023

What Are W-3 Forms?

IRS W-3 Forms are a series of forms that are used for transmitting Copy A of any forms from the IRS W-2 series when paper copies of these are filed with the Social Security Administration (SSA). These forms are used for filing and reporting taxes. They are only filed along with Copy A of W‑2 Forms and never alone.

The series is issued by the Internal Revenue Service (IRS) and contains the following forms:

- IRS Form W-3, Transmittal of Wage and Tax Statements (and it's Spanish version), is a form that employers complete and file when they need to file a paper Form W-2, Wage and Tax Statement, with the SSA.

- IRS Form W-3SS, Transmittal of Wage and Tax Statements, is a form that must be filed with the SSA by any payer or employer who needs to transmit a paper Copy A of W-Form 2AS, Form W-2GU, and Form W-2VI to the SSA.

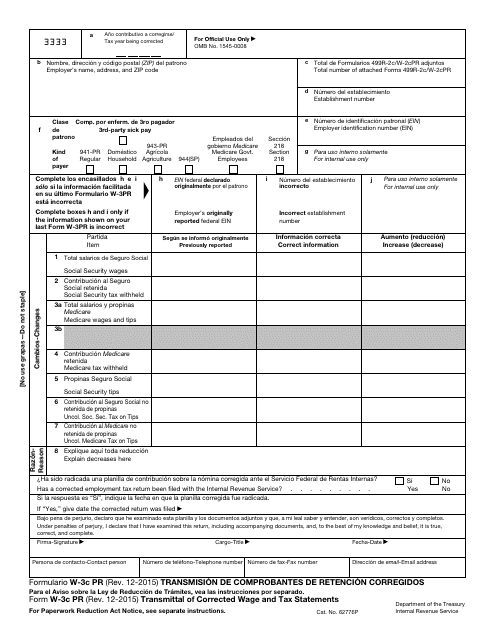

- IRS Form W-3C, Transmittal of Corrected Wage and Tax Statements (and it's Spanish version), is used for transmitting Copy A of Form W-2C, Corrected Wage and Tax Statements, to the SSA.

When Are W-3 Forms Due?

The due date for filing Form W-3SS with the SSA is January 31, whether you file using paper forms or electronically. The due date for filing Form W-3 is January 31. The W‑3C must be filed as soon as possible after you discover an error.

Related Articles

Documents:

11

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

This document is used for transmitting corrected withholding statements in Puerto Rican Spanish.

This is a supplementary document used by taxpayers to file IRS Form W-2C, Corrected Wage and Tax Statement. This form works as a summary of changes you have made to IRS Form W2, Wage and Tax Statement.

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.