IRS 945 Forms and Instructions

What Is IRS Form 945 Series?

The IRS 945 Form series is a set of three forms issued by the Internal Revenue Service (IRS) . The forms are used by employers to report taxes withheld from certain payments and tax liability for semiweekly and monthly depositors.

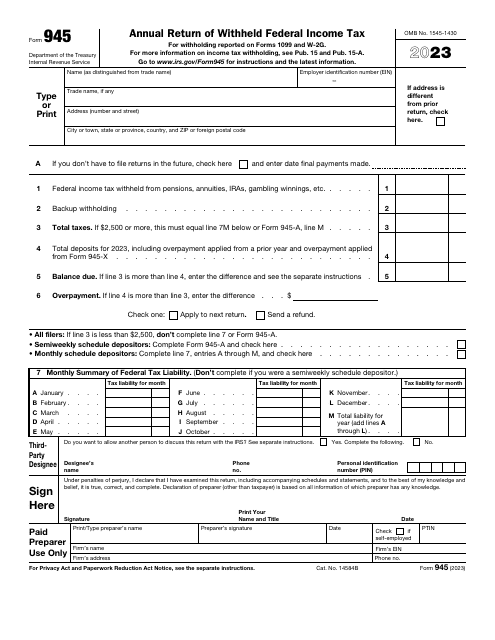

- IRS Form 945, Annual Return of Withheld Federal Income Tax, is a form used to report taxes the employer withheld from non-payroll pensions, which include the following: pensions, gambling winnings, Indian gaming profits, backup withholding, military retirement, and voluntary withholding on certain government payments.

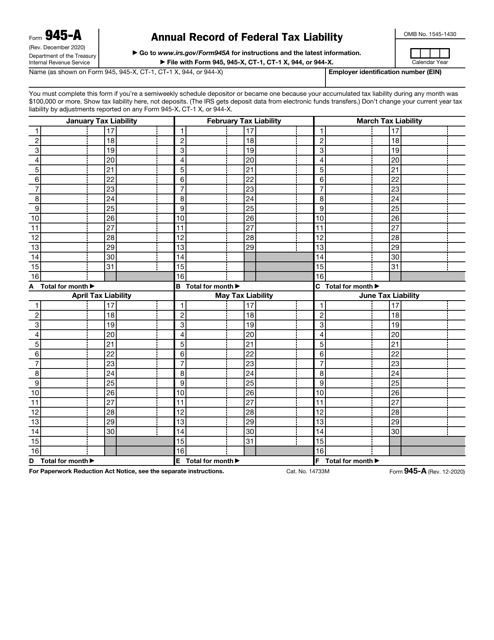

- IRS Form 945-A, Annual Record of Federal Tax Liability, is used by employers making deposits under a semiweekly schedule or monthly schedule if they have accumulated tax liability more than $100,000. This form stands out of the series because it is an accompanying form, that is filed with the IRS Form 945, IRS Form 944, IRS Form 944-X, IRS Form CT-1, or IRS Form CT-1 X. This form contains tax liability for each day the wages were paid or payroll payments were made.

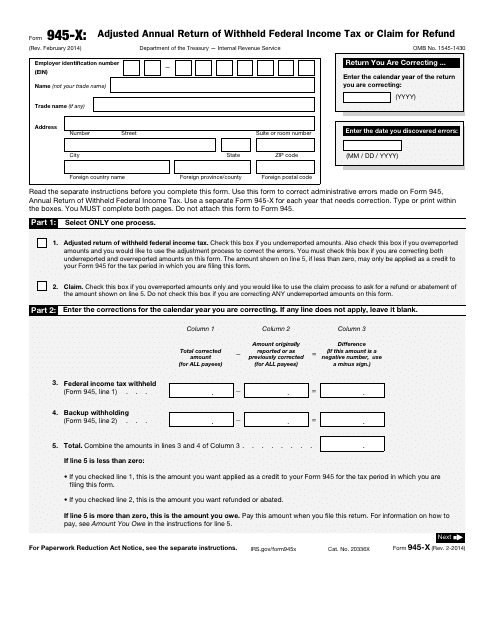

- IRS Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund, is used to correct mistakes on the IRS Form 945. Only administrative mistakes can be corrected using these forms. Mistakes that occur when the employer reports more or fewer taxes, than the actually withheld amount, are considered administrative. In addition to corrections, the IRS requires a detailed explanation of how the mistake was discovered and how the corrections were determined. A separate form is required for each return for which the corrections were made. This form should not be used to request abatement of assessed interest.

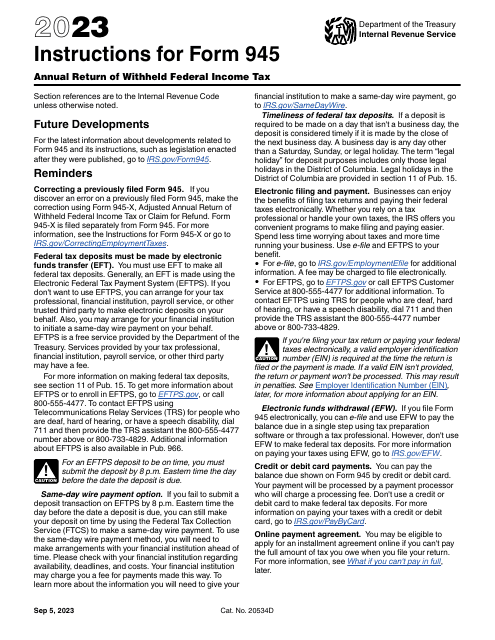

The IRS also issues official instructions for Form 945 and Form 945-X. The instructions for Form 945-A are included in the form.

When Are Forms 945 Due?

- IRS Form 945 must be filed not later than 31st January of the next year, but if deposits are paid on time, the due date is February 11th;

- The IRS Form 945-A is due on the same day as the form it is filed with;

- IRS Form 945-X can be filed within 3 years since the form with over-reported taxes was filed or 2 years since these taxes were paid. If the form is used to correct underreported taxes, the form must be filed within 3 years after filing the corrected form. If the due date falls on Saturday, Sunday, or a legal holiday, the due date is the next business day. However, it is highly recommended to file the correction form as soon as possible, after the mistake was discovered.

If any of the forms are filed late, the IRS imposes a penalty up to 25% of the amount of unpaid tax, 5% for each month the form is late. If the employer receives the notice from the IRS about the imposed penalty, they should reply with a detailed explanation, why the form was filed late and if the IRS considers it reasonable, the penalty can be avoided. Also, if the IRS receives the form late, but the envelope with the form is postmarked by the U.S. Postal Service on or before the due date and deposits are made on time, the form will be treated as filed on time.

Form 945 can be filed electronically, while the Form 945-A and 945-X should be mailed to the IRS. The mailing address for Form 945-X depends on the location the original corrected form is filed at. The mailing address for Form 945-A depends on the form it is filed with.

Related Articles

Documents:

6

This is a fiscal form used by taxpayers to modify the information they submitted via IRS Form 945, Annual Return of Withheld Federal Income Tax.

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.