IRS 944 Forms and Instructions

What Is IRS Form 944 Series?

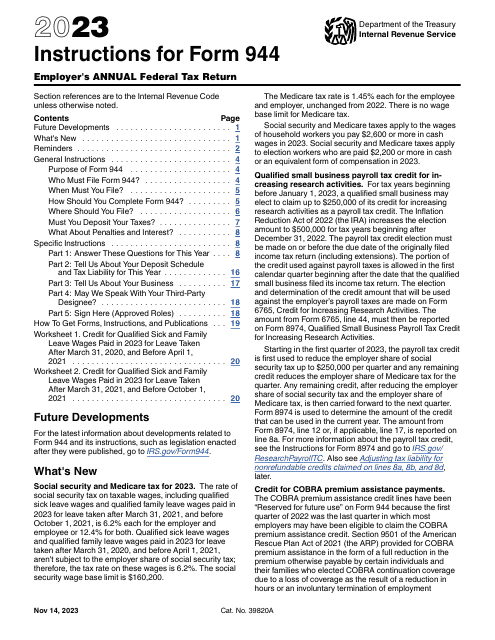

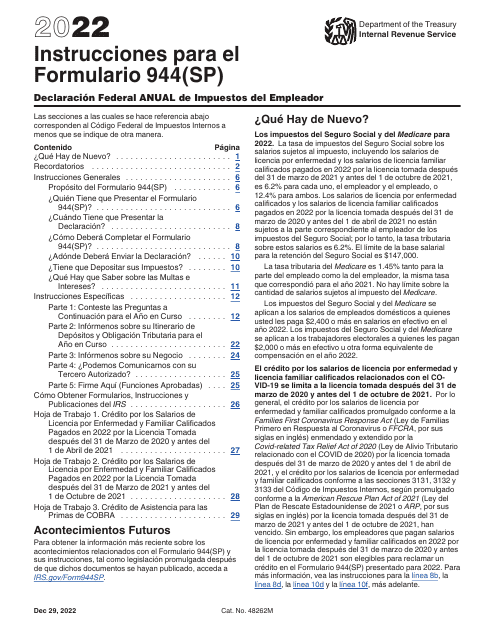

IRS Forms 944 are two tax forms distributed by the Internal Revenue Service (IRS) and used by the smallest employers to report income, Medicare, and social security taxes withheld from their employees' paychecks and pay their share of taxes. The Smallest Employer by the IRS definition is any employer that accumulated a yearly tax liability of no more than $1,000.

The series includes the following two forms:

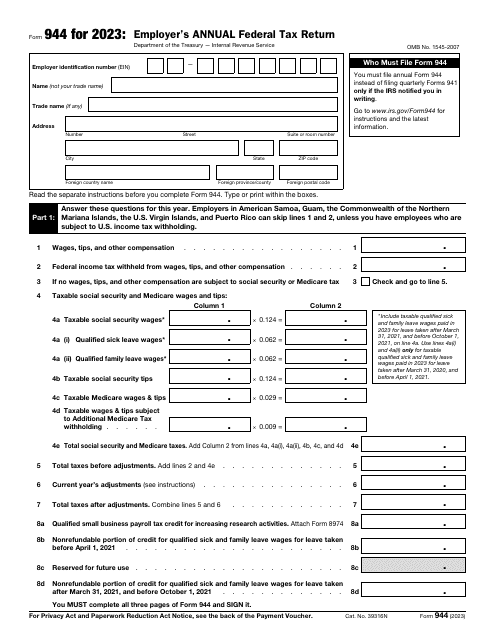

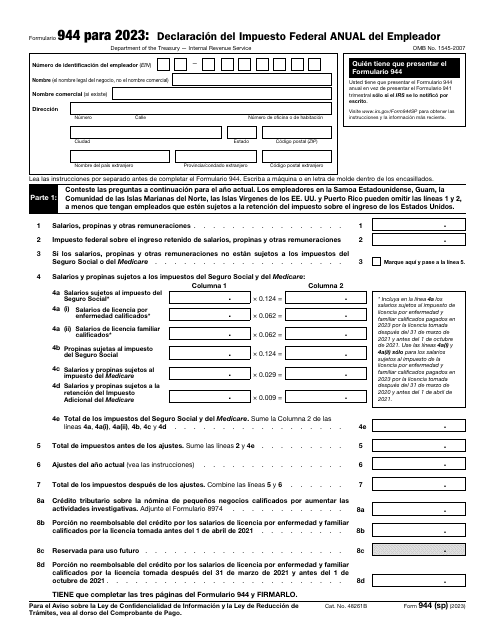

- IRS Form 944, Employer's Annual Federal Tax Return, filed on an annual basis to report tax liability and pay taxes;

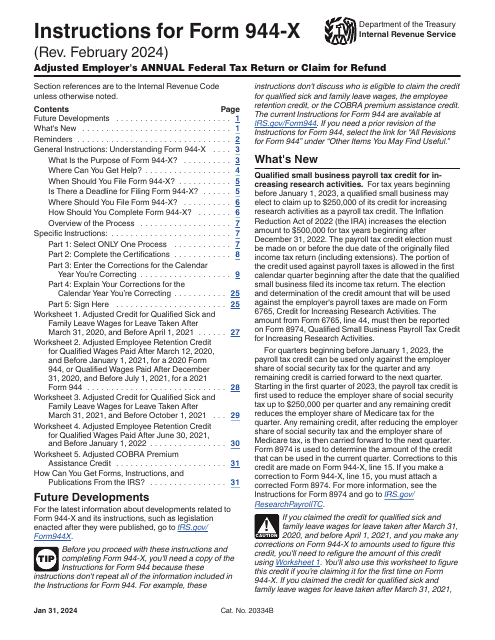

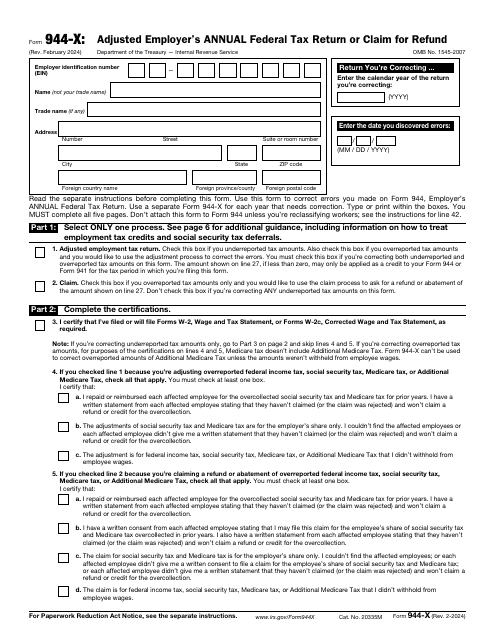

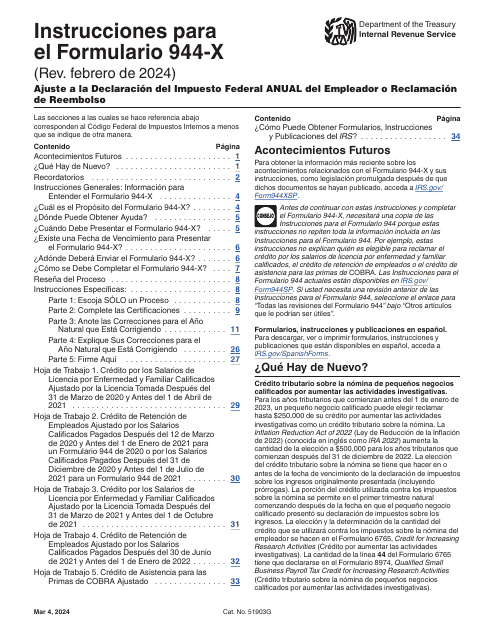

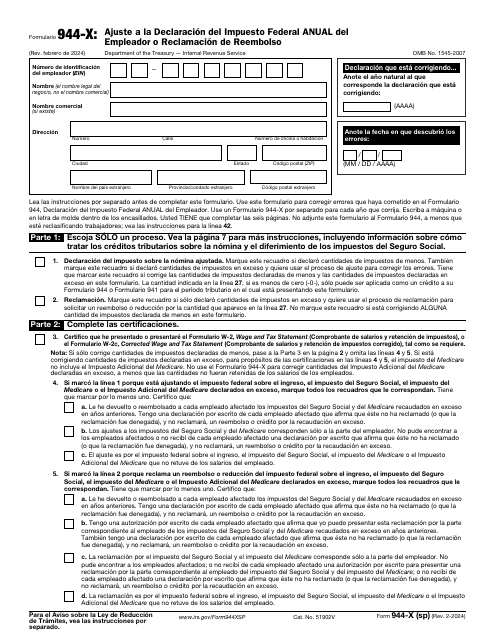

- IRS Form 944-X, Adjusted Employer's Annual Federal Tax Return or Claim for Refund, used to correct administrative mistakes on the previously filed IRS form 944. Administrative mistakes occur when the amount of taxes reported by the employer is different from the amount they actually withheld or paid. This form should contain corrections and an explanation of how the corrections were determined and how the mistake was discovered.

The Federal Employment Tax Returns are similar to the IRS 941 Forms. These are used for the same purpose but are filed four times a year at the end of each quarter and used by employers that accumulated a tax liability of more than $1,000. The IRS annually notifies the employers regarding the form they should file this year.

When Are 944 Forms Due?

- IRS Form 944 must be filed not later than January 31st of the next year. But if the employer has made deposits of taxes due for the year on time and in full payment, the due date for filing the form is February 11th.

- IRS Form 944-X should be filed as soon as possible after the mistake was discovered. If the corrections are made for over-reported taxes, the correction form can be filed within 3 years after the corrected IRS Form 944 was filed or within 2 years from the date the reported taxes were paid, whichever is later. Corrections for underreported taxes should be made within 3 years from the date the corrected form was filed. A separate Form 944-X should be used for each return that needs corrections.

The IRS imposes a penalty if Form 944 is filed late. The penalty is 5% of the amount of the unpaid tax for each month the form is late. The maximum amount of the penalty if 25%. However, if the employer receives the penalty notice from the IRS and replies with an explanation, why the form is filed late and the IRS considers the ground reasonable, the penalty can be avoided.

The IRS will consider the form as filed on time if the envelope with the form is postmarked by the U.S. Postal service or sent by an IRS-designated private delivery service (PDS) on or before the due date. The mailing address for both forms depends on the location the business is at and the type of the organization.

Related Articles

Documents:

9

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

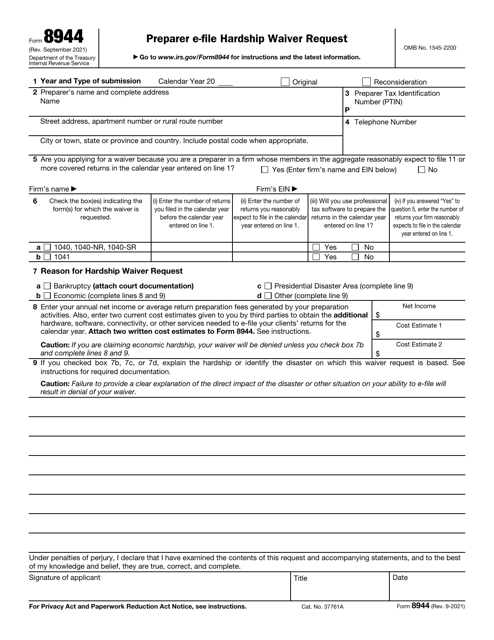

This is a formal statement completed by specified tax return preparers that cannot e-file income tax returns because of economic hardship, bankruptcy, or presidentially declared disaster.