IRS 8027 Forms and Instructions

What Is IRS 8027 Form Series?

IRS 8027 Forms are a set of documents used to report the tip income and allocated tips to the Internal Revenue Service (IRS). Both forms are given out to the employee by the employer. The series includes two forms:

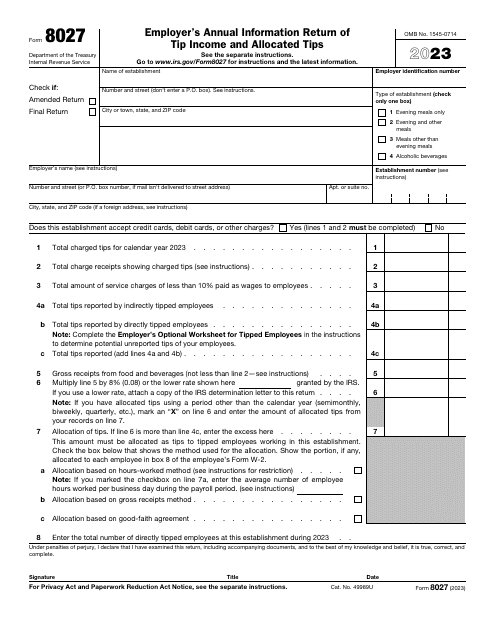

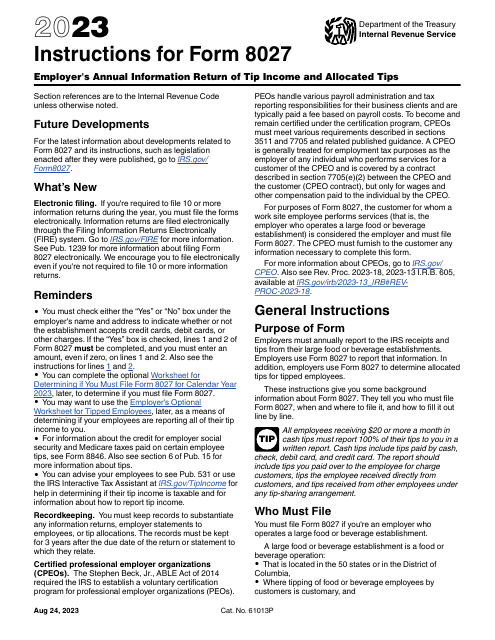

- IRS Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips, is used to annually report receipts and tips from your food and beverage establishment, and to determine allocated tips.

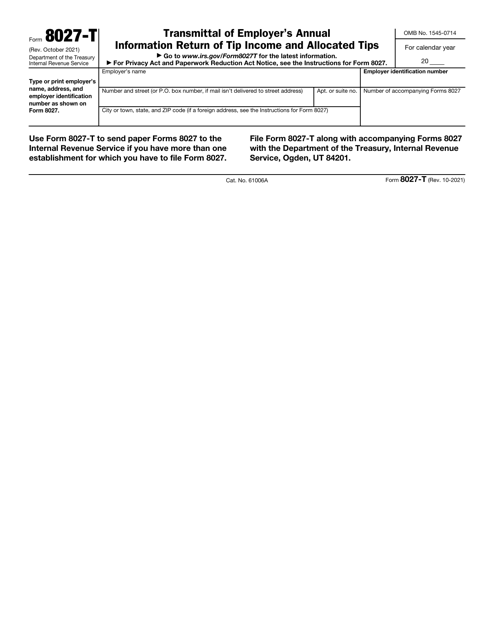

- IRS Form 8027-T, Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips, is a supplemental form sent to the IRS with Forms 8027 if you have several establishments, for which you have to file an annual information return of tip income. Do not submit Form 8027-T separately.

Do Employers Pay Taxes on Tips?

If the amounts of tips your employees received exceed $20 per calendar month, these tips are taxable. As an employer, you are responsible for withholding income and Federal Insurance Contribution Act (FICA) taxes on the employee’s tips. Besides, you must pay the employer’s part of the FICA and Federal Unemployment tax based on these tips. If the tips your employee receives exceed the $200,000 withholding threshold, you are required to withhold the 0.9% FICA Medicare surtax.

The employee is responsible for informing you about the amounts of the tips received. If the employee does not report the tips of $20 or more per calendar month, you are not liable for withholding and paying the employee their share of the social security and Medicare taxes. What’s more, you cannot be considered liable for the employer part of social security and Medicare taxes, unless you receive a notice from the IRS with a demand for taxes.

How Do Employers Report Tips to the IRS?

Your employee must keep daily tip records and inform you in a written and signed statement about the tips when their amount exceeds $20 per month. You must keep these statements in the employee’s file, and report the amount of the tips to the IRS. Include the information about the tips your employee receives on IRS Form W-2, Wage and Tax Statement, IRS Form 941, Employer's Quarterly Federal Tax Return, and IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return.

Besides, if you operate a large food or beverage establishment, you must file Form 8027 every calendar year. Submit a separate form for each establishment you operate. For example, if you provide food and beverages at more than one location, submit a separate form for each of these locations; if the food or beverages establishments are within one building (like a restaurant, cocktail lounge, and a coffee shop situated in a hotel), they are considered separate establishments and require a separate Form 8027.

You can submit your annual report on paper or electronically. If you submit more than one Form 8027, file them with Form 8027-T. The 8027-T must contain the exact number of forms you are filing. If you need to submit 250 or more 8027 Forms, you must submit them through the Filing Information Return Electronically system only. Form 8027-T is not used for electronic filing, whether you submit one annual information return or more.

Related Articles

Documents:

3

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.