California Department of Tax and Fee Administration Forms and Templates

Documents:

110

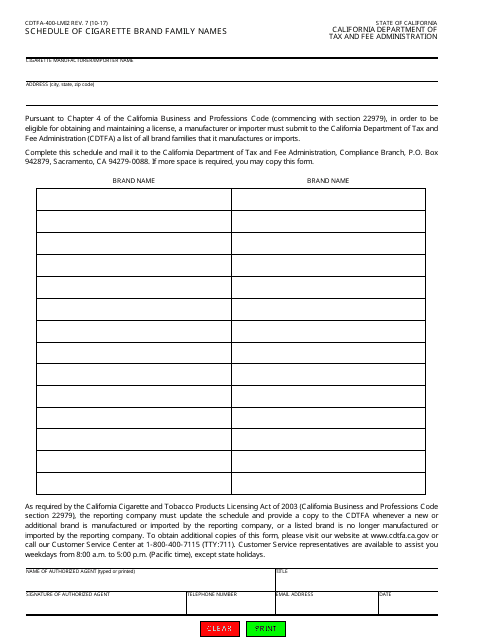

This form is used for reporting the schedule of cigarette brand family names in the state of California.

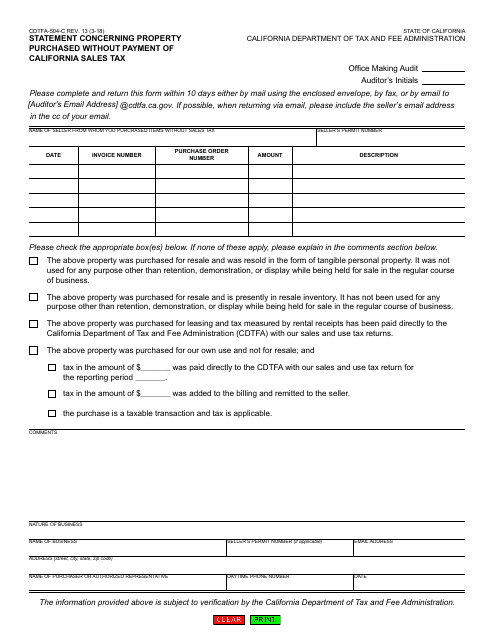

This form is used for reporting property purchased in California without paying sales tax.

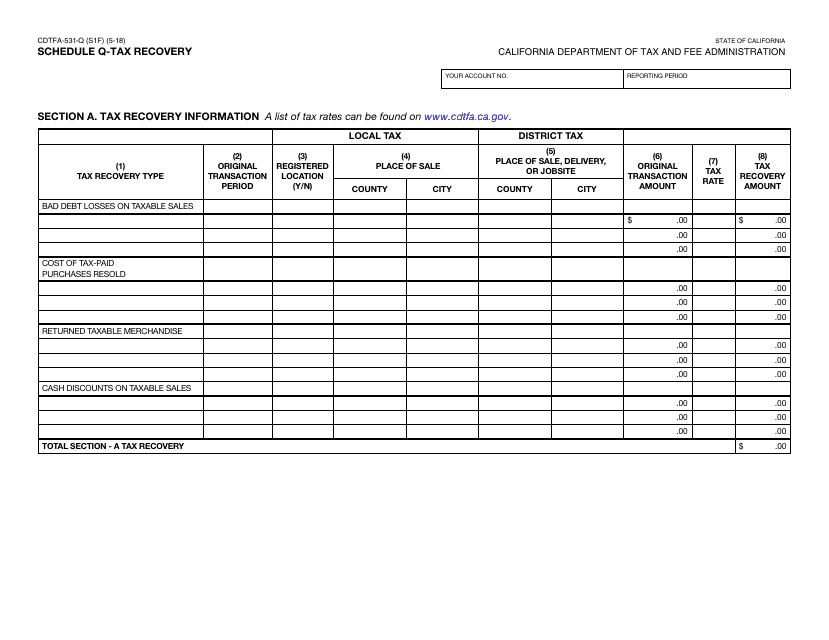

This form is used for reporting tax recovery in California.

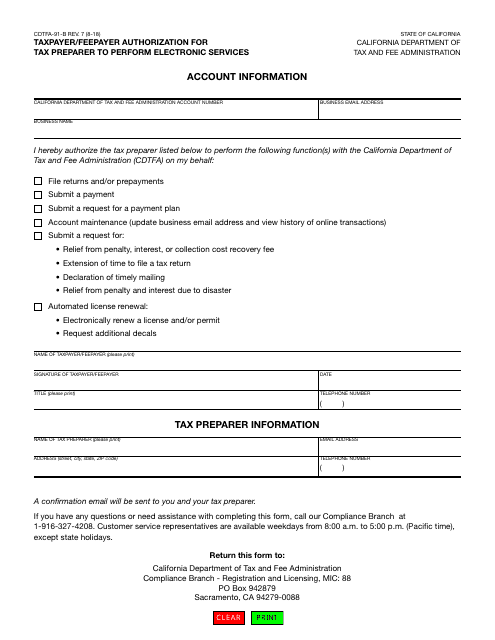

This form is used for authorizing a tax preparer to perform electronic services on behalf of a taxpayer/feepayer in California.

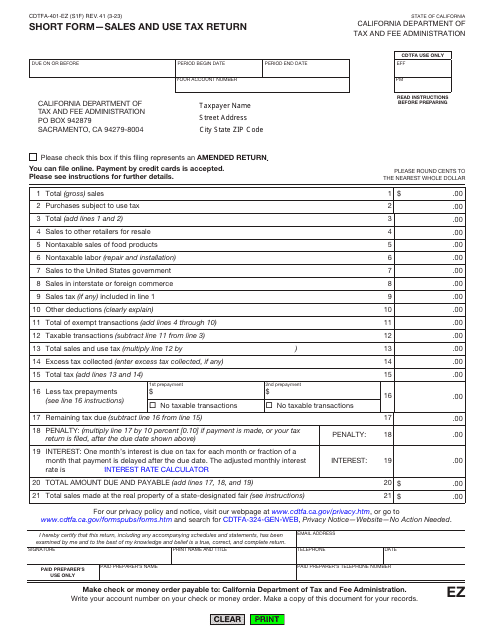

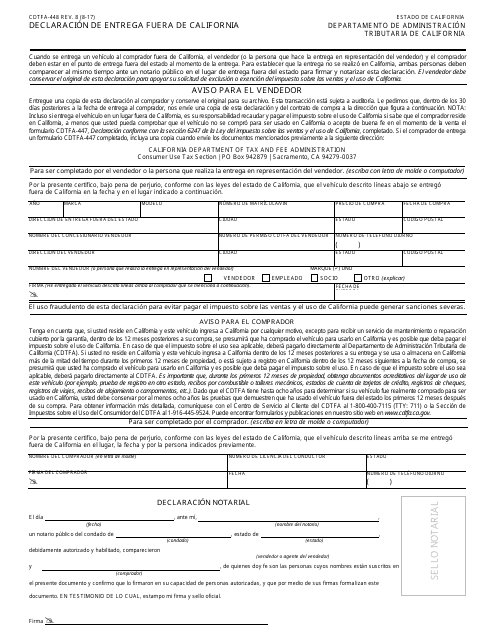

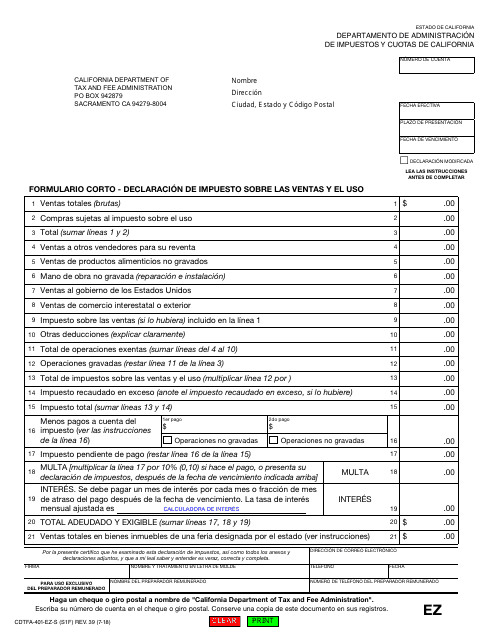

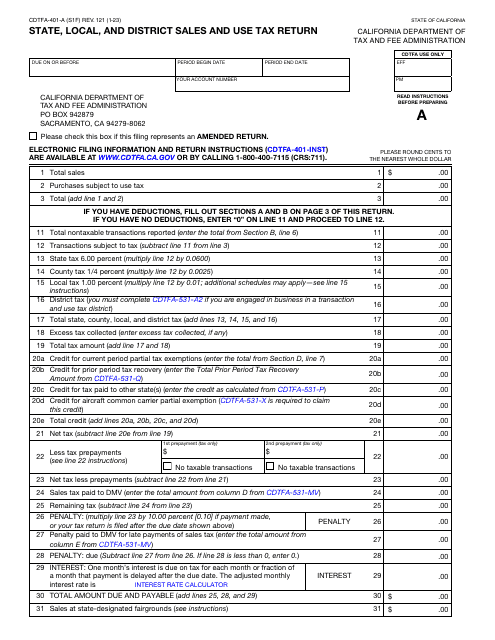

Este formulario es utilizado para realizar la Declaración de Impuesto sobre las Ventas y el Uso en California. Es un formulario corto y se utiliza para reportar y pagar los impuestos correspondientes.

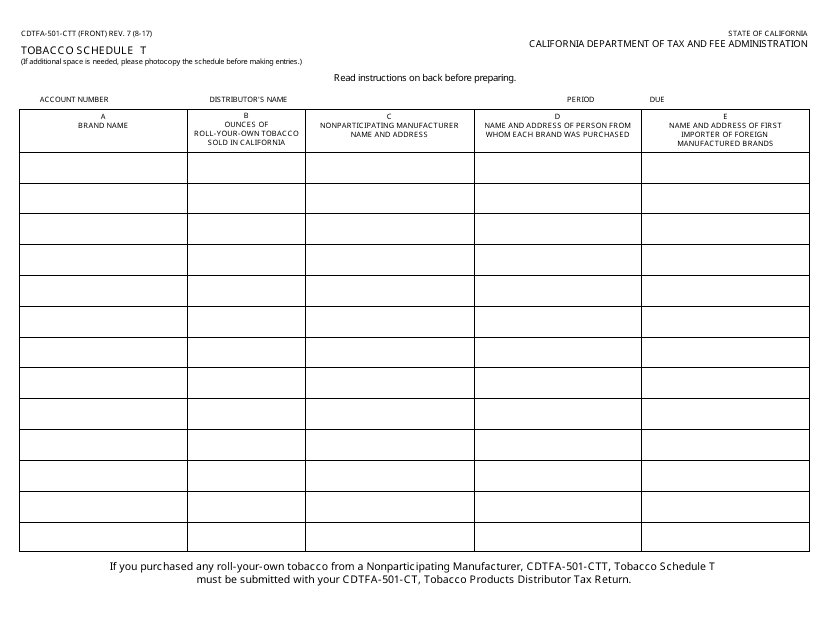

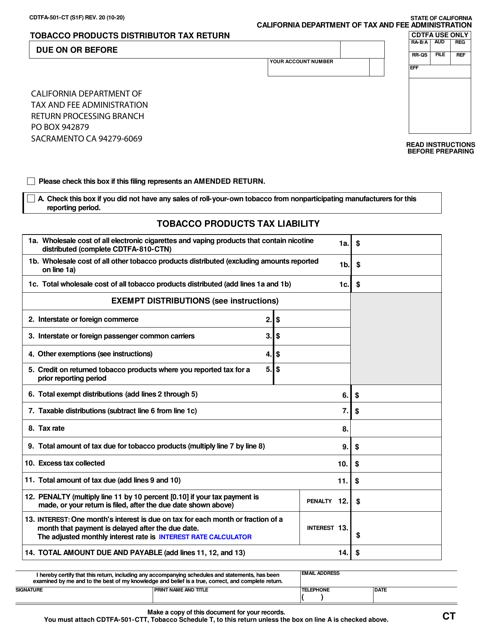

This form is used for filing the Tobacco Schedule T in California. It is required for tobacco businesses to report their sales and use tax liabilities related to tobacco products.

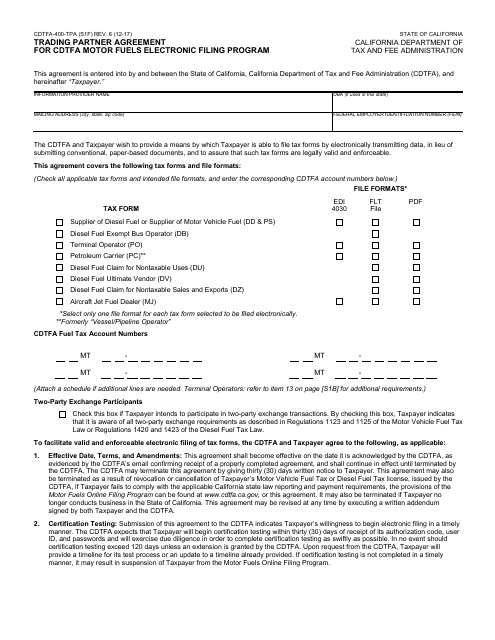

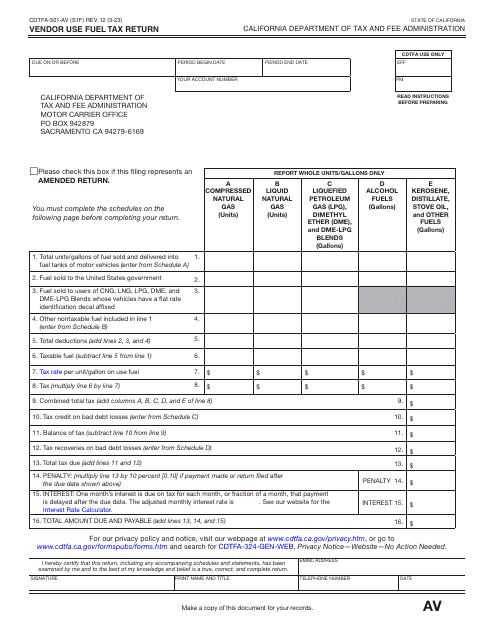

This form is used for creating a Trading Partner Agreement for the CDTFA Motor Fuels Electronic Filing Program in California.

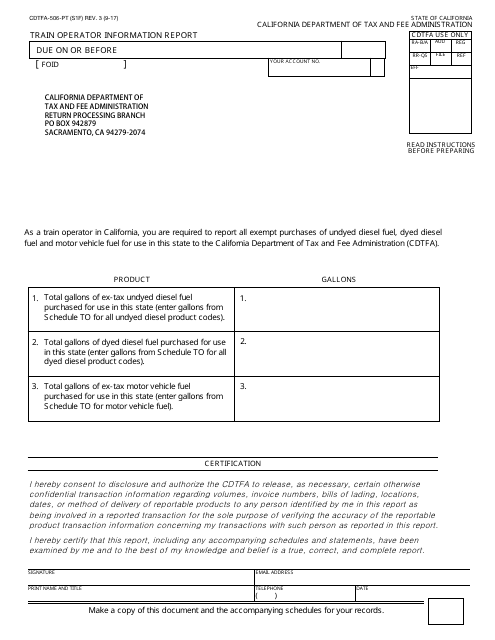

This Form is used for Train Operators in California to report their information to the California Department of Tax and Fee Administration (CDTFA).

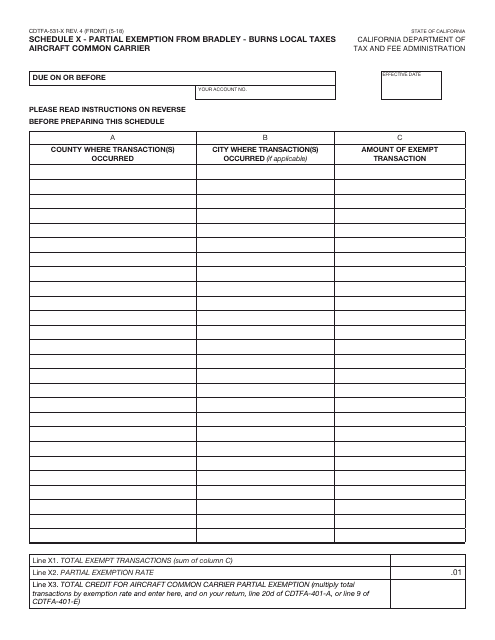

This form is used for claiming a partial exemption from Bradley-Burns local taxes for aircraft common carriers in California.

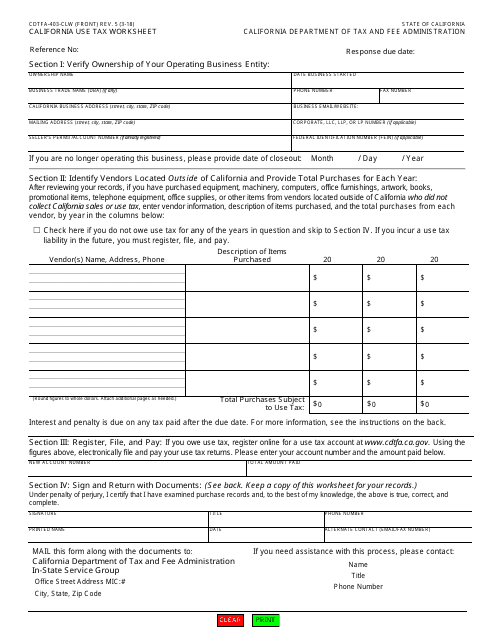

This form is used for calculating the use tax owed by California residents for out-of-state purchases. It helps determine the amount of use tax that needs to be paid to the state.

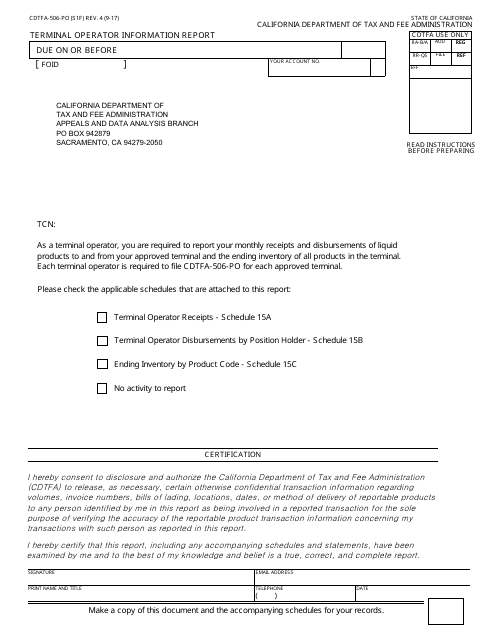

This form is used for reporting terminal operator information in California.