California Department of Tax and Fee Administration Forms and Templates

Documents:

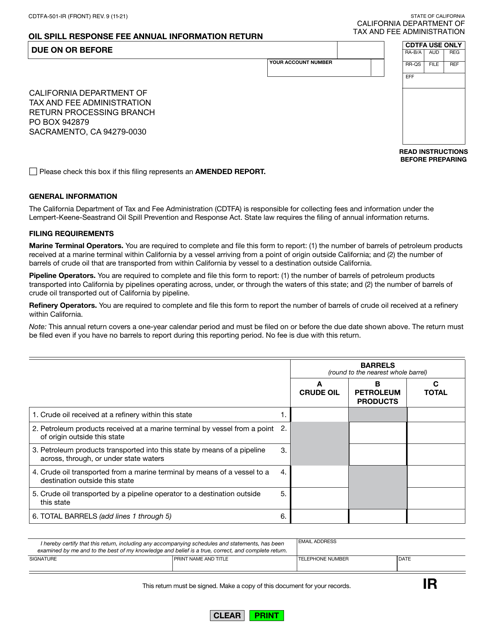

110

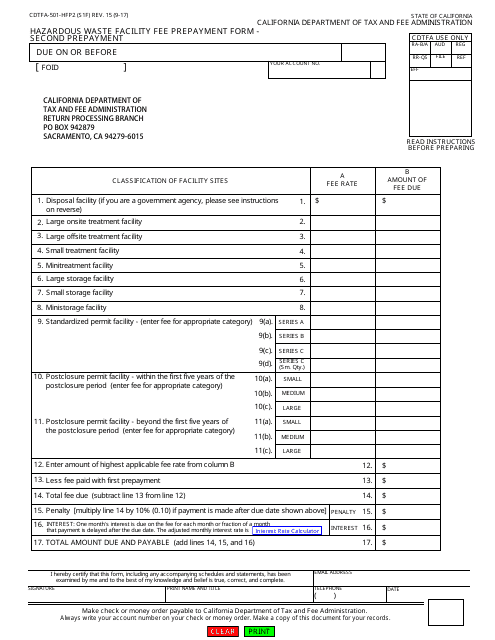

This form is used for making the second prepayment for the Hazardous Waste Facility Fee in California.

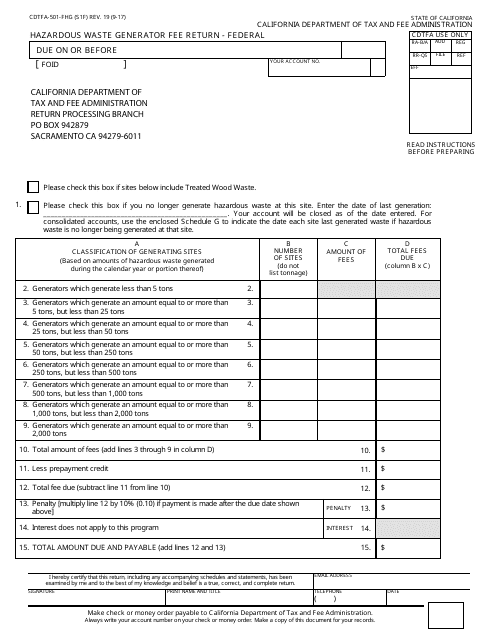

This Form is used for reporting and paying hazardous waste generator fees for federal facilities in California.

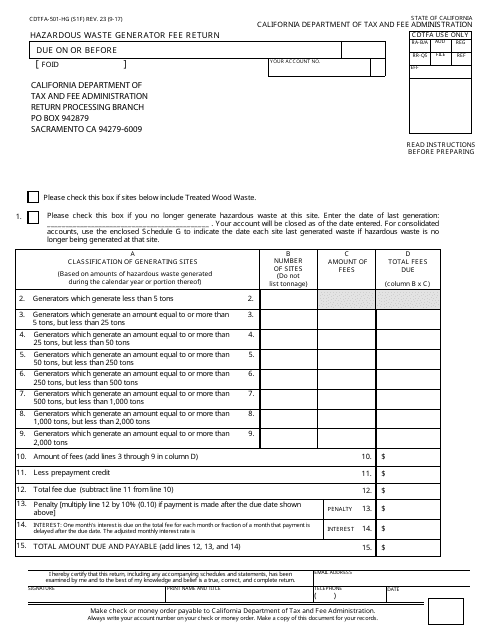

This form is used for filing the Hazardous Waste Generator Fee Return in California. It is specifically for businesses that generate hazardous waste and are required to pay a fee to the California Department of Tax and Fee Administration (CDTFA). The form helps businesses accurately report and pay the appropriate fee based on the amount of hazardous waste generated.

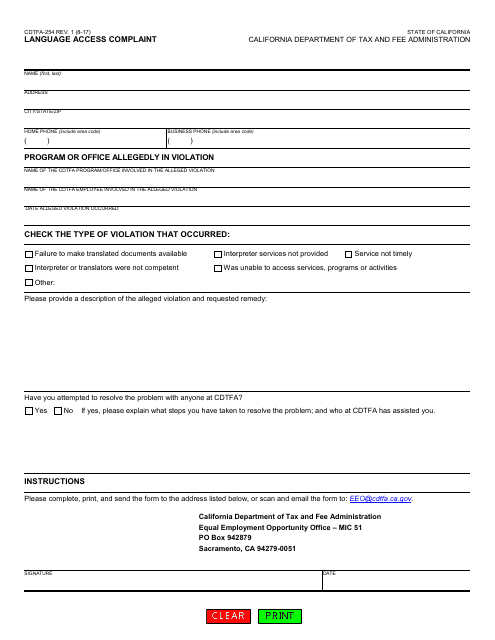

This Form is used for filing a language access complaint in California.

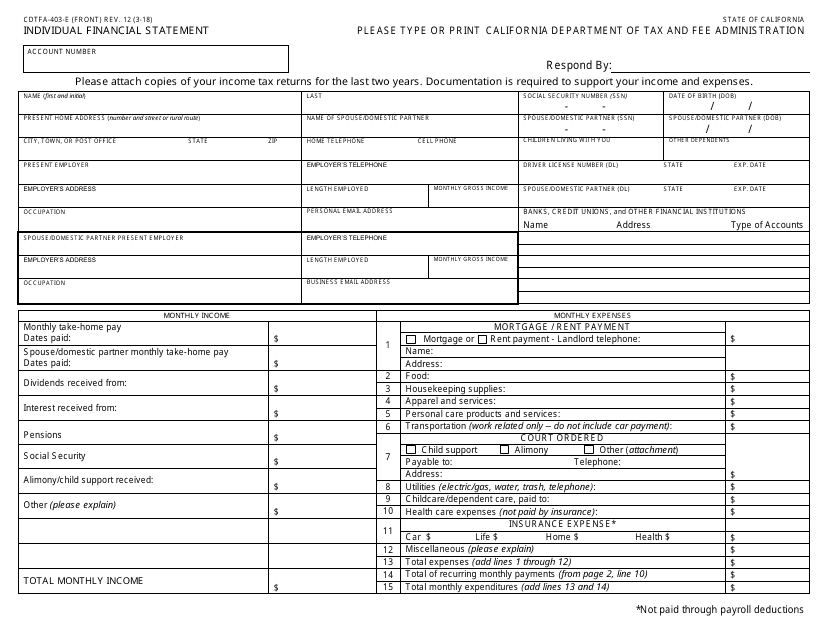

This Form is used for providing financial information by individuals in California.

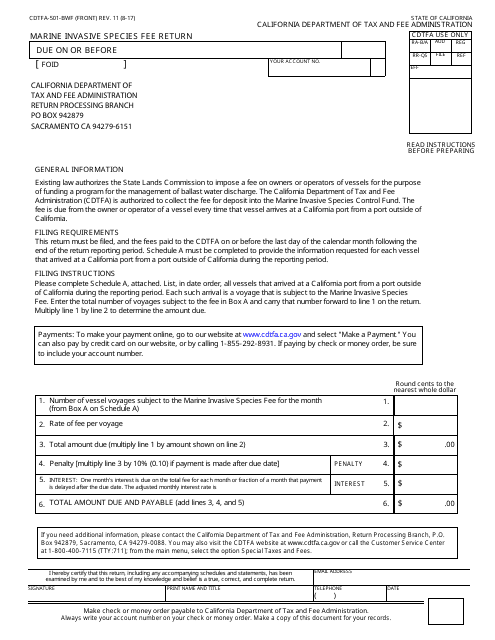

This form is used for reporting and remitting the Marine Invasive Species Fee in California. It is required for vessel owners and operators to help prevent the spread of invasive species in marine waters.

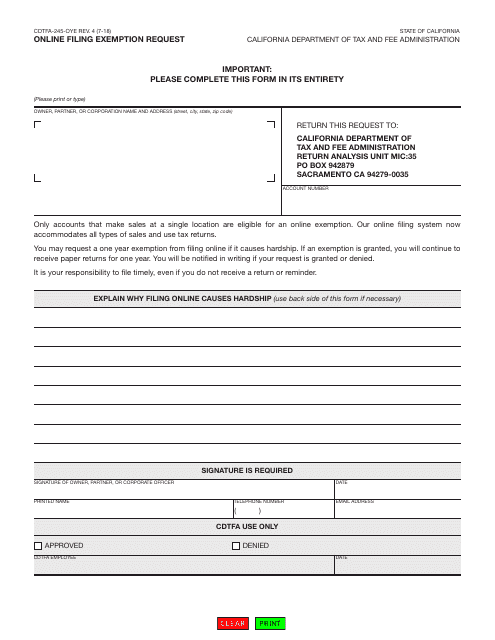

This form is used for requesting an online filing exemption in California.

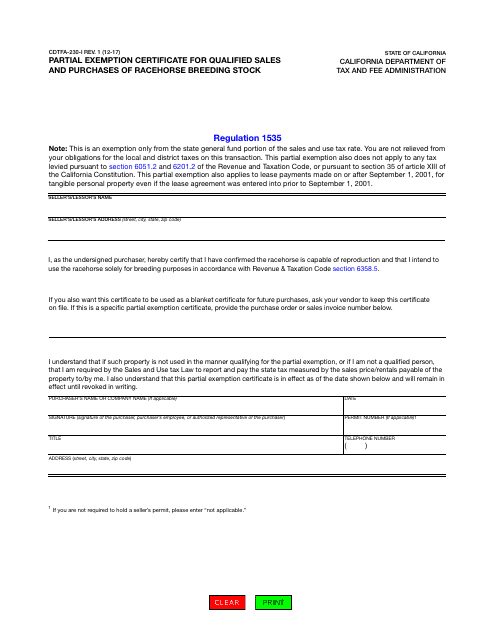

This form is used for claiming a partial exemption from sales and use tax for qualified sales and purchases of racehorse breeding stock in California.

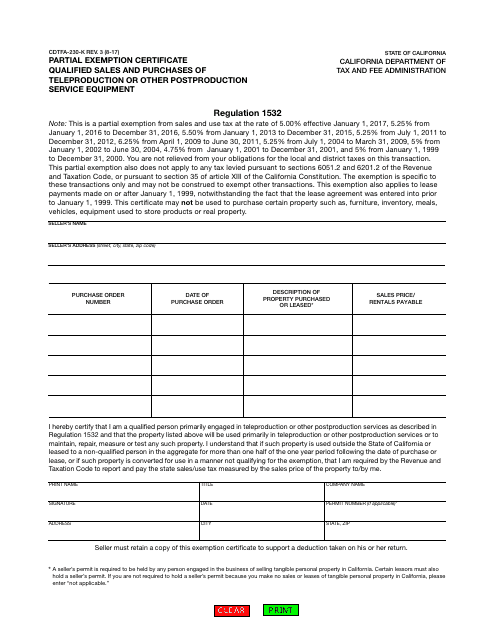

This form is used for claiming a partial exemption on sales and purchases of teleproduction or other postproduction service equipment in California.

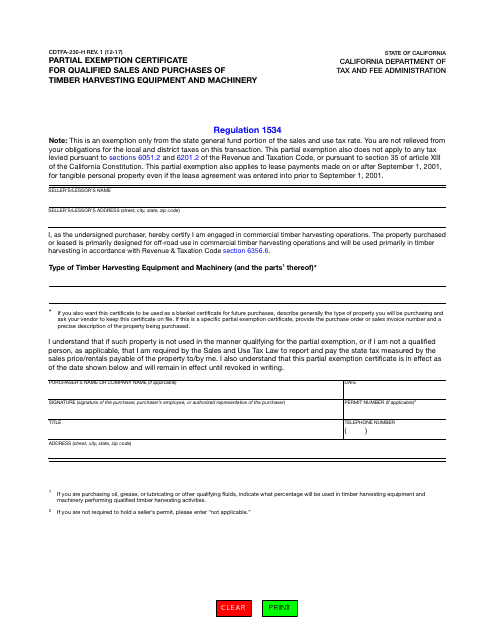

This form is used for applying for a partial exemption certificate in California for qualified sales and purchases of timber harvesting equipment and machinery.

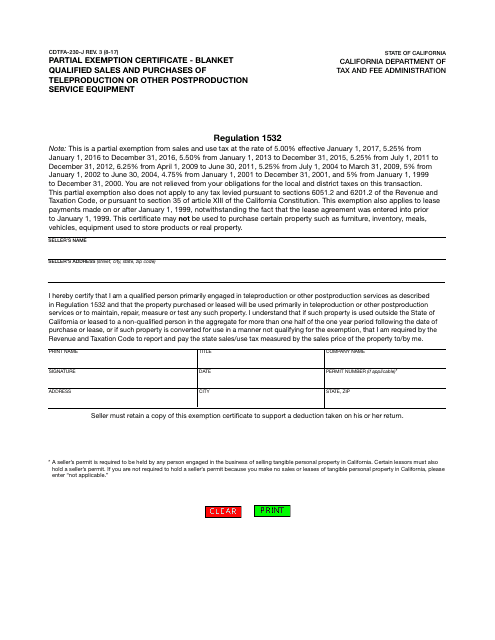

This form is used for applying for a partial exemption on sales and purchases of teleproduction or other postproduction service equipment in California.

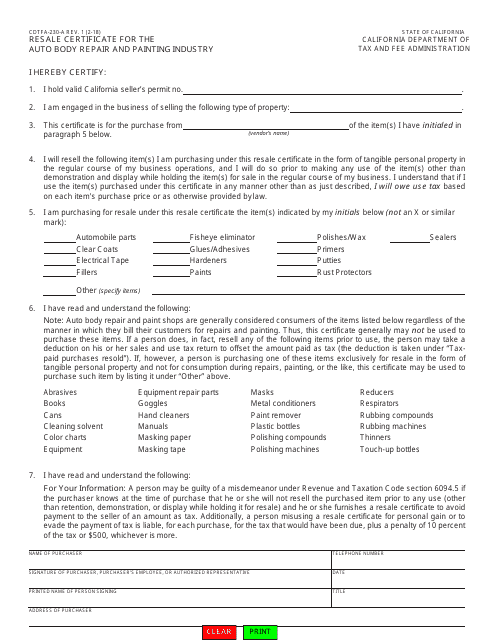

This form is used for obtaining a resale certificate specific to the auto body repair and painting industry in California. It allows businesses in this industry to purchase goods and services without paying sales tax.

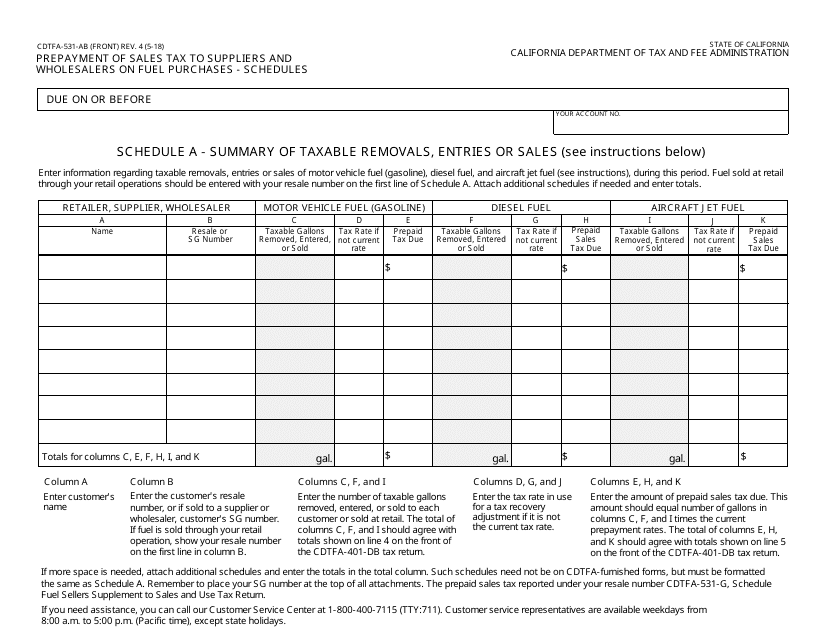

This Form is used for prepaying sales tax on fuel purchases for suppliers and wholesalers in California. It includes various schedules for reporting and submitting the prepayment.

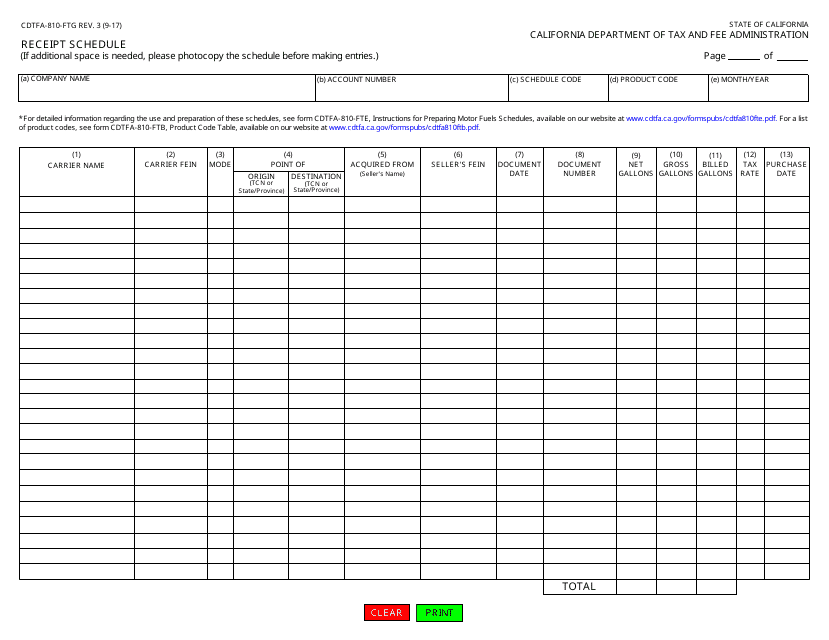

This Form is used for reporting receipt schedules in California.

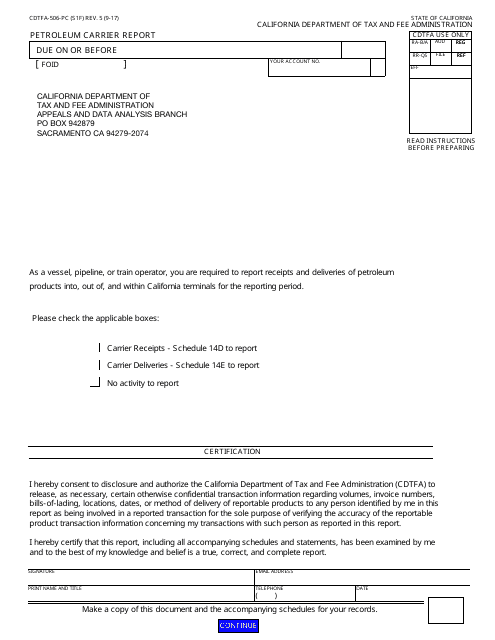

This form is used for reporting petroleum carrier activities in California.

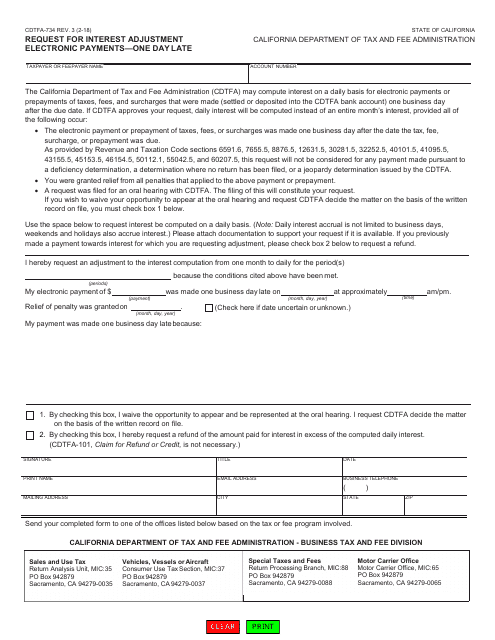

This Form is used for requesting an adjustment to interest charges for electronic payments that were one day late in California.

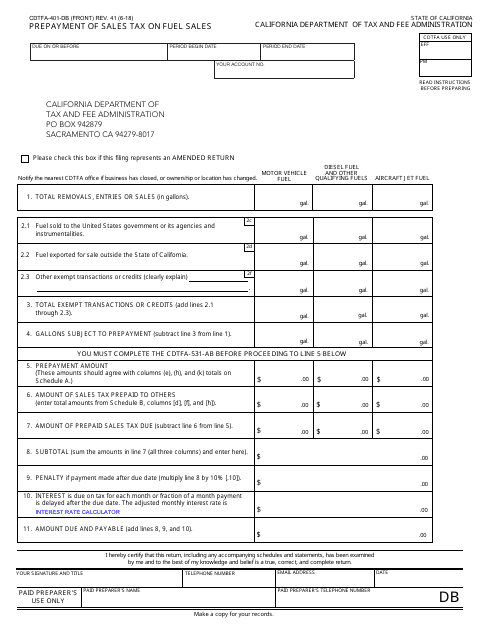

This document is for prepaying sales tax on fuel sales in California. It is used by businesses to submit their prepayment to the California Department of Tax and Fee Administration (CDTFA).

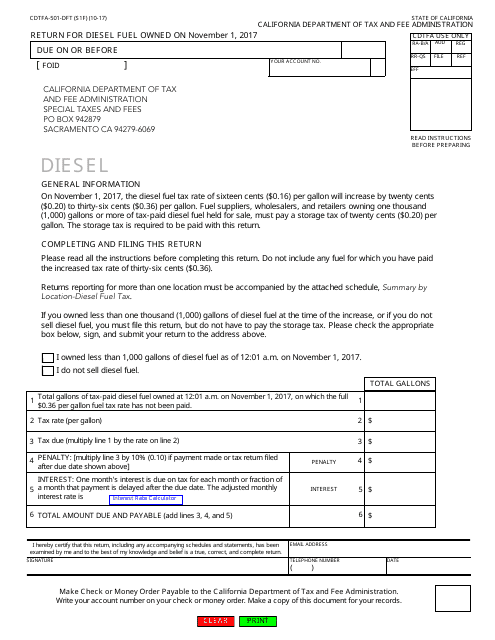

This form is used for reporting diesel fuel owned on November 1, 2017 in the state of California for tax purposes.

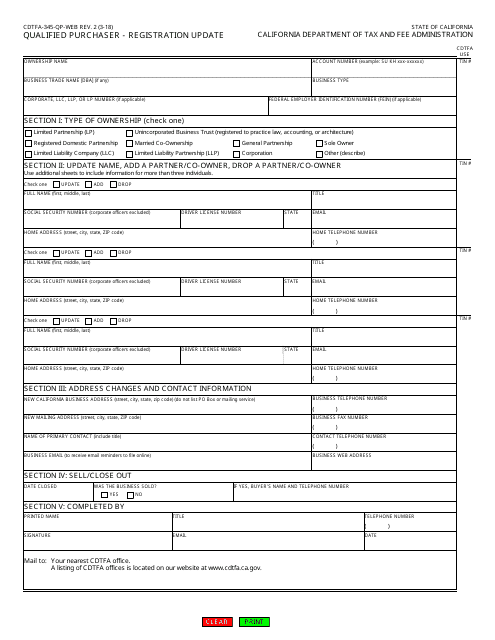

This form is used for updating registration information for qualified purchasers in California.

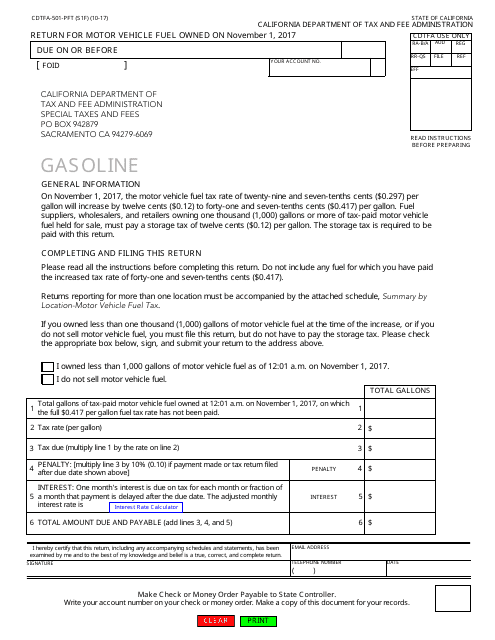

This Form is used for reporting and paying taxes on motor vehicle fuel owned in California on November 1, 2017. It is necessary for compliance with state tax laws.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

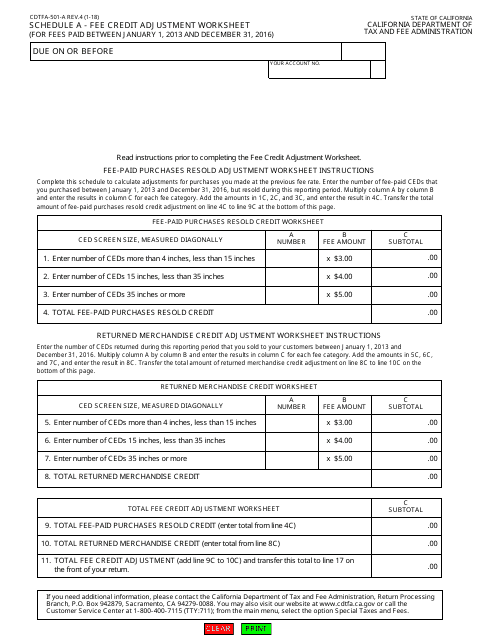

This form is used for calculating and adjusting fee credits in California.

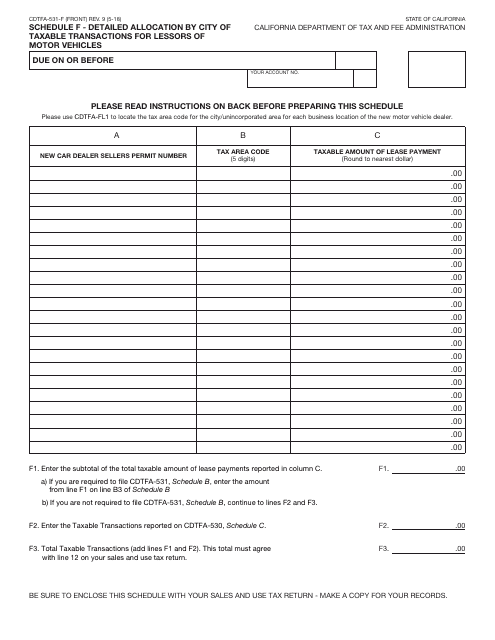

This form is used for providing a detailed breakdown by city of taxable transactions for lessors of motor vehicles in California.

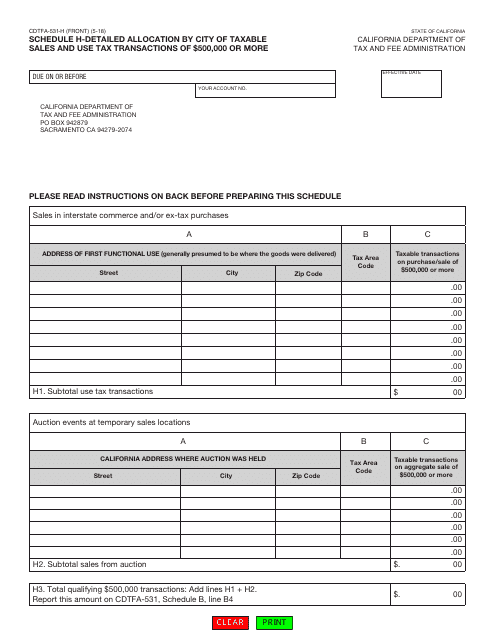

This Form is used for reporting detailed allocation by city of taxable sales and use tax transactions exceeding $500,000 in California.

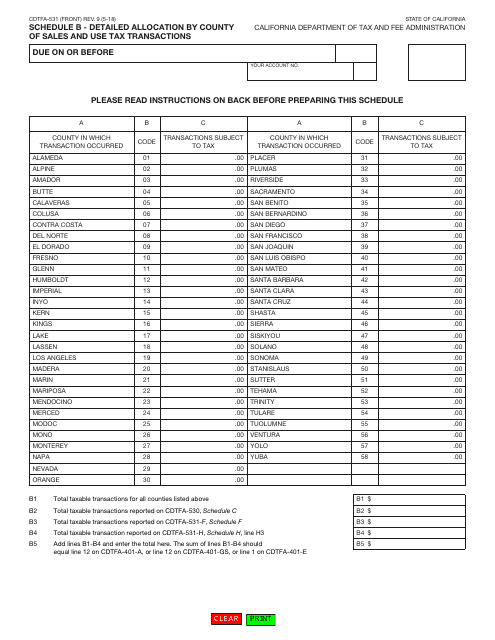

This form is used for providing a detailed breakdown of sales and use tax transactions by county in California. It helps in allocating the tax revenues to the specific counties accurately.

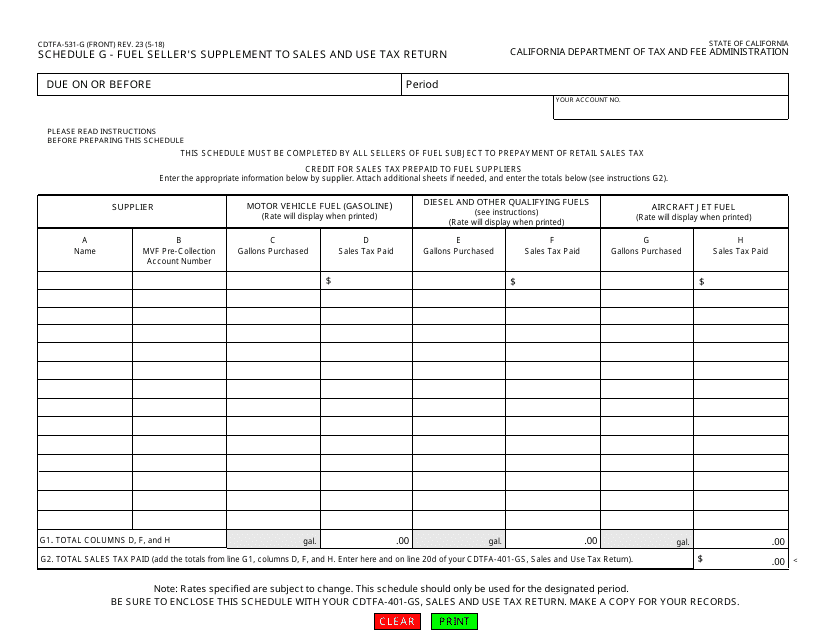

This form is used for fuel sellers in California to provide additional information for their sales and use tax return. It is a supplement form that helps sellers report their fuel sales accurately.

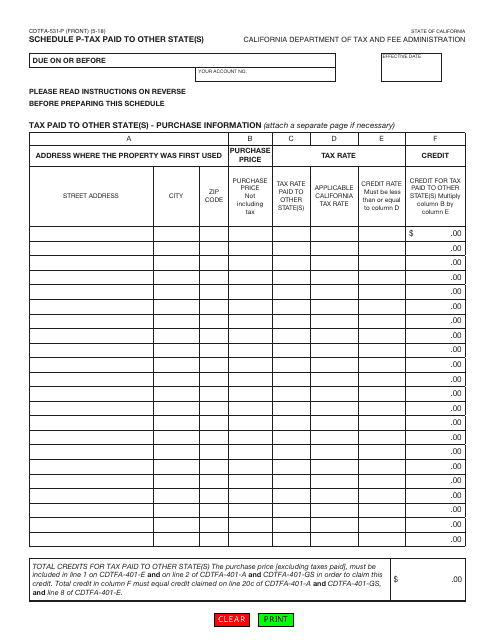

This form is used for reporting tax paid to other state(s) for California residents.