California State Board of Equalization Forms

The California State Board of Equalization (BOE) is responsible for administering various tax and fee programs in California. Their primary role is to ensure that taxpayers are paying their fair share of taxes and that the tax laws are applied consistently across the state. The BOE oversees the assessment and collection of various taxes, such as sales and use tax, property tax, and special taxes. They also handle appeals related to tax assessments and ensure compliance with state tax laws.

Documents:

244

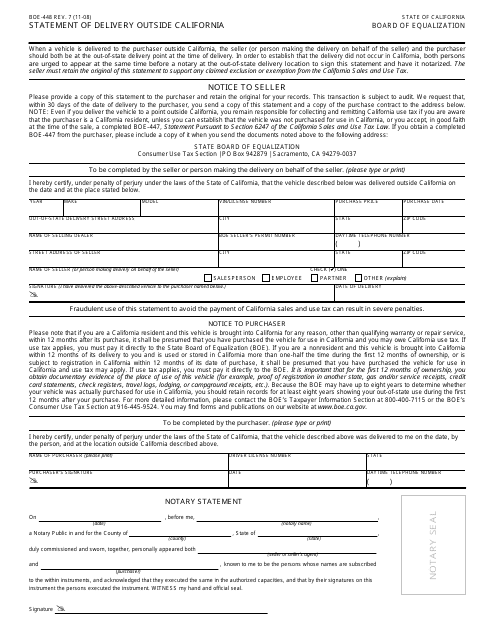

This form is used for reporting deliveries made outside of California for businesses based in California.

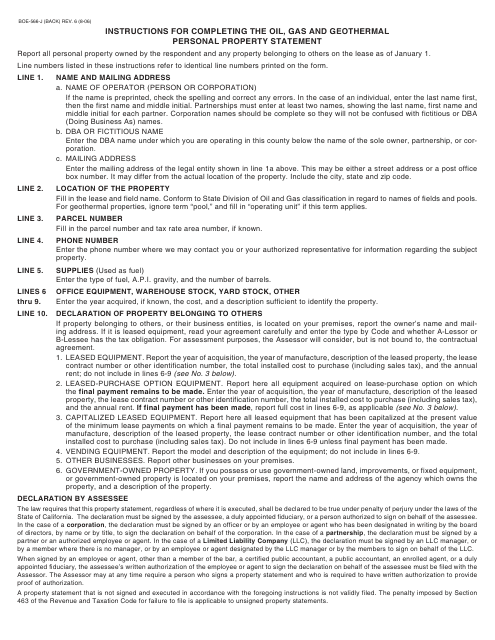

This Form is used for reporting oil, gas, and geothermal personal property in California. It provides instructions on how to fill out and submit the Form BOE-566-J.

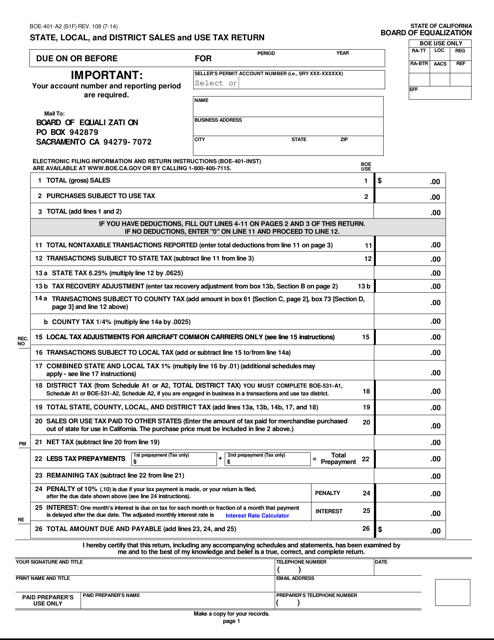

This return is a summary of the state, local, and district business activity - it describes gross sales, taxable, non-taxable and exempt sales, sales and use tax you were required to collect, and current information about your business.

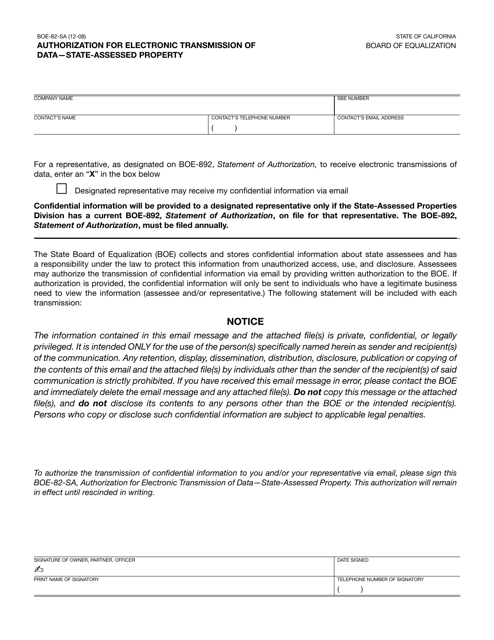

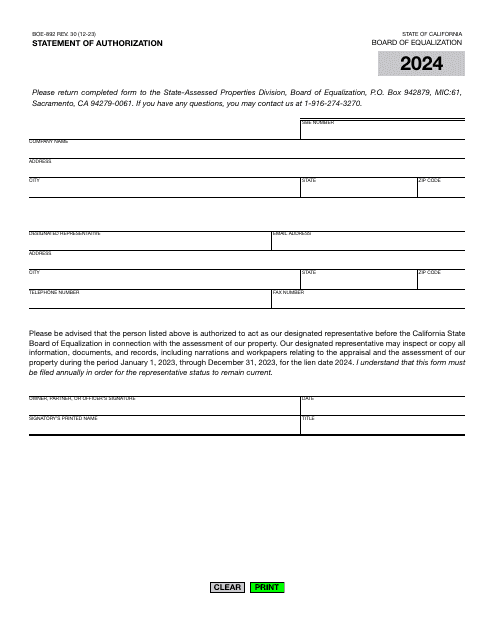

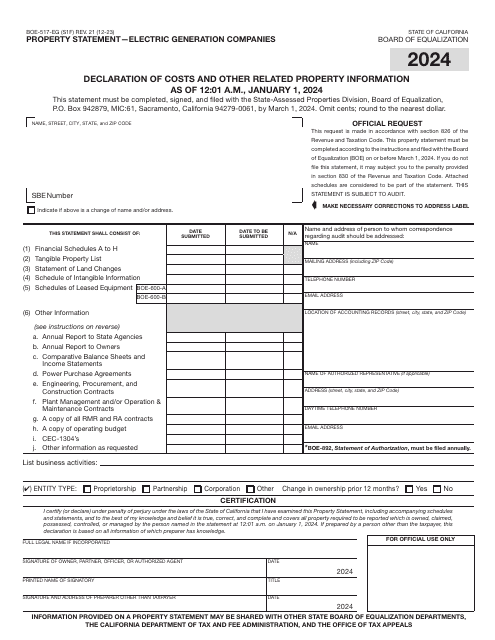

This form is used for authorizing the electronic transmission of data for state-assessed property in California.

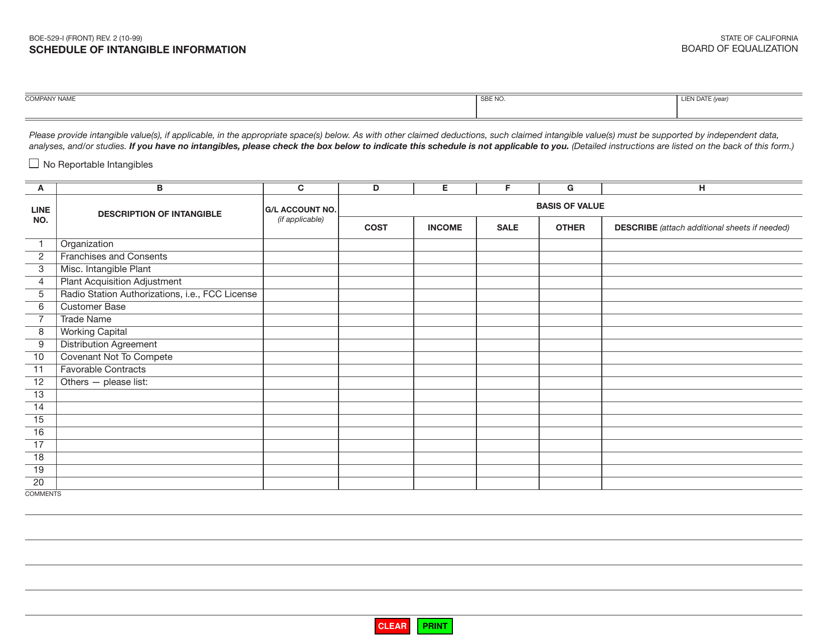

This Form is used for reporting intangible information for California tax purposes. It is part of the BOE-529-I Schedule of Intangible Information.

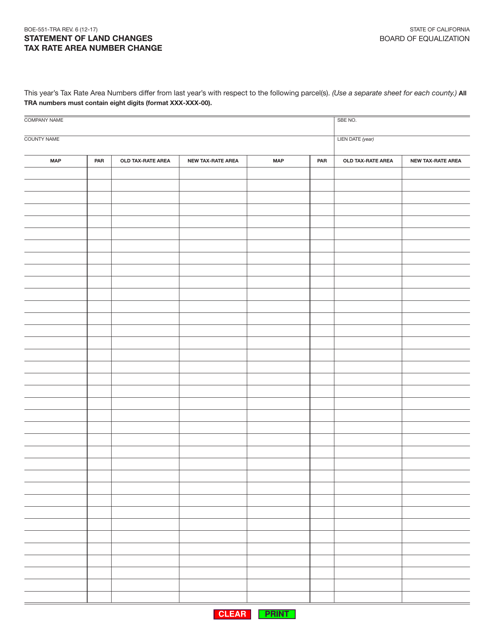

This form is used for declaring changes in the tax rate area number for property in California. It is used by individuals or organizations to update the tax rate area number associated with a specific piece of land.

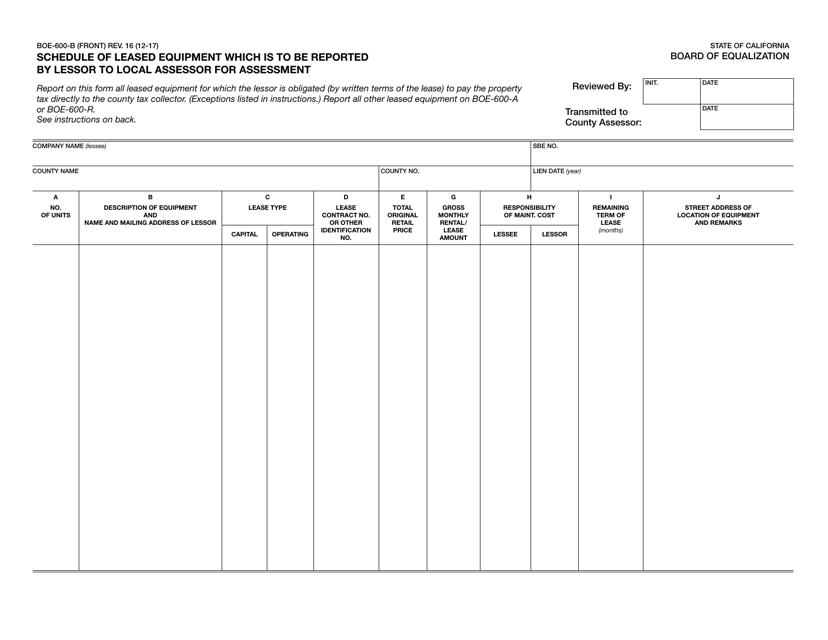

This form is used for reporting leased equipment to the local assessor for assessment purposes in California. It is specific to lessors who lease equipment to businesses or individuals. The form helps the assessor determine the value of the leased equipment for tax assessment.

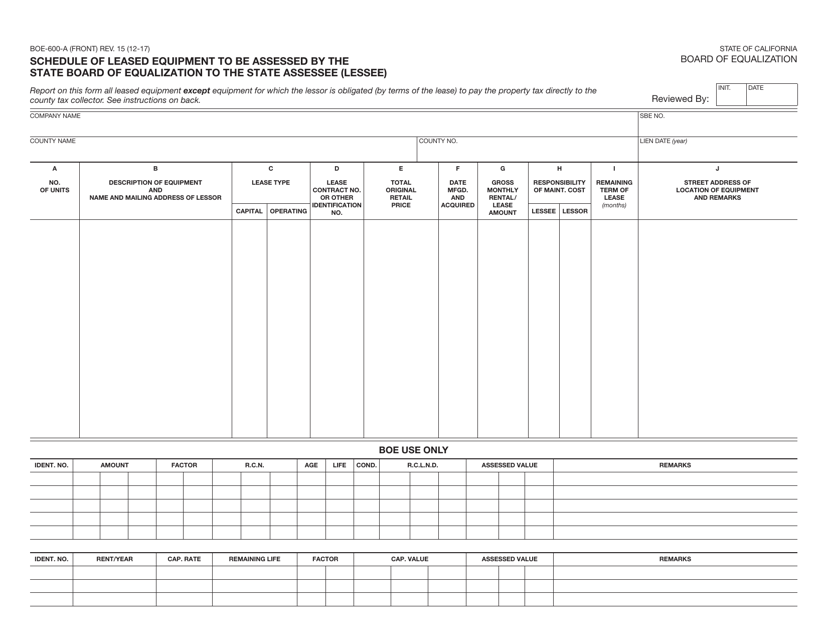

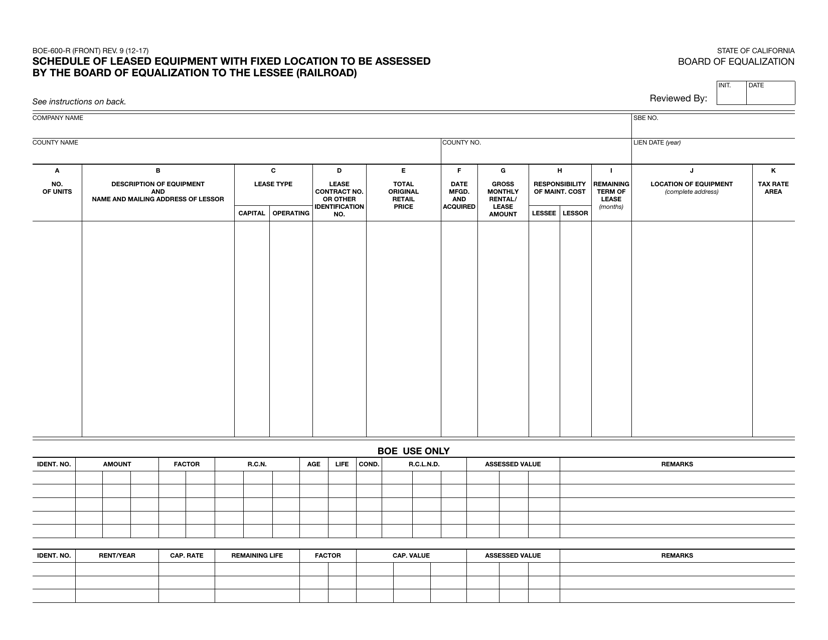

This document is used for listing all the leased equipment that will be assessed by the State Board of Equalization in California.

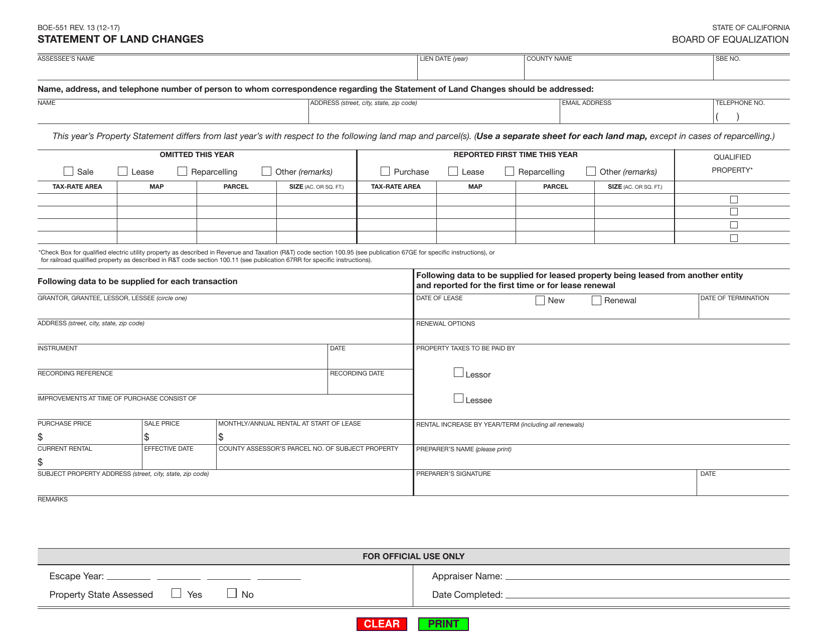

This Form is used for reporting changes in land ownership or use in the state of California. It is commonly used by property owners or developers to provide information about any alterations or updates to their land.

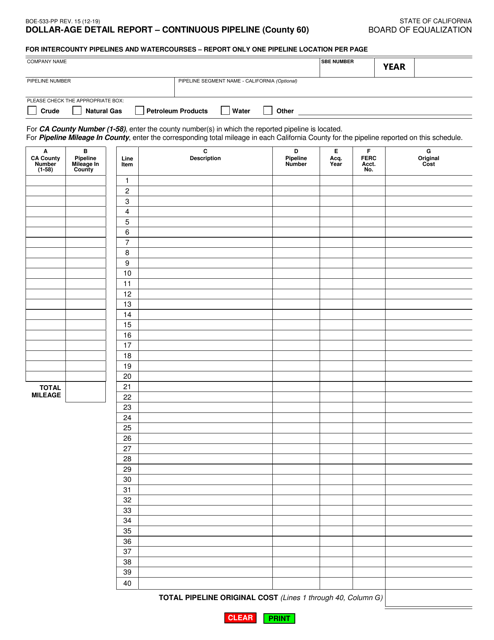

This form is used for generating a detailed report in California regarding the continuous pipeline of dollar-age details. It is specifically designed for County 60.

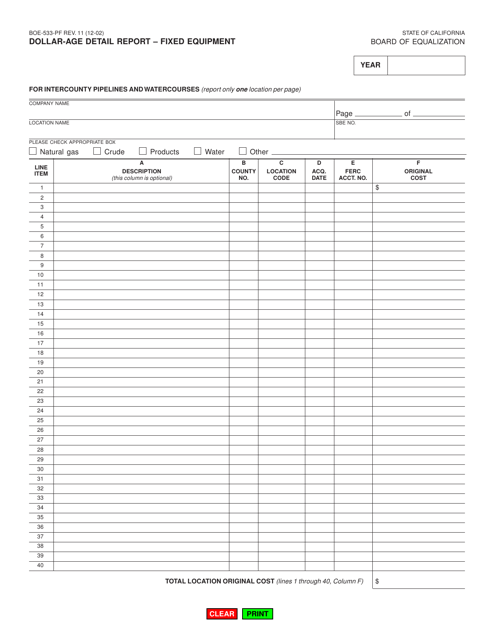

This form is used for submitting a Dollar-Age Detail Report for fixed equipment in California.

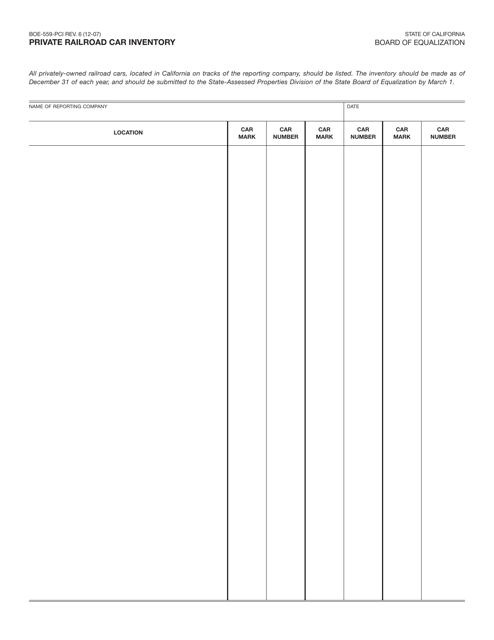

This Form is used for reporting private railroad car inventory information in California.

This form is used for reporting leased equipment with fixed location to be assessed by the Board of Equalization in California for railroad lessees.

This document provides tax tips specifically for photographers, photo finishers, and film processing laboratories in California. It offers valuable information to help individuals in these professions navigate their tax obligations effectively.

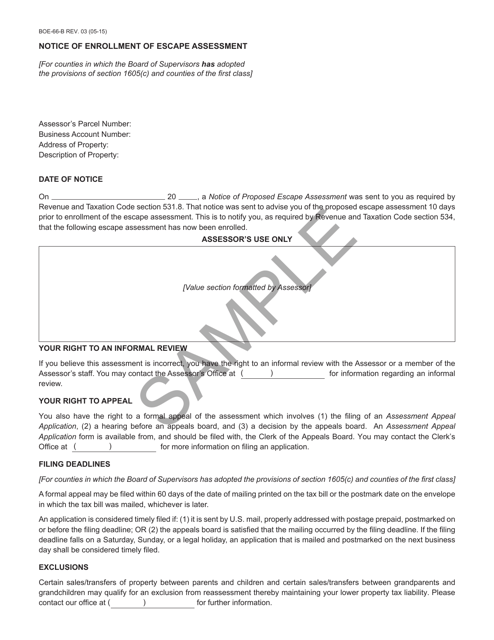

This form is used for notifying taxpayers in California about an escape assessment on their property.

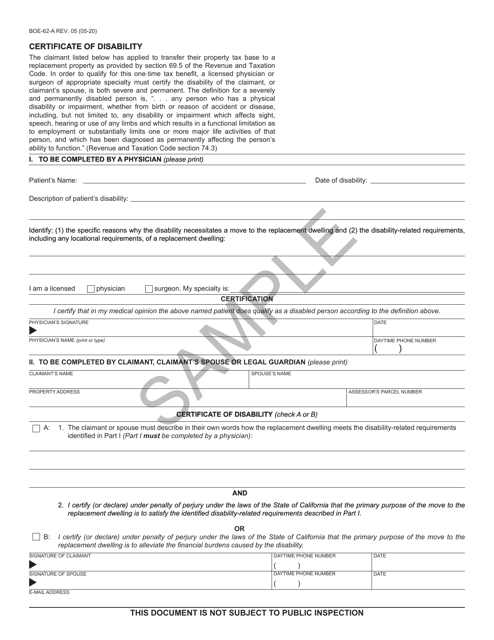

This document is a sample of the Certificate of Disability form (BOE-62-A) used in California. It is used to certify an individual's disability for tax exemption purposes.

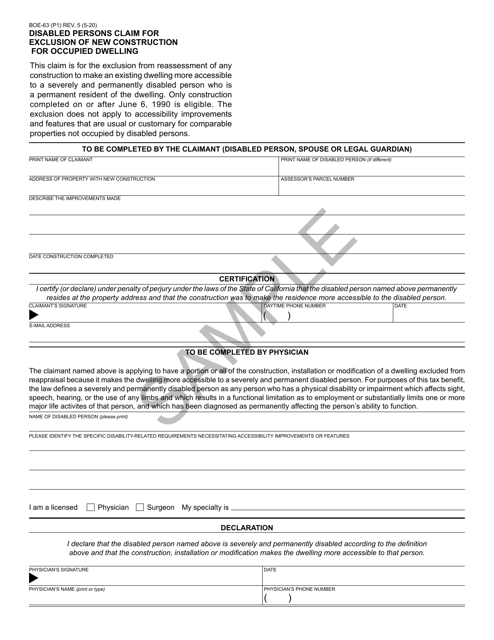

This form is used to claim exclusion of new construction for an occupied dwelling for disabled persons in California. It is a sample form for reference purposes.

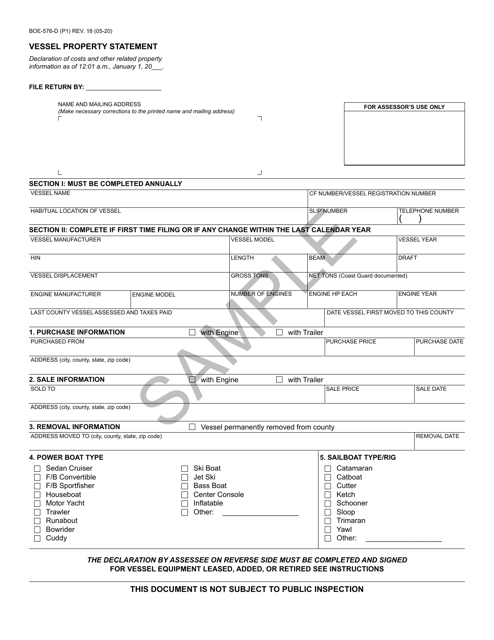

This form is used for reporting vessel property details in the state of California.