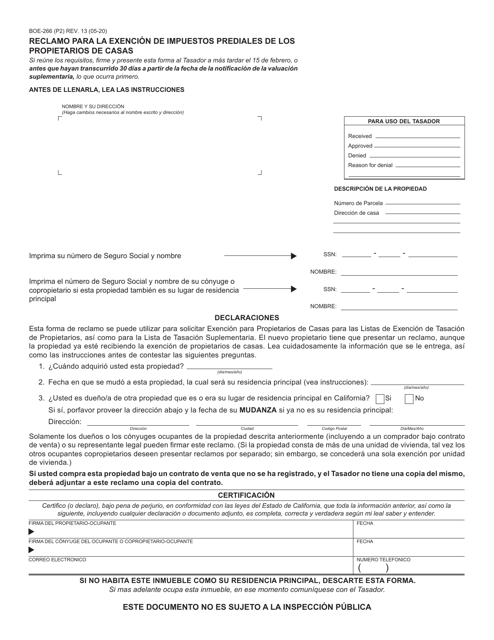

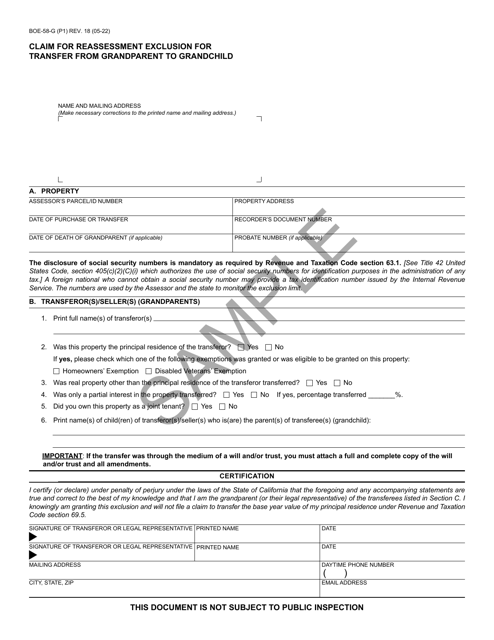

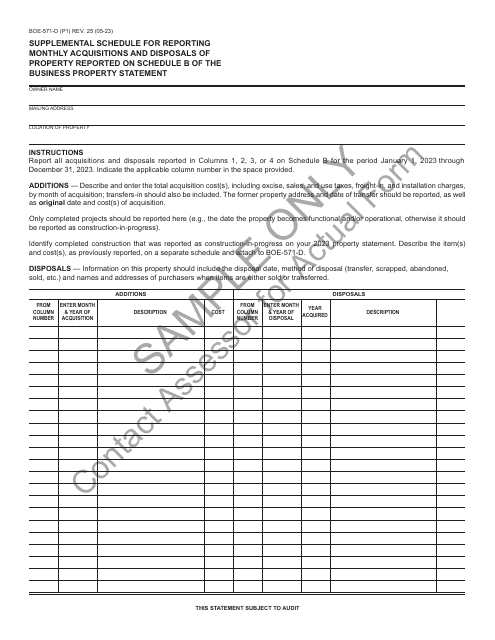

California State Board of Equalization Forms

Documents:

244

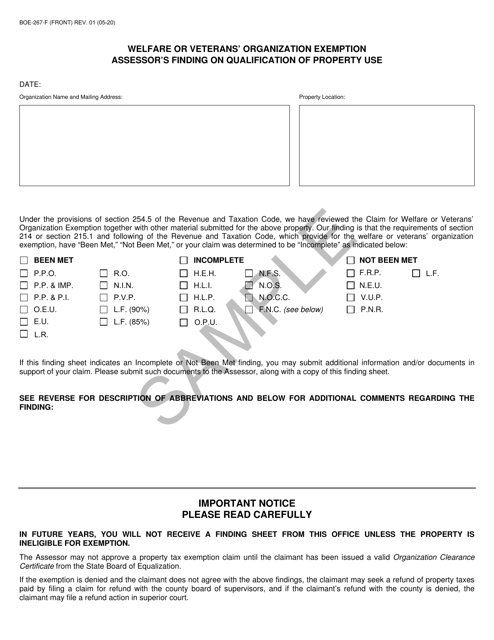

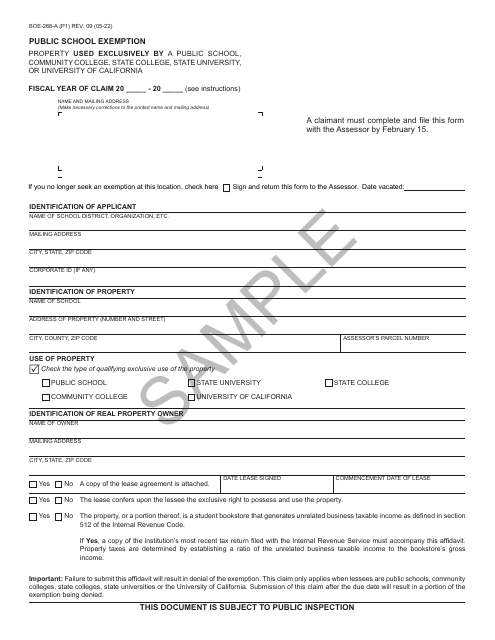

This form is used for the exemption assessment of property used by welfare or veterans' organizations in California. It is filled out by the assessor to determine if the property qualifies for exemption.

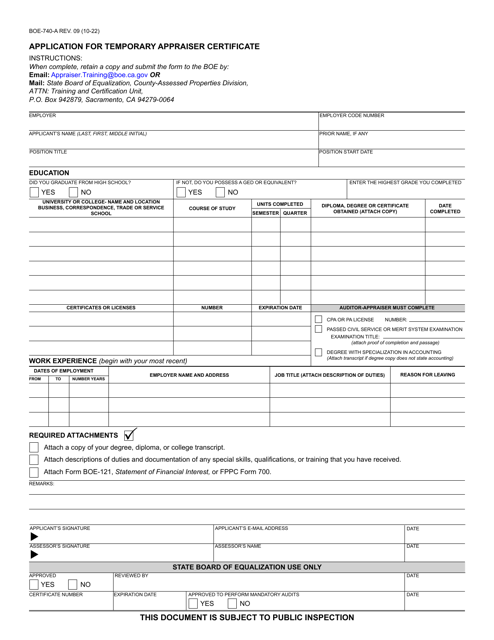

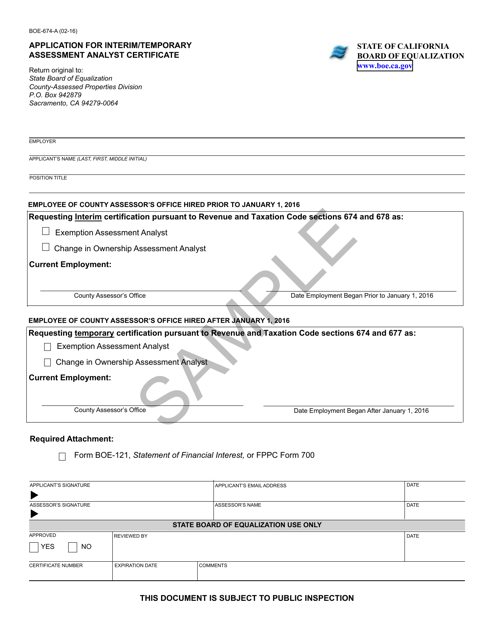

This Form is used for applying for an interim/temporary assessment analyst certificate in California.

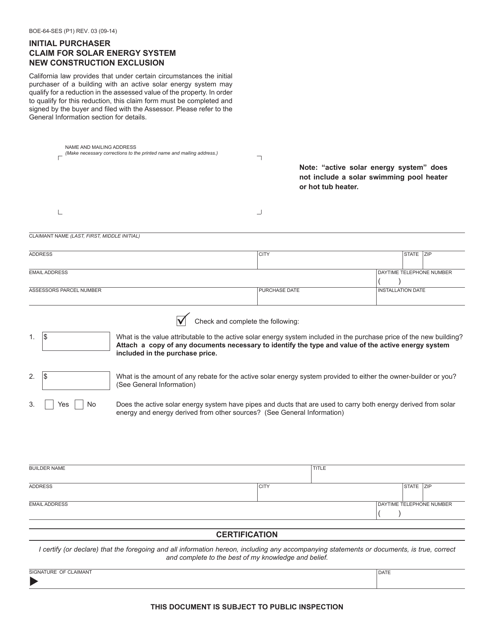

This form is used for making an initial purchaser claim for a solar energy system new construction exclusion in California.

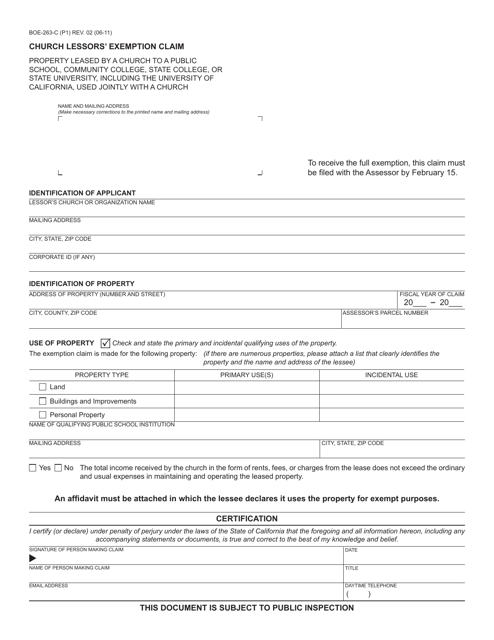

This form is used for Church Lessors to claim an exemption in California.

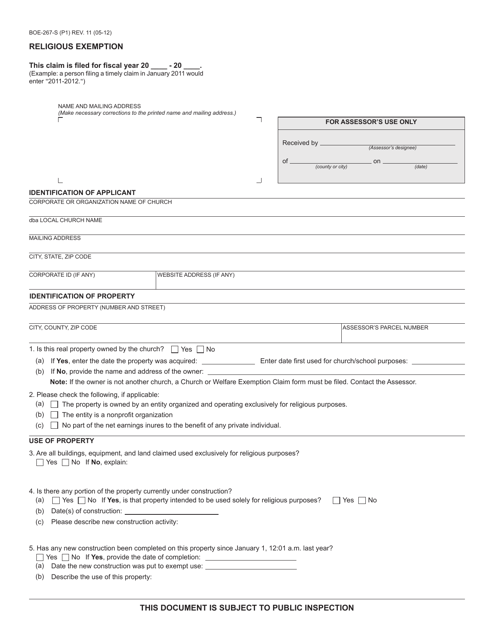

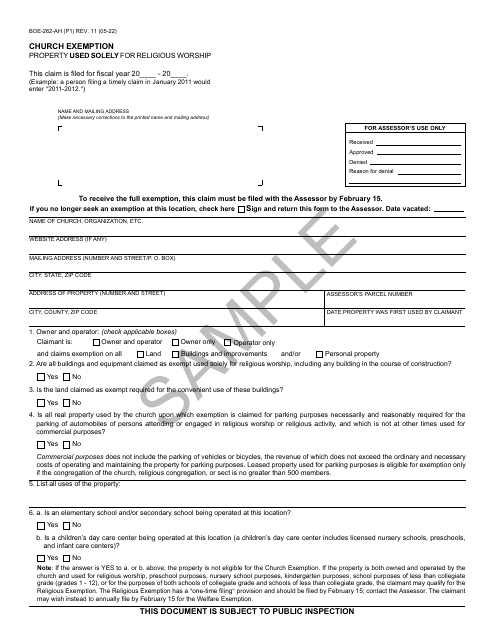

This form is used for claiming a religious exemption from certain taxes in the state of California.

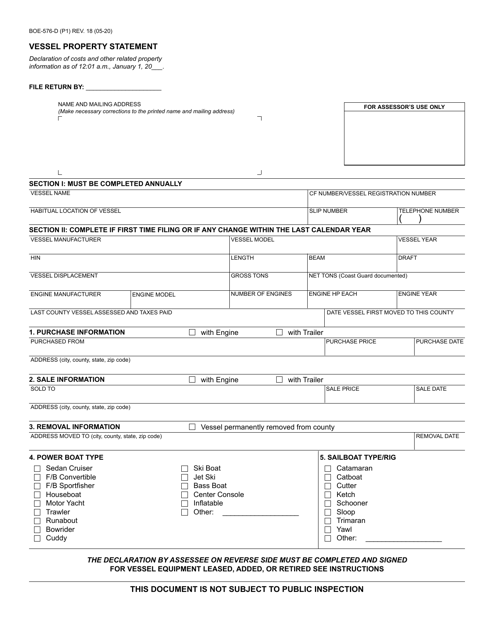

This Form is used for reporting the property information related to vessels in the state of California.

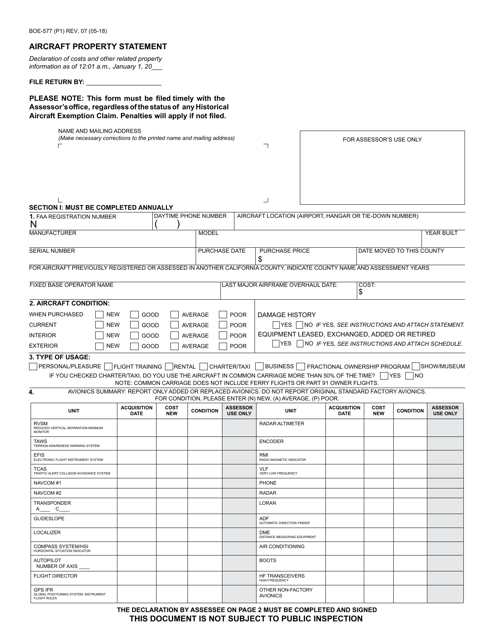

This form is used for reporting aircraft property in the state of California. It is used to provide information about the aircraft, including ownership details, value, and related tax assessments.

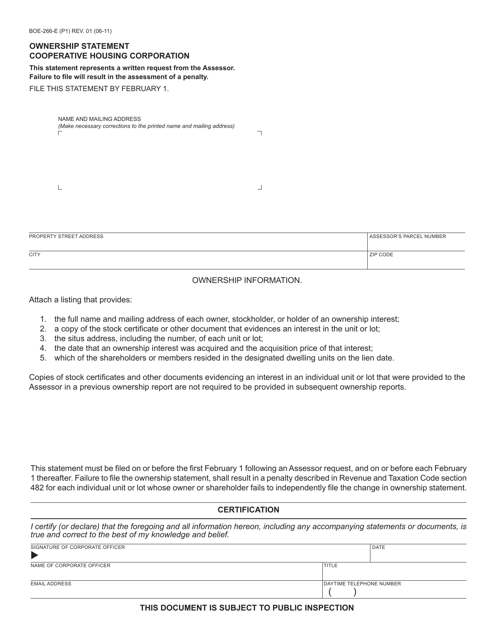

This form is used for Cooperative Housing Corporations in California to provide an ownership statement.

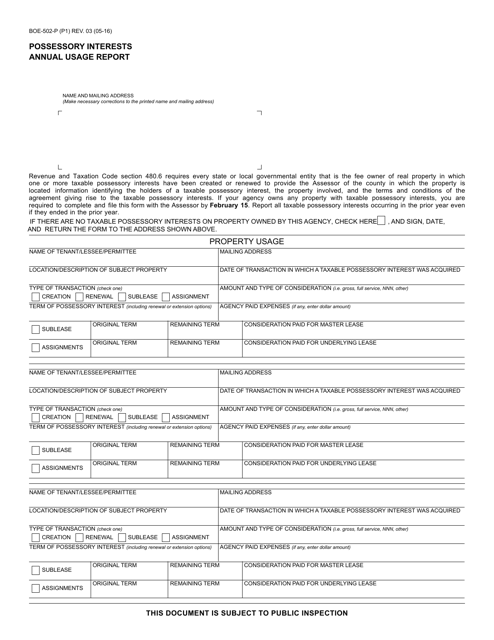

This Form is used for reporting annual usage of possessory interests in California.

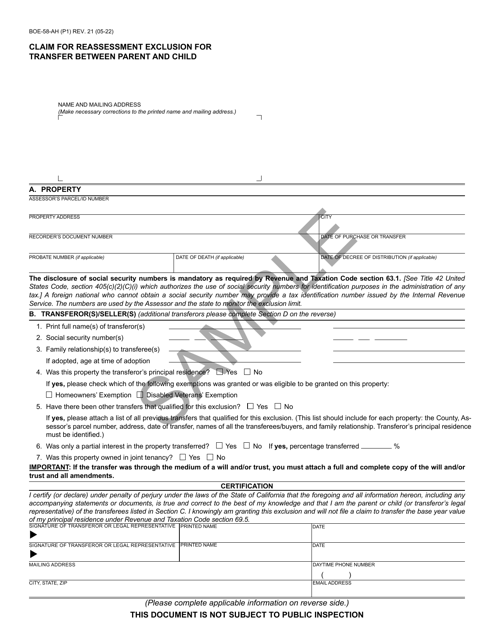

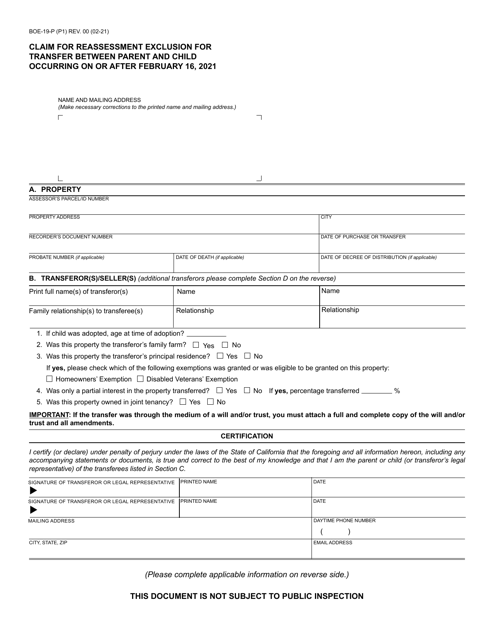

This form is used for claiming reassessment exclusion for transfers between parents and children in California that occurred on or after February 16, 2021.

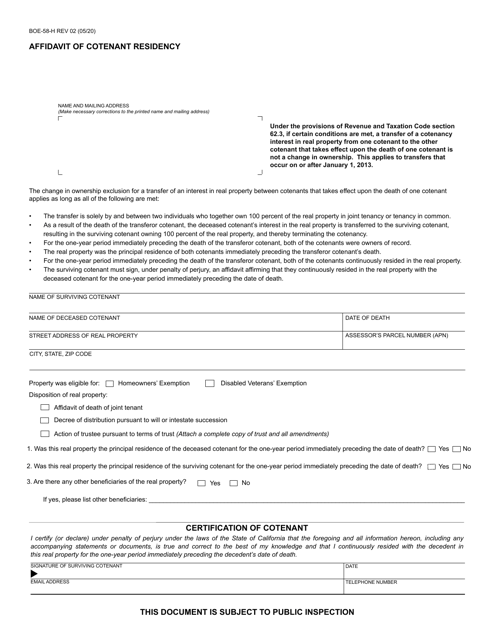

This form is used for affirming the residency of a cotenant in the state of California.

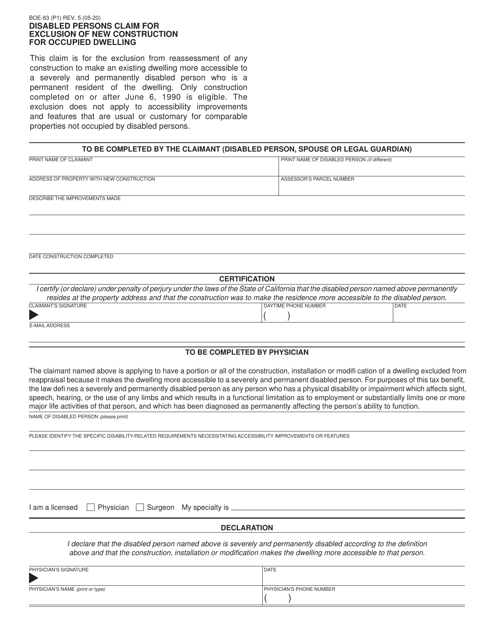

This form is used for disabled persons in California to claim an exclusion for new construction of an occupied dwelling.

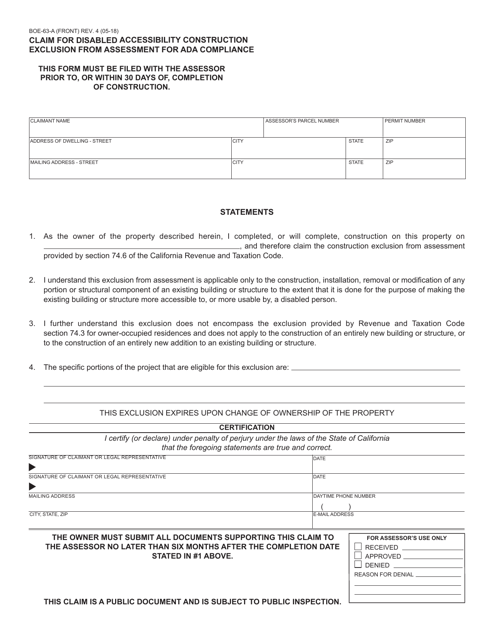

This form is used for claiming a disabled accessibility construction exclusion from assessment for ADA compliance in California.

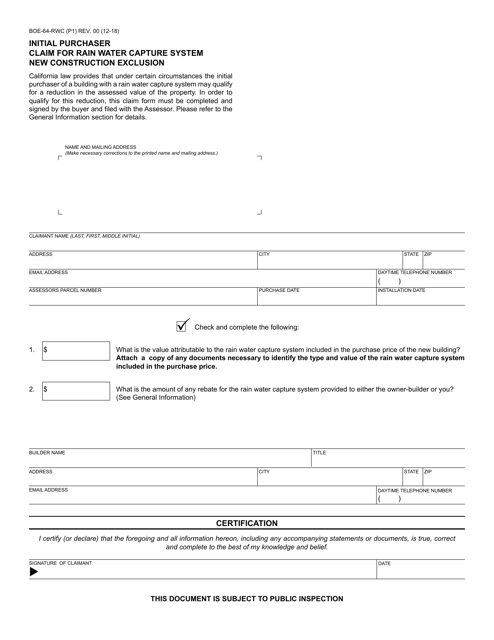

This form is used for filing a claim for the Rain Water Capture System New Construction Exclusion in California.

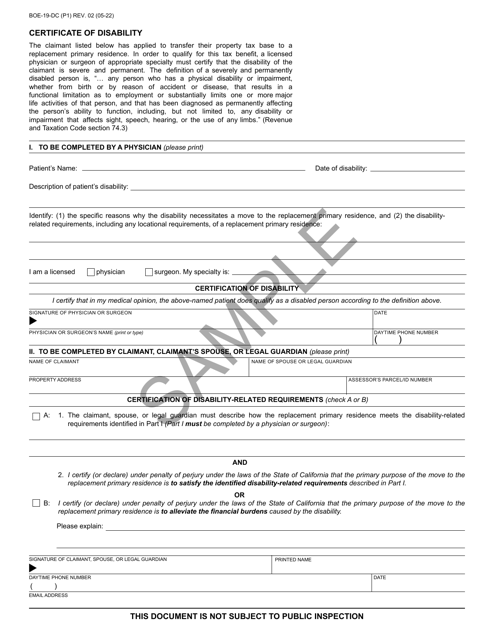

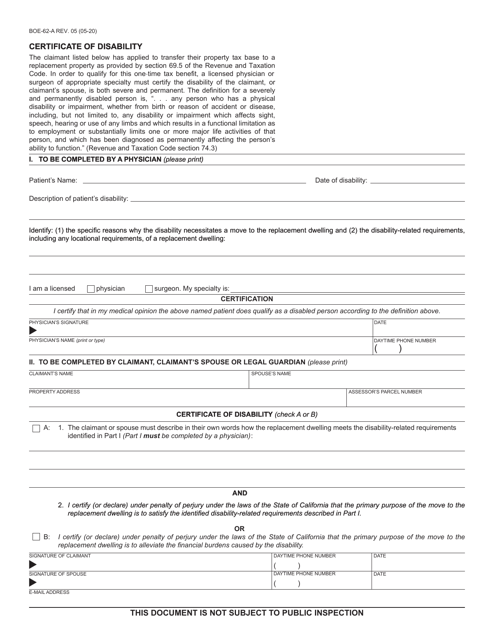

This Form is used for obtaining a Certificate of Disability in California.

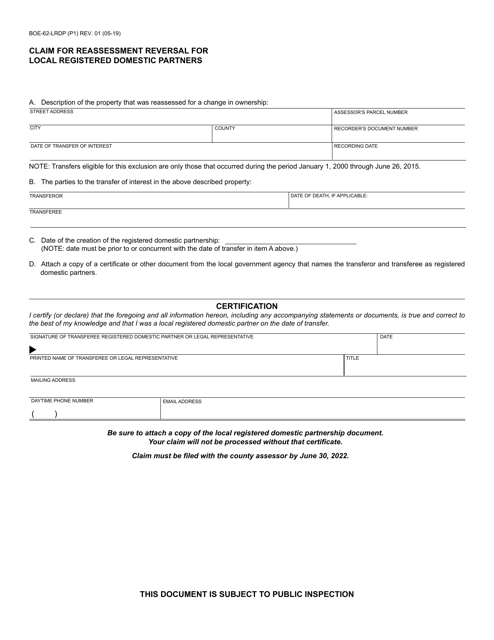

Form BOE-62-LRDP Claim for Reassessment Reversal for Local Registered Domestic Partners - California

This form is used for claiming reassessment reversal for local registered domestic partners in California.

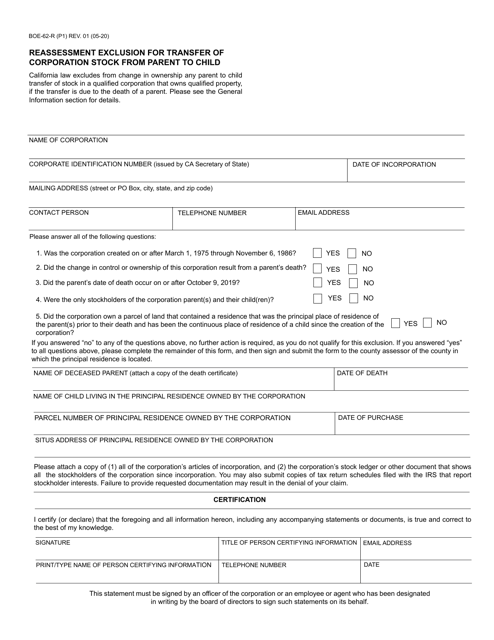

This form is used for excluding reassessment of property taxes when transferring corporation stock from a parent to a child in California.

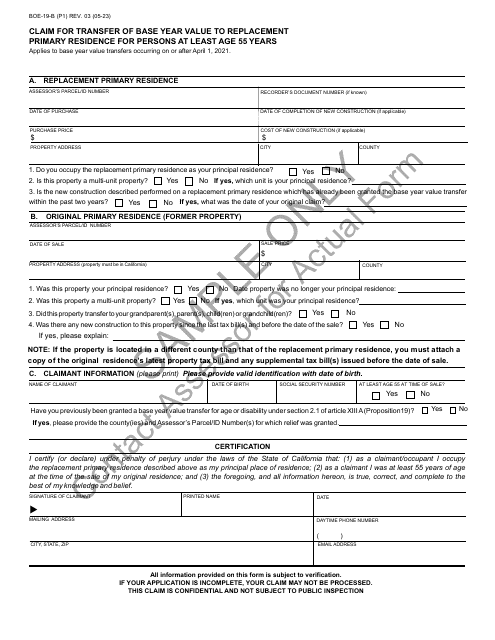

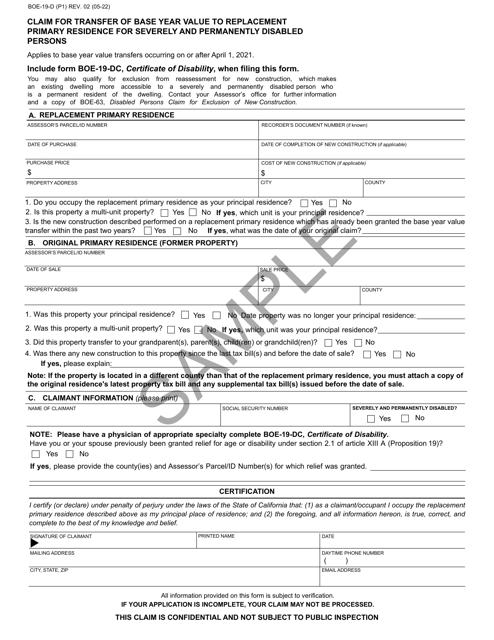

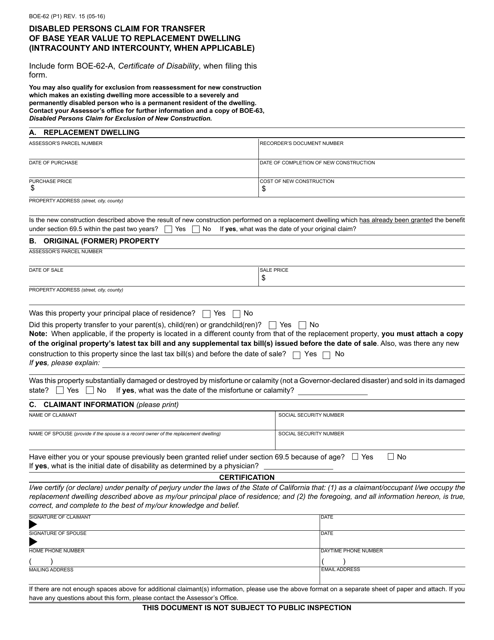

This form is used for disabled persons in California to claim the transfer of base year value to a replacement dwelling.

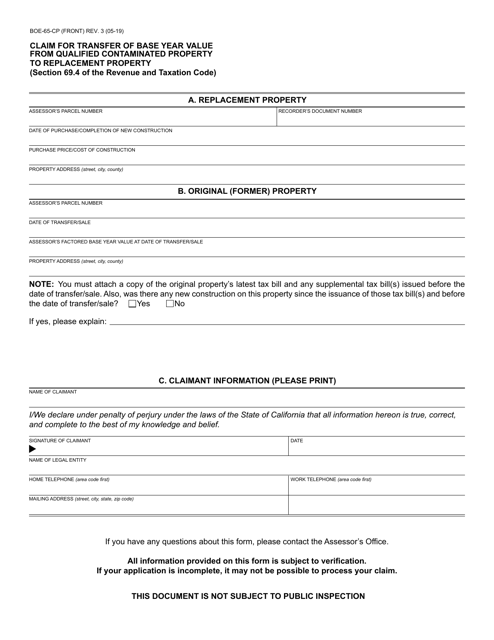

This form is used for claiming the transfer of the base year value from a contaminated property to a replacement property in California. It helps property owners transfer their property tax assessment from a contaminated property to a new property.