Oklahoma Tax Commission Forms

The Oklahoma Tax Commission (OTC) is responsible for administering and enforcing various taxes and fees in the state of Oklahoma. Some of the key functions of the OTC include collecting and administering state taxes, such as income tax, sales tax, and use tax. They also handle tax-related processes, such as issuing tax permits, managing tax registrations, and conducting audits to ensure compliance with the state's tax laws. Additionally, the OTC oversees motor vehicle registrations and titling, as well as the collection of motor vehicle excise taxes.

Documents:

677

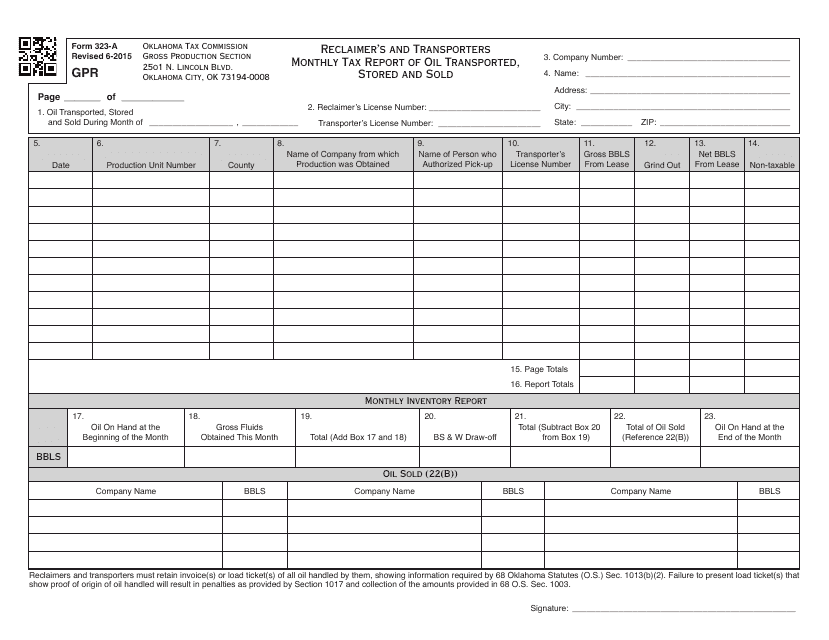

This form is used for reporting monthly taxes on oil transported, stored, and sold in Oklahoma by reclaimers and transporters.

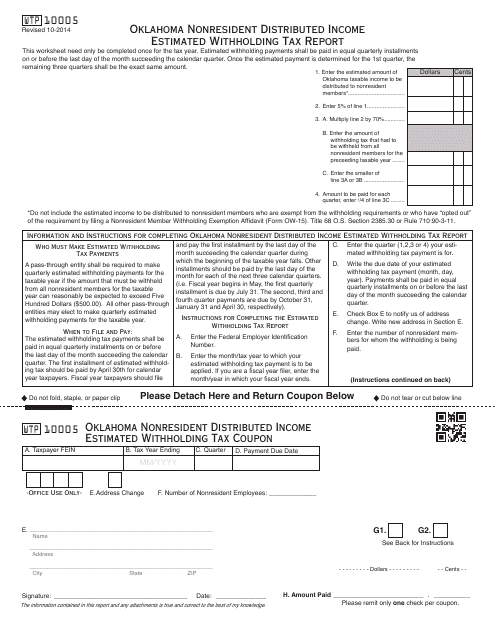

This form is used for reporting estimated withholding tax on distributed income for nonresidents in Oklahoma.

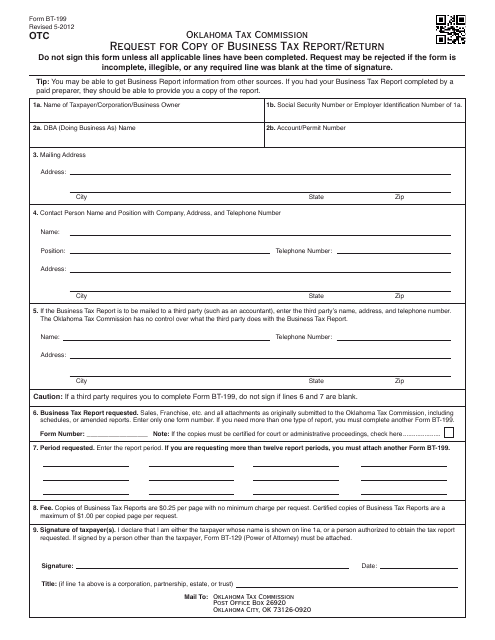

This form is used for requesting a copy of your business tax report or return in the state of Oklahoma.

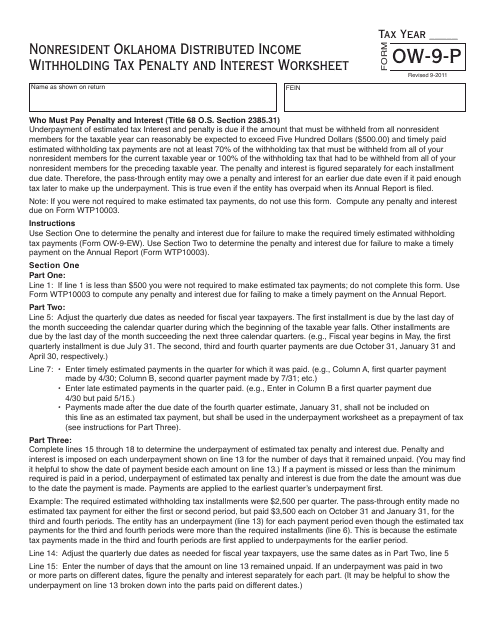

This form is used for calculating the penalty and interest on distributed income for nonresidents in Oklahoma.

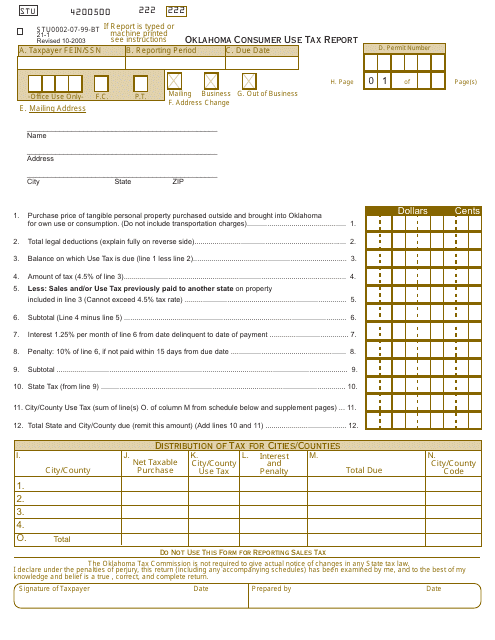

This document is used for reporting consumer use tax in Oklahoma.

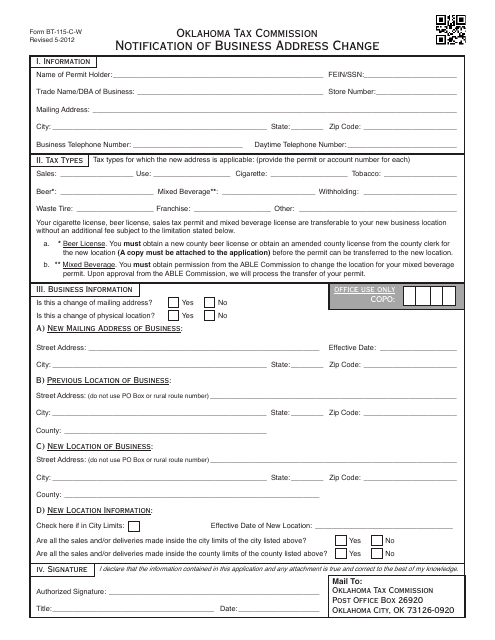

This form is used for notifying the Oklahoma Tax Commission of a change in business address.

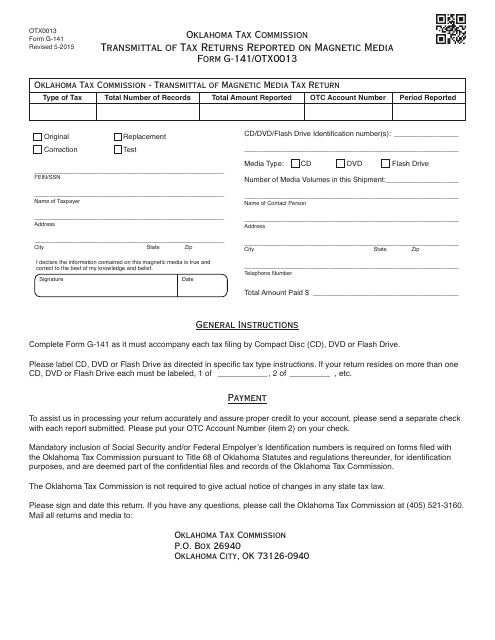

This document is used for transmitting tax returns reported on magnetic media to the Oklahoma Tax Commission (OTC).

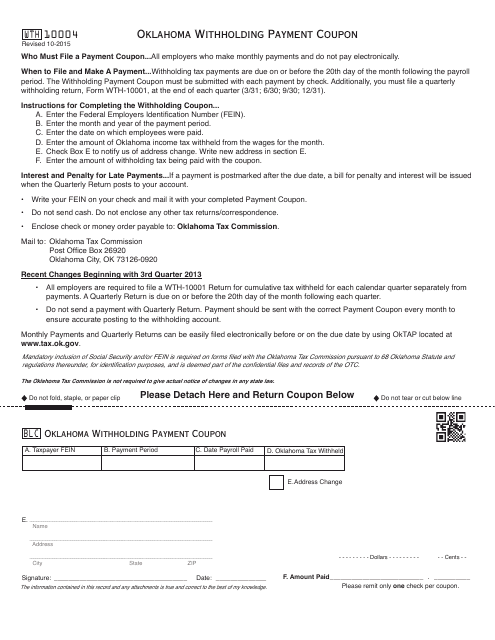

This document is a payment coupon specifically used for Oklahoma state withholding taxes. It is used to make payments for withholding taxes to the state of Oklahoma.

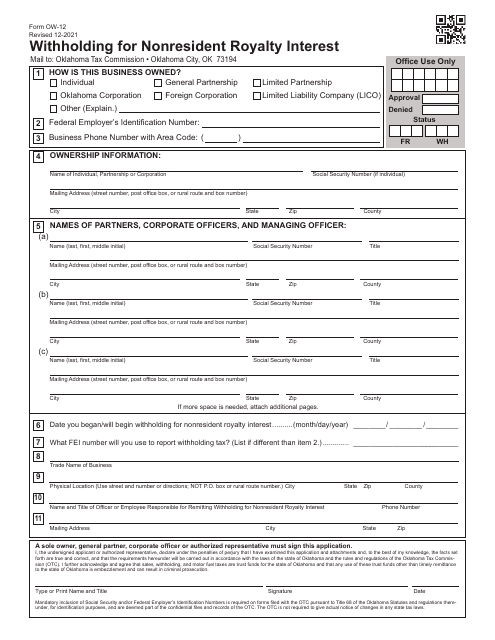

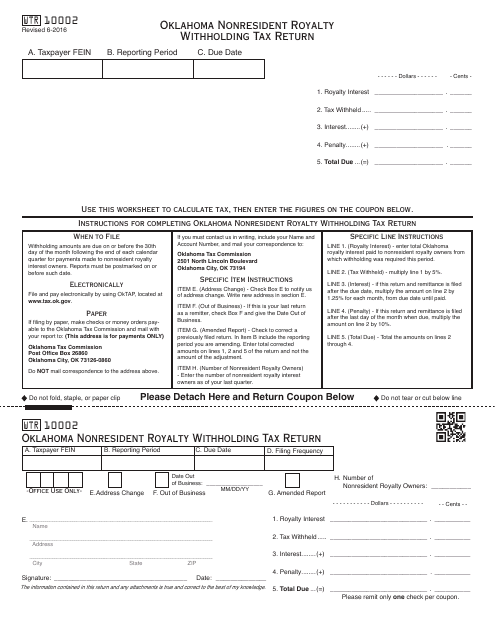

This form is used for reporting and paying nonresident royalty withholding taxes in Oklahoma. It applies to individuals or entities who receive royalty income from sources in Oklahoma but are not residents of the state.

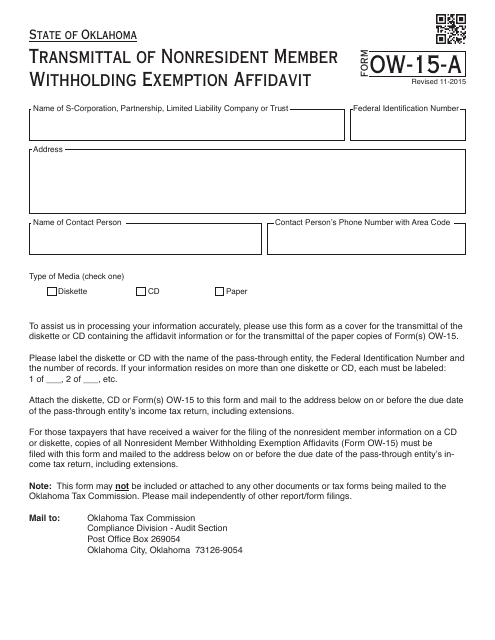

This document is used for transmitting the Nonresident Member Withholding Exemption Affidavit in Oklahoma.

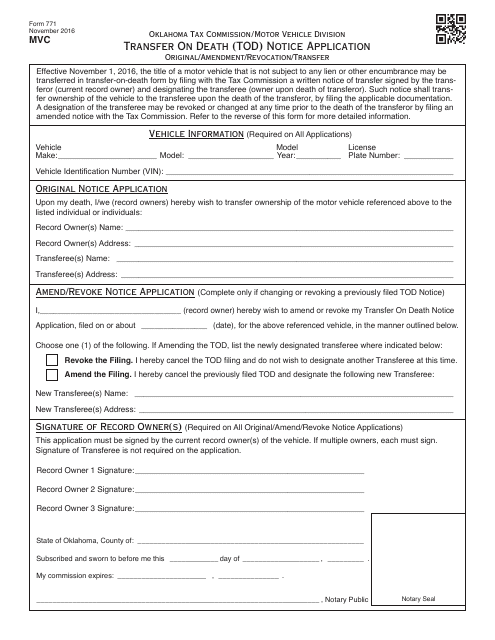

This document is used for applying for a Transfer on Death (TOD) Notice in Oklahoma.

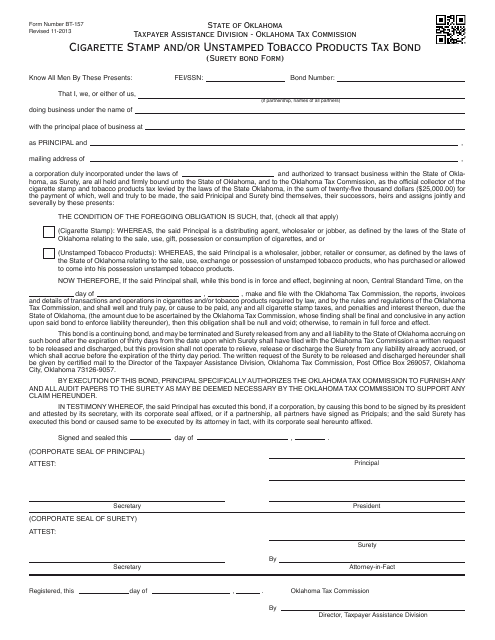

This form is used for a Cigarette Stamp and/or Unstamped Tobacco Products Tax Bond in Oklahoma. It is a surety bond form required for certain businesses selling cigarettes or tobacco products in the state.

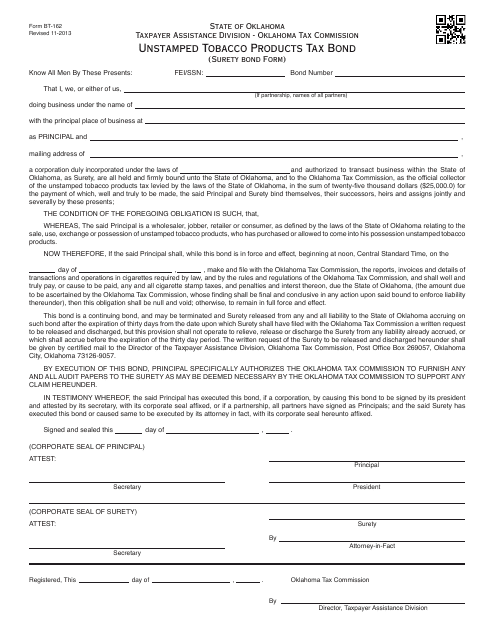

This document is used for obtaining an unstamped tobacco products tax bond in Oklahoma.

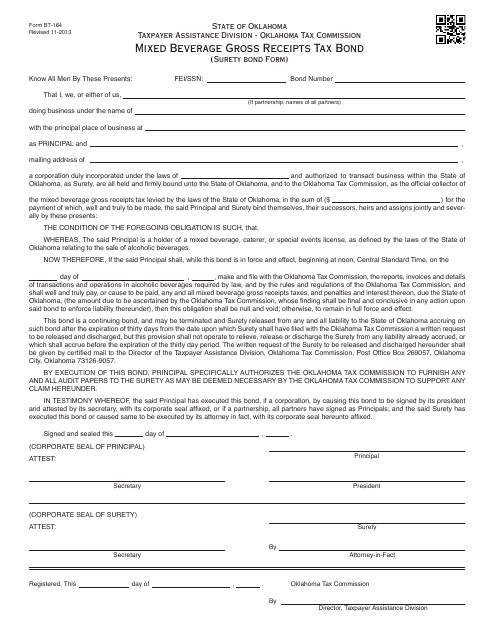

This document is used for obtaining a surety bond for the Mixed Beverage Gross Receipts Tax in Oklahoma. It is known as Form BT-164 and is used for compliance with tax regulations.

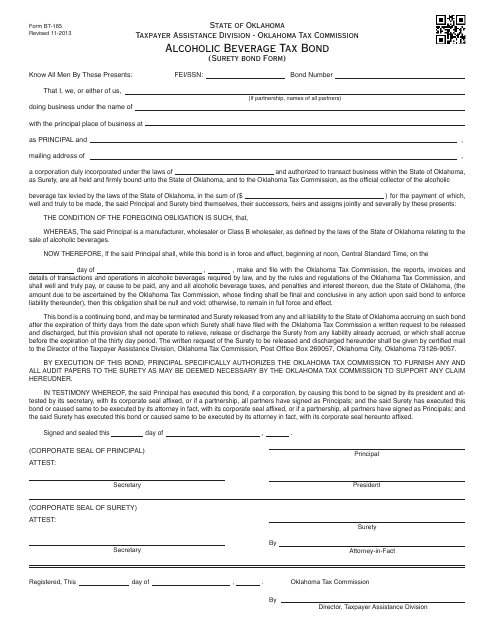

This Form is used for obtaining an Alcoholic Beverage Tax Bond (Surety Bond) in Oklahoma.

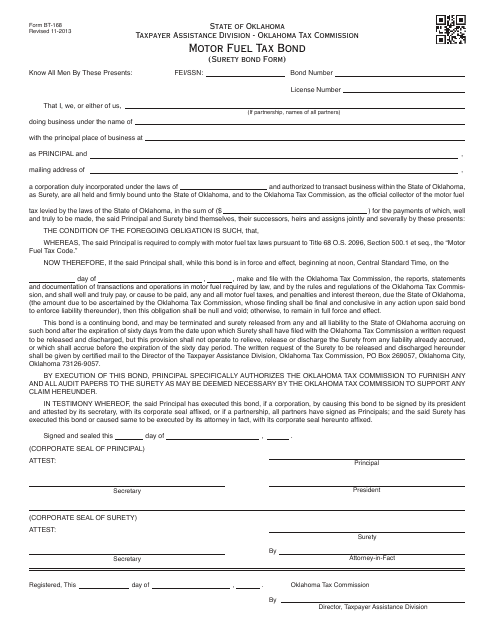

This Form is used for obtaining a Motor Fuel Tax Bond (Surety Bond) in Oklahoma for businesses that sell motor fuel over-the-counter. This bond ensures that the business complies with state laws and regulations regarding motor fuel taxes.

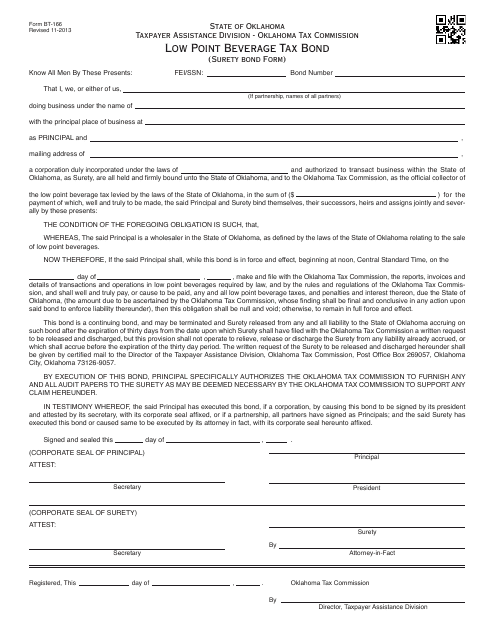

This document is for obtaining a surety bond for the Low Point Beverage Tax in Oklahoma.

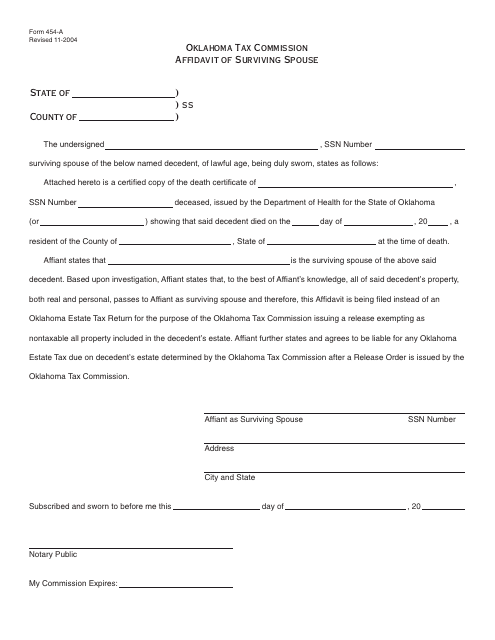

This form is used for a surviving spouse in Oklahoma to declare their status in order to claim certain benefits or rights.

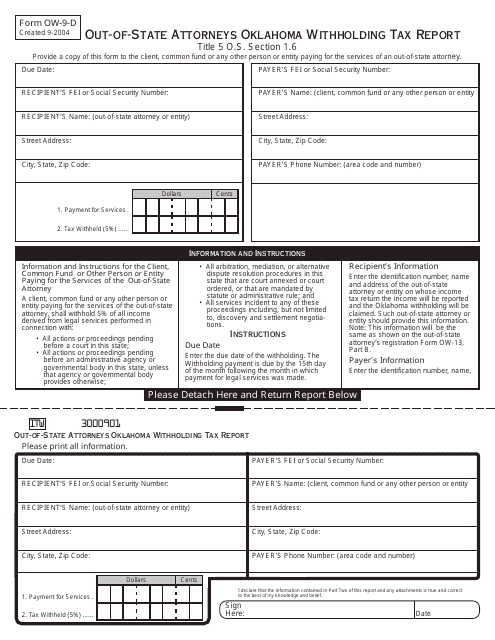

This form is used for Out-of-State Attorneys in Oklahoma to report Oklahoma withholding tax.

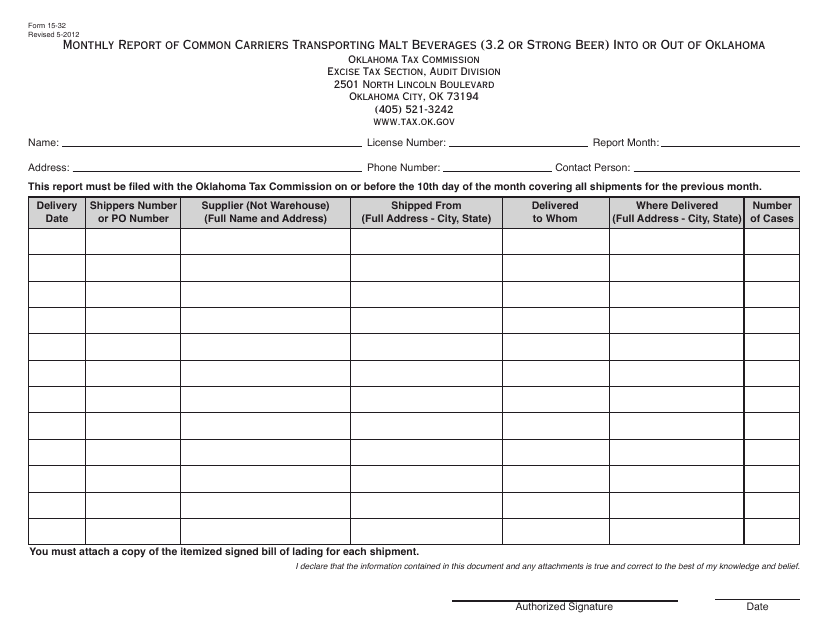

This form is used for monthly reporting of common carriers transporting malt beverages into or out of Oklahoma. The report is required for both 3.2% and strong beer.

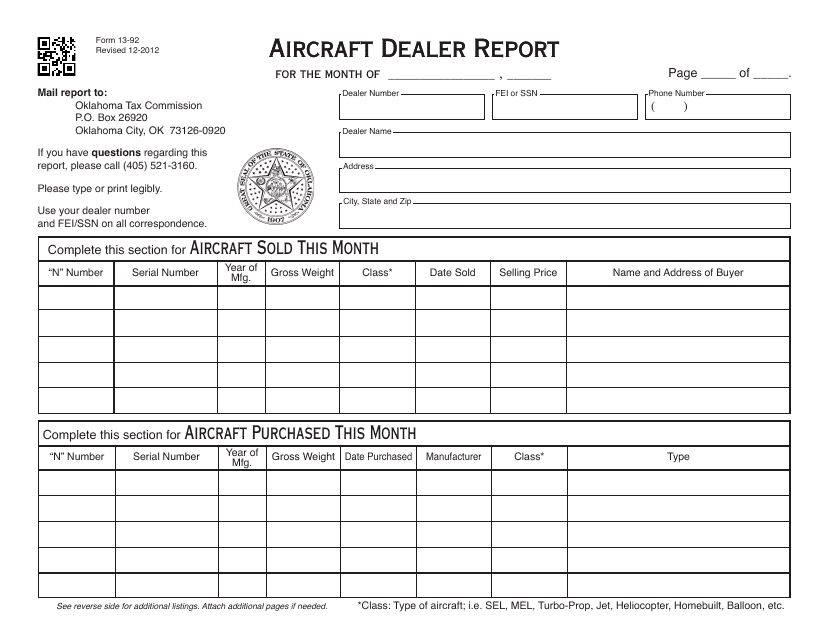

This form is used for reporting aircraft sales and purchases by aircraft dealers in the state of Oklahoma.

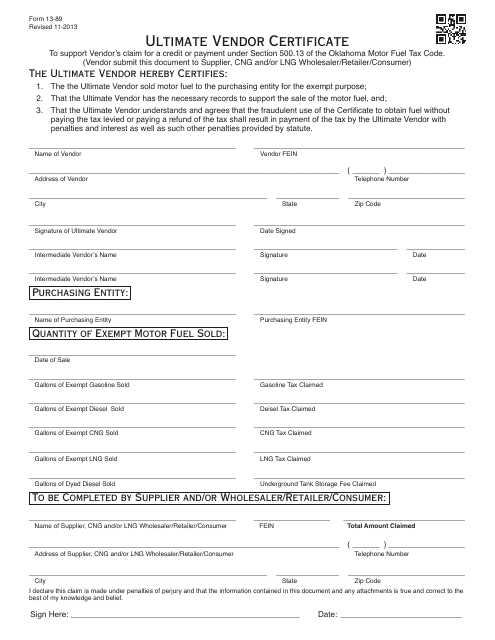

This document is a form used in Oklahoma for vendors to certify their status as the ultimate vendor for purposes of sales tax exemption.

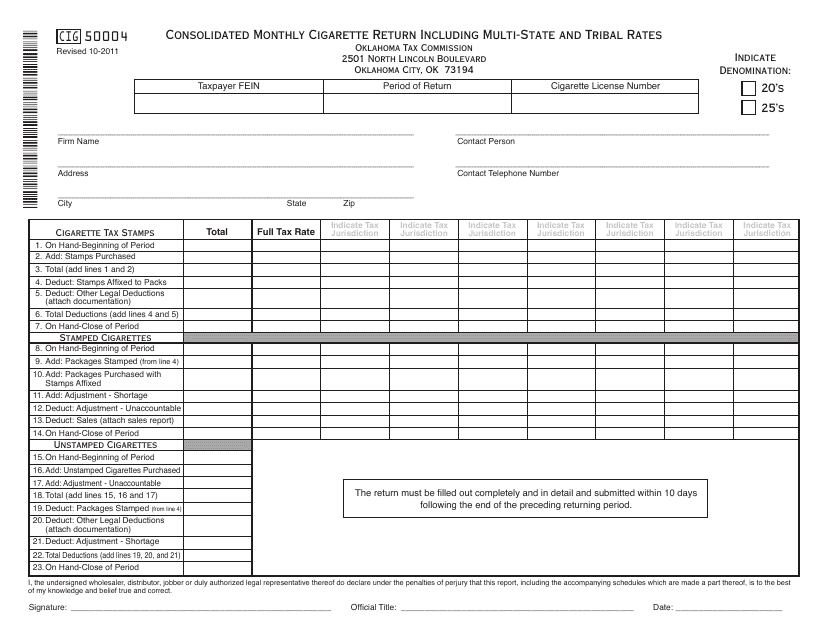

This form is used for submitting the consolidated monthly cigarette return including multi-state and tribal rates in the state of Oklahoma.

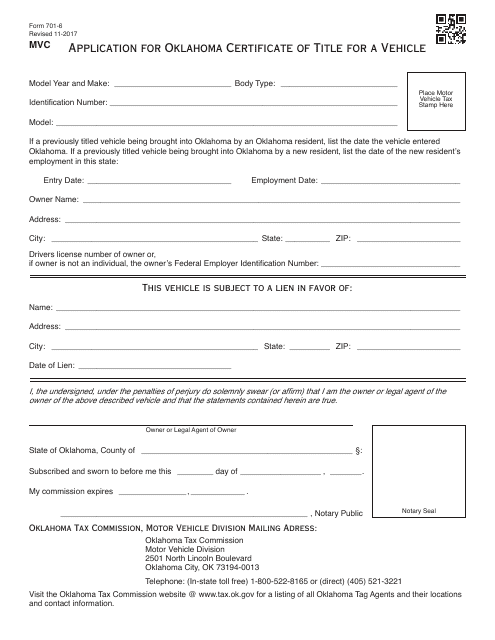

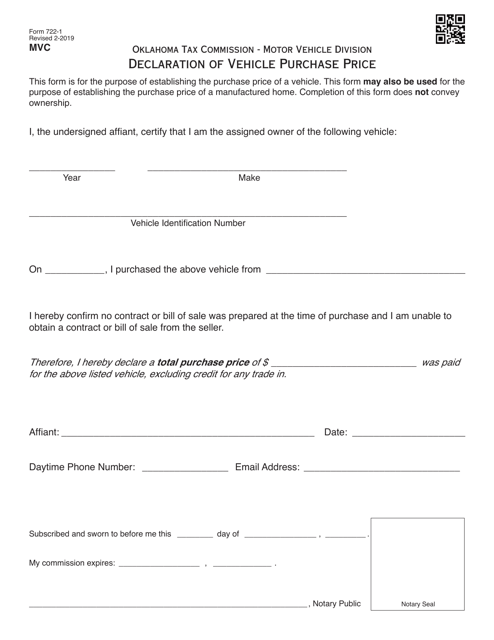

You may use this document if you would like to apply for a Certificate of Title for a vehicle in Oklahoma.

This Form is used for filing Oklahoma Sales Tax Return in the state of Oklahoma.

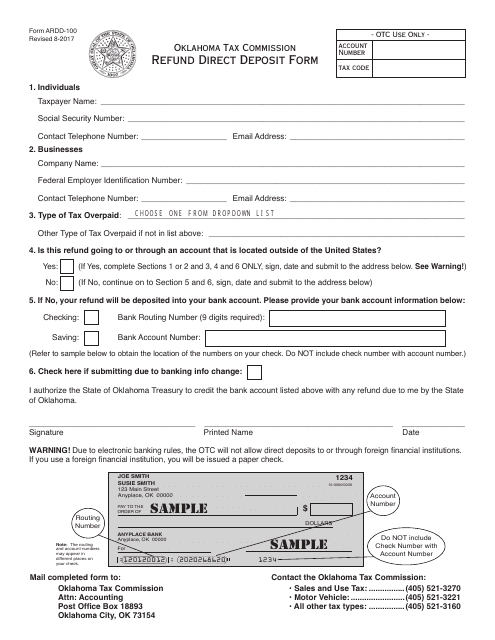

This form is used for requesting a refund through direct deposit in the state of Oklahoma.

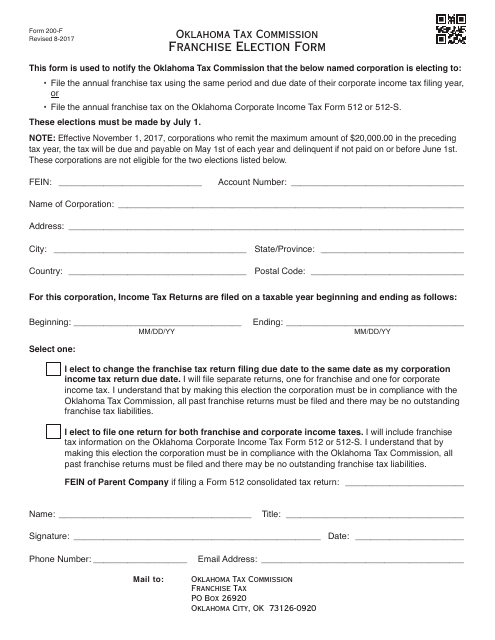

This form is used for making a franchise election in the state of Oklahoma. It allows businesses to elect their tax treatment as a franchise and submit the necessary information to the Oklahoma Tax Commission (OTC).

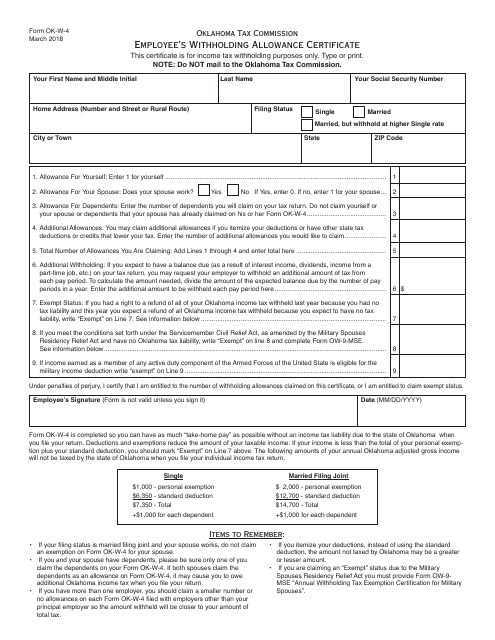

This form is used for providing information to your employer regarding the amount of federal income tax to be withheld from your paycheck. It is specifically designed for residents of Oklahoma.

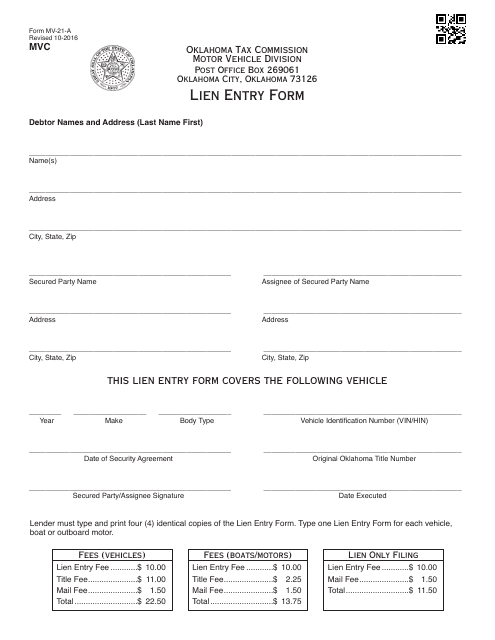

This document is for entering a lien on a motor vehicle in Oklahoma.

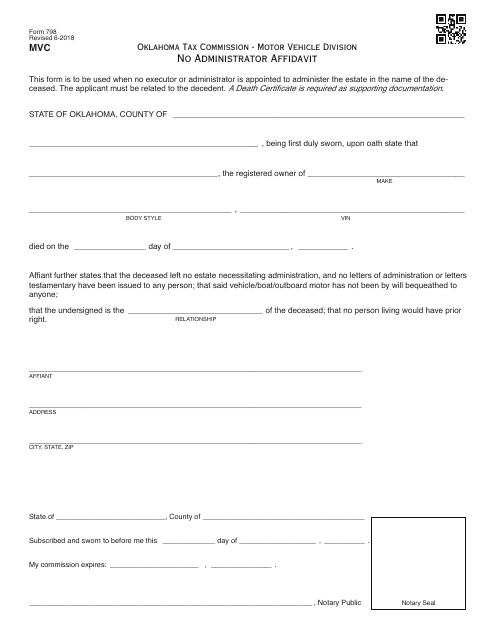

This document is used for filing an affidavit in Oklahoma when there is no administrator for a certain matter.

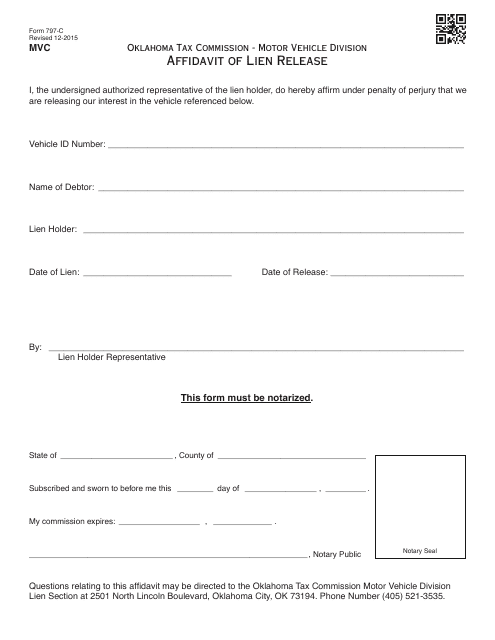

This Form is used for releasing a lien on a property or vehicle in Oklahoma. It is an affidavit that confirms the lien has been satisfied and provides proof of its release.

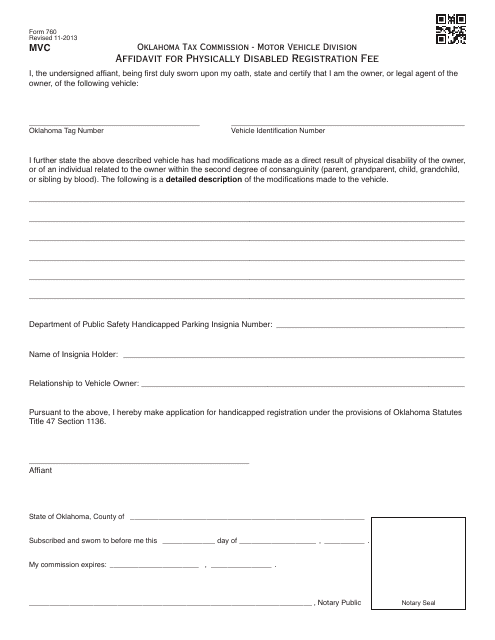

This Form is used for applying for a registration fee exemption for physically disabled individuals in Oklahoma.

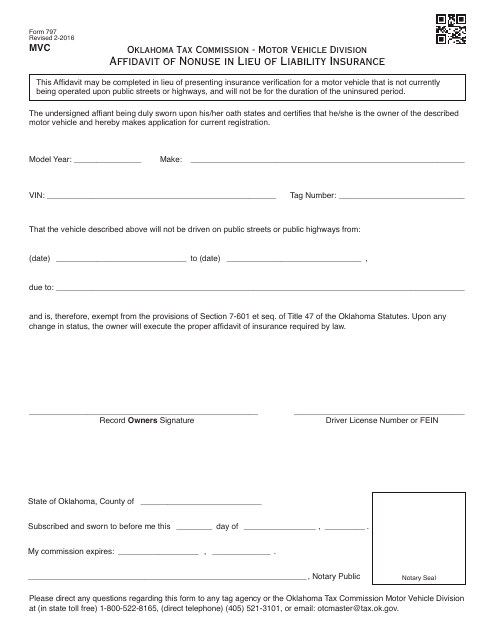

This Form is used for filing an Affidavit of Nonuse in place of liability insurance in the state of Oklahoma.

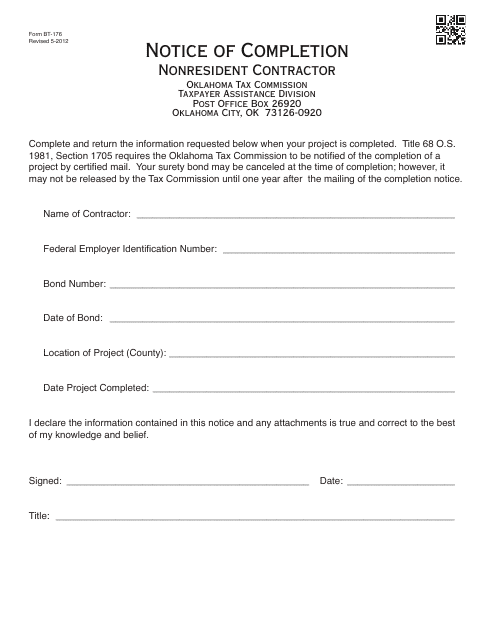

This Form is used for notifying the completion of a project by a nonresident contractor in Oklahoma.

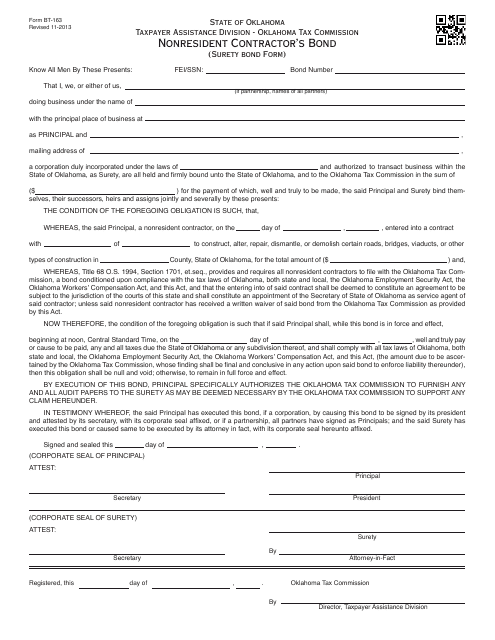

This type of document is used for obtaining a nonresident contractor's bond in Oklahoma. It is for contractors who are not residents of Oklahoma but want to work on construction projects in the state. The bond ensures that the contractor will fulfill their obligations and responsibilities as outlined in their contract.

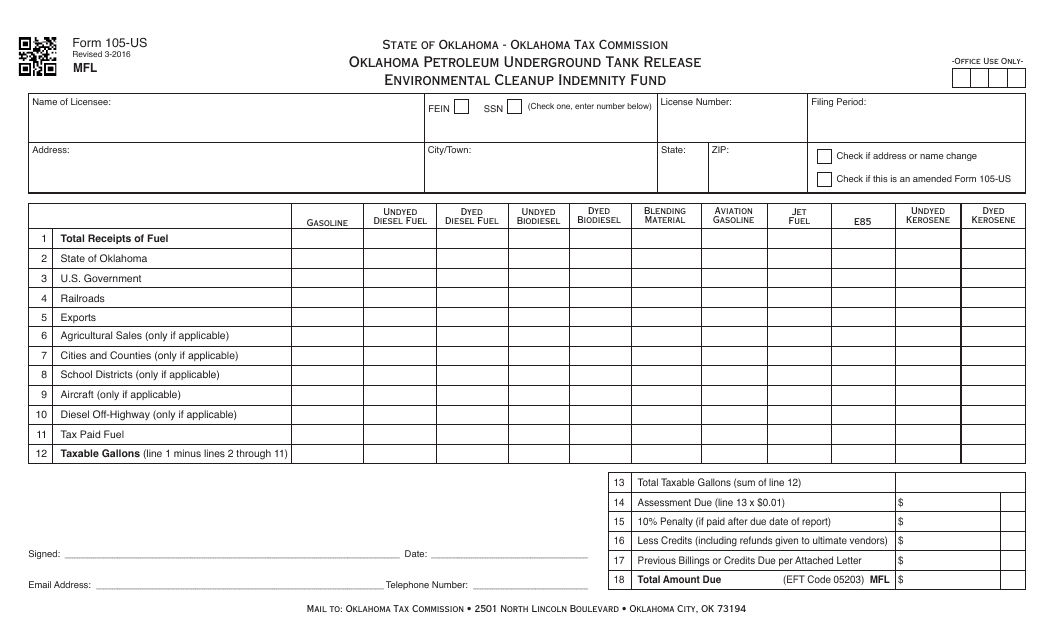

This Form is used for applying for the Oklahoma Petroleum Underground Tank Release Environmental Cleanup Indemnity Fund in the US. It provides financial assistance for the cleanup of underground petroleum tanks.

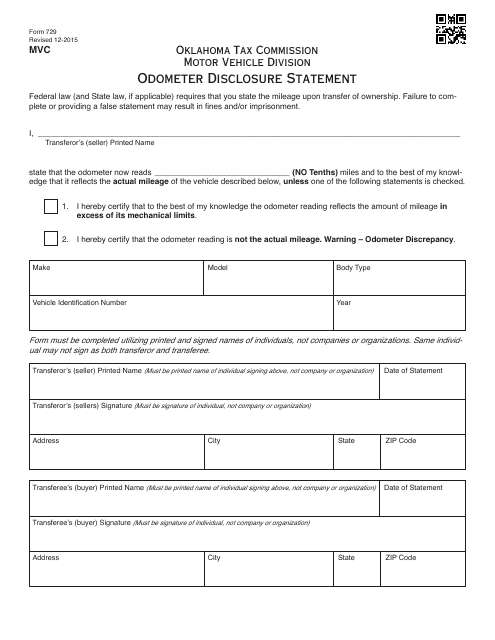

This document is used for disclosing the odometer reading when buying or selling a vehicle in Oklahoma, USA.

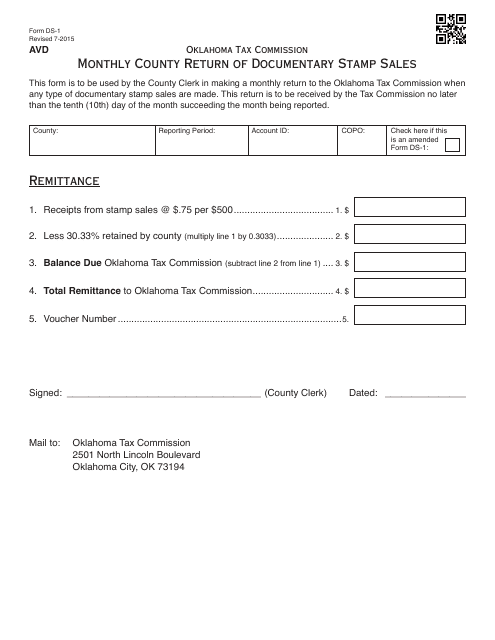

This document is a monthly return form used by counties in Oklahoma to report and record sales of documentary stamps.