Oklahoma Tax Commission Forms

Documents:

677

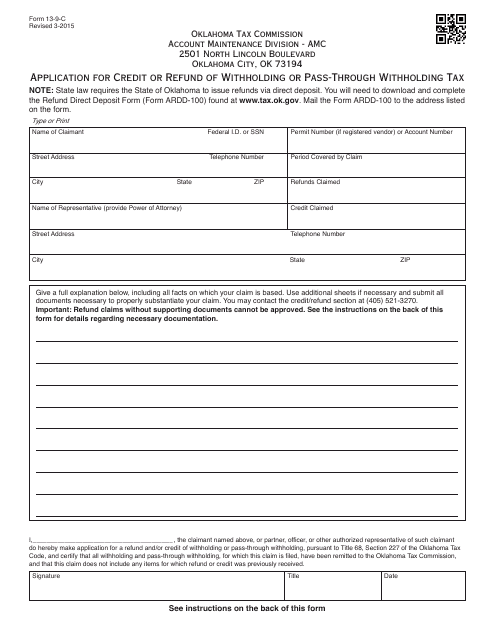

This Form is used for applying for a credit or refund of withholding or pass-through withholding tax in Oklahoma.

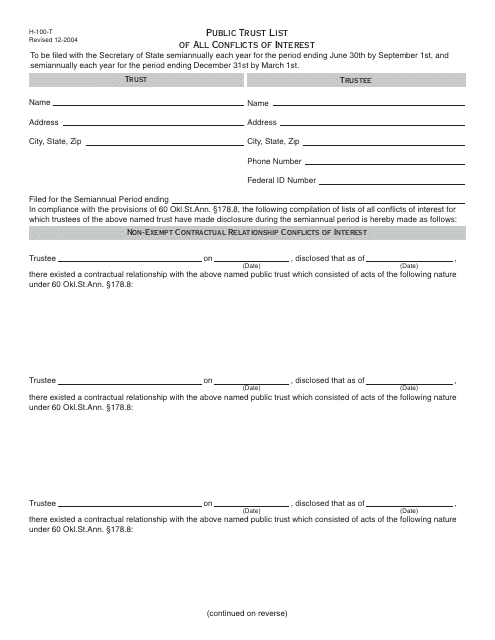

This document is a list of all conflicts of interest in the Oklahoma Public Trust, provided by the OTC Form H-100-T.

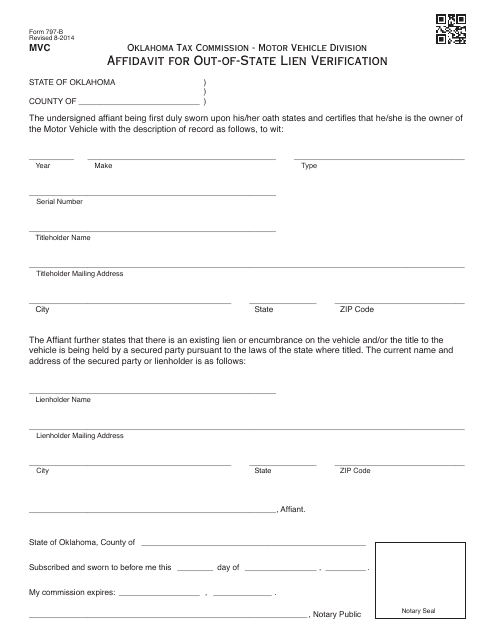

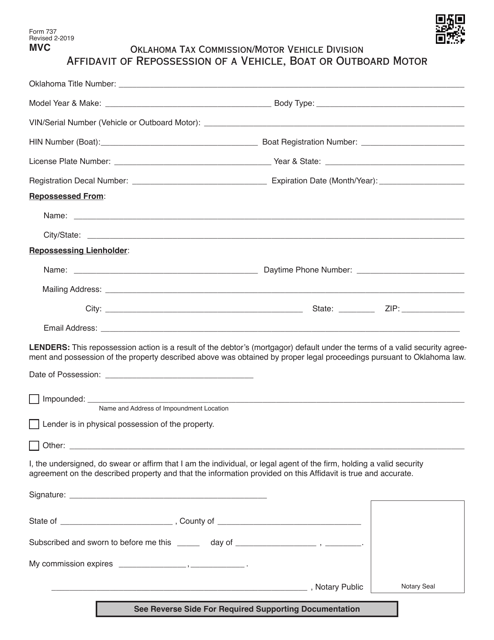

This document is used for verifying out-of-state liens in Oklahoma through an affidavit process.

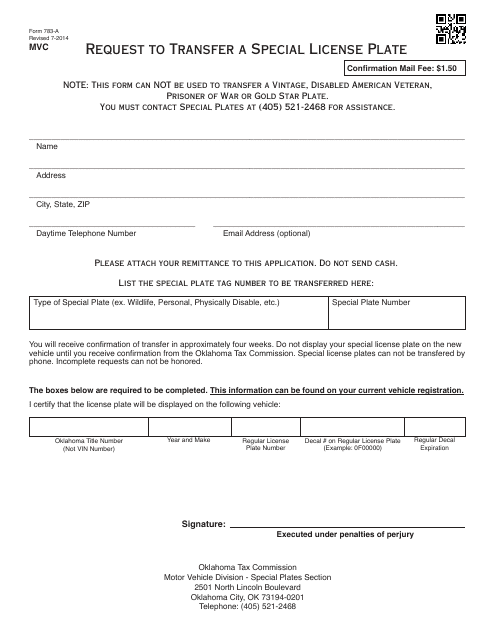

This form is used for requesting the transfer of a special license plate in Oklahoma.

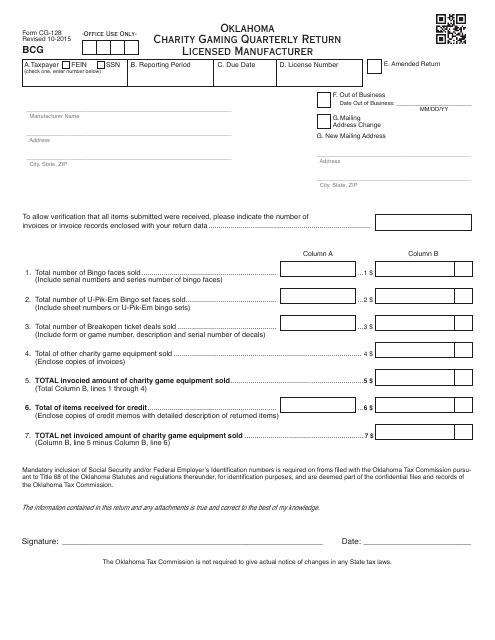

This form is used for Oklahoma licensed manufacturers to report their quarterly gaming activity for charitable purposes. It is required by the Oklahoma Charity Gaming Division.

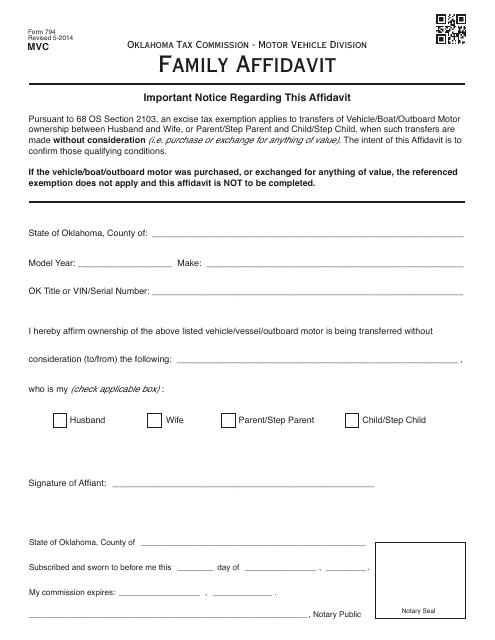

This Form is used for submitting a Family Affidavit in Oklahoma for over-the-counter (OTC) transactions.

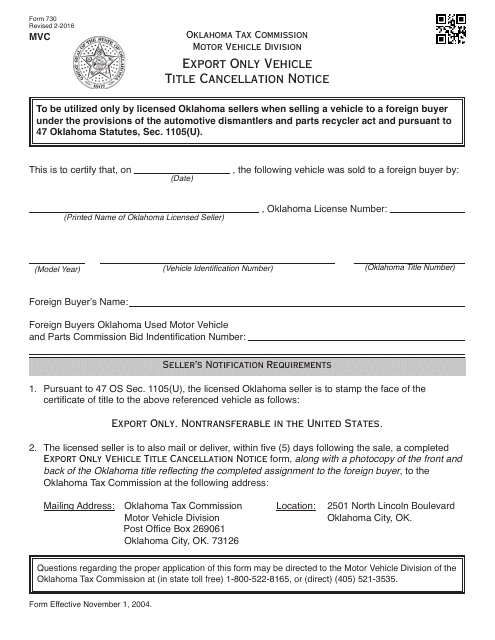

This type of document is used for canceling the title of an export-only vehicle in Oklahoma.

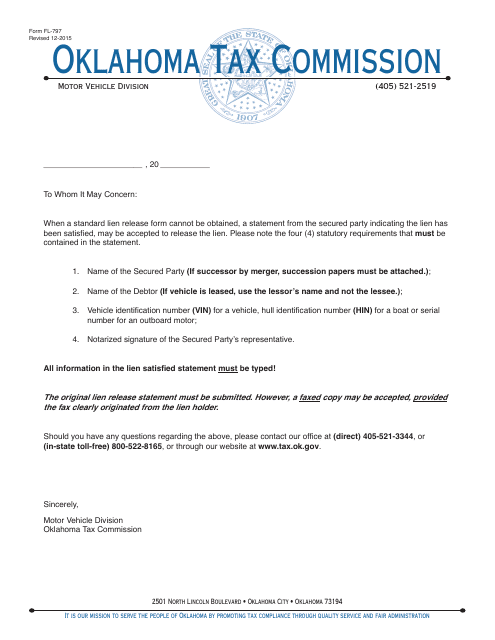

This form is used for releasing a lien on a property in Oklahoma. It is an affidavit letter that confirms the lien is no longer active.

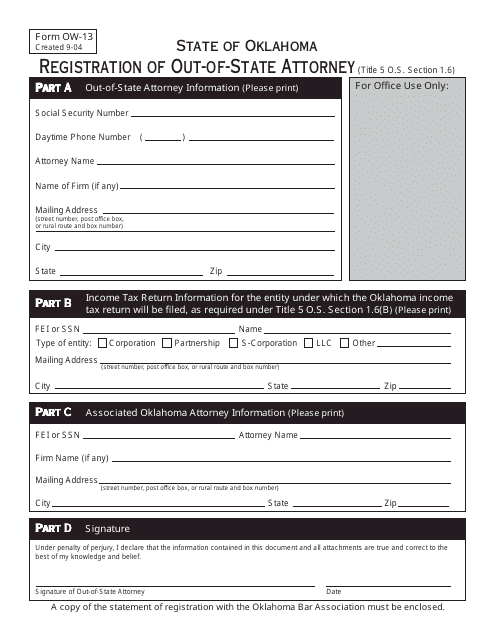

This document is used for registering an out-of-state attorney in the state of Oklahoma, as required by Title 5 O.S. Section 1.6.

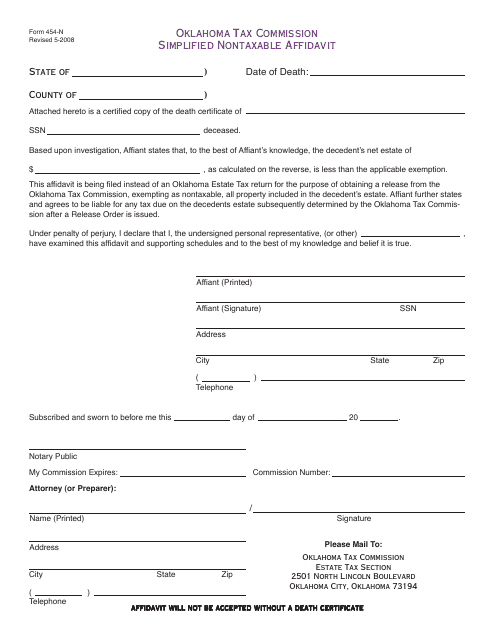

This Form is used for submitting a Simplified Nontaxable Affidavit in Oklahoma.

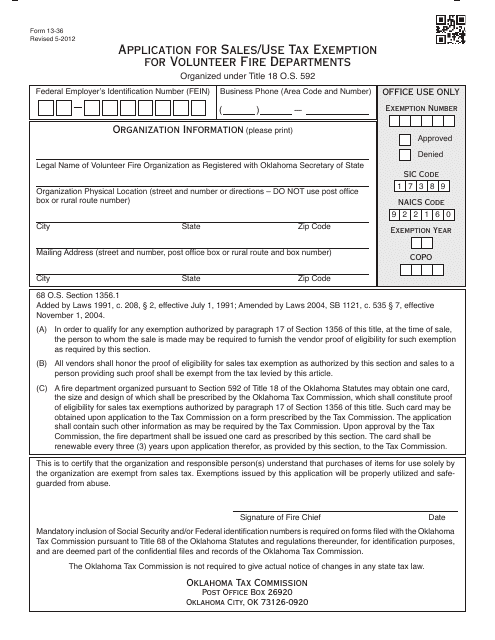

This document is used for volunteer fire departments in Oklahoma to apply for sales/use tax exemption.

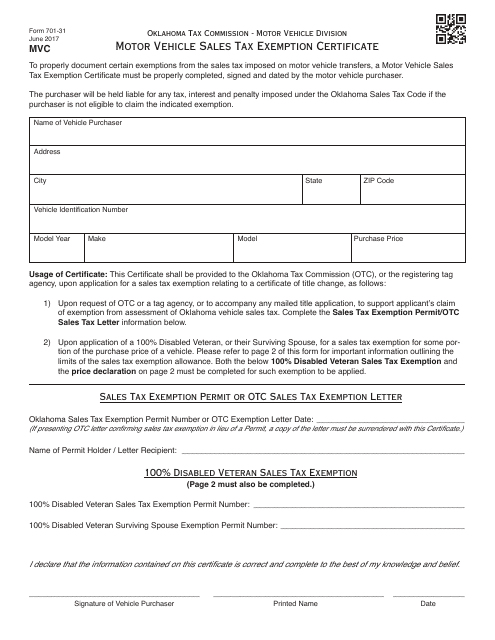

This document is used for claiming a sales tax exemption on motor vehicle purchases in Oklahoma. It is an OTC Form 701-31.

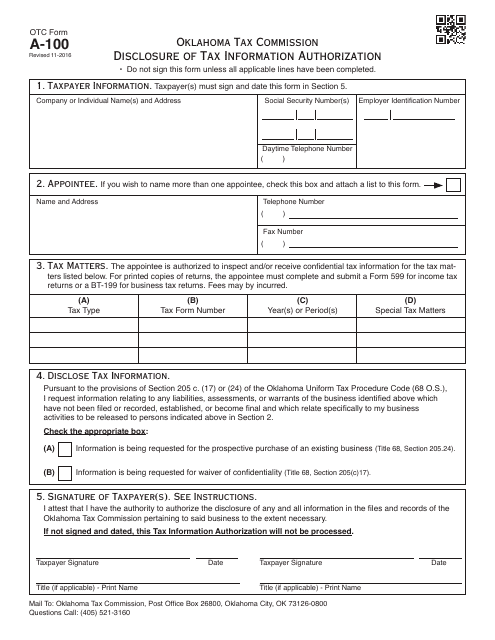

This Form is used for authorizing the disclosure of tax information in Oklahoma.

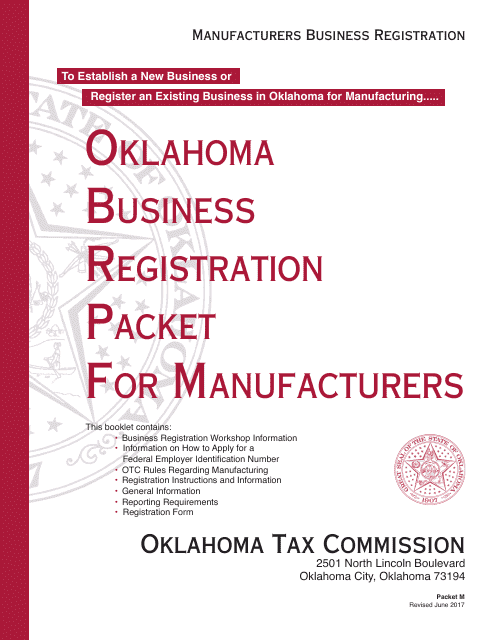

This form is used for registering businesses that manufacture products in Oklahoma. It is part of the OTC Form M Oklahoma Business Registration Packet.

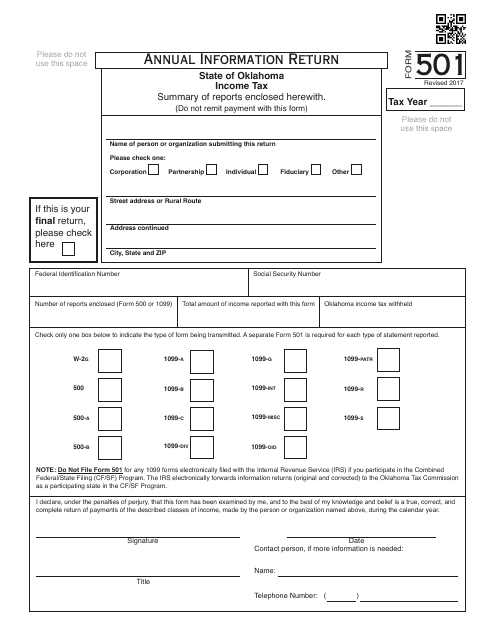

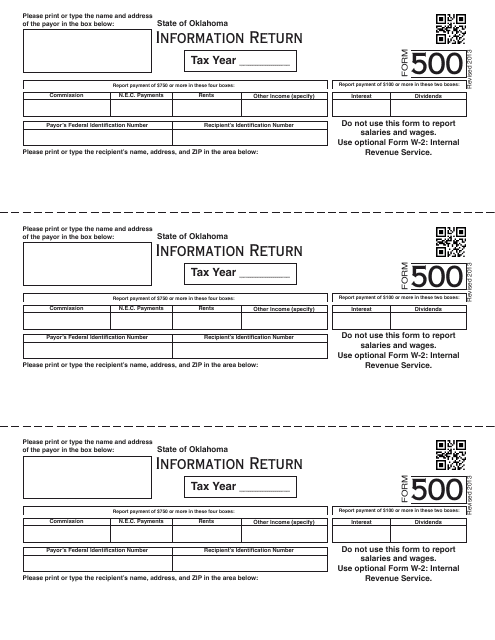

This form is used for filing the Annual Information Return in Oklahoma for OTC (Oklahoma Tax Commission). It is required for businesses to report their income and other relevant financial information for tax purposes.

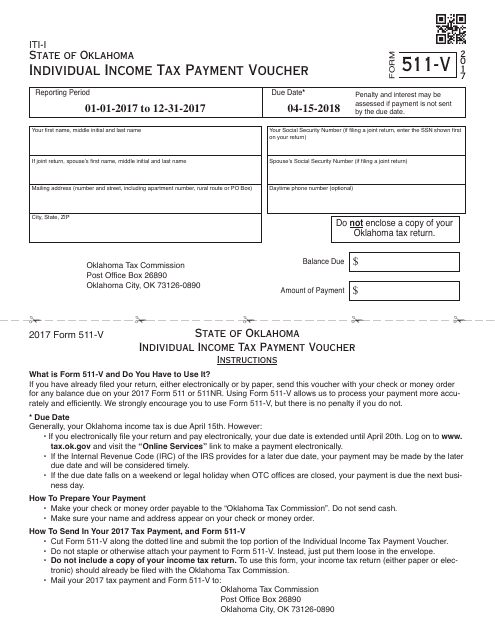

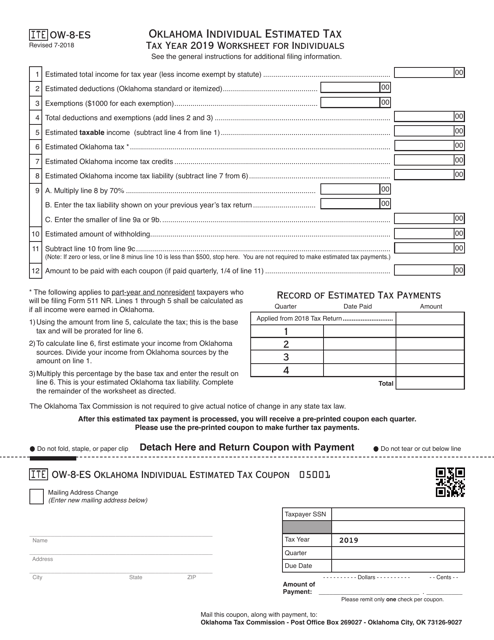

This form is used for making individual income tax payments in the state of Oklahoma. It is used by residents to submit their tax payments to the Oklahoma Tax Commission.

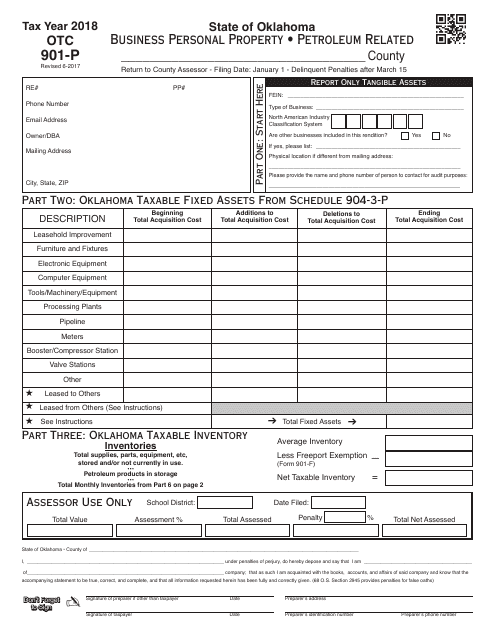

This Form is used for reporting business personal property related to petroleum in the state of Oklahoma.

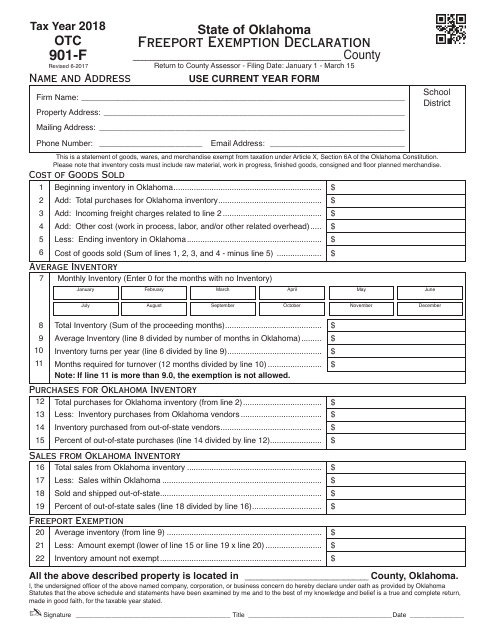

This document is used for declaring a Freeport exemption in the state of Oklahoma.

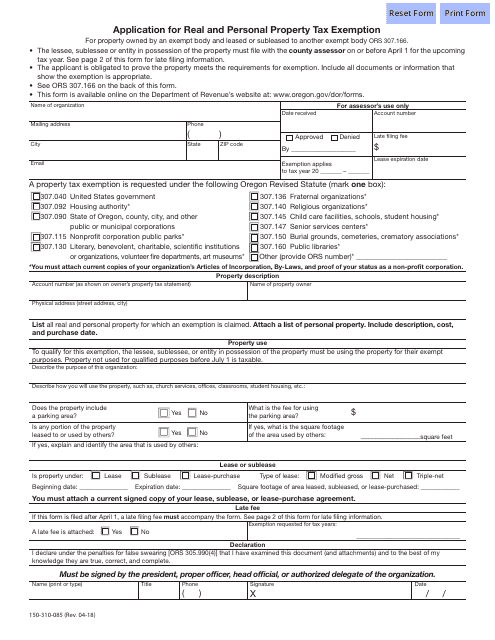

This form is used for applying for a tax exemption on real and personal property in Oklahoma.

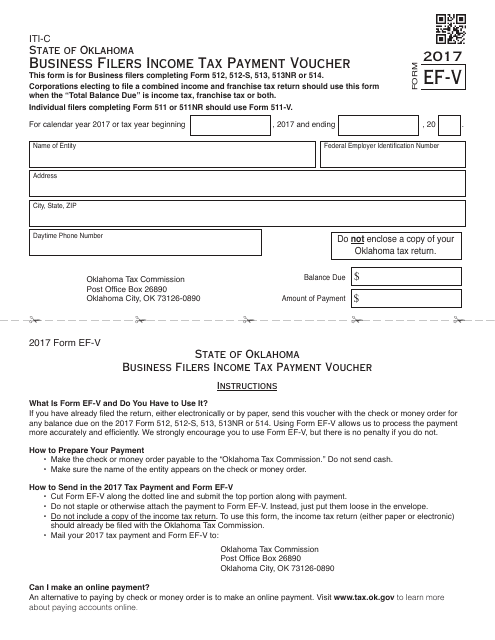

This form is used for making income tax payments for business filers in Oklahoma who are filing Form 512, 512-s, 513, 513-nr, or 514.

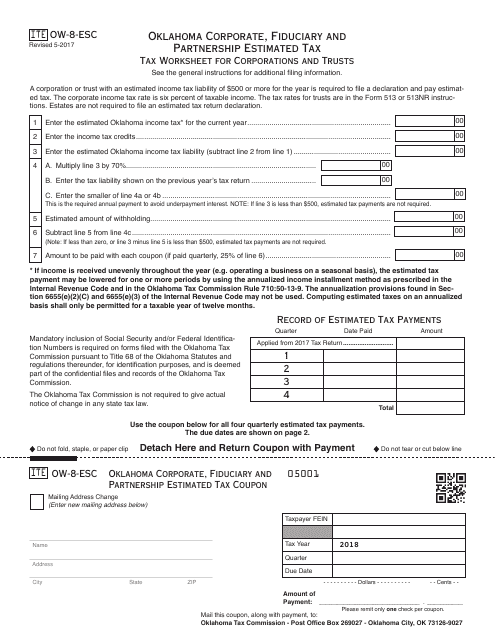

This form is used for corporations and trusts in Oklahoma to declare their estimated tax payments.

This document provides the necessary forms and instructions for filing partnership income taxes in the state of Oklahoma.

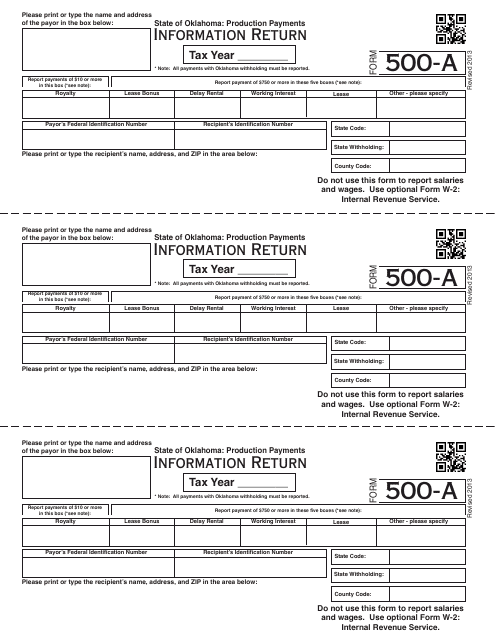

This Form is used for reporting production payments in Oklahoma.

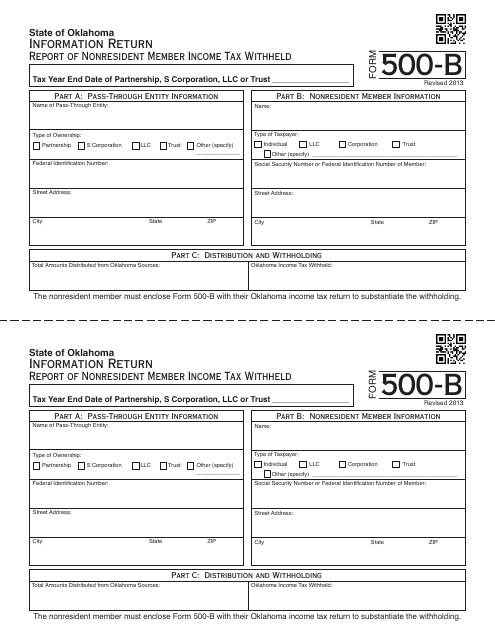

This form is used to report and withhold income tax for nonresident members in Oklahoma.

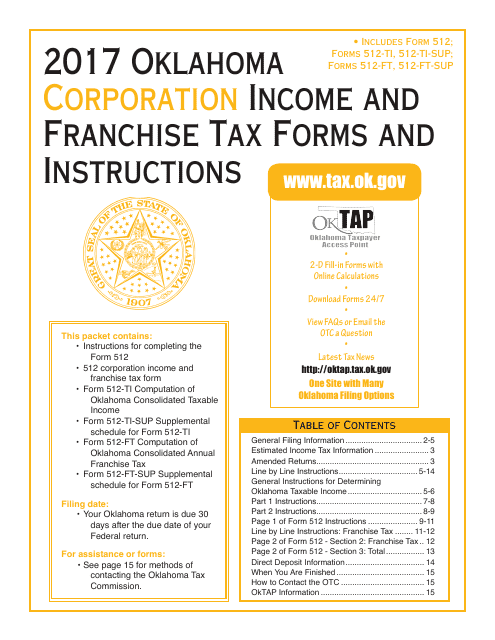

This document provides the necessary forms and instructions for filing corporation income and franchise taxes in the state of Oklahoma.

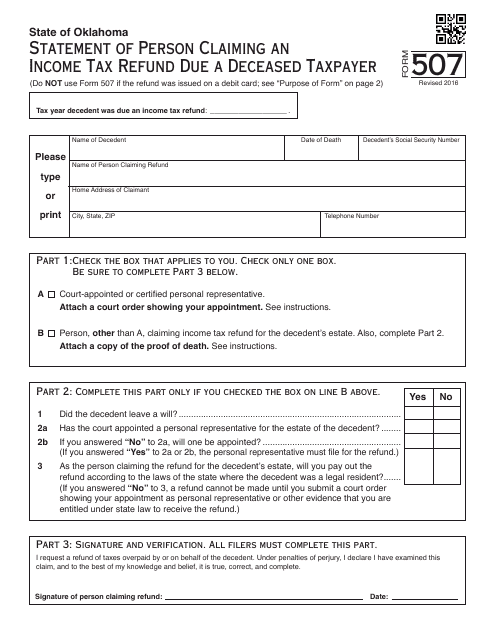

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Oklahoma.