West Virginia State Tax Division Forms

Documents:

527

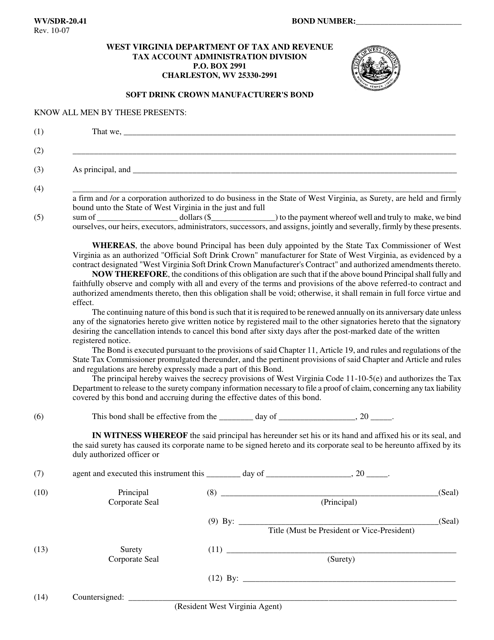

This Form is used for soft drink crown manufacturers in West Virginia to submit a bond.

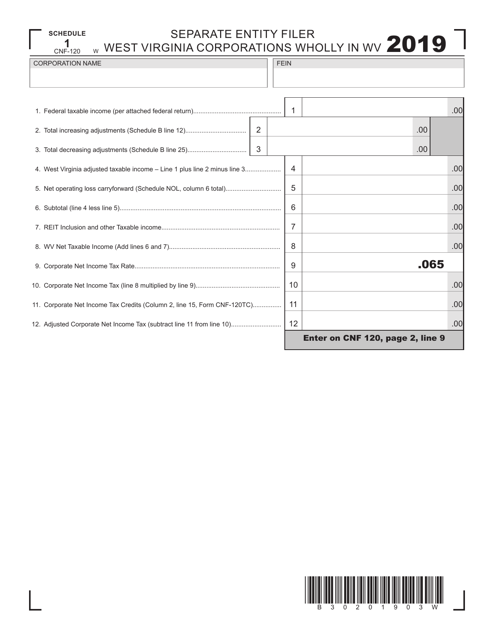

This form is used for West Virginia corporations that are separate entities and wholly based in West Virginia to file their taxes. It is known as CNF-120 Schedule 1 for corporate tax purposes.

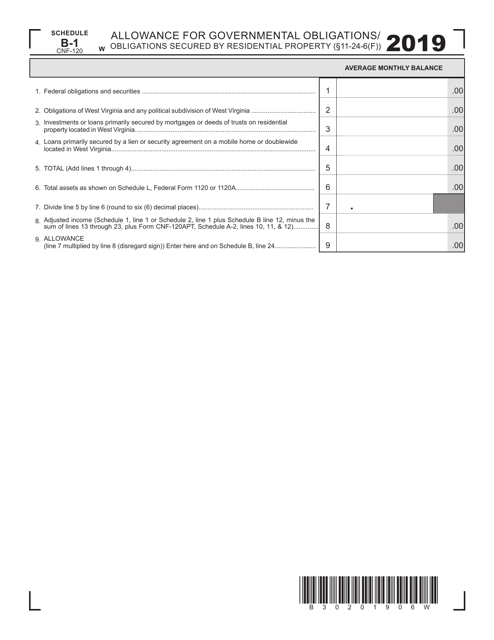

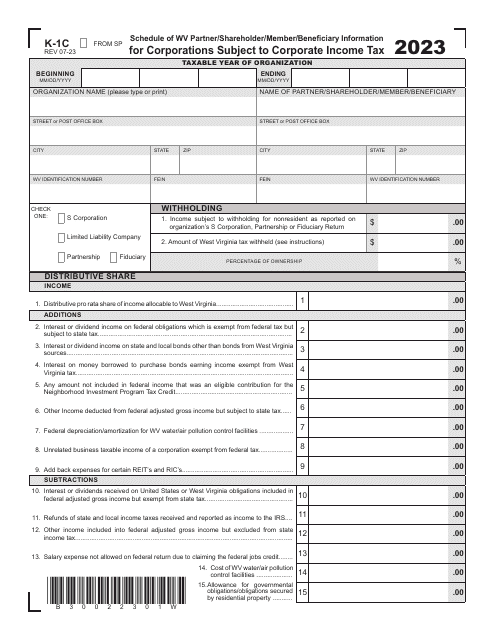

This Form is used for calculating the allowance for governmental obligations or obligations secured by residential property in West Virginia.

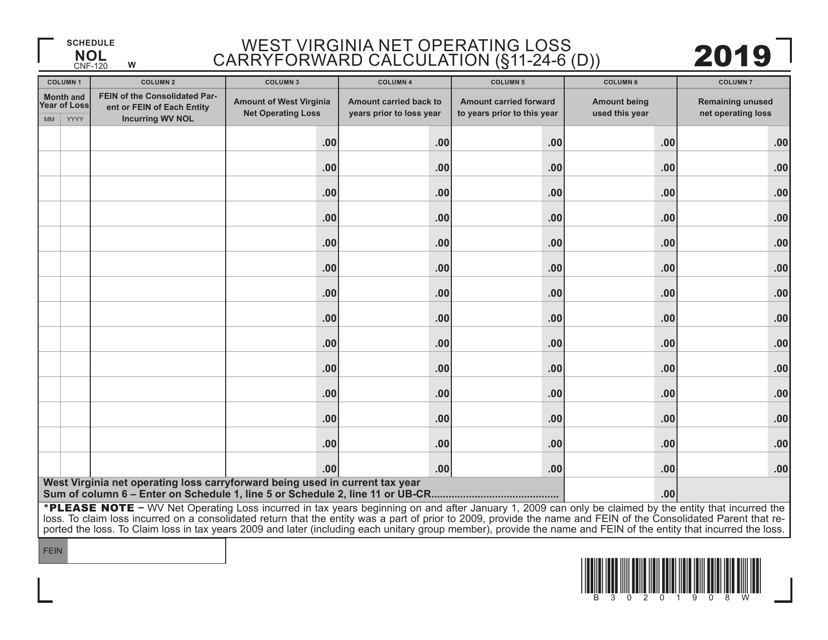

This form is used for calculating the net operating loss carryforward in West Virginia. It is specifically for taxpayers in West Virginia who are filing their state taxes.

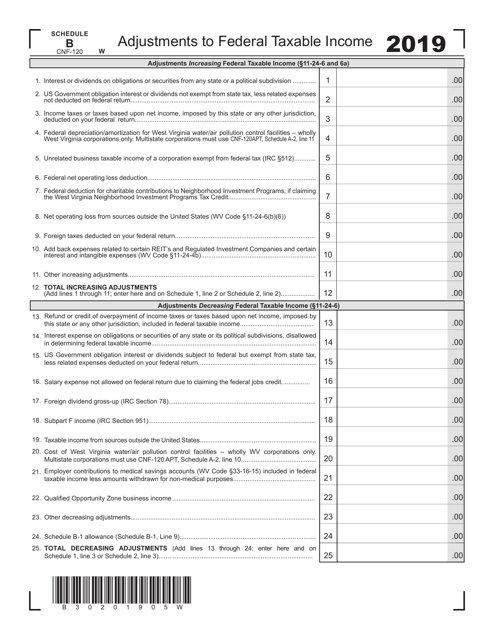

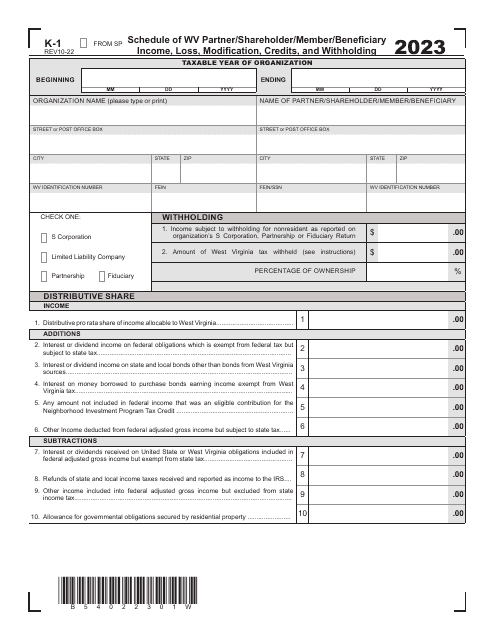

This form is used for reporting adjustments to federal taxable income for residents or businesses in West Virginia. It is required to calculate the correct state tax liability.

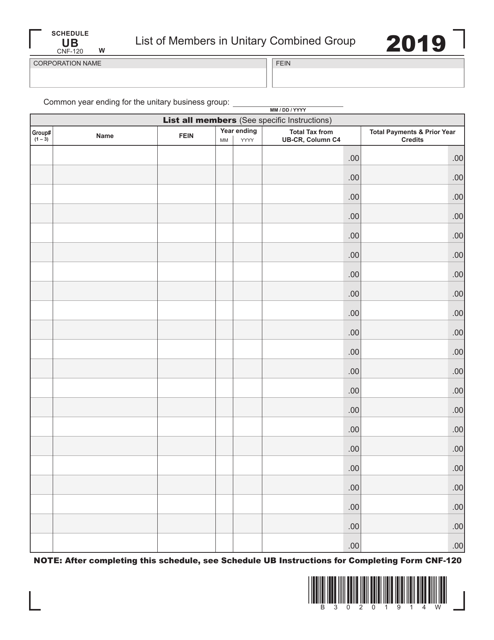

This form is used for listing the members in a unitary combined group in West Virginia for tax purposes.

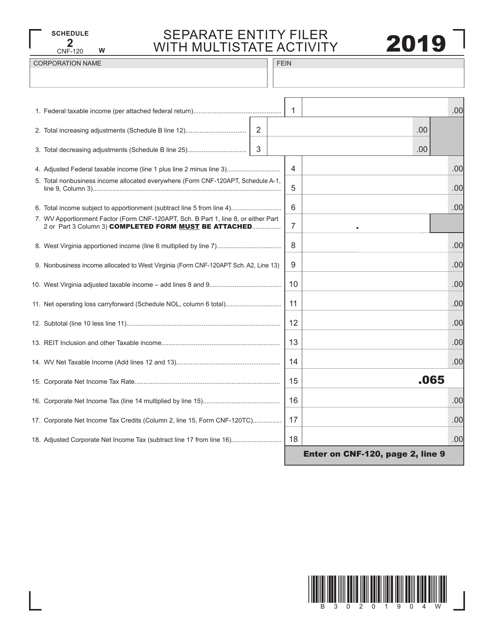

This form is used for filing taxes for separate entities with multistate activity in West Virginia.

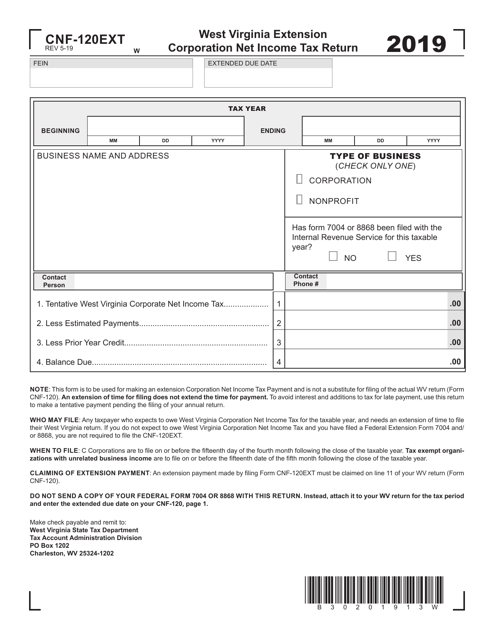

This Form is used for filing the West Virginia Extension Corporation Net Income Tax Return in West Virginia.

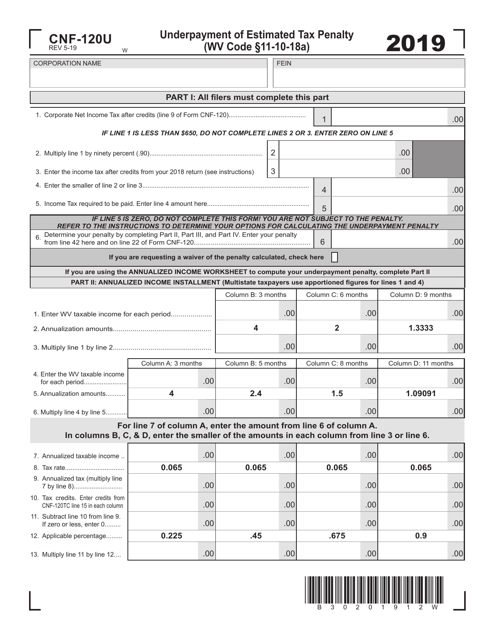

This form is used for calculating and paying the underpayment of estimated tax penalty in West Virginia.

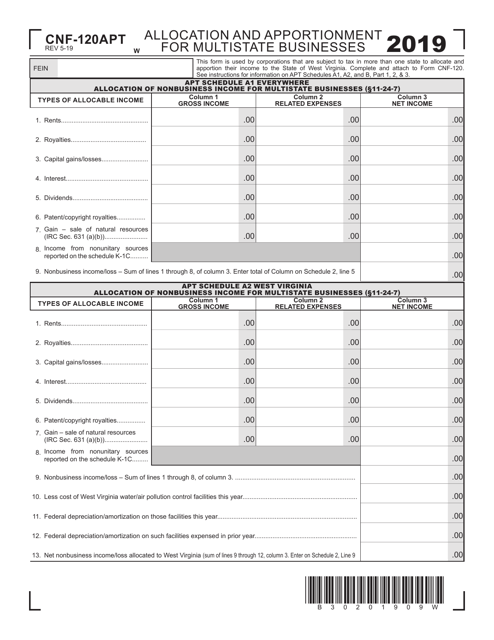

This form is used for allocating and apportioning income for multistate businesses in West Virginia.

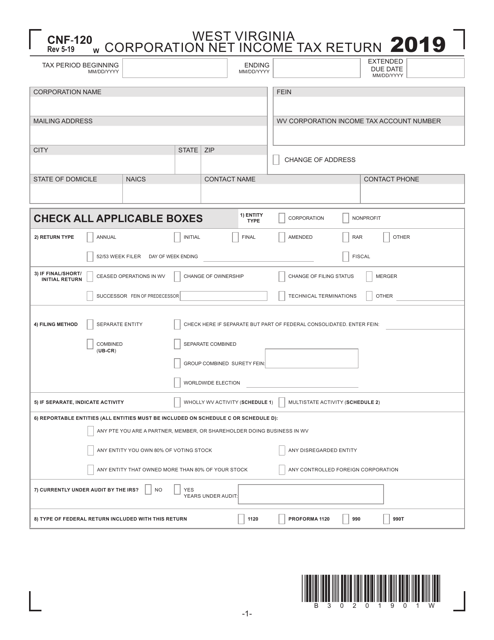

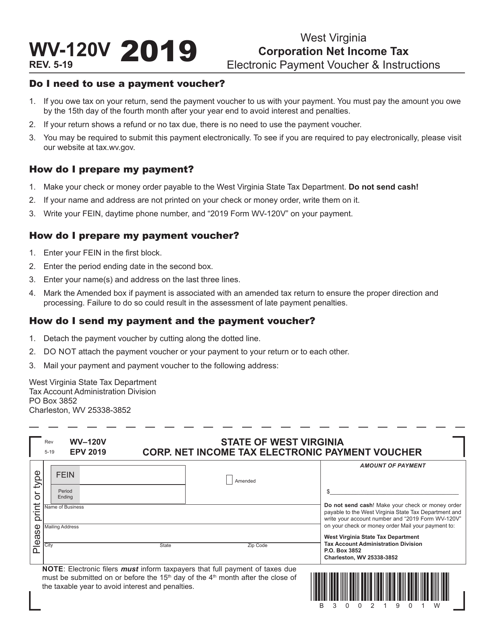

This Form is used for reporting and paying net income tax for corporations in West Virginia. The form, CNF-120, must be filled out and submitted to the West Virginia Department of Revenue. It includes instructions on how to calculate and report your corporation's net income tax liability.

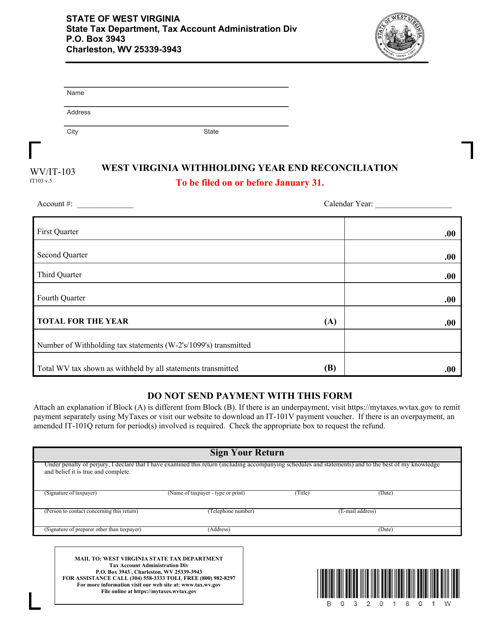

This form is used for the year-end reconciliation of withholding taxes in West Virginia.

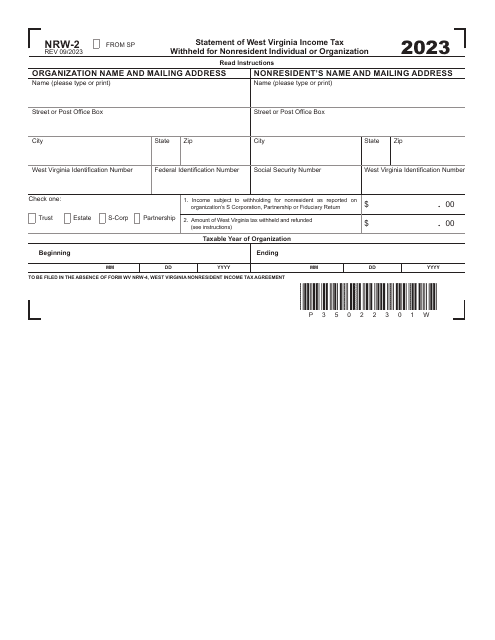

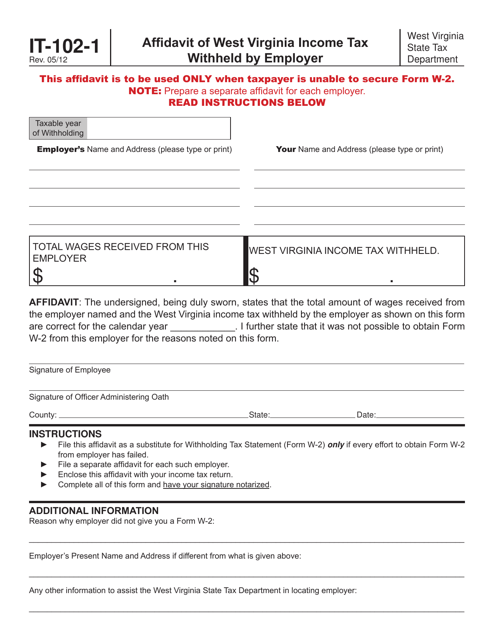

This form is used for reporting West Virginia income tax withheld by an employer in West Virginia.

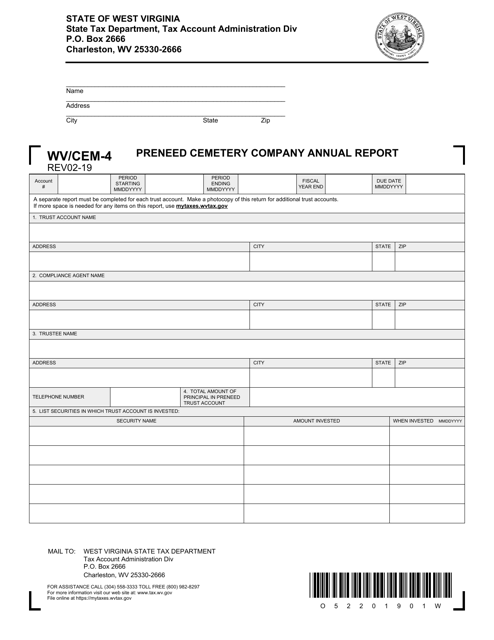

This form is used for filing the Preneed Cemetery Company Annual Report in West Virginia.

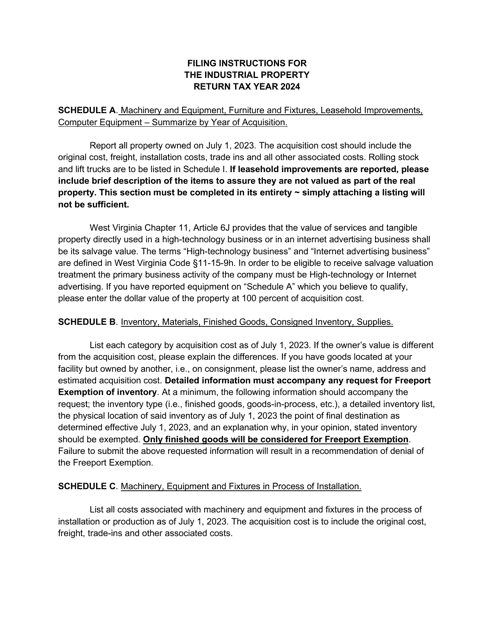

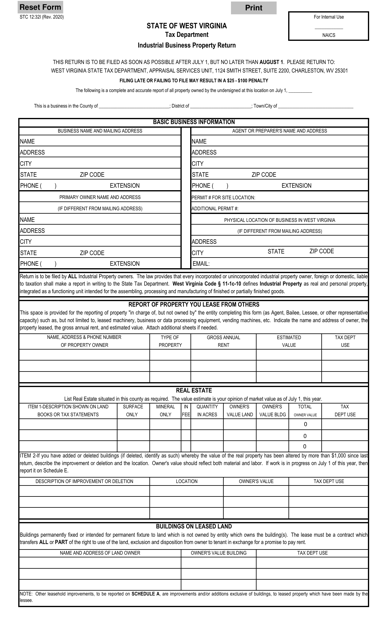

This form is used for reporting industrial business property in West Virginia. It must be filled out by property owners to provide information about their industrial assets for tax purposes.

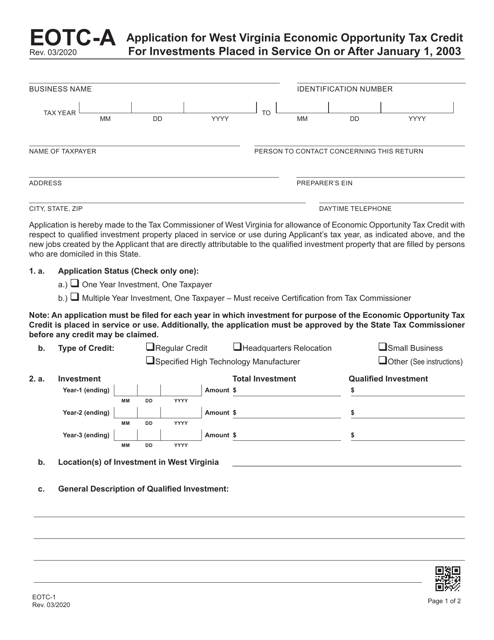

This form is used for applying for the West Virginia Economic Opportunity Tax Credit for investments made after January 1, 2003.

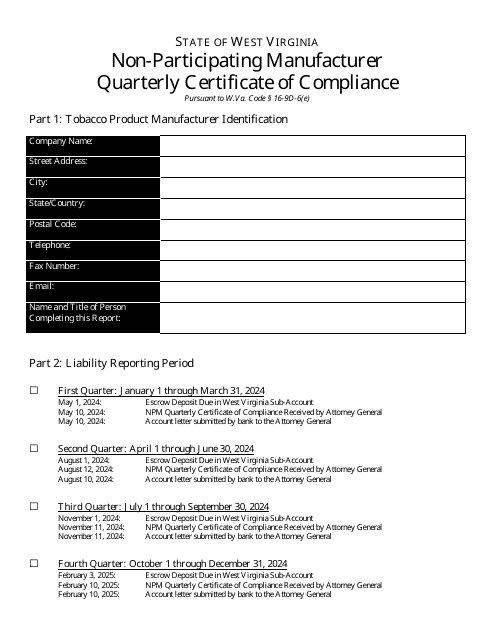

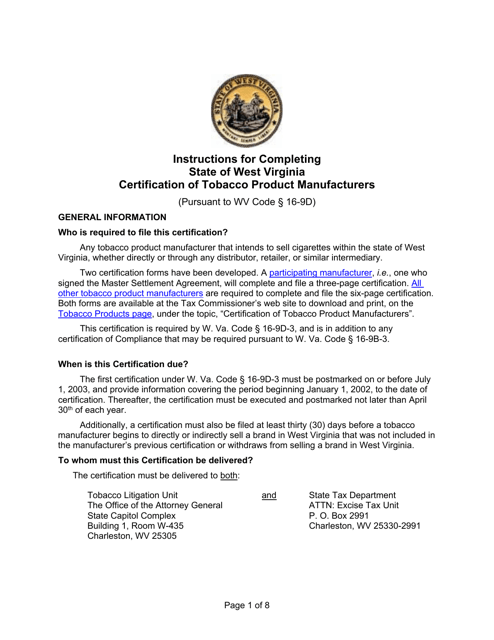

This document provides instructions for tobacco product manufacturers in West Virginia to certify their products. It outlines the requirements and procedures for obtaining certification.

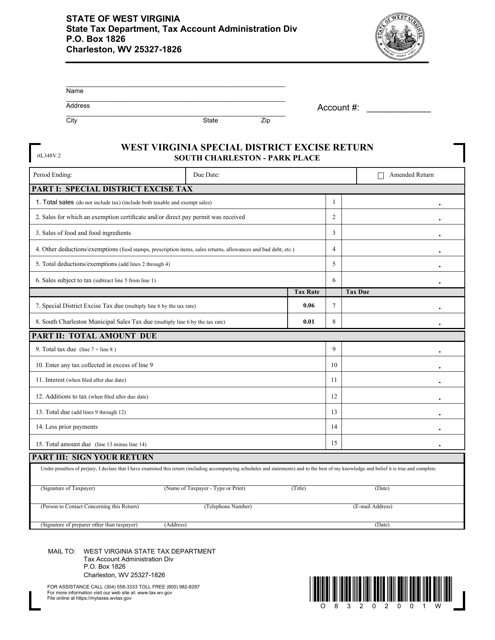

This form is used for filing the West Virginia Special District Excise Return for businesses located in South Charleston - Park Place area of South Charleston, West Virginia.

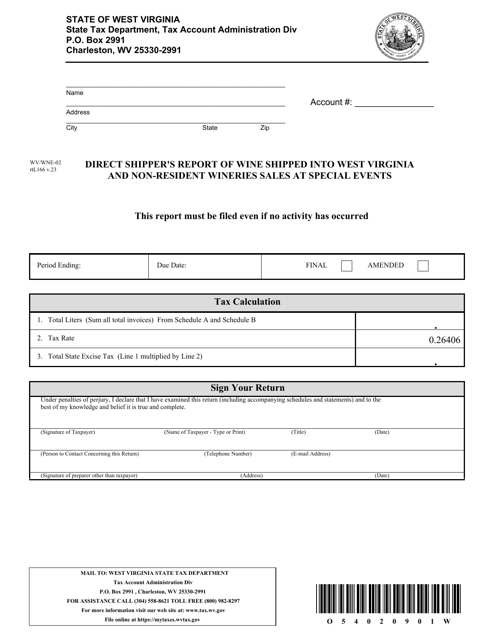

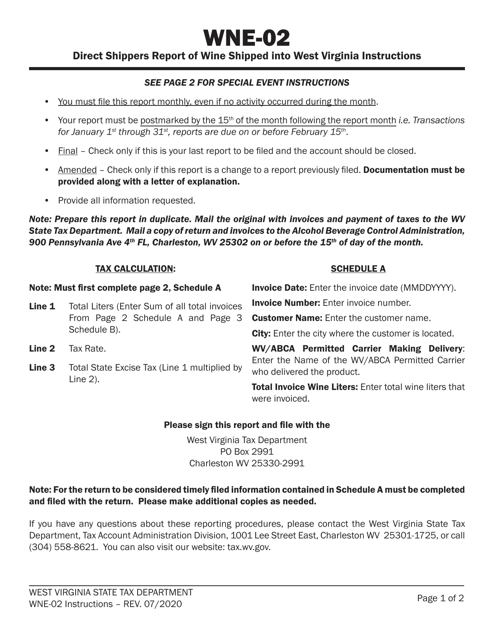

This Form is used for reporting the shipment of wine into West Virginia by direct shippers and the sales made by non-resident wineries at special events in West Virginia.

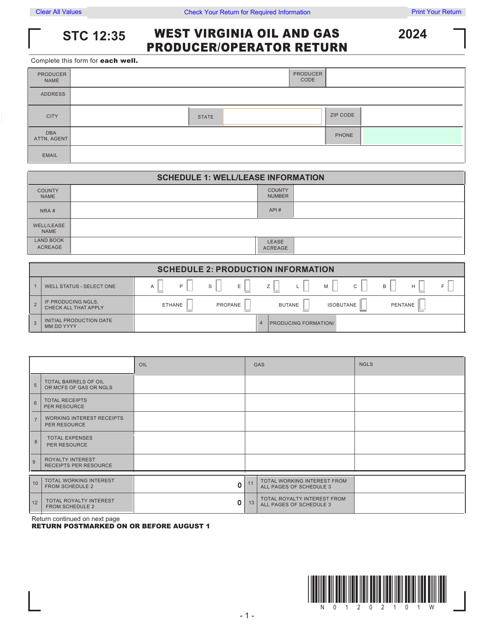

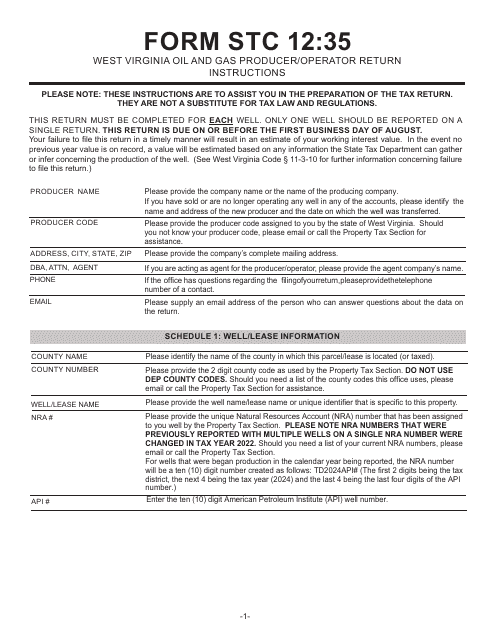

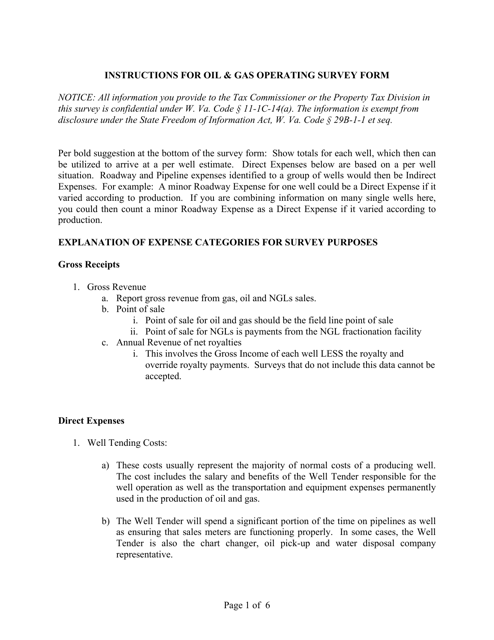

This Form is used for conducting surveys related to oil and gas operations in West Virginia. It provides instructions on how to properly fill out the survey form.

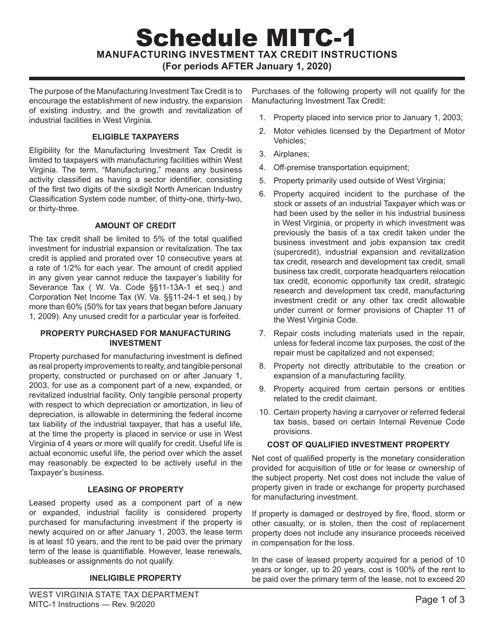

This document provides instructions for filling out Schedule WV/MITC-1, which allows businesses in West Virginia to claim a tax credit for manufacturing investments. It outlines the necessary information and steps to complete the form accurately.

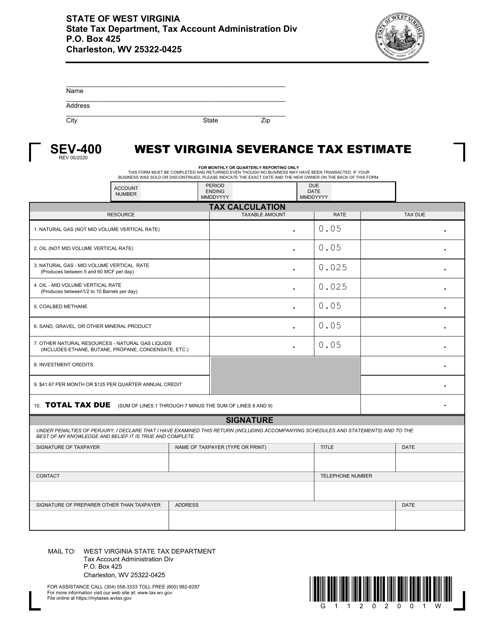

This Form is used for estimating the severance tax in West Virginia. It is used by individuals or businesses involved in extracting natural resources such as coal, oil, or gas.

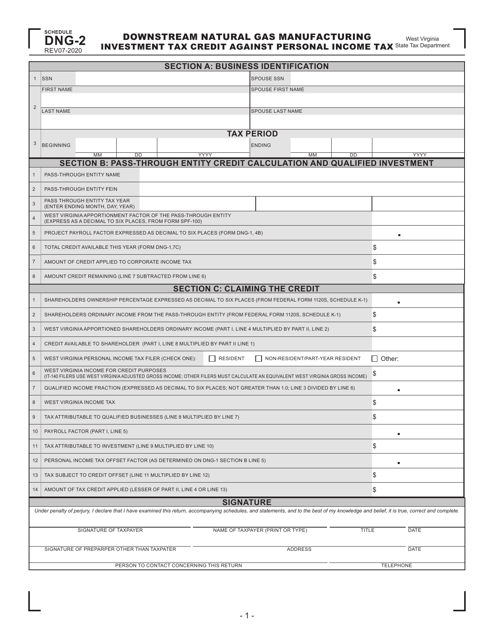

This Form is used for claiming the Downstream Natural Gas Manufacturing Investment Tax Credit Against Personal Income Tax in West Virginia.