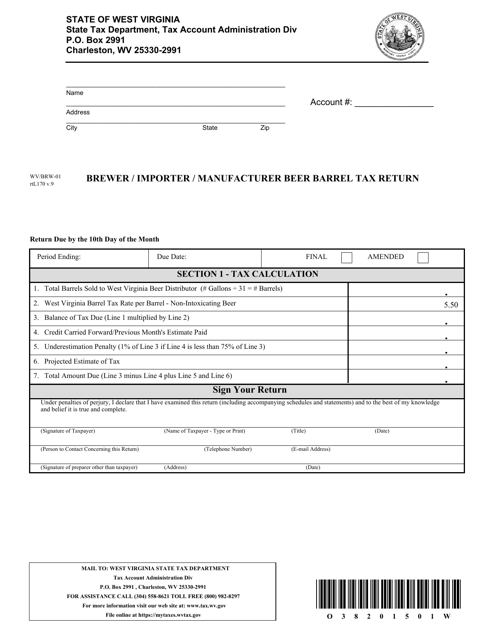

West Virginia State Tax Division Forms

Documents:

527

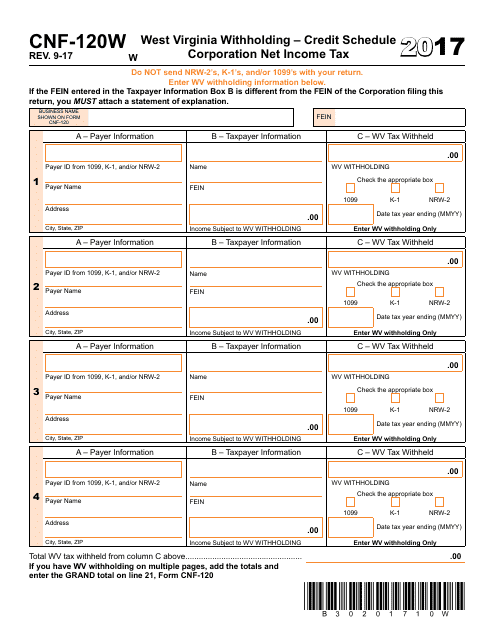

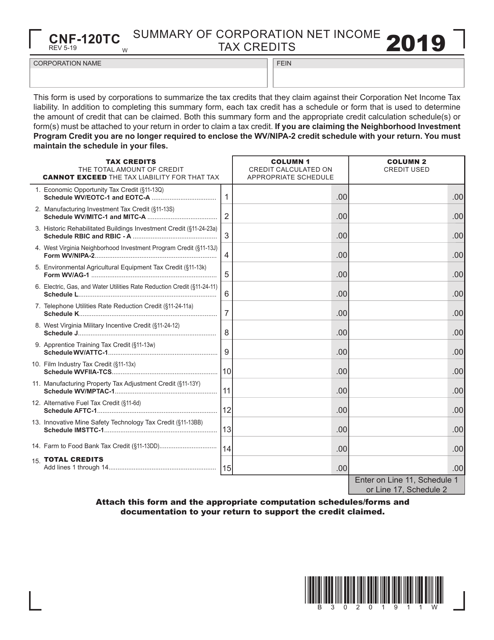

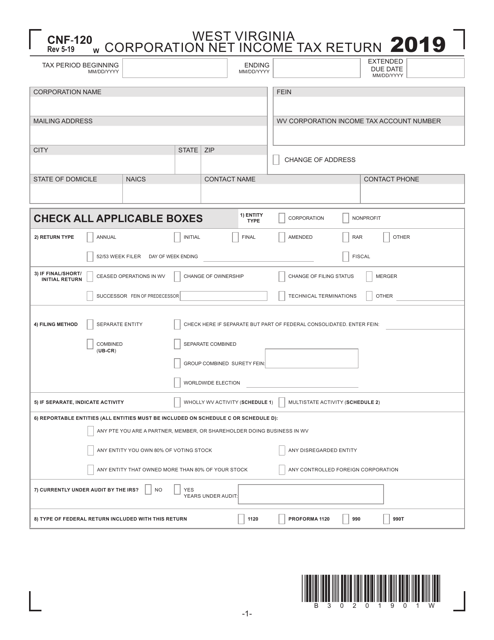

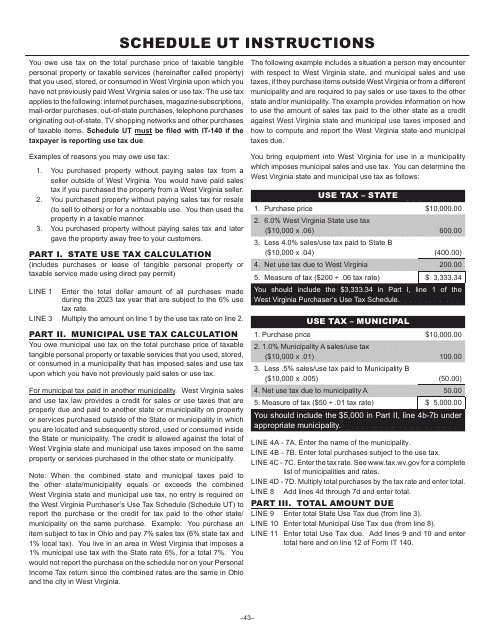

This form is used for reporting and calculating the credit schedule for corporation net income tax in West Virginia. The form is specifically for corporations that are withholding taxes in West Virginia.

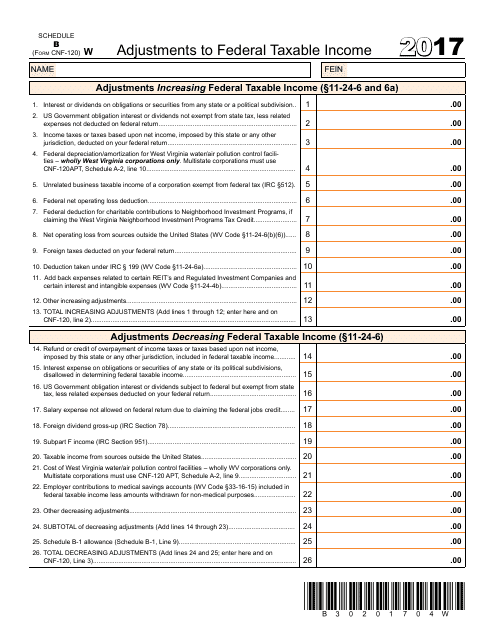

This form is used for reporting adjustments to federal taxable income for residents of West Virginia.

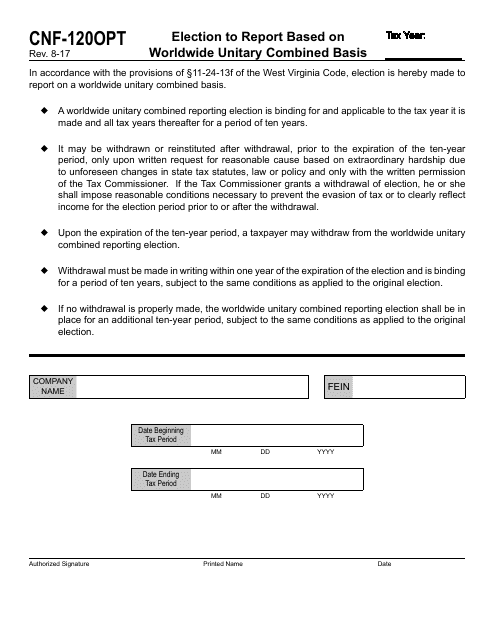

This form is used for filing an election to report taxes based on a worldwide unitary combined basis in the state of West Virginia.

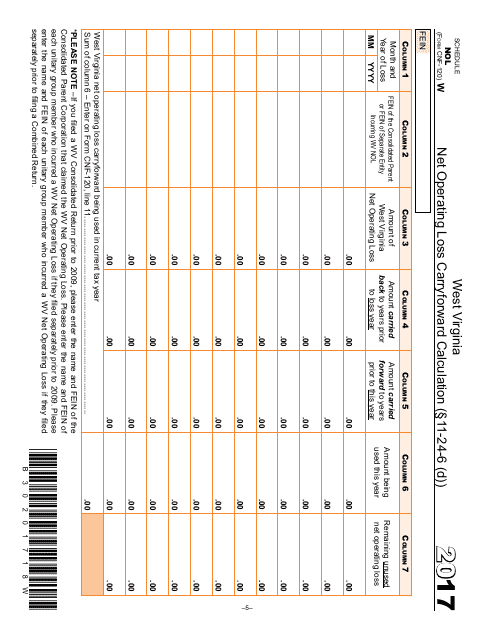

This form is used for calculating the Net Operating Loss (NOL) carryforward for individuals and businesses in West Virginia.

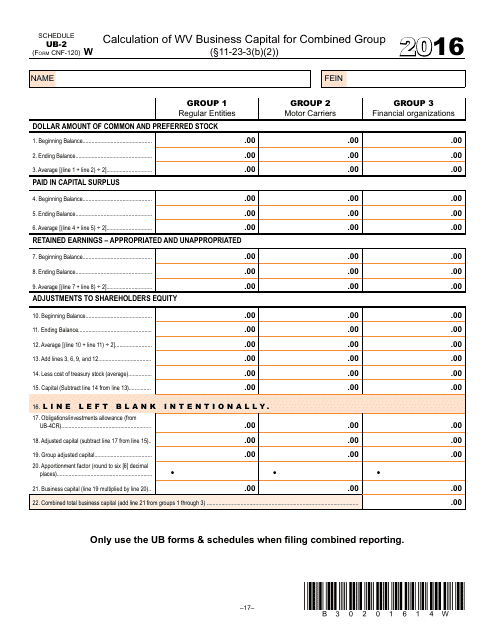

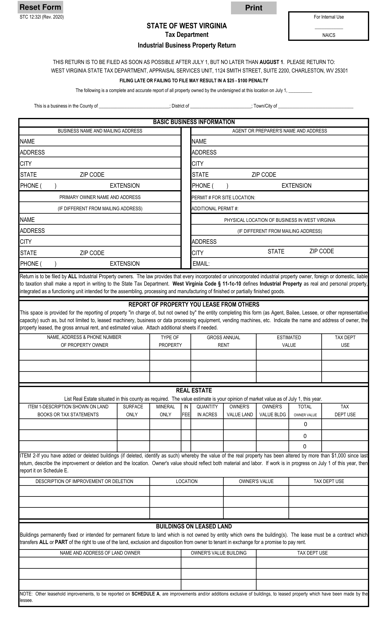

This form is used for calculating the business capital for a combined group in West Virginia.

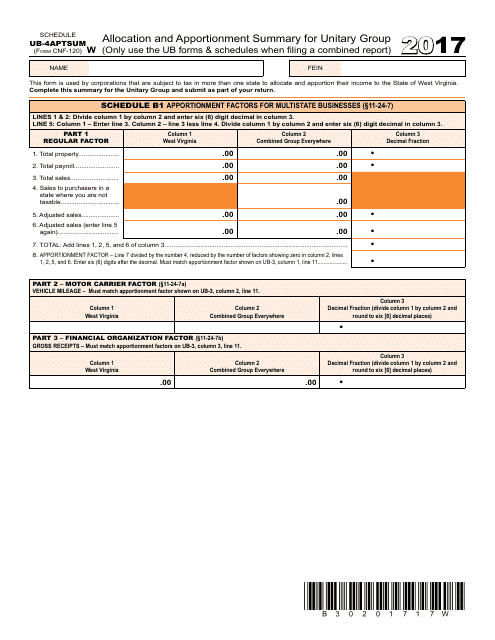

This form is used for allocating and apportioning income and expenses for a unitary group in West Virginia.

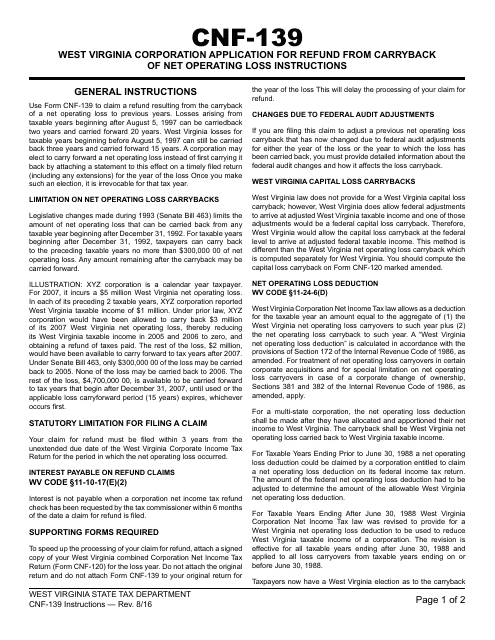

This Form is used for West Virginia corporations to apply for a refund from carryback of net operating losses. It provides instructions on how to complete the form and submit the application.

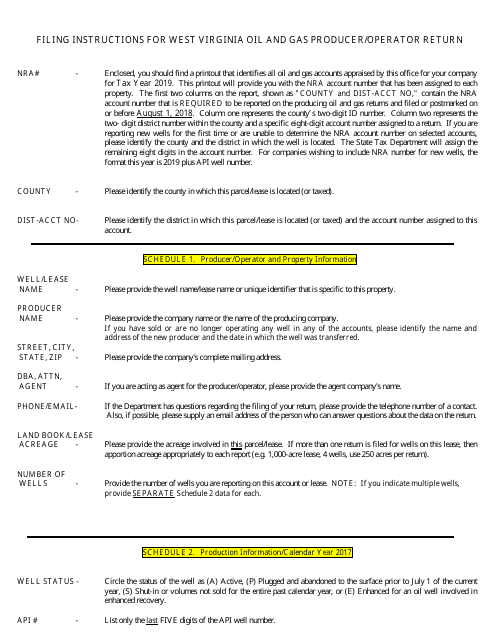

This Form is used for filing the West Virginia Oil and Gas Producer/Operator Return in West Virginia. It provides instructions on how to complete and submit the form.

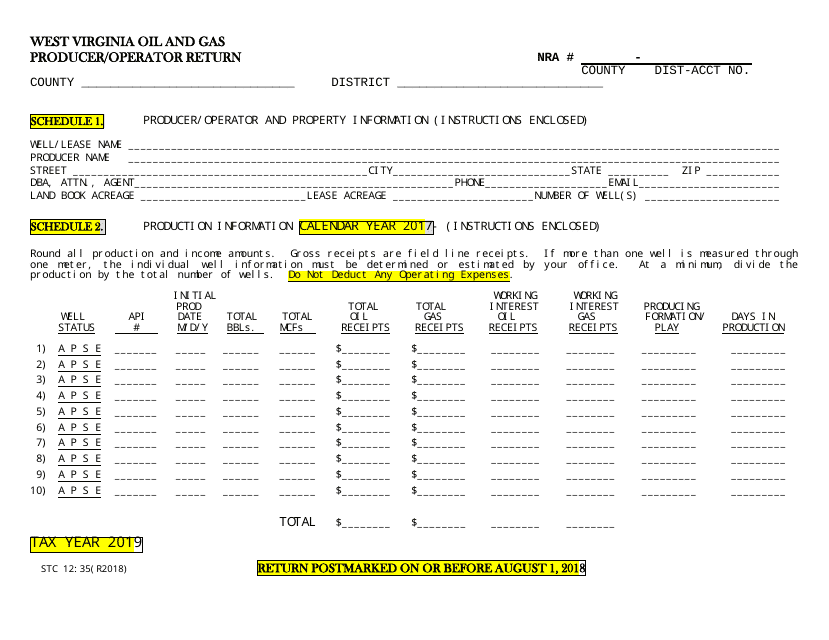

This form is used for West Virginia oil and gas producers/operators to file their return and report their activity.

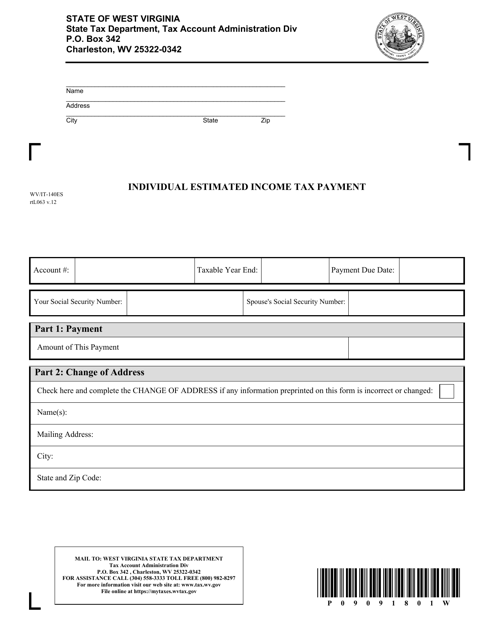

This Form is used for making estimated income tax payments for individuals in West Virginia.

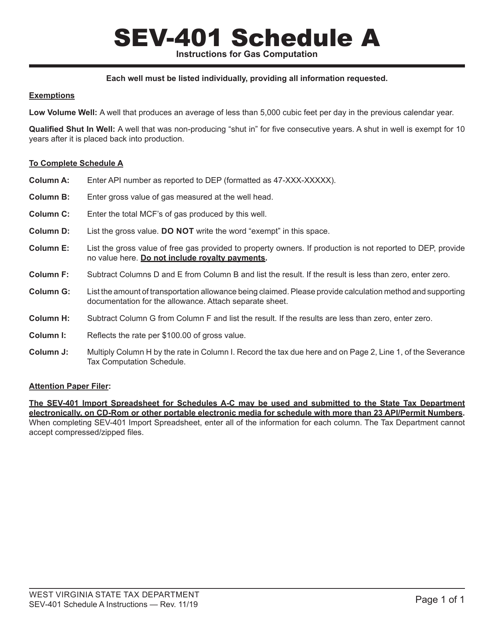

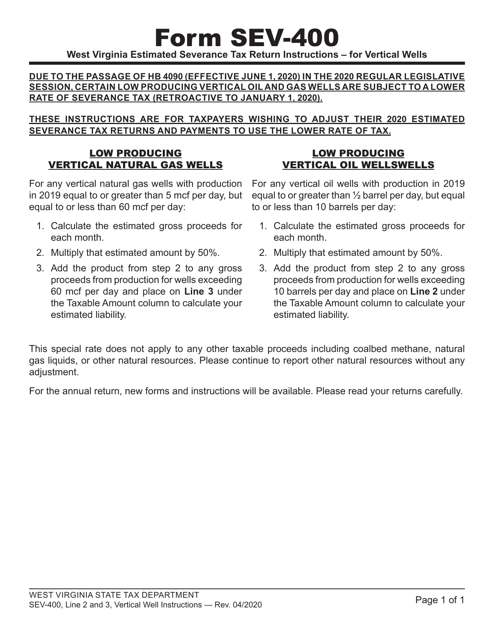

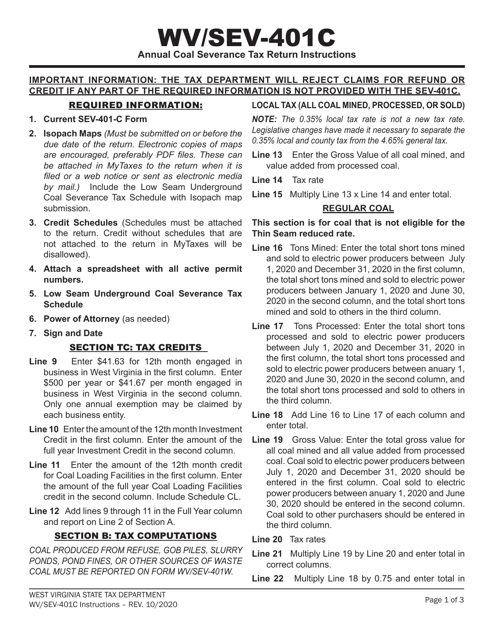

This document is used for calculating taxes and exemptions for natural gas in West Virginia. It provides instructions on how to fill out Form SEV-401 Schedule A.

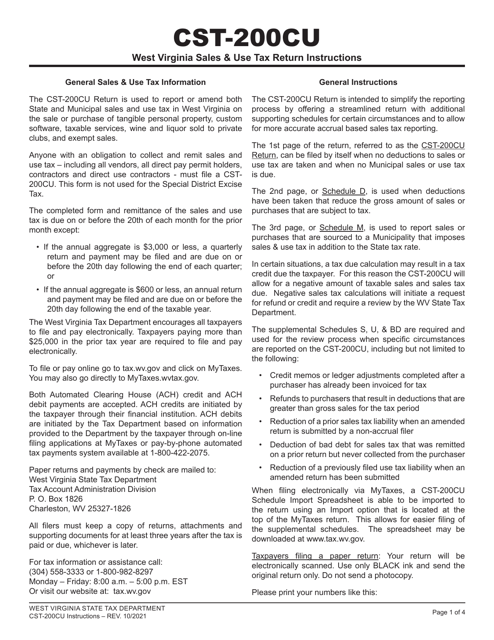

This Form is used for reporting special district excise taxes in Ohio County, West Virginia. It is specifically for The Highlands area.

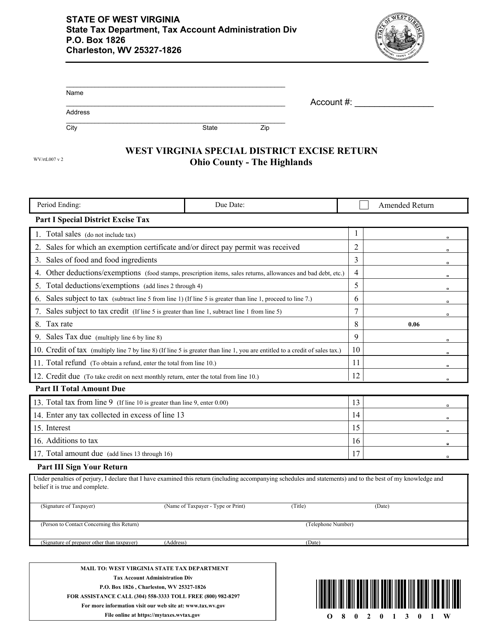

This form is used for filing the West Virginia Special District Excise Return for Harrison County, specifically for Charles Pointe, West Virginia.

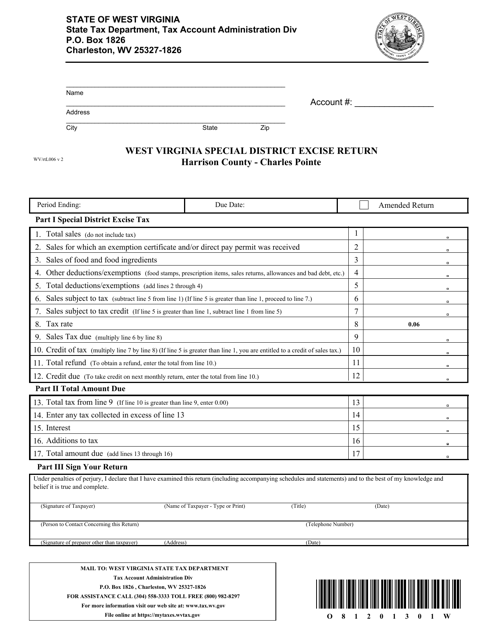

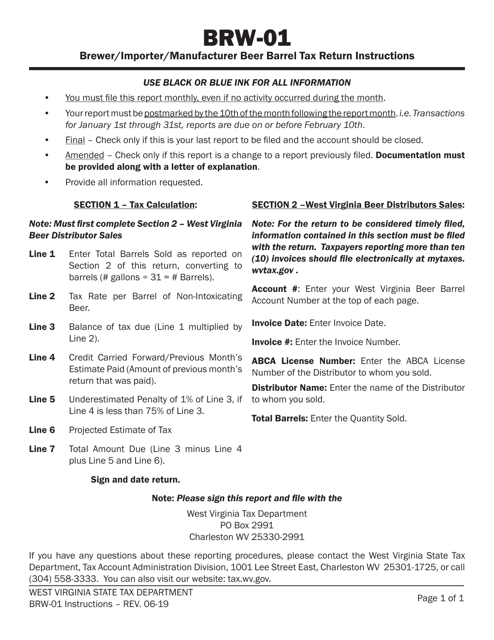

This Form is used for filing the Beer Barrel Tax Return for Brewer, Importer, and Manufacturer in West Virginia.

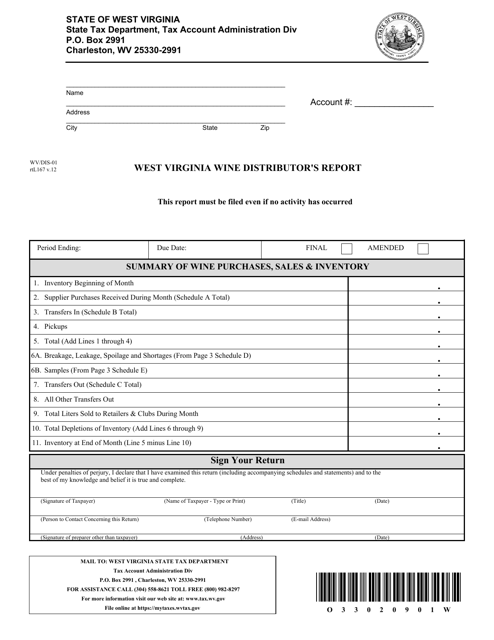

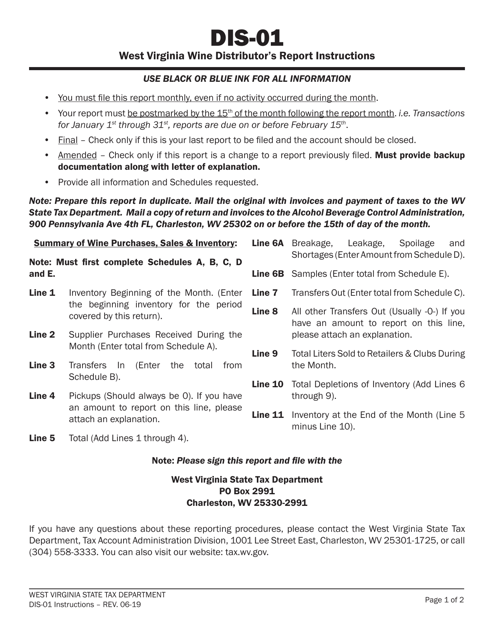

This form is used for wine distributors in West Virginia to report their activities and sales. It is required by the state to ensure compliance with regulations and taxation purposes.

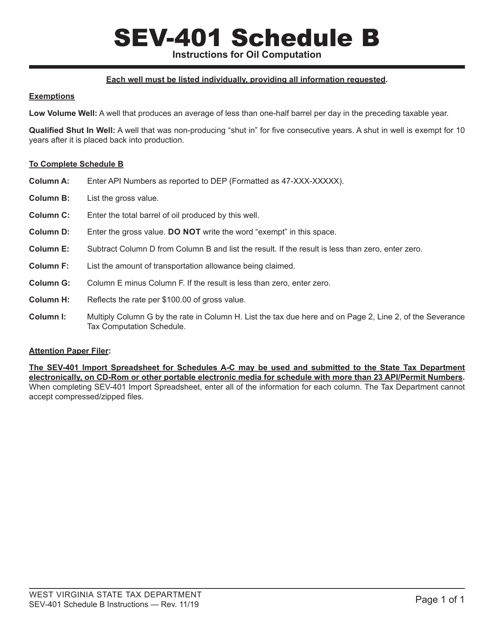

This document is used for calculating the oil tax and claiming exemptions in West Virginia.

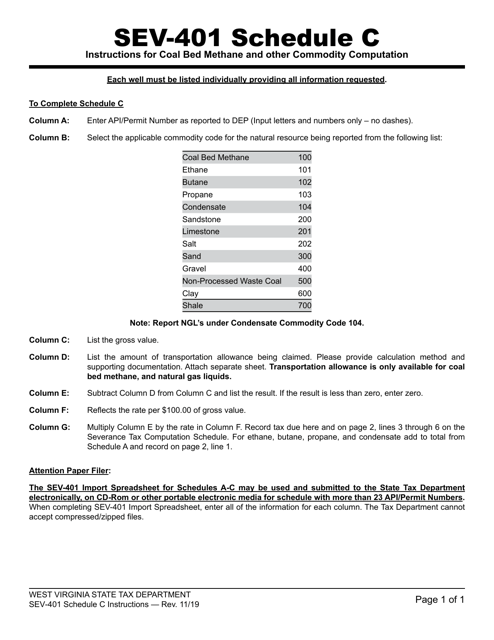

This Form is used for calculating coal bed methane and other commodity values for the state of West Virginia. It provides instructions for reporting and computing the relevant figures.

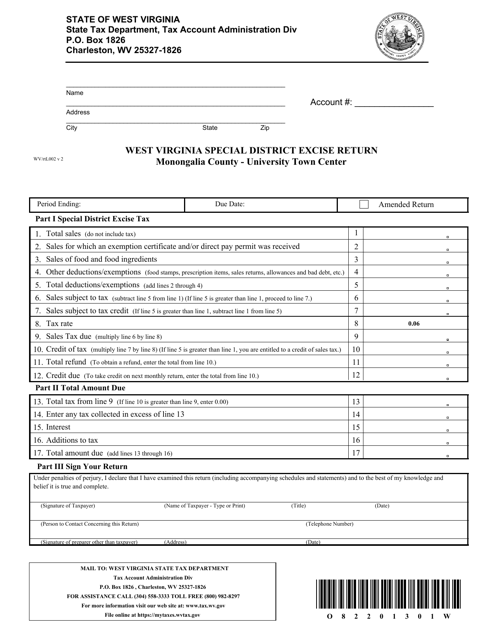

This form is used for filing the West Virginia Special District Excise Return specific to the University Town Center in Monongalia County, West Virginia.

This Form is used for Brewer/Importer/Manufacturer to report and pay beer barrel tax in West Virginia.

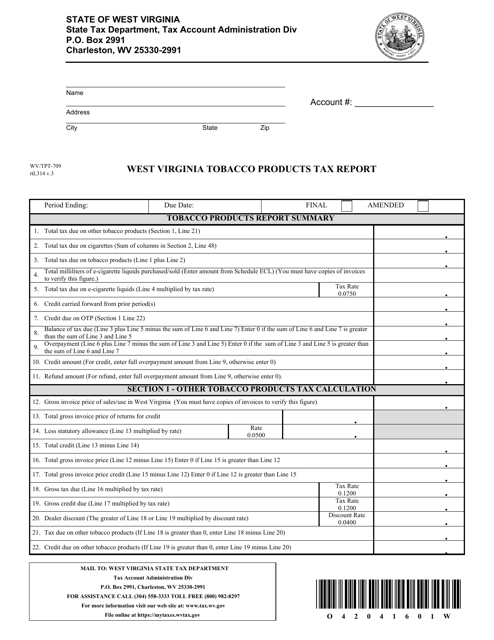

This Form is used for reporting and paying tobacco products taxes in the state of West Virginia.

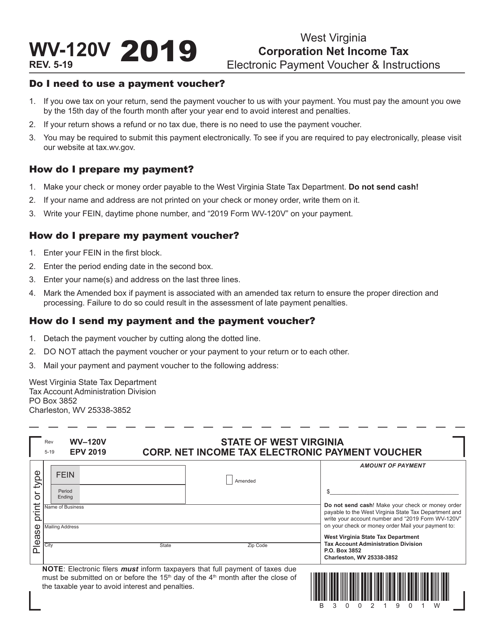

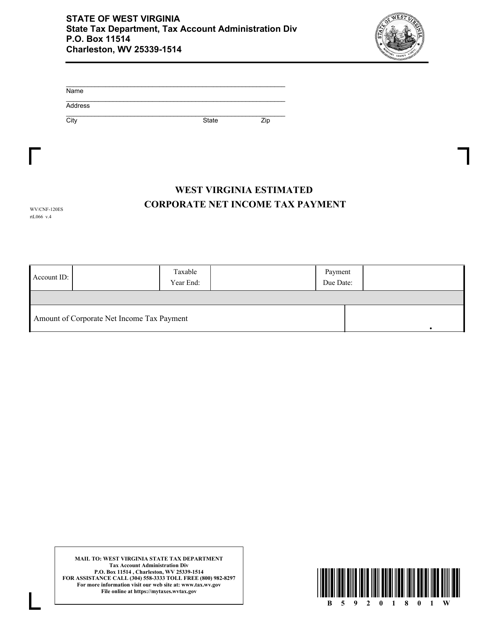

This form is used for making estimated corporate net income tax payments in West Virginia.

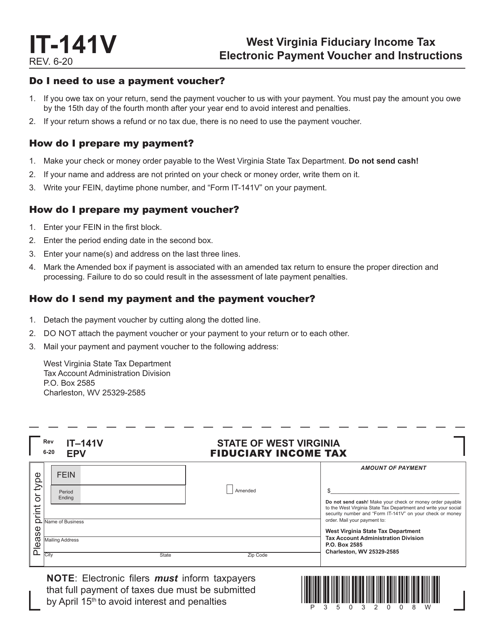

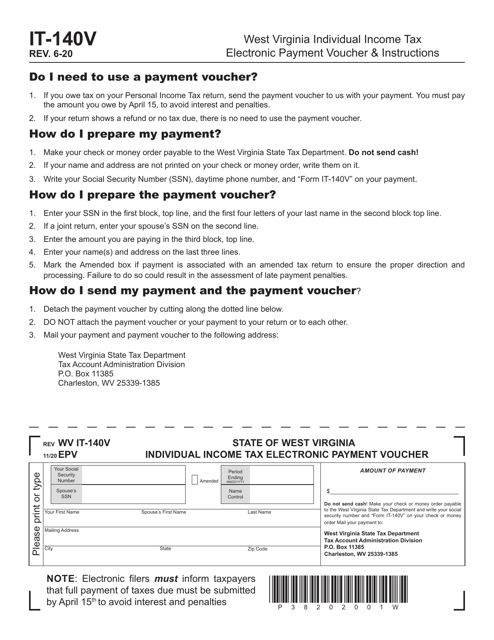

Form IT-140V State of West Virginia Individual Income Tax Electronic Payment Voucher - West Virginia

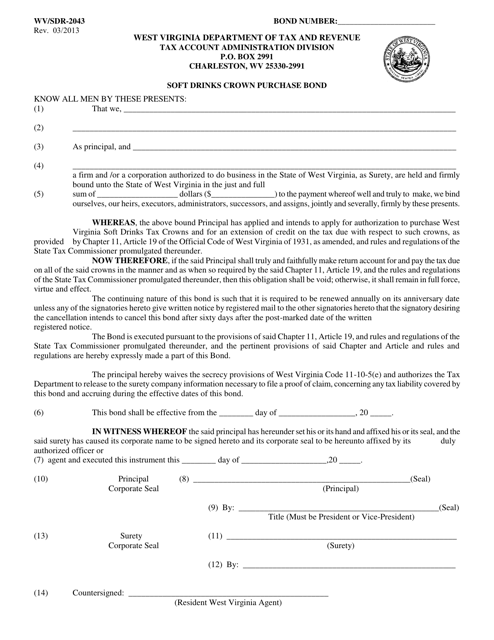

This form is used for purchasing soft drinks crown purchase bonds in West Virginia.