Washington State Department of Revenue Forms

Documents:

437

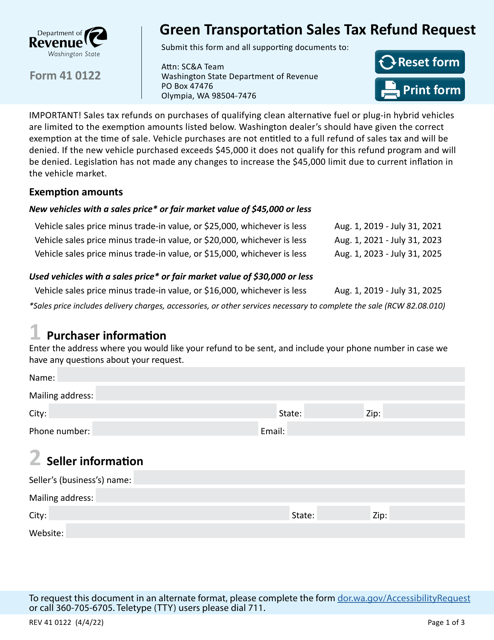

This form is used for requesting a sales tax refund for green transportation in Washington state.

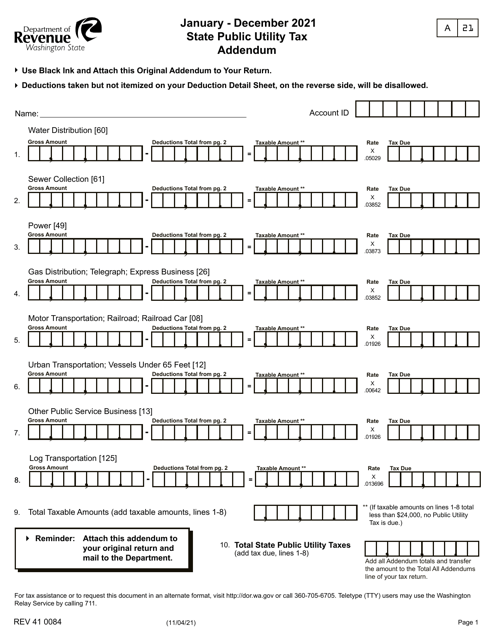

This document is an addendum to the State Public Utility Tax in Washington. It provides additional information or clarifications regarding the tax.

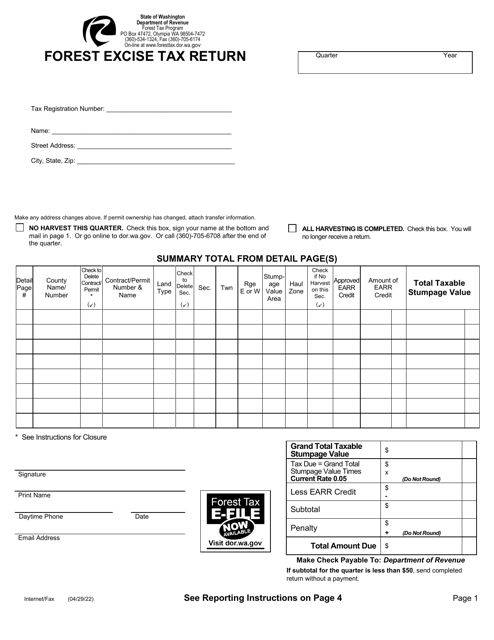

This Form is used for reporting and paying the forest excise tax in the state of Washington.

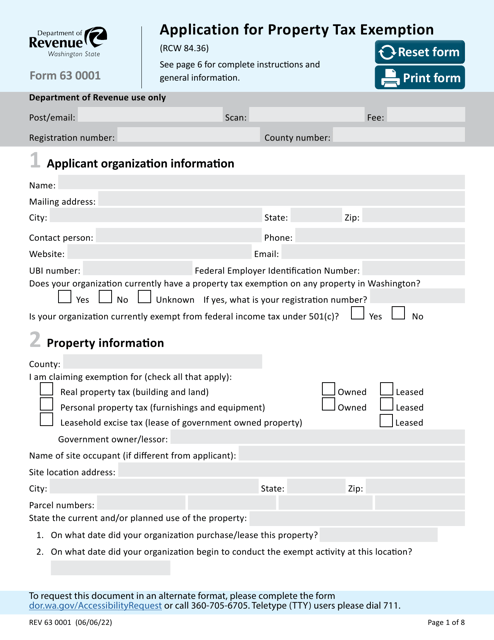

This form is used for applying for property tax exemption in the state of Washington.

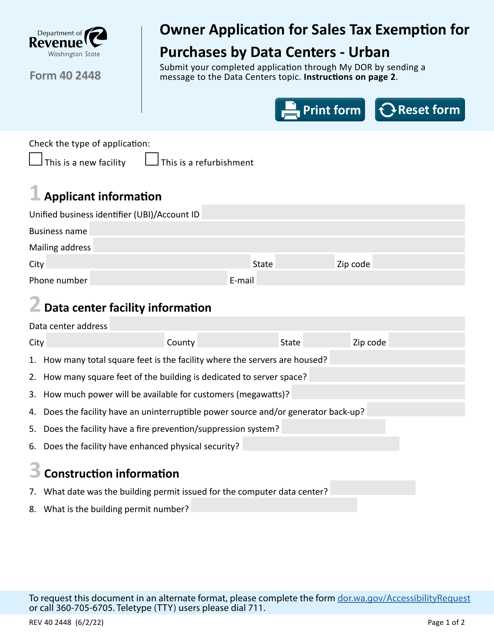

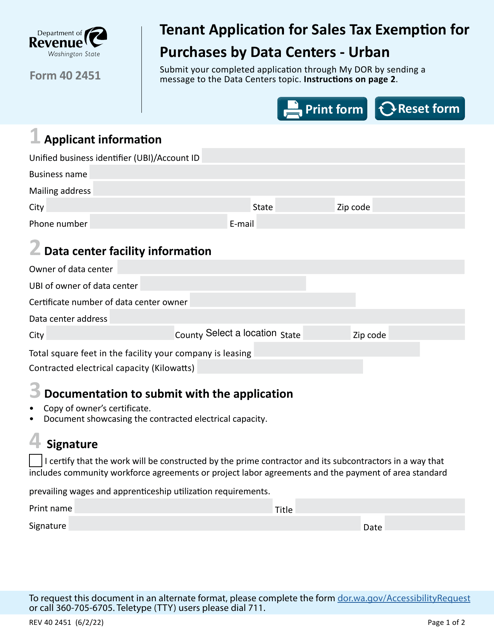

This form is used for data center owners in urban areas of Washington to apply for sales tax exemption for their purchases.

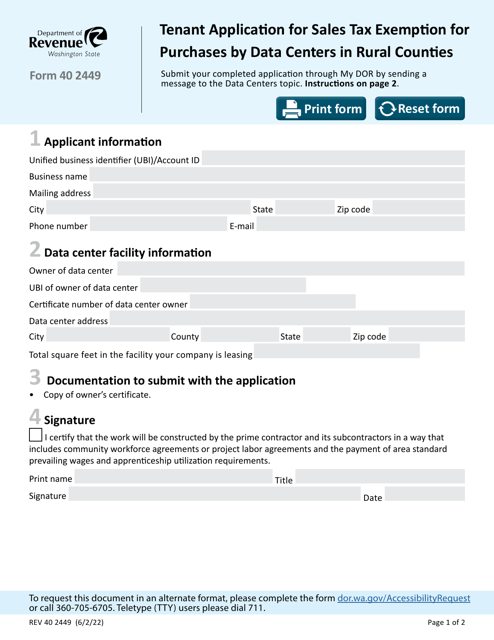

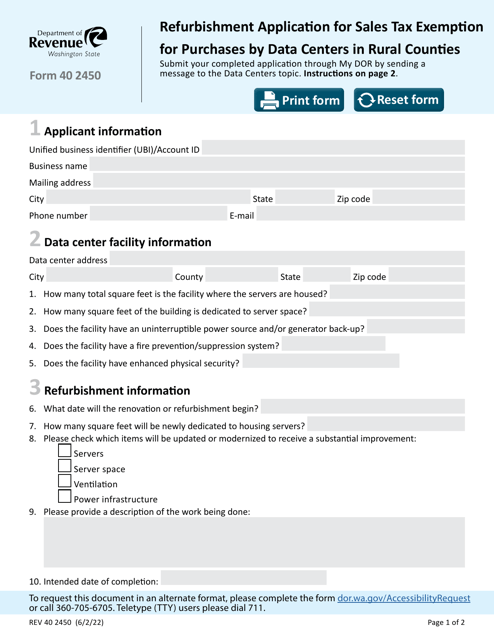

This form is used for tenants to apply for sales tax exemption on purchases made by data centers in rural counties in Washington.

This Form is used for applying for sales tax exemption for purchases made by data centers located in urban areas in the state of Washington.

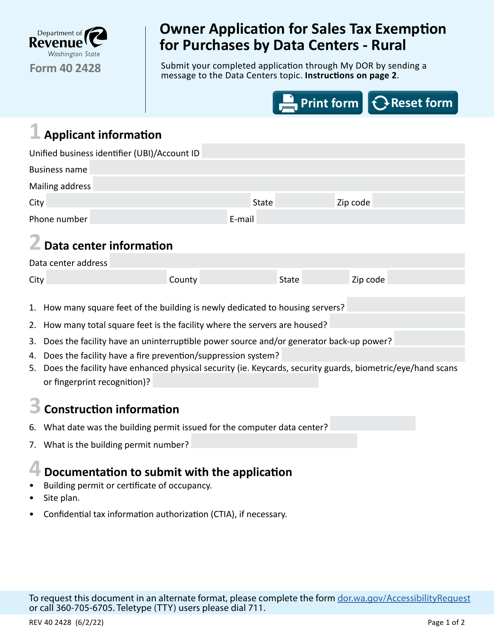

This document is used for applying for sales tax exemption on purchases made by data centers in rural counties in Washington state.

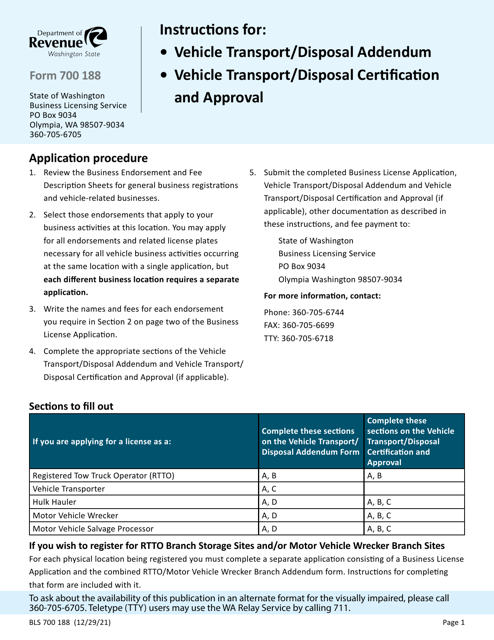

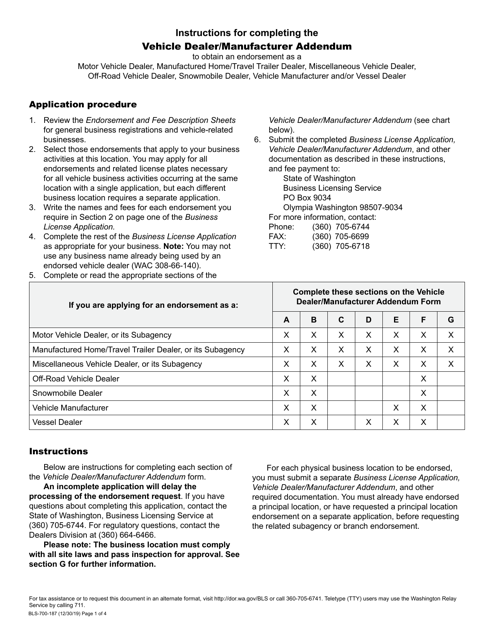

This Form is used for submitting additional information for vehicle dealers or manufacturers in Washington state.

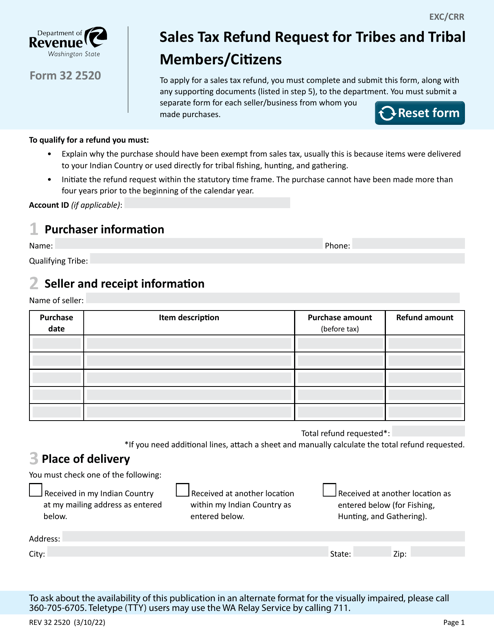

This form is used for requesting a sales tax refund for tribes and tribal members/citizens in Washington.

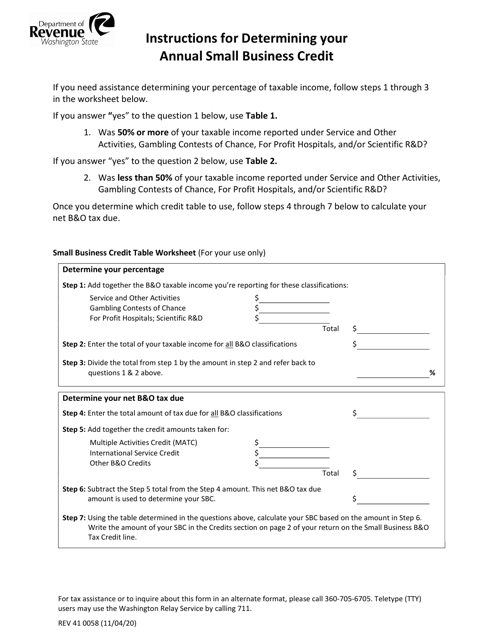

This form provides instructions on how to determine the annual small business credit in the state of Washington.

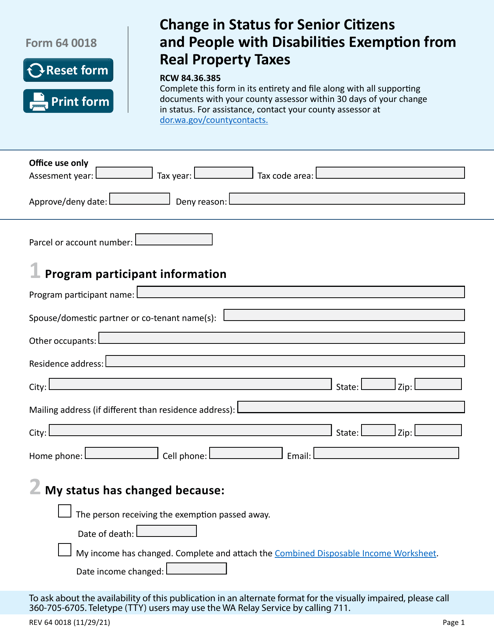

This form is used for senior citizens and people with disabilities in Washington to apply for an exemption from real property taxes due to a change in their status.

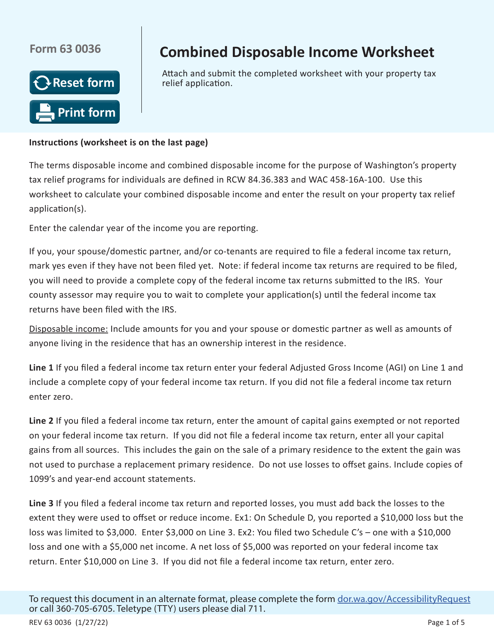

This form is used for calculating the combined disposable income in the state of Washington. It helps individuals determine their financial resources that can be used for various expenses.

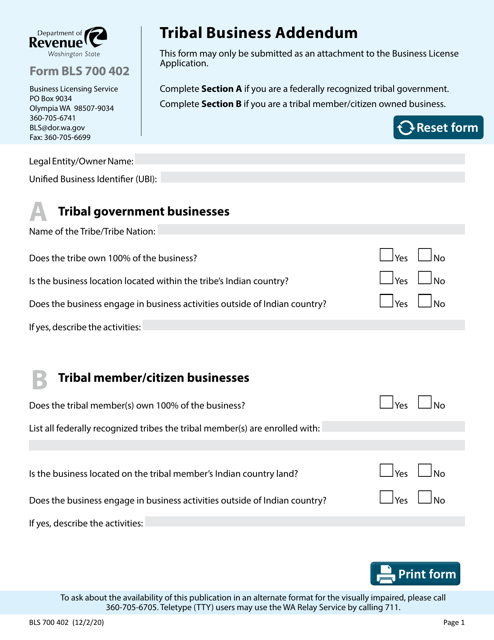

This form is used for adding a tribal business addendum specific to the state of Washington. It provides additional information and updates for tribal businesses operating in Washington.

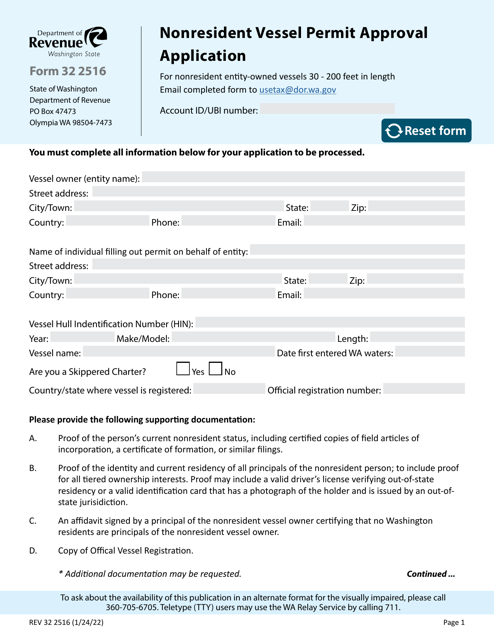

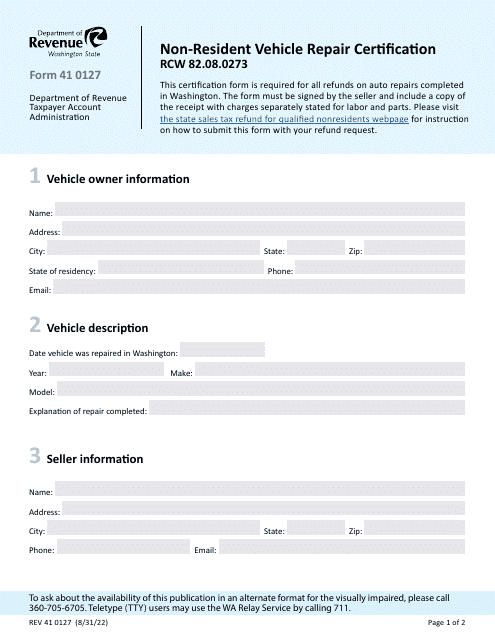

This form is used for non-resident vehicle repair certification in the state of Washington.

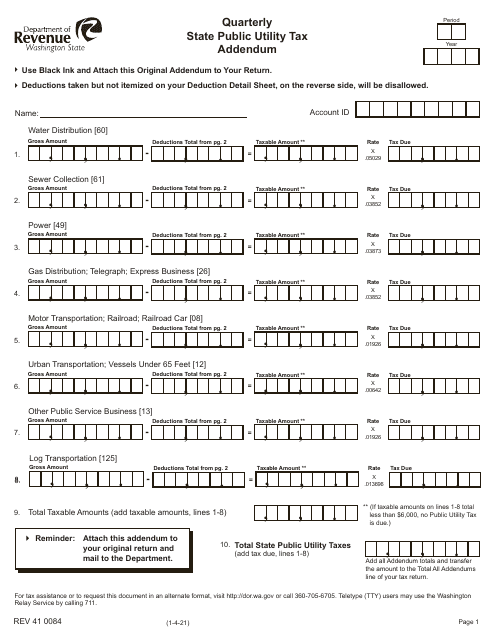

This Form is used for reporting quarterly state public utility tax in the state of Washington.

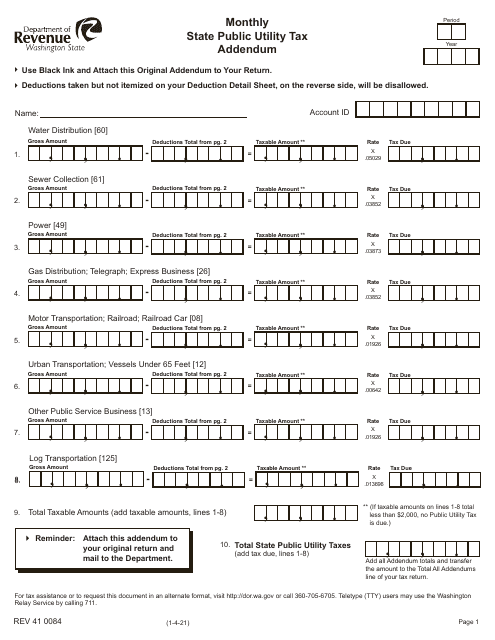

This form is used for reporting monthly state public utility taxes in Washington.

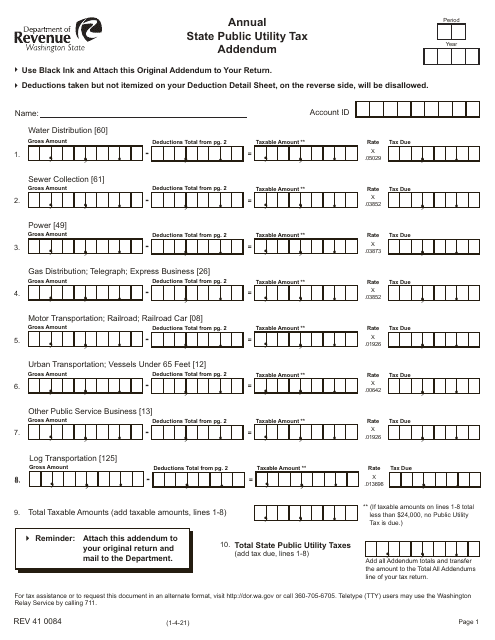

This form is used for filing an annual state public utility tax addendum in the state of Washington.

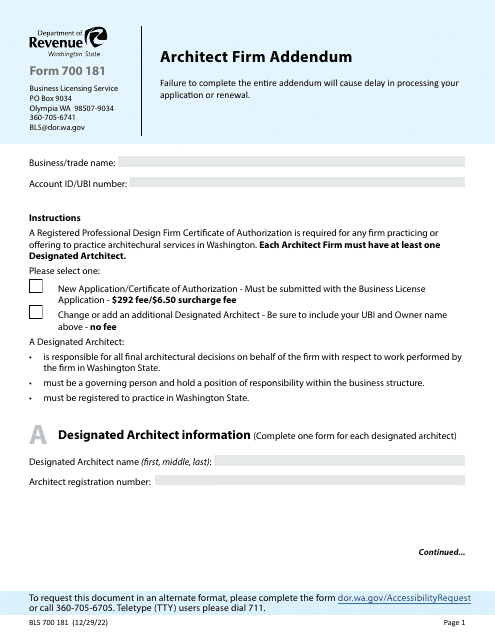

This document is an addendum form for architect firms in Washington state. It is used to provide additional information or changes to the original application form.

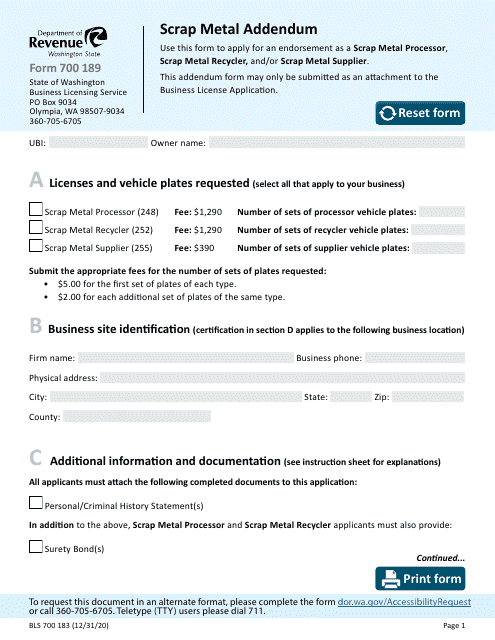

This form is used for adding an addendum to the BLS700 183 form specifically for scrap metal reporting in Washington.