Washington State Department of Revenue Forms

Documents:

437

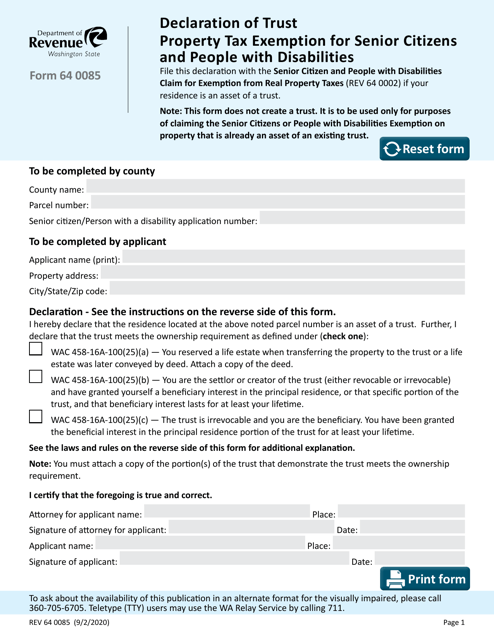

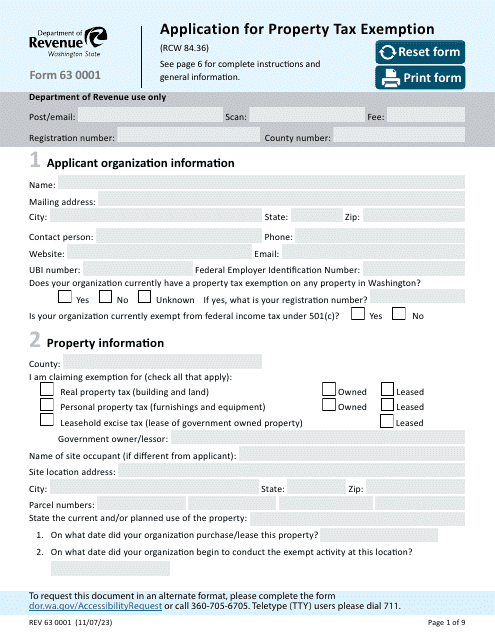

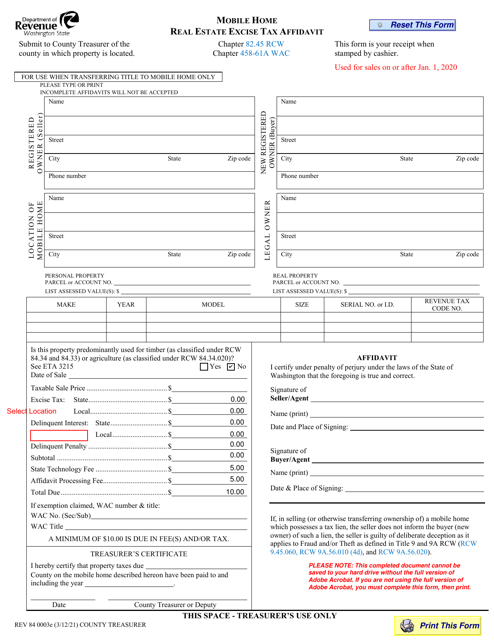

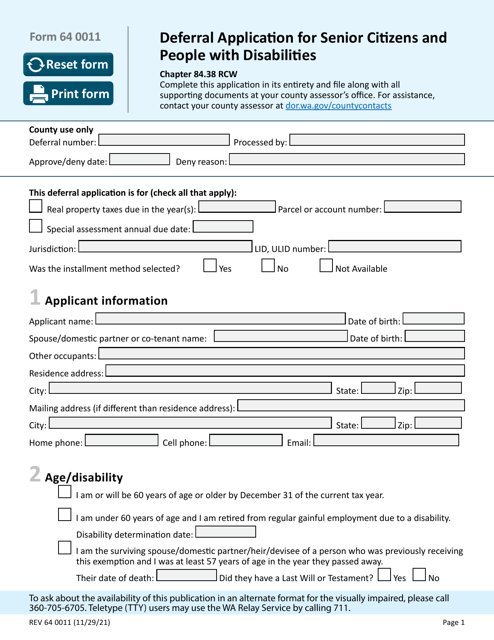

This form is used for declaring a trust for property tax exemption in Washington for senior citizens and people with disabilities. It allows eligible individuals to apply for tax relief on their property taxes.

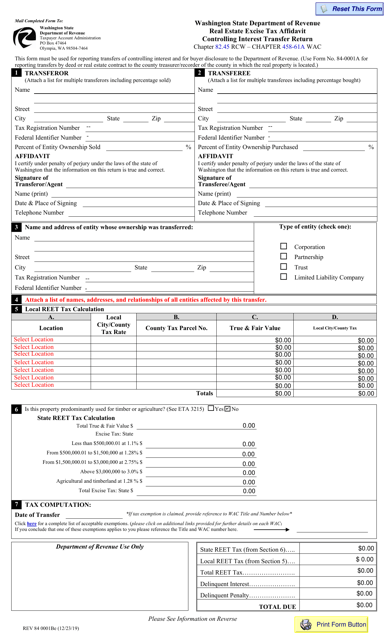

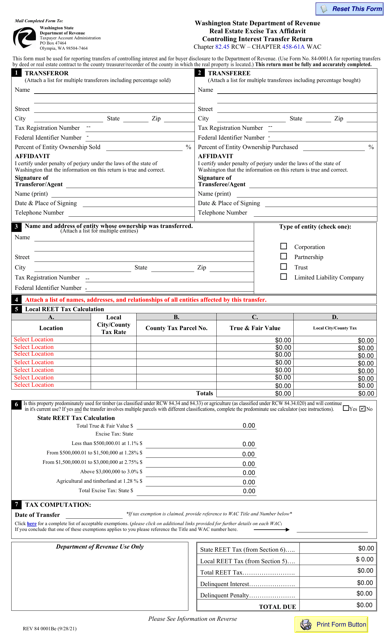

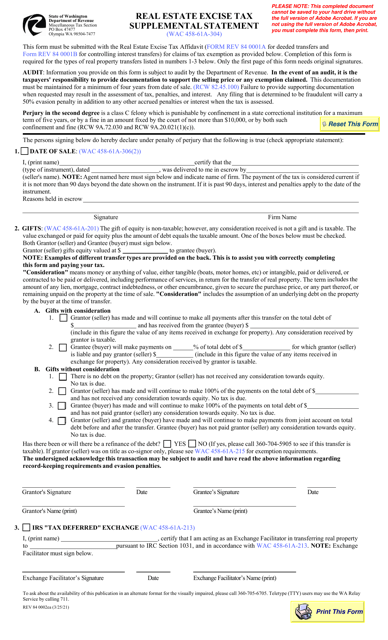

This form is used for reporting and paying real estate excise tax in Washington state when there is a transfer of controlling interest in a property. It is required by the Washington State Department of Revenue.

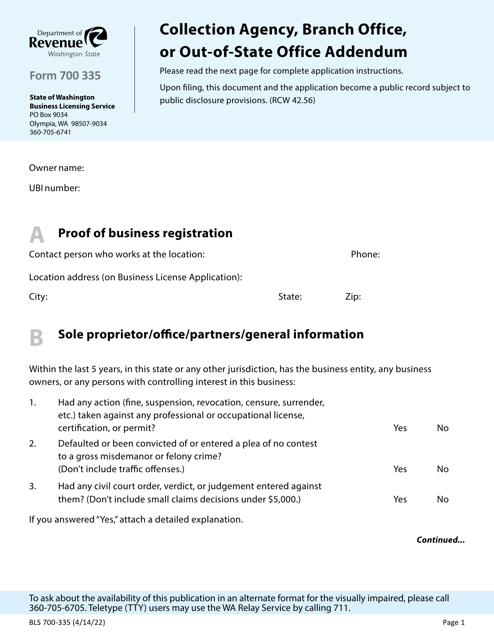

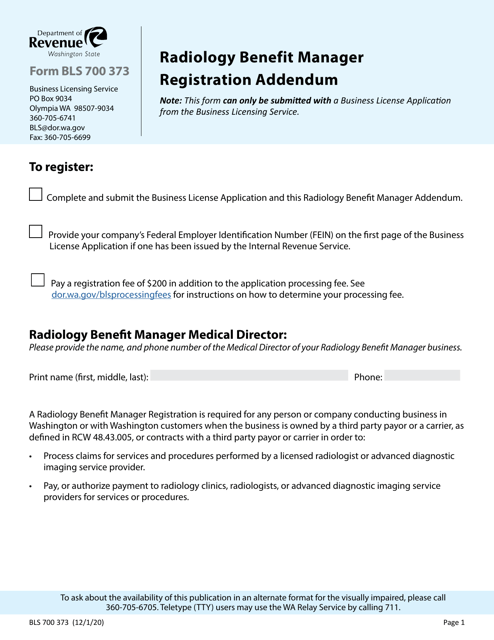

This Form is used for adding registration information to the Radiology Benefit Manager Registration in Washington.

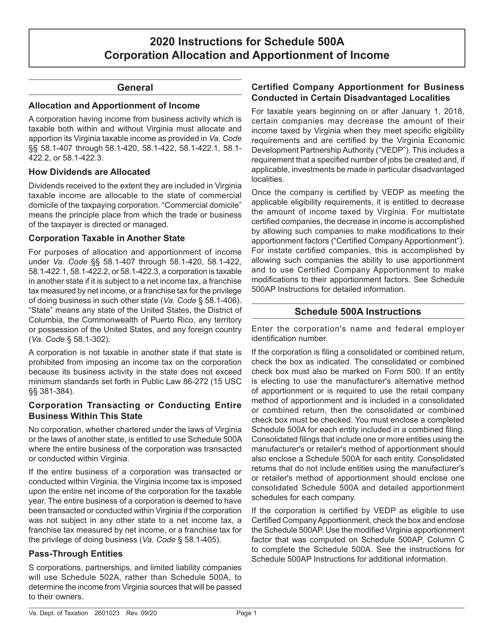

Instructions for Schedule 500A Corporation Allocation and Apportionment of Income - Washington, 2020

This type of document provides instructions for corporations in Washington to allocate and apportion their income using Schedule 500A.

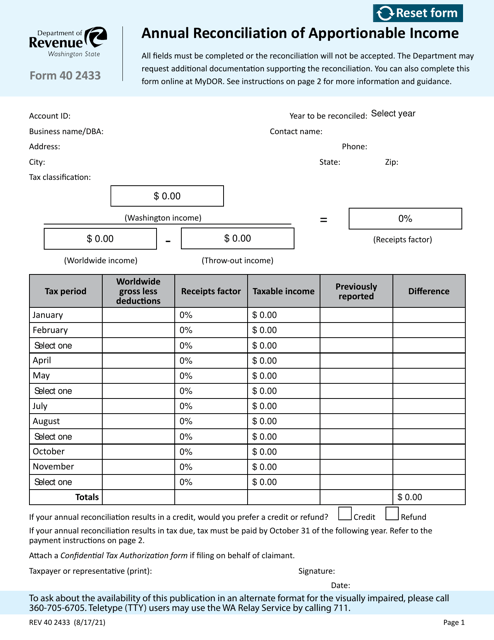

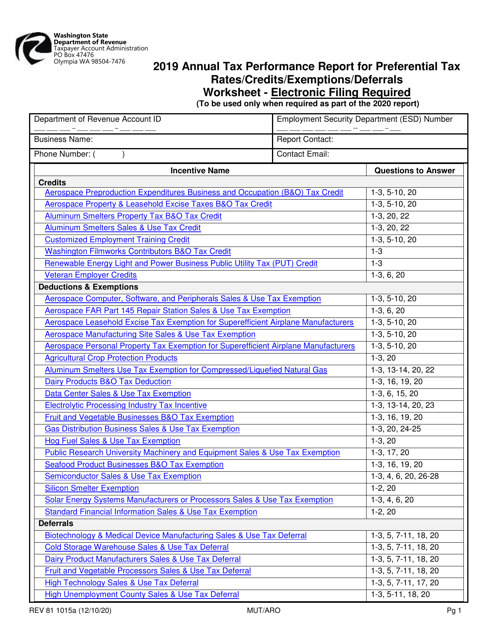

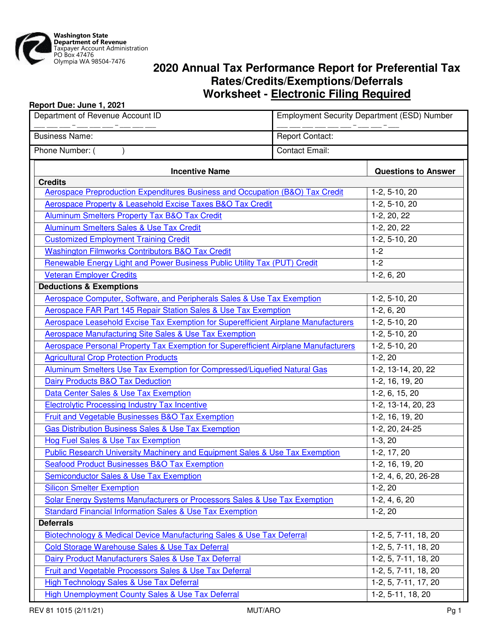

This Form is used for reporting annual tax performance for preferential tax rates, credits, exemptions, and deferrals in Washington state.

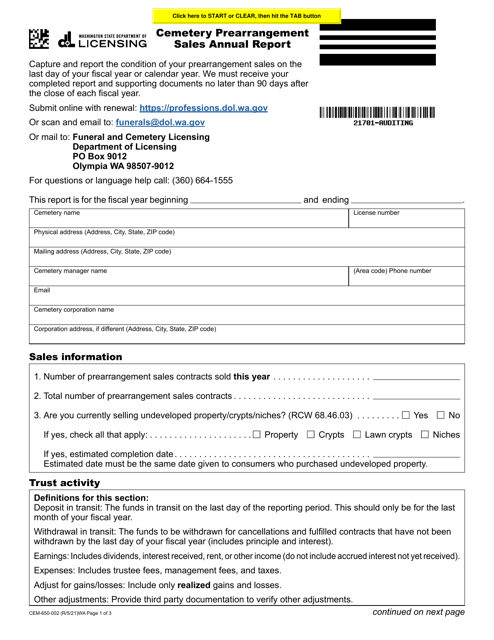

This Form is used for reporting annual sales of cemetery prearrangements in the state of Washington.

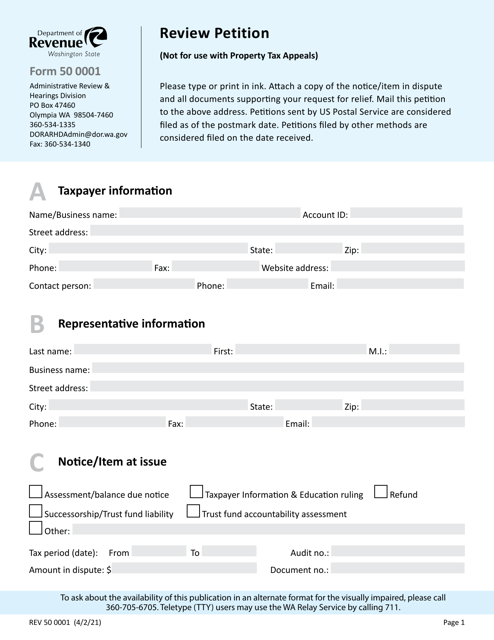

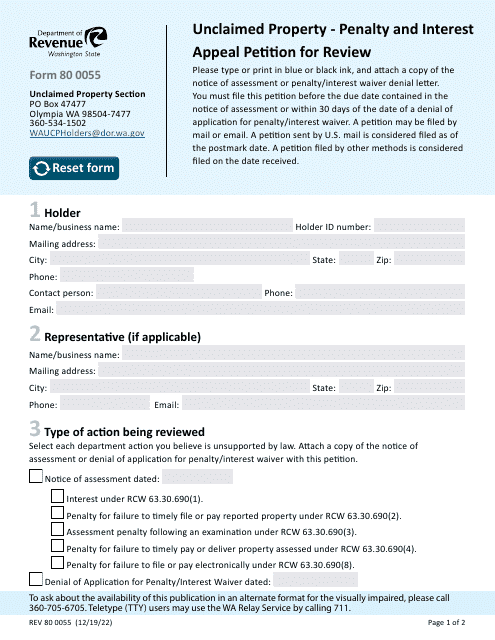

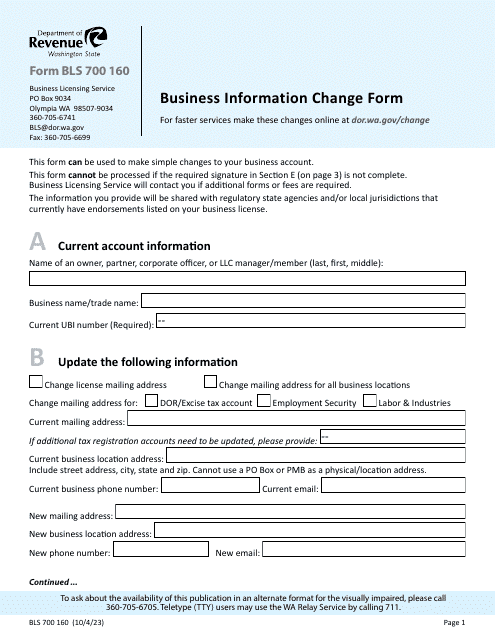

This Form is used for filing a review petition in the state of Washington. It is a document used to request a review of a previous decision or ruling.

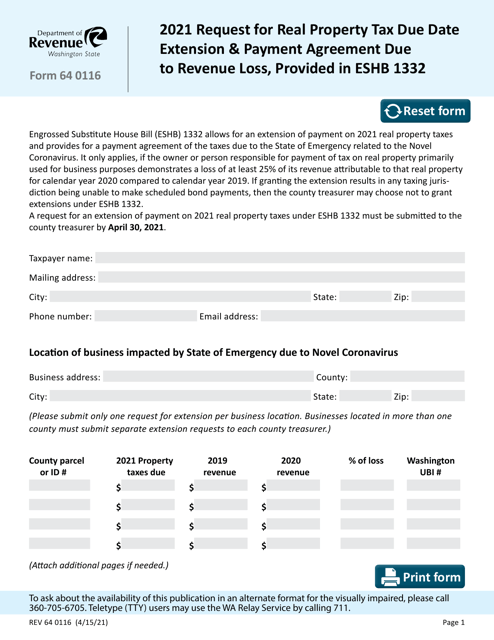

This form is used for requesting an extension of the due date for real property tax payment and entering into a payment agreement due to revenue loss, as provided in ESHB 1332 in Washington state.

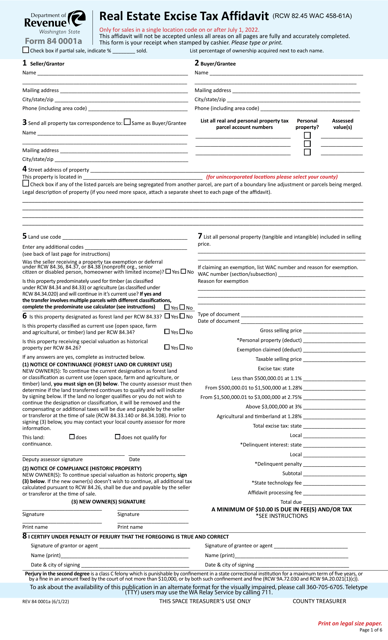

Form REV84 0001BE Real Estate Excise Tax Affidavit Controlling Interest Transfer Return - Washington

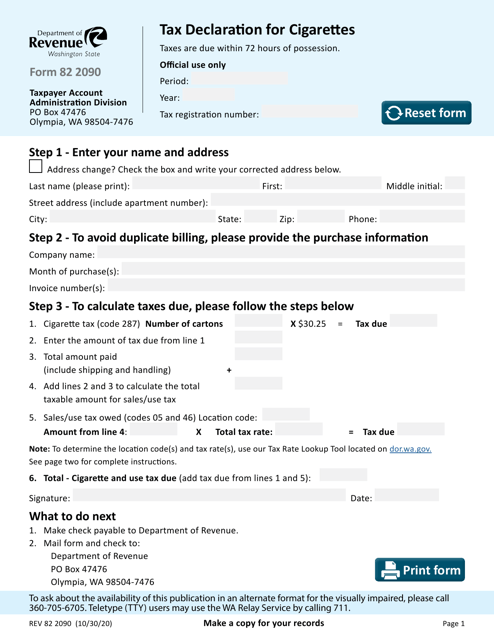

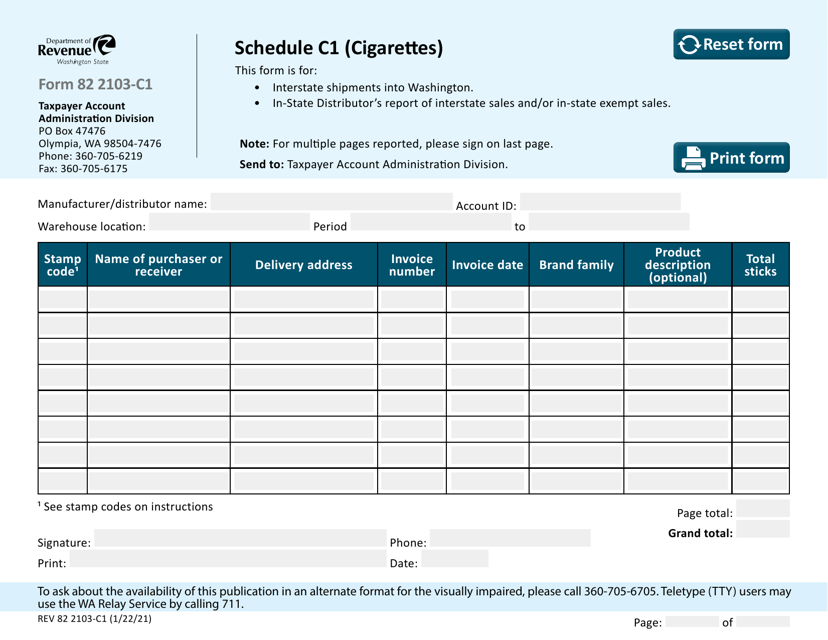

This form is used for reporting and calculating the tax owed on cigarettes in the state of Washington.

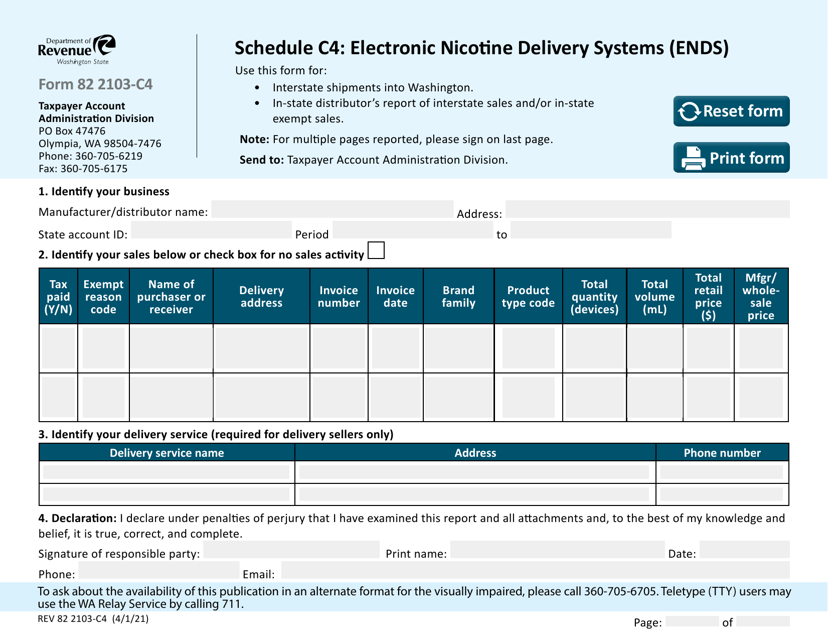

This Form is used for reporting electronic nicotine delivery systems (ENDS) sales in Washington state.

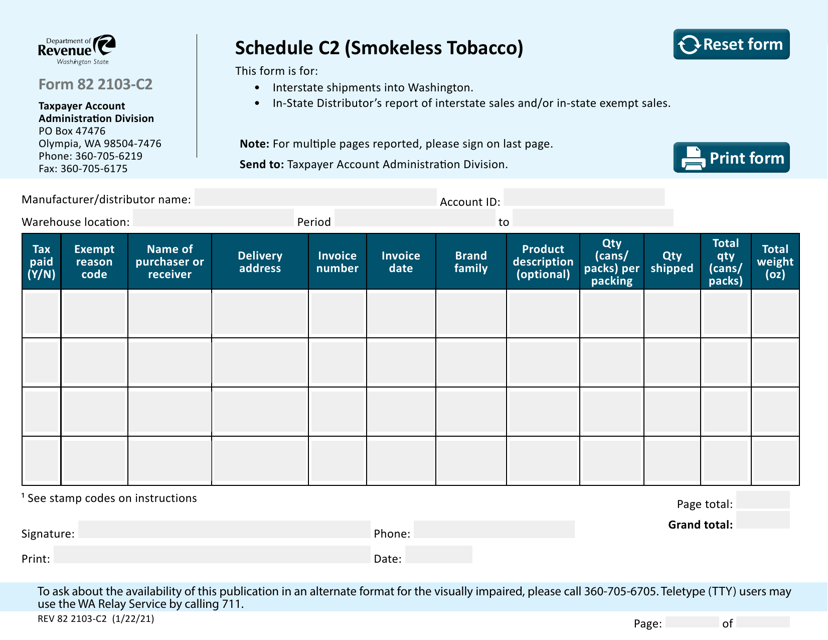

This Form is used for reporting smokeless tobacco sales in Washington state. It is known as the REV82 2103-C2 Schedule C2 form.

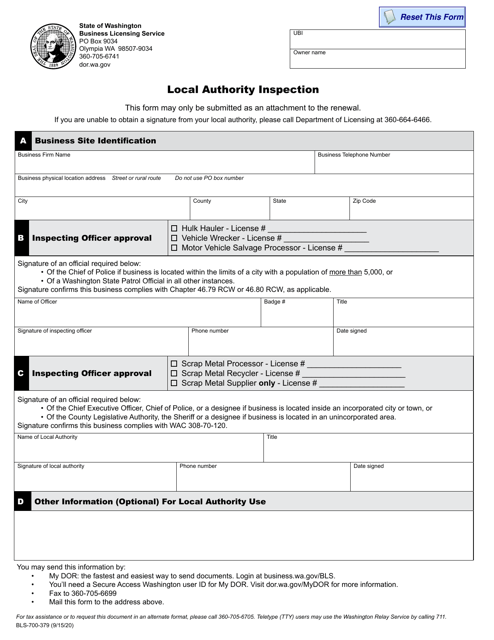

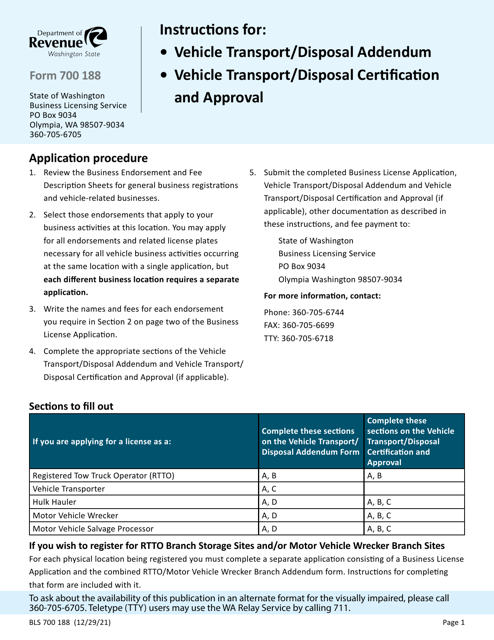

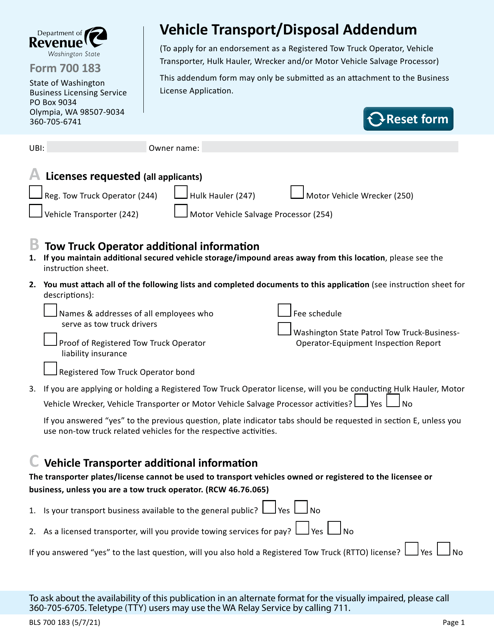

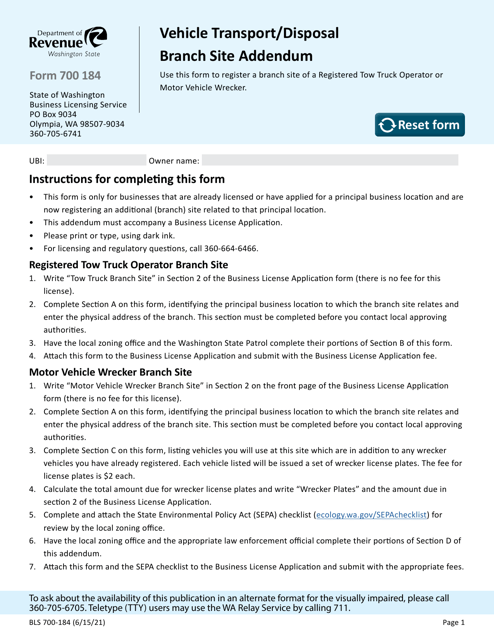

This form is used for vehicle transport or disposal in Washington state.

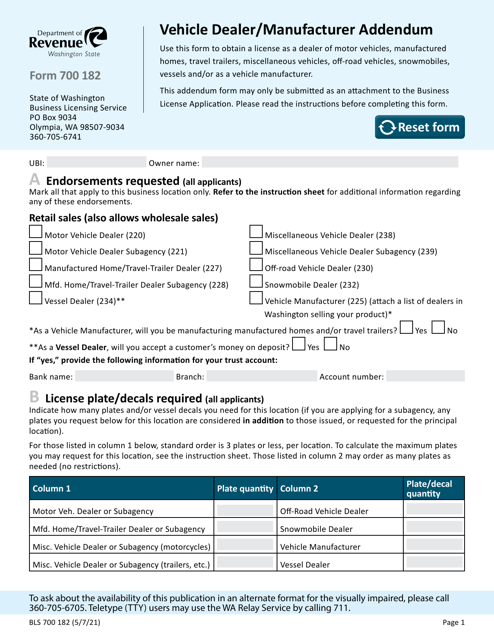

This Form is used for adding information about vehicles for dealers and manufacturers in Washington.

This form is used for adding information about vehicle transport and disposal sites in Washington.

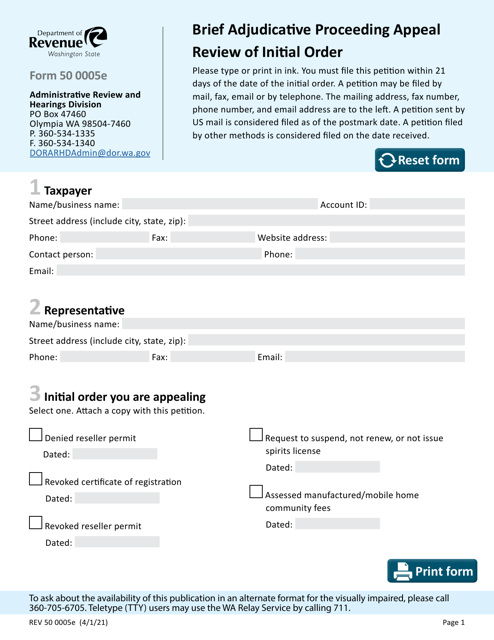

This Form is used for appealing the initial order issued during a brief adjudicative proceeding in the state of Washington.

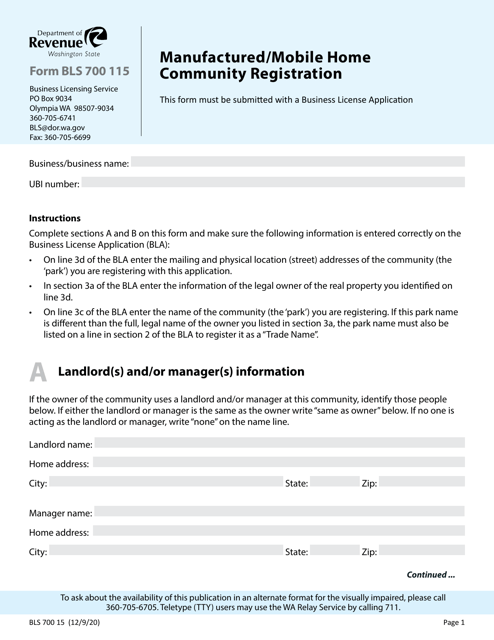

This form is used for registering a manufactured/mobile home community in Washington state.