Washington State Department of Revenue Forms

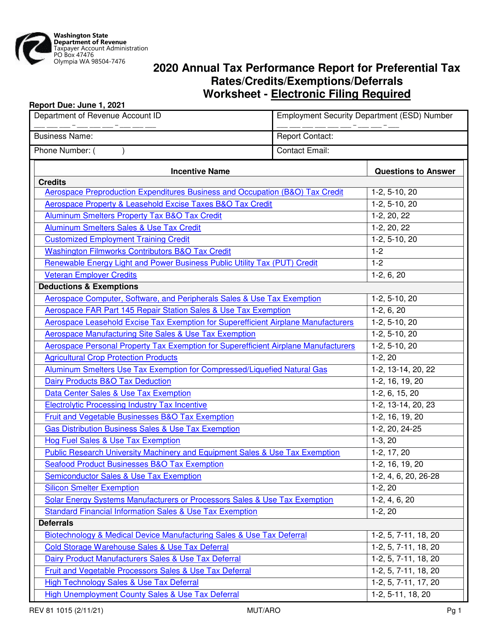

The Washington State Department of Revenue is responsible for administering and enforcing tax laws and regulations in the state of Washington. Its primary role is to collect taxes and other revenues, including sales tax, excise taxes, business and occupation taxes, property taxes, and other state taxes. The department also provides information and assistance to taxpayers, conducts audits, and handles tax appeals. Its overarching goal is to ensure compliance with tax laws and to fairly and efficiently administer the state's tax system.

Documents:

437

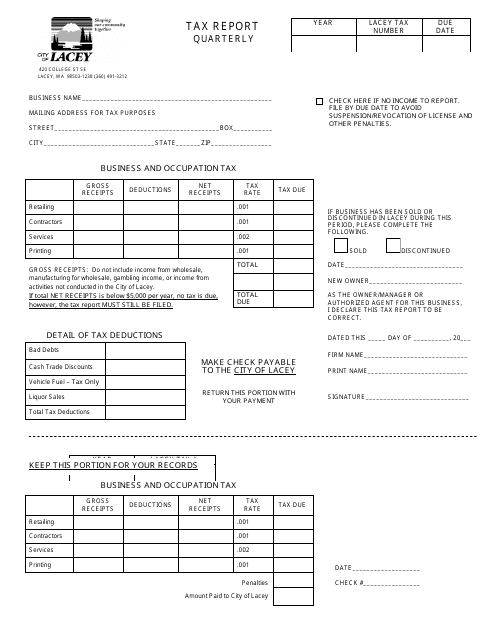

This document is a tax report for the City of Lacey, Washington on a quarterly basis. It is used to report and pay taxes owed to the city.

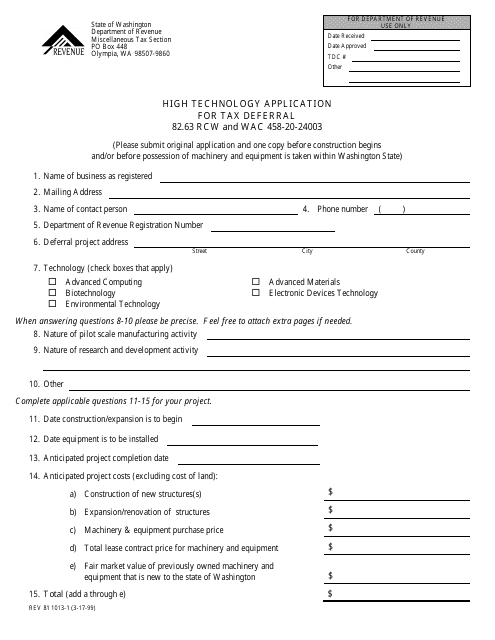

This Form is used for applying for tax deferral for high technology applications in the state of Washington.

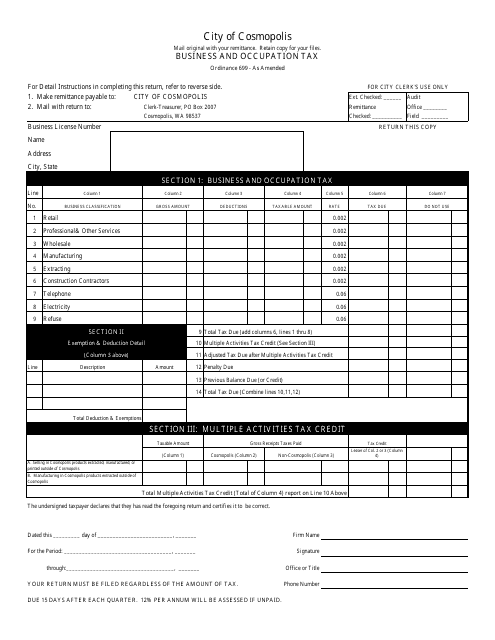

This form is used to report and pay business and occupation taxes to the City of Cosmopolis, Washington.

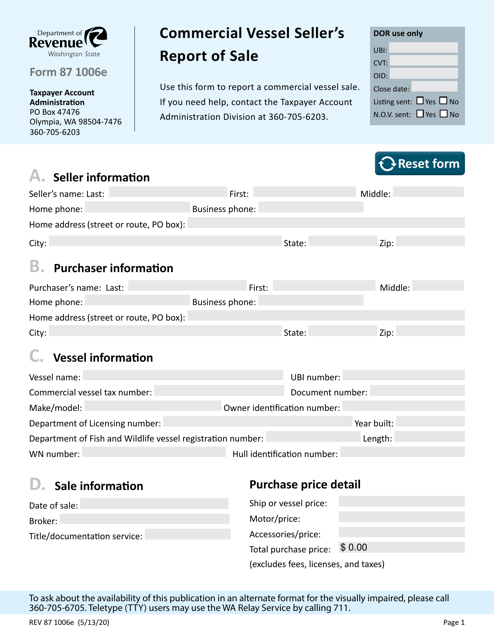

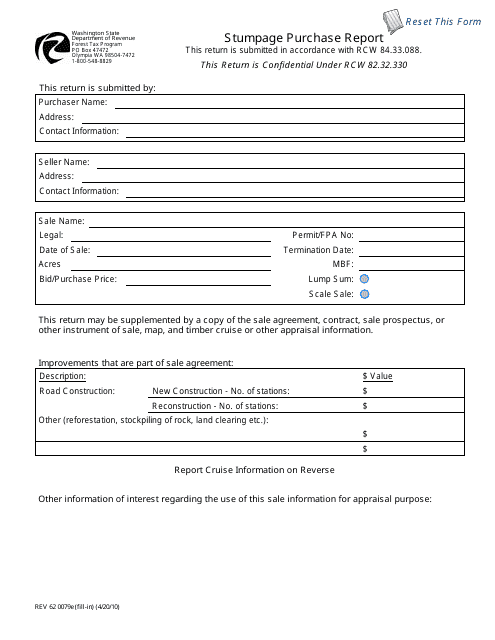

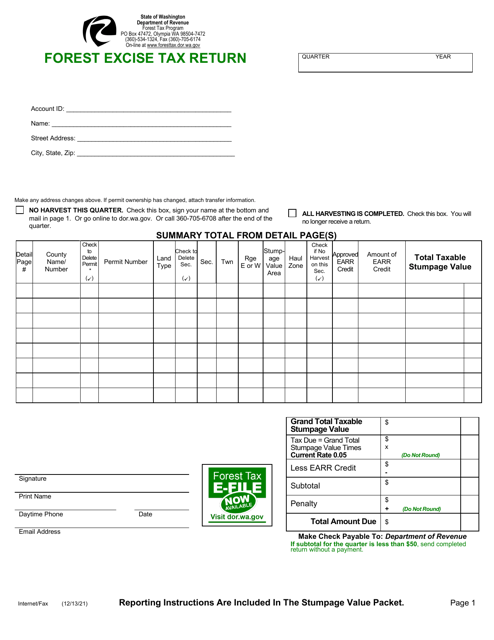

This Form is used for reporting the purchase of stumpage in the state of Washington. It provides information about the amount, location, and terms of the purchase.

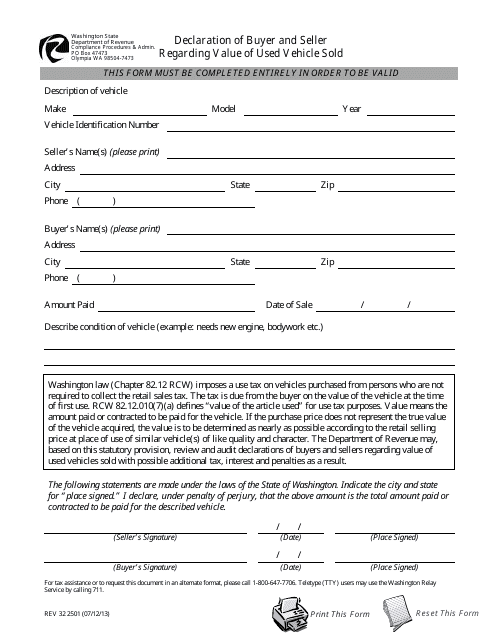

This Form is used to declare the value of a used vehicle being sold in Washington.

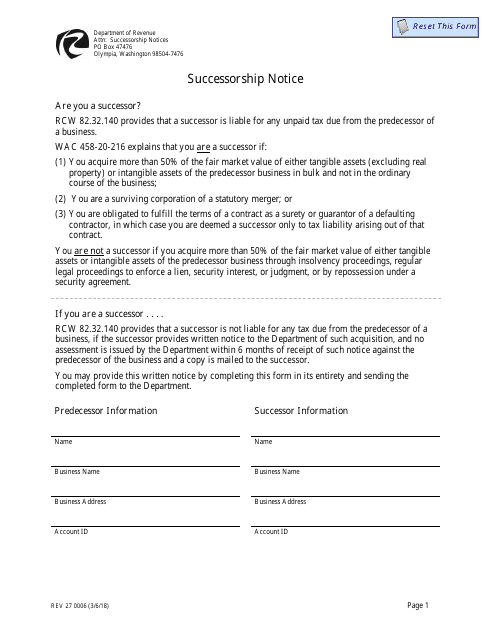

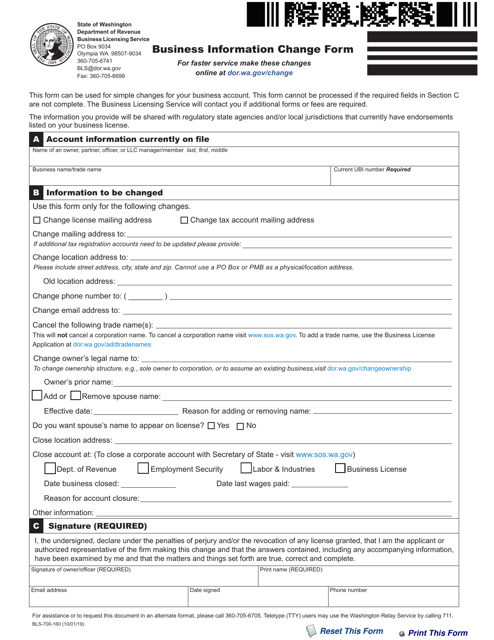

This notice informs individuals about the change in ownership or leadership of a company or organization based in Washington state. It is used to provide official information and updates regarding the new successor or leadership.

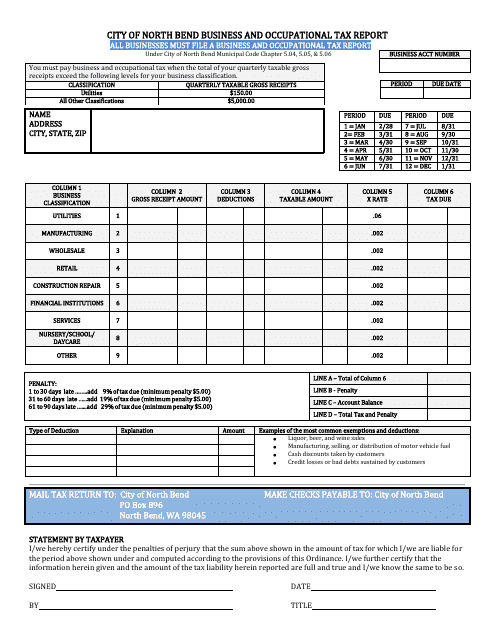

This document is used for reporting business and occupational taxes to the City of North Bend in Washington. It is required for all businesses operating within the city limits.

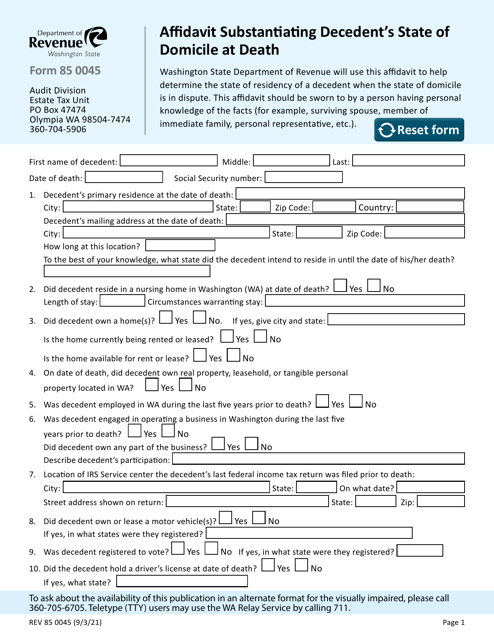

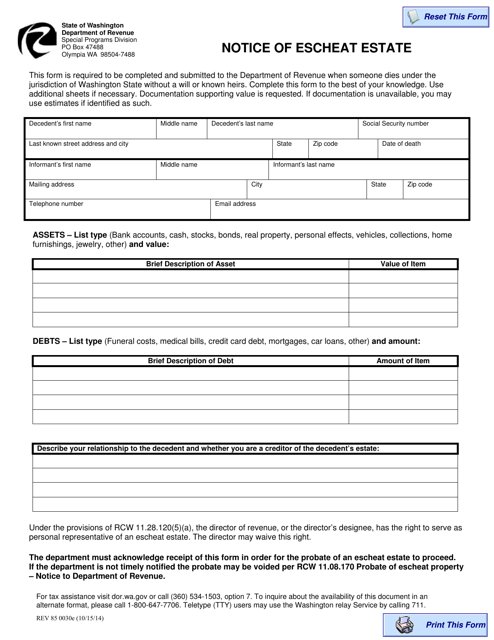

This form is used for notifying the state of Washington about an unclaimed estate that has been escheated.

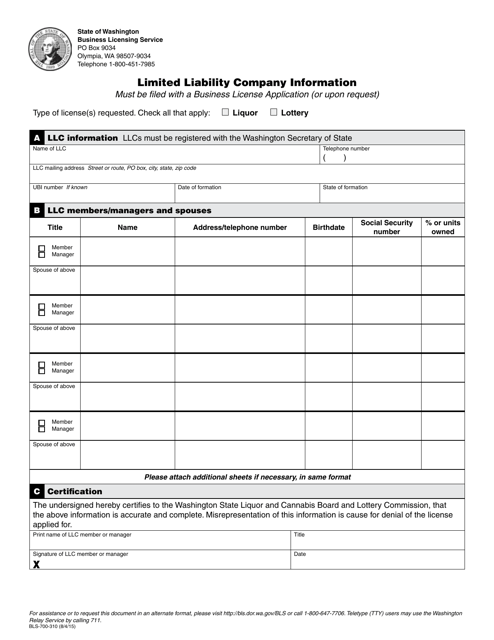

This Form is used for providing information about a limited liability company based in Washington state.

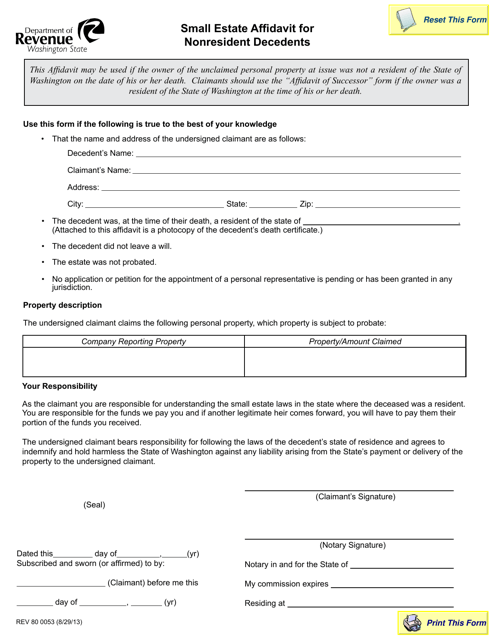

This Form is used for filing a Small Estate Affidavit for Nonresident Decedents in Washington state. It allows nonresident individuals to settle the estate of a deceased person with a smaller value of assets.

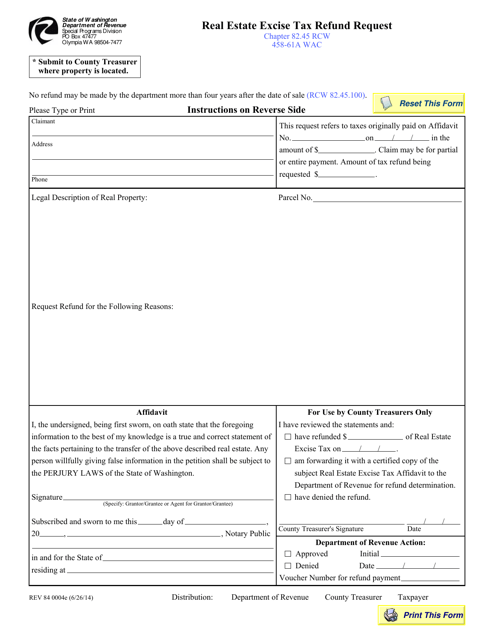

This form is used for the purpose of requesting a refund of the Real Estate Excise Tax in the state of Washington.

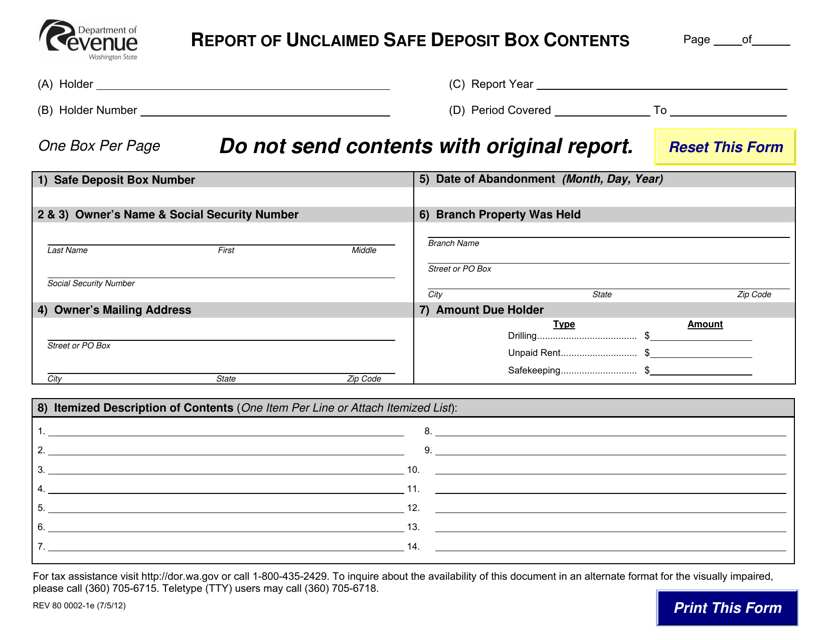

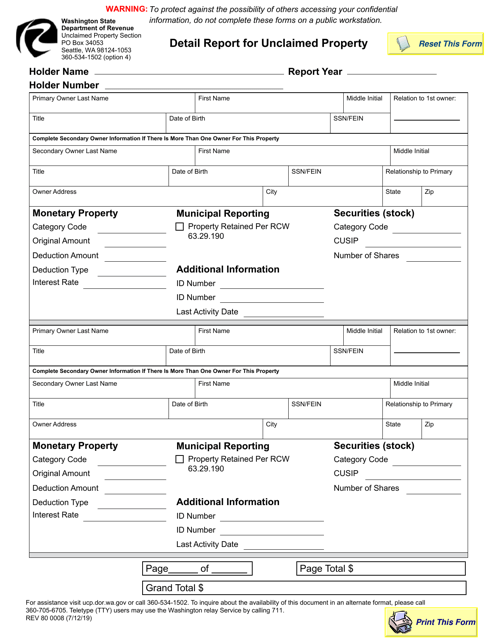

This form is used for reporting unclaimed safe deposit box contents in the state of Washington. It is required to be filled out and submitted to the appropriate authority.

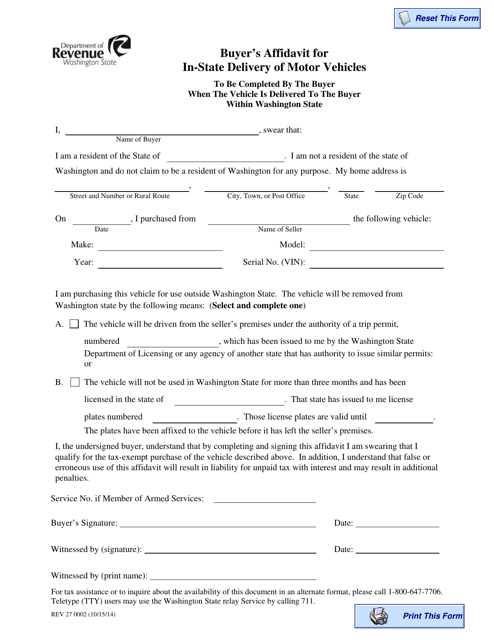

This form is used for the buyer to provide an affidavit when requesting in-state delivery of a motor vehicle in Washington.

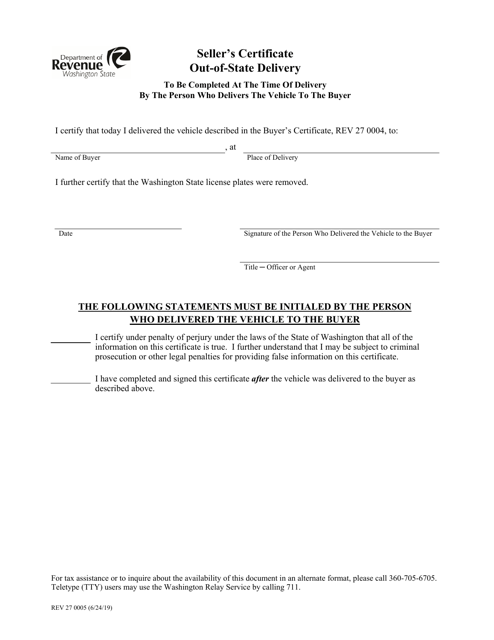

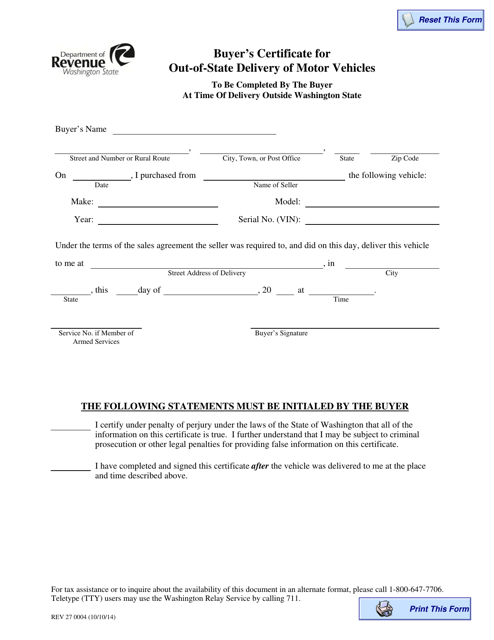

This form is used for certifying the buyer's out-of-state delivery of motor vehicles in Washington.

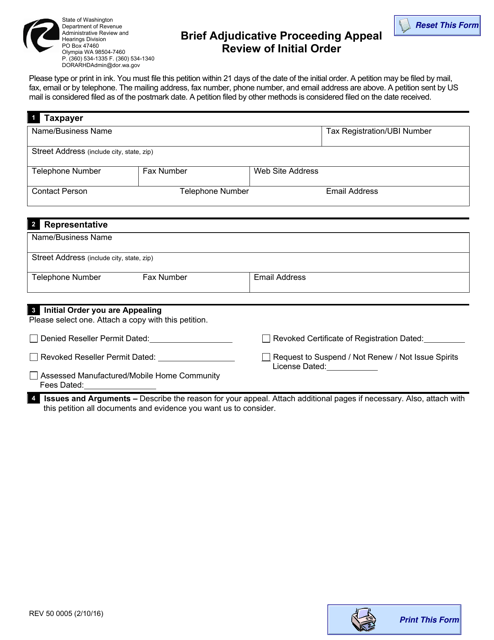

This form is used for the appeal review of an initial order in a brief adjudicative proceeding in the state of Washington.

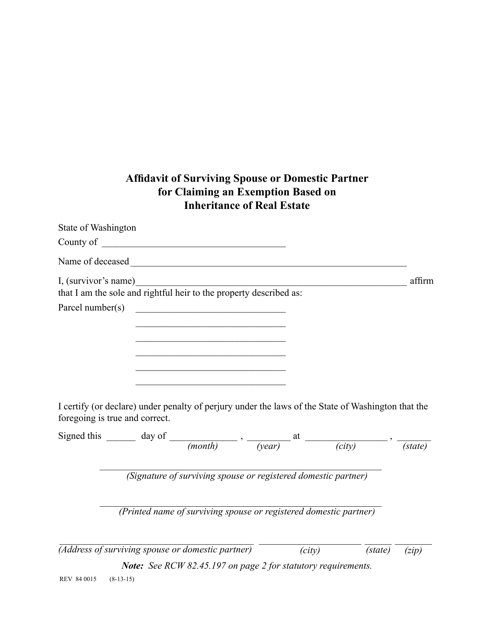

This form is used for asserting a claim for exemption on inherited real estate in Washington by surviving spouse or domestic partner.

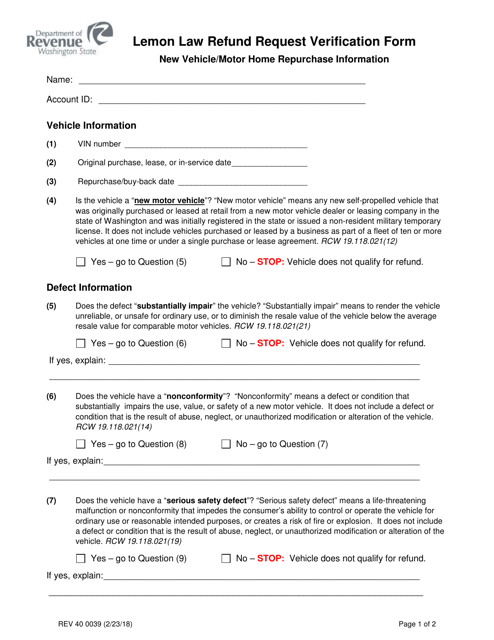

This Form is used for verifying the Lemon Law refund request in Washington state.

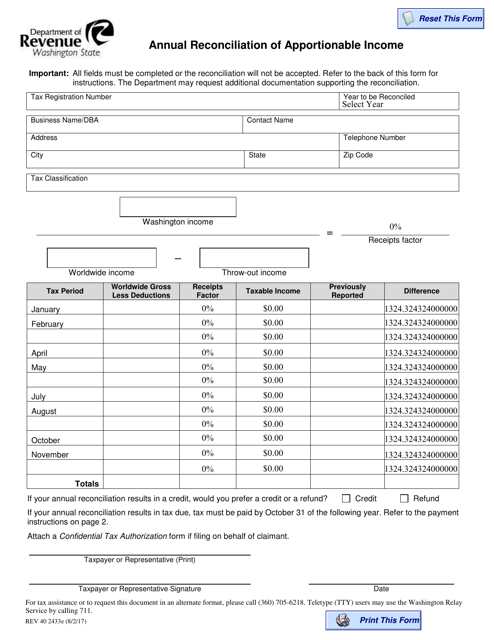

This form is used for the annual reconciliation of apportionable income in the state of Washington. It is used to determine the amount of income that is subject to taxation in the state.

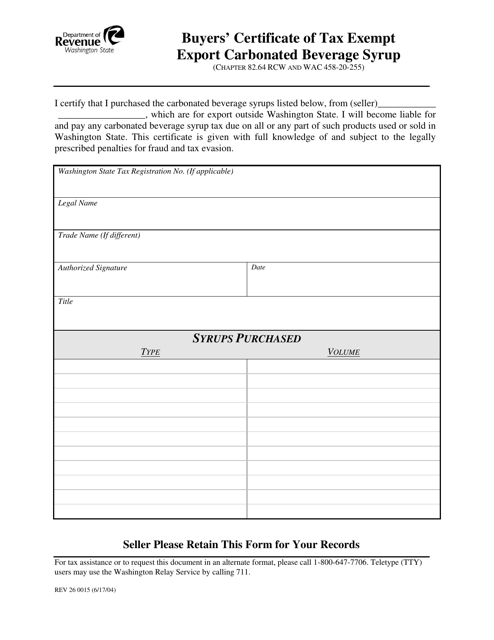

This Form is used for buyers in Washington to certify their tax-exempt export of carbonated beverage syrup.

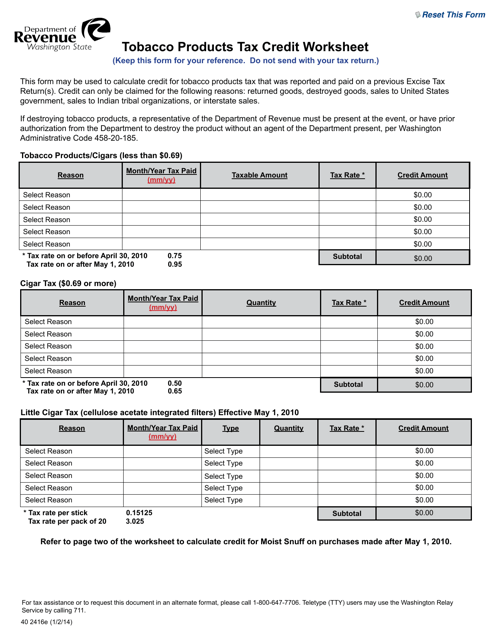

This form is used for calculating the tax credit for tobacco products in Washington state.

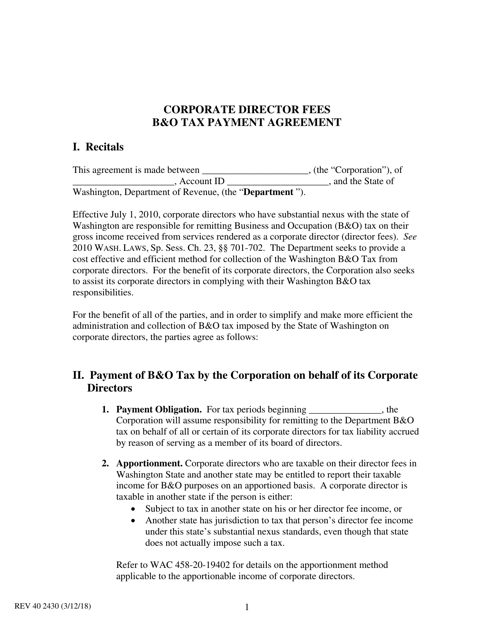

This form is used for corporate directors in Washington to make B&o tax payment agreements for their fees.

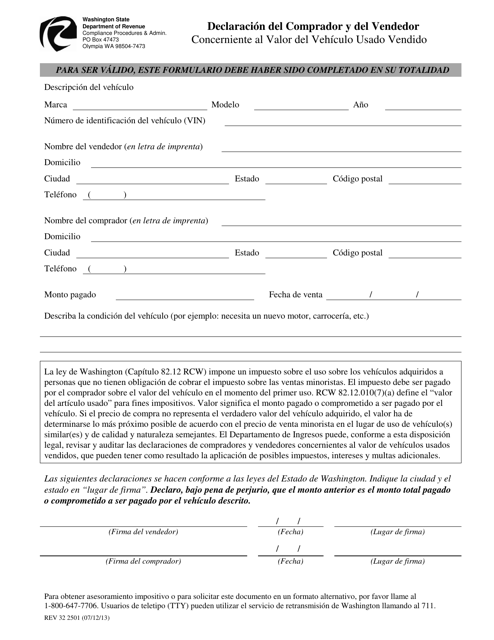

This Form is used for declaring the value of a used vehicle sold in Washington. It must be filled out by both the buyer and the seller.

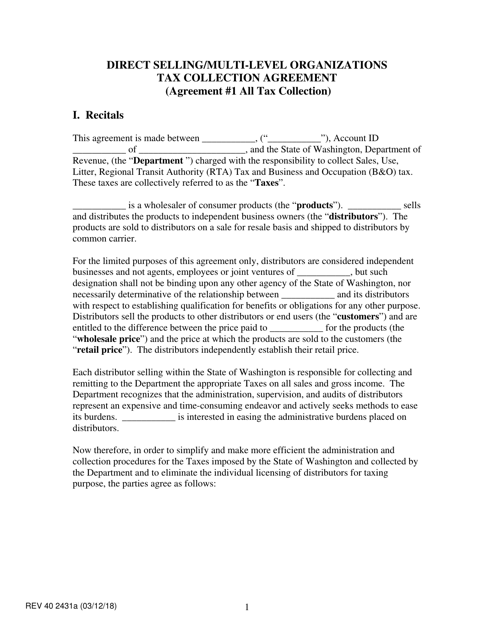

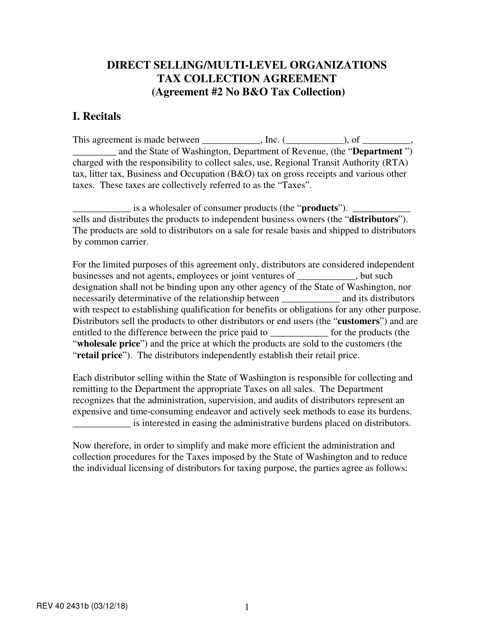

This form is used for tax collection agreements with direct selling and multi-level organizations in Washington state.

This Form is used for Direct Selling/Multi-Level Organizations to collect taxes in the state of Washington.

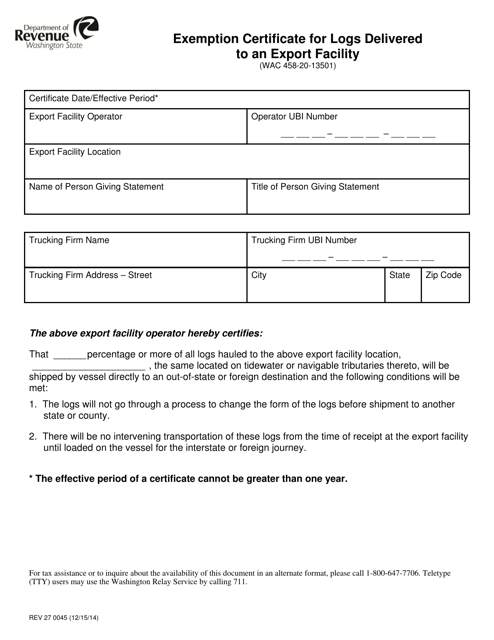

This form is used for requesting an exemption certificate for logs delivered to an export facility in Washington. It allows log exporters to certify that the logs will be exported and not subject to certain taxes.

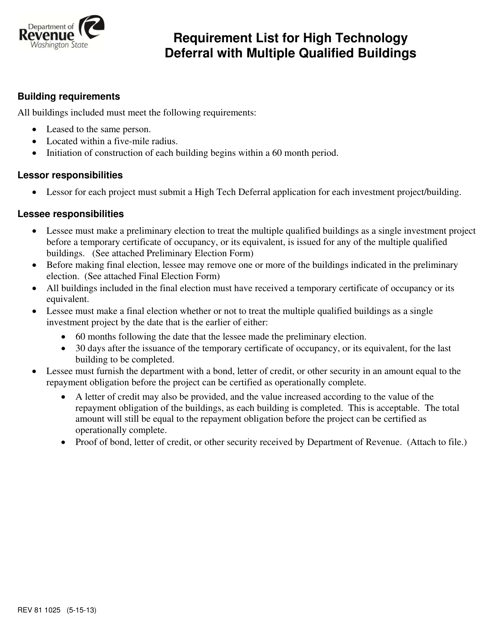

This form is used for listing the requirements for deferring high technology taxes with multiple qualified buildings in Washington.

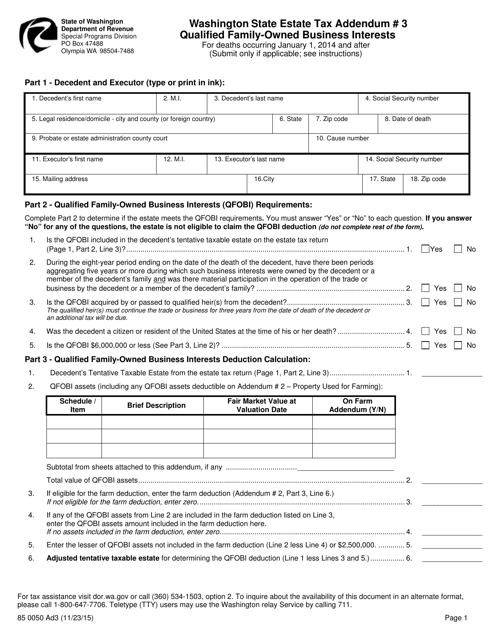

This form is used for reporting qualified family-owned business interests for Washington State Estate Tax purposes.

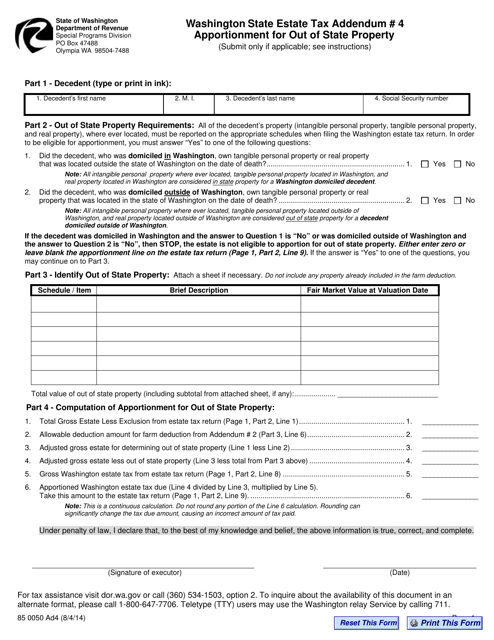

This form is used for apportioning out-of-state property for estate tax purposes in Washington State.

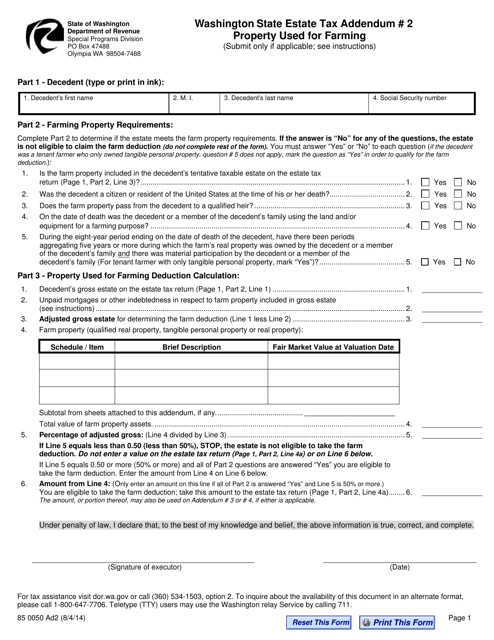

This form is used for reporting additional property used for farming in Washington state for estate tax purposes.