Washington State Department of Revenue Forms

Documents:

437

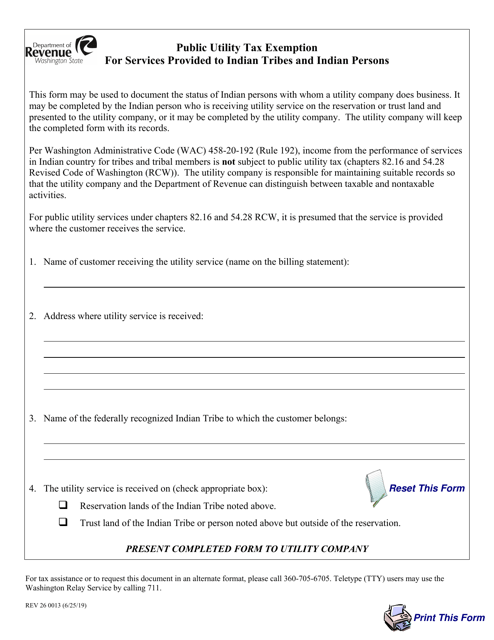

This form is used for claiming tax exemption for services provided to Indian Tribes and Indian Persons in Washington related to public utilities.

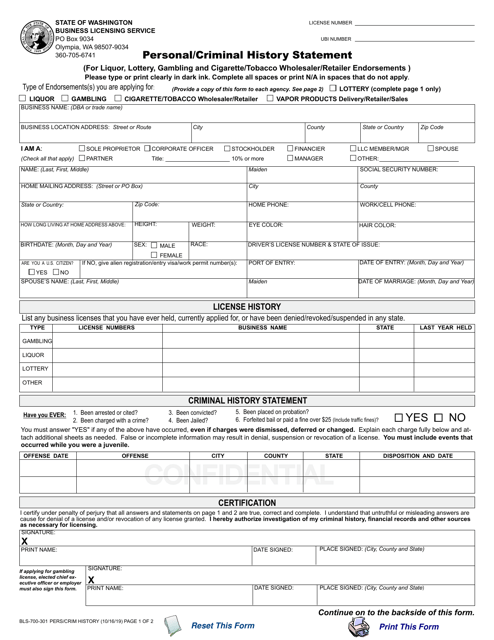

This form is used for personal and criminal history statement for individuals seeking liquor, lottery, gambling, and cigarette/tobacco wholesaler/retailer endorsements in Washington.

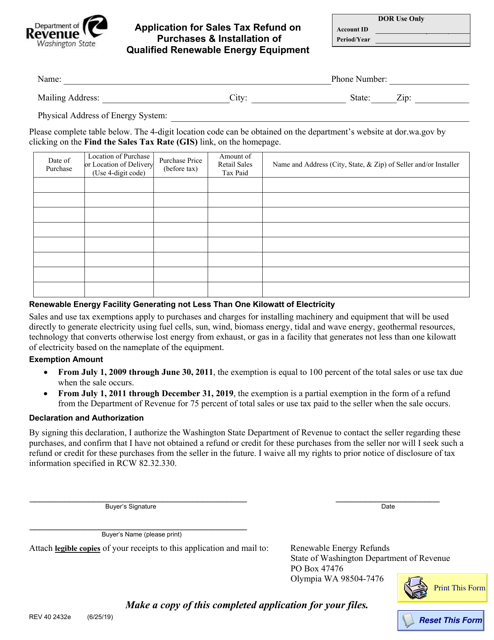

This form is used for applying for a sales tax refund on purchases and installation of qualified renewable energy equipment in Washington.

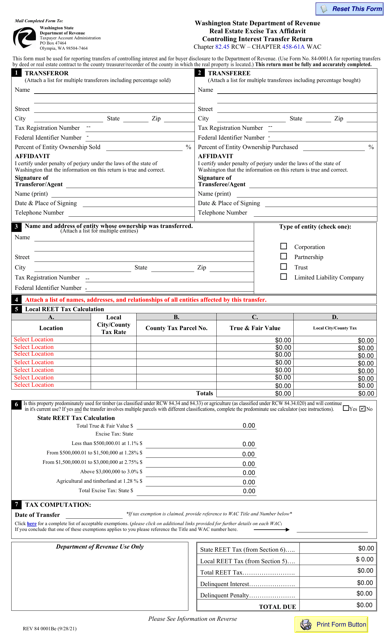

Form REV84 0001BE Real Estate Excise Tax Affidavit Controlling Interest Transfer Return - Washington

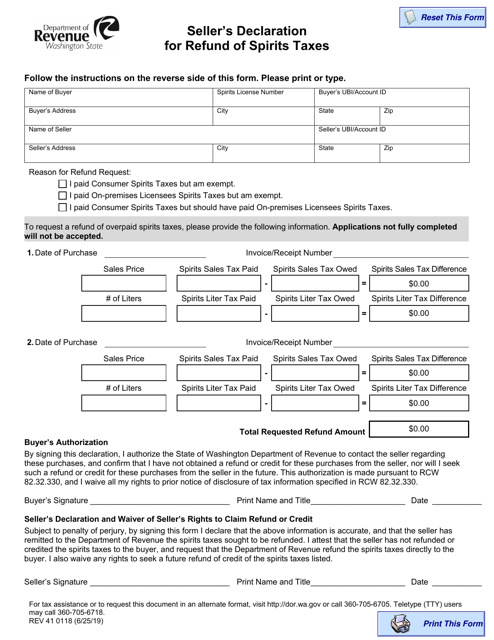

This Form is used for sellers in Washington to declare refund of spirits taxes.

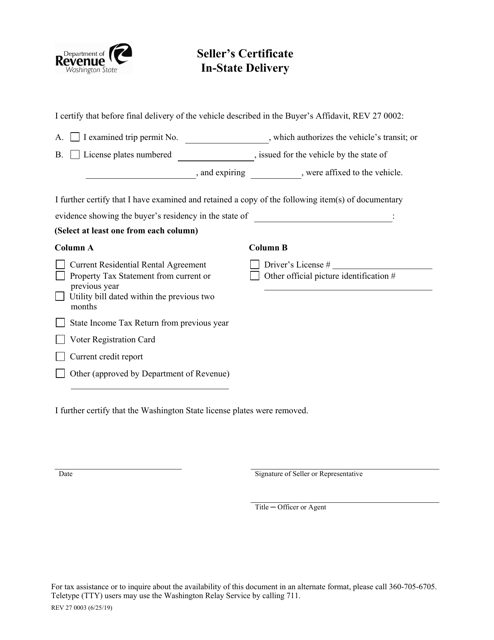

This Form is used for sellers in Washington state to certify the delivery of goods within the state. It is important for tax purposes.

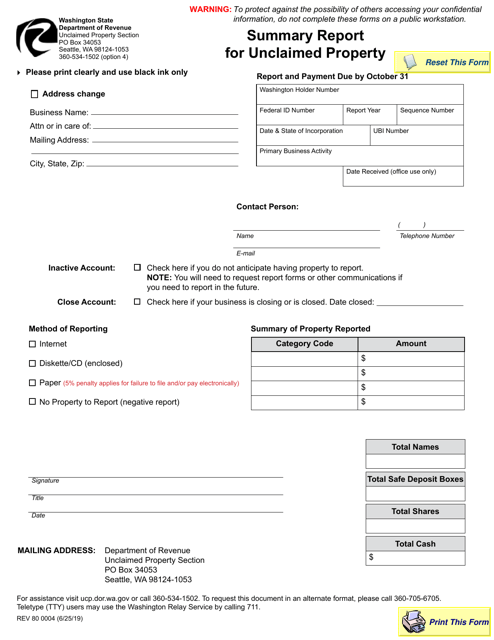

This form is used for filing a summary report for unclaimed property in the state of Washington. It provides an overview of any unclaimed property that is being held by an individual or business.

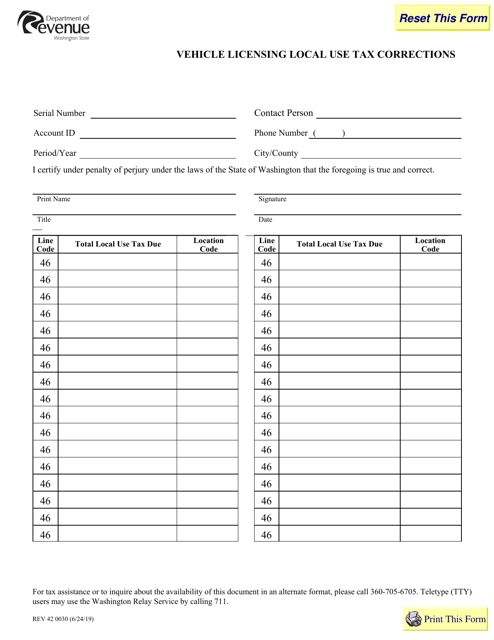

This Form is used for correcting local use tax information on vehicle licensing in Washington state.

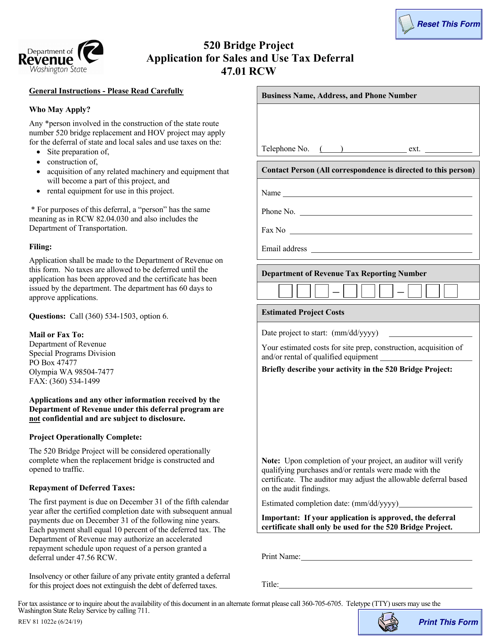

This document is an application form for the Sales and Use Tax Deferral program for the 520 Bridge Project in Washington state. It is used to request a deferral of sales and use tax for eligible construction and improvement projects related to the 520 bridge.

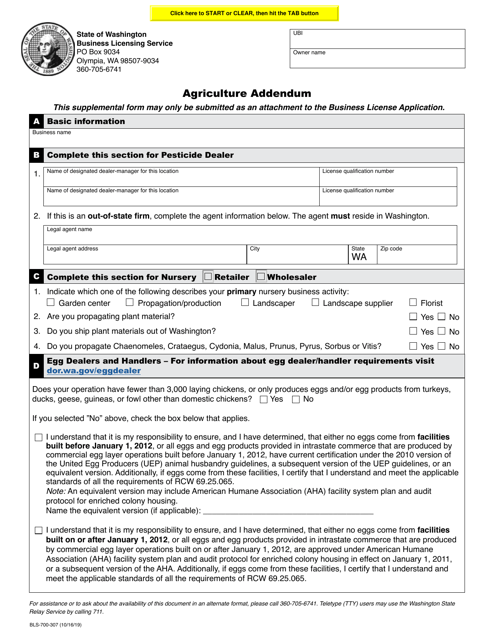

This document is an Agriculture Addendum form used in the state of Washington. It is used to provide additional information related to agricultural activities.

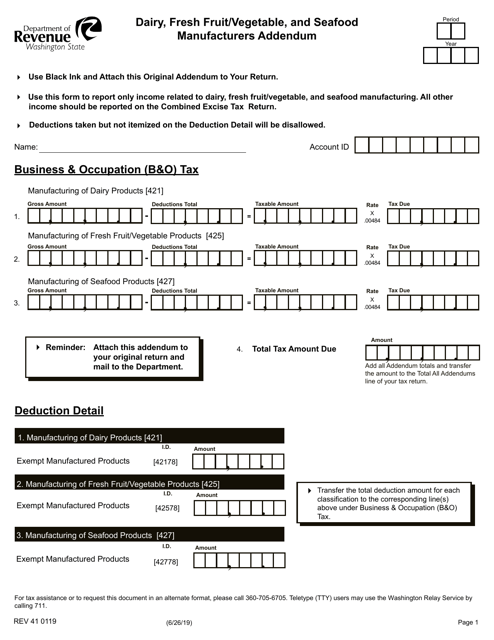

This form is used for adding an addendum to the REV41 0119 Dairy, Fresh Fruit/Vegetable, and Seafood Manufacturers form in the state of Washington.

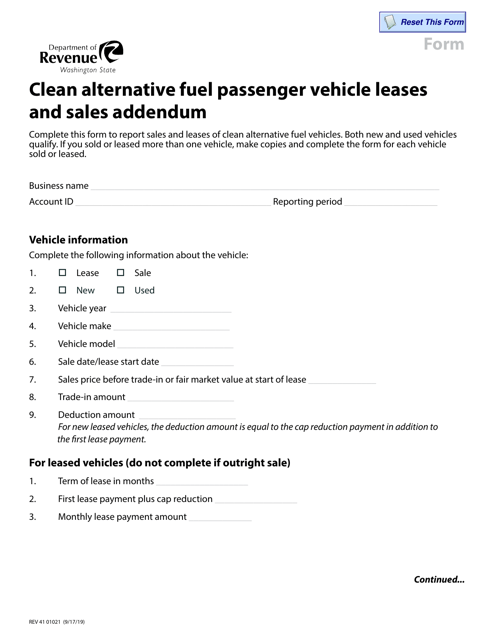

This form is used for adding an addendum to a lease or sales agreement for clean alternative fuel passenger vehicles in the state of Washington.

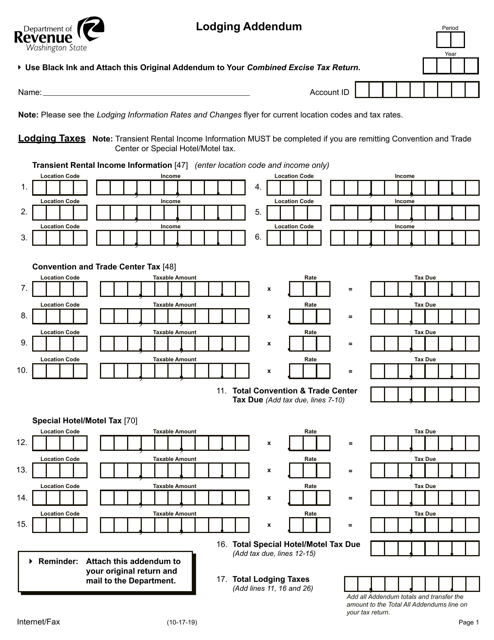

This document is an addendum to a lodging agreement in the state of Washington. It outlines additional terms and conditions related to the lodging arrangement.

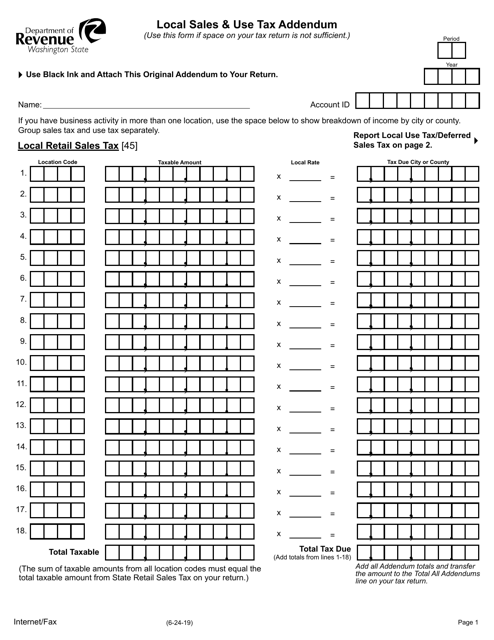

This document is an addendum to the Local Sales & Use Tax form in the state of Washington. It provides additional information or instructions related to calculating and reporting local sales and use taxes.

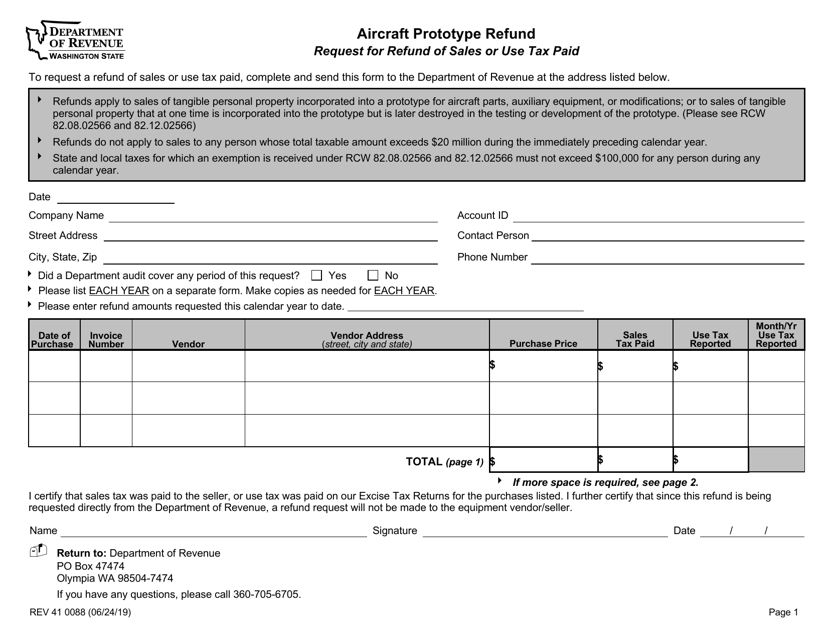

This form is used for requesting a refund of taxes paid on an aircraft prototype in Washington state.

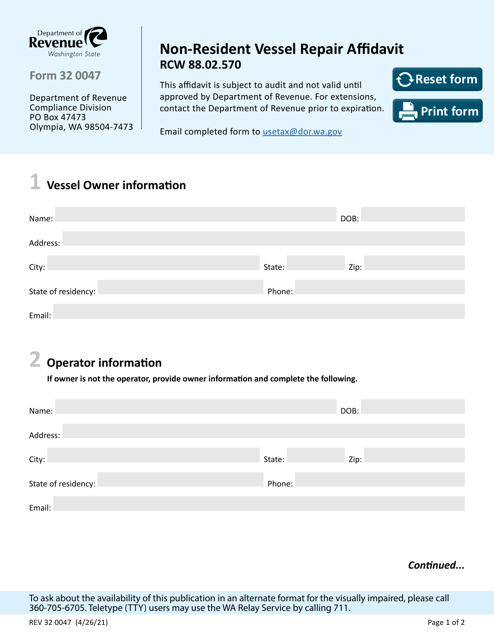

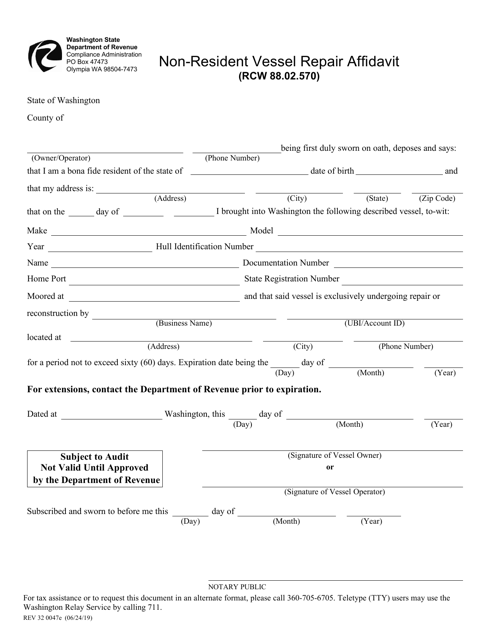

This Form is used for non-resident vessel owners to provide an affidavit for vessel repair in Washington.

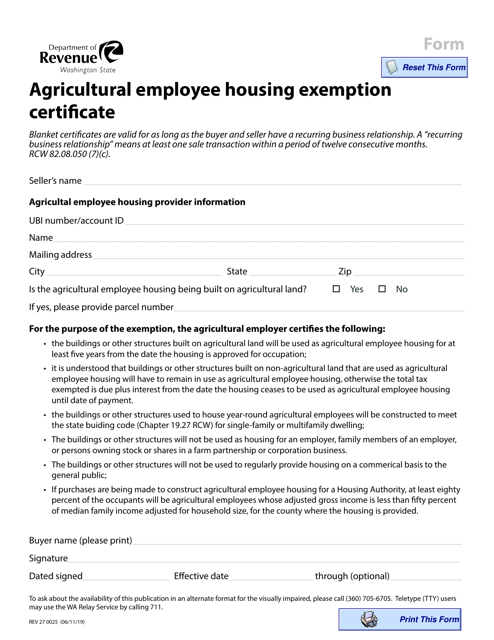

This form is used for claiming an exemption from certain housing requirements for agricultural employees in the state of Washington.

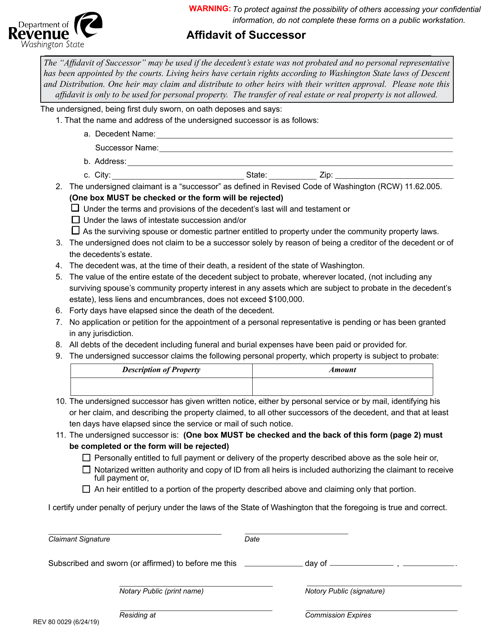

This Form is used for filing an Affidavit of Successor in the state of Washington. It is a legal document used to declare an individual as the rightful successor to a deceased person's assets and property.

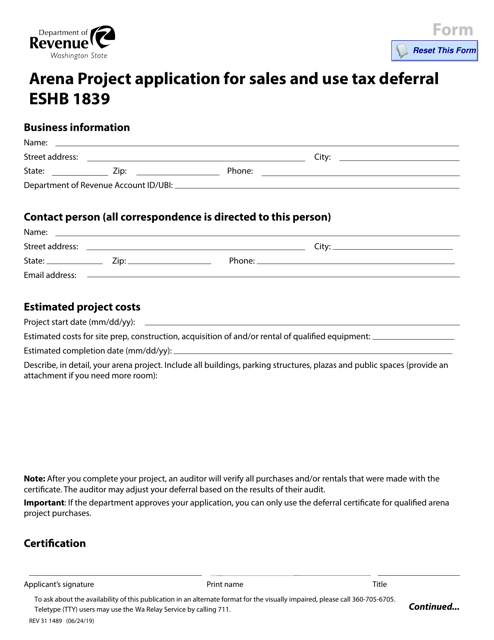

This Form is used for applying for a sales and use tax deferral for an Arena Project in Washington under Eshb 1839.

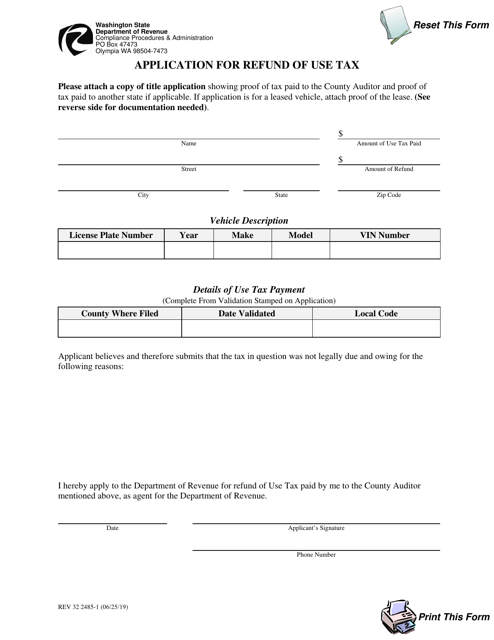

This form is used to apply for a refund of use tax paid in the state of Washington.

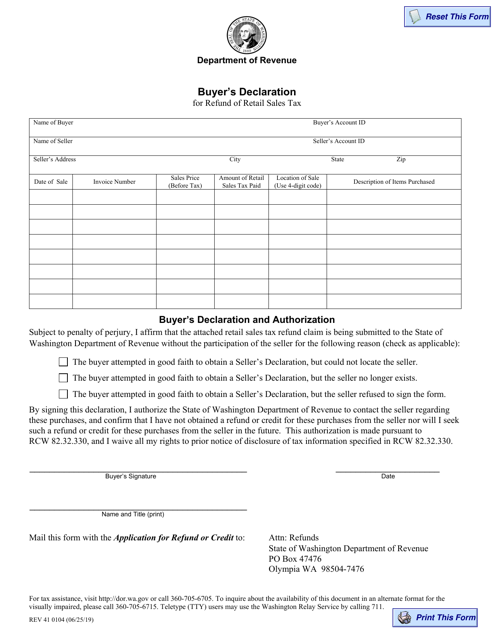

This Form is used for buyers in Washington to declare their request for refund of retail sales tax.

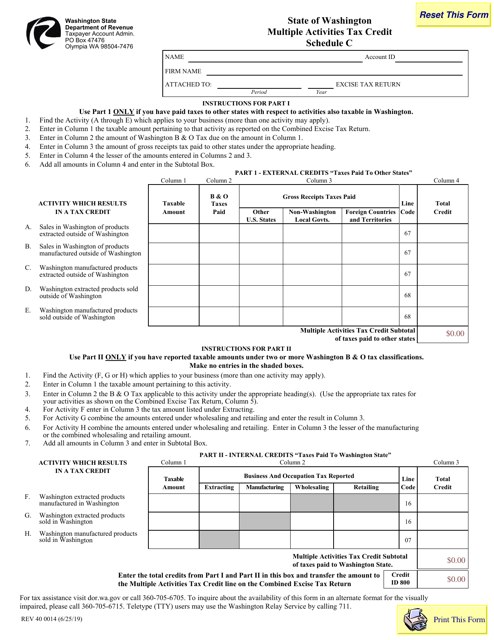

This form is used for claiming multiple activities tax credit in the state of Washington.

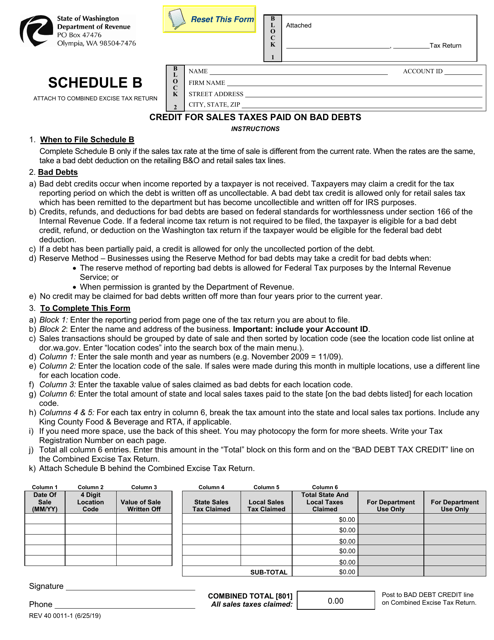

This Form is used for claiming a credit for sales taxes paid on bad debts in Washington.

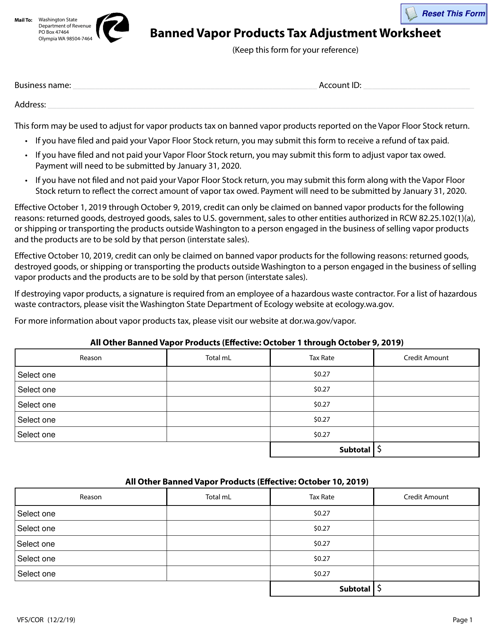

This form is used for making tax adjustments on banned vapor products in Washington state. It helps businesses calculate and report the proper amount of tax owed for these products.

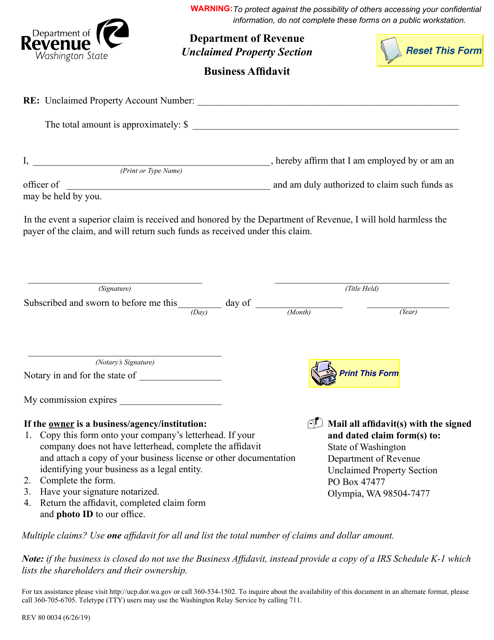

This form is used for submitting a business affidavit in Washington state.

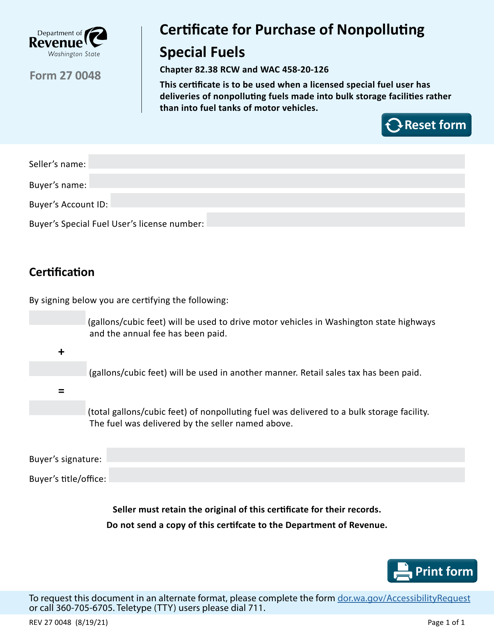

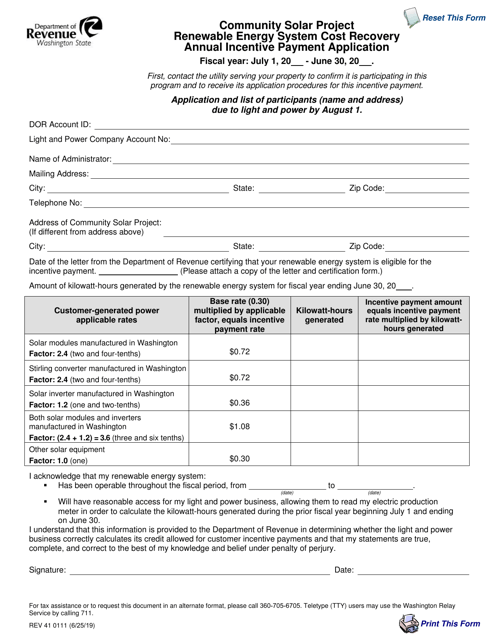

This form is used for applying for the annual incentive payment for the cost recovery of a community solar project's renewable energy system in Washington.