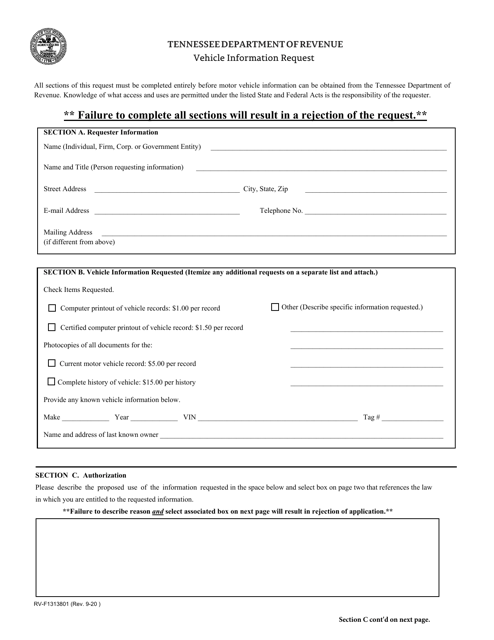

Tennessee Department of Revenue Forms

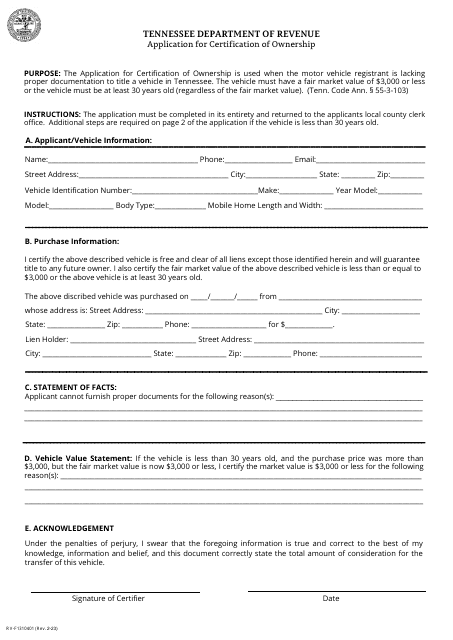

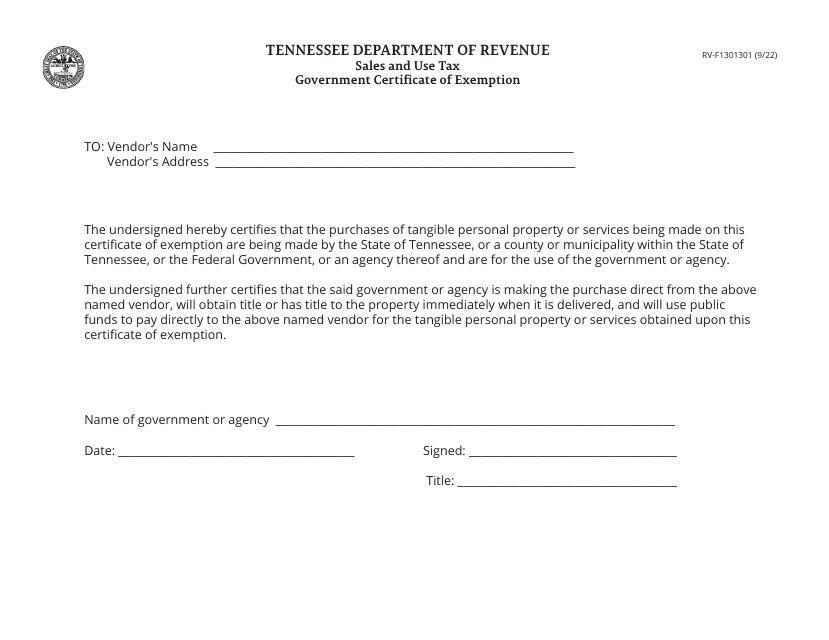

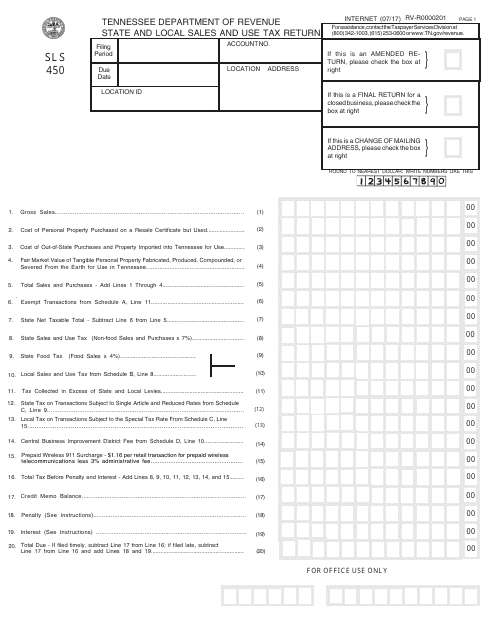

The Tennessee Department of Revenue is responsible for administering and enforcing state tax laws and regulations in the state of Tennessee. Their primary purpose is to collect various taxes and fees, such as sales tax, income tax, and motor vehicle registration fees, to fund state and local government operations and services. They also provide taxpayer assistance and support, including processing tax returns, issuing tax refunds, and providing information regarding tax compliance and regulations.

Documents:

418

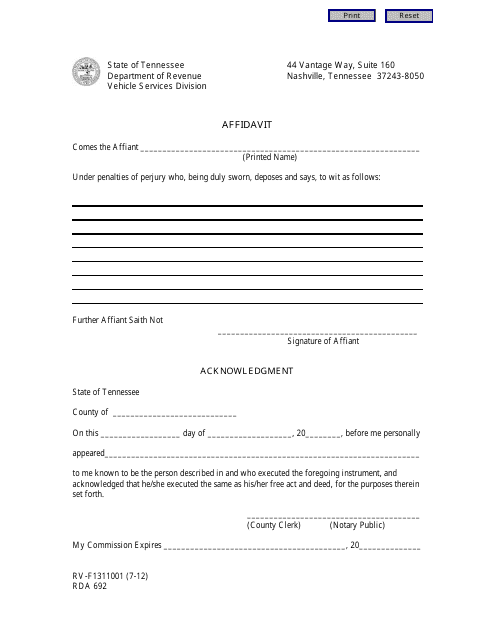

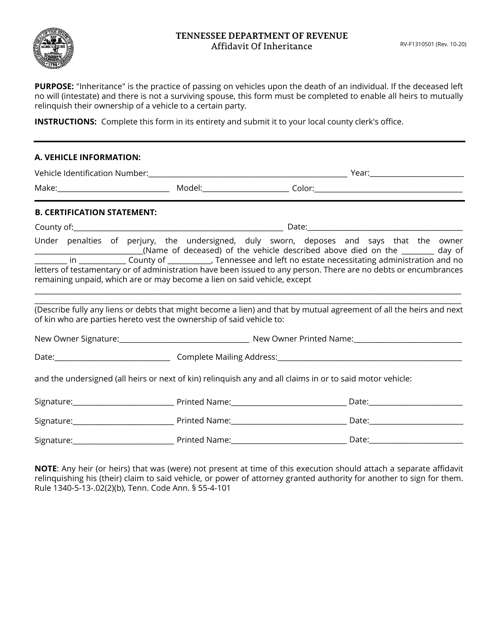

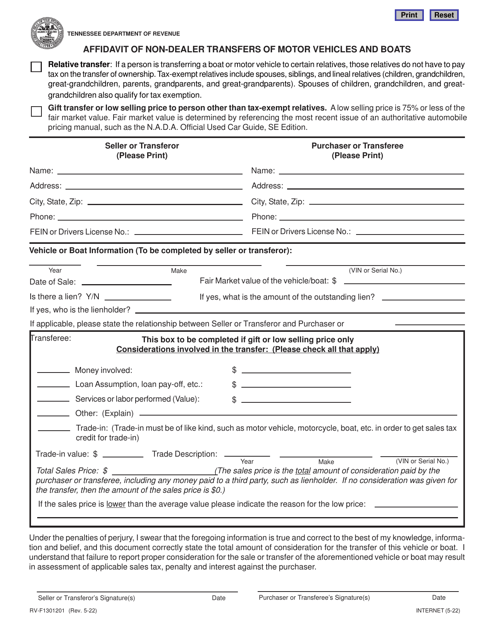

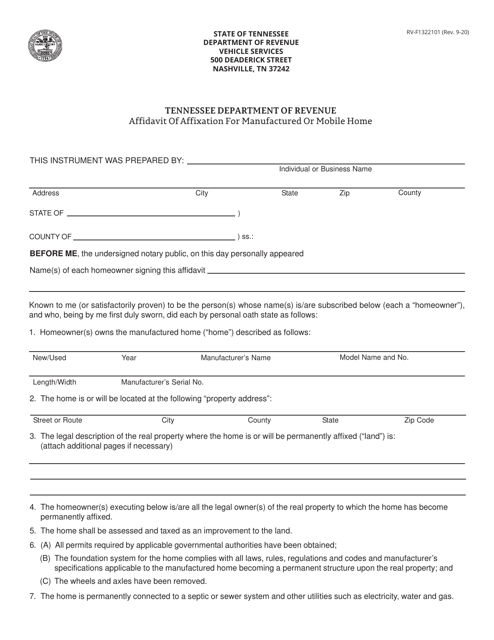

This form is used for creating an affidavit in the state of Tennessee.

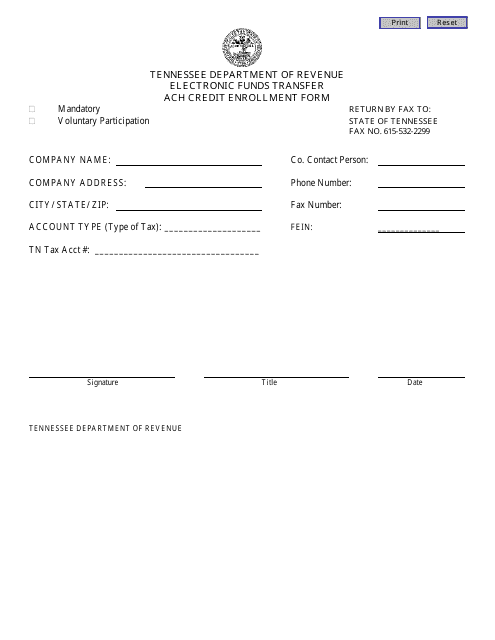

This form is used for enrolling in electronic funds transfer through the Automated Clearing House (ACH) system in Tennessee.

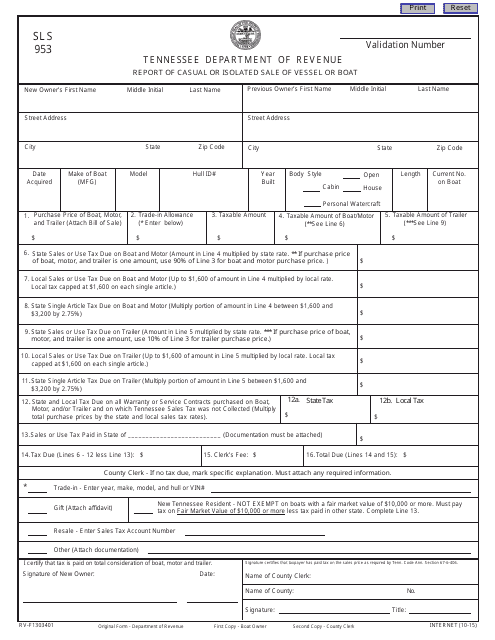

This form is used for reporting the casual or isolated sale of a vessel or boat in the state of Tennessee.

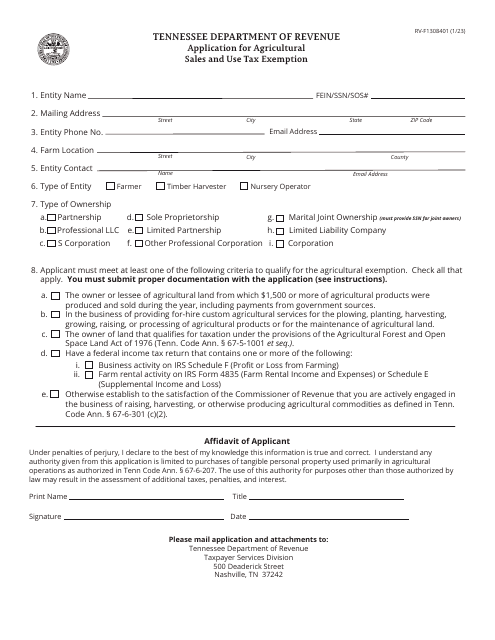

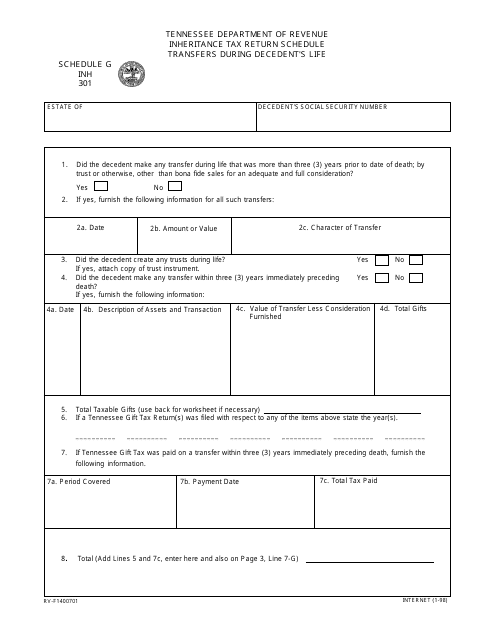

This form is used for reporting transfers made by the deceased person during their lifetime for the purpose of calculating inheritance tax in Tennessee.

This form is used for reporting and declaring quarterly franchise and excise taxes in the state of Tennessee.

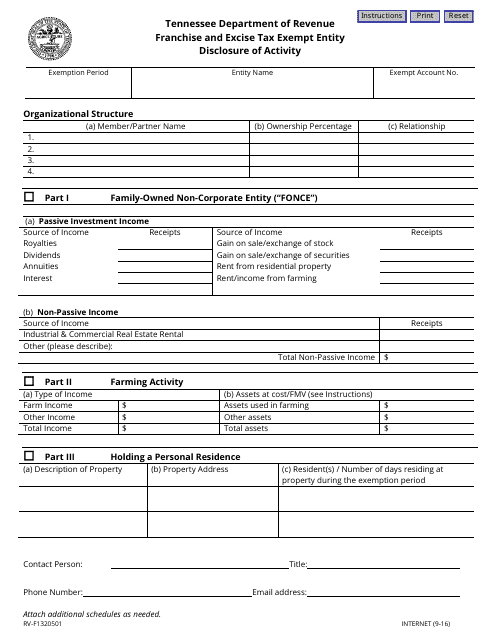

This Form is used for Tennessee businesses to disclose their activity as an exempt entity for franchise and excise tax purposes.

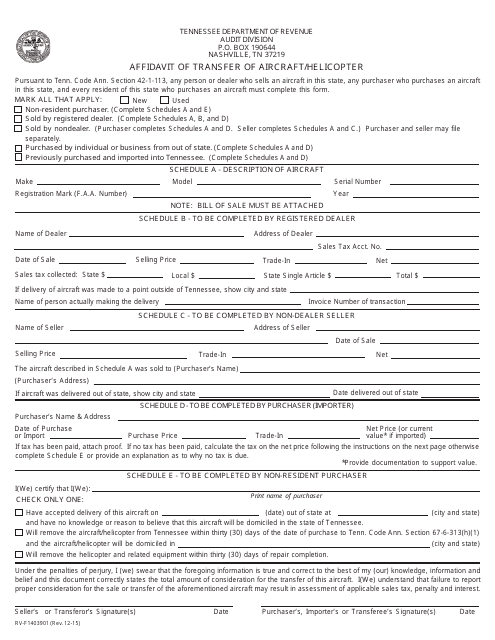

This Form is used for transferring ownership of an aircraft or helicopter in the state of Tennessee. It is an affidavit that confirms the details of the transfer.

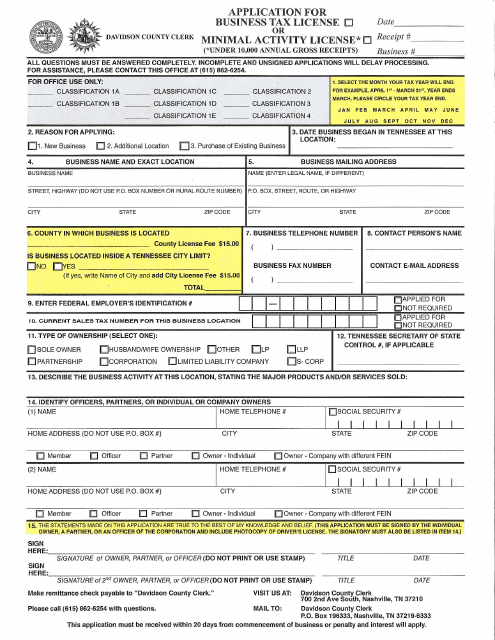

This document is used for applying for a business tax license or a minimal activity license in Davidson County, Tennessee.

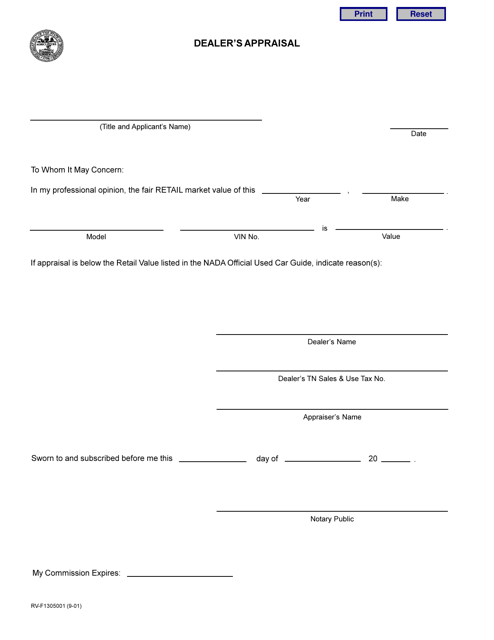

This Form is used for the appraisal of vehicles by dealers in the state of Tennessee.

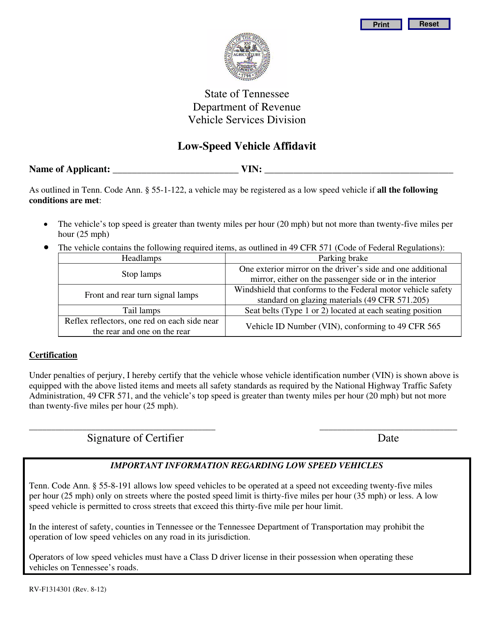

This form is used for submitting an affidavit regarding a low-speed vehicle in the state of Tennessee.

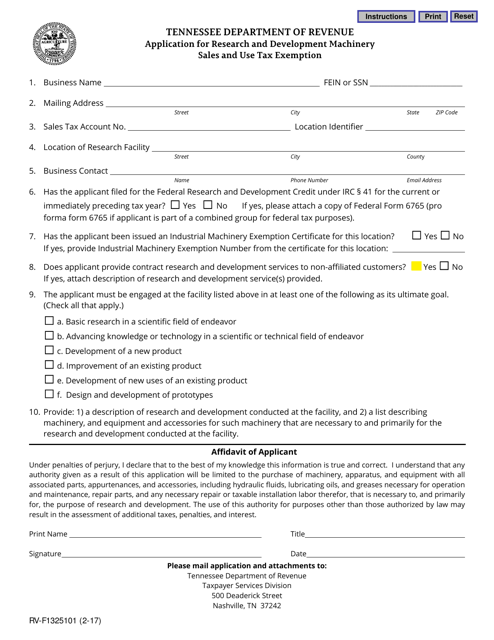

This form is used for applying for a sales and use tax exemption for research and development machinery in Tennessee. It allows businesses to claim tax benefits for equipment used in research and development activities.

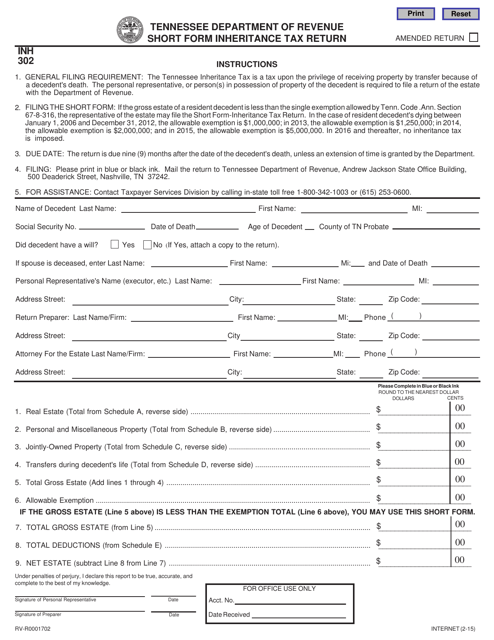

This form is used for filing the State Inheritance Tax Return in Tennessee.

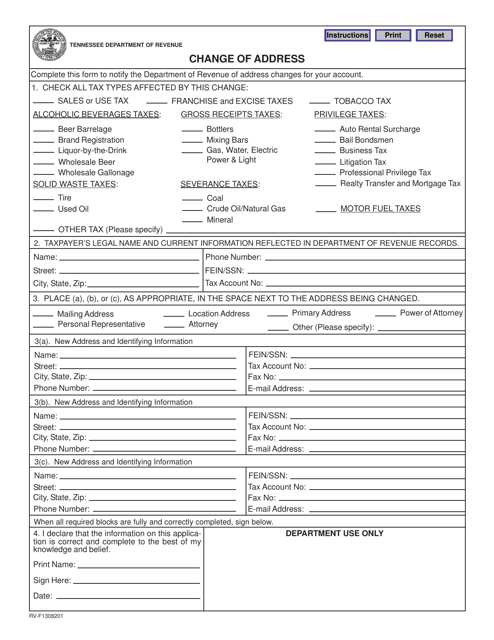

This form is used for changing your address in the state of Tennessee.

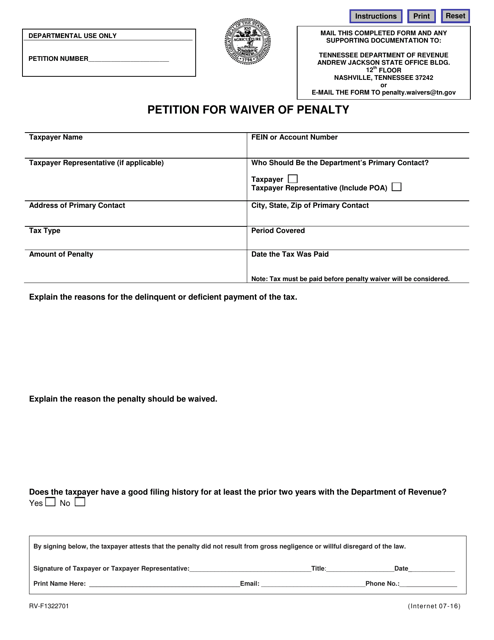

This form is used for filing a petition to request a waiver of penalty in the state of Tennessee. It is used when individuals or businesses need to request relief from penalties imposed by the Tennessee Department of Revenue.

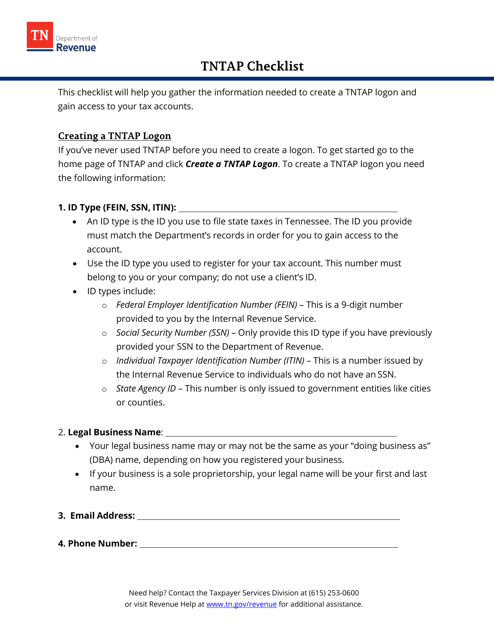

This document provides a checklist for individuals or businesses in Tennessee who need to use the TNTAP (Tennessee Taxpayer Access Point) system for various tax-related activities. The checklist helps ensure that all necessary information and requirements are met when using the TNTAP system.

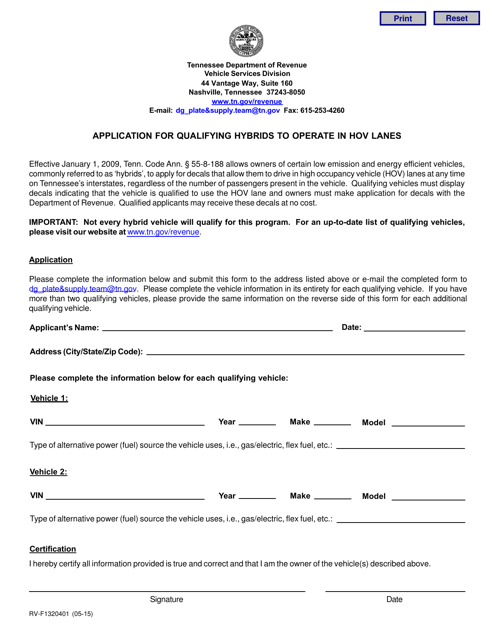

This form is used for applying to operate qualifying hybrids in the HOV lanes in Tennessee.

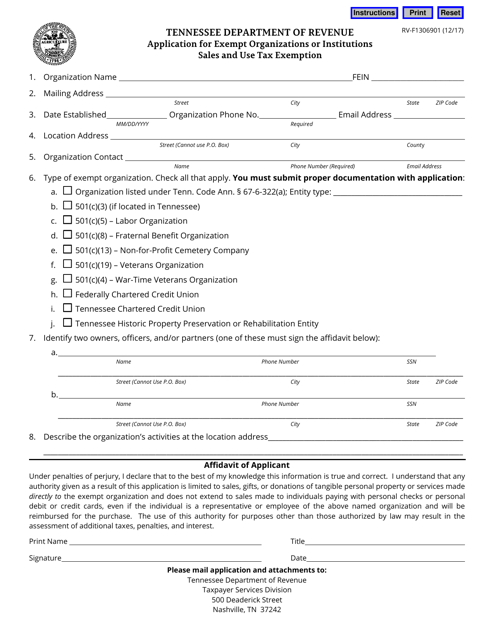

This form is used for applying for sales and use tax exemption for exempt organizations or institutions in Tennessee.

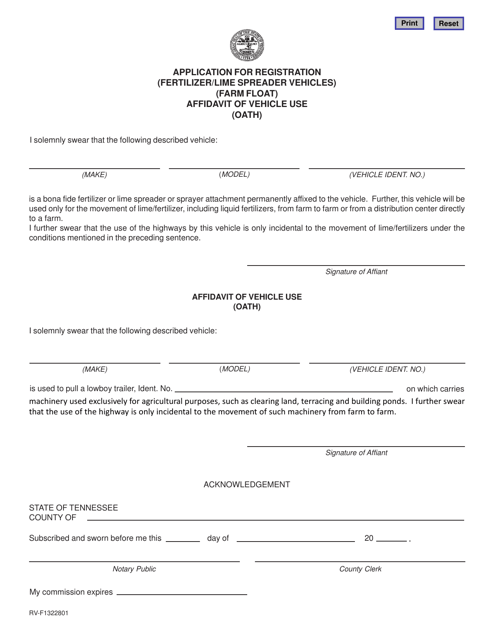

This Form is used for registering and applying for a license for fertilizer and lime spreader vehicles (also known as Farm Float) in Tennessee. It requires an affidavit of vehicle use and oath.

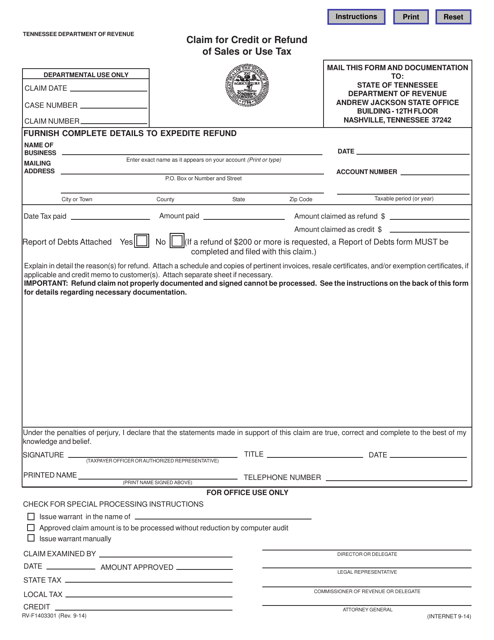

This form is used for claiming a credit or refund for sales or use tax paid in Tennessee.

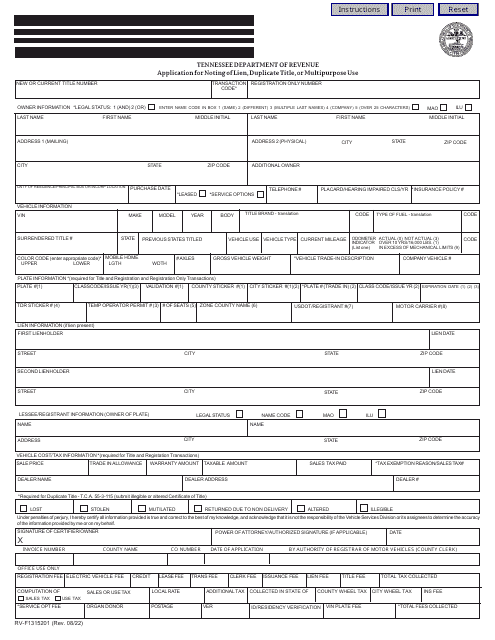

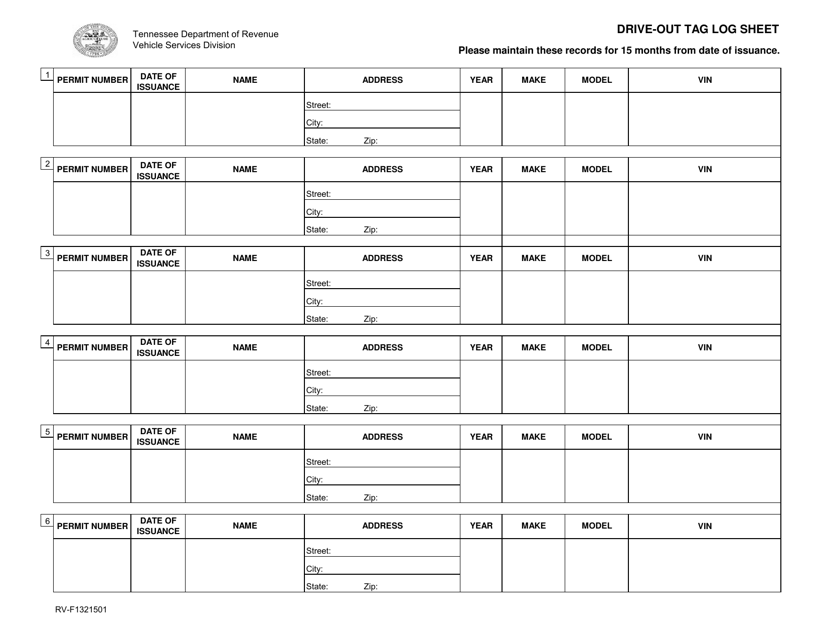

This Form is used for recording drive-out tag information for vehicles in Tennessee.

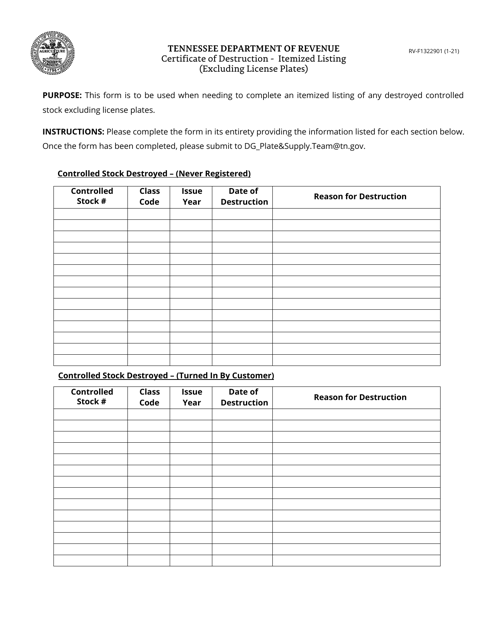

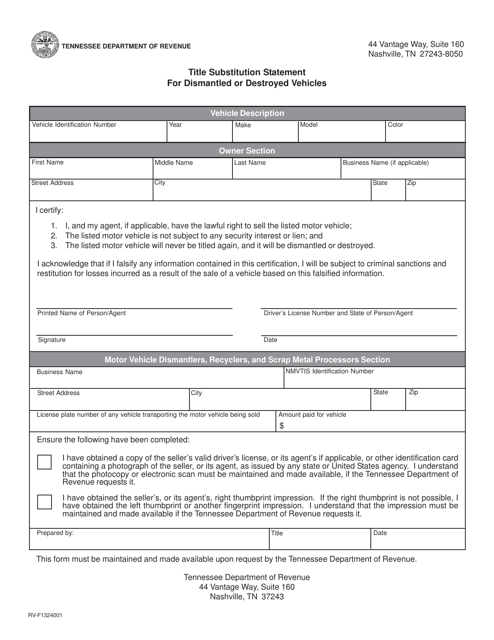

This Form is used for reporting the substitution of a vehicle that has been dismantled or destroyed in the state of Tennessee.