Pennsylvania Department of Revenue Forms

Documents:

754

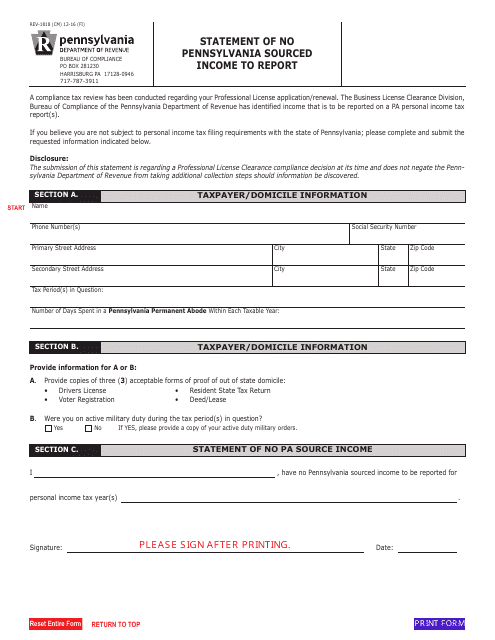

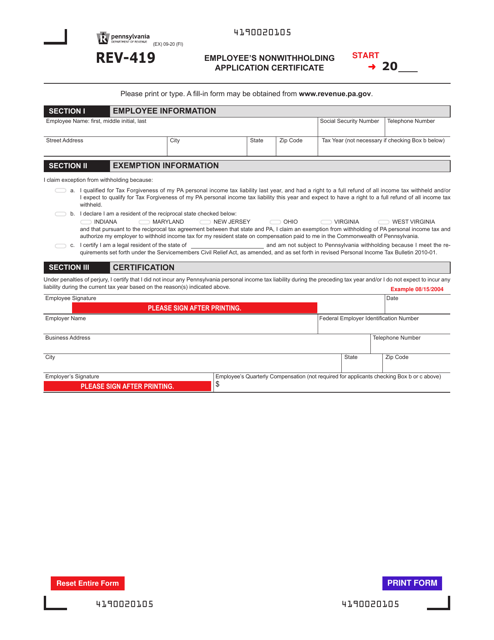

This form is used for residents of Pennsylvania to declare that they have no income from Pennsylvania sources to report.

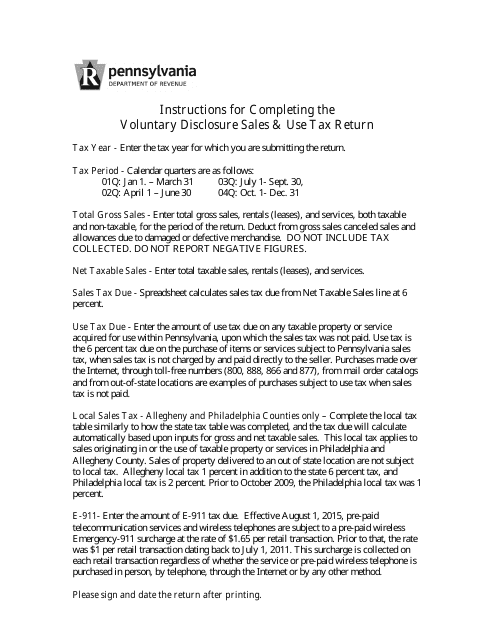

This document provides instructions for filing a Voluntary Disclosure Sales & Use Tax Return in Pennsylvania. It guides individuals on how to report and pay their sales and use taxes through the voluntary disclosure program.

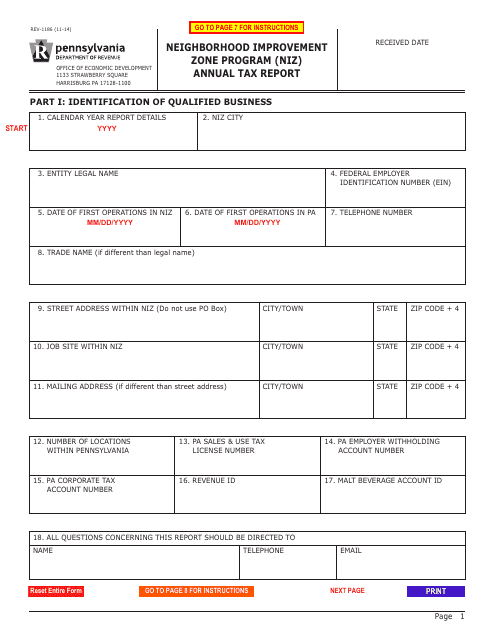

This form is used for reporting annual taxes under the Neighborhood Improvement Zone (NIZ) Program in Pennsylvania.

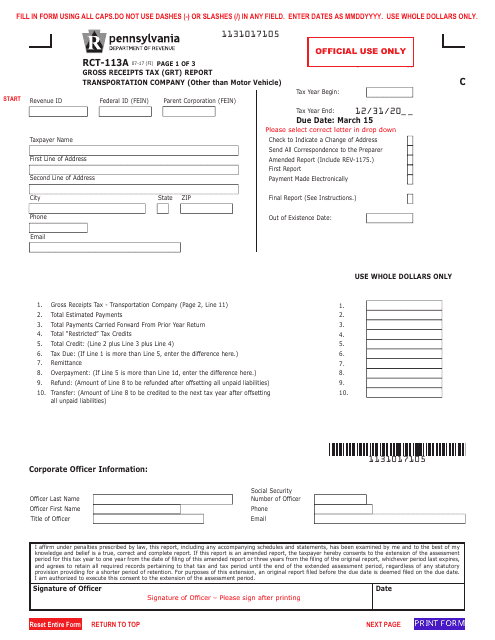

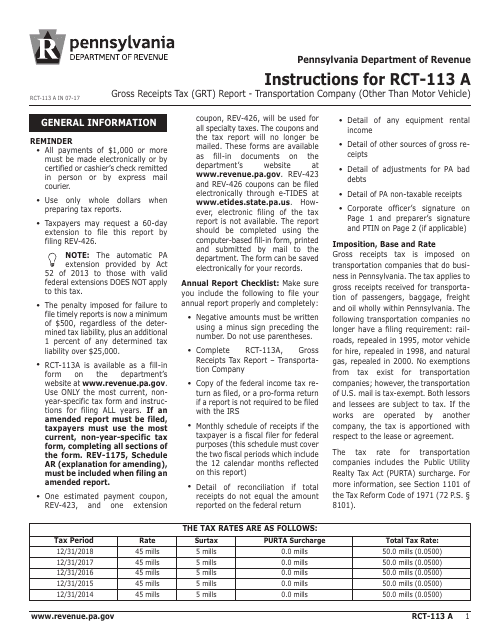

This form is used for reporting gross receipts tax for transportation companies in Pennsylvania that are not motor vehicle companies.

This Form is used for reporting Gross Receipts Tax (GRT) for transportation companies in Pennsylvania, excluding those operating motor vehicles. It provides instructions on how to accurately report and pay the tax.

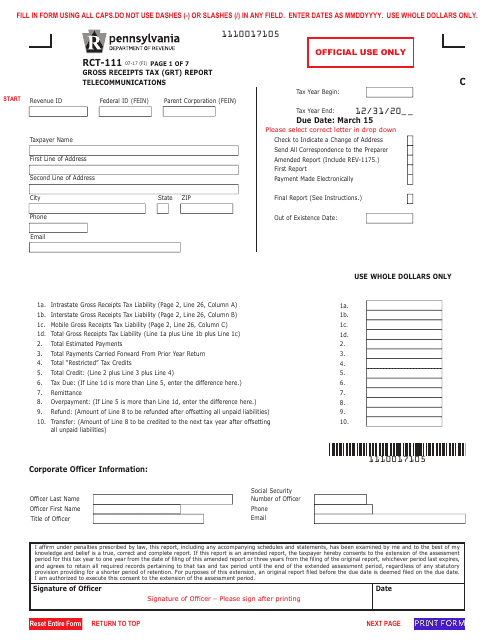

This form is used for reporting gross receipts tax (GRT) in the telecommunications industry in Pennsylvania.

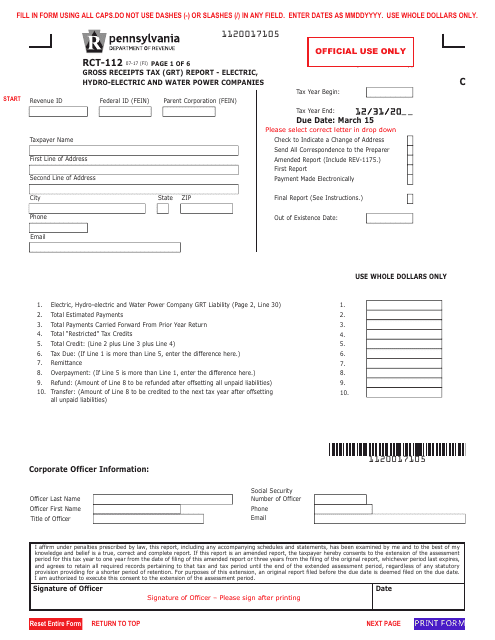

This Form is used for reporting the gross receipts tax for electric, hydro-electric, and water power companies in Pennsylvania.

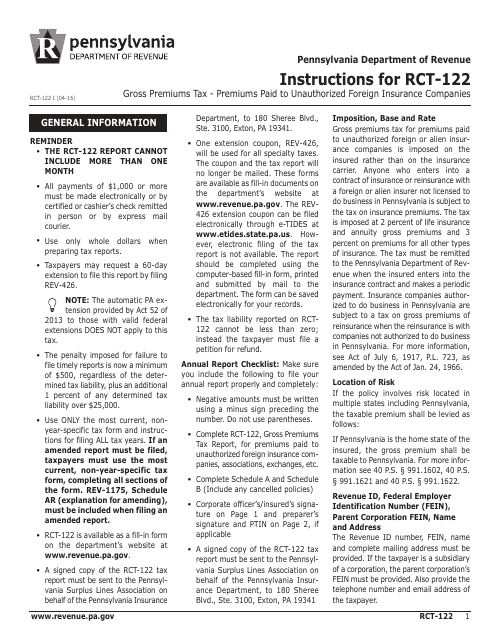

This Form is used for reporting and paying gross premiums tax on premiums paid to unauthorized foreign insurance companies in Pennsylvania.

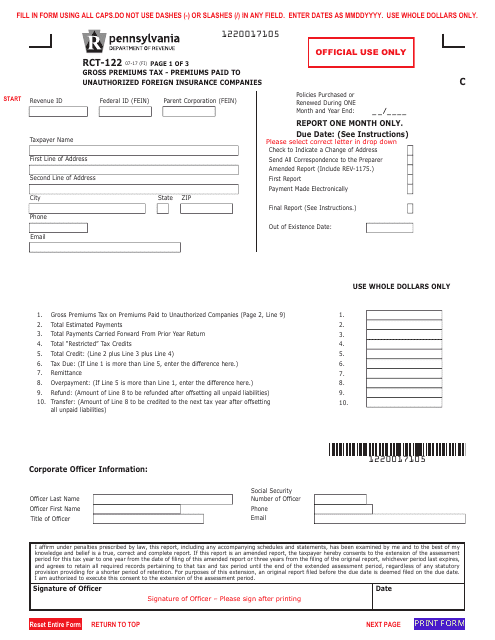

This form is used for reporting gross premiums paid to unauthorized foreign insurance companies in Pennsylvania for tax purposes.

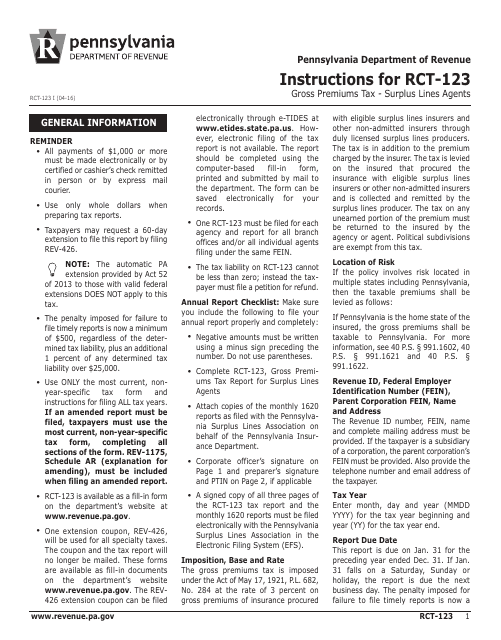

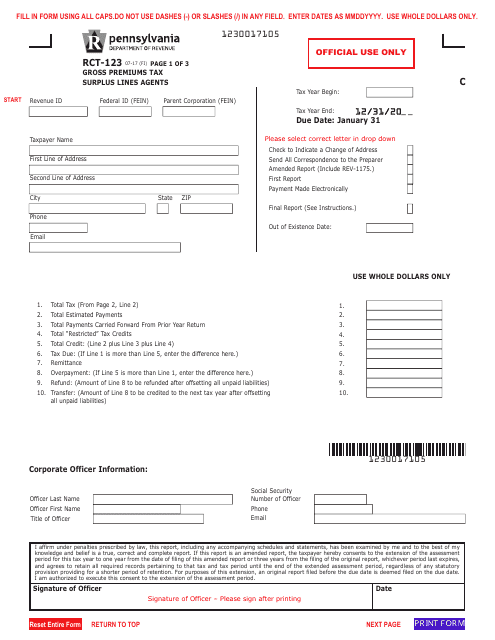

This Form is used for filing gross premiums tax by surplus lines agents in Pennsylvania.

This form is used for reporting gross premiums tax for surplus lines agents in Pennsylvania.

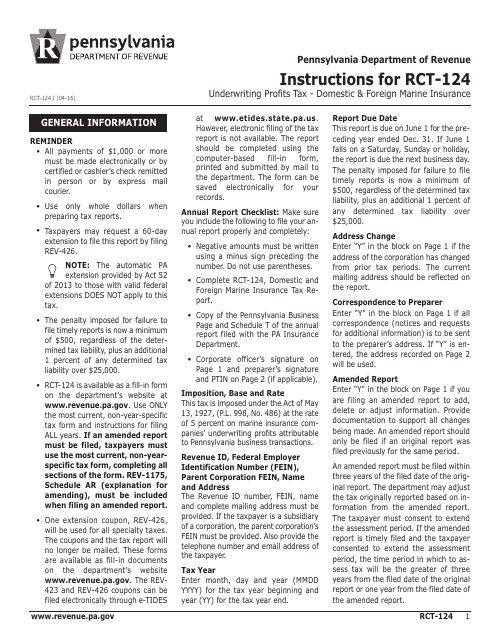

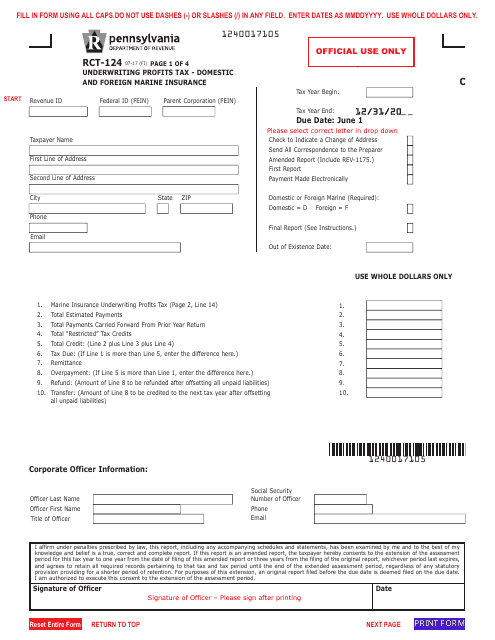

This Form is used for reporting underwriting profits tax for domestic and foreign marine insurance companies in Pennsylvania. It provides instructions on how to accurately complete and file Form RCT-124.

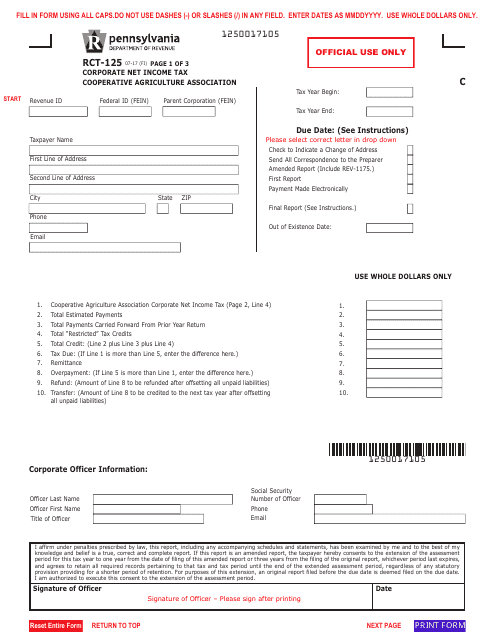

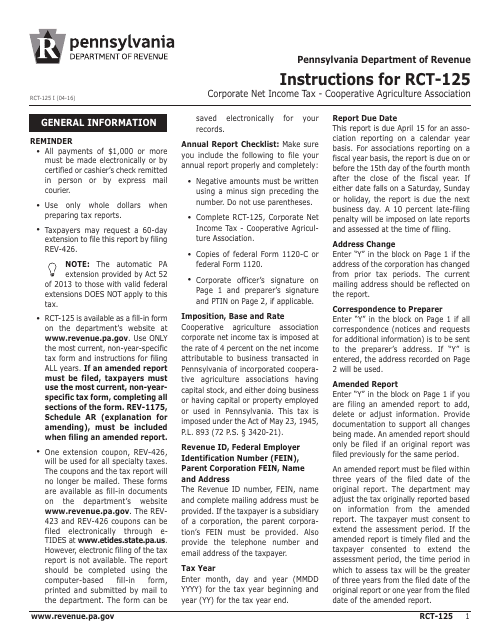

This form is used for reporting the corporate net income tax of Cooperative Agriculture Associations in Pennsylvania.

This Form is used for filing corporate net income tax for Cooperative Agriculture Associations in Pennsylvania. It provides instructions on how to accurately complete the form and submit it to the appropriate authorities.

This form is used for reporting underwriting profits tax for domestic and foreign marine insurance in Pennsylvania.

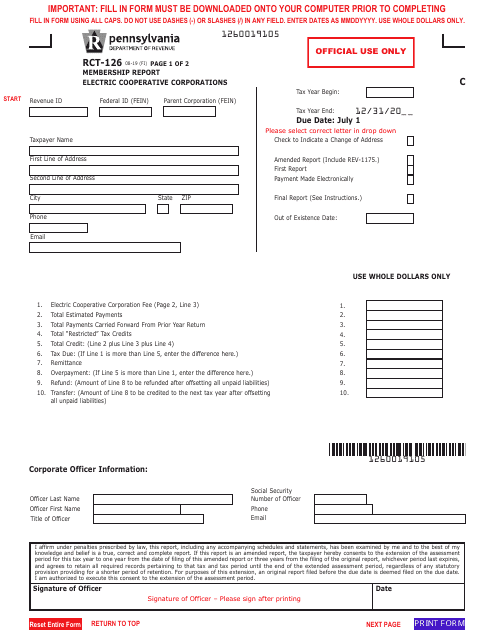

This Form is used for reporting membership information for electric cooperative corporations in Pennsylvania. It provides instructions on how to complete and submit the Form RCT-126 Membership Report.

This document provides instructions for completing Form RCT-127, which is used to report public utility realty tax in Pennsylvania.

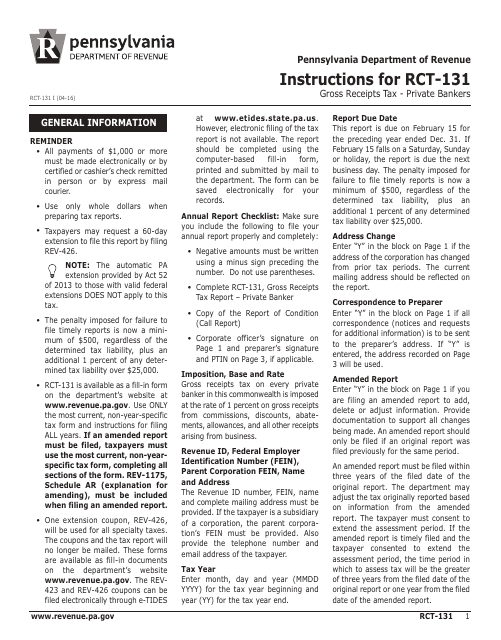

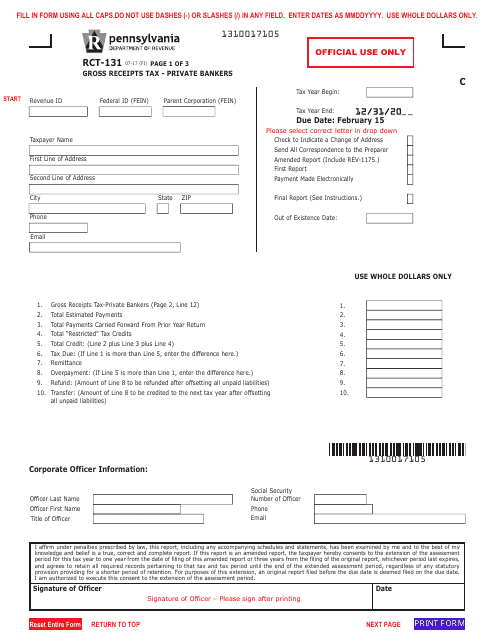

This Form is used for reporting and paying the Gross Receipts Tax for private bankers in the state of Pennsylvania. It provides instructions on how to calculate and submit the tax owed.

This Form is used for reporting gross receipts tax for private bankers in Pennsylvania.

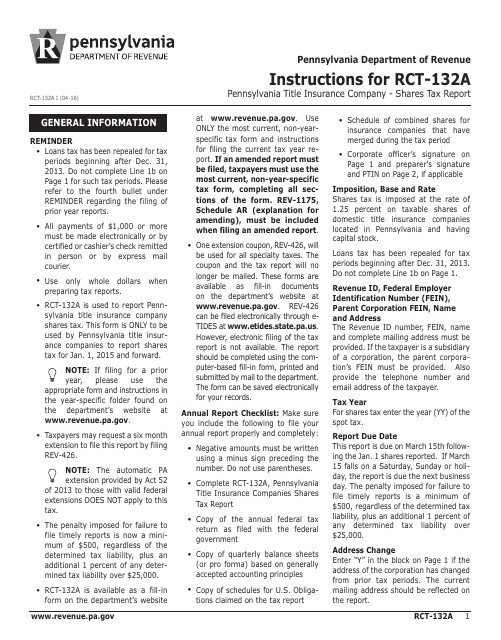

This Form is used for reporting shares tax by Pennsylvania title insurance companies. It provides instructions for completing Form RCT-132A.

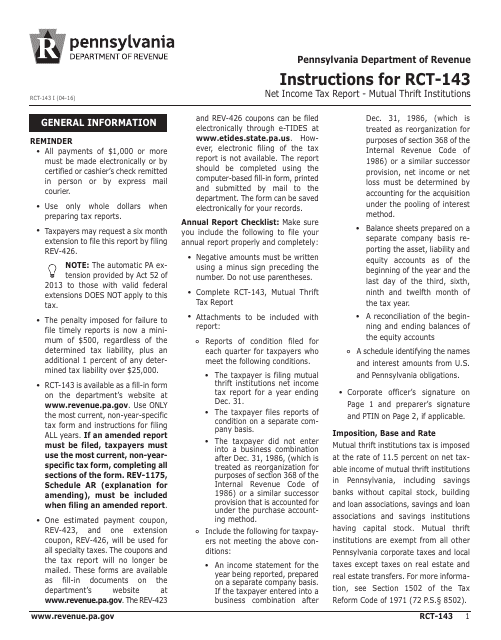

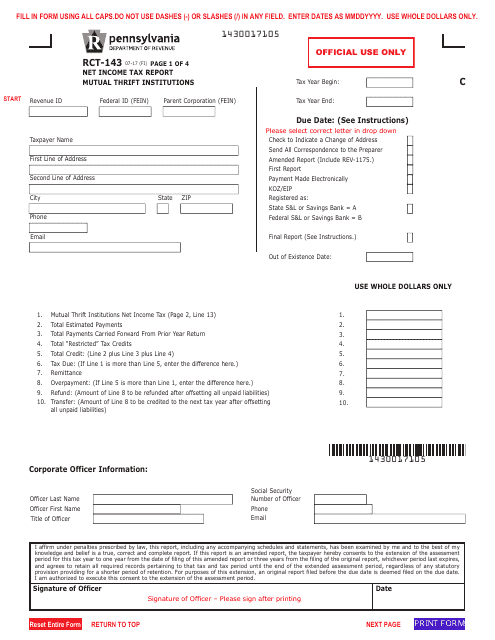

This Form is used for reporting the net income tax for mutual thrift institutions in Pennsylvania. It provides instructions for properly filling out Form RCT-143.

This form is used for reporting net income tax for mutual thrift institutions in Pennsylvania.

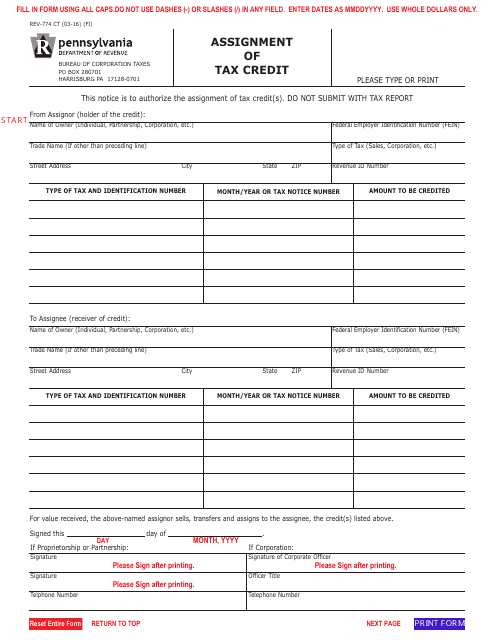

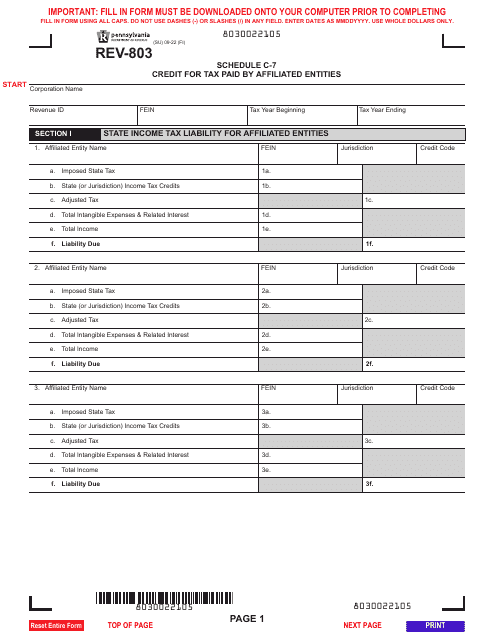

This Form is used for assigning tax credits in Pennsylvania (PA). It allows individuals or businesses to transfer their tax credits to another party.

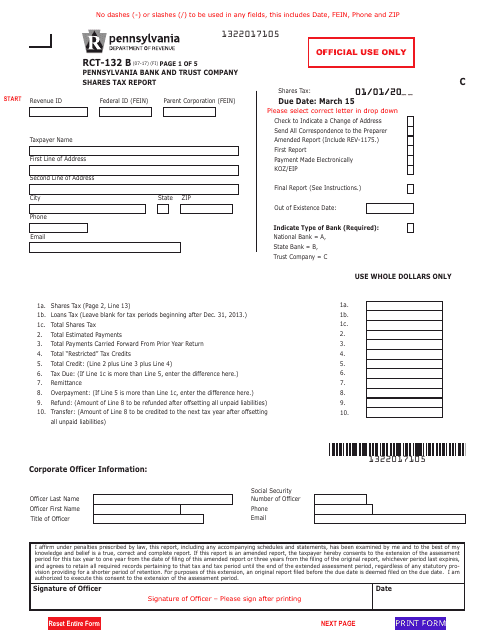

This form is used for reporting Pennsylvania Bank and Trust Company shares tax information in Pennsylvania.

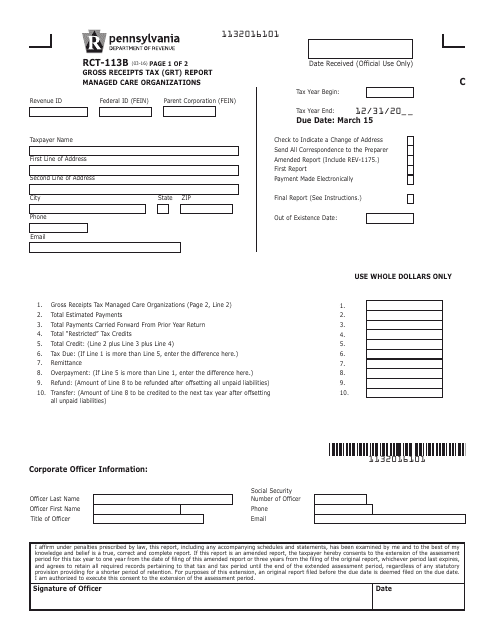

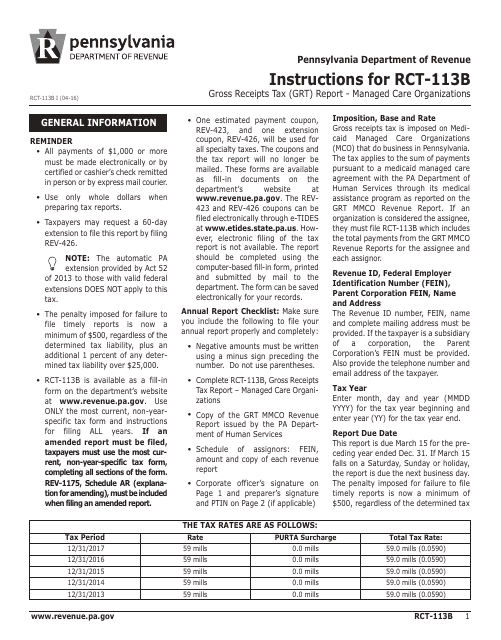

This form is used for reporting Gross Receipts Tax (GRT) for managed care organizations in Pennsylvania.

This Form is used for reporting gross receipts tax for managed care organizations in Pennsylvania. It provides instructions on how to fill out the RCT-113B Gross Receipts Tax (GRT) Report.

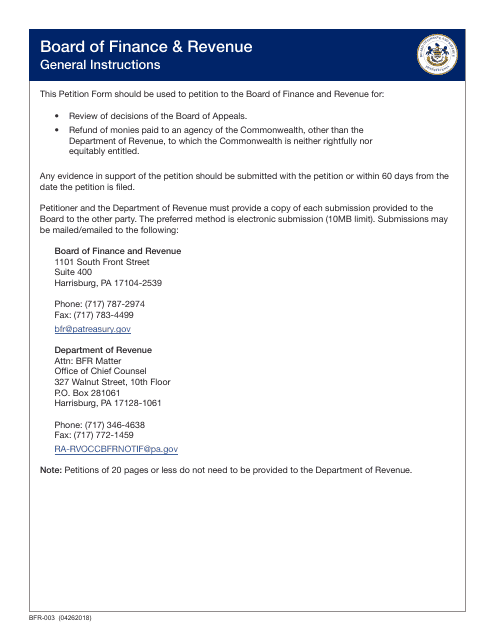

This Form is used for filing a petition in the state of Pennsylvania.

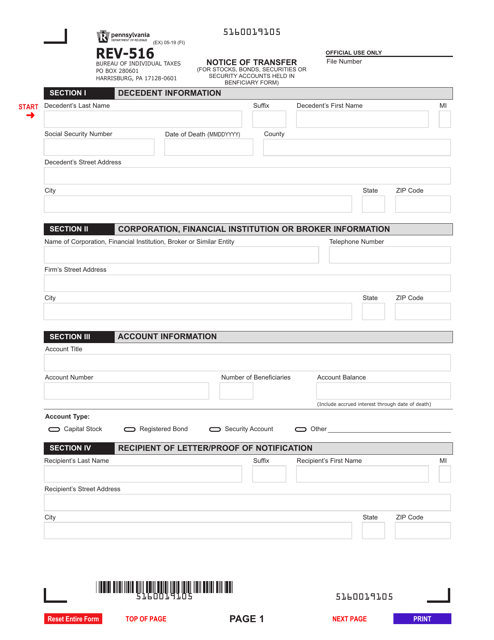

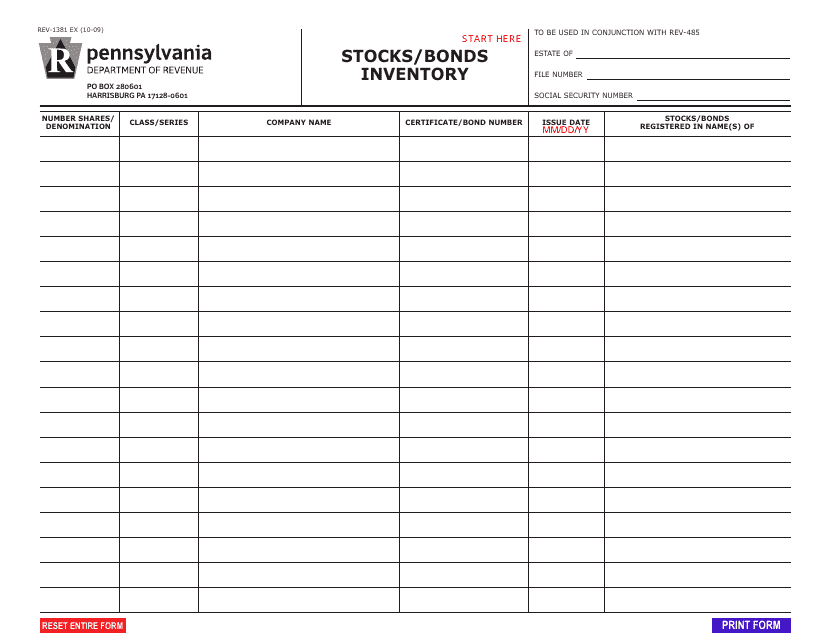

This Form is used for reporting and documenting stocks and bonds inventory in the state of Pennsylvania.

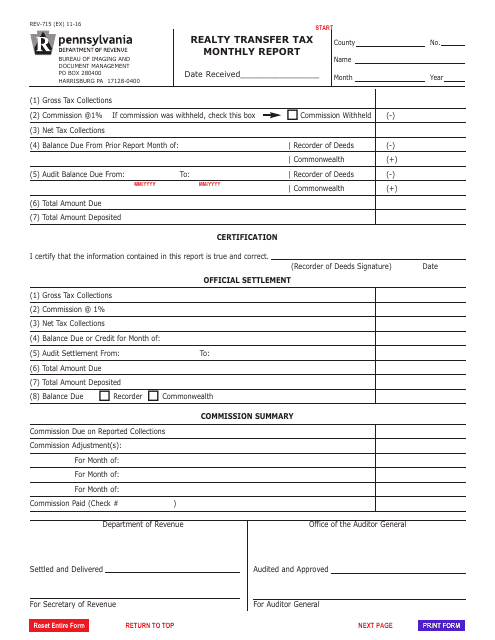

This form is used for reporting monthly realty transfer tax in Pennsylvania. It is used by individuals and businesses to report and pay taxes related to property transfers.