Pennsylvania Department of Revenue Forms

Documents:

754

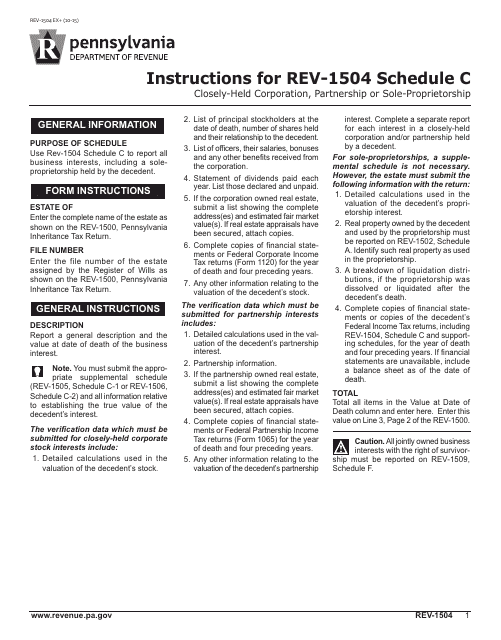

This Form is used for reporting income and deductions for a closely-held corporation, partnership, or sole-proprietorship in the state of Pennsylvania. It provides specific instructions on how to fill out Schedule C of Form REV-1504.

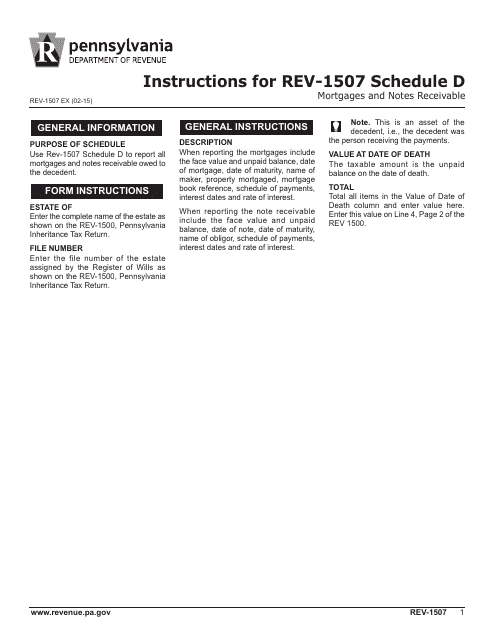

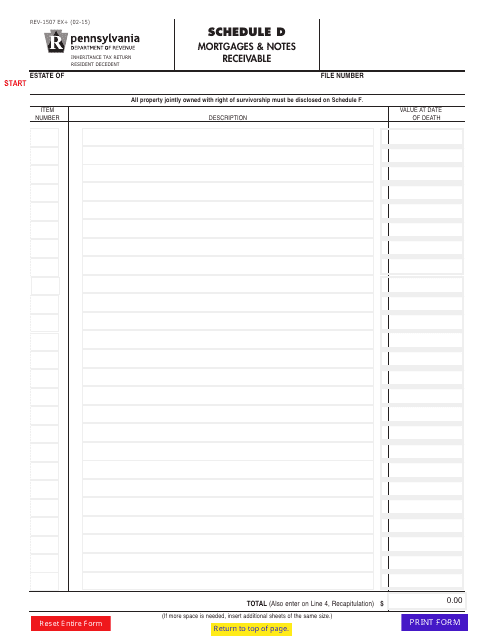

This Form is used for reporting mortgages and notes receivable in Pennsylvania. It provides instructions on how to accurately fill out Schedule D.

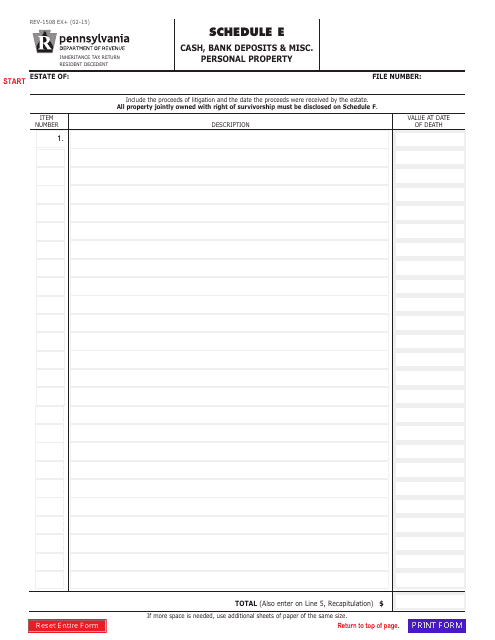

This form is used for reporting cash, bank deposits, and miscellaneous personal property in Pennsylvania.

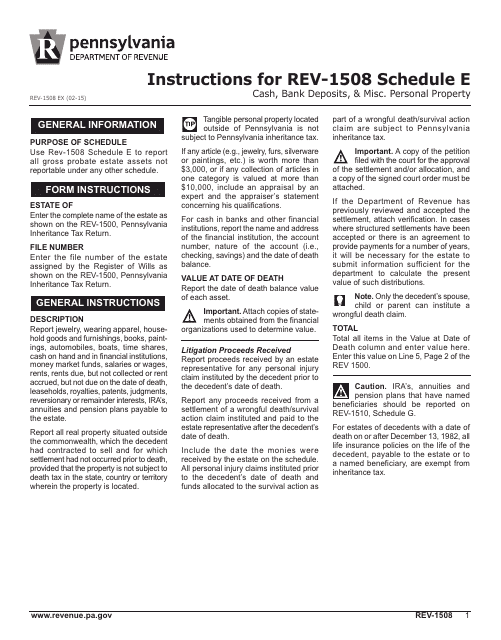

This Form is used for reporting cash, bank deposits, and miscellaneous personal property in Pennsylvania. It provides instructions for filling out the Schedule E section of Form REV-1508.

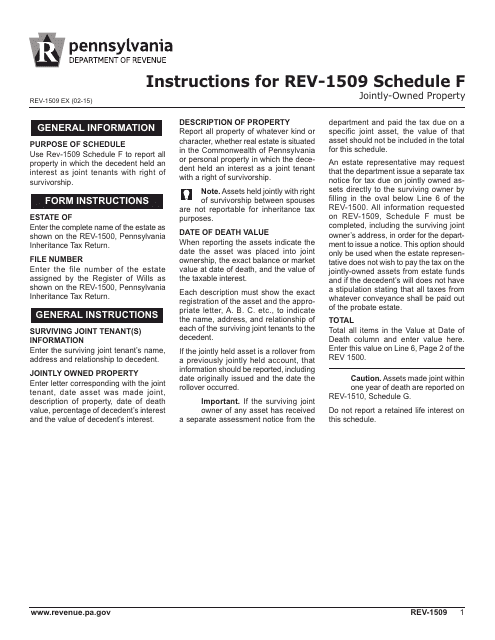

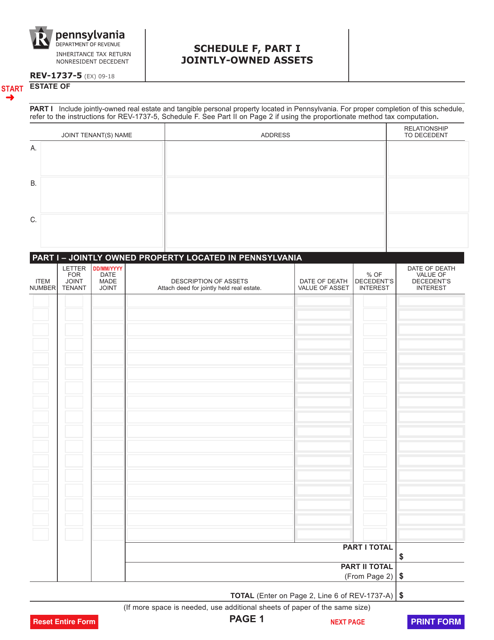

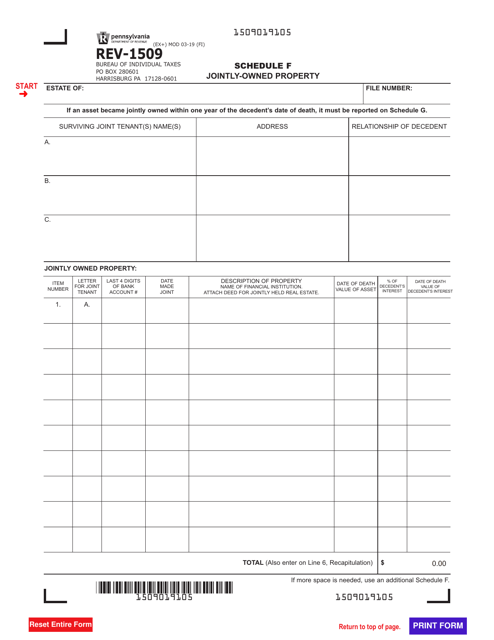

This form provides instructions for reporting jointly-owned property in Pennsylvania on Schedule F.

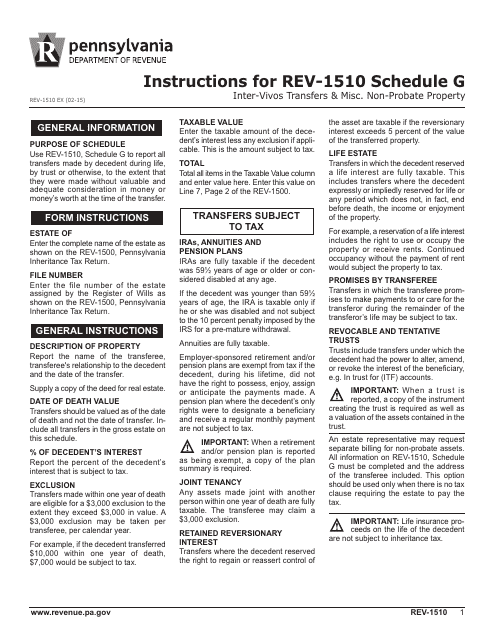

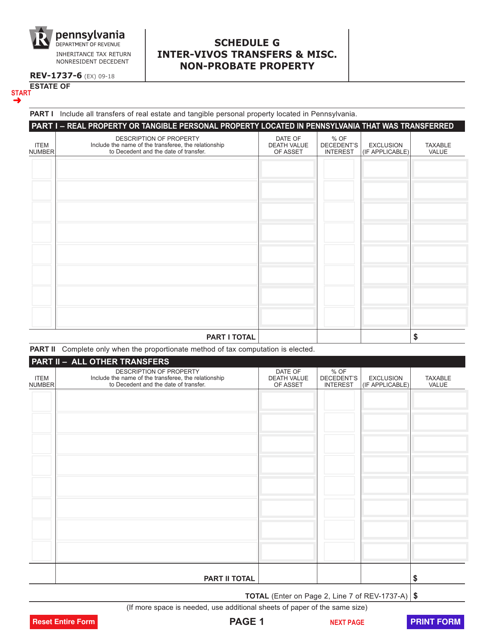

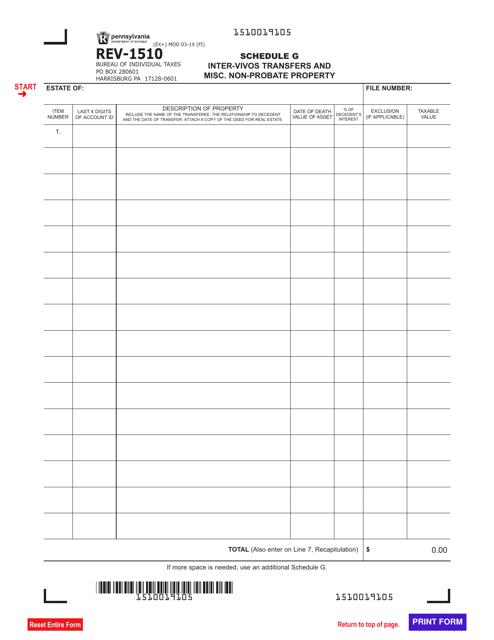

This Form is used for reporting inter-vivos transfers and non-probate property in Pennsylvania. It provides instructions for filling out Schedule G of Form REV-1510.

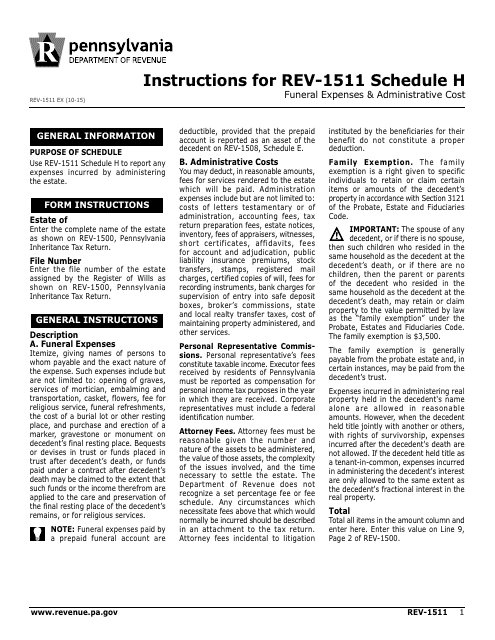

This form is used for reporting funeral expenses and administrative costs in Pennsylvania. It provides instructions on how to fill out Schedule H of Form REV-1511.

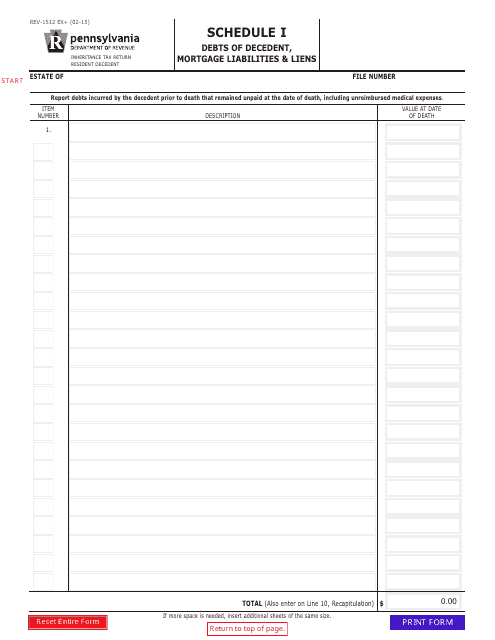

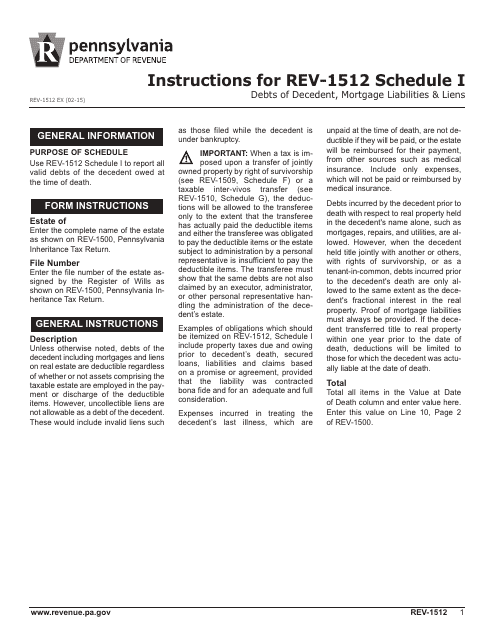

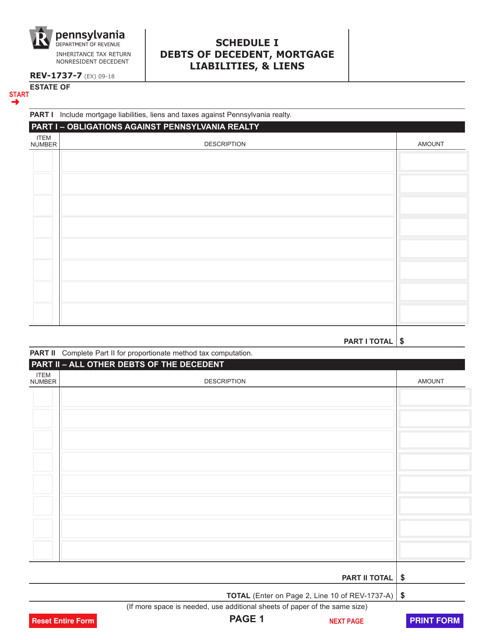

This form is used for reporting the debts, mortgage liabilities, and liens of a deceased individual in Pennsylvania.

This Form is used for reporting the debts of a deceased person, including mortgage liabilities and liens, in the state of Pennsylvania. It provides instructions on how to accurately fill out the Schedule I section of Form REV-1512.

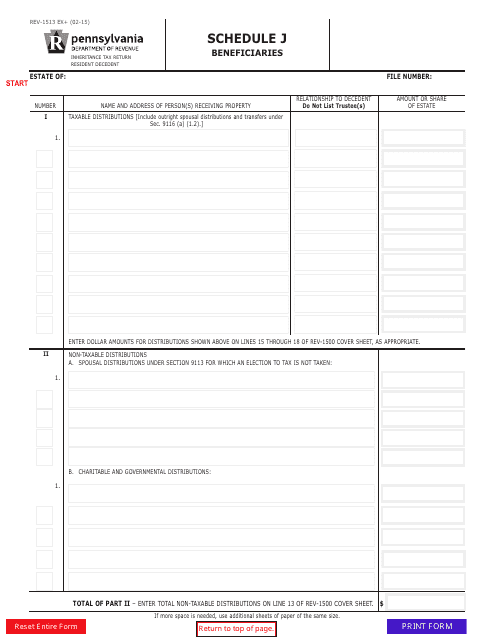

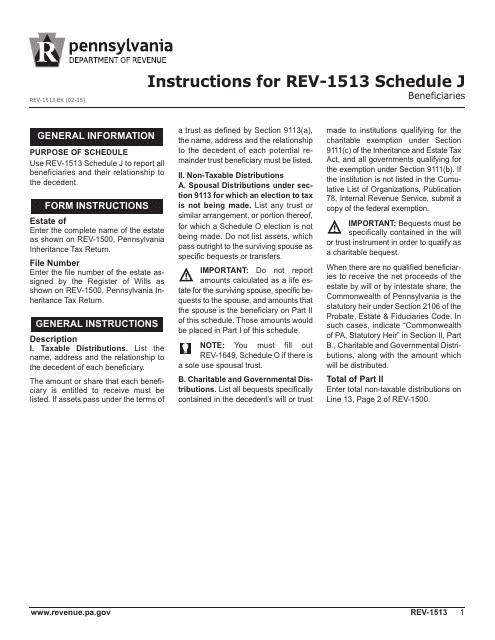

This form is used for reporting beneficiaries in the state of Pennsylvania.

This Form REV-1513 Schedule J Beneficiaries is used for reporting beneficiaries in Pennsylvania. It provides instructions for completing the schedule and ensuring accurate reporting.

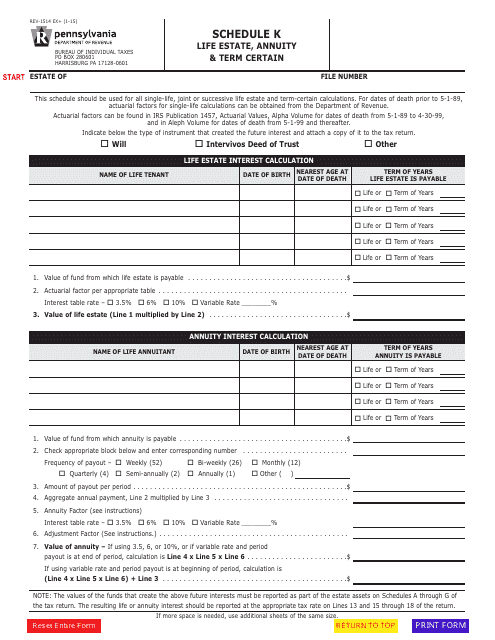

This Form is used for reporting the details of a life estate, annuity, and term certain for tax purposes in the state of Pennsylvania.

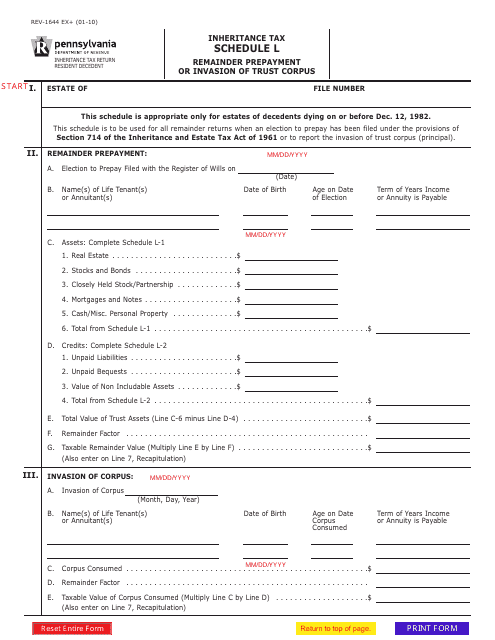

This form is used for reporting the remainder prepayment or invasion of trust corpus for inheritance tax in Pennsylvania. It is known as Form REV-1644 Schedule L.

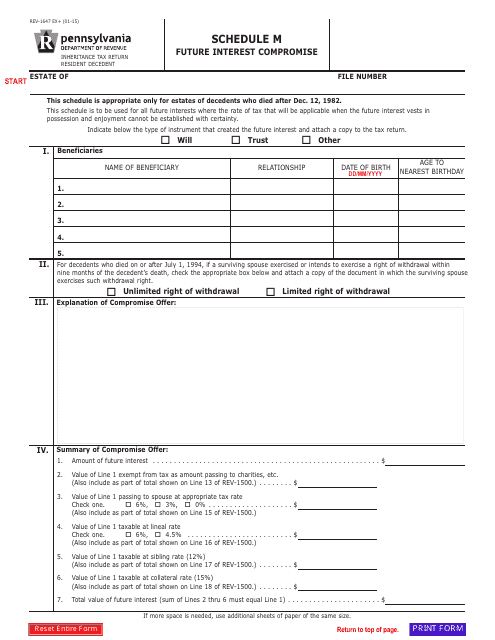

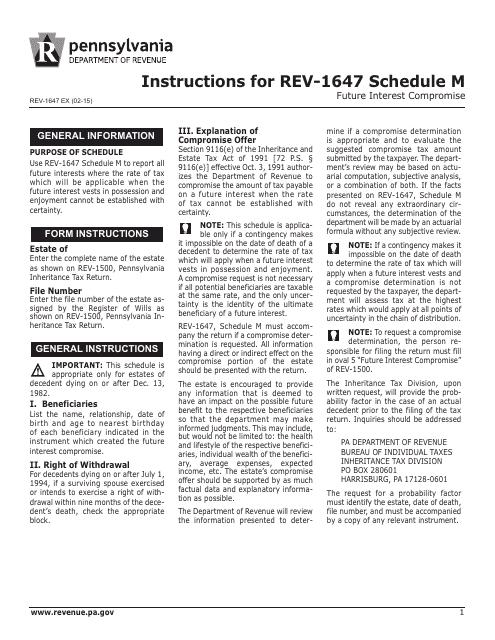

This Form is used for declaring future interest compromise in Pennsylvania.

This form is used for scheduling future interest compromise in Pennsylvania. It provides instructions on how to complete Form REV-1647.

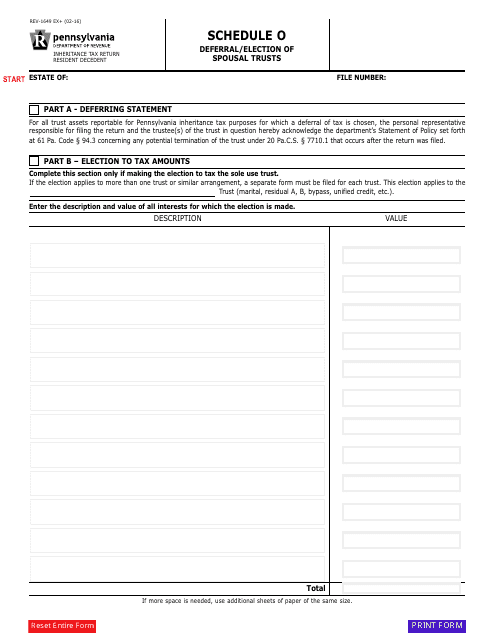

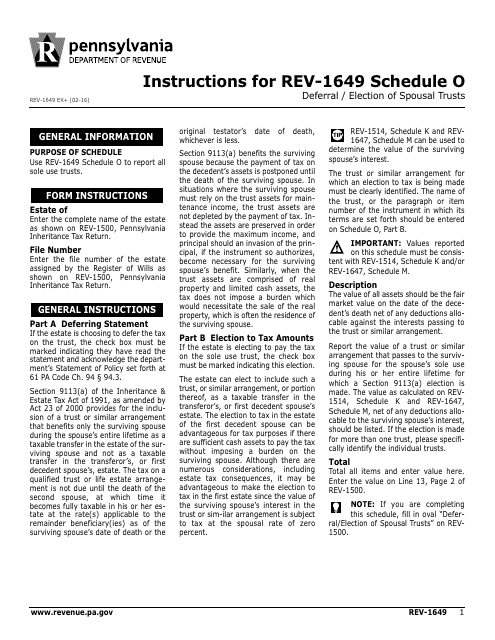

This form is used for deferral or election of spousal trusts in Pennsylvania.

This document provides instructions for filling out Form REV-1649 Schedule O, which is used in Pennsylvania for the deferral or election of spousal trusts.

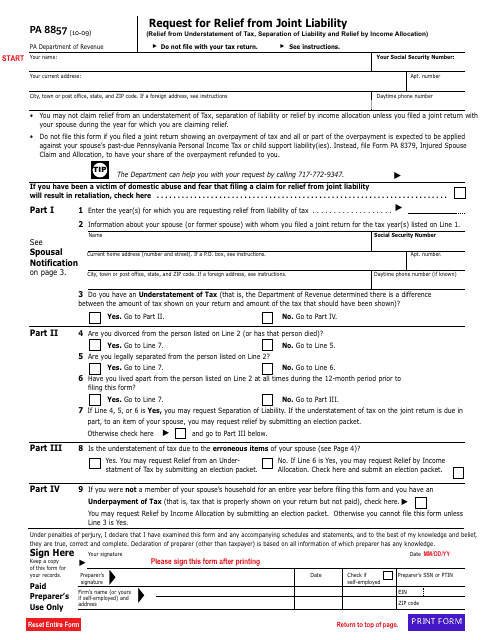

This form is used for requesting relief from joint liability for tax obligations in the state of Pennsylvania.

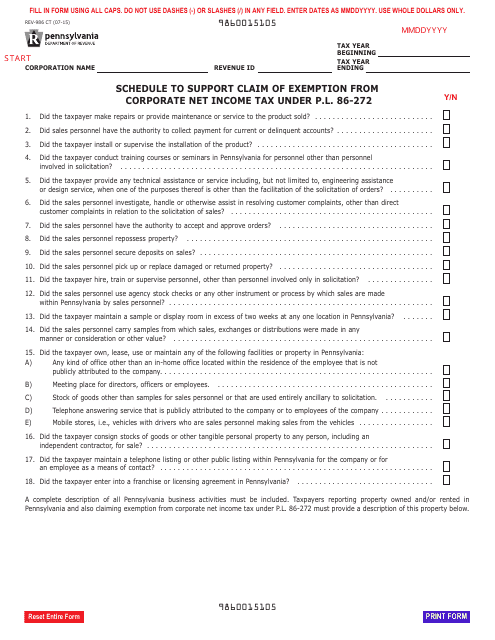

This Form is used for claiming exemption from corporate net income tax in Pennsylvania under P.l. 86-272.

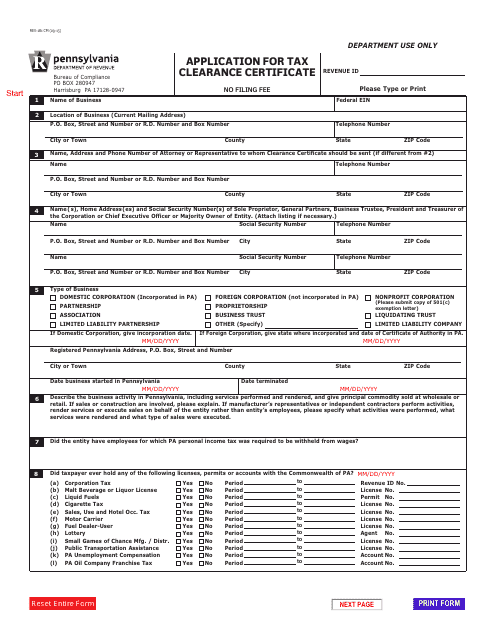

This form is used for applying for a Tax Clearance Certificate in Pennsylvania.

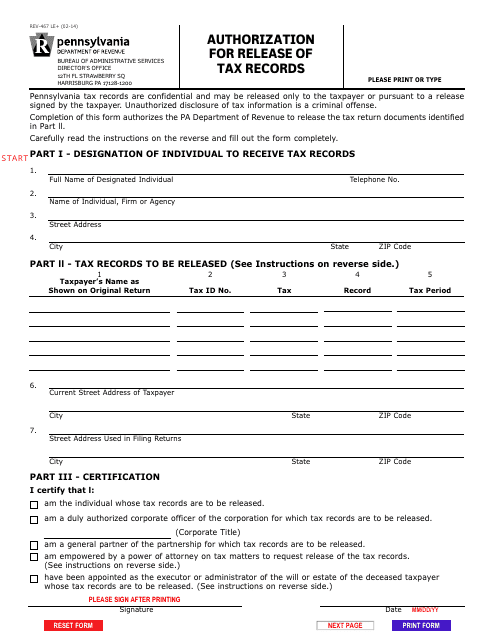

This form is used for authorizing the release of tax records in Pennsylvania.

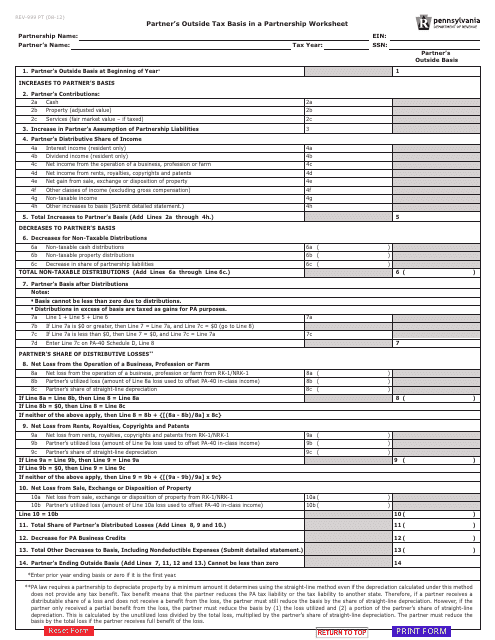

This form is used for calculating the partner's outside tax basis in a partnership in Pennsylvania.

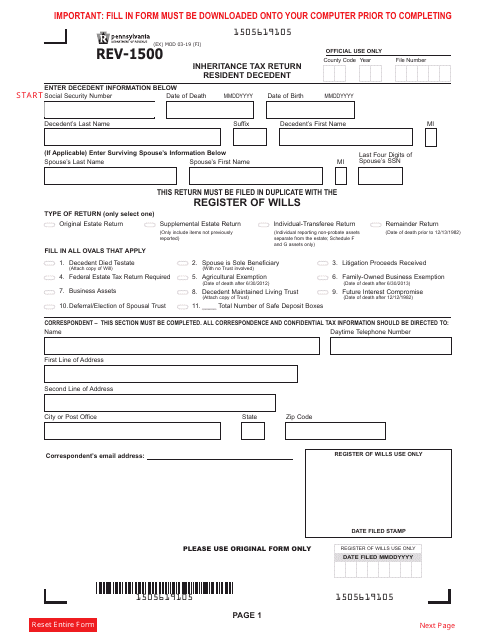

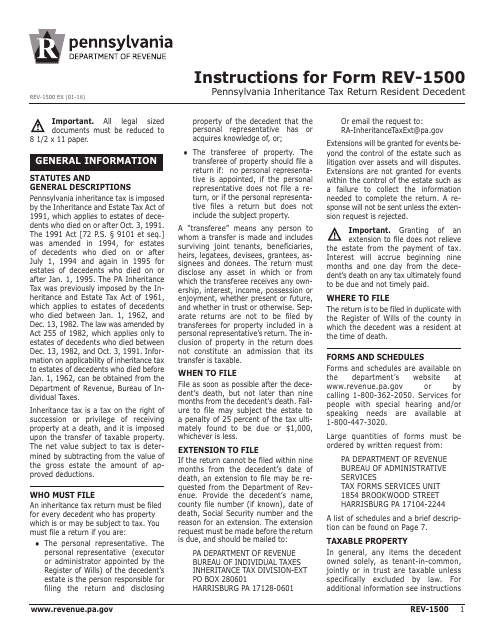

This Form is used for filing the Pennsylvania Inheritance Tax Return for a deceased resident of Pennsylvania. It provides instructions on how to complete the form accurately and report any applicable inheritance tax owed.

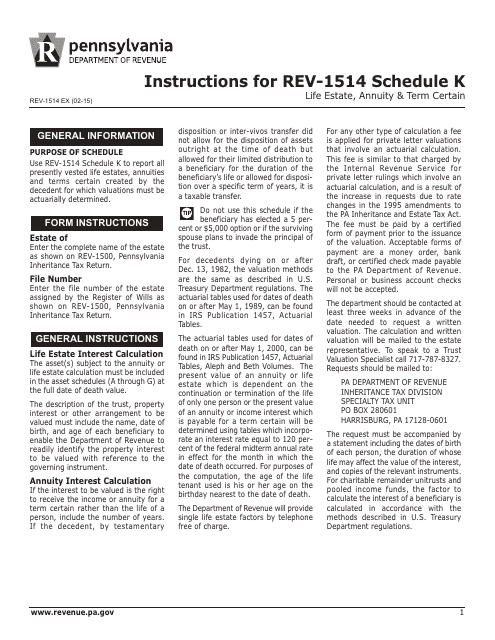

This type of document provides instructions for filling out Form REV-1514 Schedule K, which is used in Pennsylvania to report income from life estates, annuities, and term certain arrangements. It guides taxpayers on how to accurately complete the form and report their income.

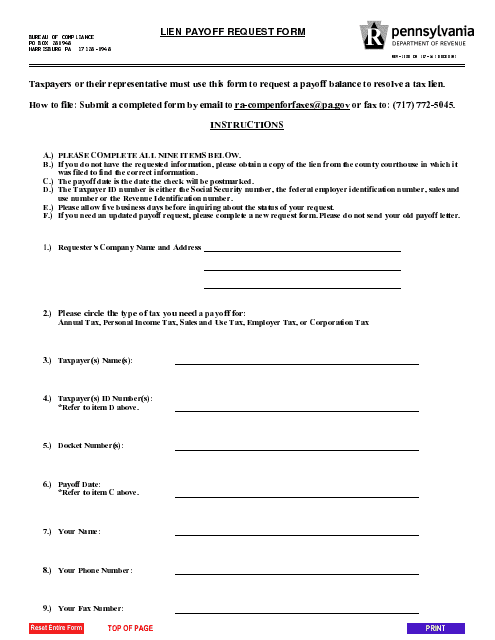

This form is used for requesting a lien payoff in Pennsylvania. It is used to request information about existing liens on a property and to facilitate the payment of those liens.

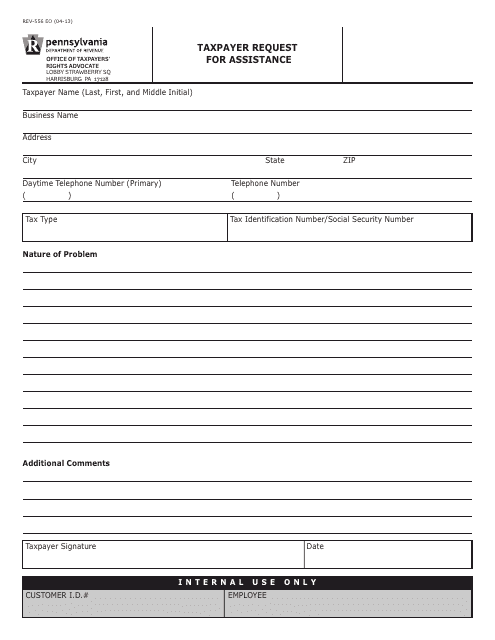

This form is used for Pennsylvania taxpayers to request assistance from the state tax authority.

This form is used for reporting mortgages and notes receivable in Pennsylvania for tax purposes.

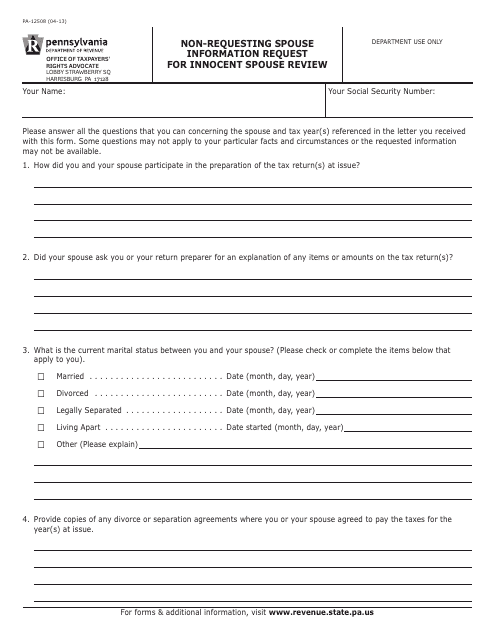

This form is used for requesting information from the non-requesting spouse in order to conduct an innocent spouse review in the state of Pennsylvania.