Pennsylvania Department of Revenue Forms

The Pennsylvania Department of Revenue is responsible for overseeing and administering Pennsylvania's tax laws and revenue collection. Its main purpose is to ensure compliance with state tax laws, collect taxes, and enforce tax regulations. The department handles various tax types, including personal income tax, sales tax, corporate tax, and inheritance tax, among others. Additionally, the department provides taxpayer assistance, offers tax forms and instructions, and processes tax returns and payments.

Documents:

754

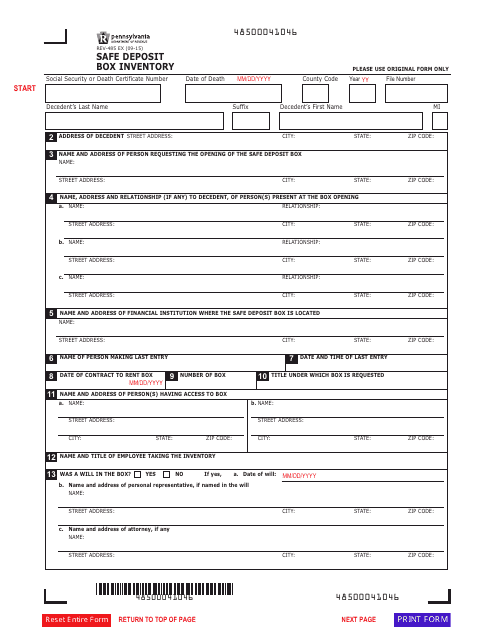

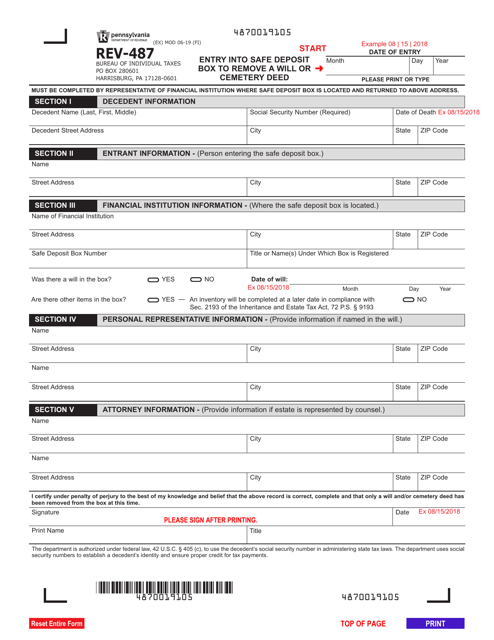

This Form is used for creating an inventory of items stored in a safe deposit box in Pennsylvania. It helps the owner keep track of their belongings and provides security.

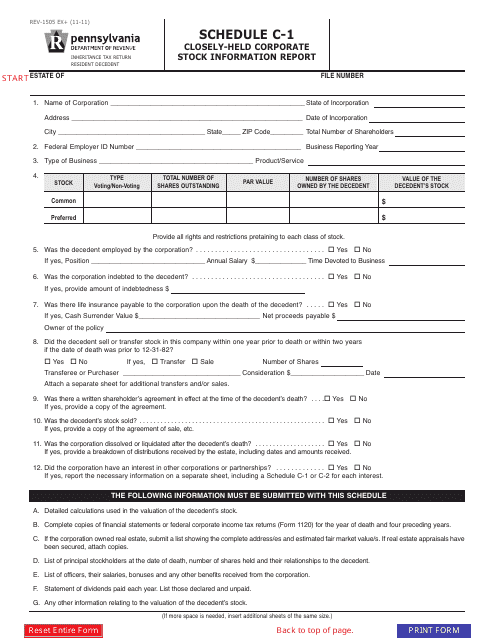

This form is used for reporting closely-held corporate stock information in Pennsylvania.

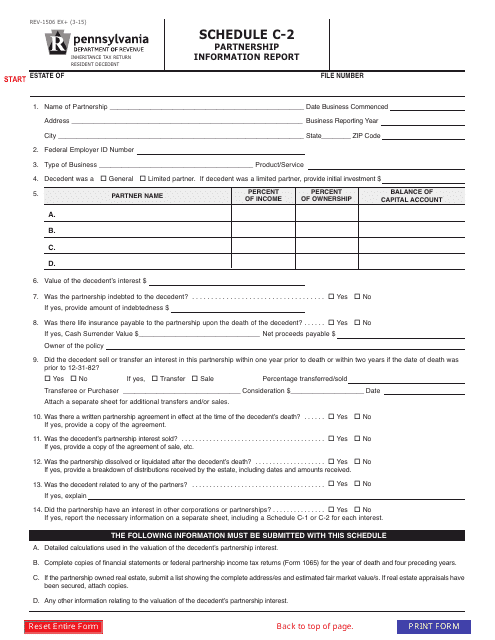

This Form REV-1506 Schedule C-2 is used for partnership information reporting in the state of Pennsylvania. It provides details about the partnership's income, deductions, and tax liabilities.

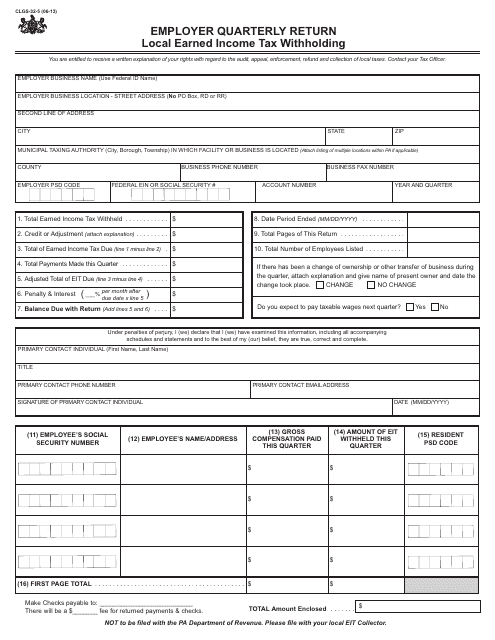

This Form is used for reporting and remitting local earned income tax withholding for employers in Pennsylvania on a quarterly basis.

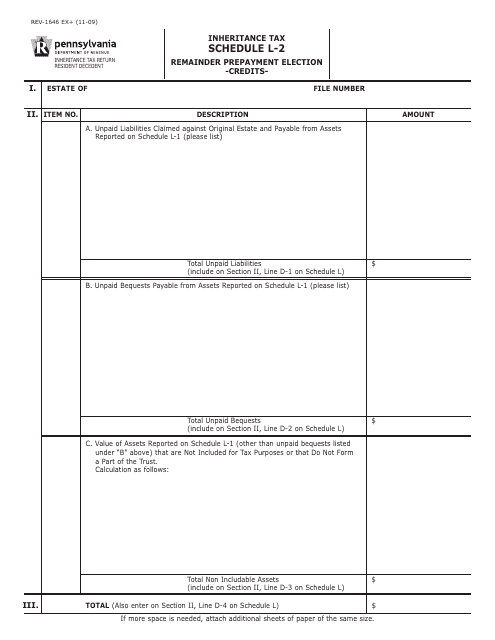

This form is used in Pennsylvania to make a prepayment election for tax credits.

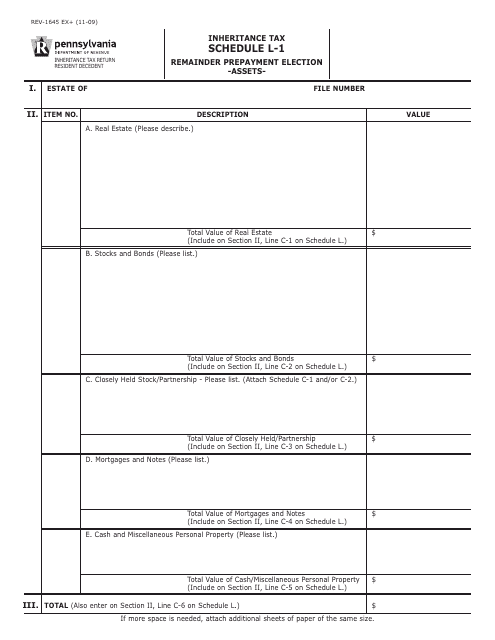

This form is used for making a prepayment election for assets in Pennsylvania.

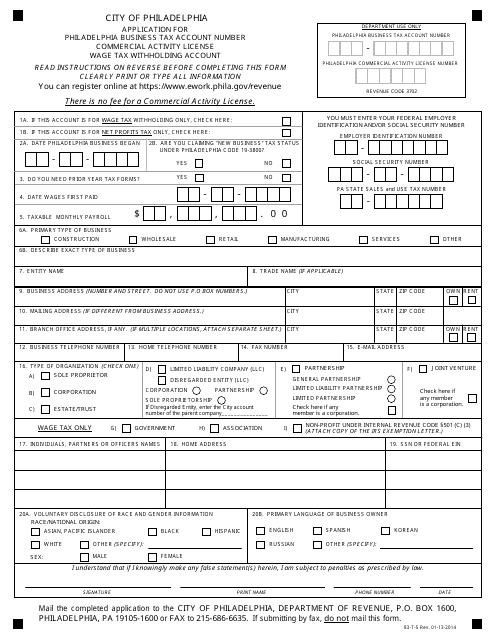

This form is used for applying for a business tax account number, commercial activity license, and wage tax withholding account in the City of Philadelphia, Pennsylvania.

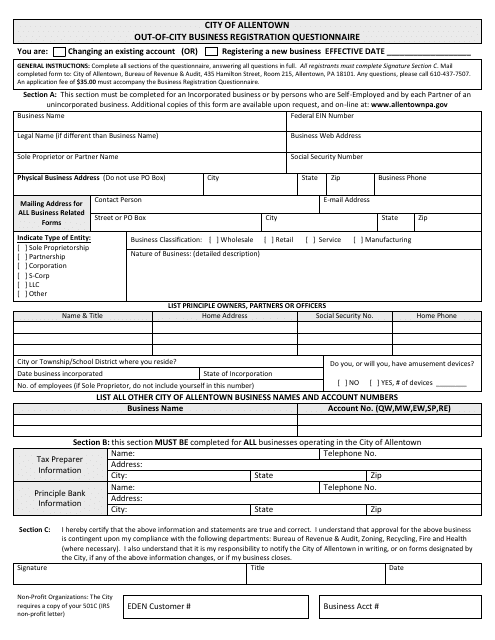

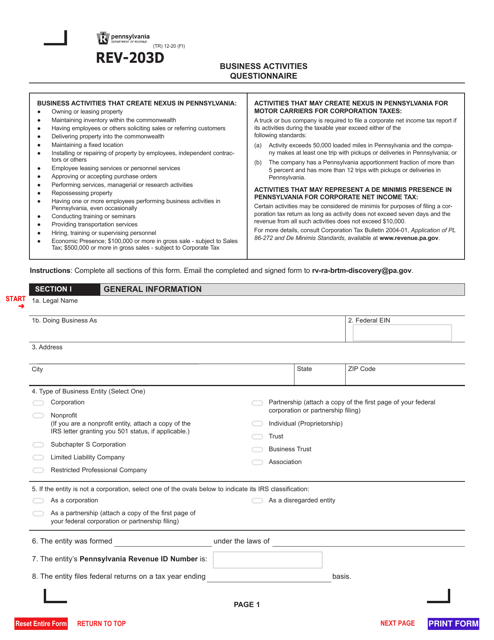

This document is a questionnaire that needs to be filled out by businesses located outside of Allentown, Pennsylvania that want to register with the city.

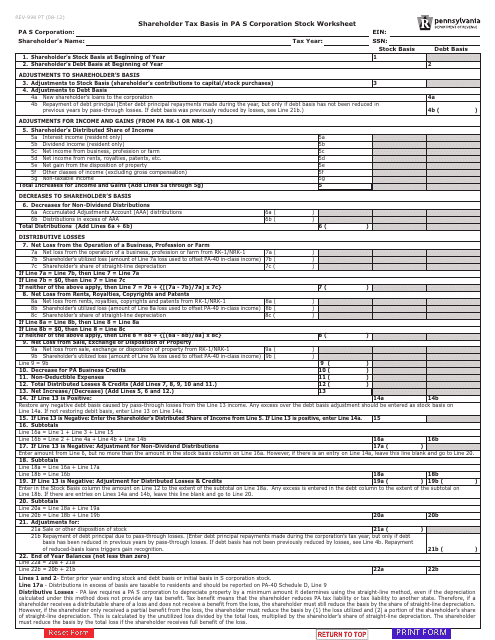

This form is used for calculating the tax basis in Pennsylvania S Corporation stock for shareholders.

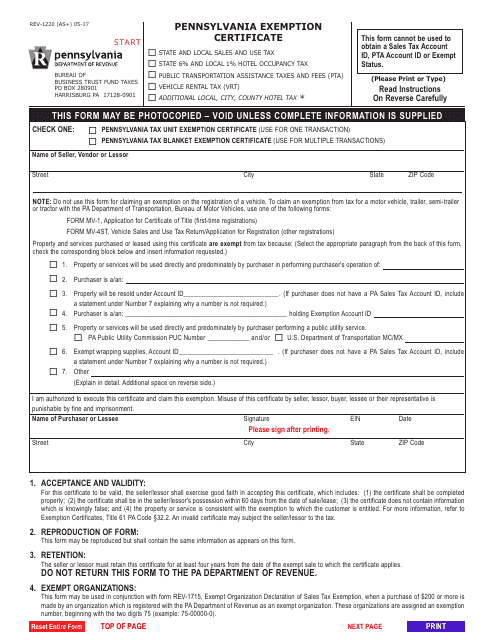

This document is a Pennsylvania Exemption Certificate used for tax purposes in the state of Pennsylvania. It is used to claim exemptions from certain types of taxes.

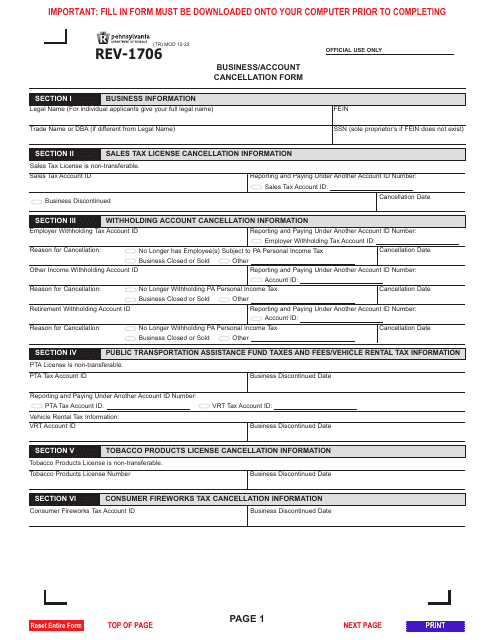

This is a legal document you need to fill out if you discontinue or sell your business, and if you cease all business operations of an entity situated in Pennsylvania.

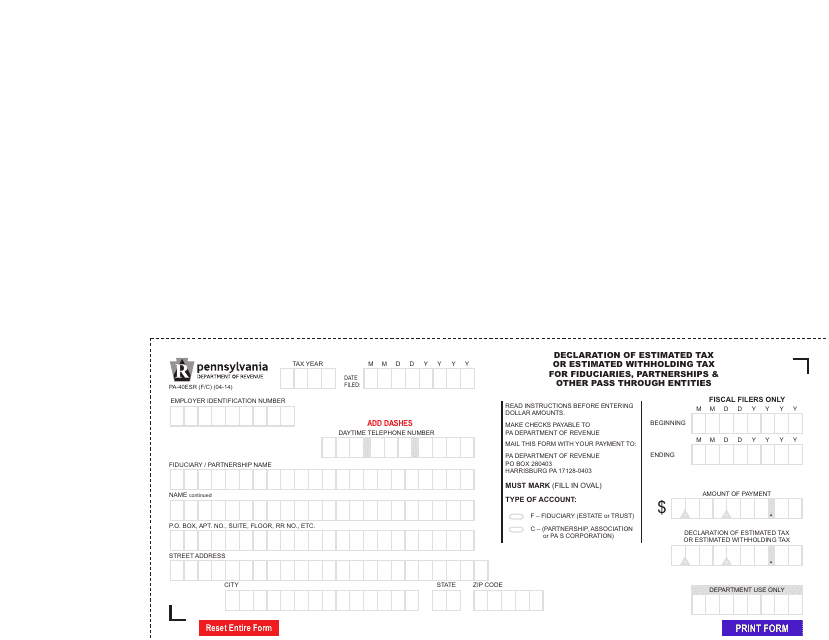

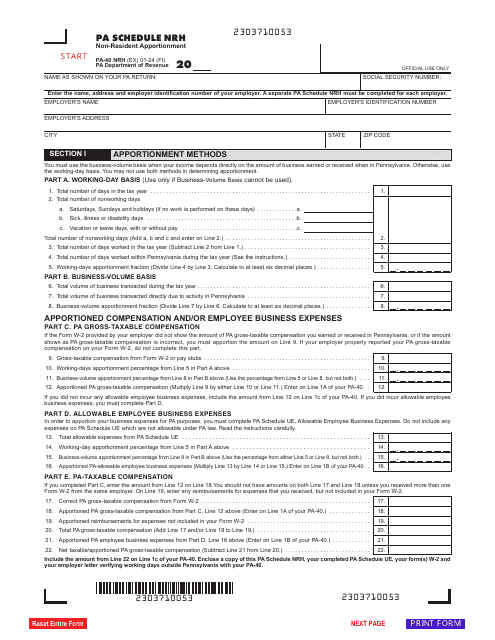

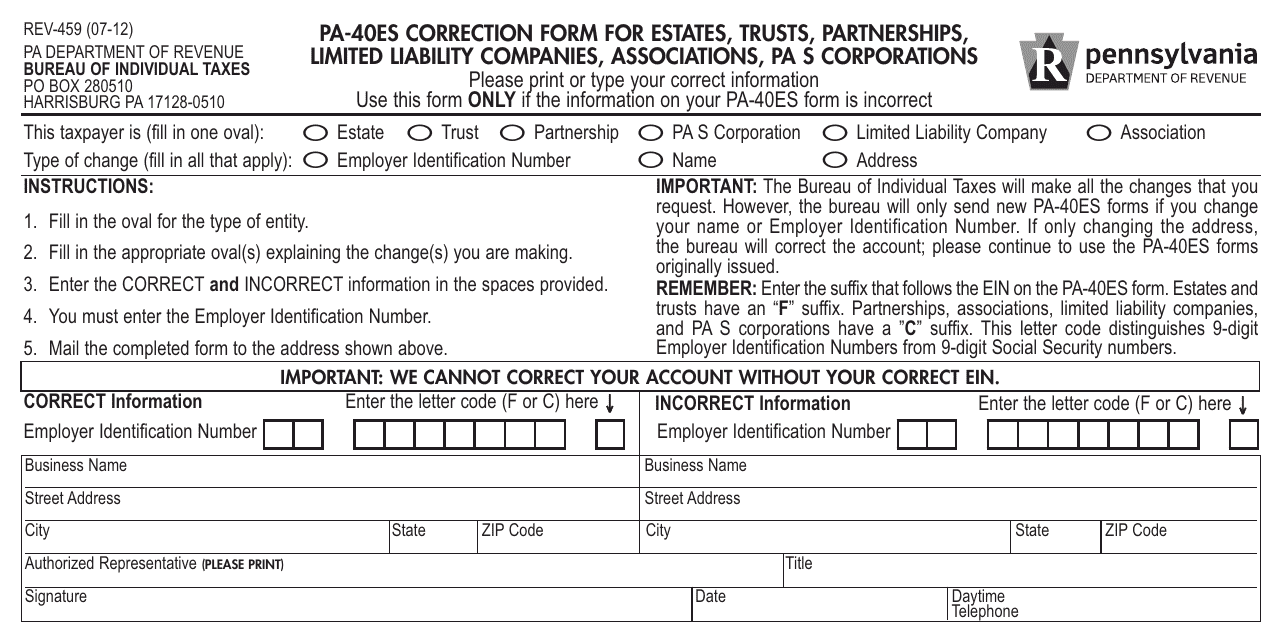

This form is used for fiduciaries, partnerships, and other pass-through entities in Pennsylvania to declare their estimated tax or estimated withholding tax.

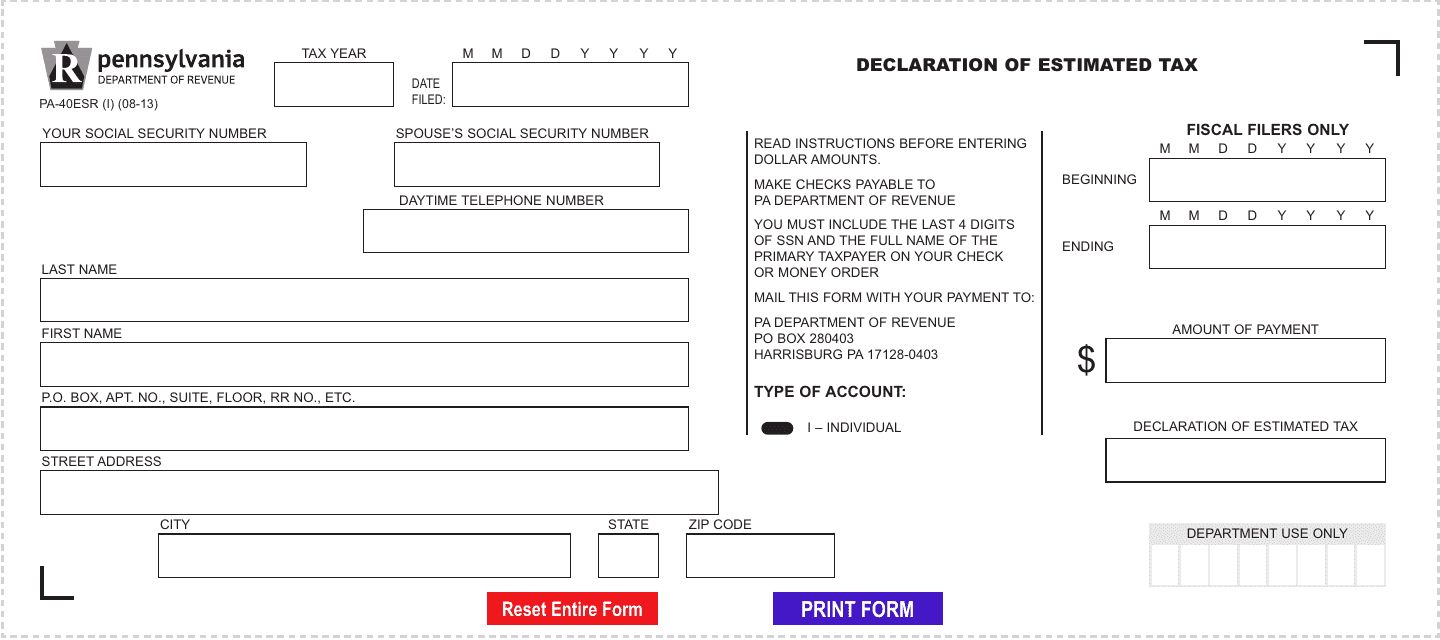

This form is used for declaring estimated tax in the state of Pennsylvania.

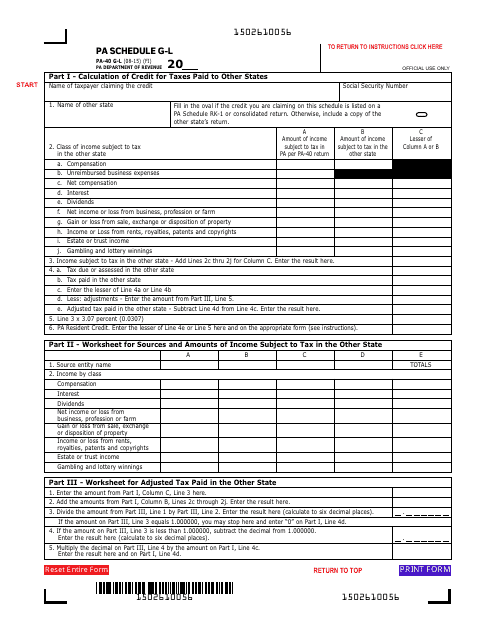

This form is used for claiming the Resident Credit for Taxes Paid in Pennsylvania for individuals filing their Pennsylvania state income tax return.

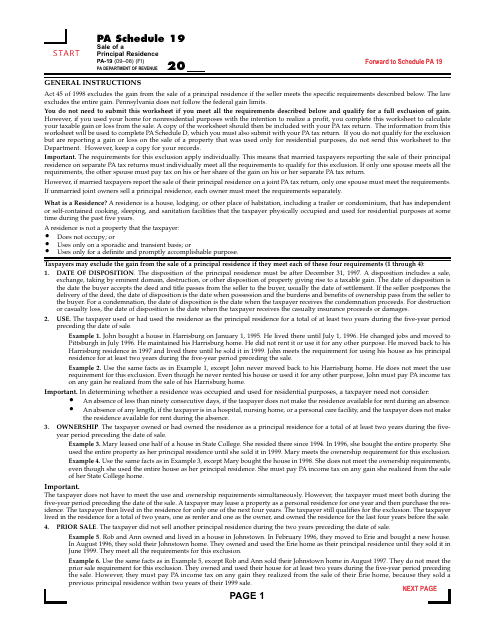

This document is used for reporting the sale of a primary residence in Pennsylvania for tax purposes. It is specific to Pennsylvania residents.

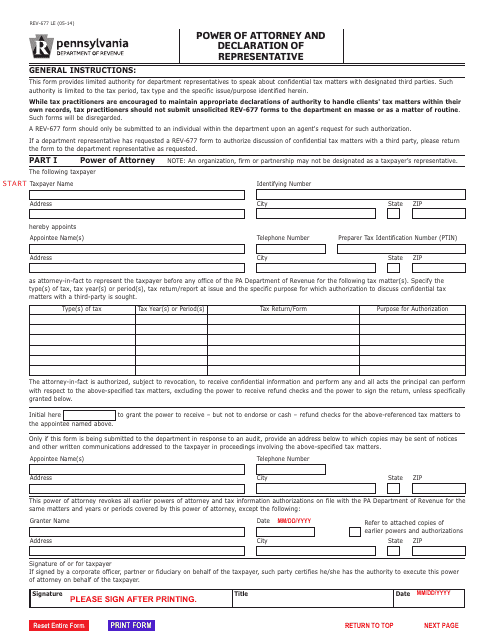

This form is used for creating a power of attorney and declaring a representative in the state of Pennsylvania.

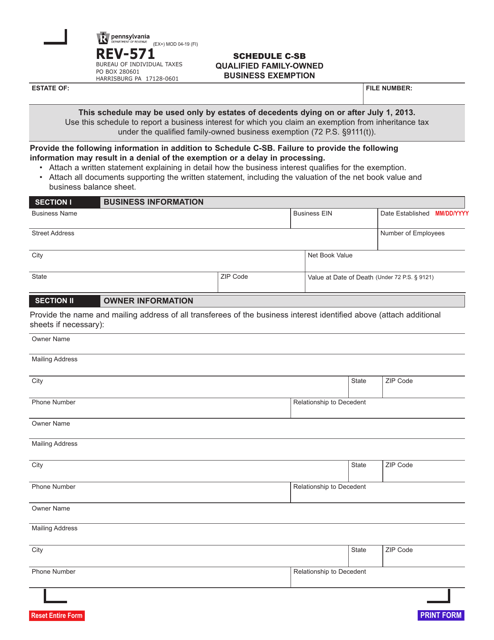

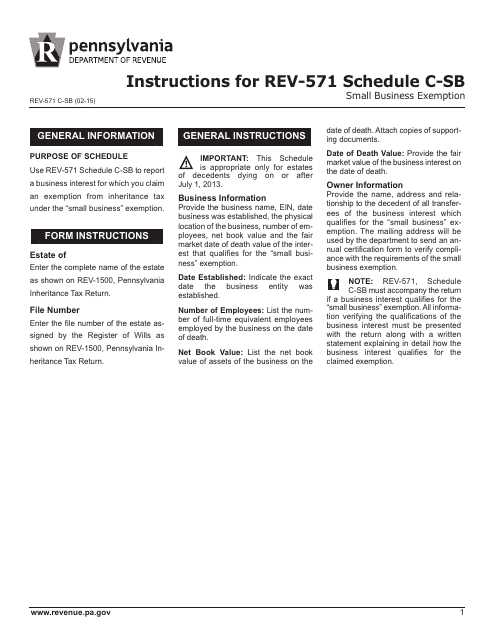

This Form is used for claiming small business exemption in Pennsylvania. It provides instructions on filling out Schedule C-SB.

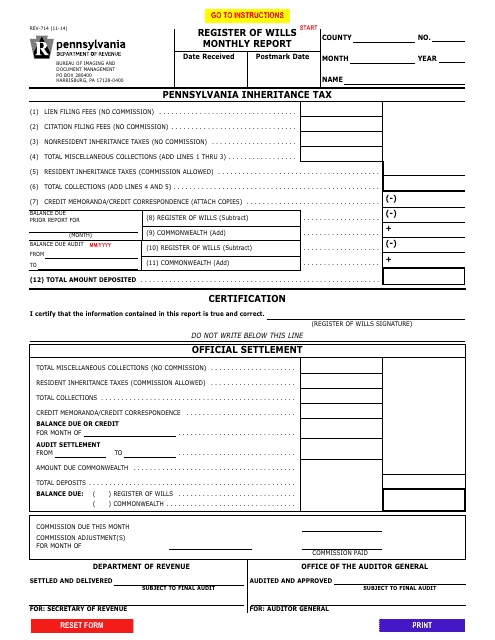

This form is used for submitting a monthly report to the Register of Wills in Pennsylvania. It provides information about the activities and transactions handled by the Register of Wills office.

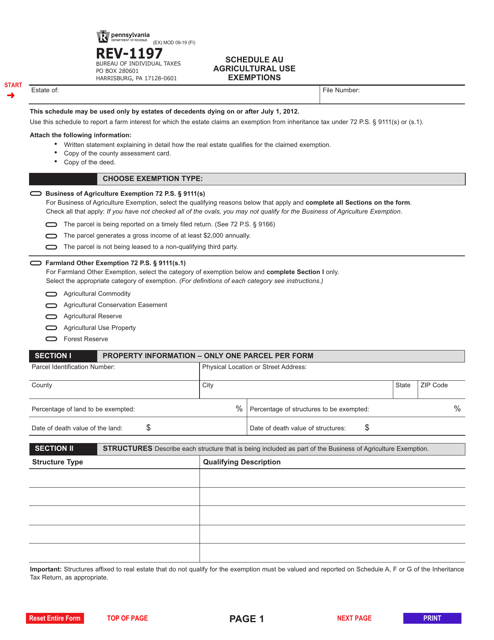

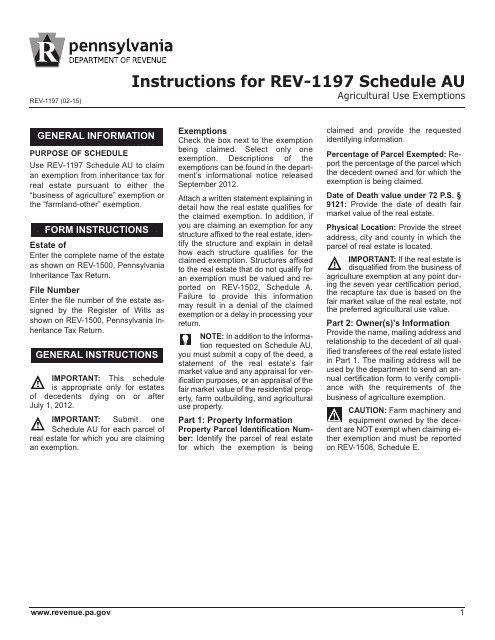

This Form is used for reporting agricultural use exemptions in Pennsylvania. It provides instructions on how to fill out Schedule AU for claiming tax exemptions on agricultural properties.

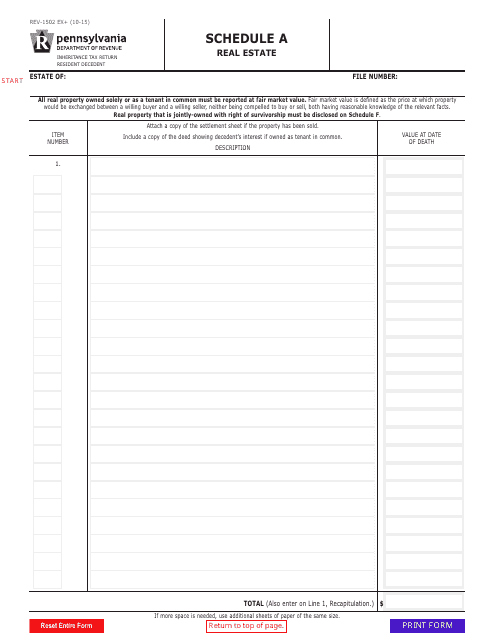

This form is used for reporting real estate information in Pennsylvania. It is known as Schedule A of Form REV-1502.

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

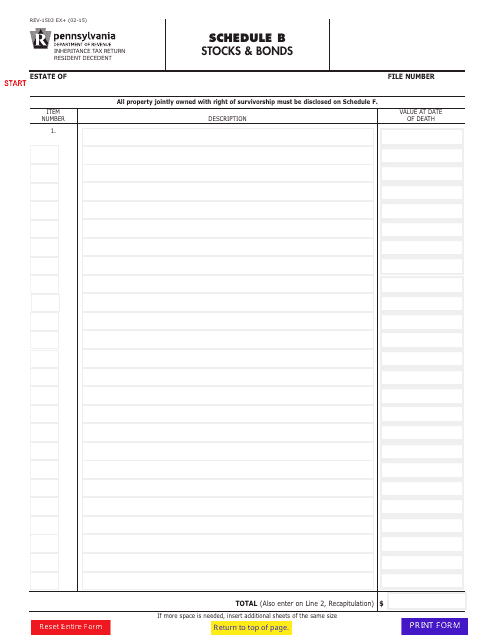

This form is used for reporting stocks and bonds in the state of Pennsylvania.

This Form is used for reporting stocks and bonds held by individuals or businesses in Pennsylvania for tax purposes. It provides instructions for completing Schedule B, which is a separate attachment to the Pennsylvania tax return.