Oregon Department of Revenue Forms

Documents:

1228

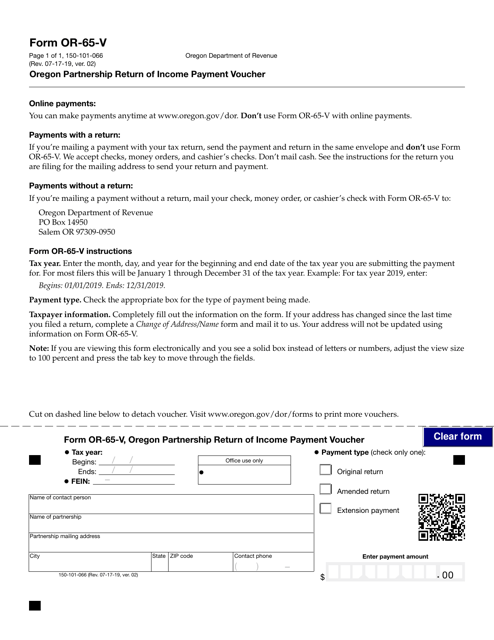

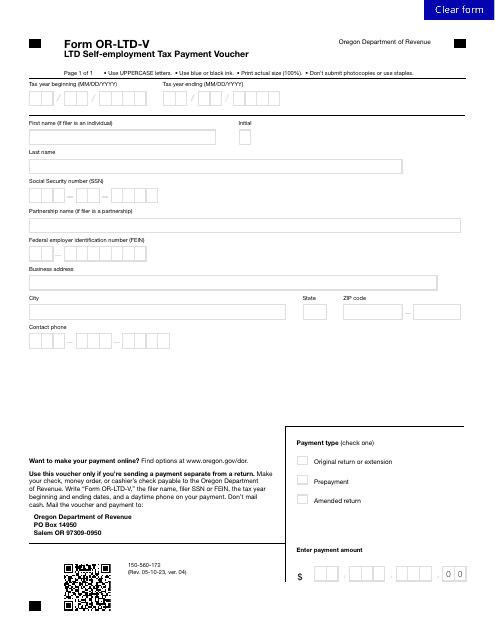

This form is used for making payments towards the Oregon Partnership Return of Income.

This Form is used for reporting Oregon Business Tax Pass-through Income and Credits.

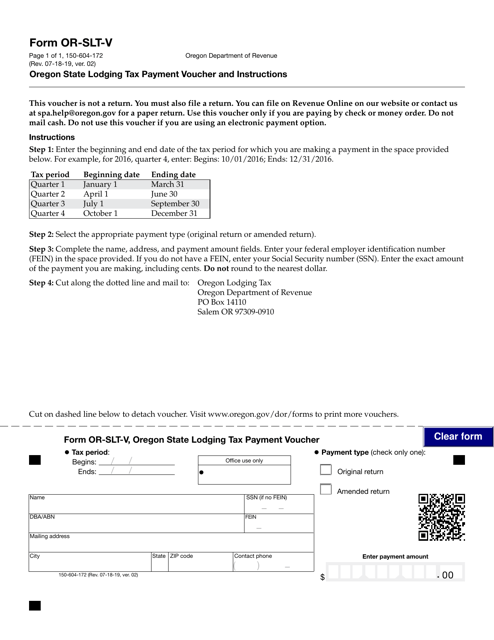

This Form is used for making lodging tax payments in the state of Oregon.

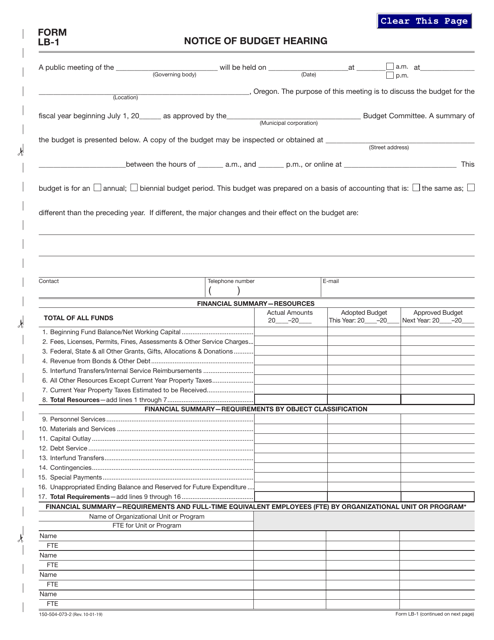

This form is used for submitting a Notice of Budget Hearing in the state of Oregon. It is used to inform the public about upcoming budget hearings.

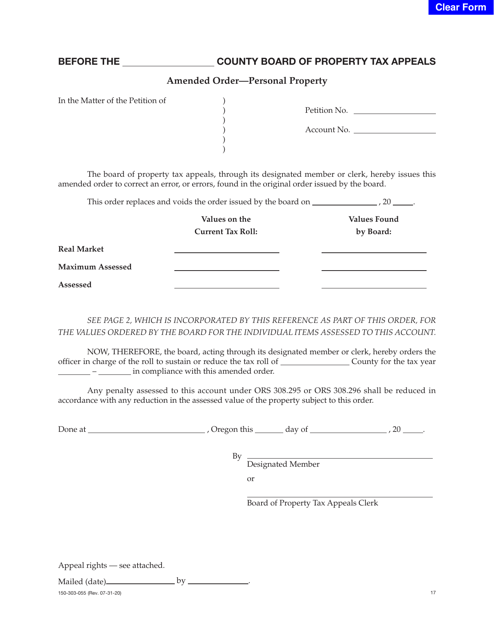

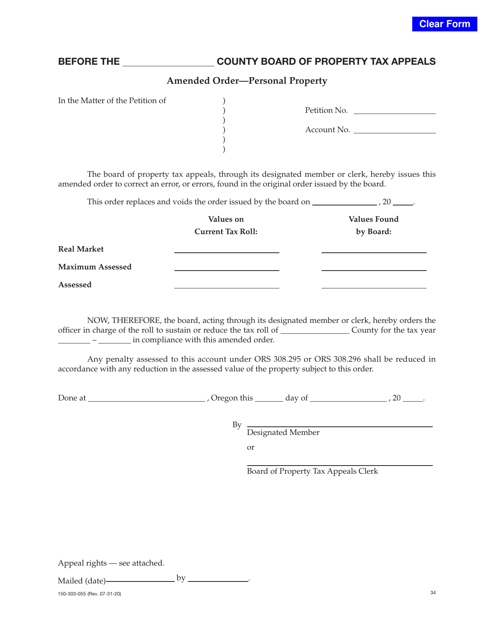

This Form is used for submitting an amended order for personal property in the state of Oregon.

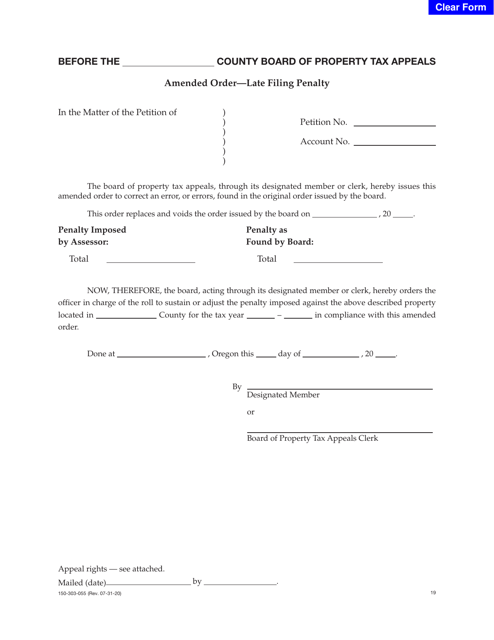

This form is used for requesting an amended order to waive the late filing penalty in Oregon.

This form is used for filing an amended order regarding personal property in the state of Oregon. It allows individuals to make changes or corrections to previously filed orders related to personal property.

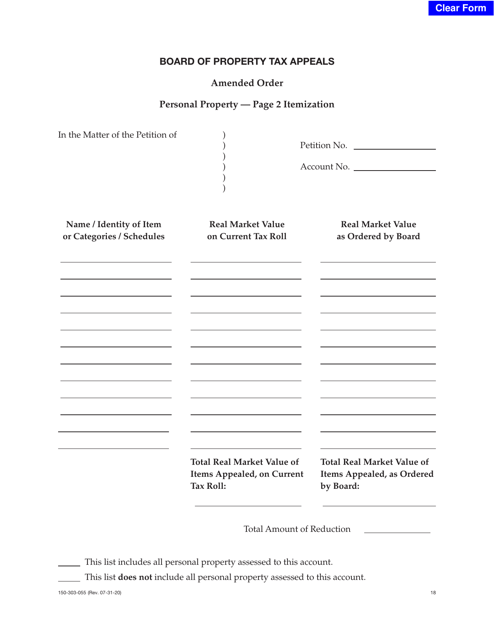

This document is an amended order form used in Oregon for itemizing personal property.

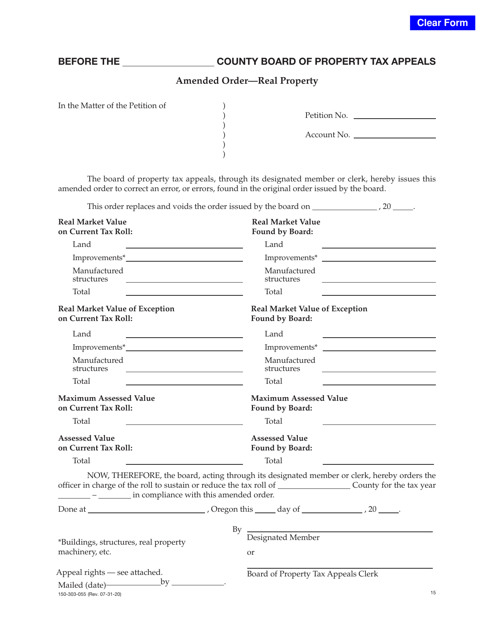

This form is used for making changes to an existing order related to real property in Oregon.

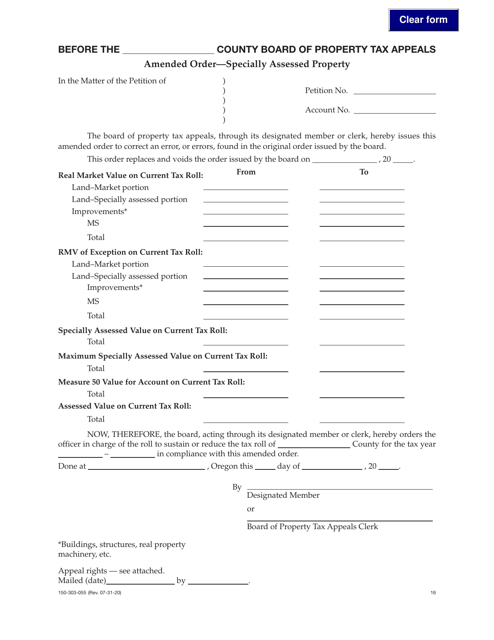

This Form is used for making an amended order for specially assessed property in Oregon.

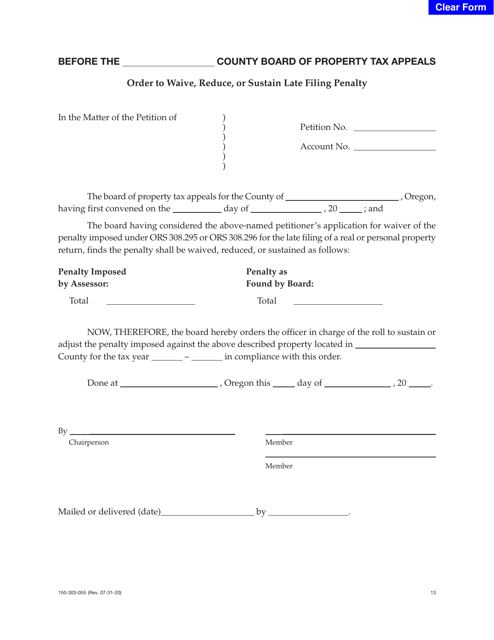

This form is used for making a request to waive, reduce, or sustain the late filing penalty in the state of Oregon.

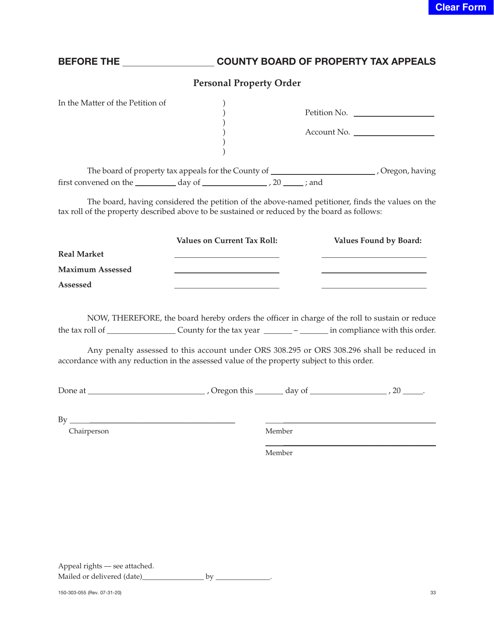

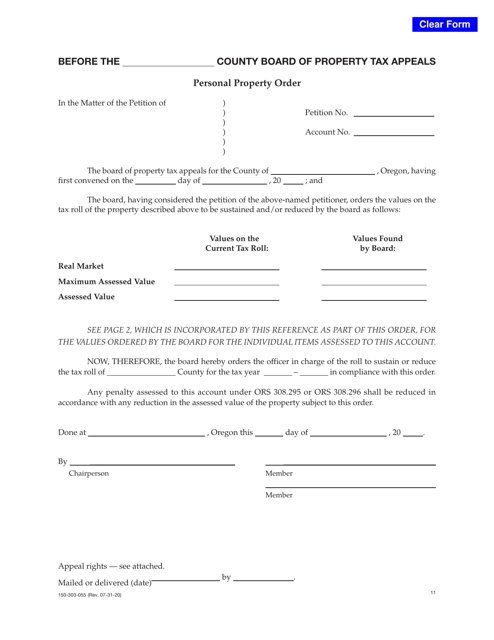

This form is used for making a personal property order in the state of Oregon.

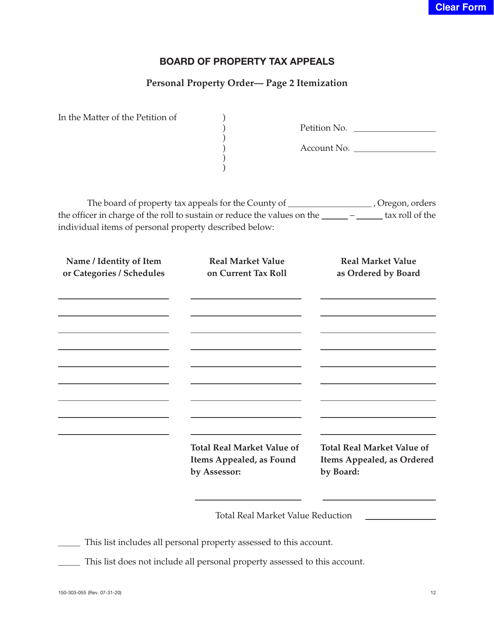

This document is a personal property order itemization form used in Oregon. It helps to list and assess the value of personal property items for tax purposes.

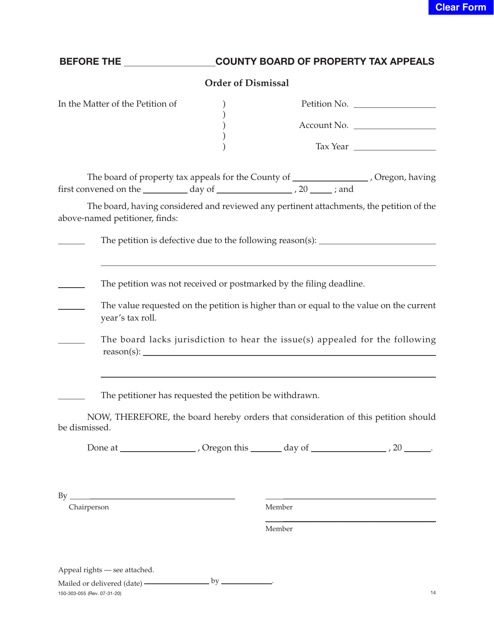

This type of document, Form 150-303-055 Order of Dismissal, is used in Oregon for dismissing a court case.

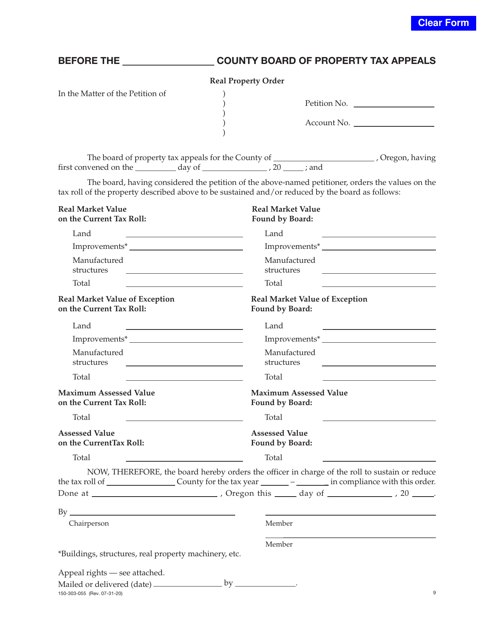

This document is used for making a real property order in the state of Oregon. It contains the necessary information and instructions for the process.

This form is used for making an order related to personal property in the state of Oregon.

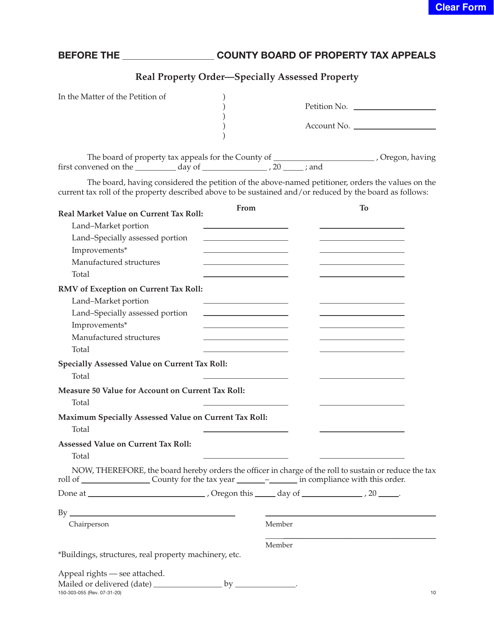

This form is used for making a real property order for specially assessed property in Oregon.