Oregon Department of Revenue Forms

Documents:

1228

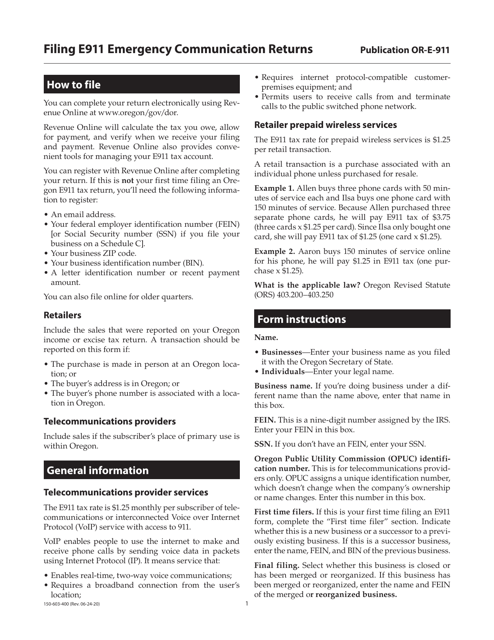

This document provides instructions for filing E911 Emergency Communication Returns in the state of Oregon.

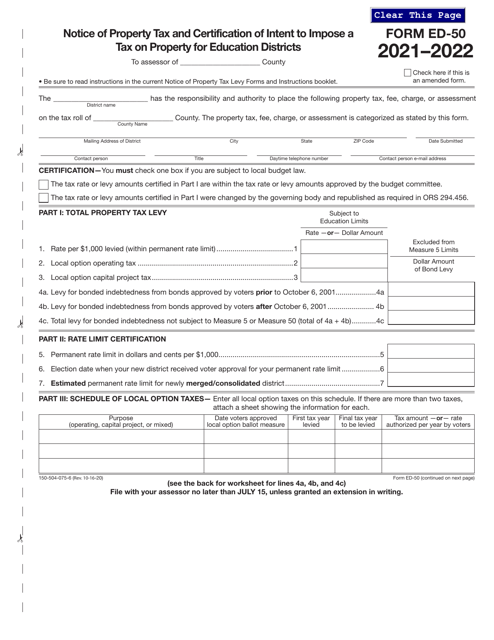

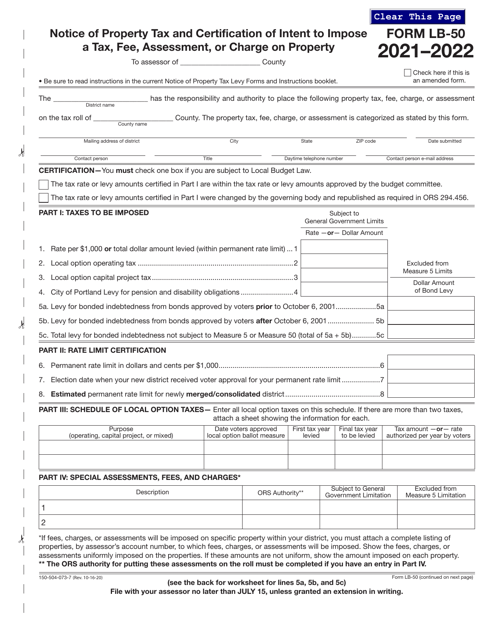

This document is used for providing notice of property tax and certification of intent to impose a tax, fee, assessment, or charge on property in Oregon.

This document provides instructions for completing Form OR-201-FP Forest Products Harvest Tax in Oregon. It explains the requirements and details for reporting and paying the forest products harvest tax.

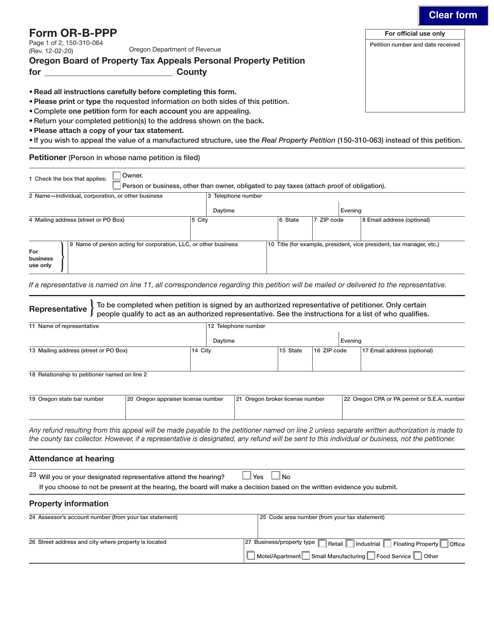

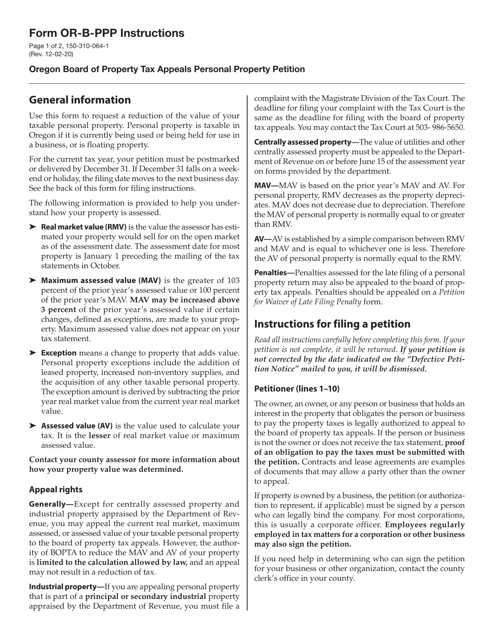

Form OR-B-PPP (150-310-064) Oregon Board of Property Tax Appeals Personal Property Petition - Oregon

This form is used for filing a personal property petition with the Oregon Board of Property Tax Appeals.

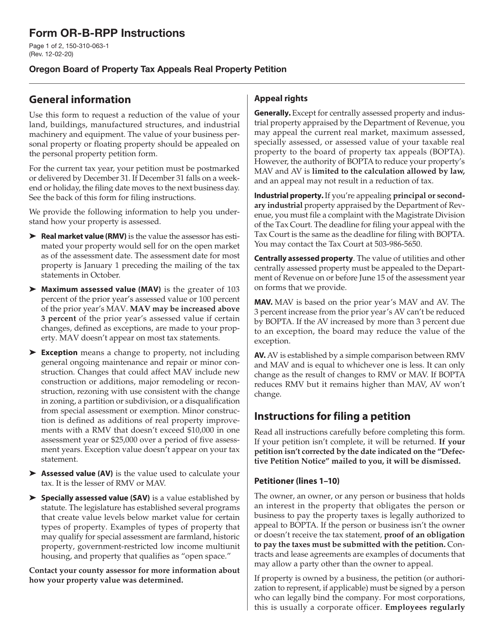

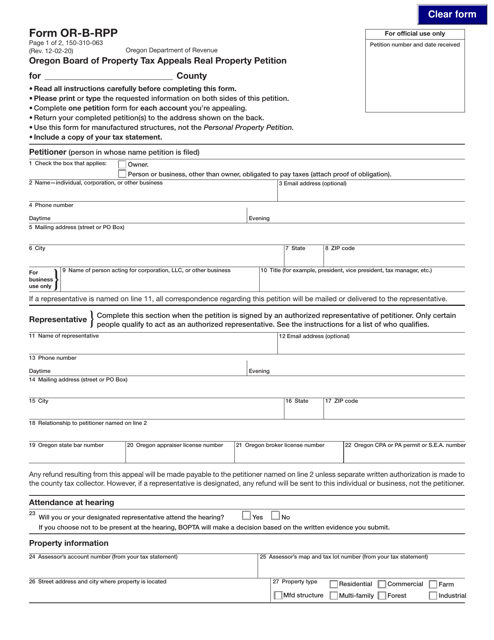

This Form is used for filing a real property petition to the Oregon Board of Property Tax Appeals in order to appeal property tax assessment in Oregon. Submitting this form allows property owners to request a review and potential adjustment of their property tax value.

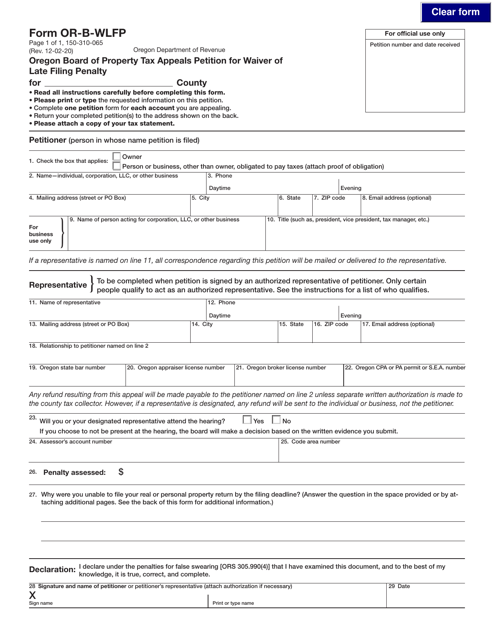

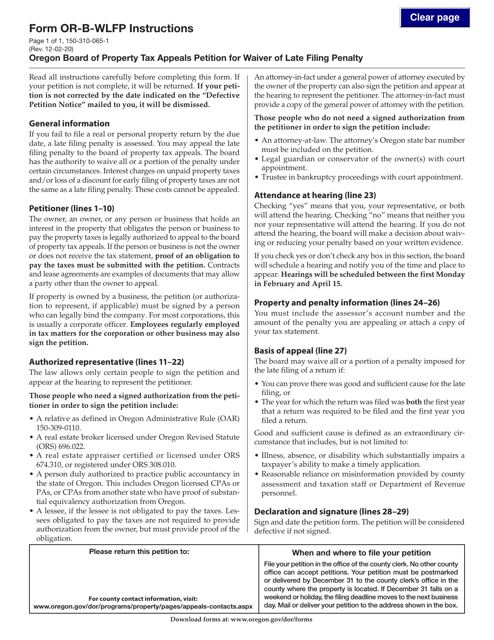

This document is for residents in Oregon who want to request a waiver of the late filing penalty for the Board of Property Tax Appeals.

This Form is used for filing a petition to the Oregon Board of Property Tax Appeals for a waiver of the late filing penalty.

This Form is used for filing a personal property petition to the Oregon Board of Property Tax Appeals. It helps individuals challenge the assessed value of their personal property for tax purposes.

This form is used for filing a real property petition with the Oregon Board of Property Tax Appeals. It is used to challenge the assessed value of a property for property tax purposes in Oregon.