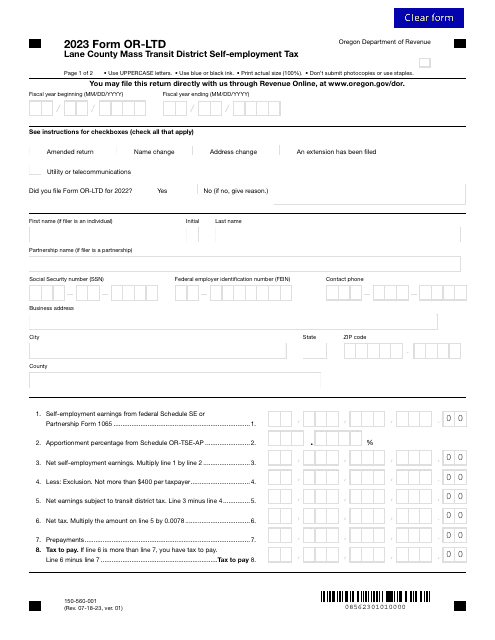

Oregon Department of Revenue Forms

Documents:

1228

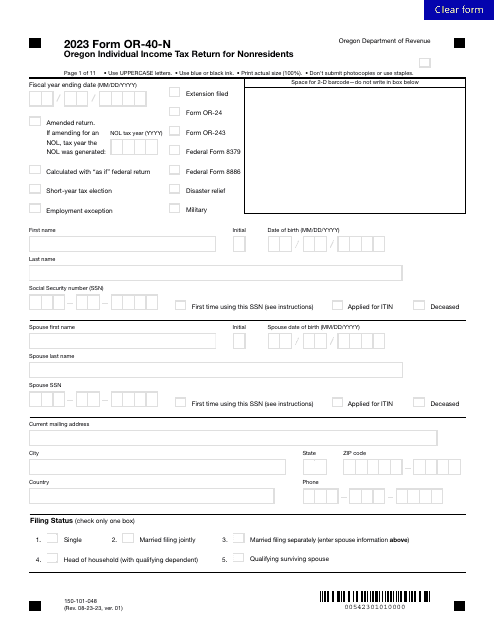

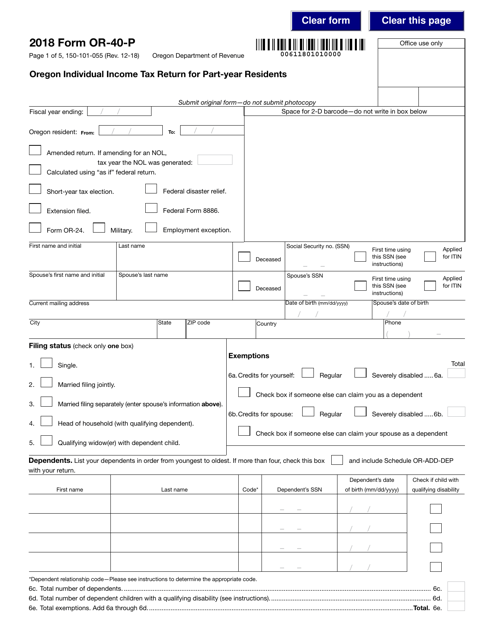

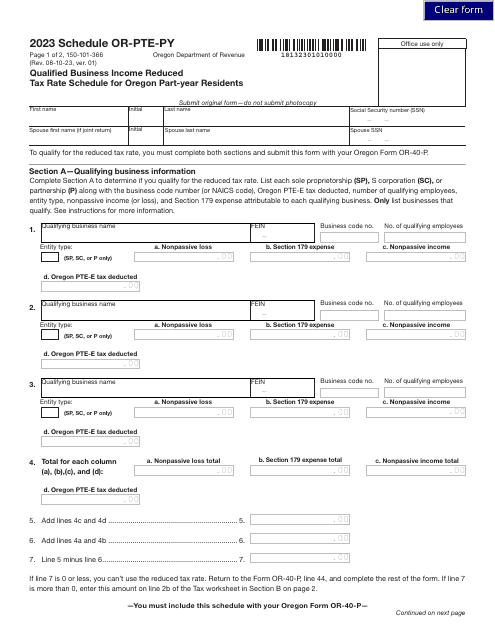

This form is used for Oregon residents who have earned income in the state for only part of the year to file their individual income tax return.

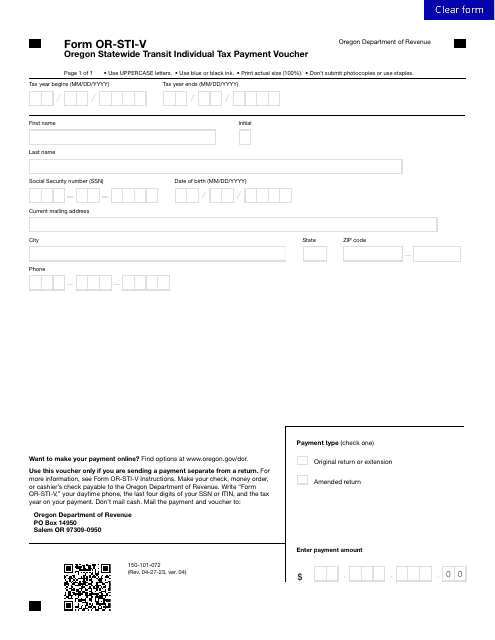

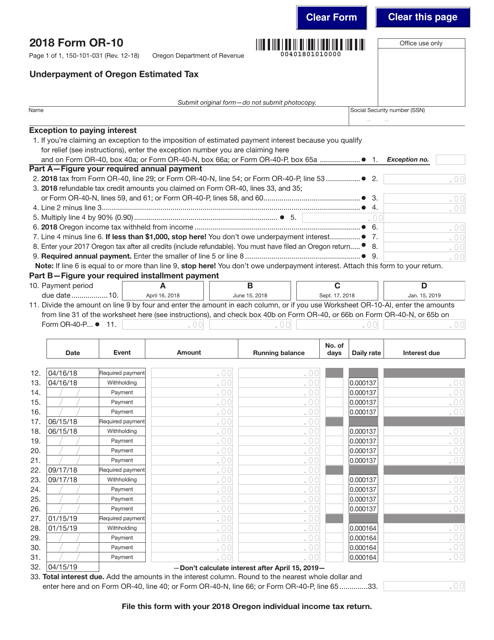

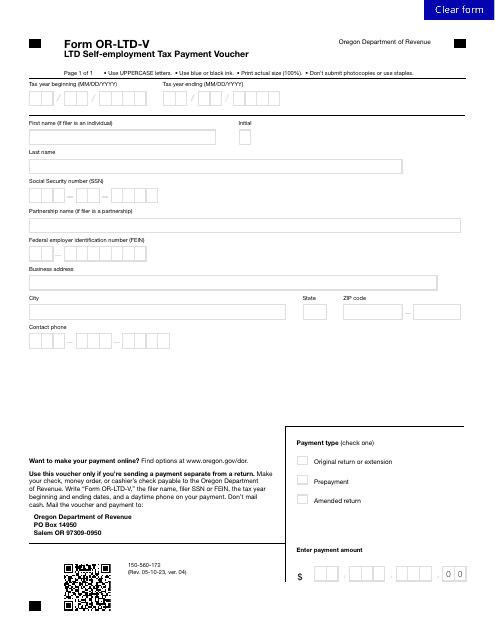

This form is used for reporting and paying the underpaid portion of Oregon estimated tax.

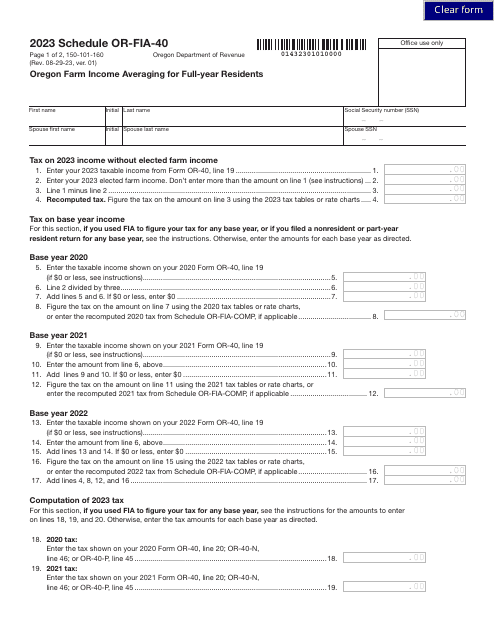

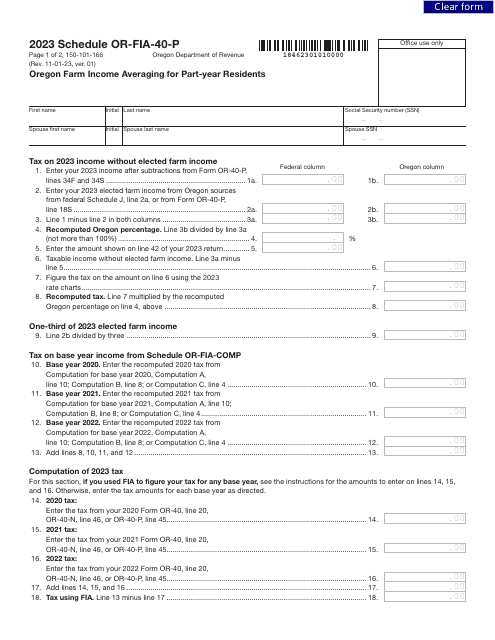

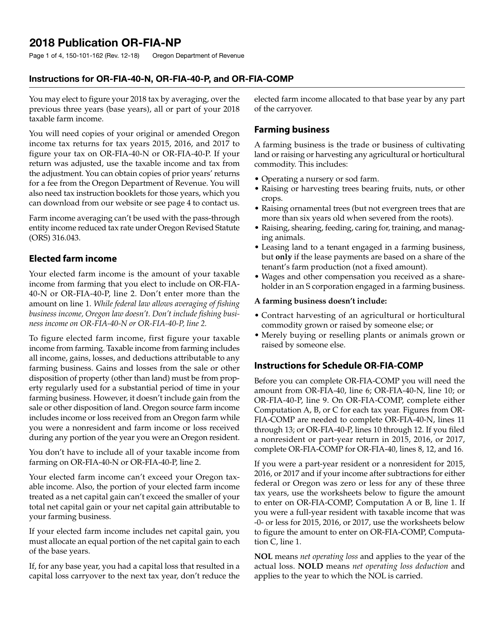

This form is used for filing publication or-Fia-Np in the state of Oregon.

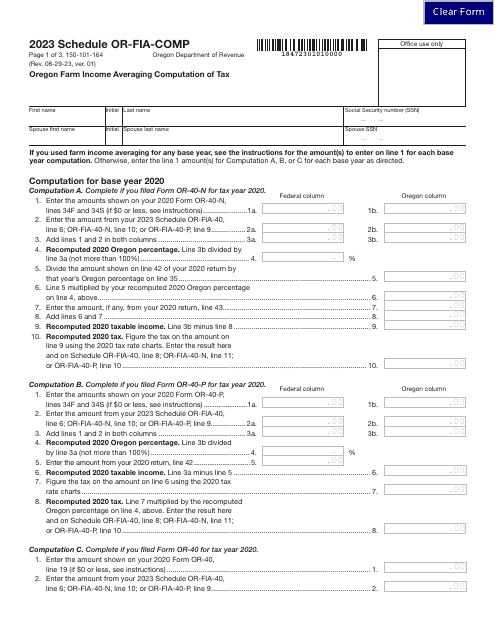

Form 150-101-164 Schedule OR-FIA-COMP Oregon Farm Income Averaging Computation of Tax - Oregon, 2023

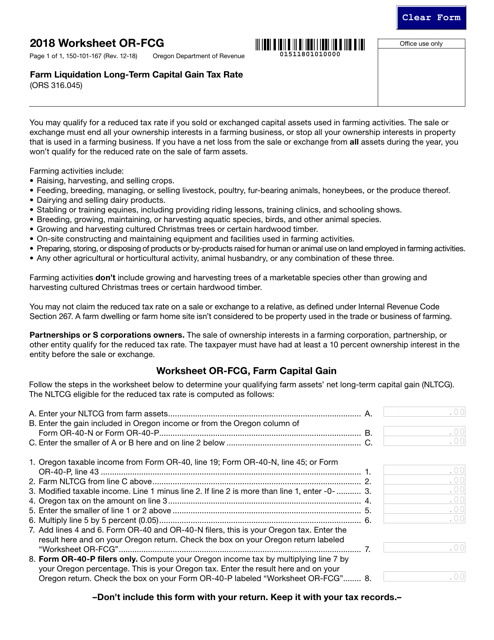

This form is used for calculating the long-term capital gain tax rate for farm liquidation in Oregon.

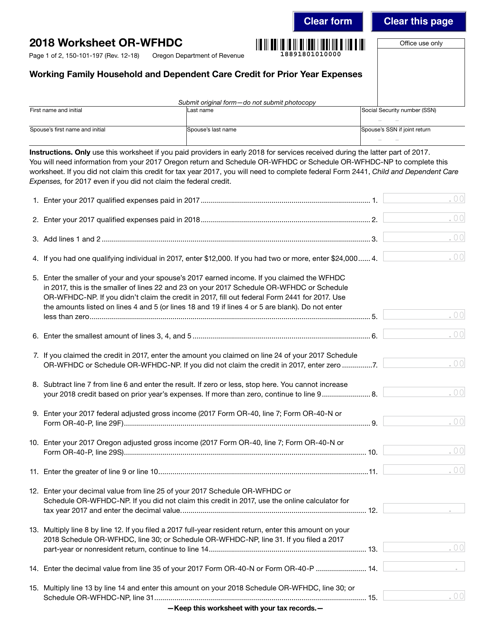

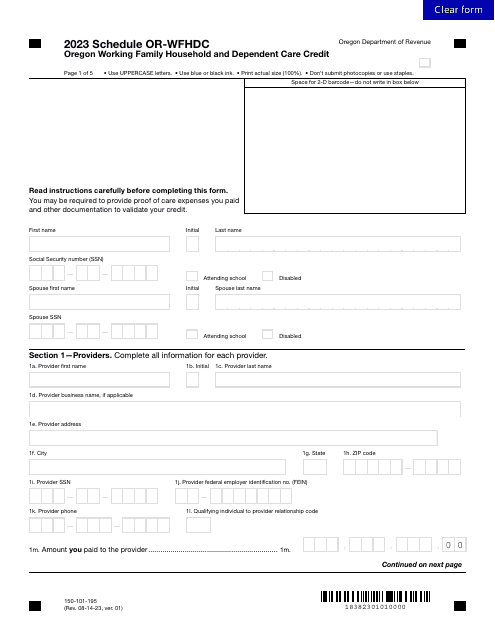

This form is used for claiming the Working Family Household and Dependent Care Credit for prior year expenses in the state of Oregon.

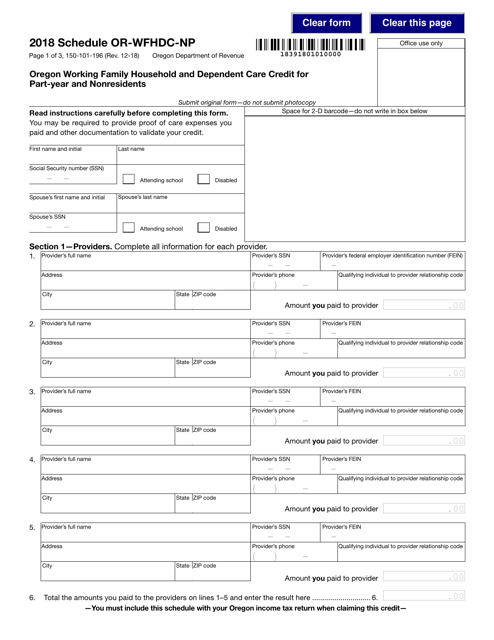

This Form is used for claiming the Working Family Household and Dependent Care Credit in Oregon for part-year residents and nonresidents.

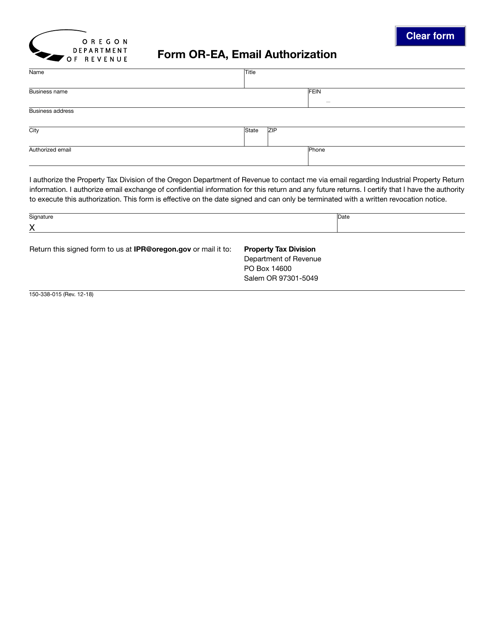

This form is used for authorizing email communication with the Oregon Department of Revenue.

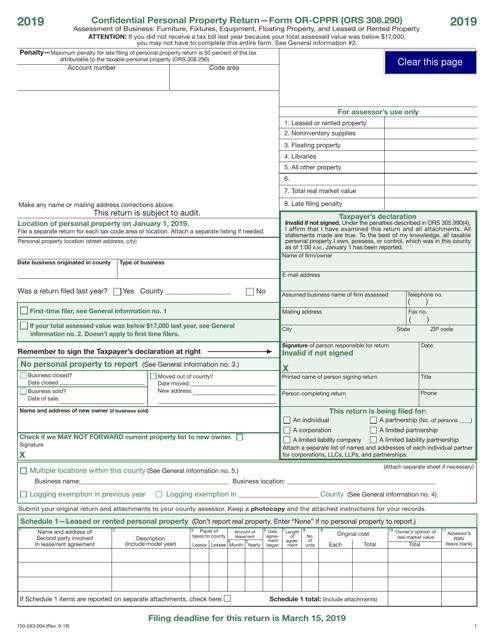

This form is used for filing a confidential personal property return in the state of Oregon.