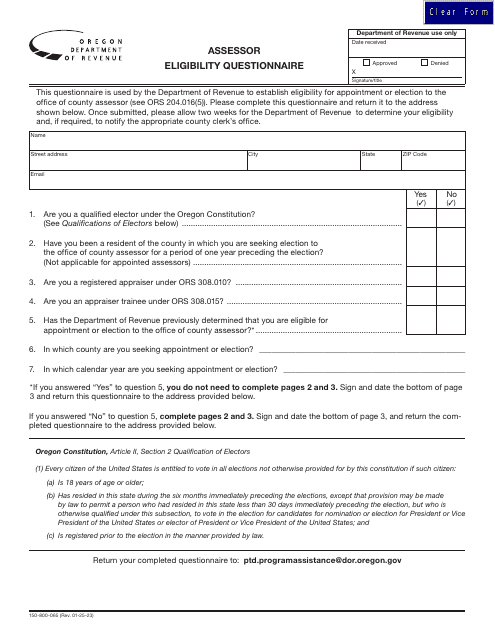

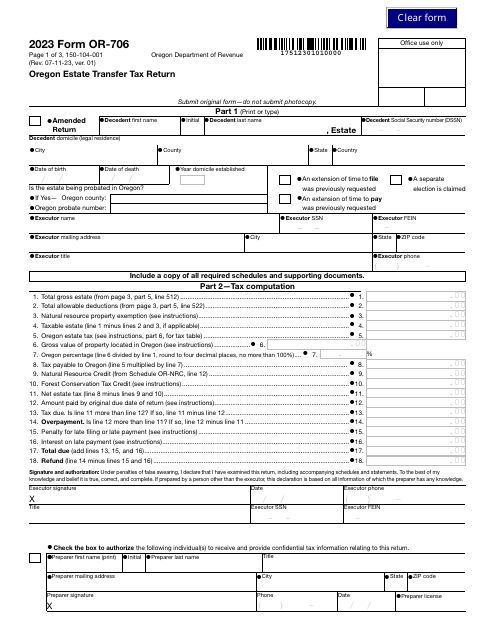

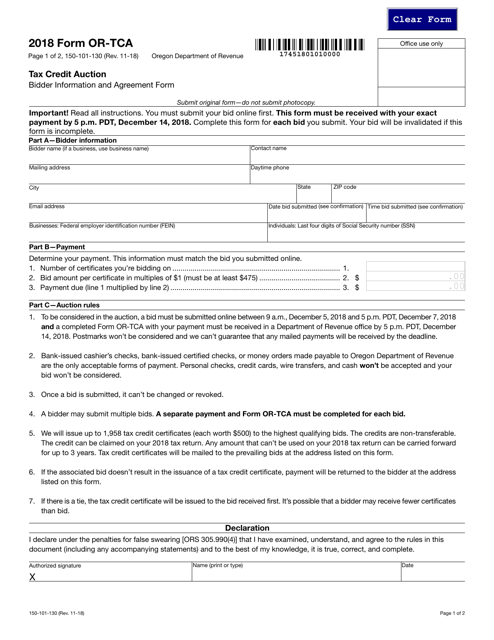

Oregon Department of Revenue Forms

Documents:

1228

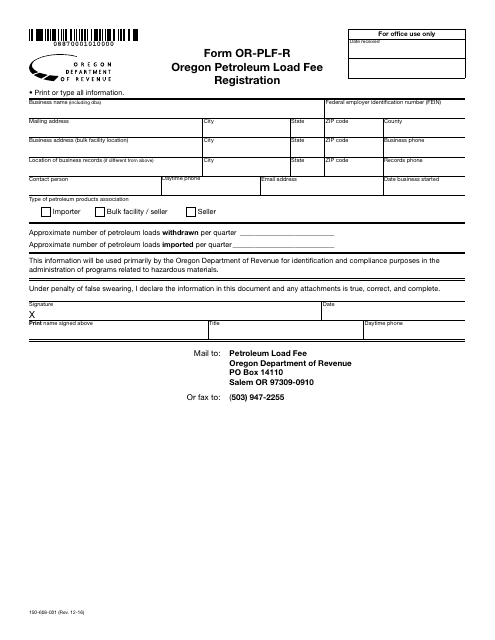

This document is used for registering and paying the petroleum load fee in the state of Oregon.

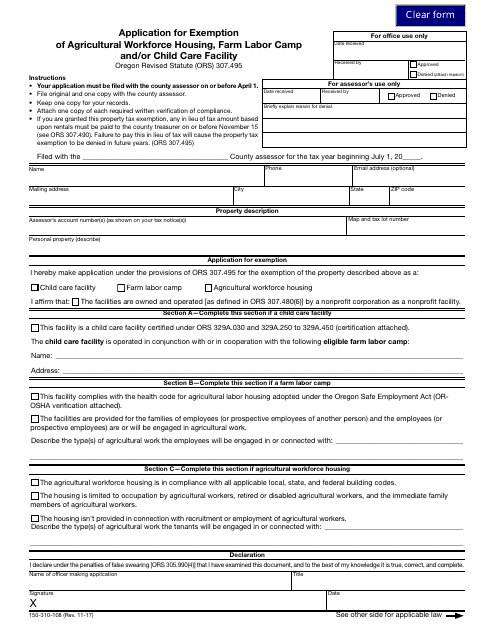

This Form is used for applying for exemption of agricultural workforce housing, farm labor camp, and/or child care facility in the state of Oregon.

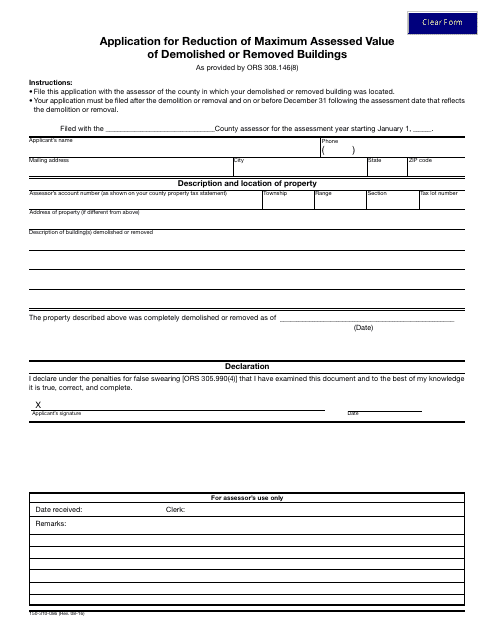

This form is used for applying to reduce the maximum assessed value of buildings that have been demolished or removed in Oregon.

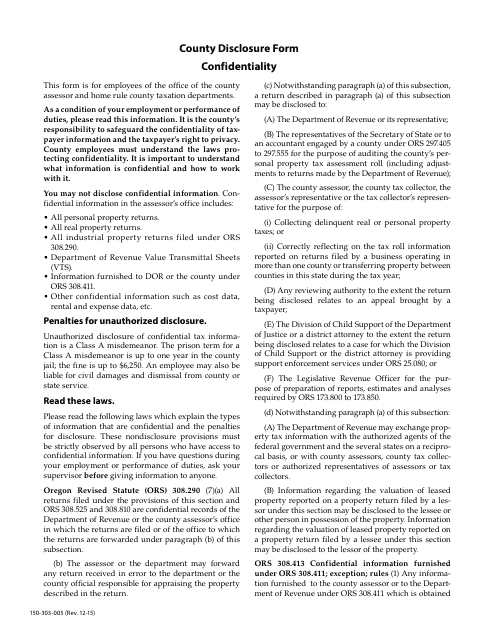

This form is used to disclose confidential information on a county level in Oregon. It also serves as a certificate of confidentiality.

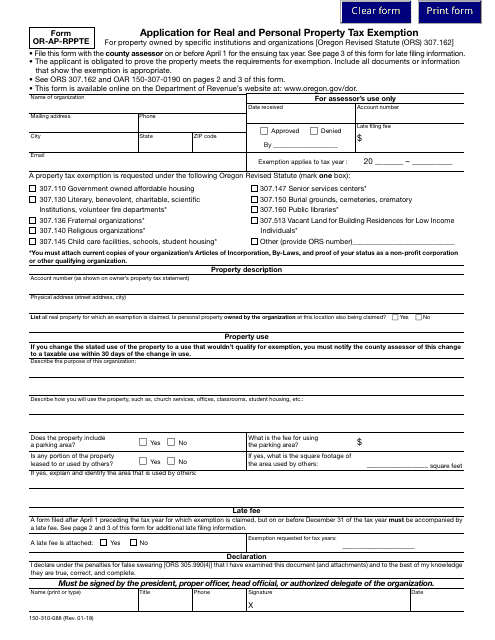

This Form is used for applying for a real and personal property tax exemption in Oregon.

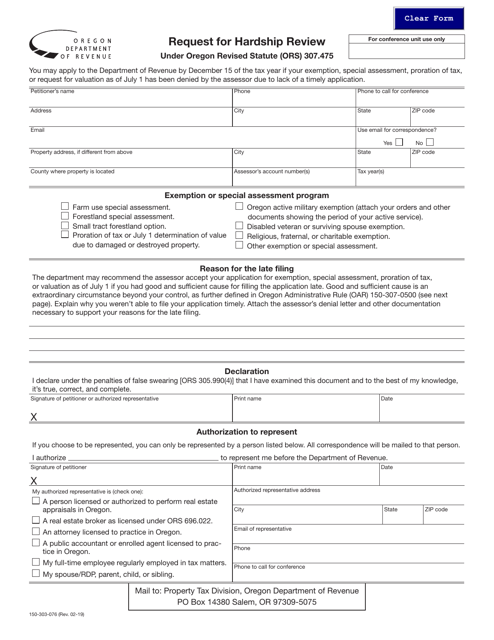

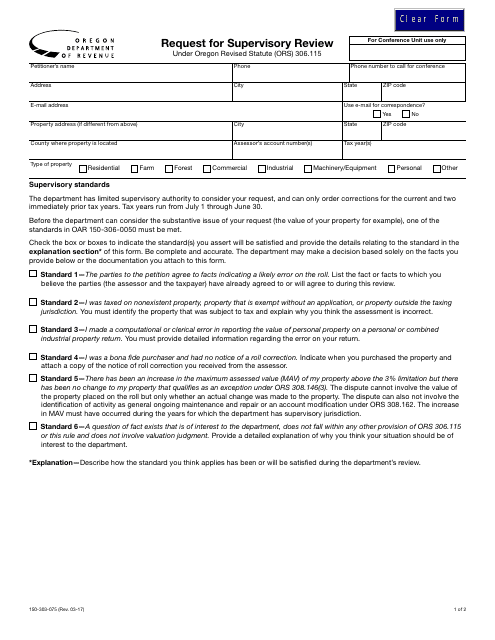

This Form is used for requesting a supervisory review in the state of Oregon.

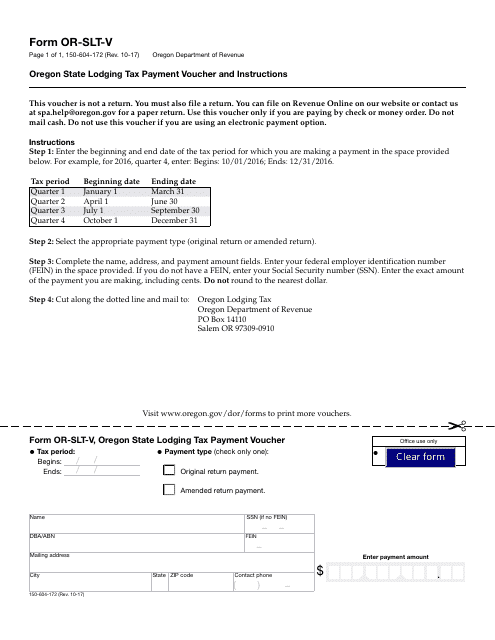

This Form is used for making lodging tax payments in the state of Oregon. It includes instructions on how to fill out the form and submit the payment.

This form is used for voting on tax election ballot measures in the state of Oregon.

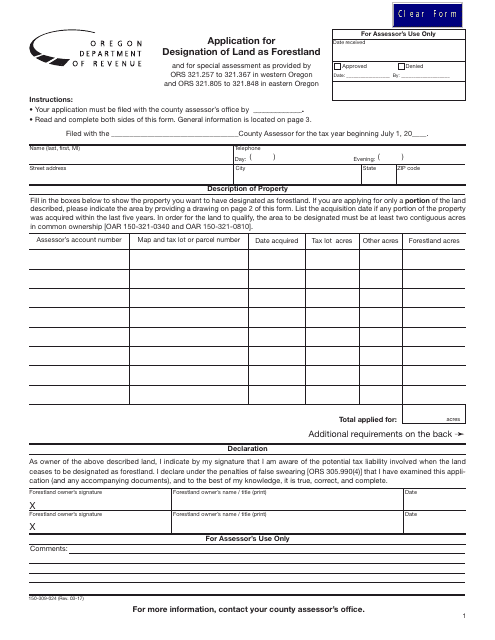

This form is used for applying to designate land in Oregon as forestland.

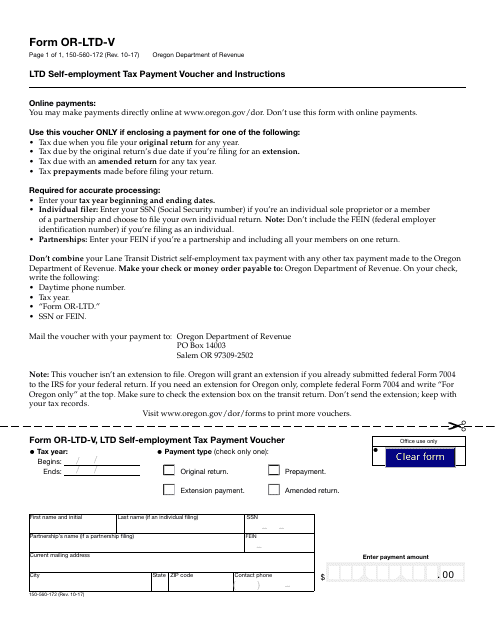

This Form is used for making self-employment tax payments in Oregon and provides instructions on how to fill it out.

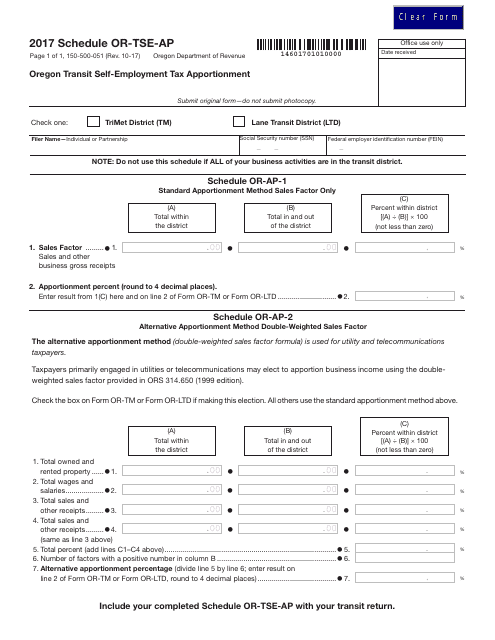

This document is used for apportioning self-employment tax for transit in Oregon.

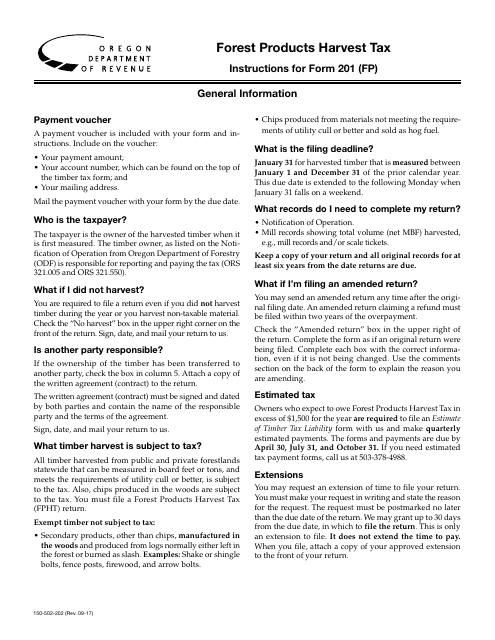

This form is used for reporting and paying the Forest Products Harvest Tax in the state of Oregon.

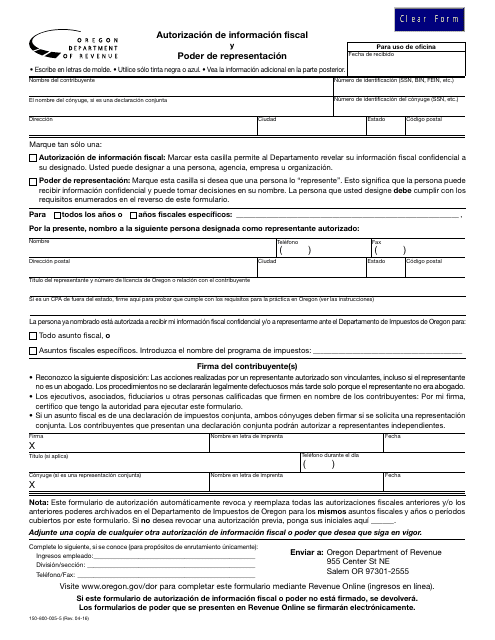

This type of document is an Authorization of Fiscal Information and Power of Representation form in Oregon, used to grant someone the authority to access and represent your tax information.

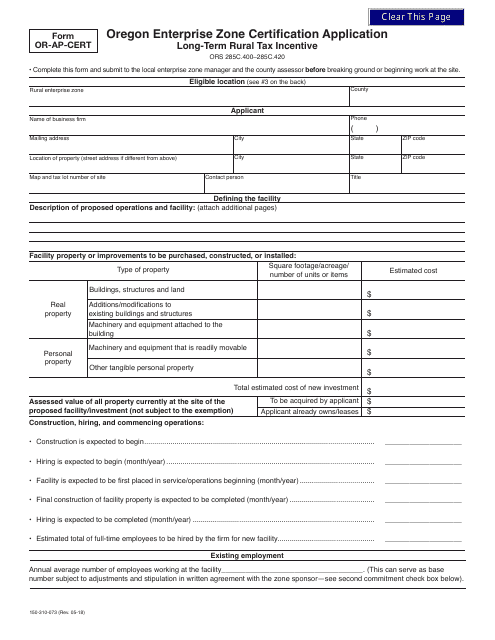

This document is used for applying for Enterprise Zone Certification in Oregon. It helps businesses determine their eligibility for certain tax incentives and benefits offered through the Enterprise Zone program.

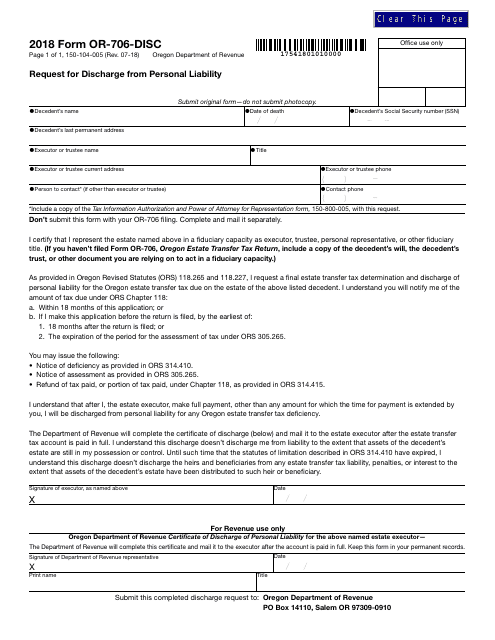

This Form is used for requesting discharge from personal liability in Oregon.

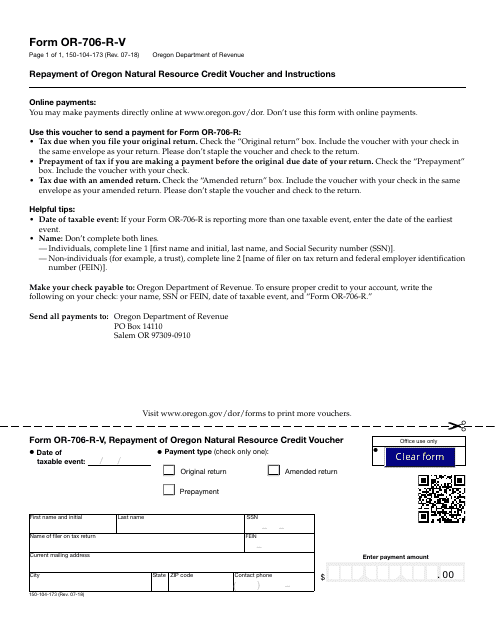

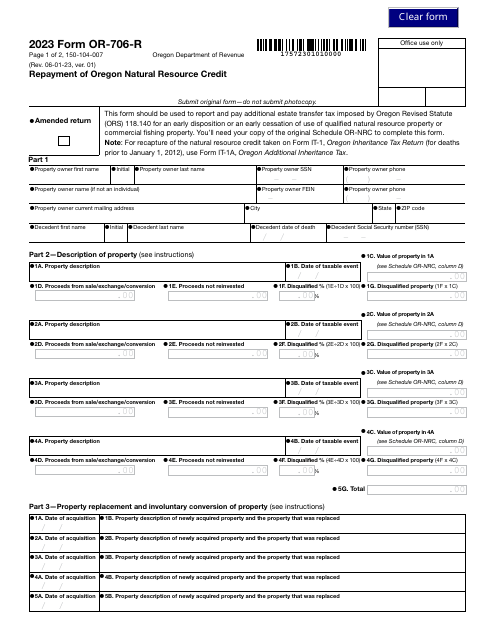

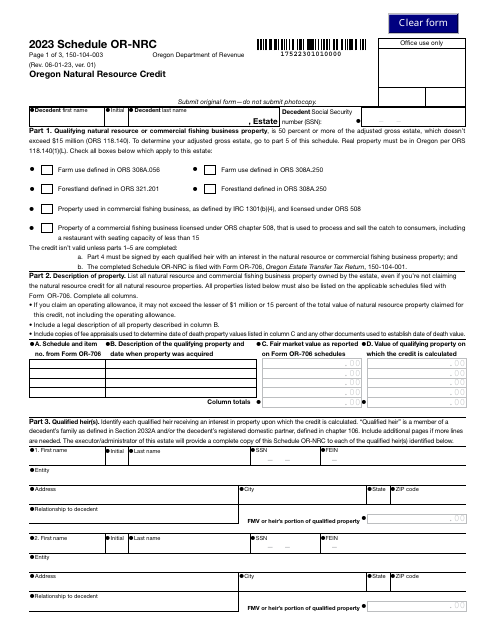

This form is used for requesting repayment of the Oregon Natural Resource Credit Voucher in the state of Oregon.

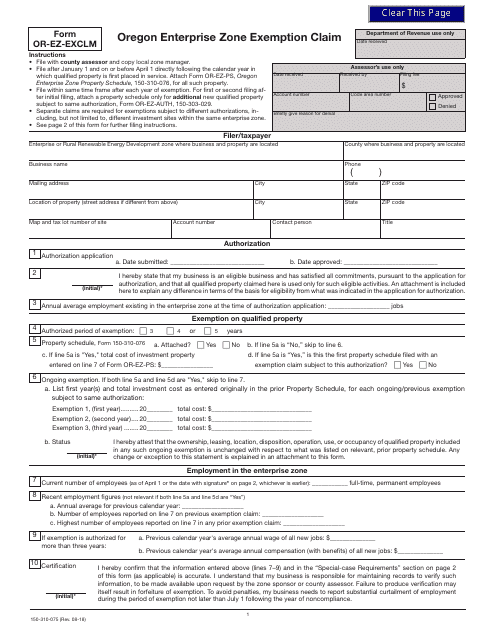

This form is used for claiming an enterprise zone exemption in Oregon. It is specifically for use by businesses to apply for tax incentives and benefits offered by the Oregon Enterprise Zone Program.

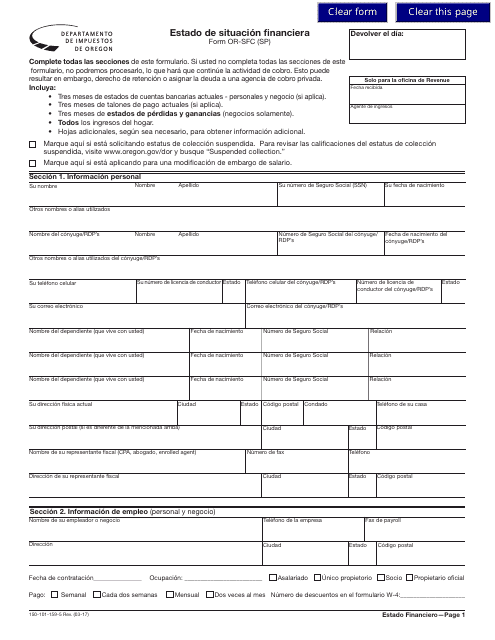

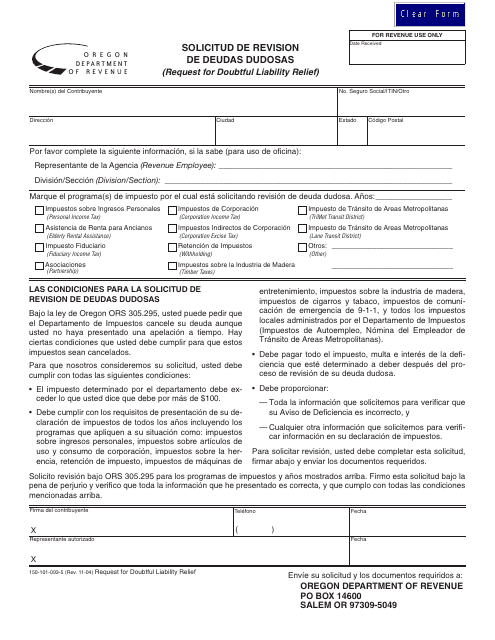

This Form is used for requesting a review of doubtful debts in Oregon. It is available in both English and Spanish.

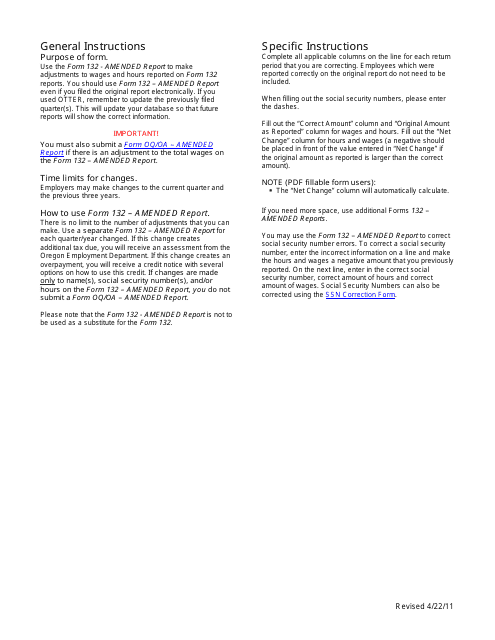

This Form is used for filing an amended report in the state of Oregon. It provides instructions on how to correct any errors or update information on a previously filed report.

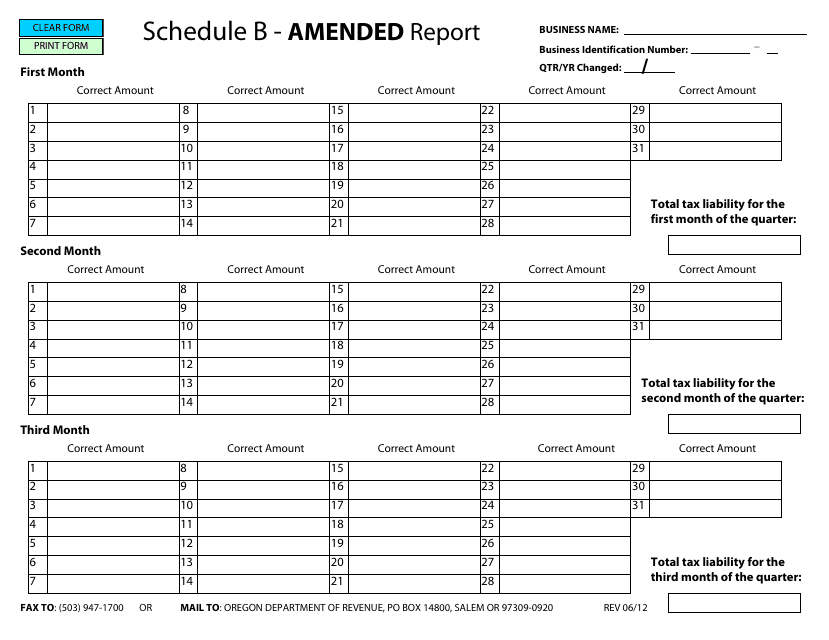

This document is used for submitting an amended report for Schedule B in the state of Oregon. It is used to correct any errors or update information on the original report.

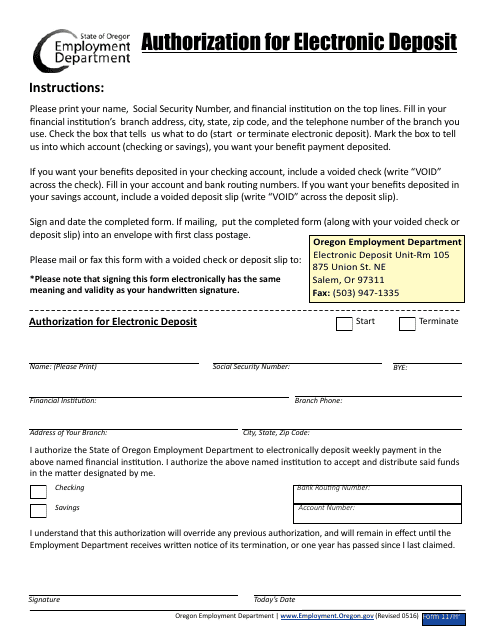

This Form is used for authorizing electronic deposits in Oregon.

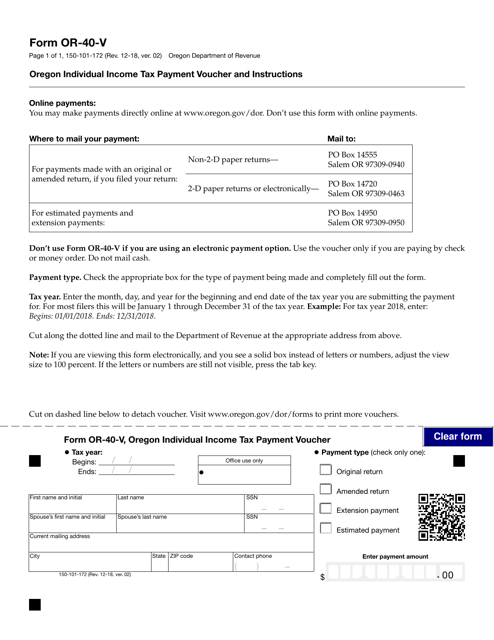

This form is used for making individual income tax payments in the state of Oregon.

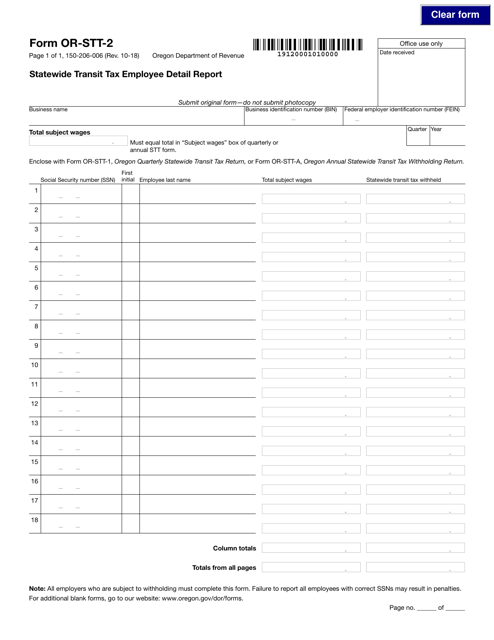

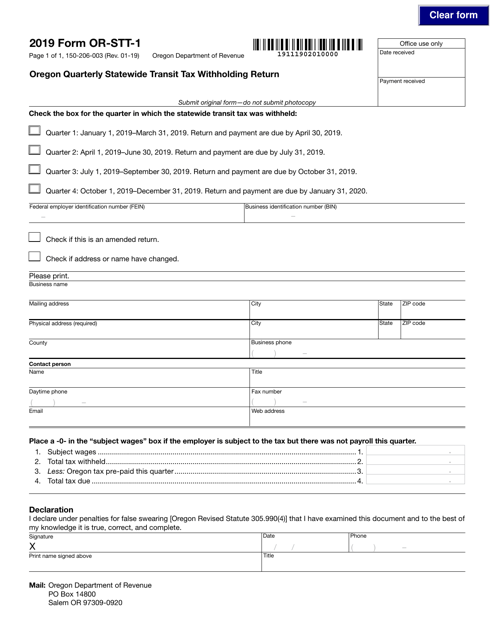

Form 150-206-003 (OR-STT-1) Oregon Quarterly Statewide Transit Tax Withholding Return - Oregon, 2019

This form is used for reporting quarterly statewide transit tax withholdings in Oregon.

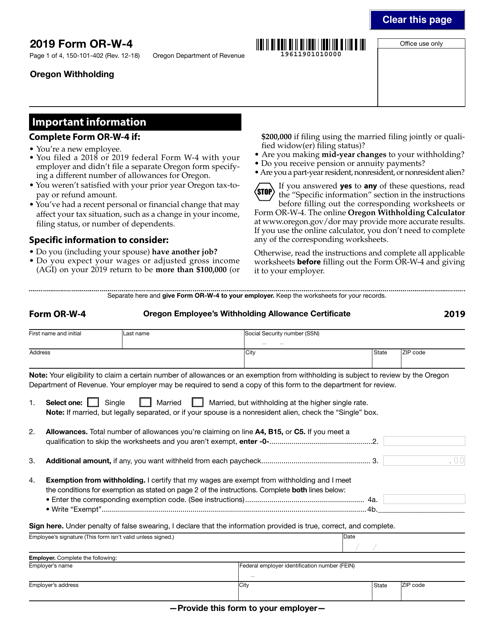

This form is used for Oregon residents to determine the correct amount of state income tax to withhold from their wages.

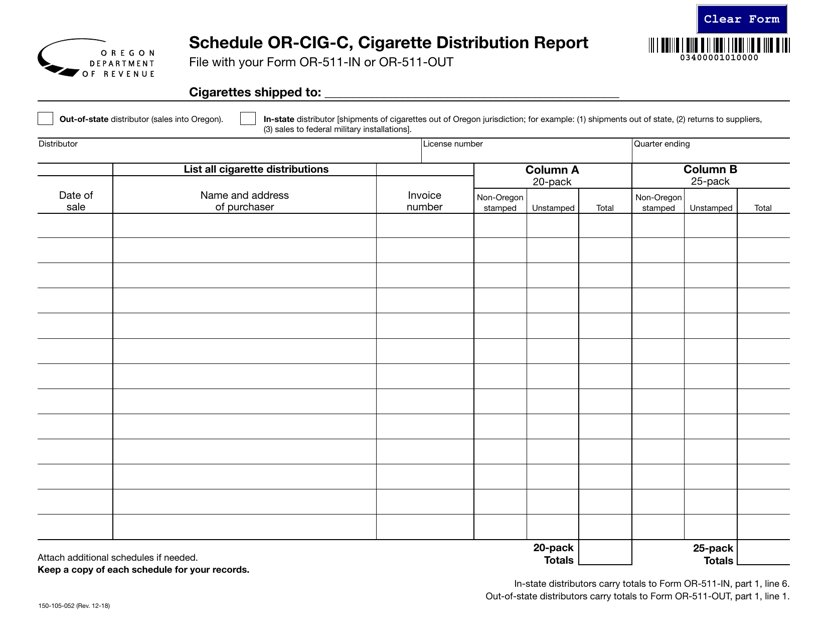

This form is used for reporting cigarette distribution in the state of Oregon. It is required for businesses involved in the sale or distribution of cigarettes.

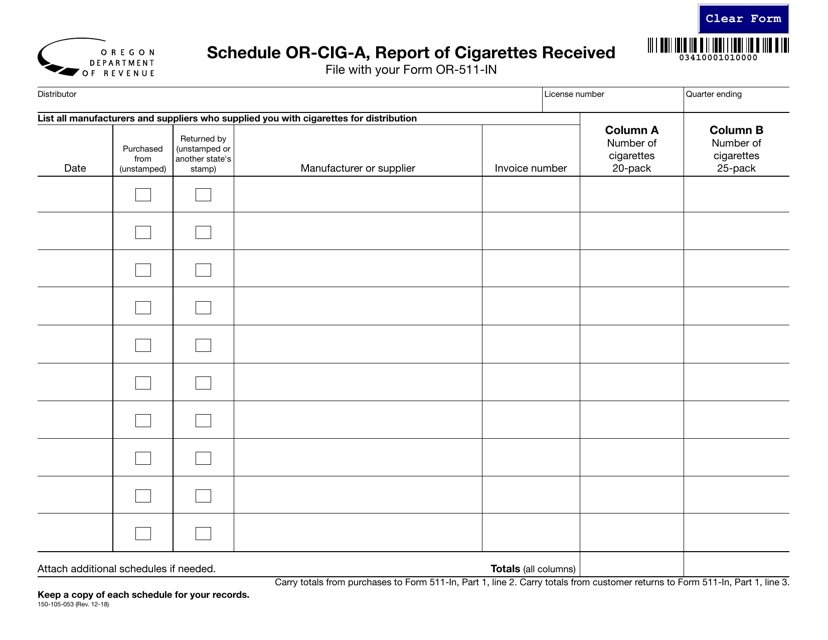

This form is used for reporting cigarettes received in Oregon.