New York State Department of Taxation and Finance Forms

Documents:

2566

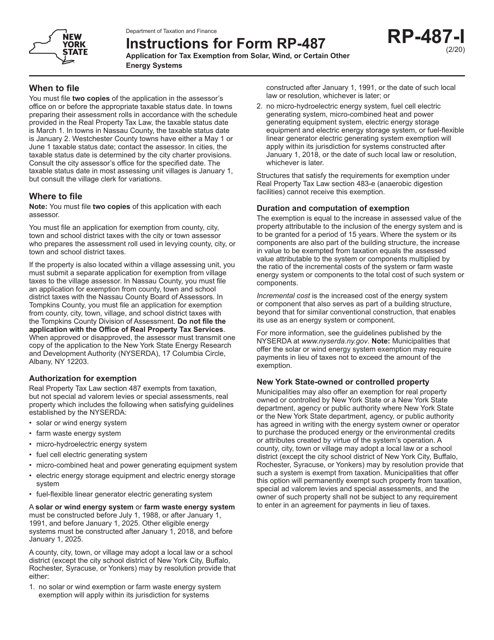

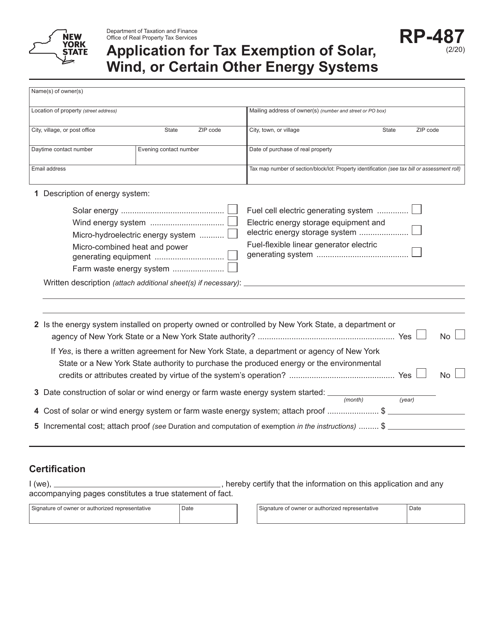

This Form is used for applying for tax exemption from solar, wind, or certain other energy systems in New York. It provides instructions on how to complete the application and qualify for the exemption.

Form RP-487 Application for Tax Exemption of Solar, Wind, or Certain Other Energy Systems - New York

This Form is used for applying for a tax exemption on solar, wind, or certain other energy systems in the state of New York.

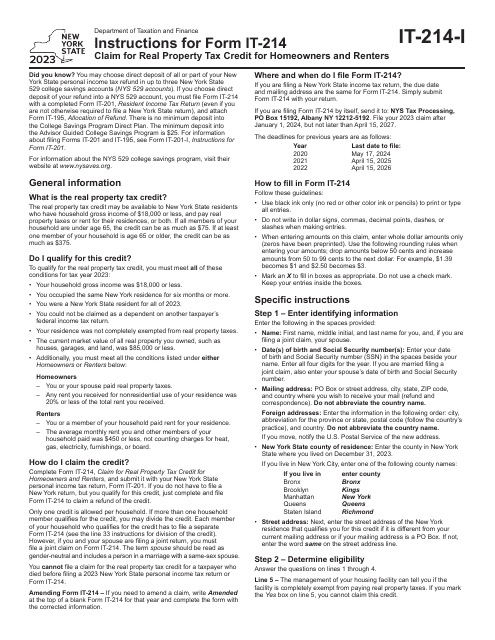

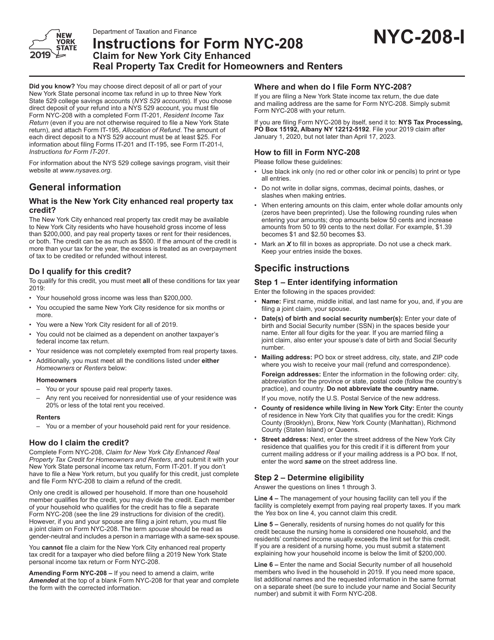

This document is used for claiming the New York City Enhanced Real Property Tax Credit for homeowners and renters in New York City. It provides instructions on how to properly fill out and submit the form to claim the tax credit.

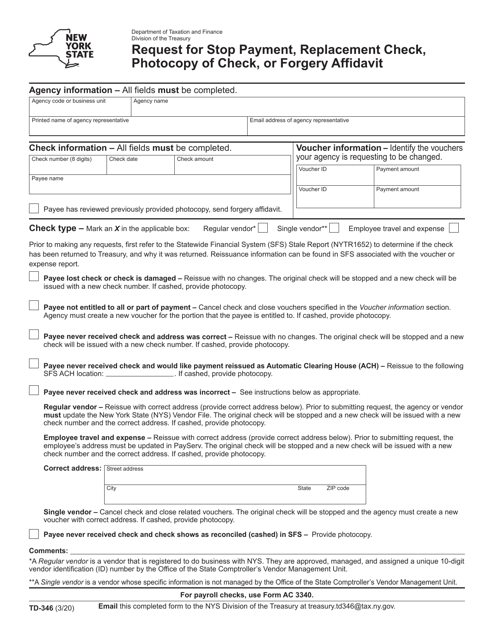

This form is used for requesting a stop payment on a check, getting a replacement check, obtaining a photocopy of a check, or filing a forgery affidavit in New York.

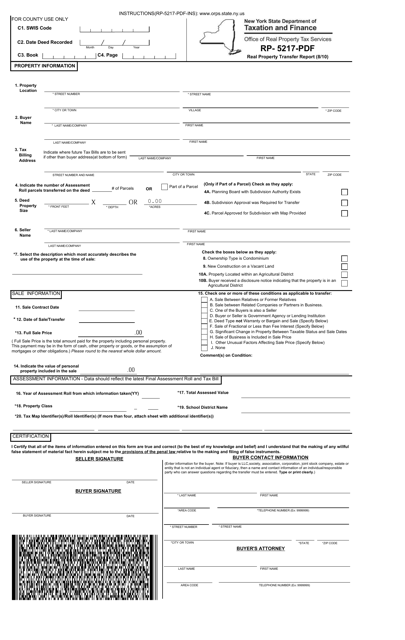

This Form is used for reporting the transfer of real property in New York.

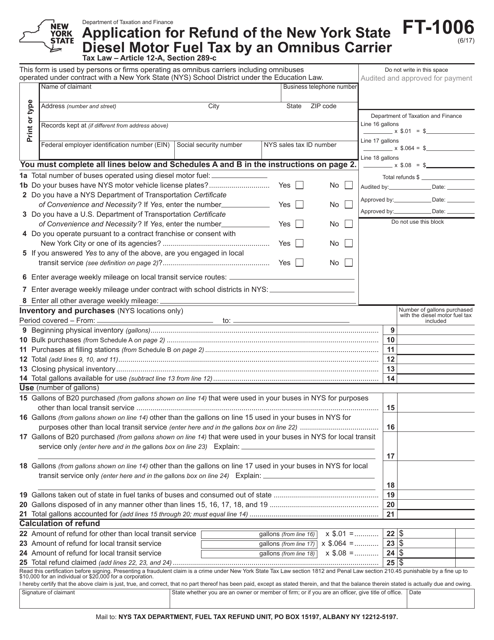

This form is used for filing an application to get a refund of the New York State Diesel Motor Fuel Tax specifically for omnibus carriers operating in New York.

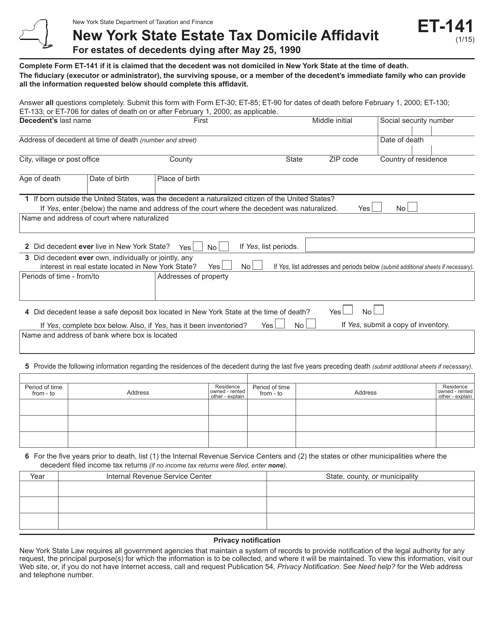

This Form is used for declaring domicile status in the state of New York for estate tax purposes.

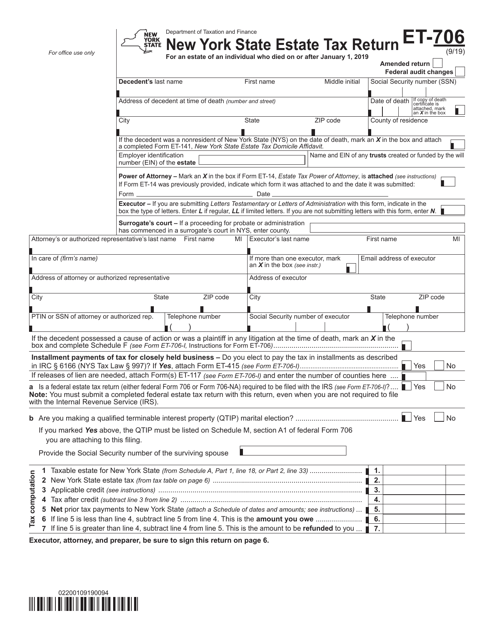

This form is used for filing the New York State Estate Tax Return in New York.

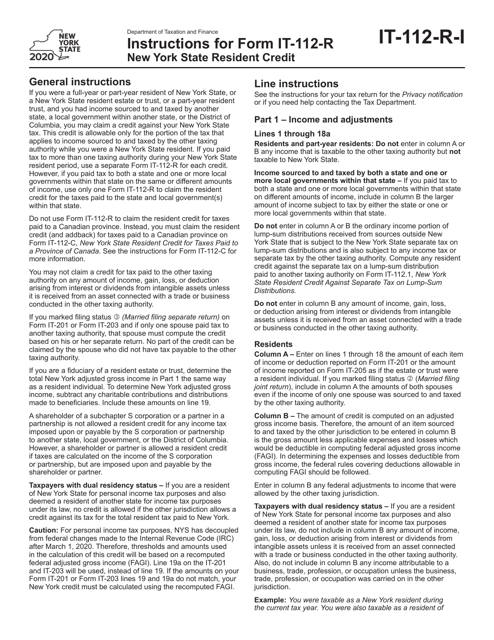

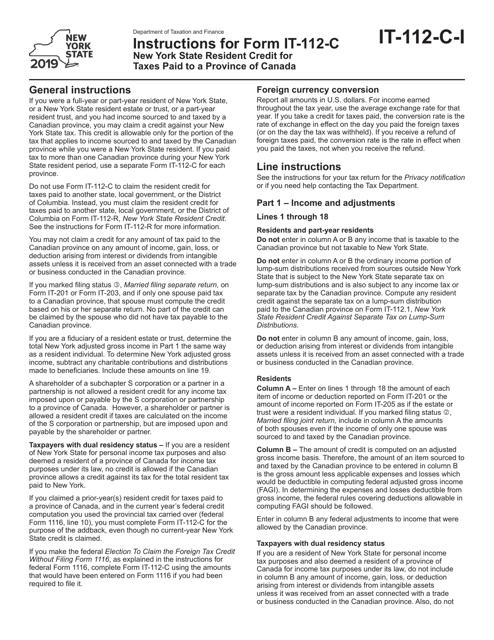

This form is used by New York State residents to claim a credit for taxes paid to a province of Canada on their New York State tax return.

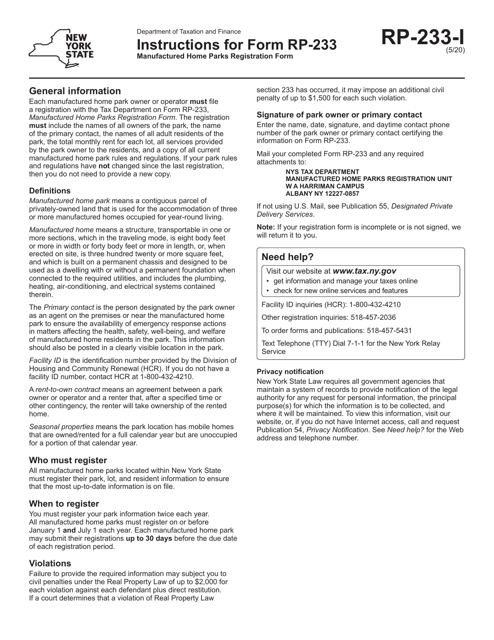

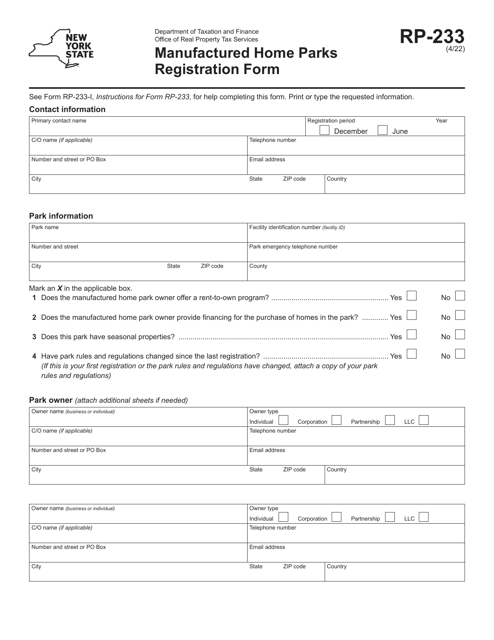

This Form is used for registering manufactured home parks in New York. It provides instructions on how to complete the RP-233 form for park owners.

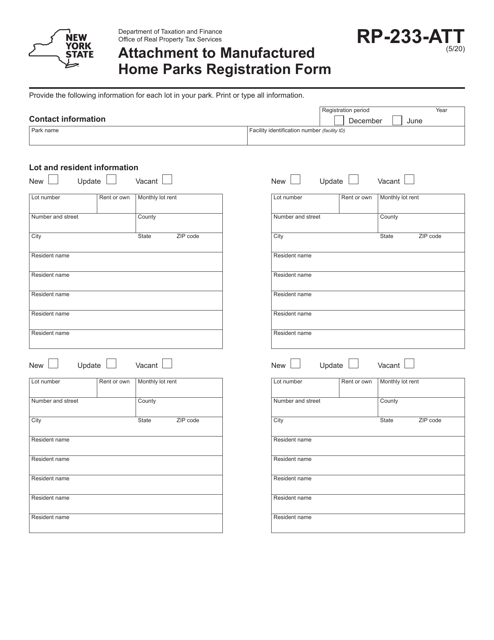

This form is an attachment to the Manufactured Home Parks Registration Form in New York. It provides additional information that is needed for the registration process.